BlackRock Smll Cos Portfolio Update

January 23 2020 - 4:34AM

UK Regulatory

TIDMBRSC

BLACKROCK SMALLER COMPANIES TRUST PLC (LEI: 549300MS535KC2WH4082)

All information is at 31 December 2019 and unaudited.

Performance at month end is calculated on a capital only basis

One Three One Three Five

month months year years years

% % % % %

Net asset value* 8.8 14.5 29.7 47.2 87.9

Share price* 9.2 24.1 42.7 78.1 122.6

Numis ex Inv Companies + AIM Index 7.1 11.9 18.8 15.7 33.1

*performance calculations based on a capital only NAV with debt at par, without

income reinvested. Share price performance calculations exclude income

reinvestment.

Sources: BlackRock and Datastream

At month end

Net asset value Capital only (debt at par value): 1,684.88p

Net asset value Capital only (debt at fair value): 1,674.81p

Net asset value incl. Income (debt at par value)1: 1,705.91p

Net asset value incl. Income (debt at fair value)1: 1,695.85p

Share price 1,712.00p

Premium to Cum Income NAV (debt at par value): 0.4%

Premium to Cum Income NAV (debt at fair value): 1.0%

Net yield2: 1.9%

Gross assets3: GBP897.8m

Gearing range as a % of net assets: 0-15%

Net gearing including income (debt at par): 2.0%

2019 Ongoing charges ratio4: 0.7%

Ordinary shares in issue5: 48,554,792

1. includes net revenue of 21.03p.

2. Yield calculations are based on dividends announced in the last 12 months

as at the date of release of this announcement, and comprise of the final

dividend of 19.20 pence per share, (announced on 03 May 2019, ex-dividend

on 16 May 2019) and the interim dividend of 12.8 pence per share (announced

on 5 November 2019, ex-dividend on 14 November 2019).

3. includes current year revenue.

4. As reported in the Annual Financial Report for the year ended 28 February

2019 the Ongoing Charges Ratio (OCR) was 0.7%. The OCR is calculated as a

percentage of net assets and using operating expenses, excluding

performance fees, finance costs and taxation.

5. excludes 1,438,731 shares held in treasury.

Sector Weightings % of portfolio

Industrials 32.8

Financials 20.8

Consumer Services 18.2

Consumer Goods 9.2

Health Care 6.1

Technology 5.2

Basic Materials 4.1

Oil & Gas 3.0

Telecommunications 0.6

-----

Total 100.0

=====

Ten Largest Equity Investments

Company % of portfolio

4imprint Group 2.6

YouGov 2.4

IntegraFin 2.2

Avon Rubber 1.8

Johnson Service Group 1.7

Watches of Switzerland 1.6

Workspace Group 1.6

Bovis Homes Group 1.5

Central Asia Metals 1.4

Oxford Instruments 1.4

Commenting on the markets, Roland Arnold, representing the Investment Manager

noted:

During December the Company's NAV per share rose by 8.8%1 to 1,684.88p on a

capital only basis, whilst our benchmark index, Numis ex Inv Companies + AIM

Index, returned 7.1%1; the FTSE 100 Index rose by 2.7%1 (all calculations are

on a capital only basis).

Equity markets continued to rise through to the end of 2019, responding

positively to the signs of progress on US/China trade and furthermore by the

outcome of the UK General Election, where Boris Johnson's Conservative party

secured a strong majority in Parliament. Unsurprisingly Sterling continued to

rise on the back of the result of the election, leading to domestic businesses

and UK small & mid-cap companies outperforming during the month.

While UK domestics drove the market higher during the month, the Company's

outperformance came from a broad range of businesses rather than a basket of

sterling earners. For example, 4imprint, which generates almost 100% of its

earnings from the US, was a top contributor to performance. The largest

contributor to performance during the month was specialist sustainable

investing fund manager, Impax Asset Management. The shares rallied in response

to strong full year results that were ahead of expectations, as investor demand

for sustainable products continues build traction. Watches of Switzerland

reported strong interim results with upgrades, whilst also announcing the

acquisition of four new showrooms. Shares in The Pebble Group rose following

its IPO (Initial Public Offering) during the month, and also benefitted from

some of our more domestic holdings including Renew and Ibstock.

Of the largest detractors to performance, a number were domestic facing

businesses that we do not own, which simply received a post-election boost, for

example, Dunelm and Frasers Group (previously Sports Direct). Importantly, and

as we have alluded to in recent reports, the result of the election does not

change our view on many of these businesses and we will not be chasing any

sterling led rallies. Shares in AB Dynamics, the manufacturer of testing

products for the automotive industry, fell in response to full year results

which although highlighted strong profit growth, warned of margin constraints

in their business and challenges facing their customers in the automotive

industry.

The significant Conservative majority in the General Election should begin to

remove the cloud that has been hanging over the UK equity market. As a result

of the increased stability in Government, the political risk premium is

certainly eroding and we would expect this to clear the way for fundamentals to

be the key driver to returns. In the mid to long-term, this outcome could

result in increased business confidence, and subsequently result in a return/

uptick in corporate spending. However, while the UK is undoubtably in better

position post the election, the path to Brexit remains complicated. Meanwhile

US/China trade negotiations, which we believe will be a far more significant

driver of equity markets, may cause further volatility. We therefore remain

focussed on bottom-up company fundamentals, with a bias towards high quality

market leading global businesses, which are operating in attractive end markets

and run by strong management teams.

1Source: BlackRock as at 31 December 2019

23 January 2020

Latest information is available by typing www.blackrock.co.uk/brsc on the

internet, "BLRKINDEX" on Reuters, "BLRK" on Bloomberg or "8800" on Topic 3 (ICV

terminal). Neither the contents of the Manager's website nor the contents of

any website accessible from hyperlinks on the Manager's website (or any other

website) is incorporated into, or forms part of, this announcement.

END

(END) Dow Jones Newswires

January 23, 2020 04:34 ET (09:34 GMT)

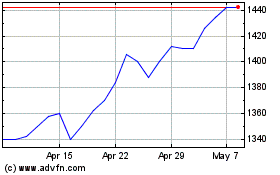

Blackrock Smaller (LSE:BRSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

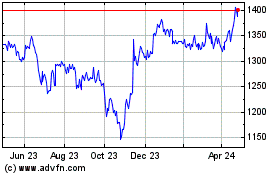

Blackrock Smaller (LSE:BRSC)

Historical Stock Chart

From Apr 2023 to Apr 2024