TIDMBLOE

RNS Number : 1784Z

Block Energy PLC

12 May 2023

12 May 2023

Block Energy plc

("Block" or the "Company")

Amended Secured Loan Facility & Related Party

Transactions

As announced on 2 February 2023, Block Energy plc, the

production and development company focused on Georgia, closed a

senior secured loan facility ("Loan Facility") of USD 1.06 million

(c. GBP0.86 million on 2 February 2023).

The Loan Facility permitted the Company to borrow an additional

contingent amount of up to USD 2.00 million during the term of the

loan from the USD 1.06 million already committed, with the existing

lenders having a right of first refusal for a period of 20 business

days to participate in any extension.

The Company has now increased the Loan Facility by USD 0.94

million (c. GBP0.75 million on 10 May 2023), and entered into an

updated Loan Agreement, with the only changes made to reflect the

increased amount of the Loan Facility and to allow new lenders to

participate in the current tranche, together with those of the

existing lenders who have elected to participate.

The funds raised will provide liquidity to maintain momentum

around scheduled crude liftings allowing the Company to accelerate

the procurement of materials for the drilling of its next Project I

wells. The first in the drilling sequence is KRT-45Z, located

approximately 1,500 metres from the recently drilled and successful

WR-B01Za well and will be spud in July.

Commenting, Phil Dimmock, Chairman of Block Energy plc,

said:

" Existing Group production is now over 620 boepd (April average

rate), and it is important that we keep the momentum going with the

drilling campaign. The success of both JKT-01 and WR-B01Za has

given us great confidence as to the full potential of Project I.

These additional funds assist in the timely procurement and

execution of the next development wells. We look forward to

updating shareholders on further developments in due course ."

The further USD 0.94 million is being lent on the same terms as

the initial Loan Facility, that being for a term of 18 months from

the date on which the Loan Facility was initially drawn down (2

February 2023), at which point the principal is repayable in full.

The Loan Facility carries an interest rate of 16% p.a., payable

quarterly in arrears in cash. The Company may elect to repay

amounts outstanding under the Loan at the end of each quarter, in

part or in full, subject to a 2% early repayment fee concerning the

outstanding principal amount.

The Company has provided a debenture to the lenders as security,

providing a fixed and floating charge over the Company's property

and assets.

Each lender will receive warrants exercisable at any point

during the three years from the Closing Date of the original

agreement (2 February 2023). The exercise price of each warrant

shall be 1.92 pence per ordinary share. The number of warrants

issued to each lender shall correspond to an exercise value equal

to 50% of their respective loan commitment under the Loan Facility.

Therefore, the number of warrants to be issued to lenders as part

of the USD 0.94 million loan in aggregate is 19,352,394.

Related Party Transactions

The Company's Chief Executive Officer, Paul Haywood, has

provided a further USD 25,000 of the Loan Facility (in addition to

the USD 90,000 already committed). Its current Chief Operating

Officer and former board director, Ken Seymour, has provided a

further USD 25,000 of the Loan Facility (in addition to the USD

100,000 already committed).

Mr Haywood and Dr Seymour are each treated as a related party of

the Company pursuant to the AIM Rules. Consequently, the

participation of Mr Haywood and Mr Seymour in the provision of the

Loan Facility constitutes related party transactions for the

purposes of AIM Rule 13.

The Independent Directors (Jeremy Asher and Philip Dimmock)

consider, having consulted with SPARK Advisory Partners Limited,

the Company's nominated adviser, that the terms of the amended Loan

Facility and the related parties' participation in the Loan

Facility are fair and reasonable insofar as Shareholders are

concerned.

**S**

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION NO 596/2014

WHICH IS PART OF ENGLISH LAW BY VIRTUE OF THE EUROPEAN (WITHDRAWAL)

ACT 2018, AS AMED. ON PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

For further information please visit

http://www.blockenergy.co.uk/ or contact:

Paul Haywood Block Energy plc Tel: +44 (0)20

(Chief Executive 3468 9891

Officer)

Neil Baldwin Spark Advisory Partners Tel: +44 (0)20

(Nominated Adviser) Limited 3368 3554

Peter Krens Tennyson Securities Tel: +44 (0)20

(Corporate Broker) 7186 9030

P hilip Dennis C elicourt Communications Tel: +44 (0)20

/ M ark Antelme 8 434 2 643

(Financial PR)

Notes to editors

Block Energy plc is an AIM-listed independent oil and gas

company focused on production and development in Georgia, applying

innovative technology to realise the full potential of previously

discovered fields.

Block has a 100% working interest in Georgian onshore licence

blocks IX and XI(B) . Licence block XI(B) is Georgia's most

productive block. During the mid-1980s, production peaked at 67,000

bopd and cumulative production reached 100 MMbbls and 80 MMbbls of

oil from the Patardzeuli and Samgori fields, respectively. The

remaining 2P reserves across block XI(B) are 64 MMboe, comprising

2P oil reserves of 36 MMbbls and 2P gas reserves of 28 MMboe.

(Source: CPR Bayphase Limited: 1 July 2015). Additionally,

following an internal technical study designed to evaluate and

quantify the undrained oil potential of the Middle Eocene within

the Patardzeuli field, the Company has estimated gross unrisked 2C

contingent resources of 200 MMbbls of oil.

The Company has a 100% working interest in licence block XI(F)

containing the West Rustavi onshore oil and gas field. Multiple

wells have tested oil and gas from a range of geological horizons.

The field has so far produced over 75 Mbbls of light sweet crude

and has 1.07 MMbbls of gross 2P oil reserves in the Middle Eocene.

It also has 38 MMbbls of gross unrisked 2C contingent resources of

oil and 608 Bcf of gross unrisked 2C contingent resources of gas in

the Middle, Upper and Lower Eocene formations (Source: CPR

Gustavson Associates: 1 January 2018, ERCE 2022).

In 2022, a Competent Person's Report provided by ERCE, ascribed

3P reserves of 3.01 million barrels, with an NPV project value of

USD 57 million, to just a portion of the West Rustavi/Krtsanisi

Middle Eocene reservoir.

Block also holds 100% and 90% working interests respectively in

the onshore oil producing Norio and Satskhenisi fields.

The Company offers a clear entry point for investors to gain

exposure to Georgia's growing economy and the strong regional

demand for oil and gas.

Glossary

-- bbls: barrels. A barrel is 35 imperial gallons.

-- Bcf: billion cubic feet.

-- boe: barrels of oil equivalent.

-- boepd: barrels of oil equivalent per day.

-- bopd: barrels of oil per day.

-- Mbbls: thousand barrels.

-- Mboe: thousand barrels of oil equivalent.

-- Mcf: thousand cubic feet.

-- MMbbls: million barrels.

-- MMboe: million barrels of oil equivalent.

-- MMcf: million cubic feet.

Notification and public disclosure of transactions by persons

discharging managerial responsibilities ("PDMRs") and persons

closely associated ("PCA") with them.

Details of the person discharging managerial responsibilities

1 / person closely associated

a) Name Paul Haywood

-------------------------------- -----------------------------------------

Reason for notification

2

---------------------------------------------------------------------------

a) Position / status CEO

-------------------------------- -----------------------------------------

b) Initial notification Initial notification

/Amendment

-------------------------------- -----------------------------------------

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

---------------------------------------------------------------------------

a) Name Block Energy plc

-------------------------------- -----------------------------------------

b) LEI 213800E2J8QA1J6KN415

-------------------------------- -----------------------------------------

Details of the transaction(s): section to be repeated for

4 (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

---------------------------------------------------------------------------

a) Description of the financial Issue of warrants to acquire ordinary

instrument, type of instrument shares in Block Energy plc

Identification code ISIN GB00BF3TBT48

-------------------------------- -----------------------------------------

b) Nature of the transaction Grant of warrants as part of subscribing

in the Loan Facility

-------------------------------- -----------------------------------------

c) Price(s) and volumes(s) Price(s) Volumes

1.92p 514,691

--------

-------------------------------- -----------------------------------------

d) Aggregated information n/a

-------------------------------- -----------------------------------------

e) Date of the transaction 12 May 2023

-------------------------------- -----------------------------------------

f) Place of the transaction Outside a trading venue

-------------------------------- -----------------------------------------

Notification and public disclosure of transactions by persons

discharging managerial responsibilities ("PDMRs") and persons

closely associated ("PCA") with them.

Details of the person discharging managerial responsibilities

1 / person closely associated

a) Name Kenneth Seymour

-------------------------------- -----------------------------------------

Reason for notification

2

---------------------------------------------------------------------------

a) Position / status Chief Operating Officer (PDMR)

-------------------------------- -----------------------------------------

b) Initial notification Initial notification

/Amendment

-------------------------------- -----------------------------------------

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

---------------------------------------------------------------------------

a) Name Block Energy plc

-------------------------------- -----------------------------------------

b) LEI 213800E2J8QA1J6KN415

-------------------------------- -----------------------------------------

Details of the transaction(s): section to be repeated for

4 (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

---------------------------------------------------------------------------

a) Description of the financial Warrants to acquire ordinary shares

instrument, type of instrument in Block Energy plc

Identification code ISIN GB00BF3TBT48

-------------------------------- -----------------------------------------

b) Nature of the transaction Grant of warrants as part of subscribing

in the Loan Facility

-------------------------------- -----------------------------------------

c) Price(s) and volumes(s) Price(s) Volume

1.92p 514,691

--------

-------------------------------- -----------------------------------------

d) Aggregated information n/a

-------------------------------- -----------------------------------------

e) Date of the transaction 12 May 2023

-------------------------------- -----------------------------------------

f) Place of the transaction Outside a trading venue

-------------------------------- -----------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDGGDUXGBDGXB

(END) Dow Jones Newswires

May 12, 2023 02:00 ET (06:00 GMT)

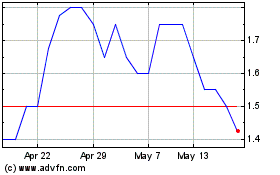

Block Energy (LSE:BLOE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Block Energy (LSE:BLOE)

Historical Stock Chart

From Apr 2023 to Apr 2024