BHP Billiton PLC Final Results of BHP US Tender Offers (5103R)

September 22 2017 - 2:00AM

UK Regulatory

TIDMBLT

RNS Number : 5103R

BHP Billiton PLC

22 September 2017

NEWS RELEASE

Release Time IMMEDIATE

Date 22 September 2017

Release Number 31/17

Final Results of BHP's US Tender Offers

BHP announced today the final results of its US Tender Offers

which formed part of a global multi-currency bond repurchase plan

launched on 21 August 2017.

BHP has used its strong cash position to fund the US$2.9 billion

global multi-currency bond repurchase plan. In total, BHP spent

US$1.9 billion repurchasing Euro and GBP bonds and US$1.0 billion

repurchasing US bonds. Early repayment of these bonds has extended

BHP's average debt maturity profile and enhanced BHP's capital

structure.

US Tender Offers

BHP Billiton Finance (USA) Limited (the Company), a wholly-owned

subsidiary of BHP Billiton Limited, today announced the expiration

of its previously announced tender offers for an aggregate purchase

price (excluding accrued and unpaid interest) of up to

US$1,000,000,000 (the Offer Cap) of its US$529,978,000 3.250%

Senior Notes due 2021 (the 2021 Notes), its US$859,938,000 2.875%

Senior Notes due 2022 (the 2022 Notes) and its US$1,500,000,000

3.850% Senior Notes due 2023 (the 2023 Notes, and together with the

2021 Notes and the 2022 Notes, the Notes) (the Tender Offers).

The Tender Offers were made pursuant to the terms and conditions

set forth in the offer to purchase dated 21 August 2017 (the Offer

to Purchase). Terms not defined in this announcement have the

meanings given to them in the Offer to Purchase.

The Tender Offers expired at 11:59 p.m., New York City time, on

21 September 2017. As announced on 8 September 2017, the Offer Cap

of US$1,000,000,000 had been reached as of the Early Tender Date of

7 September 2017.

With the completion of the Tender Offers, the Company will have

repurchased an aggregate principal amount of US$923,532,000 of

several series of its outstanding notes, as set out in the table

below:

Title of Security CUSIP/ISIN Principal amount Principal amount

Number purchased outstanding

after purchase

------------------ -------------- ----------------- -----------------

3.850% Senior 055451AU2/ US$765,587,000 US$734,413,000

Notes due 2023 US055451AU28

------------------ -------------- ----------------- -----------------

2.875% Senior 055451AQ1/ US$157,945,000 US$701,993,000

Notes due 2022 US055451AQ16

------------------ -------------- ----------------- -----------------

3.250% Senior 055451AL2/ US$0 US$529,978,000

Notes due 2021 US055451AL29

------------------ -------------- ----------------- -----------------

Legal Notices

This announcement is for informational purposes only and is not

an offer to purchase, a solicitation of an offer to purchase or a

solicitation of consents with respect to any securities.

None of the Company, the Guarantors, the Dealer Managers or

their affiliates, their respective boards of directors, the Tender

and Information Agent, the Notes trustee or any of their respective

affiliates makes any recommendation, or has expressed an opinion,

as to whether or not Holders should tender their Notes, or refrain

from doing so, pursuant to the Tender Offers.

The Company has not filed this announcement or the Offer to

Purchase with, and they have not been reviewed by, any federal or

state securities commission or regulatory authority of any country.

No authority has passed upon the accuracy or adequacy of the Tender

Offers, and it is unlawful and may be a criminal offense to make

any representation to the contrary.

United Kingdom. The communication of the Offer to Purchase and

any other documents or materials relating to the Tender Offers were

not being made by, and such documents and/or materials have not

been approved, by an authorized person for the purposes of section

21 of the Financial Services and Markets Act 2000, as amended.

Accordingly, the Offer to Purchase and such documents and/or

materials were not being distributed to, and must not be passed on

to, the general public in the United Kingdom. The communication of

the Offer to Purchase and such documents and/or materials as a

financial promotion was only being directed at and made to (i)

persons who are outside the United Kingdom, (ii) investment

professionals (as defined in Article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005, as

amended (the Financial Promotion Order)), (iii) high net worth

entities and other parties falling within Article 49(2)(a) to (d)

of the Financial Promotion Order, or (iv) any other persons to whom

it may otherwise lawfully be communicated (all such persons

together being referred to as Relevant Persons) and the

transactions contemplated herein were be available only to, and

engaged in only with, Relevant Persons. Any person who is not a

Relevant Person should not act on or rely on the Offer to Purchase

or any of its contents.

Further information on BHP can be found at: bhp.com

Media Relations Investor Relations

Email: media.relations@bhpbilliton.com Email: investor.relations@bhpbilliton.com

Australia and Asia Australia and Asia

Ben Pratt Tara Dines

Tel: +61 3 9609 3672 Tel: +61 3 9609 2222

Mobile: +61 419 968 Mobile: +61 499 249

734 005

Fiona Hadley

Tel: +61 3 9609 2211 Andrew Gunn

Mobile: +61 427 777 Tel: +61 3 9609 3575

908 Mobile: +61 402 087

354

United Kingdom and South

Africa United Kingdom and South

Africa

Neil Burrows

Tel: +44 20 7802 7484 Rob Clifford

Mobile: +44 7786 661 Tel: +44 20 7802 4131

683 Mobile: +44 7788 308

844

North America

Elisa Morniroli

Bronwyn Wilkinson Tel: +44 20 7802 7611

Mobile: +1 604 340 8753 Mobile: +44 7825 926

646

Judy Dane

Tel: +1 713 961 8283 Americas

Mobile: +1 713 299 5342

James Wear

Tel: +1 713 993 3737

Mobile: +1 347 882 3011

BHP Billiton Limited BHP Billiton Plc Registration

ABN 49 004 028 077 number 3196209

LEI WZE1WSENV6JSZFK0JC28 LEI 549300C116EOWV835768

Registered in Australia Registered in England

Registered Office: Level and Wales

18, 171 Collins Street Registered Office: Nova

Melbourne Victoria 3000 South, 160 Victoria

Australia Street

Tel +61 1300 55 4757 London SW1E 5LB United

Fax +61 3 9609 3015 Kingdom

Tel +44 20 7802 4000

Fax +44 20 7802 4111

Members of the BHP Group which is

headquartered in Australia

Follow us on social media

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCSEWSLEFWSEFU

(END) Dow Jones Newswires

September 22, 2017 02:00 ET (06:00 GMT)

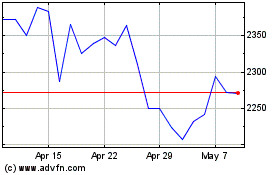

Bhp (LSE:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

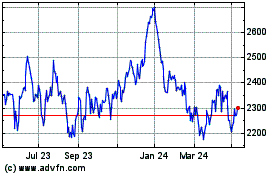

Bhp (LSE:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024