Zurich Insurance to Buy Brokerages for $760 Million After Revenue Rises

November 09 2023 - 1:48AM

Dow Jones News

By Ed Frankl

Zurich Insurance Group said Thursday that will buy a portfolio

of brokerages for $760 million, after strong revenue at both its

property-and-casualty and especially its life business in the first

nine months of the year, with an additional share buyback to

come.

The Swiss insurer said its wholly owned U.S.-based Farmers Group

will acquire three brokerage entities--Kraft Lake Insurance Agency,

Western Star Insurance Services, Farmers General Insurance

Agency--and the Farmers Exchanges flood-program servicing arm for

$760 million.

It comes after Zurich last week took a majority stake in Kotak

Mahindra Bank's casualty business to gain a greater foothold in the

Indian market.

Meanwhile, the Swiss insurer said its property-and-casualty

insurance gross written premiums rose 9% in like-for-like terms on

year to $34.59 billion in the nine months to Sept. 30, while new

business premiums at its life arm jumped 23% to $12.17 billion.

The momentum means the company is confident it will finish the

year strongly and achieve its financial targets for 2023-25, Chief

Financial Officer George Quinn said.

Zurich's Swiss solvency ratio was 266% at Sept. 30, with the

company saying it would now supplement the dividend with an

additional share buyback. It will update shareholders at an

investor day next week.

Write to Ed Frankl at edward.frankl@wsj.com

(END) Dow Jones Newswires

November 09, 2023 01:33 ET (06:33 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

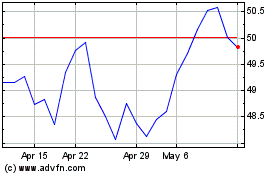

Zurich Insurance (QX) (USOTC:ZURVY)

Historical Stock Chart

From Mar 2024 to Apr 2024

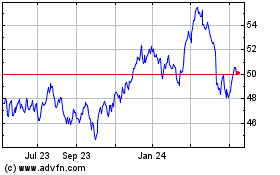

Zurich Insurance (QX) (USOTC:ZURVY)

Historical Stock Chart

From Apr 2023 to Apr 2024