UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-8

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

STRIKER OIL & GAS,

INC.

(Exact

Name of Registrant as Specified in its Charter)

|

Nevada

|

|

75-1764386

|

|

(State

or Other Jurisdiction of

Incorporation

or Organization)

|

|

(I.R.S.

Employer

Identification

Number)

|

Galleria Financial

Center

5075 Westheimer, Suite

975

Houston, TX

77056

(Address

of Principal Executive Office)

2008 Stock Option

Plan

(Full

title of the plan)

Telephone:

(713)402-6700

(Telephone

number, including area code, of agent for service)

Large

accelerated filer

Accelerated

filer

Non-accelerated

filer Smaller

reporting company

x

CALCULATION

OF REGISTRATION FEE

|

Title

of

Securities

To Be

Registered

|

Amount

Being

Registered

(1)

|

Proposed

Maximum

Offering

Price

Per

Share

(2)

|

Proposed

Maximum

Aggregate

Offering

Price

(2)

|

Amount

of

Registration

Fee

|

|

Common

Stock, par value $0.001 per share

|

4,000,000

|

$0.08

|

$320,000

|

$13

|

|

TOTAL

|

$13

|

|

(1)

|

Pursuant

to Rule 416 under the Securities Act of 1933, as amended, the number of

shares of the issuer’s Common Stock registered hereunder will be adjusted

in the event of stock splits, stock dividends or similar

transactions.

|

|

(2)

|

Estimated

solely for the purpose of calculating the amount of the registration fee

pursuant to Rule 457(h), on the basis of the average of the high and low

prices for a share of common stock as reported by the Over-The-Counter

Bulletin Board.

|

PART

I

ITEM

1. PLAN

INFORMATION

The

documents containing the information specified in Item 1 will be sent or given

to participants in the 2008 Stock Option Plan, as specified by Rule 428(b)(1) of

the Securities Act of 1933, as amended (the “Securities Act”). Such documents

are not required to be and are not filed with the Securities and Exchange

Commission (the “SEC”) either as part of this Registration Statement or as

prospectuses or prospectus supplements pursuant to Rule 424. These documents and

the documents incorporated by reference in this Registration Statement pursuant

to Item 3 of Part II of this Form S-8, taken together, constitute a prospectus

that meets the requirements of Section 10(a) of the Securities Act.

|

ITEM 2.

|

REGISTRANT

INFORMATION AND EMPLOYEE PLAN ANNUAL INFORMATION

|

Upon

written or oral request, any of the documents incorporated by reference in Item

3 of Part II of this Registration Statement (which documents are incorporated by

reference in this Section 10(a) Prospectus), other documents required to be

delivered to eligible employees, non-employee directors and consultants,

pursuant to Rule 428(b) are available without charge by contacting:

Kevan

Casey

Galleria

Financial Center

5075

Westheimer, Suite 975

Houston,

TX 77056

(713)

402-6700

EXPLANATORY

NOTE

Pursuant

to General Instruction C of Form S-8, the resale prospectus filed as part of

this Registration Statement has been prepared in accordance with the

requirements of Part I of Form S-3 and may be used for reofferings and resales

of registered shares of common stock which have been issued upon the grants of

common stock and/or options to purchase shares of common stock to executive

officers and directors of Striker Oil & Gas, Inc.

RESALE PROSPECTUS

4

,

0

00,000 SHARES OF COMMON STOCK

OF

STRIKER OIL & GAS,

INC.

This Resale Prospectus relates to the

offer and sale of up

to

4

,

0

00,000 shares of our common stock from

time to time by selling stockholders of shares of our common stock. The common

stock is issuable to the selling stockholders from time to time under the

Plan.

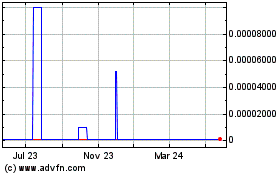

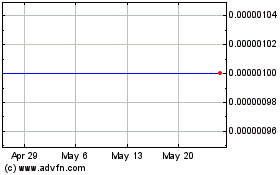

Our common stock is traded on the

Over-The-Counter Bulletin Board

under the symbol

“SOIS”

On

January 5

, 200

9

, the closing price of a share of our

common stock was $

0.08

per

share.

We will not receive any of the proceeds

from the sales by the selling stockholders. The common stock may be sold from

time to time by the selling stockholders either directly in private

transactions, or through one or more brokers or dealers, or any other market or

exchange on which the common stock is quoted or listed for trading, at such

prices and upon such terms as may be obtainable. These sales may be at fixed

prices (which may be changed), at market prices prevailing at the time of sale,

at prices related to such prevailing market prices or at negotiated

prices.

Upon any sale of the common stock, by a

selling stockholder and participating agents, brokers, dealers or market makers

may be deemed to be underwriters as that term is defined in the Securities Act,

and commissions or discounts or any profit realized on the resale of such

securities purchased by them may be deemed to be underwriting commissions or

discounts under the Securities Act.

No underwriter is being utilized in

connection with this offering. We will pay all expenses incurred in connection

with this offering and the preparation of this Resale

Prospectus.

INVESTING IN OUR COMMON STOCK INVOLVES

RISKS. SEE

“

RISK FACTORS

”

BEGINNING ON PAGE

2

.

NEITHER THE SECURITIES AND EXCHANGE

COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF

THESE SECURITIES, OR DETERMINED IF THIS RESALE PROSPECTUS IS TRUTHFUL OR

COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL

OFFENSE.

The date of this Resale Prospectus is

January

28,

2009

TABLE OF

CONTENTS

|

Risk

Factors

|

2

|

|

Where

You can Find More Information

|

6

|

|

Incorporation

of Certain Documents by Reference

|

7

|

|

Note

Regarding Forward Looking Statements

|

8

|

|

Use

of Proceeds

|

9

|

|

Dilution

|

10

|

|

Selling

Stockholders

|

11

|

|

Plan of

Distribution

|

12

|

|

Description of Securities to be

Registered

|

13

|

|

Legal

Matters

|

14

|

|

Experts

|

15

|

You should rely only on the information

contained in this Resale Prospectus or any supplement. We have not authorized

anyone to provide you with information different from that which is contained in

or incorporated by reference to this Resale Prospectus. The information

contained in this Resale Prospectus is accurate only as of the date of this

Resale Prospectus, regardless of the time of delivery of this Resale Prospectus

or of any sale of the common stock.

RISK

FACTORS

Any

investment in our securities involves a high degree of risk. You

should carefully consider the following information about these risks, together

with the other information contained in this prospectus, before you decide to

buy our securities.

Risks

Relating to the Company’s Business

We

Have a History of Losses Which May Continue, Which May Negatively Impact Our

Ability to Achieve Our Business Objectives.

We

incurred a net loss of $1,946,768

for the fiscal year ended December 31,

2007 and a net loss of

$

3,310,279 for the fiscal year ended

December 31, 2006

. We cannot assure you that we can achieve or

sustain profitability on a quarterly or annual basis in the

future. Our operations are subject to the risks and competition

inherent in the establishment of a business enterprise. There can be

no assurance that our future operations will be profitable. Revenues

and profits, if any, will depend upon various factors, including whether we will

be able to continue expansion of our revenue. We may not achieve our

business objectives and the failure to achieve such goals would have an adverse

impact on us.

If

We Are Unable to Obtain Additional Funding Our Business Operations Will be

Harmed and If We Do Obtain Additional Financing Our Then Existing Shareholders

May Suffer Substantial Dilution.

We will

require approximately $5.5 million to sustain and expand our exploration and

drilling activities during fiscal 2008. We believe that we will have

sufficient working capital to fund our current operations and debt payments for

the next twelve months; however, we will need to raise additional funds to

expand our drilling and exploration activities. Additional capital

will be required to effectively support the operations and to otherwise

implement our overall business strategy. There can be no assurance

that financing will be available in amounts or on terms acceptable to us, if at

all. The inability to obtain additional capital will restrict our

ability to grow and may reduce our ability to continue to expand our business

operations. If we are unable to obtain additional financing, we will

likely be required to curtail our development plans. Any additional

equity financing may involve substantial dilution to our then existing

shareholders.

We

Are Currently Dependent on Other Oil and Gas Operators for Operations on Our

Properties.

Some of

our current operations are properties in which we own a minority

interest. As a result, the drilling and operations are conducted by

other operators, upon which we are reliant for successful drilling and

revenues. In addition, as a result of our dependence on others for

operations on our properties, we have limited control over the timing, cost or

rate of development on such properties. As a result, drilling

operations may not occur in a timely manner or take more time than we anticipate

as well as resulting in higher expenses. The inability of these

operators to adequately staff or conduct operations on these properties, or

experience a short-fall in funding their proportionate interest, could have a

material adverse effect on our revenues and operating results.

The

Potential Profitability of Oil and Gas Ventures Depends Upon Factors Beyond Our

Control.

The

potential profitability of oil and gas properties is dependent upon many factors

beyond our control. For instance, world prices and markets for oil

and gas are unpredictable, highly volatile, potentially subject to governmental

fixing, pegging, controls, or any combination of these and other factors, and

respond to changes in domestic, international, political, social and economic

environments. Additionally, due to worldwide economic uncertainty,

the availability and cost of funds for production and other expenses have become

increasingly difficult, if not impossible, to project. These changes

and events may materially affect our financial performance.

Adverse

weather conditions can also hinder drilling operations. A productive

well may become uneconomic in the event water or other deleterious substances

are encountered which impair or prevent the production of oil and/or gas from

the well. In addition, production from any well may be unmarketable

if it is impregnated with water or other deleterious substances. The

marketability of oil and gas which may be acquired or discovered will be

affected by numerous factors beyond our control. These factors

include the proximity and capacity of oil and gas pipelines and processing

equipment, market fluctuations of prices, taxes, royalties, land tenure,

allowable production and environmental protection. These factors

cannot be accurately predicted and the combination of these factors may result

in us not receiving an adequate return on invested capital.

The

Oil and Gas Industry Is Highly Competitive and There Is No Assurance That We

Will Be Successful In Acquiring Leases.

The oil

and gas industry is intensely competitive. We compete with numerous

individuals and companies, including many major oil and gas companies, which

have substantially greater technical, financial and operational resources and

staffs. Accordingly, there is a high degree of competition for

desirable oil and gas leases, suitable properties for drilling operations and

necessary drilling equipment, as well as for access to funds. We

cannot predict if the necessary funds can be raised or that any projected work

will be completed.

If

Natural Gas or Crude Oil Prices Decrease or Our Exploration and Development

Efforts Are Unsuccessful, We May Be Required to Take Write Downs.

Our

financial statements are prepared in accordance with generally accepted

accounting principles. The reported financial results and disclosures

were developed using certain significant accounting policies, practices and

estimates, which are discussed in the Management’s Discussion and Analysis of

Financial Condition and Plan of Operations section. We follow the

full cost method of accounting for our oil and gas

properties. Accordingly, all costs associated with the acquisition,

exploration and development of oil and gas properties, including costs of

undeveloped leasehold, geological and geophysical expenses, dry holes, leasehold

equipment and overhead charges directly related to acquisition, exploration and

development activities are capitalized. Proceeds received from

disposals are credited against accumulated cost except when the sale represents

a significant disposal of reserves, in which case a gain or loss is

recognized. The sum of net capitalized costs and estimated future

development and dismantlement costs for each cost center is depleted on the

equivalent unit-of-production method, based on proved oil and gas reserves as

determined by independent petroleum engineers. Excluded from amounts

subject to depletion are costs associated with unevaluated

properties. Natural gas and crude oil are converted to equivalent

units based upon the relative energy content, which is six thousand cubic feet

of natural gas to one barrel of crude oil. Net capitalized costs are

limited to the lower of unamortized costs net of deferred tax or the cost center

ceiling. The cost center ceiling is defined as the sum of (i)

estimated future net revenues, discounted at 10% per annum, from proved

reserves, based on unescalated year-end prices and costs, adjusted for contract

provisions and financial derivatives that hedge its oil and gas reserves; (ii)

the cost of properties not being amortized; (iii) the lower of cost or market

value of unproved properties included in the cost center being amortized and;

(iv) income tax effects related to differences between the book and tax basis of

the natural gas and crude oil properties. A write down of these

capitalized costs could be required if natural gas and/or crude oil prices were

to drop precipitously at a reporting period end. Future price

declines or increased operating and capitalized costs without incremental

increases in natural gas and crude oil reserves could also require us to record

a write down.

Reserve

Estimates Depend on Many Assumptions that May Turn Out to Be Inaccurate and Any

Material Inaccuracies in These Reserve Estimates or Underlying Assumptions May

Materially Affect the Quantities and Present Value of Our Reserves.

The

process of estimating natural gas and crude oil reserves is

complex. It requires interpretations of available technical data and

various assumptions, including assumptions relating to economic

factors. Any significant inaccuracies in these interpretations or

assumptions could materially affect the estimated quantities and present value

of reserves disclosed.

In order

to prepare these estimates, we and independent petroleum engineers engaged by us

must project production rates and timing of development

expenditures. We and the engineers must also analyze available

geological, geophysical, production and engineering data, and the extent,

quality and reliability of this data can vary. The process also

requires economic assumptions with respect to natural gas and crude oil prices,

drilling and operating expenses, capital expenditures, taxes and availability of

funds. Therefore, estimates of natural gas and crude oil reserves are

inherently imprecise.

Actual

future production, natural gas and crude oil prices and revenues, taxes,

development expenditures, operating expenses and quantities of recoverable

natural gas and crude oil reserves most likely will vary from our

estimates. Any significant variance could materially affect the

estimated quantities and present value of reserves disclosed

herein. In addition, we may adjust estimates of proved reserves to

reflect production history, results of exploration and development, prevailing

natural gas and crude oil prices and other factors, many of which are beyond our

control.

Oil

and Gas Operations Are Subject to Comprehensive Regulation Which May Cause

Substantial Delays or Require Capital Outlays in Excess of Those Anticipated

Causing an Adverse Effect on the Company.

Oil and

gas operations are subject to federal, state, and local laws relating to the

protection of the environment, including laws regulating removal of natural

resources from the ground and the discharge of materials into the

environment. Oil and gas operations are also subject to federal,

state, and local laws and regulations which seek to maintain health and safety

standards by regulating the design and use of drilling methods and

equipment. Various permits from government bodies are required for

drilling operations to be conducted; no assurance can be given that such permits

will be received. Environmental standards imposed by federal or local

authorities may be changed and any such changes may have material adverse

effects on the Company’s activities. Moreover, compliance with such

laws may cause substantial delays or require capital outlays in excess of those

anticipated, thus causing an adverse effect on the

Company. Additionally, the Company may be subject to liability for

pollution or other environmental damages which it may elect not to insure

against due to prohibitive premium costs and other reasons. To date

the Company has not been required to spend any material amount on compliance

with environmental regulations. However, it may be required to do so

in the future and this may affect its ability to expand or maintain its

operations.

Exploration

and Production Activities Are Subject to Environmental Regulations Which May

Prevent or Delay the Commencement or Continuance of the Company’s

Operations.

In

general, the Company’s exploration and production activities are subject to

federal, state and local laws and regulations relating to environmental quality

and pollution control. Such laws and regulations increase the costs

of these activities and may prevent or delay the commencement or continuance of

a given operation. Compliance with these laws and regulations has not

had a material effect on the Company’s operations or financial condition to

date. Specifically, the Company is subject to legislation regarding

emissions into the environment, water discharges and storage and disposition of

hazardous wastes. In addition, legislation has been enacted which

requires well and facility sites to be abandoned and reclaimed to the

satisfaction of state authorities. However, such laws and regulations

are frequently changed and the Company is unable to predict the ultimate cost of

compliance. Generally, environmental requirements do not appear to

affect the Company any differently or to any greater or lesser extent than other

companies in the industry.

The

Company believes that its operations comply, in all material respects, with all

applicable environmental regulations. The Company’s operating

partners and the Company itself maintains insurance coverage customary to the

industry; however, it is not fully insured against all possible environmental

risks.

Exploratory

Drilling Involves Many Risks and the Company May Become Liable for Pollution or

Other Liabilities Which May Have an Adverse Effect on Its Financial

Position.

Drilling

operations generally involve a high degree of risk. Hazards such as

unusual or unexpected geological formations, power outages, labor disruptions,

blow-outs, sour gas leakage, fire, inability to obtain suitable or adequate

machinery, equipment or labor, and other risks are involved. The

Company may become subject to liability for pollution or hazards against which

it cannot adequately insure or which it may elect not to

insure. Incurring any such liability may have a material adverse

effect on its financial position and results of operations.

Any

Change to Government Regulation/Administrative Practices May Have a Negative

Impact on the Company’s Ability to Operate and Its Profitability.

The laws,

regulations, policies or current administrative practices of any government

body, organization or regulatory agency in the United States or any other

jurisdiction, may be changed, applied or interpreted in a manner which will

fundamentally alter the Company’s ability to carry on its business.

The

actions, policies or regulations, or changes thereto, of any government body or

regulatory agency, or other special interest groups, may have a detrimental

effect on the Company. Any or all of these situations may have a

negative impact on the Company’s ability to operate and/or its

profitably.

If

the Company Is Unable to Identify and Complete Future Acquisitions, It May Be

Unable to Continue Its Growth.

A portion

of the Company’s growth has been due to acquisitions of producing

properties. It expects to continue to evaluate and, where

appropriate, pursue acquisition opportunities on terms it considers to be

favorable to it. However, it may not be able to identify suitable

acquisition opportunities. Even if the Company identifies favorable

acquisition targets, there is no guarantee that it can acquire them on

reasonable terms or at all. If the Company is unable to complete

attractive acquisitions, the growth that the Company has experienced recently

may decline.

The

successful acquisition of producing properties requires an assessment of

recoverable reserves, exploration potential, future natural gas and crude oil

prices, operating costs, potential environmental and other liabilities and other

factors beyond the Company’s control. These assessments are inexact

and their accuracy inherently uncertain and such a review may not reveal all

existing or potential problems, nor will it necessarily permit the Company to

become sufficiently familiar with the properties to fully assess their merits

and deficiencies. Inspections may not always be performed on every

well, and structural and environmental problems are not necessarily observable

even when an inspection is undertaken.

In

addition, significant acquisitions can change the nature of the Company’s

operations and business depending upon the character of the acquired properties,

which may be substantially different in operating and geological characteristics

or geographic location than its existing properties.

If

the Company Is Unable to Retain the Services of Mr. Casey or if the Company Is

Unable to Successfully Recruit Qualified Managerial and Field Personnel Having

Experience in Oil and Gas Exploration, It May Not Be Able to Continue Its

Operations.

The

Company’s success depends to a significant extent upon the continued services of

Mr. Casey, the Company’s Chief Executive Officer and Mr. Robert Wonish, Chief

Operating Officer. Loss of the services of Mr. Casey or Mr. Wonish

could have a material adverse effect on the Company’s growth, revenues, and

prospective business. The Company does not have key-man insurance on

the life of Mr. Casey or Mr. Wonish. In addition, in order to

successfully implement and manage the Company’s business plan, it will be

dependent upon, among other things, successfully recruiting qualified managerial

and field personnel having experience in the oil and gas exploration and

production business. Competition for qualified individuals is

intense. There can be no assurance that the Company will be able to

find, attract and retain existing employees or that it will be able to find,

attract and retain qualified personnel on acceptable terms.

Delays

in Obtaining Oil Field Equipment and Increasing Drilling and Other Service Costs

Could Adversely Affect the Company’s Ability to Pursue Its Drilling

Program.

Due to

the recent record high oil and gas prices, there is currently a high demand for

and a general shortage of drilling equipment and supplies. Higher oil

and natural gas prices generally stimulate increased demand and result in

increased prices for drilling equipment, crews and associated supplies,

equipment and services. The Company believes that these shortages

could continue. In addition, the costs and delivery times of

equipment and supplies are substantially greater now than in prior

periods. Accordingly, the Company cannot assure you that it will be

able to obtain necessary drilling equipment and supplies in a timely manner or

on satisfactory terms, and it may experience shortages of, or material increases

in the cost of, drilling equipment, crews and associated supplies, equipment and

services in the future. Any such delays and price increases could

adversely affect the Company’s ability to pursue its drilling

program.

The

Company’s Principal Stockholders, Officers and Directors Own a Controlling

Interest in the Company’s Voting Stock and Investors Will Not Have Any Voice in

the Company’s Management.

The

Company’s officers and directors, along with two additional stockholders, own

approximately 58.8% of all votes by its shareholders. As a result,

these stockholders, acting together, will have the ability to control

substantially all matters submitted to the Company’s stockholders for approval,

including:

|

·

|

Election

of the board of directors;

|

|

·

|

Removal

of any of the directors;

|

|

·

|

Amendment

of the company’s certificate of incorporation or bylaws;

and

|

|

·

|

Adoption

of measures that could delay or prevent a change in control or impede a

merger, takeover or other business combination involving the

Company.

|

As a result of their ownership and positions, the Company’s directors,

executive officers and principal stockholders collectively are able to influence

all matters requiring stockholder approval, including the election of directors

and approval of significant corporate transactions. In addition,

sales of significant amounts of shares held by the Company’s directors and

executive officers, or the prospect of these sales, could adversely affect the

market price of the Company’s common stock. Management's stock

ownership may discourage a potential acquirer from making a tender offer or

otherwise attempting to obtain control of the Company, which in turn could

reduce its stock price or prevent its stockholders from realizing a premium over

the Company’s stock price.

Risks

Relating to the Company’s Current Financing Arrangement

There

Are a Large Number of Shares Underlying Our Convertible Debentures and Warrants

That May Be Available for Future Sale and the Sale of These Shares May Depress

the Market Price of Our Common Stock.

As of

September 30, 2008, we had 24,417,574 shares of common stock issued and

outstanding and convertible debentures outstanding that may be converted into an

estimated 6,198,927 shares of common stock and outstanding warrants to purchase

4,346,537 shares of common stock. The sale of these shares may

adversely affect the market price of our common stock.

The

Issuance of Shares Upon Conversion of the Convertible Debentures and Exercise of

Outstanding Warrants May Cause Immediate and Substantial Dilution to Our

Existing Stockholders.

The

issuance of shares upon conversion of the convertible debentures and exercise of

warrants may result in substantial dilution to the interests of other

stockholders since the selling stockholder may ultimately convert and sell the

full amount issuable on conversion. Although the debenture holder may

not convert its convertible debentures and/or exercise its warrants if such

conversion or exercise would cause it to own more than 4.99% of our outstanding

common stock, this restriction does not prevent the selling stockholder from

converting and/or exercising some of its holdings, selling these shares and then

converting the rest of its holdings. In this way, the debenture

holder could sell more than this limit while never holding more than this

limit.

If

We Are Required for Any Reason to Repay Our Outstanding Secured Convertible

Debentures, We Would Be Required to Deplete Our Working Capital, if Available,

or Raise Additional Funds. Our Failure to Repay the Convertible

Debentures, if Required, Could Result in Legal Action Against Us, Which Could

Require the Sale of Substantial Assets.

In May

2007, we entered into a securities purchase agreement for the sale of $7,000,000

principal amount of secured convertible debentures. In February 2008,

we amended the securities purchase agreement. The amended secured

convertible debentures are due and payable, with 14% interest, 42 months from

the date of issuance, unless sooner converted into shares of our common stock,

require monthly payments of principal and interest of $100,000 beginning on

March 1, 2008 and a one one-time balloon payment of $1,300,000 due and payable

on December 31, 2009. Any event of default such as our failure to

repay the principal or interest when due, our failure to issue shares of common

stock upon conversion by the holder, our failure to timely file a registration

statement or have such registration statement declared effective, breach of any

covenant, representation or warranty in the securities purchase agreement or

related secured convertible debentures, the assignment or appointment of a

receiver to control a substantial part of our properties or business, the filing

of a money judgment, writ or similar process against our company in excess of

$50,000, the commencement of a bankruptcy, insolvency, reorganization or

liquidation proceeding against us and the delisting of our common stock could

require the early repayment of the secured convertible debentures, including a

default interest rate on the outstanding principal balance of the secured

convertible debentures if the default is not cured with the specified grace

period. We anticipate that the full amount of the secured convertible

debentures will be converted into shares of our common stock, in accordance with

the terms of the secured convertible debentures. If we were required

to repay the secured convertible debentures, we would be required to use our

limited working capital and raise additional funds. If we were unable

to repay the secured convertible debentures when required, the debenture holders

could commence legal action against us and foreclose on all of our assets to

recover the amounts due. Any such action would require us to curtail

or possibly cease operations.

If

An Event of Default Occurs under the Securities Purchase Agreement, Secured

Convertible Debentures or Security Agreements, the Investor Could Take

Possession of All Our Goods, Inventory, Contractual Rights and General

Intangibles, Receivables, Documents, Instruments, Chattel Paper, and

Intellectual Property.

In

connection with the securities purchase agreement, we executed a security

agreement in favor of the investor granting it a first priority security

interest in certain of our goods, inventory, contractual rights and general

intangibles, receivables, documents, instruments, chattel paper, and

intellectual property. The security agreement states that if an event

of default occurs under the securities purchase agreement, secured convertible

debentures or security agreement, the investor has the right to take possession

of the collateral, to operate our business using the collateral, and has the

right to assign, sell, lease or otherwise dispose of and deliver all or any part

of the collateral, at public or private sale or otherwise to satisfy our

obligations under these agreements.

Risks

Relating to the Company’s Common Stock

If

the Company Fails to Remain Current in Its Reporting Requirements, It Could Be

Removed From the OTC Bulletin Board Which Would Limit the Ability of

Broker-Dealers to Sell the Company’s Securities and the Ability of Stockholders

to Sell Their Securities in the Secondary Market.

Companies

trading on the OTC Bulletin Board, such as the Company, must be reporting

issuers under Section 12 of the Securities Exchange Act of 1934, as amended, and

must be current in their reports under Section 13, in order to maintain price

quotation privileges on the OTC Bulletin Board. If the Company fails

to remain current on its reporting requirements, it could be removed from the

OTC Bulletin Board. As a result, the market liquidity for the

Company’s securities could be severely adversely affected by limiting the

ability of broker-dealers to sell the Company’s securities and the ability of

stockholders to sell their securities in the secondary market.

The

Company’s Common Stock Is Subject to the "Penny Stock" Rules of the SEC and the

Trading Market in Its Securities Is Limited, Which Makes Transactions in the

Company’s Stock Cumbersome and May Reduce the Value of an Investment in the

Company’s Stock.

The

Securities and Exchange Commission has adopted Rule 15g-9 which establishes the

definition of a "penny stock," for the purposes relevant to the Company, as any

equity security that has a market price of less than $5.00 per share or with an

exercise price of less than $5.00 per share, subject to certain

exceptions. For any transaction involving a penny stock, unless

exempt, the rules require:

|

·

|

that

a broker or dealer approve a person's account for transactions in penny

stocks; and

|

|

·

|

the

broker or dealer receive from the investor a written agreement to the

transaction, setting forth the identity and quantity of the penny stock to

be purchased.

|

In order

to approve a person's account for transactions in penny stocks, the broker or

dealer must:

|

·

|

obtain

financial information and investment experience objectives of the person;

and

|

|

·

|

make

a reasonable determination that the transactions in penny stocks are

suitable for that person and the person has sufficient knowledge and

experience in financial matters to be capable of evaluating the risks of

transactions in penny stocks

|

The

broker or dealer must also deliver, prior to any transaction in a penny stock, a

disclosure schedule prescribed by the Commission relating to the penny stock

market, which, in highlight form:

|

·

|

sets

forth the basis on which the broker or dealer made the suitability

determination; and

|

|

·

|

that

the broker or dealer received a signed, written agreement from the

investor prior to the transaction

|

Generally,

brokers may be less willing to execute transactions in securities subject to the

"penny stock" rules. This may make it more difficult for investors to

dispose of the Company’s common stock and cause a decline in the market value of

its stock.

Disclosure

also has to be made about the risks of investing in penny stocks in both public

offerings and in secondary trading and about the commissions payable to both the

broker-dealer and the registered representative, current quotations for the

securities and the rights and remedies available to an investor in cases of

fraud in penny stock transactions. Finally, monthly statements have

to be sent disclosing recent price information for the penny stock held in the

account and information on the limited market in penny stocks.

WHERE YOU CAN FIND MORE

INFORMATION

The

Company files annual, quarterly and current reports, proxy statements and other

information with the Securities and Exchange Commission (the “Commission”). You

can inspect, read and copy these reports, proxy statements and other information

at the public reference facilities the Commission maintains at Room 1024, 450

Fifth Street, N.W., Judiciary Plaza, Washington, D.C. 20549.

You can

also obtain copies of these materials at prescribed rates by writing to the

Public Reference Section of the SEC at 450 Fifth Street, N.W., Washington, D.C.

20549. You can obtain information on the operation of the public reference

facilities by calling the SEC at 1-800-SEC-0330. The Commission also maintains a

web site

http://www.sec.gov

that makes available reports, proxy statements and other information regarding

issuers that file electronically with it.

We have filed with the SEC a

Registration Statement on Form S-8 under the Securities Act of 1933, as amended,

to register with the SEC the shares of our common stock described in this Resale

Prospectus. This Resale Prospectus is part of that Registration Statement and

provides you with a general description of the Shares being registered, but does

not include all of the information you can find in the Registration Statement or

the exhibits. You should refer to the Registration Statement and its exhibits

for more information about us and the Shares being

registered.

INCORPORATION OF CERTAIN DOCUMENTS BY

REFERENCE

The SEC allows us to

“

incorporate by reference

”

information into this Resale

Prospectus, which means that we can disclose important information to you by

referring to another document filed separately by us with the SEC. The

information incorporated by reference is deemed to be part of this Resale

Prospectus, except for information superseded by this prospectus. This Resale

Prospectus incorporates by reference the documents set forth below that we have

previously filed with the SEC as of their respective filing dates. These

documents contain important information about us and our

finances.

|

(1)

|

The

Company's Annual Report on Form 10-KSB for the fiscal year ended December

31, 2007,

filed on

April 15

, 200

8, as amended on July 2, 2008 and

September 24, 2008

;

|

|

(2)

|

Quarterly Reports on Form 10-QSB

for the quarters ende

d March 31, 2007, filed on May

16

, 2007

, as amended on October 7,

2007

; June 30, 2007,

filed on August

16

, 2007

, as amended on October 9, 2007;

September 30, 2007, filed on November 14, 2007; March 31, 2008, filed on

July 2, 2008, as amended on July 2, 2008 and September 29, 2008; June 30,

2008, filed on August 19, 2008; and September 30, 2008, filed on November

19, 2008.

|

|

(3)

|

Current Reports on Form 8-K, filed

on

January 16, 2008;

January 18, 2008; February 21, 2008, February 26, 2008, as amended on

February 29, 2008; March 14, 2008; April 18, 2008; April 25, 2008; April

25, 2008; July 7, 2008; August 8, 2008, as amended on August 12, 2008;

October 3, 2008, October 29, 2008, December 29, 2008 and December 30,

2008.

|

*

All documents filed by

Strikcer Oil & Gas,

Inc. with the SEC pursuant to

Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934,

as amended, subsequent to the date of this Registration Statement and prior to

the termination of the offering to which it relates shall be deemed to be

incorporated by reference into this Registration Statement and to be a part

hereof from the date of filing of such documents. Any statement contained herein

or in a document incorporated by reference or deemed to be incorporated by

reference herein shall be deemed to be modified or superseded for purposes of

this Registration Statement to the extent that the statement is modified or

superseded by any other subsequently filed document which is incorporated or is

deemed to be incorporated by reference herein. Any statement so modified or

superseded shall not be deemed, except as so modified or superseded, to

constitute a part of this Registration Statement. Nothing in this Registration

Statement shall be deemed to incorporate information furnished by us but not

filed with the SEC pursuant to Items 2.02, 7.01 or 9.01 of Form

8-K.

NOTE REGARDING

FORWARD LOOKING STATEMENTS

Included

in this Resale Prospectus are “forward-looking” statements, as well as

historical information. Although we believe that the expectations

reflected in these forward-looking statements are reasonable, we can give no

assurance that the expectations reflected in these forward-looking statements

will prove to be correct. Our actual results could differ materially from those

anticipated in forward-looking statements as a result of certain factors,

including matters described in the section titled “Risk Factors.”

Forward-looking statements include those that use forward-looking terminology,

such as the words “anticipate,” “believe,” “estimate,” “expect,” “intend,”

“may,” “project,” “plan,” “will,” “shall,” “should,” and similar expressions,

including when used in the negative. Although we believe that the

expectations reflected in these forward-looking statements are reasonable and

achievable, these statements involve risks and uncertainties and no assurance

can be given that actual results will be consistent with these forward-looking

statements. Important factors that could cause our actual results,

performance or achievements to differ from these forward-looking statements

include the factors described in the “Risk Factors” section and elsewhere in

this Resale Prospectus.

All

forward-looking statements attributable to us are expressly qualified in their

entirety by these and other factors. We undertake no obligation to update

or revise these forward-looking statements, whether to reflect events or

circumstances after the date initially filed or published, to reflect the

occurrence of unanticipated events or otherwise.

Any

investment in our securities involves a high degree of risk. You

should carefully consider the following information about these risks, together

with the other information contained in this prospectus, before you decide to

buy our securities.

USE OF PROCEEDS

We will not receive any proceeds from

the sale of shares which may be sold pursuant to this Resale Prospectus for the

respective accounts of the selling stockholders. All such proceeds, net of

brokerage commissions, if any, will be received by the selling stockholders. See

“

Selling Stockholders

”

and

“

Plan of Distribution.

”

DILUTION

Dilution

represents the difference between the offering price and the

net

tangible

book

value

per

share immediately after completion of this offering. Net

tangible book value is the amount that results from subtracting total

liabilities and intangible assets from total assets. Dilution arises mainly as a

result of our arbitrary determination of the offering price of the shares being

offered. Dilution of the value of the shares you purchase is also a result of

the lower book value of the shares held by our existing

shareholders.

As of

September 30, 2008, the net tangible book value of our common stock was

$6,494,290 or $0.27 per share, based upon

24,417,574

shares outstanding on

September 30, 2008. Due to the nature of the 2008 Stock Option Plan,

the purchase price paid by our officer, directors, employees and consultants

under the 2008 Stock Option Plan is variable, as is the purchase price paid by

the public upon the resale by our officer, directors, employees and consultants

of our common stock. The following tables show the dilution

based upon a resale price of our common stock at $0.08 per share.

Without

taking into account any changes in the pro forma net tangible book value prior

to the this offering, other than to give effect to the issuance of 4,000,000

shares at an offering price of $0.08 per share (based upon the closing price of

our common stock on January 5, 2009) and the application of the net proceeds of

$320,000, the pro forma net tangible book value of the Company’s common stock

after this offering will be $6,814,290 or $0.21 per share. Consequently, based

on the above assumptions, the purchasers of the common stock offered hereby will

sustain an immediate substantial dilution (i.e., the difference between the

purchase price of $0.08 per share of common stock and the net tangible book

value per share) after the offering of $(0.16) per share. The following table

illustrates such dilution:

Per Share

Price ………………………………………………..……………$ 0.08

Per Share

Pro Forma Net Tangible Book Value before the Offering ……..$ 0.27

Per Share

Decrease Attributable to New Investors………………………….$(0.026)

Per Share

Pro Forma Net Tangible Book Value After the Offering ……….$ 0.21

Per Share

Dilution to New Investors ….……………………………………$(0.160)

SELLING STOCKHOLDERS

The selling stockholders will

be

our current or future

officers,

directors

, consultants

and employees

who acquire shares of our common stock

pursuant to the Plan and are considered our

“

affiliates

”

as that term is defined in the federal

securities laws. The selling stockholders may from time to time resell all, a

portion, or none of the shares of our common stock covered by this Resale

Prospectus.

As of the

date of this Prospectus, no shares of common stock were subject to existing

options under the Plan, and 4,000,000 were available for future

grants.

PLAN OF DISTRIBUTION

The Shares may be sold from time to time

by the selling stockholders, or by pledgees, donees, transferees or other

successors in interest. Such sales may be made on one or more exchanges or in

the over-the-counter market, or otherwise, at prices and at terms then

prevailing or at prices related to the then current market price, or in

negotiated transactions. The

s

hares may be sold by one or more of the

following, without limitation:

|

(a)

|

a block trade in which the broker

or dealer so engaged will attempt to sell the

s

hares as agent but may position

and resell a portion of the block as principal to facilitate the

transaction;

|

|

(b)

|

purchases by a broker or dealer as

principal and resale by such broker or dealer or for its account pursuant

to the Resale Prospectus, as

supplemented;

|

|

(c)

|

an exchange distribution in

accordance with the rules of such exchange;

and

|

|

(d)

|

ordinary brokerage transactions

and transactions in which the broker solicits

purchasers.

|

|

(1)

|

t

he selling stockholder and sales

to and through other broker-dealers or agents that participate with the

selling stockholder in the sale of the

s

hares may be deemed to be

“

underwriters

”

within the meaning of the

Securities Act in connection with these sales. In that event, any

commissions received by the broker-dealers or agents and any profit on the

resale of the Shares purchased by them may be deemed to be underwriting

commissions or discounts under the Securities

Act.

|

In addition, any securities covered by

this Resale Prospectus that qualify for sale pursuant to Rule 144 may be

sold under Rule 144 rather than pursuant to this Resale Prospectus, as

supplemented. From time to time, the selling stockholder may engage in short

sales, short sales against the box, puts and calls and other transactions in our

securities or derivatives thereof, and may sell and deliver the

s

hares in connection therewith. Sales may

also take place from time to time through brokers pursuant to pre-arranged sales

plans intended to qualify under SEC Rule 10b5-1.

There is no assurance that the

selling stockholder will sell all or any portion of the

s

hares covered by this Resale

Prospectus.

All expenses of registration of the

common stock, other than commissions and discounts of underwriters, dealers or

agents, shall be borne by us. As and when we are required to update this Resale

Prospectus, we may incur additional expenses.

DESCRIPTION OF SECURITIES

TO BE REGISTERED

General

We are authorized to issue

1,

5

0

0,000,000 shares of common stock, $.001

par value, and 25,000,000 shares of preferred stock, $0.001 par va

lue

.

Common Stock

As of

January 15

, 200

9

, there were

26,059,363

shares of common stock issued and

outstanding that was held of record by approximately

1008

stockholders

of record

.

The holders of common stock are entitled

to one vote per share with respect to all matters required by law to be

submitted to stockholders. The holders of common stock have the sole

right to vote, except as otherwise provided by law or by our certificate of

incorporation, including provisions governing any preferred

stock. The common stock does not have any cumulative voting,

preemptive, subscription or conversion rights. Election of directors

and other general stockholder action requires the affirmative vote of a majority

of shares represented at a meeting in which a quorum is

represented. The outstanding shares of common stock are validly

issued, fully paid and non-assessable.

Subject to the rights of any outstanding

shares of preferred stock, the holders of common stock are entitled to receive

dividends, if declared by our board of directors out of funds legally

available. In the event of liquidation, dissolution or winding up of

the affairs of

Striker Oil

& Gas

, the holders of

common stock are entitled to share ratably in all assets remaining available for

distribution to them after payment or provision for all liabilities and any

preferential liquidation rights of any preferred stock then

outstanding.

Nevada

anti-takeover statue and charter

provisions.

Nevada

anti-takeover

statue

. Nevada’s

“Business Combinations” statute, Sections 78.411 through 78.444 of the Nevada

Revised Statutes, which applies to Nevada corporations having at least 200

shareholders which have not opted-out of the statute, prohibits an “interested

shareholder” from entering into a “combination” with the corporation, unless

certain conditions are met. A “combination” includes (a) any merger or

consolidation with an “interested shareholder”, or any other corporation which

is or after the merger or consolidation would be, an affiliate or associate of

the interested shareholder, (b) any sale, lease, exchange, mortgage,

pledge, transfer or other disposition of assets, in one transaction or a series

of transactions, to or with an “interested shareholder,” having (i) an

aggregate market value equal to 5% or more of the aggregate market value of the

corporation’s assets determined on a consolidated basis, (ii) an aggregate

market value equal to 5% or more of the aggregate market value of all

outstanding shares of the corporation or (iii) representing 10% or more of

the earning power or net income of the corporation determined on a consolidated

basis, (c) any issuance or transfer of shares of the corporation or its

subsidiaries, to any interested shareholder, having an aggregate market value

equal to 5% or more of the aggregate market value of all the outstanding shares

of the corporation, except under the exercise of warrants or rights to purchase

shares offered, or a dividend or distribution paid or made pro rata to all

shareholders of the corporation, (d) the adoption of any plan or proposal

for the liquidation or dissolution of the corporation proposed by or under any

agreement, arrangement or understanding, whether or not in writing, with the

“interested shareholder,” (e) certain transactions which would have the

effect of increasing the proportionate share of outstanding shares of the

corporation owned by the “interested shareholder,” or (f) the receipt of

benefits, except proportionately as a shareholder, of any loans, advances or

other financial benefits by an “interested shareholder”.

An interested shareholder is a person

who (i) directly or indirectly beneficially owns 10% or more of the voting

power of the outstanding voting shares of the corporation or (ii) an

affiliate or associate of the corporation which at any time within three years

before the date in question was the beneficial owner, directly or indirectly, of

10% or more of the voting power of the then outstanding shares of the

corporation.

A corporation to which the statute

applies may not engage in a combination within three years after the interested

shareholder acquired its shares, unless the combination or the interested

shareholder’s acquisition of shares was approved by the board of directors

before the interested shareholder acquired the shares. If this approval was not

obtained, then after the three-year period expires, the combination may be

consummated if all the requirements in the corporation’s Articles of

Incorporation are met and either (a)(i) the board of directors of the

corporation approves, prior to the “interested shareholder’s” date of acquiring

shares, or as to which the purchase of shares by the “interested shareholder”

has been approved by the corporation’s board of directors before that date or

(ii) the combination is approved by the affirmative vote of holders of a

majority of voting power not beneficially owned by the “interested shareholder”

at a meeting called no earlier than three years after the date the “interested

shareholder” became such or (b) the aggregate amount of cash and the market

value of consideration other than cash to be received by holders of common

shares and holders of any other class or series of shares meets the minimum

requirements set forth in Sections 78.411 through 78.443 of the Nevada Revised

Statutes, inclusive, and prior to the consummation of the combination, except in

limited circumstances, the “interested shareholder” will not have become the

beneficial owner of additional voting shares of the

corporation.

Nevada

law permits a

Nevada

corporation to “opt out” of the

application of the Business Combinations statute by inserting a provision doing

so in its original Articles of Incorporation or Bylaws. We have not inserted

such a provision our Articles of Incorporation or our Bylaws. The Articles may

be amended at any time to subject us to the effect of the “Business

Combinations” statutes. Under

Nevada

law, our Articles of Incorporation may

be amended pursuant to a resolution adopted by our Board of Directors and

ratified by a vote of a majority of the voting power of our outstanding voting

stock.

Nevada’s “Control Share Acquisition”

statute, Sections 78.378 through 78.3793 of the Nevada Revised Statutes,

prohibits an acquiror, under certain circumstances, from voting shares of a

target corporation’s stock after crossing certain threshold ownership

percentages, unless the acquiror obtains the approval of the target

corporation’s shareholders. The statute specifies three thresholds: at least

one-fifth but less than one-third, at least one-third but less than a majority,

and a majority or more, of all the outstanding voting power. Once an acquiror

crosses one of the above thresholds, shares, which it acquired in the

transaction taking it over the threshold or within ninety days become “Control

Shares” which are deprived of the right to vote until a majority of the

disinterested shareholders restore that right. A special shareholders’ meeting

may be called at the request of the acquiror to consider the voting rights of

the acquiror’s shares no more than 50 days (unless the acquiror agrees to a

later date) after the delivery by the acquiror to the corporation of an

information statement which sets forth the range of voting power that the

acquiror has acquired or proposes to acquire and certain other information

concerning the acquiror and the proposed control share acquisition. If no such

request for a shareholders’ meeting is made, consideration of the voting rights

of the acquiror’s shares must be taken at the next special or annual

shareholders’ meeting. If the shareholders fail to restore voting rights to the

acquiror or if the acquiror fails to timely deliver an information statement to

the corporation, then the corporation may, if so provided in its Articles of

Incorporation or Bylaws, call certain of the acquiror’s shares for redemption.

The Control Share Acquisition statute also provides that the shareholders who do

not vote in favor of restoring voting rights to the Control Shares may demand

payment for the “fair value” of their shares (which is generally equal to the

highest price paid in the transaction subjecting the shareholder to the

statute).

The Control Share Acquisition statute

only applies to

Nevada

corporations with at least 200

shareholders, including at least 100 shareholders who have addresses in

Nevada

appearing on the stock ledger of the

corporation, and which do business directly or indirectly in

Nevada

. We do not have at least 100

shareholders who have addresses in

Nevada

appearing on our stock ledger.

Therefore, the Control Share Acquisition statute does not currently apply to us.

If the “Business Combination” statute and/or the “Control Share Acquisition”

statute becomes applicable to us in the future, the cumulative effect of these

terms may be to make it more difficult to acquire and exercise control over us

and to make changes in management more difficult.

Certificate of

incorporation

. Our certificate of

incorporation provides for the authorization of our board of directors to issue,

without further action by the stockholders, up to 25,000,000 shares of preferred

stock in one or more series and to fix the rights, preferences, privileges and

restrictions on the preferred stock.

These provisions are intended to enhance

the likelihood of continuity and stability in the composition of our board of

directors and in the policies formulated by our board of directors and to

discourage transactions that may involve an actual or threatened change of

control of

Striker Oil

& Gas, Inc.

These provisions are

designed to reduce the vulnerability of

Striker Oil & Gas, Inc.

to an unsolicited proposal for a

takeover of

Striker Oil

& Gas, Inc.

However, these provisions

could discourage potential acquisition proposals and could delay or prevent a

change in control of

Striker Oil & Gas, Inc.

These provisions may also

have the effect of preventing changes in the management of

Striker Oil & Gas,

Inc.

LEGAL MATTERS

The

validity of the common stock issuable under the Plan has been passed upon for us

by Brewer & Pritchard, PC.

Thomas Pritchard has

received shares of common stock in lieu of cash for past services rendered and

in the future may receive shares of common stock for services

rendered. Neither Thomas Pritchard nor Brewer & Pritchard

currently own any shares of the Company’s common stock.

Neither Thomas C.

Pritchard, nor the law firm of Brewer & Pritchard has been employed on a

contingent basis. Other than the shares of Company common stock to be issued,

neither Mr. Pritchard nor Brewer & Pritchard has or is to receive a

substantial interest direct or indirect in Registrant, nor are either of them

connected with Registrant other than in their role as outside legal counsel for

the Company.

EXPERTS

The financial statements and

management’s assessment of the effectiveness of internal control over financial

reporting (which is included in Management’s Report on Internal Control over

Financial Reporting) incorporated in this Prospectus by reference to the Annual

Report on Form 10-K

SB

for the year

ended December 31, 200

7

have been so incorporated in reliance

on the report of

Malone

& Bailey

, an

independent registered public accounting firm, given on the authority of said

firm as experts in auditing and accounting.

PART

II

ITEM 3.

INCORPORATION OF

DOCUMENTS BY REFERENCE

The

following documents filed by Striker Oil & Gas, Inc. (“the Company”) with

the Securities and Exchange Commission (“SEC”) are incorporated in this Form S-8

by reference:

|

(1)

|

The

Company's Annual Report on Form 10-KSB for the fiscal year ended December

31, 2007,

filed on April 15,

2008, as amended on July 2, 2008 and September 24, 2008

.

|

|

(2)

|

Quarterly Reports on Form 10-QSB

for the quarters ended March 31, 2007, filed on May 16, 2007, as amended

on October 7, 2007; June 30, 2007, filed on August 16, 2007, as amended on

October 9, 2007; September 30, 2007, filed on November 14, 2007; March 31,

2008, filed on July 2, 2008, as amended on July 2, 2008 and September 29,

2008; June 30, 2008, filed on August 19, 2008; and September 30, 2008,

filed on November 19, 2008.

|

|

(3)

|

Current reports on Form 8-K, filed

on January 16, 2008; January 18, 2008; February 21, 2008, February 26,

2008, as amended on February 29, 2008; March 14, 2008; April 18, 2008;

April 25, 2008; April 25, 2008; July 7, 2008; August 8, 2008, as amended

on August 12, 2008; October 3, 2008, October 29, 2008, December 29, 2008

and December 30, 2008

.

|

|

(4)

|

The

description of the Company's common stock contained in the Company's Form

10-SB filed September 27, 1999 (File No. 000-27467; Accession Number

0000890566-99-001311), including any amendment or report filed for the

purpose of updating such

description.

|

*

All documents filed by

Striker Oil & Gas, Inc.,

with the SEC pursuant to

Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934,

as amended, subsequent to the date of this Registration Statement and prior to

the termination of the offering to which it relates shall be deemed to be

incorporated by reference into this Registration Statement and to be a part

hereof from the date of filing of such documents. Any statement contained herein

or in a document incorporated by reference or deemed to be incorporated by

reference herein shall be deemed to be modified or superseded for purposes of

this Registration Statement to the extent that the statement is modified or

superseded by any other subsequently filed document which is incorporated or is

deemed to be incorporated by reference herein. Any statement so modified or

superseded shall not be deemed, except as so modified or superseded, to

constitute a part of this Registration Statement. Nothing in this Registration

Statement shall be deemed to incorporate information furnished by us but not

filed with the SEC pursuant to Items 2.02, 7.01 or 9.01 of Form

8-K.

ITEM 4.

DESCRIPTION OF

SECURITIES

Our

common stock is registered under Section 12(g) of the Securities Exchange Act of

1934 and is listed on the Over-The-Counter Bulletin Board under the symbol

“SOIS.”

ITEM 5.

INTERESTS OF NAMED

EXPERTS AND COUNSEL

The law f

irm of

Brewer & Pritchard

,

of which Thomas C. Pritchard is a

member,

has provided legal

advice to the Registrant, and has also rendered a legal opinion attached hereto

as an Exhibit, as to the validity and due issuance of the shares of the

Company’s

common

s

tock to be issued and

registered hereby.

Brewer

& Pritchard does not currently own any shares of the Company’s common stock;

however, the Com

pany will

from time to time issue shares of its common stock to

Brewer & Pritchard

or Thomas C. Pritchard as

payment for legal services rendered.

Neither

Thomas C.

Pritchard

, nor the law firm

of

Brewer &

Pritchard

has been employed

on a contingent basis.

Other than the shares of Company common

stock to be issued, n

either

Mr.

Pritchard

nor

Brewer & Pritchard

has or is to receive a substantial

interest direct or indirect in Registrant, nor are either of them connected with

Registrant other than in their role as outside legal counsel for the

Company.

ITEM 6.

INDEMNIFICATION OF

DIRECTORS AND OFFICERS

The

Company’s officers and directors are indemnified as provided by the Nevada

Revised Statutes and the Company’s bylaws.

Under the

Nevada Revised Statutes, director immunity from liability to a company or its

shareholders for monetary liabilities applies automatically unless it is

specifically limited by a company’s Articles of Incorporation, the Bylaws or by

Agreement. The Articles of Incorporation do not specifically limit the

directors’ liability; however the Bylaws specify the extent and nature of any

liability of directors, as detailed below. There are currently no agreements in

effect, which would limit such liability. Excepted from that immunity are: (a) a

willful failure to deal fairly with the company or its shareholders in

connection with a matter in which the director has a material conflict of

interest; (b) a violation of criminal law, unless the director had reasonable

cause to believe that his or her conduct was lawful or no reasonable cause to

believe that his or her conduct was unlawful; (c) a transaction from which the

director derived an improper personal profit; and (d) willful

misconduct.

Our

bylaws provide that the Company will indemnify the directors and officers to the

fullest extent not prohibited by Nevada law; provided, however, that the Company

may modify the extent of such indemnification by individual contracts with the

directors and officers; and, provided, further, that we shall not be required to

indemnify any director or officer in connection with any proceeding, or part

thereof, initiated by such person unless such indemnification: (a) is expressly

required to be made by law, (b) the proceeding was authorized by the board of

directors, (c) is provided by us, in our sole discretion, pursuant to the powers

vested us under Nevada law or (d) is required to be made pursuant to the

bylaws.

The

Company’s bylaws provide that the Company will advance to any person who was or

is a party or is threatened to be made a party to any threatened, pending or

completed action, suit or proceeding, whether civil, criminal, administrative or

investigative, by reason of the fact that he is or was a director or officer, of

the company, or is or was serving at the request of the company as a director or

executive officer of another company, partnership, joint venture, trust or other

enterprise, prior to the final disposition of the proceeding, promptly following

request therefore, all expenses incurred by any director or officer in

connection with such proceeding upon receipt of an undertaking by or on behalf

of such person to repay said amounts if it should be determined ultimately that

such person is not entitled to be indemnified under the bylaws or

otherwise.

The

Company’s bylaws provide that no advance shall be made by it to an officer of

the company, except by reason of the fact that such officer is or was a director

of the Company in which event this paragraph shall not apply, in any action,

suit or proceeding, whether civil, criminal, administrative or investigative, if

a determination is reasonably and promptly made: (a) by the board of directors

by a majority vote of a quorum consisting of directors who were not parties to

the proceeding, or (b) if such quorum is not obtainable, or, even if obtainable,

a quorum of disinterested directors so directs, by independent legal counsel in

a written opinion, that the facts known to the decision-making party at the time

such determination is made demonstrate clearly and convincingly that such person

acted in bad faith or in a manner that such person did not believe to be in or

not opposed to the best interests of the Company. Insofar as indemnification for

liabilities arising under the Securities Act of 1933 may be permitted to

directors, officers or persons controlling an issuer pursuant to the foregoing

provisions, the opinion of the Commission is that such indemnification is

against public policy as expressed in the Securities Act of 1933 and is

therefore unenforceable.

ITEM 7.

EXEMPTION FROM

REGISTRATION CLAIMED

Not

applicable.

ITEM 8.

EXHIBITS

Exhibit

No.

Identification of

Exhibit

4.1 2008

Stock Option Plan

5.1 Opinion

of Brewer & Pritchard, P.C.

23.1

Consent of Brewer & Pritchard, P.C. *

23.2

Consent of Independent Auditor

23.3

Consent of Independent Auditor

_____________________

* I

ncluded in its opinion filed as Exhibit

5.1

ITEM 9.

UNDERTAKINGS

(a) The

undersigned Registrant hereby undertakes:

|

|

(1)

|

To

file, during any period in which offers or sales are being made, a

post-effective amendment to this registration

statement:

|

i. To

include any prospectus required by Section 10(a)(3) of the Act;

|

|

ii.

|

To

reflect in the prospectus any facts or events arising after the effective

date of the Registration Statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a

fundamental change in the information set forth in the Registration

Statement. Notwithstanding the foregoing, any increase or

decrease in volume of securities offered (if the total dollar value of

securities offered would not exceed that which was registered) and any

deviation from the low or high and of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Commission

pursuant to Rule 424(b) if, in the aggregate, the changes in volume and

price represent no more than 20 percent change in the maximum aggregate

offering price set forth in the “Calculation of Registration Fee” table in

the effective registration statement;

and

|

|

|

iii.

|

To

include any material information with respect to the plan of distribution

not previously disclosed in the registration statement or any material

change to such information in the registration

statement.

|

Provided,

however, that paragraphs (a)(1)(i) and (ii) do not apply if the registration

statement is on Form S-3 or Form S-8, and the information required to be

included in a post-effective amendment by those paragraphs is contained in

periodic reports filed with or furnished to the Commission by the registrant

pursuant to Section 13 or 15(d) of the Exchange Act that are incorporated by

reference in the registration statement.

|

|

(2)

|

That,

for the purpose of determining any liability under the Securities Act,

each such post-effective amendment shall be deemed to be a new

registration statement relating to the securities offered therein, and the

offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof.

|

|

|

(3)

|

To

remove from registration by means of a post-effective amendment any of the

securities being registered which remain unsold at the termination of the

offering.

|

|

(b)

|

The

undersigned Registrant hereby undertakes that, for purposes of determining

liability under the Securities Act, each filing of the Registrant’s annual

report pursuant to Section 13(a) or 15(d) of the Exchange Act (and, where

applicable, each filing of an employee benefit plan’s annual report

pursuant to Section 15(d) of the Exchange Act) that is incorporated by

reference in the registration statement shall be deemed to be a new