Current Report Filing (8-k)

April 15 2022 - 4:08PM

Edgar (US Regulatory)

false

0001029744

0001029744

2022-04-13

2022-04-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

|

April 13, 2022 (April 15, 2022)

Date of Report (Date of earliest event reported)

|

| |

|

Sonic Foundry, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

Maryland

(State or other jurisdiction

of incorporation)

|

|

000-30407

(Commission

File Number)

|

|

39-1783372

(IRS Employer

Identification No.)

|

|

222 W. Washington Ave

Madison, WI 53703

(Address of principal executive offices)

|

(608) 443-1600

(Registrant's telephone number)

|

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

SOFO |

Nasdaq Capital Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On April 13, 2022, Sonic Foundry, Inc., a Maryland corporation (the “Company”), entered into an Underwriting Agreement (the “Underwriting Agreement”) with Maxim Group LLC (the “Underwriter”), pursuant to which the Company sold, in an underwritten public offering by the Company (the “Offering”) 1,700,000 shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”), at a public offering price of $2.55 per share. The Company has granted the Underwriter a 45-day option to purchase up to an additional 255,000 shares of Common Stock at the public offering price, less underwriting discounts and commissions.

The shares of Common Stock were offered by the Company pursuant to a registration statement on Form S-3 (File No. 333-262816), as initially filed with the Securities and Exchange Commission (the “Commission”) on February 17, 2022, and declared effective by the Commission on March 1, 2022, and a prospectus supplement dated April 13, 2022. A copy of the legal opinion and consent of McBreen & Kopko LLP relating to the validity of the issuance and sale of the shares sold in the Offering is attached as Exhibit 5.1 hereto. The Offering is expected to close on April 19, 2022, subject to the satisfaction of customary closing conditions.

The Underwriting Agreement contains customary representations and warranties, agreements and obligations, conditions to closing and termination provisions. The Underwriting Agreement provides for indemnification by the Underwriters of the Company, its directors and executive officers, and by the Company of the Underwriters, for certain liabilities, including liabilities arising under the Securities Act of 1933, as amended (the “Securities Act”) and affords certain rights of contribution with respect thereto. The foregoing description of the Underwriting Agreement is qualified in its entirety by reference to the Underwriting Agreement, which is attached as Exhibit 1.1 hereto and incorporated by reference herein.

Item 8.01 Other Events

On April 13, 2022, the Company issued a press release announcing the entry into the Underwriting Agreement. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Sonic Foundry, Inc.

(Registrant)

April 15, 2022

| |

|

|

By:

|

/s/ Kenneth A. Minor

|

|

By:

|

Kenneth A. Minor

|

|

Title:

|

Chief Financial Officer

|

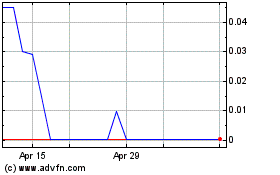

Sonic Foundry (CE) (USOTC:SOFO)

Historical Stock Chart

From Mar 2024 to Apr 2024

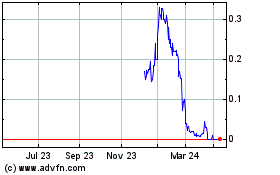

Sonic Foundry (CE) (USOTC:SOFO)

Historical Stock Chart

From Apr 2023 to Apr 2024