Roche Taps Genentech Chief to Lead Pharmaceuticals Division

December 10 2018 - 6:54AM

Dow Jones News

By Denise Roland

Roche Holding AG on Monday appointed Bill Anderson, head of its

Genentech unit, to lead the company's broader pharmaceuticals

business, elevating an insider at a critical time for the

division.

The move follows the departure of company veteran Daniel O'Day,

who is leaving the Swiss health care giant to be chief executive of

Gilead Sciences Inc. Mr. Anderson, 52, joined Genentech in 2006 and

held various sales and marketing roles before becoming head of the

subsidiary last year.

The management change comes as Roche Pharmaceuticals, the

company's largest division, confronts several challenges. Roche is,

for the first time, facing competition for its three top-selling

drugs--Herceptin, Rituxan and Avastin--as cheaper copies start to

go on sale in Europe and are set to launch in the coming years in

the U.S.

The company will also lose a lucrative revenue stream next year

after a patent protecting a key process in the manufacture of

antibody-type drugs expires this month. The Cabilly patent, as it

is known, allowed Roche to collect hundreds of millions of dollars

in royalties a year relating to some of the world's biggest-selling

drugs, including AbbVie Inc.'s Humira. The patent generated 834

million Swiss francs ($844 million) for Roche in 2017.

It will fall to Mr. Anderson to grow Roche's newer drugs, like

Ocrevus for multiple sclerosis and Perjeta for breast cancer. These

and several more of Roche's fastest-growing drugs were developed by

the Genentech subsidiary.

In an unusual arrangement, Genentech's research and development

organization competes internally with Roche's to get drugs to

late-stage development. That structure was put in place when Roche

took full ownership of Genentech in 2009 to preserve the much

younger Californian biotech company's distinctive culture.

"Bill brings both in-depth knowledge of our industry and

extensive global leadership experience," said Roche Chief Executive

Severin Schwan.

Mr. Anderson, an American, will become chief executive of Roche

Pharmaceuticals on Jan. 1. The division, which includes the

Genentech subsidiary, generates around three-quarters of Roche's

total revenue, with the rest coming from its diagnostics

business.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

December 10, 2018 06:39 ET (11:39 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

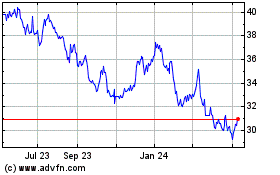

Roche (QX) (USOTC:RHHBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

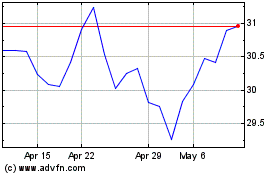

Roche (QX) (USOTC:RHHBY)

Historical Stock Chart

From Apr 2023 to Apr 2024