Reckitt Benckiser Backs 2023 View, Starts GBP1 Billion Share Buyback

October 25 2023 - 2:45AM

Dow Jones News

By Michael Susin and Joe Hoppe

Reckitt Benckiser backed its revenue growth expectations for the

full year despite slightly missing third-quarter market

expectations, and kicked off a 1 billion pound ($1.22 billion)

share-buyback program.

The consumer-goods company--which houses Dettol, Harpic and

Durex among its brands--backed guidance for 2023 revenue growth on

a like-for-like basis in the range of 3% to 5% and adjusted

operating margin to be slightly ahead of 2022 levels of 23.8%, when

excluding a one-off benefit related to U.S. nutrition.

The company reported a quarterly revenue drop of 3.6% on year on

a reported basis to GBP3.60 billion. This compares with a

company-provided market expectations of GBP3.63 billion.

Revenue growth on a like-for-like basis was 3.4%.

Reckitt said the share buyback program will begin immediately

and run over the next 12 months.

Write to Michael Susin at michael.susin@wsj.com and Joe Hoppe at

joseph.hoppe@wsj.com

(END) Dow Jones Newswires

October 25, 2023 02:30 ET (06:30 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

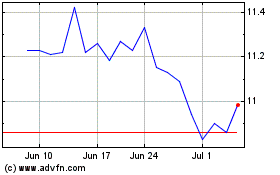

Reckitt Benckiser (PK) (USOTC:RBGLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Reckitt Benckiser (PK) (USOTC:RBGLY)

Historical Stock Chart

From Apr 2023 to Apr 2024