SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. __)

|

|

Filed by the Registrant

|

[X]

|

|

|

Filed by a Party other than the Registrant

|

[ ]

|

|

|

[ ]

|

Preliminary Proxy Statement

|

|

|

[ ]

|

Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)).

|

|

|

[X]

|

Definitive Proxy Statement

|

|

|

[ ]

|

Definitive Additional Materials

|

|

|

[ ]

|

Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12

|

PROCYON CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

[X]

|

No fee required

|

|

|

[ ]

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

1)

|

Title of each class securities to which transaction applies:

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:1 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

|

5)

|

Total fee paid:

|

|

|

[ ]

|

Fee paid previously with preliminary materials.

|

|

|

[ ]

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

1)

|

Amount Previously Paid:

|

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

|

|

3)

|

Filing Party:

|

|

|

4)

|

Date Filed:

|

PROCYON CORPORATION

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held November 12, 2019

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON NOVEMBER 12, 2019:

This Proxy Statement and the Annual Report on Form 10-K for the year ended June 30, 2019 are available on the Company’s internet website at http://www.procyoncorp.com/investor-relations.html

Notice is hereby given that the Annual Meeting of Shareholders of Procyon Corporation, a Colorado corporation (the “Company”), will be held at the offices of Procyon Corporation, 1300 S. Highland Ave, Clearwater, Florida 33756 on Tuesday, November 12, 2019, at 4:00 p.m. Eastern Time, or at any adjournment or adjournments thereof, for the following purposes:

|

|

1.

|

To elect seven directors to hold office for the term set forth in the accompanying Proxy Statement and until their successors shall have been duly elected and qualified;

|

|

|

|

|

|

|

2.

|

To ratify the appointment of Ferlita, Walsh, Gonzalez & Rodriguez, P.A. as independent registered public accountants for the 2020 fiscal year;

|

|

|

|

|

|

|

3.

|

To approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in the Procyon Corporation Proxy Statement;

|

|

|

|

|

|

|

4.

|

To consider and transact such other business as may properly come before the meeting or any adjournment thereof.

|

ALL SHAREHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING, although only shareholders of record at the close of business on September 23, 2019, will be entitled to notice of, and to vote at, the meeting or any adjournment thereof. The transfer books of the Company will not be closed.

By Order of the Board of Directors,

|

|

|

|

|

Justice W. Anderson

|

|

|

Chief Executive Officer

|

Clearwater, Florida

October 8, 2019

IMPORTANT

PLEASE MARK, DATE, SIGN, NOTE ANY CHANGE OF ADDRESS AND RETURN THE ENCLOSED PROXY CARD IMMEDIATELY IN THE ENCLOSED, SELF-ADDRESSED ENVELOPE. NO POSTAGE IS NECESSARY IF MAILED IN THE UNITED STATES. IF YOU ATTEND THE MEETING, WE WILL BE GLAD TO RETURN YOUR PROXY SO THAT YOU MAY VOTE IN PERSON.

PROCYON CORPORATION

1300 S. HIGHLAND AVENUE

CLEARWATER, FLORIDA 33756

(727) 447-2998

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

To Be Held November 12, 2019

4:00 p.m. Eastern Time

General

The enclosed proxy is solicited by the Board of Directors of Procyon Corporation (hereinafter referred to as the “Company” or “we”) for use at the Annual Meeting of Shareholders to be held at the Procyon Corporation, 1300 S. Highland Ave., Clearwater, Florida at 4:00 p.m., Eastern Time, on Tuesday, November 12, 2019, for the purposes set forth in the foregoing Notice of Annual Meeting of Shareholders. This Proxy Statement and the form of proxy will be mailed to shareholders on or about October 9, 2019. A shareholder giving a proxy has the power to revoke it at any time prior to its exercise by notifying the Secretary of the Company. Unless the proxy is revoked, or unless it is received in such form as to render it invalid, the shares represented by it will be voted in accordance with the instructions contained therein.

The record date with respect to this solicitation is September 23, 2019. All holders of record of Common Stock and Preferred Stock of the Company as of the close of business on that date are entitled to vote at the meeting. As of September 23, 2019, the Company had a total of 8,254,488 voting shares issued and outstanding consisting of 8,087,388 of Common shares, and 167,100 shares of Preferred Stock. Each Common and Preferred share is entitled to one vote. A majority of the votes entitled to be cast constitutes a quorum. If a quorum exists, action on any matter other than the election of directors will be approved if the votes cast in person or by proxy at the meeting favoring the action exceed the votes cast opposing the action. In the election of directors, that number of candidates equaling the number of directors to be elected having the highest number of votes cast in favor of their election will be elected. Abstentions and broker non-votes are not counted in the calculation of the vote. The Company’s officers and directors and director nominees, who are expected to vote for the directors nominated by the Board of Directors and to vote in accordance with the recommendations of the Board of Directors, own a majority of the Company’s outstanding shares. A shareholder may revoke a proxy at any time prior to its being voted. If a proxy is properly signed and is not revoked by the shareholder, the shares it represents will be voted at the meeting in accordance with the instructions of the shareholder. If the proxy is signed and returned without specifying choices, the shares will be voted in accordance with the recommendations of the Board of Directors. The cost of this solicitation will be borne by the Company. Employees and directors of the Company may solicit proxies on behalf of the Company but will not receive any additional compensation for such solicitation. Proxies may be solicited personally or by mail, email, facsimile or telephone.

As a matter of policy, the Company holds proxies, ballots and voting tabulations that identify individual shareholders confidential. Such documents are available for examination only by the inspectors of election, none of whom is an employee of the Company, and certain employees associated with tabulation of the vote. The identity of the vote of any shareholder is not disclosed except as may be necessary to meet legal requirements.

COMPLIANCE WITH SECTION 16(a) OF THE SECURITIES EXCHANGE ACT

Under the securities laws of the United States, the Company’s directors, its executive officers, and any persons holding more than ten percent of the Company’s Common Stock are required to report their initial ownership of the Company’s Common Stock and any subsequent changes in that ownership to the Securities and Exchange Commission and the Company. Specific due dates for these reports have been established and the Company is required to disclose any failure to file, or late filing, of such reports. Based solely on the Company’s review of the reports and amendments thereto furnished to the Company and written representations that no other reports were required to be filed in fiscal 2019, the Company’s officers, directors and beneficial owners of more than ten percent of its Common Stock complied with all Section 16(a) filing requirements.

CERTAIN RELATIONSHIPS, RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE

We adopted a written policy that requires Board approval by a disinterested majority of the directors voting for any transaction in which one of our directors, nominees for director, executive officers or greater than five percent stockholders, or their immediate family members, have a material interest. All of our directors and executive officers are required at all times, but not less than annually, to disclose all relationships they have with companies or individuals that have conducted business with, or had an interest in, our Company. Our executive officers monitor our operations, giving consideration to the disclosed relationships, and refer potential transactions to the Board of Directors for approval. The Board of Directors considers a related party transaction for its potential economic benefit to us, to ensure the transaction is, among other things, on terms no less favorable to us than those involving unrelated parties, in accordance with our policies and procedures, and that it is properly disclosed in our reports to shareholders.

Other than transactions described below, since July 1, 2018, there has not been, nor is there currently proposed, any transaction or series of similar transactions to which we were or will be a party:

|

|

•

|

in which the amount involved exceeds $120,000; and,

|

|

|

|

|

|

|

•

|

in which any director, nominee for director, executive officer, shareholder which beneficially owns five percent or more of our common stock or any member of their immediate family members, had or will have a direct or indirect material interest.

|

Regina W. Anderson, our Chairwoman and through December 2017 Chief Executive Officer and President, personally guaranteed the Company’s $250,000 line of credit of which $0 was drawn out at June 30, 2018. This line of credit expired in April of 2018 and was not renewed.

Justice W. Anderson, our Chief Executive Officer, personally guaranteed a new $250,000 line of credit of which $0 was drawn out as of June 30, 2019.

We have determined that each of our directors, except Regina W. Anderson, Justice W. Anderson and James B. Anderson, are independent within applicable rules of The NASDAQ Stock Market® (“NASDAQ Rules”). Therefore, a majority of our Board of Directors, and each member of the Audit and Compensation Committees, are independent within applicable NASDAQ rules. Further, each member of our Audit Committee is also considered independent under SEC Rule 10A-3.

ANNUAL REPORT

The Annual Report to Shareholders for the year ended June 30, 2019 (“fiscal 2019") is being sent to all shareholders with this Proxy Statement. The Annual Report to Shareholders does not form any part of the material for the solicitation of any Proxy. The Annual Report to Shareholders contains the Company’s Annual Report on Form 10-K for fiscal 2019, as filed with the Securities and Exchange Commission on September 30, 2019. An additional copy of such Report, without exhibits, is available without charge to any shareholder of the Company upon written request to James B. Anderson, Procyon Corporation, 1300 S. Highland Ave., Clearwater, Florida 33756. The Annual Report to Shareholders is also available online at http://www.procyoncorp.com/investor-relations.html.

SHAREHOLDER PROPOSALS

Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934 (the “Exchange Act”), some stockholder proposals may be eligible for inclusion in the Company’s Proxy Statement for next year’s Annual Meeting, the Company’s fiscal 2021 Annual Meeting. Shareholders who intend to submit proposals for inclusion in the 2021 Proxy Statement must do so by sending the proposal and supporting statements, if any, to the Company no later than June 11, 2020, and must meet the requirements of Rule 14a-8 under the Exchange Act. Such proposals should be sent to the attention of the Corporate Secretary, Procyon Corporation, 1300 S. Highland Ave, Clearwater, Florida 33756. The submission of a stockholder proposal does not guarantee that it will be included in the Company’s Proxy Statement. If a shareholder intends to present a proposal for consideration at the 2021 annual meeting outside of the processes of Rule 14a-8 under the Exchange Act, the SEC rules permit management to vote proxies in its discretion if we receive notice of the proposal before the close of business on August 25, 2020 and advise shareholders in our proxy statement for next year’s annual meeting about the nature of the matter and how our management intends to vote on such matter.

SHAREHOLDER COMMUNICATIONS WITH THE BOARD

The Board of Directors of the Company has implemented a process whereby shareholders may send communications to the Board’s attention. Any shareholder desiring to communicate with the Board, or one or more specific members thereof, should communicate in a writing addressed to Procyon Corporation, 1300 S. Highland Ave., Clearwater, Florida 33756. The Corporate Secretary of the Company has been instructed by the Board to promptly forward all such communications to the specified addressees thereof.

OTHER MATTERS

Except for the matters described herein, management does not intend to present any matter for action at the Annual Meeting and knows of no matter to be presented at such meeting that is a proper subject for action by the shareholders. However, if any other matters should properly come before the Annual Meeting, it is intended that votes will be cast pursuant to the authority granted by the enclosed Proxy in accordance with the best judgment of the person or person acting under the Proxy.

PROPOSALS TO BE VOTED UPON

I. ELECTION OF DIRECTORS

Information concerning the seven nominees for election as directors is shown below. If elected, each nominee will serve as director for a one-year term or until his or her successor is elected and qualified. Effective October 1, 2015, the Board of Directors has changed the number of directors from eight to seven. Michael T. Foley, our director since 2006 and Chairman of the Audit Committee, gave notice to the Company that he was resigning from the Board of Directors effective November 11, 2019. The Board of Directors has appointed Monica L. McCullough to fill the vacancy on the Board of Directors effective November 11, 2019 pursuant to our Bylaws, and has nominated Ms. McCullough stand for election in the Annual Meeting of Shareholders. All nominees, except Ms. McCullough, are now members of the Board of Directors and all nominees have been unanimously nominated to stand for election or re-election by the Board of Directors, which performs the functions of a nominating committee, and which is composed of a majority of “independent” directors, within the meaning of the applicable listing standards of The NASDAQ Stock Market® (“NASDAQ Rules”). If any nominee should for any reason become unable to serve, the shares represented by all valid proxies will be voted for the election of such other person as the Board of Directors may designate or the Board of Directors may reduce the number of directors to eliminate the vacancy. If the nominees for director are re-elected, the Board will continue to be composed of a majority of independent directors.

The following material contains information concerning the nominees, including their recent employment, positions with the Company, other directorships and age as of the date of this Proxy Statement.

|

|

|

|

|

|

|

Director

|

|

Name

|

|

Age

|

|

Capacities in Which Served

|

|

Since

|

|

Regina W. Anderson

|

|

72

|

|

Chairwoman of the Board

|

|

2005

|

|

Fred W. Suggs, Jr.

|

|

72

|

|

Director

|

|

1995

|

|

James B. Anderson

|

|

49

|

|

Director and Chief Financial Officer; Vice President - Operations, Amerx Health Care Corp.

|

|

2006

|

|

Justice W. Anderson

|

|

42

|

|

Director, Chief Executive Officer / President - Procyon President, Vice-President Marketing - Amerx Health Care Corp.

|

|

2006

|

|

Monica L. McCullough

|

|

48

|

|

Director

|

|

2019

|

|

Joseph R. Treshler

|

|

66

|

|

Director

|

|

2013

|

|

Paul E. Kudelko

|

|

79

|

|

Director

|

|

2013

|

Justice W. Anderson. Mr. Anderson currently serves as the Chief Executive Officer/President for Procyon (since January 2018) and President and V.P. of Marketing for AMERX Health Care Corporation. He has served on Procyon's Board of Directors since 2006. Mr. Anderson served as the Vice President of Sales for AMERX from January of 2001 until June of 2012 when the new V.P. of Sales was hired. Mr. Anderson has served on the Corporate Advisory Board of the American Academy of Podiatric Practice Management. Mr. Anderson joined AMERX in 2000 after receiving his B.A. degree from the University of Florida. Mr. Anderson is the son of John C. Anderson, our late President, Chief Executive Officer and Chairman of the Board, son of Regina Anderson, the Company's Chairwoman of the Board and former Chief Executive Officer/President of Procyon and the brother of James B. Anderson, our Chief Financial Officer.

Regina Anderson. Ms. Anderson has served as Chairwoman of the Board of Directors since September 2005, and as our Chief Executive Officer/President from November 2005 through December 2017. Ms. Anderson has 37 years experience in the medical field and 31 years of management experience. Ms. Anderson worked at Health South Rehabilitation Hospital for ten years as Outpatient Director, in charge of the main outpatient center plus four satellite offices. Prior to her work at HealthSouth, Regina was Vice-President of Operations at Stuffit Direct Marketing Companyfrom 1980 through 1989. Regina received her Masters Degree from Kansas State University in 1970.

James B. Anderson. Mr. Anderson, a Director since 2006, has served as our Chief Financial Officer since June 2005. In addition, from September 22, 2005, until that position was filled by Regina Anderson on November 1, 2005, Mr. Anderson served as Interim Chief Executive Officer. On June 28, 2005, Mr. Anderson was appointed to serve as the President of Sirius Medical Supply, Inc. Since 1993, Mr. Anderson has been involved with AMERX Health Care Corporation as its Chief Information Officer until 2005, when he was appointed VP of Operations. In 1996, Mr. Anderson became involved with Procyon Corporation after its merger and has since performed the duties of Vice President of Operations. Prior to Mr. Anderson's work with the Company, he was involved with importing and exporting to Russia and Direct Mail Marketing. He received a B.S. from the University of South Florida. Mr. Anderson is the son of John C. Anderson, our late President, Chief Executive Officer and Chairman of the Board, the son of Regina Anderson, the Company's Chairwoman of the Board and former Chief Executive Officer of Procyon, and the brother of Justice W. Anderson, our Chief Executive Officer/President of Procyon and Vice President of Marketing and the President of AMERX Health Care Corporation.

Fred W. Suggs, Jr. Mr. Suggs has served on our Board of Directors since 1995. He is also the Chairman of the Ethics Committee and is a member of the Compensation Committee. Mr. Suggs brings his expertise and experience as a labor lawyer. He has been a practicing attorney since 1975. He is a partner in the Greenville, South Carolina office of Ogletree, Deakins, Nash, Smoak & Stewart, specializing in labor and employment law. He has been certified as a specialist in labor and unemployment law by the South Carolina Supreme Court and is a frequent lecturer on labor and employment law issues. Mr. Suggs graduated from Kansas State University with a B.S. degree and he received his J.D. degree from the University of Alabama.

Joseph R. Treshler. Mr. Treshler was appointed director by the Board of Directors in January 2013 to fill a vacancy on the Board created by increasing the number of total Board members. Mr. Treshler serves at the Vice President of Business Management & Development of Covanta Energy Corporation, and is responsible for Covanta’s asset management, business development, project implementation, client community relations, community affairs and Clean World Initiative efforts in Florida. Mr. Treshler earned his B.S. degree in Chemical Engineering in 1974 from Iowa State University of Science and Technology. He is a Professional Engineer registered to practice in the State of Florida. Mr. Treshler was appointed by the Company’s Board of Directors to serve on the Audit Committee on January 8, 2013 and to serve on the Ethics Committee on June 7, 2013.

Dr. Paul E. Kudelko, Sr. Dr. Kudelko has served as a Director of the Company since December 2013 and is a member of the Ethics Committee. Dr. Kudelko is a retired cardiovascular physician. At the time of his retirement in 2010, Dr. Kudelko had practiced with the Clearwater Cardiovascular and Interventional Consultants for the past seven years. Dr. Kudelko attended Duquesne University, graduated from the Kirksville College of Osteopathic Medicine, and was a resident in medicine at Detroit Osteopathic Hospital and Riverside Hospital, Trenton, MI. Dr. Kudelko acted as Affiliate Assistant Professor, Department of Family Medicine, and Department of Internal Medicine, at the University of South Florida College of Medicine in Tampa, FL for a total of approximately eleven years.

Monica McCullough. Ms. McCullough is a nominee for election to the Board. If she is duly elected, we expect that she will serve as Chairman of the Audit Committee. Ms. McCullough has 25 years of accounting experience in various capacities. Her experience includes the management of several accounting functions, implementation and maintenance of Sarbanes-Oxley policies and procedures, SEC reporting, coordination of quarterly and annual audits, as well as implementing and maintaining accounting systems. She has spent the last 8 years as Facility Controller in the waste to energy industry. Ms. McCullough graduated from the University of South Florida with a B.S. degree in Accounting and is a Certified Public Accountant.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding beneficial ownership of Common Stock as of October 3, 2017 by (I) each person known by the Company to own beneficially more than 5% of the outstanding Common Stock, (ii) each director or director nominee, and (iii) all executive officers and directors as a group. Each person has sole voting and sole investment or dispositive power with respect to the shares shown except as noted. As to the Company’s preferred stock, as of October 3, 2019, no officer or director of the company owned any preferred shares.

Common Shareholdings on October 3, 2019

|

Name and Address

|

(3)

|

|

|

Number of

Shares

|

|

|

|

Percent of

Class (%)

|

|

|

Regina W. Anderson

|

|

|

|

78,060

|

|

|

|

1.0

|

|

|

Fred W. Suggs

|

(l)

|

|

|

100,000

|

|

|

|

1.2

|

|

|

James B. Anderson

|

|

|

|

81,000

|

|

(5)

|

|

1.0

|

|

|

Justice W. Anderson

|

(4)

|

|

|

3,490,500

|

|

|

|

43.2

|

|

|

Michael T. Foley

|

(2)

|

|

|

222,945

|

|

(6)

|

|

2.8

|

|

|

Joseph R. Treshler

|

(1)(2)

|

|

|

17,000

|

|

|

|

*

|

|

|

Paul E. Kudelko

|

|

|

|

0

|

|

|

|

*

|

|

|

George O. Borak

|

|

|

|

100,092

|

|

|

|

1.2

|

|

|

All directors and officers as a group (eight persons)

|

|

|

4,089,597

|

|

|

|

50.6

|

|

|

Roy M. Speer Foundation, 2535 Success Dr., Odessa, FL 33556

|

|

|

1,600,000

|

|

|

|

19.9

|

|

* Less than 1%

|

(1)

|

Member of the Compensation Committee.

|

|

(2)

|

Member of the Audit Committee. Mr. Foley will no longer be a member of the Audit Committee after November 11, 2019.

|

|

(3)

|

Except as noted above, the address for all persons listed is 1300 S. Highland Ave, Clearwater, Florida 33756

|

|

(4)

|

Mr. Anderson beneficially owns 3,350,500 shares of common stock as Trustee of the John C. Anderson Trust in accordance with Mr. Anderson's will. He also owns of record 75,000 shares of common stock.

|

|

(5)

|

Includes 10,000 shares in joint name with his wife.

|

|

(6)

|

Includes 17,945 shares of common stock owned of record by Mr. Foley's wife's trust, of which shares Mr. Foley disclaims beneficial ownership.

|

Compensation of Directors and Executive Officers.

Processes and Procedures for the Consideration and Determination of Executive and Director Compensation.

Compensation programs for our executive officers are reviewed and recommended by our Compensation Committee and are approved by the Board of Directors. None of the executive officers are members of the Compensation Committee or otherwise had any role in determining the compensation for themselves or other executives, although the Compensation Committee does receive input from the executive officers when considering adjustments to base salary and other compensation components and the Chief Executive Officer’s recommendations with respect to compensation of the other executives. The Compensation Committee conducts an annual review of our executive compensation programs to ensure that they meet the Company’s objectives. The Compensation Committee does not delegate its authority to evaluate and make recommendations to the Board concerning executive compensation to any persons. Further, the Compensation Committee has not relied in the past on any consultants in the performance of its duties. The Compensation Committee is also responsible for making recommendations concerning director compensation. Currently, the directors do not receive any compensation.

Summary Compensation Table. The following table sets forth compensation information for the two fiscal years ended June 30, 2019 and 2018 of the Company’s Chief Executive Officer and Chief Financial Officer, and the President and Vice President - Sales of our subsidiary, Amerx Health Care Corp. (the “Named Executive Officers”). Elements of compensation for our Named Executive Officers include salary, discretionary cash bonuses, non-equity incentive plan compensation and other perquisites and benefits. We do not have a pension plan and do not offer non-qualified deferred compensation arrangements. As a result, columns related to these items have been omitted from the table below.

|

Name and Principal Position

|

Year

|

|

Salary($)

|

|

|

Bonus($)

|

|

|

Option Awards ($)

|

|

|

Non-equity incentive plan compensation ($)(2)

|

|

|

All Other Compensation ($)

|

|

|

Total($)

|

|

|

Regina W. Anderson,

|

2019

|

|

$

|

70,000

|

|

|

$

|

0

|

|

|

|

0

|

|

|

$

|

5,065

|

|

|

$

|

0

|

|

|

$

|

75,065

|

|

|

President, Chief Executive Officer through December 2017

|

2018

|

|

$

|

127,890

|

|

|

$

|

0

|

|

|

|

0

|

|

|

$

|

5,973

|

|

|

$

|

0

|

|

|

$

|

133,863

|

|

|

Justice W. Anderson,

|

2019

|

|

$

|

214,043

|

|

|

$

|

0

|

|

|

$

|

0

|

|

|

$

|

15,486

|

|

|

$

|

0

|

|

|

$

|

229,529

|

|

|

President (AMERX )

CEO & President (Procyon) as of January 2018

|

2018

|

|

$

|

214,043

|

|

|

$

|

0

|

|

|

$

|

0(1)

|

|

|

$

|

15,981

|

|

|

$

|

0

|

|

|

$

|

230,024

|

|

|

James B. Anderson,

|

2019

|

|

$

|

152,900

|

|

|

$

|

0

|

|

|

|

0

|

|

|

$

|

15,486

|

|

|

$

|

0

|

|

|

$

|

168,386

|

|

|

Chief Financial Officer, Vice Pres. of Operations (AMERX )

|

2018

|

|

$

|

152,900

|

|

|

$

|

0

|

|

|

|

0

|

|

|

$

|

15,981

|

|

|

$

|

0

|

|

|

$

|

168,881

|

|

|

George O Borak,

|

2019

|

|

$

|

160,000

|

|

|

$

|

5,162

|

|

|

|

0

|

|

|

$

|

12,429

|

|

|

$

|

0

|

|

|

$

|

177,591

|

|

|

Vice Pres. Of Sales (AMERX )

|

2018

|

|

$

|

162,849

|

|

|

$

|

7,671

|

|

|

|

0

|

|

|

$

|

5,327

|

|

|

$

|

0

|

|

|

$

|

175,847

|

|

|

1.

|

Aggregate grant date fair value. 25,000 options granted with $0.19 exercise price.

|

|

2.

|

Profit sharing earned in fiscal 2018/2019 respectively, but paid on or about October 1, 2019/2020 respectively.

|

Narrative Disclosure to Summary Compensation Table

Named Executive Officer’s Employment Contracts

On March 9, 2018, Procyon and Amerx executed an Amended and Restated Executive Employment Agreement, effective January 9, 2018, with Regina W. Anderson, to serve as the Corporation's Chairwoman of the Board for term through December 31, 2018, subject to approval by the Corporation's Board of Directors at the Annual Meeting. The Agreement can be terminated upon thirty day's notice with or without cause. The Agreement provides for a base annual salary of $70,000 and other benefits, including certain incentive bonus compensation based upon the Corporation's net income before Net Operating Loss.

Justice W. Anderson's Restated and Amended Executive Employment Agreement, which is effective July 1, 2019, provides for a base annual salary of $240,000 and other benefits, including certain incentive bonus compensation based upon Amerx achieving certain financial goals for sales and net profit and at the discretion of the Board of Directors. Mr. Anderson's Agreement calls for a term of one year, but may be terminated by either party, with or without cause, upon thirty day's written notice.

James B. Anderson's Restated and Amended Executive Employment Agreement, which is effective July 1, 2019, provides for a base annual salary of $165,000 and other benefits, including short-term and long-term incentive bonus compensation based upon Amerx achieving certain operational and financial goals and at the discretion of the Board of Directors. Mr. Anderson's Agreement calls for a term of one year, but may be terminated by either party, with or without cause, upon thirty day's written notice.

George Borak's Restated and Amended Executive Employment Agreement, which is effective July 1, 2019, provides for a base annual salary of $170,000 and other benefits, including certain incentive bonus compensation based upon Amerx achieving certain financial goals for sales and net profit and at the discretion of the Board of Directors. Mr. Borak's Agreement calls for a term of one year, but may be terminated by either party, with or without cause, upon thirty day's written notice.

Outstanding Equity Awards

An Agreement to grant 40,000 Options to purchase common stock was executed and delivered to Justice Anderson, pursuant to his executive employment agreement, on September 27, 2016, but with a grant date of June 30, 2016.

An Agreement to grant 25,000 Options to purchase common stock was executed and delivered to Justice Anderson, pursuant to his executive employment agreement, on August 23, 2017, but with a grant date of June 30, 2017.

Compensation of Directors

No employee of the Company receives any additional compensation for his services as a director. No non-employee director receives any compensation for his service; however, the Board of Directors has authorized payment of reasonable travel or other out-of-pocket expenses incurred by non-management directors in attending meetings of the Board of Directors. The Board of Directors may consider alternative director compensation arrangements from time to time.

Stock Option Plan

The Company maintains the Procyon Corporation 2009 Stock Option Plan (the “2009 Option Plan”).

The 2009 Option Plan was approved by our shareholders on December 8, 2009. Pursuant to the terms of the 2009 Option Plan, the plan shall continue in effect until December 8, 2019. The purpose of the 2009 Option Plan is to advance the interests of the Company and the Company’s stockholders by enhancing the Company’s ability to attract, retain and motivate persons who are expected to make important contributions to the Company and by providing such persons with equity ownership opportunities and performance-based incentives that are intended to better align the interests of such persons with those of the Company’s stockholders.

The 2009 Option Plan provides for the granting of Incentive Stock Options, meeting the requirements of §422 of the Internal Revenue Code (the “Code”), Non-Qualified Stock Options, which do not qualify as Incentive Stock Options, and Stock Appreciation Rights (“SARs”) (together, an “Award”). The Plan is administered by our Compensation Committee.

The Board of Directors has authorized the issuance of 500,000 shares of common stock to underlie the granting of Incentive Stock Options and 500,000 shares of common stock to underlie the granting of Non-Qualified Stock Options and SARs under the 2009 Option Plan. The Board issued 250,000 shares of common stock to underlie Non-Qualified Stock Options on September 27, 2016, effective on June 30, 2016. As of June 30, 2019, 65,000 Options to purchase common stock were awarded to Justice Anderson, pursuant to the terms of his employment agreements, effective October 1, 2015 and July 1, 2016. The 1,000,000 shares of common stock that have been reserved for the 2009 Option Plan have not been registered under the Securities Act of 1933. We have no present plans to register such shares.

Eligible participants under the 2009 Option Plan must be such full or part-time officers and other Employees, Non-Employee Directors and key persons (including consultants and prospective employees) of the Company and its Subsidiaries as are selected from time to time by the Compensation Committee in its sole discretion. Only employees may receive Incentive Stock Options. Employees, non-employee directors and consultants may receive Non-Qualified Stock Options or SARs.

Non-Qualified Stock Options granted under the 2009 Option Plan many have a term of not more than ten years from the date of grant. The exercise price must be not less than 100% of the fair market value of the underlying common stock on the date of grant. Incentive Stock Options can be granted under the 2009 Option Plan for a term not exceeding ten years, except for Ten Percent Owners of our common stock, as defined in the Plan, for whom the maximum option term is five years. Incentive Stock Options are granted with an exercise price of not less than 100% of the fair market value of the underlying common stock on the date of grant. However, for Incentive Stock Options owned by Ten Percent Owners, the exercise price must be 110% of the Fair Market Value of the underlying stock on the date of grant.

Committees of the Board

The Board of Directors has delegated certain of its authority to a Compensation Committee, an Audit Committee and an Ethics Committee.

The Compensation Committee is composed of Mr. Suggs (Chairman) and Mr. Treshler. The Compensation Committee adopted a Charter on December 8, 2007. The Compensation Committee charter may be viewed on our website at http://www.procyoncorp.com/investor-relations.html. Each member of the Compensation Committee is not a former or current officer or employee of the Company and is otherwise independent within the meaning of the applicable NASDAQ Rules. The primary function of the Compensation Committee is to review and make recommendations to the Board with respect to compensation matters, including bonuses for employees, and to administer the Company’s Option Plan. Historically, review and adjustment of compensation of our executive officers has primarily been determined by our Chief Executive Officer. See also, “Processes and Procedures for the Consideration and Determination of Executive and Director Compensation,” above.

The Company formed an Audit Committee in July 2004. In December 2006, the Board nominated Michael T. Foley as Audit Committee member and Chair. In January 2013, the Board appointed Joseph R. Treshler as director and a member of the Audit Committee. The Board believes that Mr. Foley and Mr. Treshler are independent pursuant to NASDAQ rules and Mr. Foley and Mr. Treshler also meet the requirements of an “audit committee financial expert” under applicable SEC Rules. In addition, we have determined that Mr. Foley and Mr. Treshler are independent within the meaning of SEC Rule 10A-3(b)(1). Mr. Foley resigned from the Audit Committee effective November 11, 2019. The Board anticipates appointing Monica McCollough to the Audit Committee if Ms. McCullough is elected as a director.

The Audit Committee adopted a Charter, effective October 27, 2006.The Audit Committee Charter can be viewed on our website at http://www.procyoncorp.com/investor-relations.html. Pursuant to its Charter, the primary function of the Audit Committee is to review and approve the scope of audit procedures employed and to review and approve the audit reports rendered by the Company’s independent auditors and to approve the audit fees charged by the independent auditors. In addition, pursuant to the Sarbanes-Oxley Act of 2002 and rules promulgated thereunder, the Audit Committee is responsible for, among other things, pre-approving all audit and non-audit services performed by the independent auditors, approving the engagement of the auditors and receiving certain reports from the independent auditors prior to the filing of the audit report. The Audit Committee reports to the Board of Directors with respect to such matters and recommends the selection of independent auditors.

The Company does not have a Nominating Committee. However, the entire board of directors, which is comprised of a majority of independent directors pursuant to applicable NASDAQ rules, performs the function of a nominating committee. The Company believes that a separate committee is not necessary for a company of its size. For purposes of the Audit Committee and the foregoing statement, the Company has used the definition of “independent director” as contained in the corporate governance rules of NASDAQ, as amended.

The Company also formed an Ethics Committee of the board members in 2004. The members are Messrs. Suggs (Chairman) and Kudelko. The charter for the ethics committee may be viewed on the Company website (http://procyoncorp.com/images/stories/Code_of_Ethics_Senior_Officers.pdf).

Director Independence

We believe that Messrs. Suggs, Foley, Treshler and Kudelko are independent directors as defined under applicable NASDAQ rules. Regina W. Anderson, James B. Anderson and Justice W. Anderson are not deemed to be independent directors as each is an executive officer or the Company and/or its subsidiaries. We believe Messrs. Foley and Treshler also meet the audit committee independence requirements of SEC Rule 10A-3(b)(1). We believe that Monica McCollough, if elected, will be an independent director under applicable NASDAQ rules and that, if appointed to the Audit Committee, she meets the audit committee independence requirements under SEC Rule 10A-3(b)(1).

Board Leadership Structure and Role in Risk Oversight

We have no formal policy concerning the separation or combination of the Chief Executive Officer and Chairman of the Board positions. Our Board has the right to exercise its judgment to choose the Chairman as it deems best for the Company at any point in time. Currently, Regina Anderson serves as Chairwoman of the Board and Justice W. Anderson serves as Chief Executive Officer/President. The Board has not appointed a “lead independent director.” We believe that our Board leadership structure is appropriate for a company of our size, particularly where we have a majority of independent directors.

We currently have seven directors, a majority of whom are independent. There are three committees of the Board, each comprised and chaired solely by independent directors. Risk management is overseen by the Board as a whole, but also through our committees, particularly the Audit and Ethics Committees, which report to the Board. Our Board, with the assistance of the Audit and Ethics Committees, reviews the Company’s risk oversight framework, and the Board receives regular reports not only from Board committees but also directly from senior management regarding certain major risks facing the Company and its operating subsidiary and the steps taken by management to manage and mitigate those risks. We believe that our Board provides effective oversight of the risk management function, especially through the work of the Audit and Ethics committees.

Nomination Procedures

Shareholders may recommend director candidates for inclusion by the board of directors in the slate of nominees which the board recommends to shareholders for election. The qualifications of recommended candidates will be reviewed by the board. If the Board determines to nominate a stockholder-recommended candidate and recommends his or her election as a director by the shareholders, his or her name will be included in the Company’s proxy card for the stockholder meeting at which his or her election is recommended.

Shareholders may recommend individuals to the board for consideration as potential director candidates bysubmitting their names and background to the Company’s Corporate Secretary, at the Company’s address set forth above. Such recommendations will be forwarded to the board. The board will consider a recommendation only if appropriate biographical information and background material is provided on a timely basis.

In order to be considered timely, shareholder nominations for our next annual meeting for fiscal 2021, along with all required information, must be received by the Company no later than June 11, 2020.

The process followed or expected to be followed by the board to identify and evaluate candidates includes requests to board members and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates and interviews of selected candidates by members of the board.

Assuming that appropriate biographical and background material is provided for candidates recommended by shareholders, the board will evaluate those candidates by following substantially the same process, and applying substantially the same criteria, as for candidates submitted by board members or by other persons. In considering whether to recommend any candidate for inclusion in the board’s slate of recommended director nominees, including candidates recommended by shareholders, the board will consider, among other things, the candidate’s:

|

|

•

|

integrity and honesty,

|

|

|

|

|

|

|

•

|

ability to exercise sound, mature and independent business judgment in the best interests of the shareholders as a whole,

|

|

|

|

|

|

|

•

|

background and experience with manufacturing, retailing, operations, finance, marketing or other fields which will complement the talents of the other board members,

|

|

|

|

|

|

|

•

|

willingness and capability to take the time to actively participate in board and Committee meetings and related activities,

|

|

|

|

|

|

|

•

|

ability to work professionally and effectively with other board members and Company management,

|

|

|

|

|

|

|

•

|

availability to remain on the board long enough to make an effective contribution, and

|

|

|

|

|

|

|

•

|

absence of material relationships with competitors or other third parties that could present realistic possibilities of conflict of interest or legal issues; and

|

|

|

|

|

|

|

•

|

experience with accounting rules and practices.

|

The board does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees. The board believes that the backgrounds and qualifications of the directors, considered as a group, should provide a significant composite mix of experience, diversity, knowledge and abilities that will allow the board to fulfill its responsibilities.

Audit Committee Report

In October 2019, the Audit Committee, submitted the following report:

We have reviewed and discussed with management the Company’s audited financial statements for the year ended June 30, 2019 (the “Fiscal Year 2019 Financial Statements”).

We have discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1. AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T.

We have received and reviewed the written disclosures and the letter from the independent auditors required by Independence Standard No. 1 (Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees), as adopted by the Public Company Accounting Oversight Board in Rule 3200T, and have discussed with the auditors the auditors’ independence.

Based upon the reviews and discussions referred to above, we recommended to the Board of Directors that the Fiscal Year 2019 Financial Statements be included in the Company’s annual report on Form 10-K for Fiscal Year 2019 for filing with the Securities and Exchange Commission.

This Audit Committee Report shall not be deemed incorporated by reference in any document previously or subsequently filed with the Securities and Exchange Commission that incorporates by reference all or any portion of the proxy statement, in connection with the annual meeting, except to the extent that the Company specifically requests that this Report be specifically incorporated by reference.

|

|

Date: October 1, 2019

|

Michael T. Foley, Audit Committee member and Chairman

Joseph R. Treshler, Audit Committee member

|

Board and Committee Meeting Attendance

In fiscal 2019, the Board of Directors held eight formal meetings. The Compensation Committee held seven meetings, the Audit Committee held two meetings, and the Ethics Committee held two meetings during fiscal 2019. All directors attended at least 75% of the Board and applicable committee meetings in person or by telephone.

The Company encourages, but does not require, Board members to attend the annual meeting of shareholders. All but one of the directors attended last year’s annual meeting.

Code of Ethics for Senior Financial Officers

The Company has adopted a Code of Ethics for Senior Financial Officers, a copy of which can be viewed on our website, http://www.procyoncorp.com/investor-relations.html. The Code of Ethics applies to all senior financial officers of the Company, including the Chief Executive Officer, the Chief Financial Officer, the Treasurer and any other person performing similar functions.

The Board of Directors has unanimously approved and recommends that shareholders vote FOR the director nominees identified above.

II. RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS FOR THE COMPANY FOR FISCAL 2020.

Our Audit Committee has approved the engagement of Ferlita, Walsh, Gonzalez & Rodriguez, P.A. of Tampa, Florida, to act as our independent registered public accountants for fiscal 2020, subject to approval of our shareholders in this proposal for the annual meeting. Ferlita, Walsh, Gonzalez & Rodriguez, P.A., and its predecessor, has examined the financial statements of the Company beginning with the fiscal year ended June 30, 1999. No members of Ferlita, Walsh, Gonzalez & Rodriguez, P.A. are expected to be in attendance at the annual meeting.

Audit Fees. In fiscal 2019, the Company paid to its independent accountants $58,750 in fees related directly to the audit and review of the Company's financial statements. In fiscal 2018, the Company paid to its independent accountants $52,750 in fees related directly to the audit and review of the Company's financial statements.

Audit-Related Fees. The Company's independent accountants performed no other audit-related services for the Company during fiscal 2019 and 2018, other than the audit services described above.

Tax Fees: In fiscal 2019, the Company paid to its independent accountants $2,000 in fees related directly to tax preparations. In fiscal 2018, the Company paid to its independent accountants $2,000 in fees related directly to tax preparations.

Audit Committee Pre-Approval Procedures. Procyon’s independent auditor reports to, and is engaged at the direction of, the Audit Committee, with annual approval by the shareholders. Our Board implemented, and the Audit Committee ratified, procedures for the pre-approval of audit and non-audit services performed by the Company’s independent auditors. The Audit Committee has the sole authority to pre-approve all audit and non-audit services provided by the independent auditors to the Company and acts to assure that the independent auditors are not engaged to perform specific non-audit services proscribed by law or regulation.

The Board of Directors recommends a vote FOR ratification of Ferlita, Walsh, Gonzalez & Rodriguez, P.A. as independent auditors for the Company for the 2020 fiscal year.

III. ADVISORY VOTE ON EXECUTIVE COMPENSATION.

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act, and Section 14A of the Securities Exchange Act of 1934, the Company's shareholders are now entitled to vote to approve, on an advisory basis, the compensation of the Company's named executive officers as disclosed in this proxy statement in accordance with SEC rules. This vote is not intended to address any specific item of compensation, but rather the overall compensation of the Company's named executive officers and the philosophy, policies and practices described in this proxy statement.

The Company has designed its executive compensation program to attract, motivate, reward and retain the senior management talent required to achieve our corporate objectives and to increase long-term shareholder value. The compensation of the Company's named executive officers subject to the vote is disclosed above in the Executive Compensation summary, the compensation tables, and the related narrative disclosure contained in this proxy statement. We believe the mix of fixed and performance-based compensation and the terms of long-term and short-term incentive compensation for certain of our named executive officers are all designed to enable us to attract and maintain top talent while, at the same time, creating a close relationship between performance and compensation.

Accordingly, the Board is asking the shareholders to indicate their support for the compensation of the Company's named executive officers as described in this proxy statement by casting a non-binding advisory vote "FOR" the following resolution: "RESOLVED, that the compensation paid to the Company's named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Executive Compensation discussion, compensation tables and narrative discussion contained in the proxy statement, is hereby APPROVED."

Because the vote is advisory, it is not binding on the Board. Nevertheless, the views expressed by the shareholders, whether through this vote or otherwise, are important to management and the Board. Accordingly, the Board and the Compensation Committee intend to consider the results of this vote in making determinations in the future regardingexecutive compensation arrangements.

Advisory approval of this proposal requires the vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting.

The Board of Directors recommends that shareholders vote FOR Proposal 3.

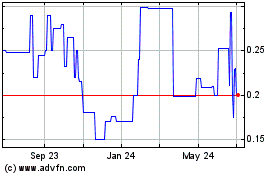

Procyon (PK) (USOTC:PCYN)

Historical Stock Chart

From Mar 2024 to Apr 2024

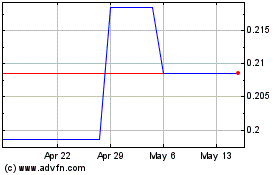

Procyon (PK) (USOTC:PCYN)

Historical Stock Chart

From Apr 2023 to Apr 2024