Current Report Filing (8-k)

July 31 2019 - 11:40AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 25, 2019

Natur

International Corp.

(Exact

name of registrant as specified in its charter)

|

Wyoming

|

|

000-54917

|

|

45-5547692

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

|

Jachthavenweg

124

1081

KJ Amsterdam

The

Netherlands

|

|

N/A

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code:

+31 20 578 7700

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company

☐

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

on exchange on which registered

|

|

None

|

|

-

|

|

-

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 — Entry into a Material Definitive Agreement

Business

Acquisition Agreements

On

July 25, 2019, Natur International Corp. (“Company”) finalized a Purchase and Recapitalization Agreement, dated as

of July 24, 2019 (“Agreement”), with DRBG Holdco, LLC, a Delaware limited liability company (“DRBG”),

Temple Turmeric, Inc., a Delaware corporation (“Temple”), Daniel Sullivan, an individual (“DS”), Tim Quick,

an individual (“TQ”), and TQ Holdings LLC, a New Hampshire limited liability company (“TQH”) to acquire

the business of Temple. Under the Agreement the Company acquired 15,121,984 shares of Series A Preferred Stock (the “Series

A Shares”) of Temple from DRBG for a nominal amount and agreed to acquire from TQH a promissory note in the principal amount

of $100,000 plus all accrued and unpaid interest. The Company caused Temple to issue to DRBG a warrant to acquire a percentage

of the Temple equity (“Warrant”). The Temple board of directors will have three of the five directors appointed by

the Company pursuant to the terms of the Series A Shares and the current certificate of incorporation of Temple. The Series A

Shares represent approximately 52% of the equity of Temple, on a fully diluted basis.

Under

the Agreement the Company will provide working capital to Temple in the amount of not less than $150,000 but up to $250,000. The

Company will acquire additional equity ownership of Temple for its investment further investment in Temple, based on a valuation

of Temple of $1,000,000. This further investment will increase the controlling position of the Company in combination with its

ownership of the Series A Shares.

The

Warrant is exercisable for the greater of 1,493,735 shares of common stock of Temple or 2.5% of the equity of the Temple on a

fully diluted basis. The exercise price per share is the par value of the common stock of Temple to be acquired upon exercise

of the Warrant. The exercise period is ten years, but not later than the earlier of the consummation of the initial public offering

by Temple or a sale transaction of Temple, as defined in the Warrant. The Warrant has a limited cashless conversion right and

has typical anti-dilution rights for dividends, reverse splits and changes in the capitalization of Temple.

The

above descriptions of the Agreement and the Warrant are only summaries and do not purport to be complete. They are qualified in

their entirety by reference to the Agreement and Warrant, which are filed as Exhibits 10.1 and 10.2, respectively, to this Current

Report on Form 8-K and are incorporated herein by reference.

Business

Description of Temple

Founded

in 2009, Brooklyn-based Temple’s mission is to bring the highest quality turmeric to the world by pioneering the first Turmeric-based

ready to drink beverage line. Temple has driven consumer understanding and demand for Turmeric as it has become more and more

widely consumed through this decade. Temple now adds adaptogenic herbs and ancient superfood formulations to beverages with a

turmeric foundation.

Item

8.01 — Other Events.

On

July 31, 2019, the Company issued a press release announcing the completion of its acquisition of Temple. A copy of the press

release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item

9.01 — Financial Statements and Exhibits.

(a) Financial

Statements of Businesses Acquired.

Unaudited

historical financial information for Temple Turmeric, Inc. as of and for the six months ended June 30, 2018 and June 30, 2019,

and audited historical information for Temple Turmeric, Inc. as of December 31, 2017 and December 31, 2018, and for the years

ended December 31, 2017 and 2018, will be included in an amendment to this Current Report on Form 8-K to be filed with the SEC

within the period required pursuant to applicable SEC rules.

(b) Pro

Forma Financial Information.

Pro

forma financial information relating to the Agreement as of and for the six months ended June 30, 2019 and the year ended December

31, 2018, will be included in an amendment to this Current Report on Form 8-K to be filed with the SEC within the period required

pursuant to applicable SEC rules.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

Natur

International Corp.

|

|

|

|

|

Date:

July 31, 2019

|

By:

|

/s/

Ruud Huisman

|

|

|

Name:

|

Ruud

Huisman

|

|

|

Title:

|

Chief

Financial Officer

|

3

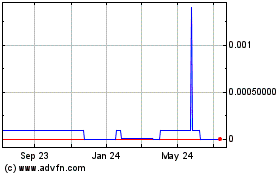

Natur (CE) (USOTC:NTRU)

Historical Stock Chart

From Mar 2024 to Apr 2024

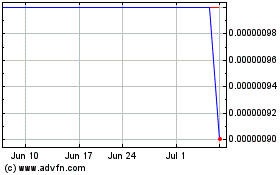

Natur (CE) (USOTC:NTRU)

Historical Stock Chart

From Apr 2023 to Apr 2024