Stocks, Bond Yields Start the Week With Fresh Declines

June 03 2019 - 8:26AM

Dow Jones News

By Avantika Chilkoti

U.S. stock markets were set to track bond yields lower Monday,

as investors assessed the prospect of fresh trade dialogue between

the U.S. and Mexico and China.

The 10-year U.S. Treasury yield dropped to 2.116% Monday from

2.139% Friday and below the 2.346% on equivalent three-month bonds

Monday.

Investors have rushed into haven bonds in recent sessions as

trade tensions returned, sending the yield on the 10-year U.S.

Treasurys lower than the equivalent three-month bonds, a phenomenon

known as an inverted yield curve and widely seen as a harbinger of

economic recession.

Meanwhile, futures pointed to opening losses on Wall Street of

0.2% for both the Dow Jones Industrial Average and the S&P

500.

The Stoxx Europe 600 was down 0.2%, led lower by the region's

banks. The Stoxx Europe 600 Bank Index lost 1% Monday, with shares

in Deutsche Bank sinking 3.6%.

Shares in Infineon Technologies dropped 8.1% after the

semiconductor firm announced plans to buy Cypress Semiconductor, a

deal that would create the biggest supplier of chips to the

automotive market.

The German market drifted lower after the chairwoman of

Chancellor Angela Merkel's junior coalition partner stepped down,

adding to uncertainty over the government in Berlin.

The yield on 10-year German government debt pushed further into

negative territory at minus-0.204%. Yields move inversely to

prices.

In Asia, the Shanghai Stock Exchange lost 0.3%, Hong Kong's Hang

Seng Index was flat and Japan's Nikkei was down 0.9%.

China and Mexico both suggested they were willing to negotiate

with the U.S. on trade issues as tensions ramped up. Last week, Mr.

Trump said on Twitter the U.S. would impose escalating tariffs on

Mexico beginning June 10 if the country doesn't stem the flow of

migrants across the border. Equity markets responded with

declines.

"All you need is one tweet and it lights a match under the

market," said Patrick Spencer, vice chairman for equities at

Baird.

Still, some investors are optimistic that tensions with the U.S.

and its various trading partners will ease as leaders see the

conflict weighing on global financial markets and economic

growth.

"It is bad for everybody, so in the end we are bound to get a

trade deal, " said Stuart Mitchell, managing partner of boutique

asset manager S.W. Mitchell Capital in London.

This weekend, Mr. Trump took to Twitter to announce that Mexico

would send a delegation to the U.S., adding that Washington wants

"action" and not just "talk" on migration.

In addition to hitting equity markets, renewed trade concerns

have driven down yields on key sovereign bonds, often seen as

havens when investors grow risk-averse.

The WSJ Dollar Index, which tracks the dollar against a basket

of 16 currencies, was broadly flat.

Analysts at Barclays now forecast a 75 basis point cut in rates

by the Federal Reserve in the second half of this year, as rising

trade tensions drag on global growth.

"We view the expansion of tariffs to Mexico as an important

development since it lowers the bar for tariffs on other important

U.S. trading partners, including Europe," wrote Michael Gapen and

Jonathan Millar at Barclays in a recent note.

Looking ahead, investors were anticipating fresh data on U.S.

manufacturing later Monday and the next jobs report Friday for

clues on how trade concerns are affecting the domestic economy.

On Tuesday, Europe's statistics agency will provide fresh

estimates on employment and inflation in the region. The figures

are expected to show an annual rate of inflation of 1.4% in May,

slowing from 1.7% in April and well under the European Central

Bank's target of just below 2%.

In commodities, global benchmark Brent crude oil was up 0.8% at

$62.49 a barrel.

Write to Avantika Chilkoti at Avantika.Chilkoti@wsj.com

(END) Dow Jones Newswires

June 03, 2019 08:11 ET (12:11 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

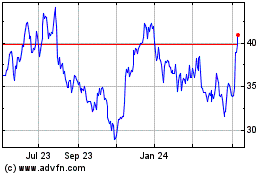

Infineon Technologies (QX) (USOTC:IFNNY)

Historical Stock Chart

From Aug 2024 to Sep 2024

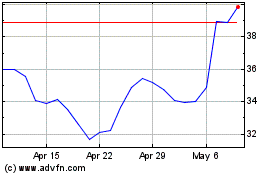

Infineon Technologies (QX) (USOTC:IFNNY)

Historical Stock Chart

From Sep 2023 to Sep 2024