Henkel Scoops Up U.S. Maker of Wisk -- WSJ

June 25 2016 - 3:03AM

Dow Jones News

By Monica Houston-Waesch and Ellen Emmerentze Jervell

Germany's Henkel AG agreed to buy the maker of All and Wisk

laundry detergents for about $3.6 billion, as the consumer-products

company presses its competition with Procter & Gamble Co. in

the U.S.

The EUR3.2 billion transaction combines Henkel, whose major

brands include Persil laundry detergent and Dial soap, with Sun

Products Corp., which in addition to detergents sells Snuggle

fabric softener and Sunlight household soaps. The deal gives the

European company a bigger presence at U.S. retail chains. Last

year, Sun Products generated sales of about $1.6 billion in the

U.S. and Canada.

"North America is one of the most important regions for us

world-wide," said Henkel Chief Executive Hans Van Bylen. The

company is pushing hard to take on P&G in its home market. The

U.S. is currently Henkel's largest region in terms of revenue, it

said. The Düsseldorf, Germany-based company reported North American

regional sales of EUR3.6 billion in 2015 out of total revenue of

about EUR18 billion.

Deutsche Bank estimates that Henkel together with Sun will have

21.3% of the U.S. liquid laundry market, leapfrogging Church &

Dwight, with 17.1%, and trailing PG's dominant 55% share.

Sun Products, which is based in Wilton, Conn., was created in

2008 after another European consumer-products giant, Unilever NV,

decided to exit the North American laundry detergent business.

That is when Unilever sold All, Snuggle and other brands to New

York-based private-equity firm Vestar Capital Partners Inc. for

about $1.45 billion.

Sun's midprice laundry detergents have been struggling in the

U.S., squeezed between P&G's Tide at the premium-priced end of

the market and Church & Dwight Co.'s Arm & Hammer discount

offering, according to analysts. The company employs around 2,000

people and has two production sites as well as one research and

development center in the U.S.

Henkel's former chief executive, Kasper Rorsted, said late last

year, before stepping down, that he wanted the company's U.S.

business to become between 25% and 27% of its total business, up

from 20% then.

In 2015, Henkel struck a deal with Wal-Mart Stores Inc. in which

the retailer agreed to be the exclusive carrier of Henkel's

premium-priced Persil, challenging Tide. It also recently acquired

other U.S. companies, including several professional hair-care

brands and Bergquist Co., a maker of insulation and other

thermal-management products.

Write to Monica Houston-Waesch at nikki.houston@wsj.com and

Ellen Emmerentze Jervell at ellen.jervell@wsj.com

(END) Dow Jones Newswires

June 25, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

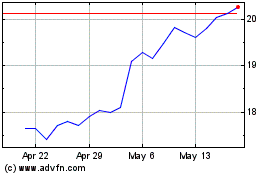

Henkel AG and Company KGAA (PK) (USOTC:HENKY)

Historical Stock Chart

From Mar 2024 to Apr 2024

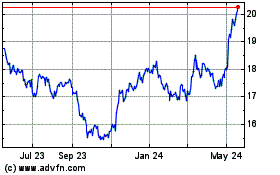

Henkel AG and Company KGAA (PK) (USOTC:HENKY)

Historical Stock Chart

From Apr 2023 to Apr 2024