Regulator Fines Glencore Copper Unit $21.3 Million -- Update

December 18 2018 - 1:39PM

Dow Jones News

By Scott Patterson

Canada's main stock-market regulator issued a record $21.3

million fine to a Glencore PLC-controlled copper-mining company to

settle allegations that it misled investors.

Regulators also fined several of the company's executives and

former directors to settle allegations that the company misstated

production figures and hid from investors the risks associated with

its reliance on Israeli businessman Dan Gertler in the Democratic

Republic of Congo.

The Ontario Securities Commission said Glencore's Katanga Mining

Ltd. relied upon, and paid associates of, Mr. Gertler to "maintain

relations" with the Congolese government, including legal, tax and

customs clearing services.

The OSC fined Katanga Mining 28.5 million Canadian dollars

(US$21.3 million), the largest amount paid to settle allegations of

misleading disclosures by a Toronto-listed company, according to a

spokeswoman for the commission. The total amount of fines levied

against Katanga and its executives and former directors is C$34.4

million, which excludes about C$1.9 million in costs they must

pay.

Katanga Mining Chairman Hugh Stoyell said in a written statement

the company "takes full responsibility for failing to meet its

disclosure obligations and to maintain effective internal

controls."

Glencore said in a written statement that the company is

"disappointed by the conduct that has led to today's settlement"

and that it has "taken appropriate remedial actions in response to

this conduct."

The OSC also levied fines against several of Glencore's former

representatives on Katanga's board, including Aristotelis

Mistakidis, one of Glencore's most senior executives, and two other

Glencore executives, Liam Gallagher and Tim Henderson. Mr.

Mistakidis was fined about C$2.5 million for authorizing and

permitting misleading statements about Katanga's copper production,

among other things.

Glencore said earlier this month Mr. Mistakidis, who at one

point ran its copper operations in Congo and elsewhere, will leave

the Swiss commodity giant at the end of the year. Mr. Mistakidis

didn't immediately respond to a request for comment.

All three stepped down from the board in November 2017 after

Glencore and Katanga confirmed the Canadian investigation. The

probe was first reported by The Wall Street Journal.

The Journal first reported Sunday that Katanga and several of

its executives and former directors had agreed to settle the

allegations, which also include claims that the company overstated

copper production over the course of several years.

Glencore owns about 86% of Katanga after buying out Mr.

Gertler's stake in the mining company in 2017.

A spokesman for Fleurette Group, Mr. Gertler's main company in

Congo, said it "has always acted appropriately and with integrity

in the DRC. Nothing has ever been proven against the company or its

executives in a court of law." Mr. Gertler has denied

wrongdoing.

Glencore said in July that it had received a subpoena from the

U.S. Justice Department demanding records related to its compliance

with American antibribery and money-laundering laws in Congo,

Nigeria and Venezuela. The Journal reported that a focus of the

probe is Glencore's ties to Mr. Gertler.

Write to Scott Patterson at scott.patterson@wsj.com

(END) Dow Jones Newswires

December 18, 2018 13:24 ET (18:24 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

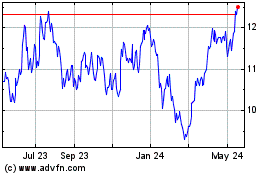

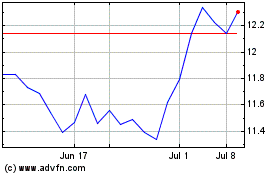

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Apr 2023 to Apr 2024