UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

SCHEDULE 13E-3

(Rule 13e-100)

TRANSACTION STATEMENT UNDER SECTION 13(e)

OF THE SECURITIES EXCHANGE ACT OF 1934 AND RULE 13e-3 THEREUNDER

RULE 13e-3 TRANSACTION STATEMENT UNDER SECTION 13e

OF THE SECURITIES EXCHANGE ACT OF 1934

DVL, INC.

______________________________________________

(Name of the Issuer)

DVL, INC.

ALAN E. CASNOFF

______________________________________________

(Name of Person(s) Filing Statement)

Common Stock, $0.01 par value

______________________________________________

(Title of Class of Securities)

233347103

______________________________________________

(CUSIP Number of Class of Securities)

Alan E. Casnoff

President and Chief Executive Officer

DVL, INC.

70 E. 55th Street

New York, New York 10022

(212) 350-9900

______________________________________________

(Name, Address and Telephone Number of Person Authorized to

Receive Notices and Communications on Behalf of the Persons Filing Statement)

With a copy to:

Louis N. Marks, Esq.

Montgomery, McCracken, Walker & Rhoads, LLP

123 South Broad Street

Avenue of the Arts

Philadelphia, PA 19109

(215) 772-1500

This statement is filed in connection with (check the appropriate box):

|

a.

|

[X]

|

The filing of solicitation materials or an information statement subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the Securities Exchange Act of 1934.

|

|

b.

|

[_]

|

The filing of a registration statement under the Securities Act of 1933.

|

|

c.

|

[_]

|

A tender offer.

|

|

d.

|

[_]

|

None of the above.

|

Check the following box if the soliciting materials or information statement referred to in checking box (a) are preliminary copies. [X]

Check the following box if the filing is a final amendment reporting the results of the transaction. [_]

Calculation of Filing Fee

|

TRANSACTION VALUATION*

|

AMOUNT OF FILING FEE**

|

|

$6,267,848

|

$ 447

|

*Calculated solely for the purposes of determining the filing fee. The transaction valuation assumes the payment for 44,770,345 shares of Common Stock of the subject Company at $0.14 per share in cash.

**The amount of the filing fee, calculated, in accordance with Rule 0-11(b) and the Commission’s Fee Rate Advisory for Fiscal Year 2010, equals .0000713 ($71.30 per million dollars) multiplied by the Total Transaction Value.

[X] Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

Amount previously paid:

|

|

$447

|

|

Filing Party:

|

DVL, Inc. and Alan E. Casnoff

|

|

|

Form or Registration No.:

|

|

Schedule 13E-3, File No. 005-37902

|

|

Date Filed:

|

October 26, 2010

|

|

|

|

|

|

|

|

|

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of this transaction, passed upon the merits or fairness of this transaction or passed upon the adequacy or accuracy of the disclosure in this document. Any representation to the contrary is a criminal offense.

Introduction

This Rule 13e-3 Transaction Statement on Schedule 13E-3, as amended (the “Schedule 13E-3”), is being filed by DVL, Inc., a Delaware corporation (“DVL”), and Alan E. Casnoff, President, Chief Executive Officer and a Director of DVL, in connection with a proposed going private transaction. At the special annual meeting of stockholders, DVL’s stockholders of record will vote on approval of amendments to DVL’s Certificate of Incorporation to effect a 1-for-7,500 reverse stock split.

This Schedule 13E-3 is being filed with the Securities and Exchange Commission (the “SEC”) concurrently with the filing of DVL’s preliminary proxy statement on Schedule 14A, as amended (the “Proxy Statement”), pursuant to Regulation 14A under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”). The information contained in the Proxy Statement, including all annexes thereto, is expressly incorporated herein by reference and the responses to each item of this Schedule 13E-3 are qualified in their entirety by reference to the information contained in the Proxy Statement. As of the date hereof, the Proxy Statement is in preliminary form and is subject to completion or amendment. This Schedule 13E-3 will be amended to reflect such completion or amendment of the Proxy Statement. Capitalized terms used and not otherwise defined herein have the meanings ascribed to such terms in the Proxy Statement.

ITEM 1. SUMMARY TERM SHEET.

The information set forth in the Proxy Statement entitled “Summary of Terms of Reverse Stock Split” is incorporated herein by reference.

ITEM 2. SUBJECT COMPANY INFORMATION.

(a)

Name and Address

. The name of the subject Company is DVL, Inc., a Delaware corporation. DVL, Inc.’s executive offices are located at 70 E. 55th Street, New York, New York 10022. DVL, Inc.’s telephone number is (212) 350-9900.

(b)

Securities

. The subject class of equity securities to which this Schedule relates is the Company’s Common Stock, $0.01 par value (“Common Stock”), of which 44,770,345 shares were outstanding as of September 30, 2010.

(c)

Trading Market and Price

. The information set forth in the Proxy Statement entitled “Reverse Stock Split; ‘Going Private;’ ‘Pink Sheet’ Quotation” and “Opinion of Financial Advisor” is incorporated herein by reference.

(d)

Dividends

. The information set forth in the Proxy Statement entitled “General Information about the Special Annual Meeting and Voting – Dividend Policy” is incorporated herein by reference.

(e)

Prior Public Offerings

. The information set forth in the Proxy Statement entitled “Market for Registrant’s Common Equity” is incorporated herein by reference.

(f)

Prior Stock Purchases

. The information set forth in the Proxy Statement entitled “Market for Registrant’s Common Equity” and “Reverse Stock Split; ‘Going Private;’ ‘Pink Sheet’ Quotation” is incorporated herein by reference.

ITEM 3. IDENTITY AND BACKGROUND OF FILING PERSON.

(a)

Name and Address

. DVL, Inc. and Alan E. Casnoff, the Company’s President and Chief Executive Officer, are the filing persons and subject company. The business address and telephone number of DVL, Inc. are set forth under Item 2(a) of this Schedule 13E-3.

Pursuant to General Instruction C to Schedule 13E-3, the information on directors and/or executive officers of DVL, Inc. is set forth in the Proxy Statement entitled “Nominees for Directors, ” and “Security Ownership of Certain Beneficial Owners, Directors and Executive Officers,” and the information on directors and/or executive officers set forth in the Annual Report on Form 10-K for the fiscal year ended December 31, 2009 entitled “Directors, Executive Officers, Promoters and Corporate Governance” is incorporated herein by reference.

The business address and telephone number for all of the directors and executive officers is c/o DVL, Inc., 70 E. 55th Street, New York, New York 10022 and (212) 350-9900.

(b)

Business and Background of Entities

. Not applicable.

(c)

Business and Background of Natural Persons

. The information on directors set forth in the Proxy Statement entitled “Nominees for Directors” and the information on executive officers set forth in the Proxy Statement entitled “Security Ownership of Certain Beneficial Owners, Directors and Executive Officers” is incorporated herein by reference.

ITEM 4. TERMS OF THE TRANSACTION.

(a)

Material Terms

. The information set forth in the Proxy Statement entitled “Special Factors,” “Reverse Stock Split; ‘Going Private;’ ‘Pink Sheet’ Quotation,” “Background and History of the Reverse Stock Split Proposal,” “Purpose of the Reverse Stock Split,” “Going Private Transaction; Schedule 13E-3 Filing,” “Structure of the Reverse Stock Split,” “Effects on Stockholders With Less Than 7,500 Shares of Common Stock,” “Effects On Stockholders With 7,500 Or More Shares Of Common Stock,” “Effects on Affiliates,” “Effects On The Company,” “General Information about the Special Annual Meeting and Voting – Special Annual Meeting and Voting Information,” “Material U.S. Federal Income Tax Consequences of the Reverse Stock Split,” “Tax Consequences of the Reverse Stock Split to U.S. Holders,” “Tax Consequences to Stockholders Who Receive Both Stock And Cash,” “Tax Consequences of the Reverse Stock Split to Non-U.S. Holders,” “U.S. Federal Income Tax Withholding Requirements for All Stockholders,” and “Tax Consequences of the Reverse Stock Split to the Company” is incorporated herein by reference.

(c)

Different Terms

. The information set forth in the Proxy Statement entitled “Special Factors,” “Effects on Stockholders With Less Than 7,500 Shares of Common Stock,” “Effects On Stockholders With 7,500 Or More Shares Of Common Stock,” and “Effect on Affiliates” is incorporated herein by reference.

(d)

Appraisal Rights

. The information set forth in the Proxy Statement entitled “Reverse Stock Split; ‘Going Private;’ ‘Pink Sheet’ Quotation” and “General Information about the Special Annual Meeting and Voting – Appraisal Rights” is incorporated herein by reference.

(e)

Provisions for Unaffiliated Security Holders

. The information set forth in the Proxy Statement entitled “Fairness of the Reverse Stock Split” is incorporated herein by reference.

(f)

Eligibility for Listing or Trading

. The information set forth in the Proxy Statement entitled “Reverse Stock Split; ‘Going Private;’ ‘Pink Sheet’ Quotation” and “Disadvantages of the Reverse Stock Split – Substantial or Complete Reduction of Public Sale Opportunities for Our Stockholders” is incorporated herein by reference.

ITEM 5. PAST CONTACTS, TRANSACTIONS, NEGOTIATIONS AND AGREEMENTS.

(a)

Transactions

. The information set forth in the Annual Report on Form 10-K for the fiscal year ended December 31, 2009 entitled “Certain Relationships and Related Transactions and Director Independence” is incorporated herein by reference.

(b)

Significant Corporate Events

. None.

(c)

Negotiations or Contacts

. None.

(e)

Agreements involving the Company’s Securities

. The information set forth in the Proxy Statement entitled “Security Ownership of Certain Beneficial Owners, Directors and Executive Officers” is incorporated herein by reference.

ITEM 6. PURPOSES OF THE TRANSACTION AND PLANS OR PROPOSALS.

(b)

Use of Securities Acquired

. The information set forth in the Proxy Statement entitled “Special Factors” and “Reverse Stock Split; ‘Going Private;’ ‘Pink Sheet’ Quotation” is incorporated herein by reference.

(c)(1)-(8)

Plans

. The information set forth in the Proxy Statement entitled “Special Factors,” “Reverse Stock Split; ‘Going Private;’ ‘Pink Sheet’ Quotation,” “Background and History of the Reverse Stock Split Proposal,” “Purpose of the Reverse Stock Split,” “Going Private Transaction; Schedule 13E-3 Filing,” “Structure of the Reverse Stock Split” and “Effects on the Company” is incorporated herein by reference. The information in the Proxy Statement on the proposal to eliminate the Authorized Preferred Stock and Amend and Restate the Company’s Certificate of Incorporation is incorporated herein by reference.

ITEM 7. PURPOSES, ALTERNATIVES, REASONS AND EFFECTS.

(a)

Purposes

. The information set forth in the Proxy Statement entitled “Special Factors,” “Reverse Stock Split; ‘Going Private;’ ‘Pink Sheet’ Quotation,” “Background and History of the Reverse Stock Split Proposal,” “Purpose of the Reverse Stock Split,” “Going Private Transaction; Schedule 13E-3 Filing,” and “Structure of the Reverse Stock Split,” “Effects on the Company” and “Advantages to the Reverse Stock Split” is incorporated herein by reference.

(b)

Alternatives

. The information set forth in the Proxy Statement entitled “Background and History of the Reverse Stock Split Proposal” and “Alternative Transactions Considered” is incorporated herein by reference.

(c)

Reasons

. The information set forth in the Proxy Statement entitled “Reverse Stock Split; ‘Going Private;’ ‘Pink Sheet’ Quotation,” “Background and History of the Reverse Stock Split Proposal,” “Purpose of the Reverse Stock Split,” “Going Private Transaction; Schedule 13E-3 Filing” and “Advantages of the Reverse Stock Split” is incorporated herein by reference.

(d)

Effects

. The information set forth in the Proxy Statement entitled “Effects on Stockholders With Less Than 7,500 Shares of Common Stock,” “Effects On Stockholders With 7,500 Or More Shares Of Common Stock,” “Effects on Affiliates” and “Effects On The Company,” is incorporated herein by reference.

ITEM 8. FAIRNESS OF THE TRANSACTION.

(a)

Fairness

. The information set forth in the Proxy Statement entitled “Special Factors,” “Background and History of the Reverse Stock Split Proposal” and “Fairness of the Reverse Stock Split” is incorporated herein by reference.

(b)

Factors Considered in Determining Fairness

. The information set forth in the Proxy Statement entitled “Special Factors,” “Background and History of the Reverse Stock Split Proposal” and “Fairness of the Reverse Stock Split” is incorporated herein by reference.

(c)

Approval of Security Holders

. The information set forth in the Proxy Statement entitled “General Information about the Special Annual Meeting and Voting – Quorum and Required Vote” is incorporated herein by reference.

(d)

Unaffiliated Representative

. The information set forth in the Proxy Statement entitled “Background and History of the Reverse Stock Split Proposal,” “Fairness of the Reverse Stock Split” is incorporated herein by reference.

(e)

Approval of Directors

. The information set forth in the Proxy Statement entitled “Special Factors,” “Reverse Stock Split; ‘Going Private;’ ‘Pink Sheet’ Quotation,” and “Background and History of the Reverse Stock Split Proposal” is incorporated herein by reference.

(f)

Other Offers

. None

ITEM 9. REPORTS, OPINIONS, APPRAISALS AND NEGOTIATIONS.

(a)

Report, Opinion or Appraisal

. The information set forth in the Proxy Statement entitled “Opinion of Financial Advisor” is incorporated herein by reference.

(b)

Preparer and Summary of the Report, Opinion or Appraisal

. The Information set forth in the Proxy Statement entitled “Opinion of Financial Advisor” is incorporated herein by reference.

(c)

Availability of Documents

. The Information set forth in the Proxy Statement entitled “Opinion of Financial Advisor” is incorporated herein by reference.

ITEM 10. SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION.

(a)

Source of Funds

. The information set forth in the Proxy Statement entitled “Financing the Reverse Stock Split” is incorporated herein by reference.

(b)

Conditions

. Not applicable.

(c)

Expenses

. The information set forth in the Proxy Statement entitled “Costs/Source of Funds and Expenses” is incorporated herein by reference.

(d)

Borrowed Funds

. The information set forth in the Proxy Statement entitled “Financing the Reverse Stock Split” is incorporated herein by reference.

ITEM 11. INTEREST IN SECURITIES OF THE SUBJECT COMPANY.

(a)

Security Ownership

. The information set forth in the Proxy Statement entitled “Security Ownership of Certain Beneficial Owners, Directors and Executive Officers” is incorporated herein by reference.

(b)

Securities Transactions

. The information set forth in the Proxy Statement entitled “Manner of Voting and Voting Required” and “Proposal 3 – Amend Company’s Charter to Eliminate Authorized Preferred Stock, Reduce Authorized Common Stock and Restate the Company’s Certificate of Incorporation in its Entirety” is incorporated herein by reference.

ITEM 12. THE SOLICITATION OR RECOMMENDATION.

(d)

Intent to tender or vote in a going-private transaction

. The information set forth in the Proxy Statement entitled “Special Factors,” “Reverse Stock Split; ‘Going Private;’ ‘Pink Sheet’ Quotation,” “Background and History of the Reverse Stock Split Proposal,” “Purpose of the Reverse Stock Split,” “Fairness of the Reverse Stock Split” and “Recommendation of Our Board of Directors” is incorporated herein by reference.

(e)

Recommendations of Others

. The information set forth in the Proxy Statement entitled “Reverse Stock Split; ‘Going Private;’ ‘Pink Sheet’ Quotation,” “Background and History of the Reverse Stock Split Proposal,” “Purpose of the Reverse Stock Split,” “Fairness of the Reverse Stock Split” and “Opinion of Financial Advisor” is incorporated herein by reference.

ITEM 13. FINANCIAL STATEMENTS.

(a)

Financial Information

. The audited consolidated financial statements set forth in our Annual Report on Form 10-K for the years ended December 31, 2009 and December 31, 2008, and the information set forth in the Proxy Statement entitled “Incorporation by Reference” and “Additional Financial Information” is incorporated herein by reference.

(b)

Pro Forma Information

. Not applicable.

ITEM 14. PERSONS/ASSETS RETAINED, EMPLOYED, COMPENSATED OR USED.

(a)

Solicitations or Recommendations

. None.

(b)

Employees and Corporate Assets

. The information set forth in the Proxy Statement entitled “Financing the Reverse Stock Split” and “Costs/Source of Funds and Expenses” is incorporated herein by reference.

ITEM 15. ADDITIONAL INFORMATION.

(a)

Agreements, Regulatory Requirements and Legal Proceedings

. The information set forth in the Proxy Statement entitled “Reverse Stock Split; ‘Going Private;’ ‘Pink Sheet’ Quotation,” and “Going Private Transaction; Schedule 13E-3 Transaction” is incorporated herein by reference.

(b)

Other Material Information

. The Company believes the Proxy Statement contains all such information as may be necessary to make all required statements in the light of the circumstances under which they are made, not materially misleading.

ITEM 16. EXHIBITS.

*(a)(1) Proxy Statement on Schedule 14A dated October 25, 2010, as amended, incorporated by reference.

*(a)(2) Annual Report on Form 10-K for the fiscal year ending December 31, 2009, dated March 31, 2010, incorporated by reference.

(b) Term Sheet for proposed $750,000 Term Loan Agreement, between DVL Mortgage Holdings, LLC and First Niagara Bank, N.A., dated August 25, 2010.

*(d) Fairness Opinion of Executive Sounding Board Advisors, Inc. dated October 15, 2010 (incorporated by reference to Exhibit C of the Proxy Statement on Schedule 14A dated October 25, 2010).

(e) Valuation and Analysis Report in Support of the Fairness Opinion, prepared by Executive Sounding Board Associates, dated October 14, 2010.

_________________

* Incorporated herein by reference.

+ To be filed by amendment.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

|

|

DVL, INC.

By:

/s/ Alan E. Casnoff

Name: Alan E. Casnoff

Title: President and Chief Executive Officer

Dated: December 22, 2010

Alan E. Casnoff

By:

/s/ Alan E. Casnoff

Dated: December 22, 2010

|

Exhibit b

August 25.2010

DVL MORTGAGE HOLDINGS. LLC

70 East 55th Street, 7th Floor

New York, NY 10022

Attn: Alan Casnoff

Re: Term Sheet for proposed $750,000 term loan

Dear Mr. Casnoff:

First Niagara Bank, N.A. (“Bank”) is pleased to present this confidential proposal outlining on a preliminary basis the terms and conditions pursuant to which Bank may be willing to extend credit. This letter (“Term Sheet”), is for discussion purposes only and should not be construed as either a commitment to lend or an obligation to issue a commitment to lend on the part of Bank. The following is a summary of the terms and conditions of the proposed financing, it being understood and agreed that this proposal does not contain all of the terms and conditions which would be contained in an actual commitment letter or in Bank's final loan documentation.

|

BORROWER:

|

DVL Mortgage Holdings, LLC

|

|

|

|

|

GUARANTOR:

|

DVL, Inc.

|

|

|

|

|

PREMISES:

|

5.4 acres site improved with Wal-Mart retail store located in Aledo, Mercer County, Illinois, & 6,400 SF Hannaford Brothers retail store located in Ossipee New Hampshire.

|

Bank proposes to make available to Borrower the following credit facilities:

PERMANENT TERMS:

|

1. Amount:

|

$750,000.

|

|

|

|

|

2. Term:

|

5 years

|

|

|

|

|

3. Interest Rate:

|

A fixed rate equal to the FHLB Rate, or Bank comparable cost of funds. plus 3.00% per annum with a floor of 5%.

|

|

|

|

|

4. Fee:

|

100bps ($7,500)

|

|

|

|

|

5. Collateral:

|

|

|

|

a.

|

Title insured assignment of first mortgage lien on Premises.

|

|

|

|

|

|

|

b.

|

Assignment of Rents and Leases.

|

|

|

|

|

|

|

c.

|

Assignment of Management contracts.

|

6. Closing Ratios:

|

|

a

|

Loan-to-value Ratio: not greater than 50% based on “as is” appraisal.

|

|

|

|

|

|

|

b.

|

Debt Service Coverage; not less than 1.10%

|

7. Amortization: 5 years.

8. Payment: Fixed monthly payments of principal and interest.

9. Prepayment:

|

|

a. Year One:

|

5% of the amount prepaid.

|

|

|

b. Year Two:

|

4% of the amount prepaid.

|

|

|

c. Year Three:

|

3% of the amount prepaid.

|

|

|

d. Year Four:

|

2% of the amount prepaid.

|

|

|

e. Year Five:

|

1% of the amount prepaid.

|

LOAN TERMS APPLICABLE TO ALL FACILITIES

COLLATERAL PERFECTION:

Liens on collateral will be perfected by filing of UCC financing statements or as otherwise appropriate.

CROSS-DEFAULT CROSS COLLATERAL IZE:

This Loan will be cross-defaulted and cross collateralized with all other existing and future Bank credits and loans to Borrower.

OTHER DOCUMENTS REQUIRED:

All other documentation or collateral deemed necessary or appropriate by bank.

CONDITIONS PRECEDENT TO FUNDING:

|

1.

|

Receipt and satisfactory review of Bank ordered appraisal, at the Borrower’s expense, indicating a LIV not exceeding 50%.

|

|

|

|

|

2.

|

Bank will require a satisfactory environmental audit of the Premises at Borrower's expense and an environmental indemnity from Borrower and Guarantor.

|

|

|

|

|

3.

|

Receipt and satisfactory review of all in place leases, and any renewals, extensions, or modifications.

|

FINANCIAL STATEMENTS:

|

1.

|

Annual audited financial statements and federal tax returns of DVL, Inc. within 120 days of Fiscal Year End.

|

|

|

|

|

2.

|

Annual P&L Statements for the individual Real Estate Holding Companies.

|

CONDITIONS:COVENAN'TS OF BORROWING:

Usual and customary for loans of this size, duration and credit rating, including, but not limited to:

|

1.

|

Loan-to-value: not greater than 50%

|

|

|

|

|

2.

|

Minimum Debt Service Coverage: not less than 1.10x

|

|

|

|

|

3.

|

All Rents from Tenants are to be directly deposited into First Niagara Bank, via ACH or physical check. Any rents not received within a 5 day grace period of the due date shall constitute an event of default.

|

EXPENSES AND INDEMNIFICATION

: Borrower shall agree to pay or cause to be paid at or before the Closing all charges and fees with respect to the Loan including and not by way of limitation, title insurance, appraisal and the legal fees and disbursements of Bank's counsel.

CREDIT INVESTIGATION:

By signing below, Borrower and each individual guarantor provide written authorization to Bank in connection with the proposed credit facilities to obtain customer, vendor and credit reference checks, tax lien searches, litigation and judgment searches and background reports on Borrower and key individuals at or associated with Borrower (including, without limitation, credit information obtained from one or more national credit bureaus) and in obtaining any credit investigation for the purpose of considering any update, renewal, extension, amendment, review or collection of the proposed facilities or an additional credit.

Borrower acknowledges that this proposal represents an outline for discussion purposes only, and may not include all the terms and conditions pursuant to which Bank may be interested in extending credit to Borrower. Borrower further acknowledges that this proposal is solely for Borrower's informational purposes and is not to be shown to, or relied upon third parties. While the terms and conditions set forth in this proposal outline the proposed financing, they are not intended nor should they be construed as a commitment on the part of Bank to provide financing, nor as an obligation to commit to provide financing.

We look forward to discussing the terms and conditions set forth above and to working with you to accomplish the proposed financing. Please do not hesitate to contact me at 215.859.9565 should you have any questions or require additional information.

Thank you for allowing us the opportunity to present this proposal.

Very truly yours,

FIRST NIAGARA BANK, N.A.

By:

/s/ Ryan S. Crouthamel

Narne: Ryan S. Crouthamel

Title: Vice President

The undersigned agrees to the credit investigation set forth above and the authorization to obtain the credit reports.

DVL Mortgage Holdings, LLC

By:

/s/ Alan Casnoff

(SEAL)

Name: Alan Casnoff

Title: Pres

DVL, Inc.

By:

/s/ Alan Casnoff

(SEAL)

Name: Alan Casnoff

Title: Pres

Exhibit e

Presentation to DVL, Inc.

VALUATION AND ANALYSIS REPORT IN SUPPORT OF THE FAIRNESS OPINION

Confidential

October 14, 2010

Disclosure

The following presentation and its analysis are solely for the use of the Board of Directors of DVL, Inc., and are not intended to be, nor should they be, relied upon by any other party, including the shareholders of DVL, Inc. The consent of Executive Sounding Board Associates Inc. (“ESBA”) is required prior to the disclosure of this presentation, its analyses, the assessment made by ESBA or any other documentation provided by ESBA.

These materials are based only on information contained in publicly available documents and certain other information provided to ESBA by DVL, Inc. ESBA relied upon the accuracy and completeness of the information from these public documents and other information supplied by DVL, Inc. ESBA has not attempted to investigate or verify the accuracy or completeness of such publicly available information or other information provided to ESBA.

These materials should be considered only in connection with the presentation being provided by ESBA in connection herewith. The preparation of these materials was completed on October 14, 2010 and based on information publicly available or provided to ESBA through such date. ESBA is not obligated to update this presentation or its analyses except as outlined in the engagement letter dated July 28, 2010 to reflect any information that becomes publicly available or that is provided to ESBA after such date.

EXECUTIVE SOUNDING BOARD ASSOCIATES INC.

!!! Click on table and press F9 to update!

1. TRANSACTION OVERVIEW

2. DVL, INC

3. OVERVIEW OF VALUATION METHODOLOGIES

4.

VALUATION SUMMARY AND CONSIDERATIONS

|

|

·

|

Comparable Company Analysis

|

|

|

·

|

Discounted Cash Flow (DCF) Analysis

|

5. ATTACHMENTS

|

|

·

|

The Board of Directors of DVL, Inc., (“DVL”, or “the Company”) has retained Executive Sounding Board Associates Inc. (“ESBA”) as its financial advisor to provide an opinion as to the fairness (the “Opinion”), from a financial point of view, to the public stockholders of DVL of the proposed reverse stock split in connection with a going private transaction.

|

|

|

·

|

Holders of 7,500 or more shares prior to the Company’s proposed 1-for-7,500 reverse stock split would be entitled to a cash payment equal to $.14 per share. This represents a 23.7% premium over $.1132 per share, which is the average closing price of the Common Stock during the 20 trading day period immediately preceding the date of this report.

|

|

|

·

|

The Company’s common stock is publicly traded on the over-the-counter market and is quoted on the OTCBB maintained by the FINRA under the symbol “DVLN.OB”. DVL has approximately 44.77 million shares of Common Stock outstanding as of their most recent 10-Q (dated August 13, 2010 for the period ending June 30, 2010).

|

PROPOSED TRANSACTION TERMS SUMMARY

|

Transaction:

|

|

1-for-7,500 reverse stock split, wherein holders of record owning less than 7,500 shares will receive

cash in lieu of shares. Additionally, holders of record are exempt from paying any transaction costs or fees associated with the disposition of their shares in connection with the proposed reverse stock split.

|

|

|

|

|

|

Purpose:

|

|

The purpose of the aforementioned transaction is to reduce the administrative burden and associated expenses of being a public company by an estimated $250,000-$350,000 per year. This will be accomplished by reducing the current number of shareholders of record to less than 300, thereby enabling the company to deregister its shares and “go private”.

|

|

|

|

|

|

Purchaser:

|

|

DVL, Inc.

|

|

|

|

|

|

Securities:

|

|

Shares of Common Stock, $.01 par value.

|

|

|

|

|

|

Purchase Price Per Share

|

|

|

|

(Less

Than 7,500 Shares):

|

|

123.7% of the average of the closing prices of the Common Stock during the 20 trading days immediately preceding the date of this report.

|

BACKGROUND AND EVENTS LEADING TO TRANSACTION

|

|

·

|

DVL was founded in 1971 as a Pennsylvania common law trust and incorporated in 1977 as a Delaware corporation. The Company has principal executive offices in New York, New York.

|

|

|

·

|

DVL operates as a commercial finance company in the United States. The Company is primarily engaged in (a) the ownership of residual interests in securitized portfolios of structured settlements, (b) the ownership and servicing of a portfolio of secured commercial mortgage loans made to limited partnerships in which DVL serves as general partner, which are referred to as an Affiliated Limited Partnership, (c) the ownership of real estate, and (d) the performance of real estate asset management and administrative services.

|

|

|

·

|

As of the most recent 10-Q (dated August 13, 2010, for the six month period ending June 30, 2010), the “Total shareholders’ equity” (accounting book value) was $25.5 million. In contrast, the market capitalization of the Company was $5.037 million as of October 13, 2010.

|

|

|

·

|

As of the most recent 10-K (dated March 31, 2010, for the year ending December 31, 2009), cash flow from operations was sufficient to fulfill DVL’s current cash requirements through at least March 2011. However, as it has had to do in previous years, the Company expects that it will continue to be required to augment cash flow from operations with additional cash generated from either the sale or refinancing of portions of their assets and/or borrowings. As such, the Company has lacked sufficient cash flow from operations to meet their cash requirements or to permit them to pay a dividend on shares of common stock.

|

|

|

·

|

The purpose of the transaction is to reduce the administrative burden and associated expenses of being a public company. These include, but are not limited to those arising from the filing of periodic reports and complying with various requirements, such as those imposed under the Sarbanes-Oxley Act. Specifically, DVL’s management estimates that the benefits of the transaction will translate into an annual cost savings of approximately $250,000-$300,000 per year. Procedurally, the process of transitioning from a public company a private company (“going private”) is accomplished by deregistering the Company’s shares through a reduction in the number of shareholders to fewer than 300. This is expected to be the effect of the proposed 1-for-7,500 reverse stock split. The Company anticipates that, upon consummation of the “going private” transaction, it will be in a better position to meet short-term working capital needs and maximize the value of its assets.

|

|

|

·

|

Additionally, management believes that a going private transaction is the most effective way to deliver value to smaller shareholders, who have seen little to no capital appreciation on their equity investments in the Company, and have faced a limited market for the sale of their shares.

|

|

|

·

|

In estimating the Fair Market Value (“FMV”) of the Company on a “going concern” basis, ESBA used two traditional approaches: “Intrinsic” and “Market” based approaches. The Intrinsic approach involved the discounting of projected cash flows; while the Market approach involved the derivation of financial ratios from comparable public companies and the application of these financial ratios to the corresponding financial data of DVL.

|

|

|

·

|

In the case of a “going private” minority buyout transaction such as is this one; a “Premiums Paid Analysis” traditionally supplements the foregoing approaches. A minority buyout transaction is one in which the controlling shareholder(s) (often insiders) purchase(s) the remaining shares of the firm from the minority shareholders. The purpose of performing this type of analysis is to take into account that

target shareholders may expect a premium for minority interest transactions in order to address control premiums and the supply and demand characteristic of the target stock. In conducting this analysis,

ESBA examined relevant transactions and compared the prices being paid to minority shareholders in those deals with the closing price of their shares prior to the announcement of the transaction.

|

|

|

·

|

ESBA’s findings represent a composite of the results produced by each of the foregoing valuation approaches. In the course of applying these approaches, ESBA took into consideration several aspects of the Company’s operations and assets, including the fact that they are diverse. Further, the majority of these assets consist of unique and intangible financial instruments, which are small in relation to their complexity

.

|

|

|

·

|

DVL reports its financials in only three business segments: “Residual interests segment”, “Real estate segment”, and “Corporate/other”. In addition, to a large extent, the Company’s financial statements are filed on a consolidated basis. As a practical matter, however, DVL’s business can be viewed as comprised of the following segments:

|

|

|

o

|

S-2: Residual Interests

|

|

|

o

|

Mortgage Loans/Affiliated Limited Partnership Investments

|

|

|

o

|

Real Estate – Development Sites

|

|

|

o

|

Real Estate – Environmental Sites

|

|

|

o

|

Real Estate Management/Corporate

|

|

|

·

|

In an effort to develop a more full understanding of these operations, ESBA worked with the Company to generate alternative, consolidating financial statements for the five above business categories. These will be addressed in following sections.

|

SCOPE OF ENGAGEMENT (CONT’D)

|

|

·

|

In carrying out our mandate to provide an independent valuation of DVL, ESBA took into account its assessment of general economic, market, and financial conditions as well as its experience in connection with similar asset classes. In undertaking this exercise, ESBA’s involvement included:

|

|

|

o

|

Reviewing a draft of the preliminary proposal, as described in a draft of DVL’s proxy statement.

|

|

|

o

|

Reviewing the Company’s Quarterly Reports on Form 10-Q for the six months and three months ended June 30, and March 31, 2010, respectively, and its Annual Reports on Form 10-K for the years ended December 31, 2009, 2008, and 2007.

|

|

|

o

|

Reviewed DVL’s financial projections for the period July 1, 2010-December 31, 2010 and 2011-2015.

|

|

|

o

|

Developing a macro-level knowledge of developments within DVL’s industry and business operations.

|

|

|

o

|

Discussing with members of the senior management of DVL: the Company’s business, operating results, financial condition, and prospects.

|

|

|

o

|

Comparing stock prices, operating results, and financial condition of certain publicly traded companies with similar businesses.

|

|

|

o

|

Comparing valuation multiples and other financial terms of mergers and acquisitions of certain companies which ESBA deemed reasonably comparable to DVL, to similar data for DVL.

|

|

|

o

|

Comparing premiums or discounts to recent share prices for certain recent reverse stock splits.

|

|

|

o

|

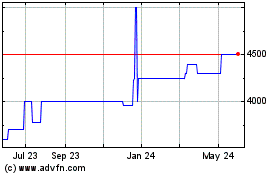

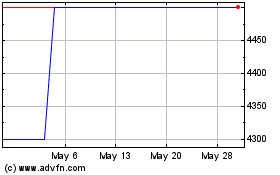

Analyzing DVL’s stock price and volume trading history.

|

|

|

o

|

Reviewing certain other information and performing other analyses that ESBA deemed appropriate.

|

|

|

·

|

The Opinion of ESBA is necessarily based upon market, economic and other conditions, as they exist on, and could be evaluated by October 14, 2010

.

Accordingly, although subsequent developments may affect its opinion, ESBA does not assume any obligation to update, review

,

or reaffirm its opinion.

|

|

|

·

|

ESBA assumes, with the consent of the Company, that this report of our valuation findings will be incorporated into a proxy statement prepared by the Company in connection with the proposed Transaction outlined above. Further, the Transaction will be consummated in accordance with the terms described to ESBA and as generally set forth in the proposed proxy statement, without any further amendments thereto, and without material changes to any of the conditions to any obligations or, in the alternative, that any such amendments, revisions or changes thereto will not be detrimental to DVL.

|

|

|

·

|

ESBA has not made a physical inspection of the properties and facilities of the Company and has not made or obtained any evaluations or appraisals of the assets and liabilities (contingent or otherwise).

|

SCOPE OF ENGAGEMENT (CONT’D)

|

|

·

|

ESBA has relied upon and assumed the accuracy and completeness of all of the financial and other information provided to it by the Company without assuming any responsibility for an independent verification of any such information and has further relied upon the assurance of the Company’s management that it is not aware of any facts or circumstances that would make any such information inaccurate or misleading.

|

|

|

·

|

To the extent applicable for a transaction of this kind, ESBA assumes that the Transaction will be consummated in a manner that complies in all material respects with the applicable provisions of the Securities Exchange Act of 1934, as amended, and all other applicable federal and state statues, rules

,

and regulations.

|

|

|

·

|

ESBA has not been requested to opine as to, and the Opinion does not in any manner address, the underlying business decision of the Company to proceed with or affect the Transaction.

|

|

|

·

|

ESBA was not asked to consider, and its Opinion does not address, the relative merits of the Transaction as compared to any alternative business strategy that might exist for the Company.

|

|

|

·

|

This Opinion is for the use and benefit of the Board of Directors of the Company in connection with its consideration of the Transaction and is not intended to be and does not constitute a recommendation to any shareholder of the Company. The foregoing in this presentation is not meant to and does not express any opinion as to the value of DVL for other purposes

.

|

DVL is a commercial finance company with several business segments engaged in different activities. The Company’s estimated revenues for 2010 are $9.3 million, with an EBITDA of $5.8 million. The Company’s estimated Consolidated Income Statement for 2010 and projected Consolidated Income Statement for 2011-2015 are presented in the following schedule:

COMPANY OVERVIEW (CONT’D)

COMPANY OVERVIEW (CONT’D)

The derivation of EBITDA for each of these six years is presented in the following schedule:

Detail of EBITDA

|

|

|

|

|

|

Projected

|

|

|

|

|

2010

|

|

|

2011

|

|

|

2012

|

|

|

2013

|

|

|

2014

|

|

|

2015

|

|

|

Net Income

|

|

$

|

2,165

|

|

|

$

|

2,920

|

|

|

$

|

3,044

|

|

|

$

|

3,207

|

|

|

$

|

3,112

|

|

|

$

|

2,483

|

|

|

Add back: Interest expense

|

|

|

3,106

|

|

|

|

2,526

|

|

|

|

2,102

|

|

|

|

1,693

|

|

|

|

1,404

|

|

|

|

1,338

|

|

|

Add back: Taxes

|

|

|

154

|

|

|

|

100

|

|

|

|

120

|

|

|

|

140

|

|

|

|

160

|

|

|

|

180

|

|

|

Add back: Depreciation and amortization

|

|

|

106

|

|

|

|

106

|

|

|

|

106

|

|

|

|

106

|

|

|

|

106

|

|

|

|

106

|

|

|

Add back: Discontinued operations

|

|

|

295

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA

|

|

$

|

5,826

|

|

|

$

|

5,652

|

|

|

$

|

5,372

|

|

|

$

|

5,146

|

|

|

$

|

4,782

|

|

|

$

|

4,107

|

|

ESBA views DVL’s businesses as comprised of the following five segments:

|

|

·

|

S-2: Residual Interests

|

|

|

o

|

This segment consists of S2 Holdings, Inc. (“S-2”, a wholly-owned subsidiary of the Company) and represents DVL’s ownership of residual interests in securitized portfolios of structured settlement receivables. As of the latest 10-K (dated March 31, 2010 for the year ending December 31, 2009), these assets consisted of a 99.9% Class B membership interest in Receivables II-A LLC (“Receivables II-A”) and Receivables II-B LLC, (“Receivables II-B”).

|

|

|

o

|

Receivables II-A and Receivables II-B receive all of the residual cash flow from five pools of securitized structured settlements after payment is made to the secured note holders.

|

|

|

o

|

In aggregate, the securitizations in which Receivables II-A and Receivables II-B hold the residual interest contain approximately 3,200 individual structured settlement receivables, which are backed by annuities issued by various insurance companies. Based on projected future cash flows, the carrying value to DVL on the residual interests is approximately 14.36% as of the latest 10-K (dated March 31, 2010).

|

COMPANY OVERVIEW (CONT’D)

|

|

o

|

DVL acquired the Class B membership interests from J. G. Wentworth (“JGW”) in 2000 and 2001 in exchange for the issuance of limited recourse promissory notes by S-2 bearing interest at 8% per annum with principal and interest payable solely from monthly cash flow (after payment of underlying debt and third party expenses).

|

|

|

o

|

The JGW promissory notes payable from cash flows mature from August 15, 2020 through December 31, 2021 and are secured by a pledge of S-2’s interests in Receivables II-A, Receivables II-B and all proceeds and distributions related to such interests.

|

|

|

o

|

The principal amount of the notes and the purchase price are adjusted, from time to time, based upon the performance of the underlying receivables. Permanent impairments are recorded immediately through results of operations. Favorable changes in future cash flows are recognized through results of operations as interest over the remaining life of the retained interest.

|

|

|

o

|

The purchase agreements contain annual minimum and maximum levels of cash flow that will be retained by the Company after the payment of interest and principal on the notes payable, which are as follows:

|

|

Years

|

Minimum

|

Maximum

|

|

|

|

|

|

2010 to final payment on notes payable

|

$1,050,000

|

$1,150,000

|

|

|

|

|

|

|

·

|

Mortgage Loan Portfolio/ Affiliated Limited Partnership Investments:

|

|

|

o

|

The mortgage loans held by the Company are either ‘wrap around’ mortgage loans made to Affiliated Limited Partnerships (“ALPs”) or mortgages where the underlying first mortgage has been fully amortized.

|

|

|

o

|

In most cases, the ALPs bought the land and building from Wal-Mart and subsequently leased it back to Walmart. In order to purchase the property, the ALPs committed equity and borrowed the remainder of the purchase price by taking out a junior mortgage originated by DVL. The junior mortgage “wraps” around the existing mortgage and DVL is subsequently responsible for making the payments on the first mortgage.

|

COMPANY OVERVIEW (CONT’D)

|

|

o

|

The properties are currently of three types:

|

|

|

¨

|

Leased to Wal-Mart with short remaining terms.

|

|

|

¨

|

Leased to alternate users after a Wal-Mart lease has expired.

|

|

|

¨

|

Vacant and currently not leased.

|

|

|

o

|

The majority of the mortgage payments, which flow from Wal-Mart to the ALPs are used to pay the required monthly principal and interest payments on the underlying mortgage which the ‘wrap around’ mortgage “wraps”. DVL builds equity in the ‘wrap around’ mortgage loans over time as the principal balance of the underlying mortgage loans is amortized.

|

|

|

o

|

DVL, as the holder of the mortgages, is entitled to receive, as additional debt service, a portion of the ALPs’ percentage rental income, if any.

|

|

|

o

|

The satisfaction of any of the ‘wrap around’ mortgage loans is dependent on the ability of the underlying ALP to enter into a lease extension with the current tenant, find a new tenant, or be able to sell the property for sufficient value. If the ALP is unable to do so, it is likely that DVL will foreclose on the corollary ‘wrap around’ mortgage loan. Furthermore, in order to sell any of the underlying properties (prior to such default); the Partnership Agreements require the consent of the Limited Partners.

|

|

|

o

|

The properties leased to alternative users are principally properties which were previously leased to Wal-Mart. In most instances, the alterative tenant is paying less rent than Wal-Mart and is not responsible for structural repairs, while Wal-Mart had been responsible for all repairs.

|

|

|

·

|

Real Estate - Development Sites

|

|

|

o

|

This segment consists of eight buildings totaling 347,000 square feet on eight and one half acres located in an industrial park in Kearny, NJ. These properties are leased to various unrelated tenants who occupy space in multi-story industrial buildings and an 89,000 square foot building on approximately eight acres of adjacent land leased to K-Mart in Kearny, NJ.

|

COMPANY OVERVIEW (CONT’D)

|

|

o

|

The Development Site represents a portion of the Passaic River Development area designated for redevelopment by the town of Kearny, New Jersey. In connection with the redevelopment of the Kearny Property, on December 11, 2007, DVL entered into a Redevelopment Agreement with the Town of Kearny, calling for, as an initial stage, the development of up to approximately 150,000 square feet of retail space. If DVL were to default on any of the terms of this Agreement, it can be terminated. To date, DVL has not commenced construction on the redevelopment and, in the current economic environment, may not in the near future. Additionally, construction has been delayed by litigation with existing tenants, a weak leasing market, a downward trend in rents, and difficulty in obtaining favorable financing.

|

|

|

·

|

Real Estate - Environmental Sites

|

|

|

o

|

This segment consists of two properties owned and/or managed by DVL, the Bogota Property, NJ and the Fort Edward, NY property. Both properties have significant environmental liabilities.

|

|

|

o

|

In October 2004, DVL entered into an agreement with Bogota Associates and Industrial Associates, the owners of the land leasehold interest in the Bogota, New Jersey property

,

pursuant to which the master operating lease with DVL was cancelled in consideration of the aforementioned partnerships’ agreeing to repay expenses including real estate taxes and environmental remediation costs as well as $50,000 upon completion of a sale of the property to a third party.

|

|

|

o

|

Additionally, DVL owns an 8.25% limited partner interest in one other Partnership that owns a portion of the property. As of December 31, 2009, the sale has not yet been consummated and a third party continues to lease space.

|

|

|

o

|

In connection with the Fort Edward property, DVL has filed an action in State Court against General Electric and Niagara Mohawk Power Corporation for the reimbursement of remediation expenses spent to date by DVL. Both defendants continue to vigorously defend the case.

|

COMPANY OVERVIEW (CONT’D)

|

|

·

|

Real Estate Management/Corporate:

|

|

|

o

|

This category represents the corporate functions required to administer the business.

|

For the most part, the Company’s financial statements are prepared on a

consolidated

basis. However, in order to familiarize itself with the financial characteristics of each of the above five business units, ESBA was provided by the Company pro forma

consolidating

financial statements, referred to previously. These statements are presented in Attachment A, and include data for three six month periods—Actual for December 31, 2009, Actual for June 30, 2010, and Estimated for December 31, 2010. Additionally, Cash Flow and Income Statement data for two 12-month periods—TTM June 30, 2010 and Full Year 2010—were developed using the data from the three aforementioned six month periods.

OWNERSHIP, MANAGEMENT AND EMPLOYEES

Significant Insider Ownership

|

Lawrence J. Cohen

1

|

10.5%

|

|

|

Jay Chazanoff

1

|

6.4%

|

|

|

Ron Jacobs

|

4.3%

|

|

|

Stephen Simms

|

4.0%

|

|

|

|

|

|

|

All Insiders

2

|

31.02%

|

|

|

All Others

3

|

68.98%

|

|

Executive Officers and Directors

|

Officer

|

|

Position

|

|

Gary Flicker

Alan E. Casnoff

Neil Koenig

Ira Akselrad

|

|

Chairman of the Board

Chief Executive Officer, President and Director

Chief Financial Officer, Executive Vice President

Board Member

|

Employees

As of December 31, 2009, DVL had no employees. The Company’s affairs are administered by Compensation Solutions, Inc. (“CSI”), pursuant to the terms of a “leasing” contract. Pursuant to the leasing contract, CSI provides DVL with the necessary personnel, including certain executive officers, necessary to administer the Company’s affairs. As of August 31, 2010, CSI provided 10 employees to DVL under lease.

1

According to the Schedule 13D filed with the SEC, Messrs, Cohen, and Chazanoff are part of a group that holds in the aggregate, 12,193,850 shares of common stock representing 27.2% of the outstanding common shares.

2

This includes the Significant Insider Ownership identified above. This figure may or may not take into account the ownership identified in footnote 1.

3

This includes shares issuable upon the exercise of warrants by J.G. Wentworth S.S.C. LP, which currently represents a 6.8% ownership interest in the Company. This percentage assumes the issuance of 3,000,000 common shares before anti-dilution provisions.

|

3

|

OVERVIEW OF VALUATION METHODOLOGIES

|

OVERVIEW OF VALUE DEFINITIONS

Liquidation Value:

|

|

·

|

The value a seller might expect to receive for the net assets of the business.

|

|

|

·

|

The value does not take into account any going-concern value or synergies created through the operation of the assets together.

|

|

|

·

|

Applicable in distress situations, asset-intensive industries, certain financial businesses, or with hard-to-value assets.

|

|

|

·

|

May represent the lowest acceptable value for a business.

|

|

|

·

|

The range of Liquidation Value also depends on the methodologies, which include:

|

|

|

o

|

FMV of fixed and intangible assets

.

|

|

|

o

|

Orderly liquidation value

.

|

Fair market value (“FMV”):

|

|

·

|

Defined by the IRS as “the price at which a property would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or to sell, and both having reasonable knowledge of the facts” (Treasury Regulation Sec. 20.2031-1[b].)

.

|

Investment Value:

|

|

·

|

The value of a business to a specific buyer based on the nature and characteristics of the buyer including potential synergies or economies of scale that might result from the purchase.

|

|

|

·

|

This value assumes a controlling interest in the business acquired by the buyer.

|

|

|

·

|

This often represents the maximum value that might be realized through a sale to a strategic buyer.

|

Enterprise Value:

|

|

·

|

The value of the Company without outside bank or other non-trade debt.

|

Equity Value:

|

|

·

|

The Enterprise Value minus the outside bank or other non-trade debt.

|

OVERVIEW OF FAIR MARKET VALUE

In the majority of purchase decisions not involving a traditional operating business, the FMV of the company can be difficult to derive. The principal reasons include:

|

|

·

|

The market can be very limited, with only a handful of potential buyers;

|

|

|

·

|

The market value of a business depends on the timing, market conditions and the process that is employed to realize the value.

|

|

|

·

|

Each company is one of a kind. Different factors related to valuation include:

|

|

|

·

|

The value of a business is also largely predicated on whom a prospective buyer is, what knowledge the buyer possesses, and the level of synergy the buyer can bring post integration.

|

OVERVIEW OF VALUATION METHODOLOGIES

The two generally accepted categories of approaches to assessing the value of a business are often described as the “Market” and “Intrinsic” approaches. ESBA made use of both approaches in deriving its Opinion.

|

|

·

|

The “Market” approaches that ESBA used involved:

|

|

|

o

|

A “Premiums Paid Analysis”, involving a comparison of the acquisition price with the closing prices per share of the acquired company one-week and one-month prior to the announcement of the transaction

|

|

|

o

|

Comparing a business to guideline firms in similar lines of business whose stocks are publicly traded (“Comparable Companies Analysis”).

|

|

|

¨

|

This comparison-based analysis is used to develop multiples of enterprise value to various parameters including revenues, EBITDA and EBIT. These multiples are benchmarks that are then applied as ratios on a comparative basis to various financial statistics of the company.

|

|

|

·

|

The “Intrinsic” approach that ESBA used involved:

|

|

|

o

|

A Discounted Cash Flow Analysis (“DCF”)

,

which estimates the fair market value of a company by discounting its future stream of cash flows to the present.

|

COMPARISON OF VALUATION METHODOLOGIES

|

Methodology

|

Advantages

|

Limitations

|

|

Premiums Paid Analysis

|

Technical representation of the current market premiums for a substantial number of stocks.

|

n

Potentially “broad brush” analysis that does not take into consideration pricing multiples or fundamentals as it has no direct relation to the company outlook or business prospects.

|

|

Comparable Company Analysis

|

Reflects up-to-date, market-based valuation information.

|

n

Financial information available on the companies is generally limited to historical data and 1-2 years of financial forecasts — No long-term projections.

n

Current market multiples may be market driven and may not be representative of long-term business prospects.

n

Does not reflect control premium.

|

|

Discounted Cash Flow Analysis

|

Reflects expected future cash flow of the business — directly related to the business being valued.

|

n

Financial information is generally based on the judgment of management preparing projections.

n

Does not reflect any synergies available to an acquirer.

|

|

4

|

VALUATION SUMMARY AND CONSI

D

ERATIONS

|

Valuation Summary

(US Dollars in Thousands)

In conducting its premiums paid analysis, ESBA focused on “going private” transactions in the past twelve months, both across all of the primary market sectors, as well as the “Financial Sector”, specifically, corresponding to DVL’s status as a commercial finance company. As shown in the following two charts and Attachment B, the premiums paid for the different sectors varied widely by sector. The following specific summary observations apply:

|

|

●

|

The median premiums paid in the Financial Sector versus the stock prices one week and one month prior to the announcement of the transactions were 12.3% and 11.8%, respectively.

|

|

|

●

|

By contrast, the composite median premiums paid across all market sectors versus the stock prices one week and one month prior to the announcement of the transactions were 10.8% and 13.7%, respectively (Attachment B).

|

|

|

●

|

It should be noted, that by contrast, the one-month premiums for Healthcare and Information Technology (two comparatively active sectors) were 39.8% and 34.1%, respectively.

|

PREMIUMS PAID ANALYSIS (CONT'D)

PREMIUMS PAID ANALYSIS (CONT'D)

PREMIUMS PAID ANALYSIS (CONT'D)

The following chart shows the number of companies included in each of the sector charts; the grand total of companies in the sample was 242 (A complete listing of these companies is presented in Attachment B).

PREMIUMS PAID ANALYSIS (CONT'D)

The following chart lists all 32 companies comprising the Financial Sector. A majority of these companies are foreign public companies.

PREMIUMS PAID ANALYSIS (CONT'D)

In consideration of the foregoing data, ESBA assigned a range of premiums from 11% to 13%, as follows:

Consequently, this produced low and high ranges for “Derived Enterprise Value” of $41,523,440 and $41,624,799.

ESBA’s use of the 20-day average closing stock price reflects our view that this is most representative of the value that the stock market has assigned to the value of DVL’s stock. For additional perspective, the chart below lists the average closing stock prices for several periods extending beyond the 20 trading days:

COMPARABLE COMPANY ANALYSIS

The following table presents a summary of the relevant comparative financial ratios derived from ESBA’s analysis of other public companies. As indicated, all eight of these companies are foreign entities. Among the countries represented in this mix were Hong Kong (2 companies), India (2), Kuwait, and Japan. In the course of its extensive research, ESBA was unable to identify any domestic U.S. companies that were comparable to DVL in terms of:

|

|

●

|

Small size (e.g., market capitalization, revenues, and EBITDA)

.

|

|

|

●

|

Unusual mix of financial and real estate mortgage operations and assets

.

|

|

|

●

|

Status as a thinly-traded pink sheet/bulletin board company

.

|

|

|

●

|

Absence of security analyst following

.

|

COMPARABLE COMPANY ANALYSIS (CONT'D)

COMPARABLE COMPANY ANALYSIS (CONT'D)

COMPARABLE COMPANY ANALYSIS (CONT'D)

As an example of ESBA’s thought process in selecting companies for comparison to DVL, the simple fact is that there are very few U.S. public companies with a market capitalization in the $5 million range of DVL. Further, the selection of a somewhat larger domestic U.S. company that, for example, was traded on the Nasdaq would have distorted the findings. This is because such a stock would have been more liquid and had more visibility to larger pools of investment capital.

At the same time, the selection of public companies elsewhere in the world is consistent with the fact that a large portion of investor community is agnostic with respect to the stock exchange on which it invests. Many U.S. companies are multinational in their operations and holdings. In addition, in the current financial climate, many investors are consciously investing in locations outside the U.S. in the belief that such companies offer a more favorable return outlook.

The foregoing having been said, ESBA gave this valuation approach only a one times weighting, in contrast to the two times weighting that it gave to the findings of the Premiums Paid Analysis.

It should also be pointed out in this section that ESBA did not apply financial ratios from the “Precedent Transactions” valuation approach. Similar to its experience in the Comparable Company Analysis, ESBA could not identify enough recent M & A transactions involving companies with DVL’s characteristics to derive meaningful valuation data.

The following provides a brief narrative description of the business operations of each of the companies used in the Comparable Company Analysis:

COMPARABLE COMPANY ANALYSIS (CONT'D)

Uni-Asia Finance Corporation (SGX:C3T)

Uni-Asia Finance Corporation engages in the finance arrangement and investment management of alternative assets primarily shipping and real estate in Japan and China. The company acts as the arranger and agent for the structured financing provided by third party financial institutions; and offers asset management services with a focus on residential properties and hotel projects primarily in Japan. It also involves in the ship chartering arrangements; provision of property investment, project management, accounting and administration services, and corporate finance services; and operation and management of hotels for business travelers and tourists. As of December 31, 2009, the company had 11 vessels comprising 4 handy size dry bulk ships, 2 product tankers, and 5 containerships; and operated 13 hotels, as well as acted as an asset manager for 11 hotels. Uni-Asia Finance Corporation was founded in 1997 and is headquartered in Hong Kong, Hong Kong.

Winfair Investment Co. Ltd. (SEHK:287)

Winfair Investment Company Limited and its subsidiaries engage in the property and share investments, property development, and securities dealing activities in Hong Kong. The company invests in short-term and long-term securities, as well as develops and leases residential and commercial properties. Winfair Investment Company was founded in 1971 and is based in Kowloon, Hong Kong.

A.D. Works Co., Ltd. (JASDAQ:3250)

A.D. Works Co., Ltd. operates in the real estate appraisal and consultancy business in Japan. It provides appraisal in the public sector, general appraisal evaluation, and due diligence; and consulting services, including proposal of the measure against inheritance, planning of effective use of the land for a company, and advice about real estate investment or management. The company also provides various supporting services for the real estate fund business, including survey, appraisal, and valuation of the subject property; offering the investment property; acquisition; operation; management; and disposition. In addition, it provides real estate management services comprising the arrangement of lessee's moving-in and out, the correspondence to a demand of lessee, collection of rent, planning, and sales promotion. Further, the company offers real estate fluidization services, such as acquisition of property by principal investment; and improve the property by the original scheme that include leasing, management, renovation, and sale at last. It also offers properties for real estate fund, J-REIT, and private investors. The company was formerly known as Aoki dyeing Works Co., Ltd. and changed its name to A.D. Works Co., Ltd. in 1995. A.D. Works Co. was founded in 1886 and is headquartered in Tokyo, Japan.

COMPARABLE COMPANY ANALYSIS (CONT'D)

Lancor Holdings Ltd. (BSE:509048)

LANCOR Holdings Limited operates as a property development company in India. It engages in the development, rental, investment, maintenance, brokerage, and management of properties. The company develops commercial and residential projects. It operates in Chennai, Bangalore, and Coimbatore. The company is based in Chennai, India.

SMIFS Capital Markets Ltd. (BSE:508905)

SMIFS Capital Markets Limited operates as merchant banker and underwriter in India. It principally focuses on corporate finance, merchant banking, corporate advisory, treasury management, project finance, and underwriting services. The company offers merchant banking/investment banking services, such as public issue/rights issue/preferential allotment, private placement, and underwriting; and financial advisory services, including mergers, acquisitions, and takeovers. It also provides assistance to corporate bodies through syndication of loans from various bodies corporate/banks and financial institutions; private placement services to foreign institutional investors, Indian financial institutions, and high net worth individuals; and project financing through financial institutions/banks. In addition, the company operates as dealers in debt/bonds and g-sec; and markets IPOs and mutual funds. Further, it operates as a marketing associate to various mutual funds and has a network for placement of debts. The company is based in Kolkata, India.

MENA Real Estate Company KSCC (KWSE:MENA)

MENA Real Estate Company K.S.C. engages in the purchase, sale, ownership, management, and development of real estates and land in Kuwait and internationally. The company owns, manages, operates, invests, and rents hotels, clubs, motels, hospitality houses, rest houses, parks, gardens, restaurants, cafeteria, housing complexes, touristic and health resorts, entertainment and sports projects, and shops. It also provides real estate advisory services; establishes and manages real estate investment funds; and establishes real estate auctions. The company was formerly known as Gulf Development Real Estate Company and changed its name to MENA Real Estate Company K.S.C. in February 2007. MENA Real Estate Company K.S.C. was founded in 2004 and is based in Sharq, Kuwait.

COMPARABLE COMPANY ANALYSIS (CONT'D)

First Jamaica Investments Ltd. (JMSE:FJI)

First Jamaica Investments Limited engages in investments, and property management and rental activities in Jamaica. Its Investments segment provides investment management services; and involves in the holding of securities. The company’s Property Management and Rental segment engages in the rental and management of commercial real estate. First Jamaica Investments Limited also involves in property development activities. The company is based in Kingston, Jamaica. First Jamaica Investments Limited is a subsidiary of Pan-Jamaican Investment Trust Limited.

Kenya Reinsurance Corporation Ltd. (NASE)

Kenya Reinsurance Corporation Limited provides reinsurance and financial services to insurance companies in Kenya, Africa, the Middle East, and Asia. The company offers a range of reinsurance services, such as fire and allied classes, accident, engineering and machinery breakdown, public liability, professional indemnity, personal accident/medical, goods in transit, cash in transit, fidelity guarantee, workmen's compensation, livestock and bonds, miscellaneous classes, marine hull and cargo, aviation, motor, and life. It also engages in investing in properties comprising office building to earn rentals and capital appreciation, land for the development of office property, and housing projects for rental and/or capital appreciation. The company is based in Nairobi, Kenya.

DISCOUNTED CASH FLOW (DCF) ANALYSIS

ESBA prepared a discounted cash flow analysis to derive a range of values for the Enterprise Value of DVL utilizing projections through 2015 provided by Management. ESBA calculated the present values of the projected adjusted EBITDA (unlevered after-tax net income plus depreciation and amortization) for 2011 through 2015. The following table

provides this analysis:

In deriving the discounted value of the cash flows, ESBA made use of discount rates ranging from 9% to 12%. This provided a premium over the Company’s cost of capital (about 8%). In addition, ESBA made use of a range of multiples of 5.5 to 8.5 times for purposes of calculating the terminal value of the business at the end of the fifth year of the projection period (2015). This multiple was derived after giving consideration to the multiples obtained from ESBA’s Comparable Company Analysis.

As indicated in the table, under the DCF, the Enterprise Value of the Company estimated using the DCF approach ranges from $30,478,000 to $41,300,000.

CONSOLIDATING BALANCE SHEET (PRO FORMA)

CONSOLIDATING INCOME STATEMENT (PRO FORMA)

CONSOLIDATING STATEMENT OF CASH FLOWS (PRO FORMA)

CONSOLIDATING STATEMENT OF CASH FLOWS (PRO FORMA)

PREMIUM PAID ANALYSIS - ALL SECTORS

|

SIC Codes [Target/Issuer]

|

All Transactions Announced Date (Including Bids and Letters of Intent)

|

Target/Issuer

|

Transaction Status

|

Merger/Acquisition Features

|

Total Transaction Value ($USDmm, Historical rate)

|

Market Capitalization [Latest] ($USDmm, Historical rate) [Target/Issuer]

|

Target Stock Premium - 1 Week Prior (%)

|

Target Stock Premium - 1 Month Prior (%)

|

|

-

|

10/05/2010

|

Etropal AD (BUL:5EO)

|

Announced

|

Majority Shareholder Increasing Ownership Stake; Majority Shareholder Purchasing Remaining Shares

|

-

|

7.17

|

-

|

-

|

|

|

|

|

|

|

|

|

|

|

|

-

|

09/22/2010

|

Kazansky Vertoletny Zavod (RTS:KHEL)

|

Closed

|

Majority Shareholder Increasing Ownership Stake

|

-

|

289.7

|

-

|

-

|

|

|

|

|

|

|

|

|

|

|

|

-

|

09/14/2010

|

Autoprevoz (BELEX:APCA)

|

Announced

|

Majority Shareholder Increasing Ownership Stake; Majority Shareholder Purchasing Remaining Shares

|

0.633

|

-

|

0

|

40.0

|

|

|

|

|

|

|

|

|

|

|

|

-

|

08/24/2010

|

Territorial Generation Company No 13 (MICEX:TGK13)

|

Announced

|

Majority Shareholder Increasing Ownership Stake; Majority Shareholder Purchasing Remaining Shares

|

-

|

614.0

|

-

|

-

|

|

|

|

|

|

|

|

|

|

|

|

-

|

07/27/2010

|

Dhofar Power Company SAOG (MSM:DHPS)

|