Today's Logistics Report: Maersk Seeks Anchor; Canada's Rail Standoff; Garlic Markets Pressed

February 21 2020 - 10:31AM

Dow Jones News

By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

The world's biggest container shipping line is racing to

withdraw capacity as fast as business demand is falling. A.P.

Moeller-Maersk Chief Executive Soren Skou says Maersk Line has

pulled more than 50 scheduled sailings from its China services

since late January, the WSJ's Costas Paris and Dominic Chopping

report, part of the broader retrenchment of shipping services in

the wake of the coronavirus outbreak. The company's large scale

leaves it heavily exposed to the steep decline in China volumes

since Beijing imposed an extraordinary series of restrictions aimed

at restricting the spread of the virus. Factory output remains

weak, but Mr. Skou says transport barriers within China are

hampering exports as well since truck drivers face big hurdles in

moving goods to ports. That could add to Maersk's financial pain

this year after the carrier unveiled a surprise $72 million net

loss in the quarter ending Dec. 31.

TRANSPORTATION

A standoff on Canada's freight rail tracks is starting to bite

into the country's economy. The two-week-old blockade of rail lines

by protestors of a proposed natural-gas pipeline is stranding key

shipments and snarling supply chains, the WSJ's Paul Vieira

reports, triggering layoffs in some operations and raising alarms

at factories and export centersI. Canadian National Railway is

laying off 450 workers while shipping customers scramble for scarce

alternatives. One logistics broker says freight rates for trucks

have climbed as much as 20% since the protests began for those

shippers that can secure road transport. Food-packaging provider

CKF Inc. says the blockades "have caused some supply-chain chaos,"

but the company is eating the higher costs to keep customers

satisfied. Economists say the stoppages threaten to shave 0.1% to

0.3% from Canada's economic output this month, but the damage could

grow the longer the interruption continues.

COMMODITIES

There's no escape in the kitchen from the impact of the

coronavirus outbreak. Prices for garlic are jumping to the highest

levels in two years, the WSJ's Lucy Craymer reports, because of

disruptions in supply from China, the world's biggest producer of

the aromatic bulbs. The rising garlic costs contrast with a more

general downturn in agriculture prices because of dimming demand in

China, highlighting the fractured impact of the outbreak on trade

flows. Garlic production in China has slowed since authorities

sounded alarms over the spread of the virus in late January.

Because garlic takes nine months to grow, the recent price

increases may be the first taste of still higher prices over the

coming year. One of America's largest garlic producers and

suppliers says it has reached out to growers in other countries to

mitigate big increases in wholesale prices.

QUOTABLE

IN OTHER NEWS

The U.S. forecasts a tough year for American farmers, with weak

prices for key commodities hurting earnings. (WSJ)

Beverage supplier Diageo will pay $5 million to settle

securities charges that it hit performance goals by pressuring

distributors to buy products in excess of demand. (WSJ)

Royal Dutch Shell expects liquefied natural gas production

growth to slow by half this year. (WSJ)

Sportswear maker Puma SE says its chief challenge in China is

obtaining trucking and shipping permits for wholesale and

e-commerce distribution. (WSJ)

The U.S. Department of Transportation will make $1 billion

available f or infrastructure projects through its BUILD program.

(Supply Chain Management Review)

Chinese personal computer supplier Lenovo plans to increase

production overseas because of domestic manufacturing disruptions.

(South China Morning Post)

Caterpillar named Pam Heminger vice president in charge of its

strategic procurement division. (Industrial Distribution)

Seaspan's fourth-quarter profit rose 10.1% to $70.7 million and

the container ship owner says its charter markets are insulated

from the coronavirus impact. (Lloyd's List)

Investment group Jefferies lowered its estimates for listed

dry-bulk shipping companies. (TradeWinds)

Dry-bulk operator Star Bulk Carriers Corp.'s fourth-quarter

profit more than doubled to $23.5 million. (ShippingWatch)

London-based Clarksons PLC acquired Spanish shipbroking firm

Martankers. (Splash 247)

Atlas Air says shippers and freight forwarders are trying to

line up capacity for an expected surge in China exports in the

second quarter. (Air Cargo World)

Air France-KLM group cargo revenues fell 13.7% on a 5% drop in

tonnage. (Air Cargo News)

ABOUT US

Paul Page is editor of WSJ Logistics Report. Follow the WSJ

Logistics Report team: @PaulPage , @jensmithWSJ and @CostasParis.

Follow the WSJ Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

February 21, 2020 10:16 ET (15:16 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

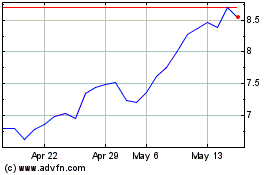

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

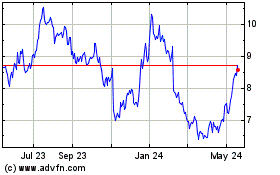

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Apr 2023 to Apr 2024