Scorpio Tankers Inc. Announces Update on Its Stock Buyback Program, Newbuilding Vessel Deliveries, and Second Quarter Earning...

July 22 2014 - 6:48AM

Marketwired Canada

Scorpio Tankers Inc. (NYSE: STNG) (the "Company") announced today an update on

its Stock Buyback Program, Newbuilding vessel deliveries, and second quarter

2014 earnings release date.

Stock Buyback Program

The Company has purchased 6,327,861 of its common shares in the open market at

an average price of $9.74 per share since July 1, 2014 under its $150 Million

Stock Buyback Plan (the "Plan") that was announced on June 30, 2014 and has

$88.1 million remaining under the Plan.

During 2014, the Company has acquired 29.0 million of its common shares that are

being held as treasury shares at an average price of $9.26 per share. The

acquisitions include (i) 11,326,646 common shares that were purchased in the

open market at an average price of $9.35 per share, (ii) 7,500,000 common shares

at $8.94 per share that were acquired in exchange for 3,422,665 shares in Dorian

and (iii) 10,127,600 common shares at $9.38 per share that were acquired in

conjunction with the Company's offering of $360 million of Convertible Senior

Notes due 2019.

As of July 22, 2014, the Company has 172,206,301 common shares issued and

outstanding.

Newbuilding Vessel Deliveries

The Company has recently taken delivery of four product tankers under its

Newbuilding Program:

-- STI Powai, an MR product tanker, was delivered in July 2014 from Hyundai

Mipo Dockyard of South Korea ("HMD"). Upon delivery the vessel began a

time charter for up to 120 days at approximately $18,000 per day.

-- STI Aqua, an MR product tanker, was delivered in July 2014 from SPP

Shipyard of South Korea ("SPP"). Upon delivery the vessel began a time

charter for up to 120 days at approximately $18,000 per day.

-- STI Pimlico, a Handymax Ice Class 1A product tanker, was delivered from

HMD in July 2014. Upon delivery, this vessel began a time charter for up

to 120 days at approximately $15,000 per day.

-- STI Elysees, an LR2 product tanker, was delivered from Hyundai Samho

Heavy Industries ("HSHI") in July 2014.

Second Quarter Earnings Release Date

The Company will announce its second quarter 2014 earnings before the open of

trading on the NYSE on Monday, July 28, 2014.

About Scorpio Tankers Inc.

Scorpio Tankers Inc. is a provider of marine transportation of petroleum

products worldwide. Scorpio Tankers Inc. currently owns 31 tankers (one LR2

tanker, two LR1 tankers, four Handymax tankers, 23 MR tankers, and one

post-Panamax tanker) with an average age of 2.0 years, time charters-in 26

product tankers (eight LR2, six LR1, four MR and eight Handymax tankers), and

has contracted for 43 newbuilding product tankers (21 MR, 11 LR2, and 11

Handymax ice class-1A product tankers), 29 are expected to be delivered to the

Company throughout 2014 and 14 in 2015. The Company also owns approximately 16%

of Dorian LPG Ltd. Additional information about the Company is available at the

Company's website www.scorpiotankers.com, which is not a part of this press

release.

Forward-Looking Statements

Matters discussed in this press release may constitute forward-looking

statements. The Private Securities Litigation Reform Act of 1995 provides safe

harbor protections for forward-looking statements in order to encourage

companies to provide prospective information about their business.

Forward-looking statements include statements concerning plans, objectives,

goals, strategies, future events or performance, and underlying assumptions and

other statements, which are other than statements of historical facts. The

Company desires to take advantage of the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995 and is including this cautionary

statement in connection with this safe harbor legislation. The words "believe,"

"anticipate," "intends," "estimate," "forecast," "project," "plan," "potential,"

"may," "should," "expect," "pending" and similar expressions identify

forward-looking statements.

The forward-looking statements in this press release are based upon various

assumptions, many of which are based, in turn, upon further assumptions,

including without limitation, our management's examination of historical

operating trends, data contained in our records and other data available from

third parties. Although we believe that these assumptions were reasonable when

made, because these assumptions are inherently subject to significant

uncertainties and contingencies which are difficult or impossible to predict and

are beyond our control, we cannot assure you that we will achieve or accomplish

these expectations, beliefs or projections.

In addition to these important factors, other important factors that, in our

view, could cause actual results to differ materially from those discussed in

the forward-looking statements include the failure of counterparties to fully

perform their contracts with us, the strength of world economies and currencies,

general market conditions, including fluctuations in charter rates and vessel

values, changes in demand for tanker vessel capacity, changes in our operating

expenses, including bunker prices, drydocking and insurance costs, the market

for our vessels, availability of financing and refinancing, charter counterparty

performance, ability to obtain financing and comply with covenants in such

financing arrangements, changes in governmental rules and regulations or actions

taken by regulatory authorities, potential liability from pending or future

litigation, general domestic and international political conditions, potential

disruption of shipping routes due to accidents or political events, vessels

breakdowns and instances of off-hires and other factors. Please see our filings

with the Securities and Exchange Commission for a more complete discussion of

these and other risks and uncertainties.

FOR FURTHER INFORMATION PLEASE CONTACT:

Scorpio Tankers Inc.

212-542-1616

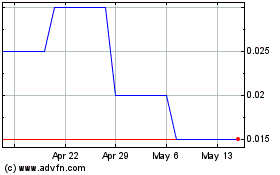

Spot Coffee Canada (TSXV:SPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

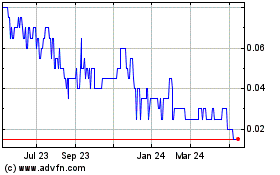

Spot Coffee Canada (TSXV:SPP)

Historical Stock Chart

From Apr 2023 to Apr 2024