SandRidge Energy Defends Bid for Atinum Midcon's Drilling Portfolio

October 28 2016 - 2:22PM

Dow Jones News

By Katy Stech

SandRidge Energy Inc. defended its move to purchase Atinum

Midcon I LLC's oil and gas drilling investments out of bankruptcy,

urging a federal judge to disregard protest from Wells Fargo Bank

N.A. officials who said the bank's proposal to forgive $75 million

is a better offer.

In court papers, SandRidge lawyers said the offer from Wells

Fargo, which handles Atinum's loan of more than $265 million,

wasn't valid because it covered only a subset of Atinum's roughly

1,600 oil and gas wells in northern Oklahoma and southern

Kansas.

Under its offer, Wells Fargo offered to forgive $75 million in

debt owed by Atinum, a Houston energy investor. SandRidge's bid is

valued about $67 million, made up of $47 million in cash and about

$19 million in forgiven debt.

Earlier this week, Wells Fargo officials argued that lawyers who

put Atinum into bankruptcy in U.S. Bankruptcy Court in Houston on

July 22 wrongly declared SandRidge's offer as superior.

They argued in court filings that Atinum officials were

motivated to placate SandRidge and sell the company's portfolio

quickly for insurance reasons: Equity owners could get roughly $240

million on account of their lost investment if the case is

converted to chapter 7 before the end of 2016.

More broadly, Wells Fargo lawyers also said SandRidge was to

blame for many of Atinum's financial problems, pressuring it to

invest in a "series of disastrous wells" SandRidge drilled and

completed in late 2015 and early 2016.

In response, SandRidge said in court papers that Wells Fargo's

"claims are without merit."

Judge Marvin Isgur agreed to hear arguments on the dispute at a

hearing Friday.

Founded in 2011 with the purchase of some ownership interests in

roughly 860,000 gross acres of oil and gas interests located in the

Mississippian Lime formation, Atinum made a deal with SandRidge to

find underground oil and gas deposits and build wells to pull the

resource out.

SandRidge itself recently emerged from bankruptcy, using the

process to cut $3.7 billion in debt and transfer ownership to a

group of bondholders. The Oklahoma City company emerged from

protection Oct. 4.

The proposed purchase by SandRidge would take Atinum's ownership

out of the hands of private-equity funds managed by JB Asset

Management Co., a South Korean asset-management company, according

to court papers.

Atinum blamed its bankruptcy on the drop in oil and gas prices.

The price drop, caused by an oversupply, led Atinum's revenue from

oil and gas sales to fall to $76 million last year from roughly

$176 million in 2014.

Write to Katy Stech at katherine.stech@wsj.com

(END) Dow Jones Newswires

October 28, 2016 14:07 ET (18:07 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

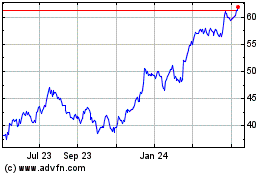

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

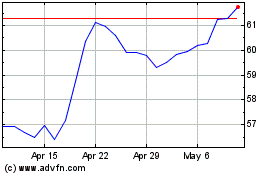

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Apr 2023 to Apr 2024