Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

January 29 2024 - 12:43PM

Edgar (US Regulatory)

Schedule of Investments

November 30, 2023

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Principal |

|

|

|

|

| |

|

Interest |

|

|

Maturity |

|

|

Amount |

|

|

|

|

| |

|

Rate |

|

|

Date |

|

|

(000) |

|

|

Value |

|

| |

|

| Municipal Obligations–159.80%(a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pennsylvania–150.56% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allegheny (County of), PA; |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2016 C-76, GO Bonds |

|

|

5.00% |

|

|

|

11/01/2041 |

|

|

$ |

10,410 |

|

|

$ |

10,850,383 |

|

| |

|

| Series 2020 C-78, GO Bonds |

|

|

4.00% |

|

|

|

11/01/2049 |

|

|

|

2,000 |

|

|

|

1,900,265 |

|

| |

|

| Allegheny (County of), PA Airport Authority; Series 2021 A, RB (INS - AGM)(b)(c) |

|

|

4.00% |

|

|

|

01/01/2056 |

|

|

|

3,000 |

|

|

|

2,627,624 |

|

| |

|

| Allegheny (County of), PA Airport Authority (Pittsburgh Airport); Series 2023 A, RB (INS - AGM)(b)(c) |

|

|

5.50% |

|

|

|

01/01/2053 |

|

|

|

3,000 |

|

|

|

3,228,734 |

|

| |

|

| Allegheny (County of), PA Hospital Development Authority (Allegheny Health Network Obligated Group

Issue); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2018 A, RB(d)(e) |

|

|

5.00% |

|

|

|

04/01/2047 |

|

|

|

7,885 |

|

|

|

7,973,874 |

|

| |

|

| Series 2018 A, Ref. RB |

|

|

5.00% |

|

|

|

04/01/2047 |

|

|

|

1,000 |

|

|

|

1,011,271 |

|

| |

|

| Allegheny (County of), PA Hospital Development Authority (University of Pittsburgh Medical Center); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2007 A-1, RB (3 mo. USD LIBOR + 0.82%)(f) |

|

|

4.60% |

|

|

|

02/01/2037 |

|

|

|

1,325 |

|

|

|

1,250,811 |

|

| |

|

| Series 2019 A, Ref. RB |

|

|

4.00% |

|

|

|

07/15/2038 |

|

|

|

3,915 |

|

|

|

3,866,212 |

|

| |

|

| Allegheny (County of), PA Sanitary Authority; |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2015, Ref. RB |

|

|

5.00% |

|

|

|

12/01/2045 |

|

|

|

7,880 |

|

|

|

8,001,387 |

|

| |

|

| Series 2018, RB |

|

|

4.00% |

|

|

|

06/01/2048 |

|

|

|

2,100 |

|

|

|

2,012,578 |

|

| |

|

| Series 2022, RB |

|

|

5.75% |

|

|

|

06/01/2052 |

|

|

|

1,750 |

|

|

|

1,972,873 |

|

| |

|

| Allentown (City of), PA Neighborhood Improvement Zone Development Authority; Series 2022, Ref. RB |

|

|

5.00% |

|

|

|

05/01/2042 |

|

|

|

1,000 |

|

|

|

1,000,511 |

|

| |

|

| Allentown (City of), PA Neighborhood Improvement Zone Development Authority (City Center); Series 2018, RB(g) |

|

|

5.00% |

|

|

|

05/01/2042 |

|

|

|

500 |

|

|

|

491,125 |

|

| |

|

| Berks (County of), PA Industrial Development Authority (Highlands at Wyomissing (The)); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2017 A, Ref. RB |

|

|

5.00% |

|

|

|

05/15/2042 |

|

|

|

500 |

|

|

|

467,388 |

|

| |

|

| Series 2017 A, Ref. RB |

|

|

5.00% |

|

|

|

05/15/2047 |

|

|

|

600 |

|

|

|

542,434 |

|

| |

|

| Series 2017 C, RB |

|

|

5.00% |

|

|

|

05/15/2047 |

|

|

|

1,175 |

|

|

|

1,062,267 |

|

| |

|

| Berks (County of), PA Municipal Authority (Reading Hospital Medical Center);

Series 2012 A, RB |

|

|

5.00% |

|

|

|

11/01/2044 |

|

|

|

3,500 |

|

|

|

1,861,117 |

|

| |

|

| Bucks (County of), PA Industrial Development Authority (Pennswood Village);

Series 2018, Ref. RB |

|

|

5.00% |

|

|

|

10/01/2037 |

|

|

|

980 |

|

|

|

968,369 |

|

| |

|

| Chester (County of), PA Health & Education Facilities Authority (Simpson Senior Services); Series

2019, Ref. RB |

|

|

5.00% |

|

|

|

12/01/2051 |

|

|

|

3,625 |

|

|

|

2,504,122 |

|

| |

|

| Chester (County of), PA Industrial Development Authority (Avon Grove Charter School); Series 2017 A, Ref.

RB |

|

|

5.00% |

|

|

|

12/15/2047 |

|

|

|

1,160 |

|

|

|

1,099,073 |

|

| |

|

| Chester (County of), PA Industrial Development Authority (Collegium Charter School); Series 2017 A,

RB |

|

|

5.25% |

|

|

|

10/15/2047 |

|

|

|

2,555 |

|

|

|

2,292,493 |

|

| |

|

| Chester (County of), PA Industrial Development Authority (Longwood Gardens) (Sustainability Bonds); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2019, RB |

|

|

5.00% |

|

|

|

12/01/2044 |

|

|

|

2,250 |

|

|

|

2,401,540 |

|

| |

|

| Series 2019, RB |

|

|

4.00% |

|

|

|

12/01/2049 |

|

|

|

1,650 |

|

|

|

1,582,059 |

|

| |

|

| Chester (County of), PA Industrial Development Authority (University Student Housing, LLC at West Chester

University of Pennsylvania); Series 2013, RB |

|

|

5.00% |

|

|

|

08/01/2045 |

|

|

|

2,425 |

|

|

|

2,246,352 |

|

| |

|

| Clairton (City of), PA Municipal Authority; Series 2012 B, RB |

|

|

5.00% |

|

|

|

12/01/2037 |

|

|

|

1,920 |

|

|

|

1,920,105 |

|

| |

|

| Coatesville School District; |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2020 A, GO Bonds (INS - BAM)(c)(h) |

|

|

0.00% |

|

|

|

10/01/2034 |

|

|

|

150 |

|

|

|

97,069 |

|

| |

|

| Series 2020 A, GO Bonds (INS - BAM)(c)(h) |

|

|

0.00% |

|

|

|

10/01/2038 |

|

|

|

1,450 |

|

|

|

732,107 |

|

| |

|

| Series 2020 B, Ref. GO Bonds (INS - BAM)(c)(h) |

|

|

0.00% |

|

|

|

10/01/2033 |

|

|

|

275 |

|

|

|

186,526 |

|

| |

|

| Series 2020 B, Ref. GO Bonds (INS - BAM)(c)(h) |

|

|

0.00% |

|

|

|

10/01/2034 |

|

|

|

550 |

|

|

|

355,918 |

|

| |

|

| Series 2020 C, Ref. GO Bonds (INS - BAM)(c)(h) |

|

|

0.00% |

|

|

|

10/01/2033 |

|

|

|

360 |

|

|

|

244,180 |

|

| |

|

| Commonwealth Financing Authority; |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2018, RB(d)(e) |

|

|

5.00% |

|

|

|

06/01/2031 |

|

|

|

3,500 |

|

|

|

3,733,782 |

|

| |

|

| Series 2018, RB(d)(e) |

|

|

5.00% |

|

|

|

06/01/2032 |

|

|

|

2,000 |

|

|

|

2,132,365 |

|

| |

|

| Series 2018, RB(d)(e) |

|

|

5.00% |

|

|

|

06/01/2033 |

|

|

|

2,000 |

|

|

|

2,131,009 |

|

| |

|

| Series 2018, RB(d)(e) |

|

|

5.00% |

|

|

|

06/01/2035 |

|

|

|

3,045 |

|

|

|

3,227,875 |

|

| |

|

| Cumberland (County of), PA Municipal Authority (Diakon Lutheran); Series 2015, Ref. RB |

|

|

5.00% |

|

|

|

01/01/2038 |

|

|

|

2,345 |

|

|

|

2,314,610 |

|

| |

|

| Dauphin (County of), PA General Authority (Pinnacle Health System);

Series 2016 A, Ref. RB |

|

|

5.00% |

|

|

|

06/01/2035 |

|

|

|

1,145 |

|

|

|

1,176,492 |

|

| |

|

| Delaware (County of), PA Authority (Eastern University); Series 2012, RB |

|

|

5.25% |

|

|

|

10/01/2032 |

|

|

|

310 |

|

|

|

310,022 |

|

| |

|

| Delaware (County of), PA Authority (Villanova University); Series 2015, RB |

|

|

5.00% |

|

|

|

08/01/2045 |

|

|

|

785 |

|

|

|

794,897 |

|

| |

|

| Delaware Valley Regional Finance Authority; Series 2002, RB |

|

|

5.75% |

|

|

|

07/01/2032 |

|

|

|

3,500 |

|

|

|

4,115,831 |

|

| |

|

| Doylestown Hospital Authority; Series 2019, RB |

|

|

4.00% |

|

|

|

07/01/2045 |

|

|

|

450 |

|

|

|

330,494 |

|

| |

|

See accompanying notes which are an integral

part of this schedule.

|

|

|

|

|

Invesco Pennsylvania Value Municipal Income Trust |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Principal |

|

|

|

|

| |

|

Interest |

|

|

Maturity |

|

|

Amount |

|

|

|

|

| |

|

Rate |

|

|

Date |

|

|

(000) |

|

|

Value |

|

| |

|

| Pennsylvania–(continued) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DuBois (City of), PA Hospital Authority (Penn Highlands Healthcare); Series 2018, Ref. RB |

|

|

5.00% |

|

|

|

07/15/2048 |

|

|

$ |

2,350 |

|

|

$ |

2,352,537 |

|

| |

|

| East Hempfield (Township of), PA Industrial Development Authority (Student Services, Inc. Student Housing at

Millersville University of Pennsylvania);

Series 2014, RB(i)(j) |

|

|

5.00% |

|

|

|

07/01/2024 |

|

|

|

750 |

|

|

|

756,771 |

|

| |

|

| East Hempfield (Township of), PA Industrial Development Authority (Willow Valley Communities); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2016, Ref. RB |

|

|

5.00% |

|

|

|

12/01/2030 |

|

|

|

790 |

|

|

|

806,236 |

|

| |

|

| Series 2016, Ref. RB |

|

|

5.00% |

|

|

|

12/01/2039 |

|

|

|

2,780 |

|

|

|

2,798,492 |

|

| |

|

| Erie (City of), PA Higher Education Building Authority (AICUP Financing Program); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2021, RB |

|

|

4.00% |

|

|

|

05/01/2036 |

|

|

|

100 |

|

|

|

92,859 |

|

| |

|

| Series 2021, RB |

|

|

4.00% |

|

|

|

05/01/2041 |

|

|

|

400 |

|

|

|

343,343 |

|

| |

|

| Series 2021, RB |

|

|

5.00% |

|

|

|

05/01/2047 |

|

|

|

150 |

|

|

|

141,838 |

|

| |

|

| Franklin (County of), PA Industrial Development Authority (Menno-Haven, Inc.); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2018, Ref. RB |

|

|

5.00% |

|

|

|

12/01/2053 |

|

|

|

3,380 |

|

|

|

2,543,662 |

|

| |

|

| Series 2019, RB |

|

|

5.00% |

|

|

|

12/01/2049 |

|

|

|

510 |

|

|

|

394,151 |

|

| |

|

| Franklin Regional School District; Series 2019, GO Bonds |

|

|

4.00% |

|

|

|

05/01/2046 |

|

|

|

2,000 |

|

|

|

1,931,925 |

|

| |

|

| Fulton (County of), PA Industrial Development Authority (The Fulton County Medical Center); Series 2016, Ref.

RB |

|

|

5.00% |

|

|

|

07/01/2040 |

|

|

|

4,375 |

|

|

|

4,003,177 |

|

| |

|

| Geisinger Authority (Geisinger Health System); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2017 A-1, Ref. RB |

|

|

5.00% |

|

|

|

02/15/2045 |

|

|

|

6,060 |

|

|

|

6,106,908 |

|

| |

|

| Series 2017 A-1, Ref. RB |

|

|

4.00% |

|

|

|

02/15/2047 |

|

|

|

2,000 |

|

|

|

1,834,512 |

|

| |

|

| Lancaster (City of), PA Industrial Development Authority (Landis Homes Retirement Community); Series 2021,

Ref. RB |

|

|

4.00% |

|

|

|

07/01/2056 |

|

|

|

1,000 |

|

|

|

681,234 |

|

| |

|

| Lancaster (City of), PA Industrial Development Authority (Willow Valley Communities); Series 2019,

RB |

|

|

5.00% |

|

|

|

12/01/2049 |

|

|

|

1,545 |

|

|

|

1,528,684 |

|

| |

|

| Lancaster (County of), PA Hospital Authority (Brethren Village); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2017, Ref. RB |

|

|

5.13% |

|

|

|

07/01/2037 |

|

|

|

700 |

|

|

|

641,201 |

|

| |

|

| Series 2017, Ref. RB |

|

|

5.25% |

|

|

|

07/01/2041 |

|

|

|

1,500 |

|

|

|

1,362,106 |

|

| |

|

| Lancaster (County of), PA Hospital Authority (Landis Homes Retirement Community); Series 2015, Ref.

RB |

|

|

5.00% |

|

|

|

07/01/2045 |

|

|

|

3,800 |

|

|

|

3,330,887 |

|

| |

|

| Lancaster (County of), PA Hospital Authority (Masonic Villages); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2015, Ref. RB |

|

|

5.00% |

|

|

|

11/01/2035 |

|

|

|

790 |

|

|

|

795,753 |

|

| |

|

| Series 2023, Ref. RB |

|

|

5.13% |

|

|

|

11/01/2038 |

|

|

|

1,000 |

|

|

|

1,031,673 |

|

| |

|

| Lancaster (County of), PA Hospital Authority (Penn State Health); Series 2021, RB |

|

|

5.00% |

|

|

|

11/01/2046 |

|

|

|

3,250 |

|

|

|

3,338,244 |

|

| |

|

| Lancaster School District; Series 2020, GO Bonds (INS -

AGM)(c) |

|

|

4.00% |

|

|

|

06/01/2036 |

|

|

|

1,275 |

|

|

|

1,296,859 |

|

| |

|

| Latrobe (City of), PA Industrial Development Authority (Seton Hill University); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2021, Ref. RB |

|

|

4.00% |

|

|

|

03/01/2046 |

|

|

|

265 |

|

|

|

207,621 |

|

| |

|

| Series 2021, Ref. RB |

|

|

4.00% |

|

|

|

03/01/2051 |

|

|

|

265 |

|

|

|

198,851 |

|

| |

|

| Lehigh (County of), PA (Lehigh Valley Health Network); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2019 A, Ref. RB |

|

|

5.00% |

|

|

|

07/01/2044 |

|

|

|

3,000 |

|

|

|

3,076,262 |

|

| |

|

| Series 2019, Ref. RB |

|

|

4.00% |

|

|

|

07/01/2049 |

|

|

|

7,945 |

|

|

|

7,217,325 |

|

| |

|

| Lehigh (County of), PA General Purpose Authority; Series 2023, RB |

|

|

7.00% |

|

|

|

06/01/2053 |

|

|

|

1,250 |

|

|

|

1,283,071 |

|

| |

|

| Lehigh (County of), PA General Purpose Authority (Lehigh Valley Academy);

Series 2022, RB |

|

|

4.00% |

|

|

|

06/01/2052 |

|

|

|

2,000 |

|

|

|

1,649,030 |

|

| |

|

| Littlestown Area School District; Series 2023 A, GO Bonds (INS - BAM)(c) |

|

|

5.00% |

|

|

|

10/01/2050 |

|

|

|

1,000 |

|

|

|

1,056,544 |

|

| |

|

| Maxatawny (Township of), PA Municipal Authority (Diakon Lutheran Social Ministries); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2022 A, RB |

|

|

5.00% |

|

|

|

01/01/2042 |

|

|

|

500 |

|

|

|

464,002 |

|

| |

|

| Series 2022 A, RB |

|

|

4.50% |

|

|

|

01/01/2045 |

|

|

|

450 |

|

|

|

381,289 |

|

| |

|

| Mechanicsburg Area School District; Series 2020 AA, GO Bonds |

|

|

4.00% |

|

|

|

05/15/2050 |

|

|

|

2,000 |

|

|

|

1,902,627 |

|

| |

|

| Montgomery (County of), PA; Series 2023, RB(g) |

|

|

6.50% |

|

|

|

09/01/2043 |

|

|

|

1,700 |

|

|

|

1,710,375 |

|

| |

|

| Montgomery (County of), PA Higher Education & Health Authority (Holy Redeemer Health System); Series

2014 A, Ref. RB |

|

|

5.00% |

|

|

|

10/01/2027 |

|

|

|

1,460 |

|

|

|

1,463,804 |

|

| |

|

| Montgomery (County of), PA Higher Education & Health Authority (Philadelphia Presbytery Homes,

Inc.); Series 2017, Ref. RB |

|

|

5.00% |

|

|

|

12/01/2047 |

|

|

|

4,915 |

|

|

|

4,356,780 |

|

| |

|

| Montgomery (County of), PA Higher Education & Health Authority (Thomas Jefferson University); Series

2022, Ref. RB |

|

|

4.00% |

|

|

|

05/01/2056 |

|

|

|

5,755 |

|

|

|

4,927,653 |

|

| |

|

| Montgomery (County of), PA Industrial Development Authority (ACTS Retirement-Life Communities,

Inc.); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2016, Ref. RB |

|

|

5.00% |

|

|

|

11/15/2036 |

|

|

|

4,285 |

|

|

|

4,316,365 |

|

| |

|

| Series 2020 C, RB |

|

|

4.00% |

|

|

|

11/15/2043 |

|

|

|

200 |

|

|

|

167,133 |

|

| |

|

| Series 2020 C, RB |

|

|

5.00% |

|

|

|

11/15/2045 |

|

|

|

380 |

|

|

|

365,303 |

|

| |

|

| Montgomery (County of), PA Industrial Development Authority (Germantown Academy); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2021, Ref. RB |

|

|

4.00% |

|

|

|

10/01/2036 |

|

|

|

1,000 |

|

|

|

914,790 |

|

| |

|

| Series 2021, Ref. RB |

|

|

4.00% |

|

|

|

10/01/2046 |

|

|

|

625 |

|

|

|

500,825 |

|

| |

|

See accompanying notes which are an integral

part of this schedule.

|

|

|

|

|

Invesco Pennsylvania Value Municipal Income Trust |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Principal |

|

|

|

|

| |

|

Interest |

|

|

Maturity |

|

|

Amount |

|

|

|

|

| |

|

Rate |

|

|

Date |

|

|

(000) |

|

|

Value |

|

| |

|

| Pennsylvania–(continued) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Montgomery (County of), PA Industrial Development Authority (Haverford School); Series 2019, Ref. RB |

|

|

4.00% |

|

|

|

03/01/2049 |

|

|

$ |

1,750 |

|

|

$ |

1,557,165 |

|

| |

|

| Montgomery (County of), PA Industrial Development Authority (Meadwood Senior Living); Series 2018 A, Ref.

RB |

|

|

5.00% |

|

|

|

12/01/2048 |

|

|

|

1,270 |

|

|

|

1,146,065 |

|

| |

|

| Montgomery (County of), PA Industrial Development Authority (Waverly Heights Ltd.); Series 2019, Ref.

RB |

|

|

5.00% |

|

|

|

12/01/2044 |

|

|

|

1,000 |

|

|

|

1,011,176 |

|

| |

|

| Northampton (County of), PA General Purpose Authority (St. Luke’s University Health Network); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2016, Ref. RB |

|

|

5.00% |

|

|

|

08/15/2036 |

|

|

|

1,170 |

|

|

|

1,197,157 |

|

| |

|

| Series 2016, Ref. RB |

|

|

5.00% |

|

|

|

08/15/2046 |

|

|

|

625 |

|

|

|

630,244 |

|

| |

|

| Series 2018 A, Ref. RB |

|

|

4.00% |

|

|

|

08/15/2048 |

|

|

|

2,355 |

|

|

|

2,044,336 |

|

| |

|

| Northampton (County of), PA Industrial Development Authority (Morningstar Senior Living, Inc.); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2019, Ref. RB |

|

|

5.00% |

|

|

|

11/01/2039 |

|

|

|

500 |

|

|

|

444,473 |

|

| |

|

| Series 2019, Ref. RB |

|

|

5.00% |

|

|

|

11/01/2044 |

|

|

|

950 |

|

|

|

802,633 |

|

| |

|

| Series 2019, Ref. RB |

|

|

5.00% |

|

|

|

11/01/2049 |

|

|

|

1,050 |

|

|

|

856,076 |

|

| |

|

| Northeastern Pennsylvania (Commonwealth of) Hospital & Education Authority (Kings College); Series

2019, RB |

|

|

5.00% |

|

|

|

05/01/2049 |

|

|

|

3,200 |

|

|

|

2,895,698 |

|

| |

|

| Pennsylvania (Commonwealth of); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| First Series 2020, GO Bonds |

|

|

2.13% |

|

|

|

05/01/2040 |

|

|

|

2,500 |

|

|

|

1,722,693 |

|

| |

|

| Second series 2013, GO Bonds |

|

|

5.00% |

|

|

|

10/15/2031 |

|

|

|

1,500 |

|

|

|

1,501,376 |

|

| |

|

| Series 2018 A, Ref. COP |

|

|

4.00% |

|

|

|

07/01/2046 |

|

|

|

1,960 |

|

|

|

1,811,275 |

|

| |

|

| Series 2022, GO Bonds |

|

|

5.00% |

|

|

|

10/01/2042 |

|

|

|

1,000 |

|

|

|

1,108,300 |

|

| |

|

| Pennsylvania (Commonwealth of) (Municipal Real Estate Funding, LLC);

Series 2018 A, Ref. COP |

|

|

5.00% |

|

|

|

07/01/2043 |

|

|

|

3,750 |

|

|

|

3,866,396 |

|

| |

|

| Pennsylvania (Commonwealth of) Economic Development Financing Authority; Series 2023 A-2, RB |

|

|

4.00% |

|

|

|

05/15/2053 |

|

|

|

1,750 |

|

|

|

1,568,140 |

|

| |

|

| Pennsylvania (Commonwealth of) Economic Development Financing Authority (Capital Region Parking System);

Series 2013, RB |

|

|

6.00% |

|

|

|

07/01/2053 |

|

|

|

3,280 |

|

|

|

3,281,170 |

|

| |

|

| Pennsylvania (Commonwealth of) Economic Development Financing Authority (Covanta Holding Corp.) (Green

Bonds); Series 2019 A, RB(b)(g) |

|

|

3.25% |

|

|

|

08/01/2039 |

|

|

|

2,600 |

|

|

|

1,838,303 |

|

| |

|

| Pennsylvania (Commonwealth of) Economic Development Financing Authority (National Gypson Co.); Series 2014,

Ref. RB(b) |

|

|

5.50% |

|

|

|

11/01/2044 |

|

|

|

2,365 |

|

|

|

2,367,147 |

|

| |

|

| Pennsylvania (Commonwealth of) Economic Development Financing Authority

(PA Bridges Finco L.P.); Series

2015, RB(b) |

|

|

5.00% |

|

|

|

12/31/2034 |

|

|

|

2,760 |

|

|

|

2,804,735 |

|

| |

|

| Pennsylvania (Commonwealth of) Economic Development Financing Authority (Penndot Major Bridges); Series 2022,

RB(b) |

|

|

5.25% |

|

|

|

06/30/2053 |

|

|

|

1,400 |

|

|

|

1,446,112 |

|

| |

|

| Pennsylvania (Commonwealth of) Economic Development Financing Authority (Pennsylvania Rapid Bridge

Replacement); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2015, RB(b) |

|

|

5.00% |

|

|

|

12/31/2038 |

|

|

|

2,640 |

|

|

|

2,659,271 |

|

| |

|

| Series 2015, RB(b) |

|

|

5.00% |

|

|

|

06/30/2042 |

|

|

|

1,750 |

|

|

|

1,754,040 |

|

| |

|

| Pennsylvania (Commonwealth of) Economic Development Financing Authority (Philadelphia Biosolids Facilities);

Series 2020, Ref. RB |

|

|

4.00% |

|

|

|

01/01/2032 |

|

|

|

400 |

|

|

|

393,404 |

|

| |

|

| Pennsylvania (Commonwealth of) Economic Development Financing Authority (Presbyterian Senior

Living); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2021, Ref. RB |

|

|

4.00% |

|

|

|

07/01/2041 |

|

|

|

350 |

|

|

|

296,590 |

|

| |

|

| Series 2021, Ref. RB |

|

|

4.00% |

|

|

|

07/01/2046 |

|

|

|

1,000 |

|

|

|

810,704 |

|

| |

|

| Series 2023, RB |

|

|

5.25% |

|

|

|

07/01/2049 |

|

|

|

710 |

|

|

|

689,546 |

|

| |

|

| Pennsylvania (Commonwealth of) Economic Development Financing Authority (UPMC); Series 2022 A, Ref.

RB |

|

|

4.00% |

|

|

|

02/15/2052 |

|

|

|

500 |

|

|

|

450,332 |

|

| |

|

| Pennsylvania (Commonwealth of) Higher Educational Facilities Authority (Drexel University); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2016, Ref. RB |

|

|

5.00% |

|

|

|

05/01/2035 |

|

|

|

3,590 |

|

|

|

3,676,102 |

|

| |

|

| Series 2020 A, Ref. RB (INS - AGM)(c) |

|

|

4.00% |

|

|

|

05/01/2041 |

|

|

|

3,000 |

|

|

|

2,943,577 |

|

| |

|

| Series 2020 A, Ref. RB (INS - AGM)(c) |

|

|

4.00% |

|

|

|

05/01/2050 |

|

|

|

1,750 |

|

|

|

1,593,758 |

|

| |

|

| Pennsylvania (Commonwealth of) Higher Educational Facilities Authority (La Salle University); Series 2012,

RB |

|

|

5.00% |

|

|

|

05/01/2042 |

|

|

|

3,320 |

|

|

|

2,661,939 |

|

| |

|

| Pennsylvania (Commonwealth of) Higher Educational Facilities Authority (Thomas Jefferson University); Series

2015, Ref. RB |

|

|

5.25% |

|

|

|

09/01/2050 |

|

|

|

3,155 |

|

|

|

3,168,862 |

|

| |

|

| Pennsylvania (Commonwealth of) Higher Educational Facilities Authority (Trustees University of Pennsylvania);

Series 2017, RB(e) |

|

|

5.00% |

|

|

|

08/15/2046 |

|

|

|

7,800 |

|

|

|

8,050,460 |

|

| |

|

| Pennsylvania (Commonwealth of) Higher Educational Facilities Authority (University of Pennsylvania Health

System); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2017 A, RB |

|

|

5.00% |

|

|

|

08/15/2042 |

|

|

|

3,925 |

|

|

|

4,024,325 |

|

| |

|

| Series 2019, RB |

|

|

4.00% |

|

|

|

08/15/2044 |

|

|

|

5,810 |

|

|

|

5,607,976 |

|

| |

|

| Pennsylvania (Commonwealth of) Housing Finance Agency; Series

2019-131 A, RB |

|

|

3.10% |

|

|

|

10/01/2044 |

|

|

|

2,500 |

|

|

|

1,938,894 |

|

| |

|

See accompanying notes which are an integral

part of this schedule.

|

|

|

|

|

Invesco Pennsylvania Value Municipal Income Trust |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Principal |

|

|

|

|

| |

|

Interest |

|

|

Maturity |

|

|

Amount |

|

|

|

|

| |

|

Rate |

|

|

Date |

|

|

(000) |

|

|

Value |

|

| |

|

| Pennsylvania–(continued) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pennsylvania (Commonwealth of) Housing Finance Agency (Social bonds); Series 2023 141-A, RB |

|

|

5.75% |

|

|

|

10/01/2053 |

|

|

$ |

992 |

|

|

$ |

1,050,848 |

|

| |

|

| Pennsylvania (Commonwealth of) Public School Building Authority (Delaware County Community college); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2023, RB (INS - BAM)(c) |

|

|

4.00% |

|

|

|

10/01/2042 |

|

|

|

1,000 |

|

|

|

929,832 |

|

| |

|

| Series 2023, RB (INS - BAM)(c) |

|

|

5.25% |

|

|

|

10/01/2044 |

|

|

|

1,100 |

|

|

|

1,158,594 |

|

| |

|

| Series 2023, RB (INS - BAM)(c) |

|

|

4.13% |

|

|

|

10/01/2048 |

|

|

|

1,000 |

|

|

|

908,273 |

|

| |

|

| Pennsylvania (Commonwealth of) Public School Building Authority (Harrisburg School); Series 2016 A, Ref. RB

(INS - AGM)(c) |

|

|

5.00% |

|

|

|

12/01/2030 |

|

|

|

3,235 |

|

|

|

3,402,122 |

|

| |

|

| Pennsylvania (Commonwealth of) Turnpike Commission; |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| First series 2023, Ref. RB |

|

|

5.00% |

|

|

|

12/01/2043 |

|

|

|

1,000 |

|

|

|

1,060,871 |

|

| |

|

| Second Series 2017, Ref. RB |

|

|

5.00% |

|

|

|

12/01/2038 |

|

|

|

2,710 |

|

|

|

2,801,564 |

|

| |

|

| Second Series 2017, Ref. RB |

|

|

5.00% |

|

|

|

12/01/2041 |

|

|

|

700 |

|

|

|

719,314 |

|

| |

|

| Series 2009 C, RB (INS - AGM)(c) |

|

|

6.25% |

|

|

|

06/01/2033 |

|

|

|

5,840 |

|

|

|

6,287,368 |

|

| |

|

| Series 2009 E, RB |

|

|

6.38% |

|

|

|

12/01/2038 |

|

|

|

720 |

|

|

|

791,032 |

|

| |

|

| Series 2014 A-3, RB(h)

|

|

|

0.00% |

|

|

|

12/01/2041 |

|

|

|

3,000 |

|

|

|

1,298,037 |

|

| |

|

| Series 2014, Ref. RB(i) |

|

|

5.00% |

|

|

|

12/01/2034 |

|

|

|

1,500 |

|

|

|

1,519,498 |

|

| |

|

| Series 2017 A, RB(d)(e) |

|

|

5.50% |

|

|

|

12/01/2042 |

|

|

|

10,000 |

|

|

|

10,358,488 |

|

| |

|

| Series 2017 B-1, RB |

|

|

5.25% |

|

|

|

06/01/2047 |

|

|

|

5,370 |

|

|

|

5,499,905 |

|

| |

|

| Series 2018 A-2, RB |

|

|

5.00% |

|

|

|

12/01/2043 |

|

|

|

1,965 |

|

|

|

2,059,891 |

|

| |

|

| Series 2019 A, RB |

|

|

5.00% |

|

|

|

12/01/2044 |

|

|

|

1,000 |

|

|

|

1,044,361 |

|

| |

|

| Series 2019 A, RB (INS - AGM)(c) |

|

|

4.00% |

|

|

|

12/01/2049 |

|

|

|

1,305 |

|

|

|

1,267,250 |

|

| |

|

| Series 2019 A, RB |

|

|

5.00% |

|

|

|

12/01/2049 |

|

|

|

5,000 |

|

|

|

5,211,659 |

|

| |

|

| Series 2021 A, Ref. RB |

|

|

4.00% |

|

|

|

12/01/2051 |

|

|

|

4,500 |

|

|

|

4,259,434 |

|

| |

|

| Series 2021 A, Ref. RB |

|

|

4.00% |

|

|

|

12/01/2051 |

|

|

|

6,000 |

|

|

|

5,651,390 |

|

| |

|

| Series 2022 B, Ref. RB |

|

|

5.25% |

|

|

|

12/01/2052 |

|

|

|

2,000 |

|

|

|

2,175,313 |

|

| |

|

| Series 2023, Ref. RB (SIFMA Municipal Swap Index +

0.85%)(f)(j) |

|

|

4.15% |

|

|

|

07/15/2026 |

|

|

|

2,000 |

|

|

|

1,994,900 |

|

| |

|

| Pennsylvania Higher Education Assistance Agency; |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2021 A, RB(b) |

|

|

2.63% |

|

|

|

06/01/2042 |

|

|

|

960 |

|

|

|

820,577 |

|

| |

|

| Series 2023 B, RB(b) |

|

|

5.00% |

|

|

|

06/01/2050 |

|

|

|

500 |

|

|

|

485,146 |

|

| |

|

| Pennsylvania Higher Education Assistance Agency (Senior Bonds); Series 2023 A, RB(b) |

|

|

4.00% |

|

|

|

06/01/2044 |

|

|

|

2,845 |

|

|

|

2,751,144 |

|

| |

|

| Pennsylvania State University (The); Series 2016 A, RB |

|

|

5.00% |

|

|

|

09/01/2041 |

|

|

|

3,245 |

|

|

|

3,366,654 |

|

| |

|

| Philadelphia (City of), PA; |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2017 15, Ref. RB |

|

|

5.00% |

|

|

|

08/01/2047 |

|

|

|

1,100 |

|

|

|

1,117,190 |

|

| |

|

| Series 2017 A, RB(d)(e) |

|

|

5.25% |

|

|

|

10/01/2052 |

|

|

|

7,405 |

|

|

|

7,686,369 |

|

| |

|

| Series 2017 A, Ref. GO Bonds |

|

|

5.00% |

|

|

|

08/01/2036 |

|

|

|

2,550 |

|

|

|

2,699,309 |

|

| |

|

| Series 2017 B, Ref. RB(b) |

|

|

5.00% |

|

|

|

07/01/2042 |

|

|

|

4,000 |

|

|

|

4,080,869 |

|

| |

|

| Series 2017 B, Ref. RB(b) |

|

|

5.00% |

|

|

|

07/01/2047 |

|

|

|

3,000 |

|

|

|

3,037,818 |

|

| |

|

| Series 2017, Ref. GO Bonds |

|

|

5.00% |

|

|

|

08/01/2041 |

|

|

|

3,250 |

|

|

|

3,377,837 |

|

| |

|

| Series 2019 A, Ref. GO Bonds |

|

|

5.00% |

|

|

|

08/01/2031 |

|

|

|

100 |

|

|

|

112,738 |

|

| |

|

| Series 2019 B, GO Bonds |

|

|

5.00% |

|

|

|

02/01/2037 |

|

|

|

1,000 |

|

|

|

1,077,121 |

|

| |

|

| Series 2020 A, RB |

|

|

5.00% |

|

|

|

11/01/2050 |

|

|

|

4,750 |

|

|

|

4,988,195 |

|

| |

|

| Series 2020 C, Ref. RB(b) |

|

|

4.00% |

|

|

|

07/01/2034 |

|

|

|

1,300 |

|

|

|

1,314,227 |

|

| |

|

| Series 2020 C, Ref. RB(b) |

|

|

4.00% |

|

|

|

07/01/2050 |

|

|

|

2,000 |

|

|

|

1,767,145 |

|

| |

|

| Series 2021, Ref. RB (INS - AGM)(b)(c) |

|

|

4.00% |

|

|

|

07/01/2037 |

|

|

|

1,000 |

|

|

|

993,435 |

|

| |

|

| Sixteenth Series 2020 A, RB (INS - AGM)(c) |

|

|

4.00% |

|

|

|

08/01/2045 |

|

|

|

2,000 |

|

|

|

1,954,226 |

|

| |

|

| Sixteenth Series 2020 A, RB (INS - AGM)(c) |

|

|

5.00% |

|

|

|

08/01/2050 |

|

|

|

2,500 |

|

|

|

2,641,269 |

|

| |

|

| Philadelphia (City of), PA Authority for Industrial Development; |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2003, VRD RB (LOC - TD Bank, N.A.)(k)(l)

|

|

|

3.25% |

|

|

|

12/01/2034 |

|

|

|

2,065 |

|

|

|

2,065,000 |

|

| |

|

| Series 2017, Ref. RB(g) |

|

|

5.00% |

|

|

|

03/15/2045 |

|

|

|

1,850 |

|

|

|

1,532,334 |

|

| |

|

| Philadelphia (City of), PA Authority for Industrial Development (Children’s Hospital of Philadelphia);

Series 2014 A, RB(e)(i)(j) |

|

|

5.00% |

|

|

|

07/01/2024 |

|

|

|

6,000 |

|

|

|

6,061,015 |

|

| |

|

| Philadelphia (City of), PA Authority for Industrial Development (Cultural and Commercials Corridors); Series

2016, Ref. RB |

|

|

5.00% |

|

|

|

12/01/2031 |

|

|

|

3,160 |

|

|

|

3,249,457 |

|

| |

|

| Philadelphia (City of), PA Authority for Industrial Development (First Philadelphia Preparatory Charter

School); Series 2014 A, RB |

|

|

7.00% |

|

|

|

06/15/2033 |

|

|

|

2,930 |

|

|

|

2,973,934 |

|

| |

|

| Philadelphia (City of), PA Authority for Industrial Development (Independence Charter School - West); Series

2019, RB |

|

|

5.00% |

|

|

|

06/15/2050 |

|

|

|

1,025 |

|

|

|

893,409 |

|

| |

|

| Philadelphia (City of), PA Authority for Industrial Development (Kipp Philadelphia Charter School); Series

2016 B, RB |

|

|

5.00% |

|

|

|

04/01/2046 |

|

|

|

2,360 |

|

|

|

2,116,964 |

|

| |

|

See accompanying notes which are an integral

part of this schedule.

|

|

|

|

|

Invesco Pennsylvania Value Municipal Income Trust |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Principal |

|

|

|

|

| |

|

Interest |

|

|

Maturity |

|

|

Amount |

|

|

|

|

| |

|

Rate |

|

|

Date |

|

|

(000) |

|

|

Value |

|

| |

|

| Pennsylvania–(continued) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Philadelphia (City of), PA Authority for Industrial Development (La Salle University); Series 2017, Ref.

RB |

|

|

5.00% |

|

|

|

05/01/2026 |

|

|

$ |

1,850 |

|

|

$ |

1,806,964 |

|

| |

|

| Philadelphia (City of), PA Authority for Industrial Development (MaST Community Charter School II); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2020, RB |

|

|

5.00% |

|

|

|

08/01/2030 |

|

|

|

365 |

|

|

|

373,425 |

|

| |

|

| Series 2020, RB |

|

|

5.00% |

|

|

|

08/01/2040 |

|

|

|

620 |

|

|

|

613,411 |

|

| |

|

| Series 2020, RB |

|

|

5.00% |

|

|

|

08/01/2050 |

|

|

|

1,400 |

|

|

|

1,317,870 |

|

| |

|

| Philadelphia (City of), PA Authority for Industrial Development (MaST I Charter School); Series 2016 A, Ref.

RB |

|

|

5.25% |

|

|

|

08/01/2046 |

|

|

|

1,500 |

|

|

|

1,502,671 |

|

| |

|

| Philadelphia (City of), PA Authority for Industrial Development (St. Joseph’s University); Series 2022,

RB |

|

|

5.25% |

|

|

|

11/01/2052 |

|

|

|

2,000 |

|

|

|

2,077,075 |

|

| |

|

| Philadelphia (City of), PA Authority for Industrial Development (Temple University); First Series 2015, Ref.

RB |

|

|

5.00% |

|

|

|

04/01/2045 |

|

|

|

1,970 |

|

|

|

1,990,568 |

|

| |

|

| Philadelphia (City of), PA Authority for Industrial Development (Thomas Jefferson University); Series 2017 A,

Ref. RB |

|

|

5.00% |

|

|

|

09/01/2047 |

|

|

|

980 |

|

|

|

982,452 |

|

| |

|

| Philadelphia (City of), PA Authority for Industrial Development (University Square Apartments); Series 2017,

RB |

|

|

5.00% |

|

|

|

12/01/2058 |

|

|

|

2,000 |

|

|

|

1,917,734 |

|

| |

|

| Philadelphia (City of), PA Authority for Industrial Development (Wesley Enhanced Living Obligated

Group); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2017, Ref. RB |

|

|

5.00% |

|

|

|

07/01/2042 |

|

|

|

1,525 |

|

|

|

1,240,332 |

|

| |

|

| Series 2017, Ref. RB |

|

|

5.00% |

|

|

|

07/01/2049 |

|

|

|

3,500 |

|

|

|

2,718,034 |

|

| |

|

| Philadelphia (City of), PA Hospitals & Higher Education Facilities Authority (Temple University

Health System); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2017, Ref. RB |

|

|

5.00% |

|

|

|

07/01/2032 |

|

|

|

1,980 |

|

|

|

2,028,719 |

|

| |

|

| Series 2017, Ref. RB |

|

|

5.00% |

|

|

|

07/01/2034 |

|

|

|

1,000 |

|

|

|

1,019,619 |

|

| |

|

| Philadelphia (City of), PA Parking Authority; Series 1999 A, RB (INS - AMBAC)(c) |

|

|

5.25% |

|

|

|

02/15/2029 |

|

|

|

1,645 |

|

|

|

1,647,630 |

|

| |

|

| Philadelphia School District (The); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2007 A, Ref. GO Bonds (INS - NATL)(c) |

|

|

5.00% |

|

|

|

06/01/2025 |

|

|

|

1,965 |

|

|

|

2,007,779 |

|

| |

|

| Series 2019 A, GO Bonds |

|

|

5.00% |

|

|

|

09/01/2044 |

|

|

|

2,450 |

|

|

|

2,545,659 |

|

| |

|

| Pittsburgh (City of), PA Water & Sewer Authority; |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2019 A, RB (INS - AGM)(c) |

|

|

5.00% |

|

|

|

09/01/2044 |

|

|

|

2,255 |

|

|

|

2,383,359 |

|

| |

|

| Series 2019 B, Ref. RB (INS - AGM)(c) |

|

|

4.00% |

|

|

|

09/01/2034 |

|

|

|

1,600 |

|

|

|

1,636,622 |

|

| |

|

| Series 2020 B, RB (INS - AGM)(c) |

|

|

4.00% |

|

|

|

09/01/2045 |

|

|

|

1,350 |

|

|

|

1,314,654 |

|

| |

|

| Series 2020 B, RB (INS - AGM)(c) |

|

|

4.00% |

|

|

|

09/01/2050 |

|

|

|

3,540 |

|

|

|

3,364,226 |

|

| |

|

| Series 2023 A, RB (INS - AGM)(c) |

|

|

4.25% |

|

|

|

09/01/2053 |

|

|

|

450 |

|

|

|

442,863 |

|

| |

|

| Southcentral Pennsylvania General Authority (WellSpan Health Obligated Group); Series 2019 A, Ref.

RB |

|

|

5.00% |

|

|

|

06/01/2049 |

|

|

|

2,750 |

|

|

|

2,814,698 |

|

| |

|

| Southeastern Pennsylvania Transportation Authority; Series 2022, RB |

|

|

5.25% |

|

|

|

06/01/2052 |

|

|

|

2,000 |

|

|

|

2,169,710 |

|

| |

|

| Washington (County of), PA Redevelopment Authority; Series 2018, Ref. RB |

|

|

5.00% |

|

|

|

07/01/2035 |

|

|

|

1,000 |

|

|

|

975,938 |

|

| |

|

| Washington (County of), PA Redevelopment Authority (Victory Centre); Series 2018, Ref. RB |

|

|

5.00% |

|

|

|

07/01/2028 |

|

|

|

750 |

|

|

|

748,455 |

|

| |

|

| West Cornwall Township Municipal Authority (Pleasant View Retirement Community); Series 2018 C, Ref.

RB |

|

|

5.00% |

|

|

|

12/15/2048 |

|

|

|

3,670 |

|

|

|

3,184,741 |

|

| |

|

| West Shore Area Authority (Messiah Village); Series 2015 A, Ref. RB |

|

|

5.00% |

|

|

|

07/01/2035 |

|

|

|

1,500 |

|

|

|

1,435,103 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

408,784,933 |

|

| |

|

|

|

|

|

|

| Puerto Rico–7.27% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Children’s Trust Fund; |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series 2002, RB |

|

|

5.63% |

|

|

|

05/15/2043 |

|

|

|

1,265 |

|

|

|

1,279,363 |

|

| |

|

| Series 2005 A, RB(h) |

|

|

0.00% |

|

|

|

05/15/2050 |

|

|

|

17,475 |

|

|

|

3,218,280 |

|

| |

|

| Series 2005 B, RB(h) |

|

|

0.00% |

|

|

|

05/15/2055 |

|

|

|

7,700 |

|

|

|

819,959 |

|

| |

|

| Series 2008 A, RB(h) |

|

|

0.00% |

|

|

|

05/15/2057 |

|

|

|

9,170 |

|

|

|

677,706 |

|

| |

|

| Series 2008 B, RB(h) |

|

|

0.00% |

|

|

|

05/15/2057 |

|

|

|

28,400 |

|

|

|

1,590,974 |

|

| |

|

| Puerto Rico (Commonwealth of); Series 2021 A, GO Bonds(h)

|

|

|

0.00% |

|

|

|

07/01/2033 |

|

|

|

12,000 |

|

|

|

7,320,639 |

|

| |

|

| Puerto Rico (Commonwealth of) Aqueduct & Sewer Authority; Series 2022 A, Ref. RB(g) |

|

|

5.00% |

|

|

|

07/01/2033 |

|

|

|

1,000 |

|

|

|

1,012,009 |

|

| |

|

| Puerto Rico (Commonwealth of) Electric Power Authority; Series 2007 VV, Ref. RB (INS - NATL)(c) |

|

|

5.25% |

|

|

|

07/01/2030 |

|

|

|

2,660 |

|

|

|

2,637,712 |

|

| |

|

| Puerto Rico (Commonwealth of) Highway & Transportation Authority;

Series 2022 C, RB(m) |

|

|

5.00% |

|

|

|

07/01/2053 |

|

|

|

1,825 |

|

|

|

1,181,680 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19,738,322 |

|

| |

|

|

|

|

|

|

| Virgin Islands–1.14% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Virgin Islands (Government of) Port Authority; Series 2014 B, Ref. RB |

|

|

5.00% |

|

|

|

09/01/2044 |

|

|

|

970 |

|

|

|

849,107 |

|

| |

|

See accompanying notes which are an integral

part of this schedule.

|

|

|

|

|

Invesco Pennsylvania Value Municipal Income Trust |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Principal |

|

|

|

|

| |

|

Interest |

|

|

Maturity |

|

|

Amount |

|

|

|

|

| |

|

Rate |

|

|

Date |

|

|

(000) |

|

|

Value |

|

| |

|

| Virgin Islands–(continued) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Virgin Islands (Government of) Public Finance Authority (Garvee); Series 2015, RB(g) |

|

|

5.00% |

|

|

|

09/01/2030 |

|

|

$ |

2,230 |

|

|

$ |

2,255,276 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,104,383 |

|

| |

|

|

|

|

|

|

| Guam–0.83% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Guam (Territory of) (Section 30); Series 2016 A, Ref. RB |

|

|

5.00% |

|

|

|

12/01/2046 |

|

|

|

1,250 |

|

|

|

1,187,045 |

|

| |

|

| Guam (Territory of) Waterworks Authority; Series 2014 A, Ref. RB |

|

|

5.00% |

|

|

|

07/01/2029 |

|

|

|

1,055 |

|

|

|

1,062,609 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,249,654 |

|

| |

|

| TOTAL INVESTMENTS IN SECURITIES(n)–159.80% (Cost

$455,262,380) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

433,877,292 |

|

| |

|

| FLOATING RATE NOTE OBLIGATIONS–(12.19)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Notes with interest and fee rates ranging from 3.82% to 3.86% at 11/30/2023 and contractual maturities of

collateral ranging from 06/01/2031 to 10/01/2052(o) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(33,100,000 |

) |

| |

|

| VARIABLE RATE MUNI TERM PREFERRED SHARES–(50.66)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(137,556,953 |

) |

| |

|

| OTHER ASSETS LESS LIABILITIES–3.05% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8,286,391 |

|

| |

|

| NET ASSETS APPLICABLE TO COMMON SHARES–100.00% |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

271,506,730 |

|

| |

|

|

|

| Investment Abbreviations: |

|

| AGM – Assured Guaranty Municipal Corp. |

| AMBAC – American Municipal Bond Assurance Corp. |

| BAM – Build America Mutual Assurance Co. |

| COP – Certificates of Participation |

| GO – General Obligation |

| INS – Insurer |

| LIBOR – London Interbank Offered Rate |

| LOC – Letter of Credit |

| NATL – National Public Finance Guarantee Corp. |

| RB – Revenue Bonds |

| Ref. – Refunding |

| SIFMA – Securities Industry and Financial Markets Association |

| USD – U.S. Dollar |

| VRD – Variable Rate Demand |

Notes to Schedule of Investments:

| (a) |

Calculated as a percentage of net assets. Amounts in excess of 100% are due to the Trust’s use of leverage.

|

| (b) |

Security subject to the alternative minimum tax. |

| (c) |

Principal and/or interest payments are secured by the bond insurance company listed. |

| (d) |

Security is subject to a reimbursement agreement which may require the Trust to pay amounts to a counterparty in the event

of a significant decline in the market value of the security underlying the TOB Trusts. In case of a shortfall, the maximum potential amount of payments the Trust could ultimately be required to make under the agreement is $23,895,000. However, such

shortfall payment would be reduced by the proceeds from the sale of the security underlying the TOB Trusts. |

| (e) |

Underlying security related to TOB Trusts entered into by the Trust. |

| (f) |

Interest or dividend rate is redetermined periodically. Rate shown is the rate in effect on November 30, 2023.

|

| (g) |

Security purchased or received in a transaction exempt from registration under the Securities Act of 1933, as amended (the

“1933 Act”). The security may be resold pursuant to an exemption from registration under the 1933 Act, typically to qualified institutional buyers. The aggregate value of these securities at November 30, 2023 was $8,839,422, which

represented 3.26% of the Trust’s Net Assets. |

| (h) |

Zero coupon bond issued at a discount. |

| (i) |

Advance refunded; secured by an escrow fund of U.S. Government obligations or other highly rated collateral.

|

| (j) |

Security has an irrevocable call by the issuer or mandatory put by the holder. Maturity date reflects such call or put.

|

| (k) |

Demand security payable upon demand by the Trust at specified time intervals no greater than thirteen months. Interest

rate is redetermined periodically by the issuer or agent based on current market conditions. Rate shown is the rate in effect on November 30, 2023. |

| (l) |

Principal and interest payments are fully enhanced by a letter of credit from the bank listed or a predecessor bank,

branch or subsidiary. |

| (m) |

Convertible capital appreciation bond. The interest rate shown represents the coupon rate at which the bond will accrue at

a specified future date. |

| (n) |

This table provides a listing of those entities that have either issued, guaranteed, backed or otherwise enhanced the

credit quality of more than 5% of the securities held in the portfolio. In instances where the entity has guaranteed, backed or otherwise enhanced the credit quality of a security, it is not primarily responsible for the issuer’s obligations

but may be called upon to satisfy the issuer’s obligations. |

|

|

|

|

|

| Entity |

|

Percent |

|

| |

|

| Assured Guaranty Municipal Corp. |

|

|

8.61% |

|

| |

|

| (o) |

Floating rate note obligations related to securities held. The interest and fee rates shown reflect the rates in effect at

November 30, 2023. At November 30, 2023, the Trust’s investments with a value of $51,355,237 are held by TOB Trusts and serve as collateral for the $33,100,000 in the floating rate note obligations outstanding at that date.

|

The valuation policy and a listing of other significant accounting policies are available in the most recent shareholder report.

See accompanying notes which are an integral

part of this schedule.

|

|

|

|

|

Invesco Pennsylvania Value Municipal Income Trust |

Notes to Quarterly Schedule of Portfolio Holdings

November 30, 2023

(Unaudited)

NOTE 1–Additional Valuation Information

Generally Accepted Accounting

Principles (“GAAP”) defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, under current market conditions.

GAAP establishes a hierarchy that prioritizes the inputs to valuation methods, giving the highest priority to readily available unadjusted quoted prices in an active market for identical assets (Level 1) and the lowest priority to significant

unobservable inputs (Level 3), generally when market prices are not readily available. Based on the valuation inputs, the securities or other investments are tiered into one of three levels. Changes in valuation methods may result in transfers in or

out of an investment’s assigned level:

|

|

|

| Level 1 – |

|

Prices are determined using quoted prices in an active market for identical assets. |

| Level 2 – |

|

Prices are determined using other significant observable inputs. Observable inputs are inputs that other market participants may use in pricing a security. These may include quoted prices for similar securities, interest rates,

prepayment speeds, credit risk, yield curves, loss severities, default rates, discount rates, volatilities and others. |

| Level 3 – |

|

Prices are determined using significant unobservable inputs. In situations where quoted prices or observable inputs are unavailable (for example, when there is little or no market activity for an investment at the end of the

period), unobservable inputs may be used. Unobservable inputs reflect Invesco Advisers, Inc.’s assumptions about the factors market participants would use in determining fair value of the securities or instruments and would be based on the best

available information. |

As of November 30, 2023, all of the securities in this Trust were valued based on Level 2 inputs (see the Schedule of

Investments for security categories). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities. Because of the inherent uncertainties of valuation, the values

reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

|

|

|

|

|

Invesco Pennsylvania Value Municipal Income Trust |

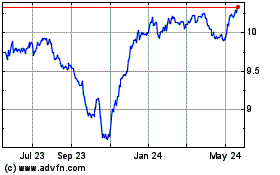

Invesco Pennsylvania Val... (NYSE:VPV)

Historical Stock Chart

From Mar 2024 to Apr 2024

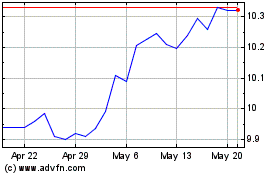

Invesco Pennsylvania Val... (NYSE:VPV)

Historical Stock Chart

From Apr 2023 to Apr 2024