Current Report Filing (8-k)

December 30 2019 - 8:39AM

Edgar (US Regulatory)

false 0001124610 0001124610 2019-12-30 2019-12-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): December 30, 2019

VMWARE, INC.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

Delaware

|

|

001-33622

|

|

94-3292913

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

3401 Hillview Avenue, Palo Alto, CA

|

|

94304

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (650) 427-5000

N/A

(Former Name or Former Address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common stock

|

|

VMW

|

|

The New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Introductory Note

As previously disclosed in the Current Report on Form 8-K filed by VMware, Inc., a Delaware corporation (the “Company”), with the Securities and Exchange Commission (the “SEC”) on August 22, 2019, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”), dated as of August 22, 2019, with Pivotal Software, Inc., a Delaware corporation (“Pivotal”), and Raven Transaction Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of the Company (“Merger Sub”), providing for, subject to the terms and conditions of the Merger Agreement, the merger of Merger Sub with and into Pivotal (the “Merger”), with Pivotal surviving the Merger as a wholly-owned subsidiary of the Company. On December 30, 2019, the Company completed its acquisition of Pivotal pursuant to the Merger Agreement and Pivotal became a wholly-owned subsidiary of the Company.

Also as previously disclosed in the Current Report on Form 8-K filed by the Company with the SEC on August 22, 2019, the Company, Dell Technologies Inc., a Delaware Corporation (“Dell Technologies”), EMC Equity Assets LLC, a Delaware limited liability company (“EMC”) and, solely with respect to certain sections therein, EMC Corporation, a Massachusetts corporation (“EMC Parent”), entered into a Consent and Support Agreement (the “Support Agreement”), dated as of August 22, 2019, pursuant to which, among other things and subject to the terms and conditions set forth therein, each of the Company, Dell Technologies and EMC became obligated to enter into the Second Amended and Restated Tax Sharing Agreement (the “Second Amended TSA”) with Dell Technologies, EMC and their respective affiliates. The Second Amended TSA was to be generally effective for tax periods (or portions thereof) beginning after the consummation of the Merger (such periods, “Post-Closing Periods,” and tax periods (or portions thereof) ending on or before the date of the Second Amended TSA, “Pre-Closing Periods”). The Second Amended TSA amends and restates the Amended and Restated Tax Sharing Agreement, entered into on September 6, 2016 (the “First Amended TSA”). The First Amended TSA amended and restated the Tax Sharing Agreement dated August 13, 2007, and subsequently amended on January 1, 2011 (as amended, the “Prior TSA”), to which EMC and the Company were parties. The Second Amended TSA provides for certain modifications and clarifications to the First Amended TSA, including but not limited to:

|

|

•

|

The Company’s liability for its share of the Dell Technologies’ consolidated or combined group’s liability for any tax period will not exceed the amount of the liability that the Company would have incurred had the Company and its affiliates not been a part of such consolidated or combined group;

|

|

|

•

|

The Company’s liability for amounts pursuant to Section 965 of the Internal Revenue Code, as amended, shall be solely governed by the Section 965 Letter Agreement dated April 1, 2019 (which agreement was filed by the Company on Form 10-Q for the period ended May 3, 2019).

|

|

|

•

|

(i) As provided in the First Amended TSA, the Prior TSA shall continue in full force and effect with respect to tax periods ending prior to and on the Effective Time (as that term is defined in the Agreement and Plan of Merger dated as of October 12, 2015, as amended by the First Amendment to the Agreement and Plan of Merger, dated as of May 16, 2016), (ii) the First Amended TSA shall continue in full force and effect with respect to tax periods (or portions thereof) ending after the Closing and on or before the date of the Second Amended TSA, (iii) the Second Amended TSA shall be effective with respect to Post-Closing Periods, (iv) the Tax Sharing Agreement by and among Dell Technologies and its affiliates, EMC and its affiliates, and Pivotal dated as of February 8, 2017 (the “Pivotal TSA”) shall survive and remain in effect with respect to Pre-Closing Periods, and (v) in the event of any conflict between the Pivotal TSA, on the one hand, and the Prior TSA, the First Amended TSA, and the Second Amended TSA, on the other hand, the latter shall control.

|

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

On December 30, 2019, the Company, Dell Technologies and EMC entered into the Second Amended TSA.

The information set forth in the Introductory Note is incorporated herein by reference. The description of the Second Amended TSA contained herein does not purport to be complete and is qualified in its entirety by reference to the full text of the Second Amended TSA, which is attached hereto as Exhibit 10.1 and incorporated herein by reference. Additional information about the Tax Sharing Agreement is set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended February 1, 2019, which was filed with the SEC on March 29, 2019.

|

Item 7.01

|

Regulation FD Disclosure.

|

On December 30, 2019, the Company and Pivotal issued a joint press release announcing the consummation of the Merger. The joint press release is attached as Exhibit 99.1 hereto and is incorporated herein by reference.

The information in Item 7.01 of this report on Form 8-K, including the information in Exhibit 99.1 hereto, is furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed “filed” for any purpose, including for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information in Item 7.01 of this Current Report on Form 8-K, including the information in Exhibit 99.1 hereto, shall not be deemed incorporated by reference into any filing under the Securities Act, or the Exchange Act regardless of any general incorporation language in such filing.

The information set forth in the Introductory Note is incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

VMWARE, INC.

|

|

|

|

|

|

By:

|

|

/s/ Craig Norris

|

|

Name:

|

|

Craig Norris

|

|

Title:

|

|

Vice President, Deputy General Counsel and Assistant Secretary

|

Dated: December 30, 2019

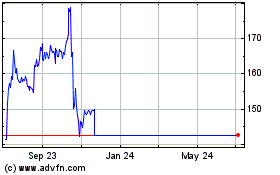

Vmware (NYSE:VMW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vmware (NYSE:VMW)

Historical Stock Chart

From Apr 2023 to Apr 2024