Uber's Food-Delivery Business, Cost Cuts Cushion Pandemic Hit -- Update

February 10 2021 - 6:50PM

Dow Jones News

By Preetika Rana

Uber Technologies Inc. posted a narrower annual loss on the back

of its food-delivery business and aggressive cost cuts, even as the

coronavirus pandemic crushed its core ride-hailing operations.

The San Francisco-based company on Wednesday reported a net loss

of $6.76 billion for 2020, compared with a loss of $8.5 billion the

year before. While widespread shelter-in-place orders crippled

Uber's rides business, food delivery thrived as the same health

mandates kept people from going to restaurants. Revenue for the

year declined 14% to $11.13 billion.

Uber overhauled its business during the health crisis, cutting

about a quarter of its staff and shedding noncore businesses, among

other moves, leading to $1 billion in savings on fixed expenses

last year. Meanwhile, the company doubled down on delivery, buying

small food-delivery rival Postmates Inc. last year and ferrying new

items such as groceries and medicines.

Uber's delivery bookings in the fourth quarter increased more

than twofold from year-earlier levels. However, rides bookings

halved. That downturn was broadly in line with ride-share rival

Lyft Inc., whose fourth-quarter revenue declined 44%.

Overall, Uber's fourth-quarter revenue fell 16% to $3.16

billion. The net loss for the period narrowed to $968 million, from

$1.09 billion in the year-earlier quarter. The latest results were

slightly below Wall Street's expectations.

But Uber's adjusted loss before interest, taxes, depreciation

and amortization beat analysts' projections. Like Lyft, Uber has

said it expects to become profitable by that measure by year-end --

a goal executives reiterated on a conference call with analysts

Wednesday.

Uber posted an adjusted Ebitda loss of $454 million for the

fourth quarter, compared with a year-earlier loss of $615 million.

Analysts surveyed by FactSet had predicted on average a loss of

$507 million on that basis in the latest period.

Food delivery, an expensive logistical undertaking, has

typically been a drag on Uber's bottom line. But Uber trimmed its

adjusted Ebitda loss from delivery to $145 million in the fourth

quarter, from $461 million a year earlier, marking the unit's best

three-month performance.

Uber's shares are up more than 80% from early November,

benefiting from a big regulatory win in the company's home state

and, more recently, from Covid-19 vaccine distribution. Shares were

down about 4% in after-hours trading Wednesday.

Write to Preetika Rana at preetika.rana@wsj.com

(END) Dow Jones Newswires

February 10, 2021 18:35 ET (23:35 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

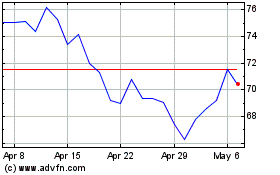

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Mar 2024 to Apr 2024

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Apr 2023 to Apr 2024