0001043337FALSE00010433372024-02-282024-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 28, 2024

STONERIDGE, INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Ohio | 001-13337 | 34-1598949 |

(State or Other Jurisdiction

of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

39675 MacKenzie Drive, Suite 400, Novi, Michigan 48377

(Address of principal executive offices, and Zip Code)

(248) 489-9300

Registrant’s Telephone Number, Including Area Code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

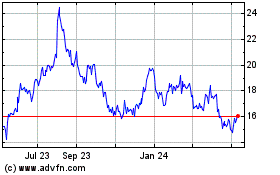

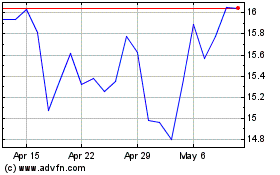

| Common Shares, without par value | SRI | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

ITEM 2.02 Results of Operations and Financial Condition.

On February 28, 2024, Stoneridge, Inc. (the “Company”) issued a press release announcing its results for the fourth quarter and full-year ended December 31, 2023. A copy of the press release is attached hereto as Exhibit 99.1. On February 29, 2024, members of the Company’s management will hold a full-year and fourth quarter 2023 earnings conference call to discuss the Company’s financial results and the presentation attached hereto as Exhibit 99.2, will accompany management’s comments.

The press release and earnings conference call presentation contain certain non-GAAP financial measures, including Adjusted Sales, Adjusted Gross Profit and Margin, Adjusted Operating Income (Loss) and Margin, Adjusted Income Before Tax, Adjusted Net Income (Loss), Adjusted Earnings (Loss) per Share (“Adjusted EPS”), Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”), EBITDA Margin, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Income Tax Expense, Net Debt, Adjusted Net Debt and Adjusted Cash (collectively, the “Non-GAAP Financial Measures”). Management believes that the presentation of the Non-GAAP Financial Measures used in the press release and earnings conference call presentation are useful to both management and investors in their analysis of the Company’s financial position, results of operations and expected results of operations because the Non-GAAP Financial Measures facilitate a period to period comparison of operating results by excluding significant unusual, non-recurring items in 2023 and 2022. For 2023, these items relate to the sales from spot purchase recoveries, after-tax and pre-tax business realignment costs, after-tax and pre-tax Brazilian indirect tax credits, net, after-tax and pre-tax gain on disposal of fixed assets, after-tax and pre-tax environmental remediation costs, after-tax deferred financing fee write off and adjustments for debt compliance calculations. For 2022, these items relate to sales from spot purchase recoveries, pre-tax business realignment costs, pre-tax Brazilian indirect tax credits, net and adjustments for debt compliance calculations. These non-GAAP financial measures, however, should not be considered in isolation or as a substitute for the most comparable GAAP financial measures. Investors are cautioned that non-GAAP financial measures used by the Company may not be comparable to non-GAAP financial measures used by other companies. Adjusted Sales, Adjusted Gross Profit and Margin, Adjusted Operating Income (Loss) and Margin, Adjusted Income Before Tax, Adjusted Net Income (Loss), Adjusted EPS, EBITDA, EBITDA Margin, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Income Tax Expense, Net Debt, Adjusted Net Debt and Adjusted Cash should not be considered a substitute for Sales, Gross Profit, Operating Income (Loss), Income (Loss) Before Tax, Net Income (Loss), Earnings (Loss) per Share, Income Tax Expense, Debt or Cash and Cash Equivalents prepared in accordance with GAAP.

ITEM 7.01 Regulation FD Disclosure.

The information set forth in Item 2.02 above is hereby incorporated herein by reference.

The information in this report, including the press release and the earnings conference call presentation furnished as Exhibits 99.1 and 99.2 hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, and shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. In addition, the exhibits furnished herewith contain statements intended as “forward-looking statements” that are subject to the cautionary statements about forward-looking statements set forth in such exhibits.

ITEM 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| |

| |

| |

| |

| |

| 104 | Cover Page Interactive Data File (the Cover Page Interactive Data File is embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| Stoneridge, Inc. |

| |

| Date: February 28, 2024 | /s/ Matthew R. Horvath |

| Matthew R. Horvath Chief Financial Officer and Treasurer (Principal Financial Officer) |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Stoneridge Reports Fourth Quarter 2023 Results

Achieves Q4 Sequential EPS Improvement In Line with Prior Expectations

Establishes 2024 Midpoint Revenue Guidance of $1 Billion And Midpoint EBITDA of $67 Million (Midpoint EBITDA Margin Expansion Of 170 Basis Points vs. 2023)

Maintains 2027 Long-Term Target and Establishes 2028 Revenue Target of $1.35 - $1.55 Billion and EBITDA Margin Target of 12.0% - 14.0%

2023 Fourth Quarter Results

•Sales of $229.5 million

•Adjusted sales of $229.4 million

•Gross profit of $45.5 million

•Adjusted gross profit of $45.7 million (19.9% of adjusted sales)

•Operating income of $6.0 million

•Adjusted operating income of $6.2 million (2.7% of adjusted sales)

•Adjusted EBITDA of $15.6 million (6.8% of adjusted sales)

•Earnings per share (“EPS”) of $0.11

•Adjusted earnings per share of $0.12

2024 Full-Year Guidance

•Midpoint sales of $1 billion

•Midpoint EBITDA of $67 million

•Midpoint EBITDA margin of 6.7%

NOVI, Mich. – February 28, 2024 – Stoneridge, Inc. (NYSE: SRI) today announced financial results for the fourth quarter ended December 31, 2023, with sales of $229.5 million and earnings per share of $0.11. Adjusted sales for the fourth quarter were $229.4 million and adjusted earnings per share were $0.12. This results in full-year sales of $975.8 million with a loss per share of $(0.19). Adjusted sales for the full-year were $961.2 million while adjusted loss per share was $(0.08). The exhibits attached hereto provide reconciliation detail on normalizing adjustments of non-GAAP financial measures used in this press release.

For the fourth quarter of 2023, Stoneridge reported gross profit of $45.5 million and adjusted gross profit of $45.7 million (19.9% of adjusted sales). Operating income was $6.0 million and adjusted operating income was $6.2 million (2.7% of adjusted sales). Adjusted EBITDA was $15.6 million (6.8% of adjusted sales),

For the full-year ended December 31 2023, Stoneridge reported gross profit of $201.3 million and adjusted gross profit of $202.1 million (21.0% of adjusted sales). Operating income was $12.8 million and adjusted

operating income was $16.2 million (1.7% of adjusted sales). Adjusted EBITDA was $48.1 million (5.0% of adjusted sales) an increase of 150 basis points relative to the full-year 2022.

Jim Zizelman, president and chief executive officer, commented, “In the fourth quarter, we delivered on our previously provided EPS expectations driving sequential improvement from the third quarter. In 2023, we faced significant macroeconomic headwinds specifically related to the UAW strike, and the slower-than-expected rate of penetration for electric vehicles. That said, we delivered on the financial commitments we outlined at the beginning of the year, driven by the execution of our new program launches and the ramp-up of recently launched programs, continuous improvement in our manufacturing facilities and the execution of operating expense initiatives to both reduce cost and improve efficiency. Looking forward, we will continue to evaluate our cost structure and organization to ensure that we are optimizing cost and organizational capability. Finally, we remain focused on efficient cash generation and specifically, reducing our inventory to generate incremental cash as we continue to grow. As a result, we have set ourselves up for continued strong performance in 2024.”

Zizelman continued, “We remain focused on executing our long-term growth strategy. By leveraging our drivetrain agnostic technologies and our products aligned with industry megatrends, we expect to drive outsized growth over the long-term. Contributing to this growth are our MirrorEye® and Smart 2 tachograph products, both of which launched on significant platforms this year and will continue to grow in both the OEM and aftermarket channels going forward. Earlier this week, we announced our next OEM MirrorEye programs will be launching with Volvo in Europe in mid-2024 and in North America in early 2025. Earlier this month, we announced the extension of our Federal Motor Carrier Safety Administration (FMCSA) exemption for an additional 5 years which will allow our US-based fleet partners to maximize on the safety and fuel economy benefits of MirrorEye. Today, we are announcing three additional fleet partnerships with PS Logistics, Stokes Trucking and Cargo Transporters. These fleets understand the significant safety and fuel economy benefits of MirrorEye and have committed to equipping all of their long-haul trucks with MirrorEye over time. Furthermore, our Smart 2 tachograph launched earlier this year providing significant growth opportunities aligned with regulatory changes and requirements over the next several years.”

Zizelman concluded, “We have a strong backlog, products aligned with industry megatrends and drivetrain agnostic technologies that will allow us to continue to grow as market preferences and customer platforms continue to evolve. We continue to focus on operational improvements and material cost reductions to drive gross margin expansion while we leverage our existing cost structure to expand operating margin as we grow. While we made a significant amount of progress in 2023, we are expecting continued improvement in 2024. Stoneridge remains well positioned to outpace our underlying end market growth and drive significant earnings expansion going-forward.”

Fourth Quarter in Review

Control Devices sales of $75.4 million decreased by 12.2% relative to the fourth quarter of 2022. This decrease was primarily due to lower sales in the North American passenger vehicle end market due in part to the UAW strike as well as reduced electric vehicle production volumes, partially offset by higher sales in China. Fourth quarter adjusted operating margin of 1.2% declined by 520 basis points relative to the fourth quarter of 2022, primarily due to unfavorable fixed cost leverage as a result of decreased sales as well as incremental costs incurred related to a distressed supplier.

Electronics adjusted sales of $146.8 million increased by 8.9% relative to the fourth quarter of 2022. This increase was primarily driven by higher customer production volumes and the launch of new programs and ramp-up of existing programs in the European and North American commercial vehicle end markets, along with favorable foreign currency translation, partially offset by lower sales in the European and North American off-highway end markets. Fourth quarter adjusted operating margin of 7.5% improved by 380 basis points relative to the fourth quarter of 2022, primarily due to higher contribution from incremental sales, direct material cost

improvements including the impact of price increases and lower D&D costs due to the timing of customer reimbursements.

Stoneridge Brazil sales of $13.9 million increased by 6.4% relative to sales in the fourth quarter of 2022. This increase was primarily due to favorable foreign currency translation and higher sales in local OEM products. Fourth quarter adjusted operating margin of 7.0% increased by approximately 100 basis points relative to the fourth quarter of 2022, primarily due to higher sales and lower material costs.

Cash and Debt Balances

As of December 31, 2023, Stoneridge had cash and cash equivalents balances totaling $40.8 million. Total debt as of December 31, 2023 was $191.5 million resulting in net debt of $150.6 million. Per the terms of our Credit Facility, the Company remains compliant with the required covenants and reported a net debt to trailing twelve-month EBITDA compliance ratio of 3.13x.

The Company continues to focus on operating performance and working capital improvement to drive cash performance, particularly related to inventory reduction. As a result, the Company expects a net debt to EBITDA ratio for compliance purposes of 2.0x - 2.5x by the end of 2024.

2024 Outlook

The Company is issuing guidance ranges for its full-year 2024 performance including sales guidance of $990 million to $1,010 million, gross margin guidance of 22.0% to 22.75%, operating margin guidance of 2.75% to 3.25%, earnings per share guidance of $0.30 to $0.40 and EBITDA guidance of $64 million to $70 million, or 6.5% to 6.9% of sales.

Matt Horvath, chief financial officer, commented “Our midpoint revenue guidance of $1 billion results in approximately 4% growth relative to 2023, which outpaces our weighted-average OEM end markets which are expected to decline by 5%. We expect continued strong growth primarily due to the launch of MirrorEye with Peterbilt in North America and with Volvo in Europe mid-year. We expect that our Smart 2 tachograph platform will continue to grow in both OEM and aftermarket applications as regulations continue to drive adoption in Europe.”

Horvath continued, “We expect strong contribution margins on our growth as we continue to focus on operational improvement and material cost reduction actions to drive gross margin expansion. Similarly, the annualized impact of the cost actions taken last year in addition to our continued focus on an optimized structure from both a resources and cost perspective, are expected to drive operating leverage on continued growth. Driven primarily by our expected revenue growth, focus on gross margin improvement and leveraging our global footprint to maximize our capabilities and output, we expect EBITDA margin expansion of 150 to 190 basis points relative to 2023 resulting in EBITDA of $64 million to $70 million in 2024.”

Horvath concluded, “Finally, we are reaffirming and advancing the long-term targets we outlined last year as we expect 2028 revenue of $1.45 billion and EBITDA margin of 13.0% at the midpoint of our long-term guided ranges. We remain focused on building a strong foundation for continued earnings expansion as we capitalize on our robust backlog and impressive portfolio of advanced technologies. Stoneridge remains well positioned to continue to outperform our underlying markets and drive margin expansion resulting in long-term shareholder value creation.”

Conference Call on the Web

A live Internet broadcast of Stoneridge’s conference call regarding 2023 fourth quarter results can be accessed at 9:00 a.m. Eastern Time on Thursday, February 29, 2024, at www.stoneridge.com, which will also offer a webcast replay.

About Stoneridge, Inc.

Stoneridge, Inc., headquartered in Novi, Michigan, is a global designer and manufacturer of highly engineered electrical and electronic systems, components and modules for the automotive, commercial, off-highway and agricultural vehicle markets. Additional information about Stoneridge can be found at www.stoneridge.com.

Forward-Looking Statements

Statements in this press release contain “forward-looking statements” under the Private Securities Litigation Reform Act of 1995. These statements appear in a number of places in this report and may include statements regarding the intent, belief or current expectations of the Company, with respect to, among other things, our (i) future product and facility expansion, (ii) acquisition strategy, (iii) investments and new product development, (iv) growth opportunities related to awarded business, and (v) operational expectations. Forward-looking statements may be identified by the words “will,” “may,” “should,” “designed to,” “believes,” “plans,” “projects,” “intends,” “expects,” “estimates,” “anticipates,” “continue,” and similar words and expressions. The forward-looking statements are subject to risks and uncertainties that could cause actual events or results to differ materially from those expressed in or implied by the statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, among other factors:

•the ability of our suppliers to supply us with parts and components at competitive prices on a timely basis, including the impact of potential tariffs and trade considerations on their operations and output;

•fluctuations in the cost and availability of key materials (including semiconductors, printed circuit boards, resin, aluminum, steel and copper) and components and our ability to offset cost increases through negotiated price increases with our customers or other cost reduction actions, as necessary;

•global economic trends, competition and geopolitical risks, including impacts from ongoing or potential global conflicts and any related sanctions and other measures, or an escalation of sanctions, tariffs or other trade tensions between the U.S. and other countries;

•our ability to achieve cost reductions that offset or exceed customer-mandated selling price reductions;

•the reduced purchases, loss or bankruptcy of a major customer or supplier;

•the costs and timing of business realignment, facility closures or similar actions;

•a significant change in automotive, commercial, off-highway or agricultural vehicle production;

•competitive market conditions and resulting effects on sales and pricing;

•foreign currency fluctuations and our ability to manage those impacts;

•customer acceptance of new products;

•our ability to successfully launch/produce products for awarded business;

•adverse changes in laws, government regulations or market conditions affecting our products, our suppliers, or our customers’ products;

•our ability to protect our intellectual property and successfully defend against assertions made against us;

•liabilities arising from warranty claims, product recall or field actions, product liability and legal proceedings to which we are or may become a party, or the impact of product recall or field actions on our customers;

•labor disruptions at our facilities, or at any of our significant customers or suppliers;

•business disruptions due to natural disasters or other disasters outside of our control;

•the amount of our indebtedness and the restrictive covenants contained in the agreements governing our indebtedness, including our revolving Credit Facility;

•capital availability or costs, including changes in interest rates;

•the failure to achieve the successful integration of any acquired company or business;

•risks related to a failure of our information technology systems and networks, and risks associated with current and emerging technology threats and damage from computer viruses, unauthorized access, cyber-attack and other similar disruptions; and

•the items described in Part I, Item IA (“Risk Factors”) in our Form 10-K filed with the SEC.

The forward-looking statements contained herein represent our estimates only as of the date of this release and should not be relied upon as representing our estimates as of any subsequent date. While we may elect to update these forward-looking statements at some point in the future, we specifically disclaim any obligation to do so, whether to reflect actual results, changes in assumptions, changes in other factors affecting such forward-looking statements or otherwise.

Use of Non-GAAP Financial Information

This press release contains information about the Company’s financial results that is not presented in accordance with accounting principles generally accepted in the United States (“GAAP”). Such non-GAAP financial measures are reconciled to their closest GAAP financial measures at the end of this press release. The provision of these non-GAAP financial measures for 2023 and 2022 is not intended to indicate that Stoneridge is explicitly or implicitly providing projections on those non-GAAP financial measures, and actual results for such measures are likely to vary from those presented. The reconciliations include all information reasonably available to the Company at the date of this press release and the adjustments that management can reasonably predict.

Management believes the non-GAAP financial measures used in this press release are useful to both management and investors in their analysis of the Company’s financial position and results of operations. In particular, management believes that adjusted sales, adjusted gross profit and margin, adjusted operating income and margin, adjusted income (loss) before tax, adjusted net income (loss), adjusted earnings (loss) per share, adjusted EBITDA, adjusted EBITDA margin, adjusted tax expense, adjusted tax rate, adjusted net debt and adjusted cash are useful measures in assessing the Company’s financial performance by excluding certain items that are not indicative of the Company’s core operating performance or that may obscure trends useful in evaluating the Company’s continuing operating activities. Management also believes that these measures are useful to both management and investors in their analysis of the Company’s results of operations and provide improved comparability between fiscal periods.

Adjusted sales, adjusted gross profit and margin, adjusted operating income and margin, adjusted income (loss) before tax, adjusted net income (loss), adjusted earnings (loss) per share, adjusted EBITDA, adjusted EBITDA margin, adjusted tax expense, adjusted tax rate, adjusted net debt and adjusted cash should not be considered in isolation or as a substitute for sales, gross profit, operating income, income (loss) before tax, net income (loss), earnings (loss) per share, tax expense, tax rate, debt, cash and cash equivalents, cash provided by operating activities or other income statement or cash flow statement data prepared in accordance with GAAP.

For more information, contact Kelly K. Harvey, Director Investor Relations (Kelly.Harvey@Stoneridge.com).

CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | | | | |

| December 31, (in thousands) | | 2023 | | 2022 |

| | | | |

| ASSETS | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 40,841 | | | $ | 54,798 | |

Accounts receivable, less reserves of $1,058 and $962, respectively | | 166,545 | | | 158,155 | |

| Inventories, net | | 187,758 | | | 152,580 | |

| Prepaid expenses and other current assets | | 34,246 | | | 44,018 | |

| Total current assets | | 429,390 | | | 409,551 | |

| Long-term assets: | | | | |

| Property, plant and equipment, net | | 110,126 | | | 104,643 | |

| Intangible assets, net | | 47,314 | | | 45,508 | |

| Goodwill | | 35,295 | | | 34,225 | |

| Operating lease right-of-use asset | | 10,795 | | | 13,762 | |

| Investments and other long-term assets, net | | 46,980 | | | 44,416 | |

| Total long-term assets | | 250,510 | | | 242,554 | |

| Total assets | | $ | 679,900 | | | $ | 652,105 | |

| | | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | | |

| Current liabilities: | | | | |

| Current portion of debt | | $ | 2,113 | | | $ | 1,450 | |

| Accounts payable | | 111,925 | | | 110,202 | |

| Accrued expenses and other current liabilities | | 64,203 | | | 66,040 | |

| Total current liabilities | | 178,241 | | | 177,692 | |

| Long-term liabilities: | | | | |

| Revolving credit facility | | 189,346 | | | 167,802 | |

| Deferred income taxes | | 7,224 | | | 8,498 | |

| Operating lease long-term liability | | 7,684 | | | 10,594 | |

| Other long-term liabilities | | 9,688 | | | 6,577 | |

| Total long-term liabilities | | 213,942 | | | 193,471 | |

| Shareholders' equity: | | | | |

Preferred Shares, without par value, 5,000 shares authorized, none issued | | — | | | — | |

Common Shares, without par value, 60,000 shares authorized, 28,966 and 28,966 shares issued and 27,549 and 27,341 shares outstanding at December 31, 2023 and December 31, 2022, respectively, with no stated value | | — | | | — | |

| Additional paid-in capital | | 227,340 | | | 232,758 | |

Common Shares held in treasury, 1,417 and 1,625 shares at December 31, 2023 and December 31, 2022, respectively, at cost | | (43,344) | | | (50,366) | |

| Retained earnings | | 196,509 | | | 201,692 | |

| Accumulated other comprehensive loss | | (92,788) | | | (103,142) | |

| Total shareholders' equity | | 287,717 | | | 280,942 | |

| Total liabilities and shareholders' equity | | $ | 679,900 | | | $ | 652,105 | |

CONSOLIDATED STATEMENTS OF OPERATIONS

| | | | | | | | | | | | | | | | | | | | |

| Year ended December 31, (in thousands, except per share data) | | 2023 | | 2022 | | 2021 |

| | | | | | |

| Net sales | | $ | 975,818 | | | $ | 899,923 | | | $ | 770,462 | |

| Costs and expenses: | | | | | | |

| Cost of goods sold | | 774,512 | | | 724,997 | | | 603,604 | |

| Selling, general and administrative | | 117,395 | | | 106,695 | | | 116,000 | |

| Gain on sale of Canton Facility, net | | — | | | — | | | (30,718) | |

| | | | | | |

| Design and development | | 71,075 | | | 65,296 | | | 66,165 | |

| Operating income | | 12,836 | | | 2,935 | | | 15,411 | |

| Interest expense, net | | 13,000 | | | 7,097 | | | 5,189 | |

| Equity in loss (earnings) of investee | | 522 | | | 823 | | | (3,658) | |

| Other expense, net | | 1,236 | | | 5,711 | | | 1,444 | |

| (Loss) income before income taxes | | (1,922) | | | (10,696) | | | 12,436 | |

| Provision for income taxes | | 3,261 | | | 3,360 | | | 9,030 | |

| Net (loss) income | | $ | (5,183) | | | $ | (14,056) | | | $ | 3,406 | |

| | | | | | |

| (Loss) earnings per share: | | | | | | |

| Basic | | $ | (0.19) | | | $ | (0.52) | | | $ | 0.13 | |

| Diluted | | $ | (0.19) | | | $ | (0.52) | | | $ | 0.12 | |

| | | | | | |

| Weighted-average shares outstanding: | | | | | | |

| Basic | | 27,443 | | 27,258 | | 27,114 |

| Diluted | | 27,443 | | 27,258 | | 27,416 |

CONSOLIDATED STATEMENTS OF CASH FLOWS

| | | | | | | | | | | | | | | | | | | | |

| Year ended December 31, (in thousands) | | 2023 | | 2022 | | 2021 |

| | | | | | |

| OPERATING ACTIVITIES: | | | | | | |

| Net (loss) income | | $ | (5,183) | | | $ | (14,056) | | | $ | 3,406 | |

| Adjustments to reconcile net income to net cash provided by (used for) operating activities: | | | | | | |

| Depreciation | | 26,749 | | | 26,720 | | | 27,823 | |

| Amortization, including accretion and write-off of deferred financing costs | | 8,132 | | | 8,055 | | | 6,648 | |

| Deferred income taxes | | (4,038) | | | (5,110) | | | (511) | |

| Loss (earnings) of equity method investee | | 522 | | | 823 | | | (3,658) | |

| Gain on sale of fixed assets | | (860) | | | (241) | | | (165) | |

| Share-based compensation expense | | 3,322 | | | 5,942 | | | 5,960 | |

| Excess tax deficiency (benefit) related to share-based compensation expense | | 230 | | | 543 | | | (563) | |

| Gain on sale of Canton Facility, net | | — | | | — | | | (30,718) | |

| Gain on disposal of business and joint venture, net | | — | | | — | | | (2,942) | |

| | | | | | |

| | | | | | |

| Change in fair value of earn-out contingent consideration | | — | | | — | | | 2,065 | |

| Changes in operating assets and liabilities: | | | | | | |

| Accounts receivable, net | | (5,854) | | | (13,161) | | | (17,019) | |

| Inventories, net | | (31,563) | | | (20,127) | | | (51,270) | |

| Prepaid expenses and other assets | | 16,625 | | | (5,159) | | | (5,116) | |

| Accounts payable | | 1,090 | | | 18,489 | | | 16,515 | |

| Accrued expenses and other liabilities | | (4,226) | | | 4,088 | | | 13,297 | |

| Net cash provided by (used for) operating activities | | 4,946 | | | 6,806 | | | (36,248) | |

| | | | | | |

| INVESTING ACTIVITIES: | | | | | | |

| Capital expenditures, including intangibles | | (38,498) | | | (31,609) | | | (27,031) | |

| Proceeds from sale of fixed assets | | 1,869 | | | 158 | | | 268 | |

| Proceeds from settlement of net investment hedges | | — | | | 3,820 | | | — | |

| Proceeds from disposal of business, net | | — | | | — | | | 1,837 | |

| Proceeds from disposal of joint venture, net | | — | | | — | | | 20,999 | |

| Proceeds from sale of Canton Facility, net | | — | | | — | | | 35,167 | |

| Investment in venture capital fund, net | | (350) | | | (950) | | | (3,199) | |

| Net cash (used for) provided by investing activities | | (36,979) | | | (28,581) | | | 28,041 | |

| | | | | | |

| FINANCING ACTIVITIES: | | | | | | |

| Revolving credit facility borrowings | | 117,369 | | | 21,562 | | | 91,913 | |

| Revolving credit facility payments | | (96,568) | | | (18,000) | | | (64,000) | |

| Proceeds from issuance of debt | | 35,757 | | | 38,940 | | | 45,753 | |

| Repayments of debt | | (35,102) | | | (42,248) | | | (48,107) | |

| Earn-out consideration cash payment | | — | | | (6,276) | | | — | |

| Other financing costs | | (2,251) | | | (484) | | | (18) | |

| Repurchase of Common Shares to satisfy employee tax withholding | | (1,720) | | | (791) | | | (2,665) | |

| Net cash provided by (used for) financing activities | | 17,485 | | | (7,297) | | | 22,876 | |

| | | | | | |

| Effect of exchange rate changes on cash and cash equivalents | | 591 | | | (1,677) | | | (3,041) | |

| Net change in cash and cash equivalents | | (13,957) | | | (30,749) | | | 11,628 | |

| Cash and cash equivalents at beginning of period | | 54,798 | | | 85,547 | | | 73,919 | |

| | | | | | |

| Cash and cash equivalents at end of period | | $ | 40,841 | | | $ | 54,798 | | | $ | 85,547 | |

| | | | | | |

| Supplemental disclosure of cash flow information: | | | | | | |

| Cash paid for interest | | $ | 13,007 | | | $ | 7,293 | | | $ | 6,055 | |

| Cash paid for income taxes, net | | $ | 10,302 | | | $ | 6,178 | | | $ | 11,267 | |

Regulation G Non-GAAP Financial Measure Reconciliations

Reconciliation to US GAAP

Exhibit 1 - Reconciliation of Adjusted EPS

| | | | | | | | | | | |

| Reconciliation of Q4 2023 Adjusted EPS |

| (USD in millions, except EPS) | Q4 2023 | | Q4 2023 EPS |

| Net Income | $ | 3.0 | | | $ | 0.11 | |

| | | |

| Add: After-Tax Business Realignment Costs | 0.1 | | | — | |

| | | |

| Add: After-Tax Deferred Financing Fee Write Off | 0.2 | | 0.01 |

| | | |

| | | |

| | | |

| | | |

| | | |

| Adjusted Net Income | $ | 3.4 | | | $ | 0.12 | |

| | | | | | | | | | | |

| Reconciliation of Full-Year 2023 Adjusted EPS |

| (USD in millions, except EPS) | 2023 | | 2023 EPS |

| Net Loss | $ | (5.2) | | | $ | (0.19) | |

| | | |

| Add: After-Tax Business Realignment Costs | 3.7 | | | 0.13 |

| Add: After-Tax Brazilian Indirect Tax Credits, Net | (0.3) | | | (0.01) |

| Add: After-Tax Deferred Financing Fee Write Off | 0.2 | | | 0.01 |

| Less: After-Tax Gain on Disposal of Fixed Assets | (0.6) | | | (0.02) |

| Add: After-Tax Environmental Remediation Costs | 0.1 | | — | |

| | | |

| | | |

| | | |

| Adjusted Net Loss | $ | (2.1) | | | $ | (0.08) | |

Exhibit 2 – Reconciliation of Adjusted EBITDA

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| (USD in millions) | Q4 2022 | | 2022 | | Q1 2023 | | Q2 2023 | | Q3 2023 | | Q4 2023 | | | | 2023 |

| Income (Loss) Before Tax | $ | 0.7 | | | $ | (10.7) | | | $ | (8.1) | | | $ | (1.5) | | | $ | 4.4 | | | $ | 3.2 | | | | | $ | (1.9) | |

| | | | | | | | | | | | | | | |

| Interest expense, net | 2.2 | | | 7.1 | | | 2.7 | | | 3.1 | | | 3.3 | | | 3.8 | | | | | 13.0 | |

| Depreciation and amortization | 8.2 | | | 33.7 | | | 8.3 | | | 8.4 | | | 8.5 | | | 8.4 | | | | | 33.6 | |

| EBITDA | $ | 11.1 | | | $ | 30.1 | | | $ | 3.0 | | | $ | 10.0 | | | $ | 16.2 | | | $ | 15.5 | | | | | $ | 44.7 | |

| | | | | | | | | | | | | | | |

| Add: Pre-Tax Business Realignment Costs | — | | | 0.3 | | | 1.3 | | | 1.9 | | | 1.2 | | | 0.1 | | | | | 4.5 | |

| Less: Pre-Tax Gain on Disposal of Fixed Assets | — | | | — | | | (0.8) | | | — | | | — | | | — | | | | | (0.8) | |

| Add: Pre-Tax Environmental Remediation Costs | — | | | — | | | 0.1 | | | — | | | — | | | — | | | | | 0.1 | |

| Add: Pre-Tax Brazilian Indirect Tax Credits, Net | — | | | (0.6) | | | — | | | — | | | (0.5) | | | — | | | | | (0.5) | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Adjusted EBITDA | $ | 11.1 | | | $ | 29.8 | | | $ | 3.6 | | | $ | 11.9 | | | $ | 17.0 | | | $ | 15.6 | | | | | $ | 48.1 | |

Exhibit 3 – Reconciliation of Adjusted Gross Profit

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| (USD in millions) | Q4 2022 | | 2022 | | | | | | | | Q4 2023 | | 2023 |

| Gross Profit | $ | 45.5 | | | $ | 174.9 | | | | | | | | | $ | 45.5 | | | $ | 201.3 | |

| | | | | | | | | | | | | |

| Add: Pre-Tax Business Realignment Costs | — | | | — | | | | | | | | | 0.1 | | | 0.8 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Adjusted Gross Profit | $ | 45.5 | | | $ | 174.9 | | | | | | | | | $ | 45.7 | | | $ | 202.1 | |

Exhibit 4 - Reconciliation of Adjusted Operating Income

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| (USD in millions) | Q4 2022 | | 2022 | | | | | | | | Q4 2023 | | 2023 |

| Operating Income | $ | 6.0 | | | $ | 2.9 | | | | | | | | | $ | 6.0 | | | $ | 12.8 | |

| | | | | | | | | | | | | |

| Add: Pre-Tax Business Realignment Costs | — | | | 0.3 | | | | | | | | | 0.1 | | | 4.5 | |

| Less: Pre-Tax Gain on Disposal of Fixed Assets | — | | | — | | | | | | | | | — | | | (0.8) | |

| Add: Pre-Tax Environmental Remediation Costs | — | | | — | | | | | | | | | — | | | 0.1 | |

| Add: Pre-Tax Brazilian Indirect Tax Credits, Net | — | | | (0.6) | | | | | | | | | — | | | (0.5) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Adjusted Operating Income | $ | 6.0 | | | $ | 2.7 | | | | | | | | | $ | 6.2 | | | $ | 16.2 | |

Exhibit 5 – Segment Adjusted Operating Income

Reconciliation of Control Devices Adjusted Operating Income

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| (USD in millions) | Q4 2022 | | 2022 | | | | | | | | Q4 2023 | | 2023 |

| Control Devices Operating Income | $ | 5.5 | | | $ | 23.9 | | | | | | | | | $ | 0.9 | | | $ | 13.6 | |

| | | | | | | | | | | | | |

| Less: Pre-Tax Gain on Disposal of Fixed Assets | — | | | — | | | | | | | | | — | | | (0.8) | |

| Add: Pre-Tax Environmental Remediation Costs | — | | | — | | | | | | | | | — | | | 0.1 | |

| Add: Pre-Tax Business Realignment Costs | — | | | — | | | | | | | | | — | | | 0.5 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Control Devices Adjusted Operating Income | $ | 5.5 | | | $ | 23.9 | | | | | | | | | $ | 0.9 | | | $ | 13.4 | |

Reconciliation of Electronics Adjusted Operating Income

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| (USD in millions) | Q4 2022 | | 2022 | | | | | | | | Q4 2023 | | 2023 |

| Electronics Operating Income | $ | 4.9 | | | $ | 5.1 | | | | | | | | | $ | 10.8 | | | $ | 27.3 | |

| | | | | | | | | | | | | |

| Add: Pre-Tax Business Realignment Costs | — | | | — | | | | | | | | | 0.1 | | | 2.8 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Electronics Adjusted Operating Income | $ | 4.9 | | | $ | 5.1 | | | | | | | | | $ | 11.0 | | | $ | 30.2 | |

Reconciliation of Stoneridge Brazil Adjusted Operating Income

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| (USD in millions) | Q4 2022 | | 2022 | | | | | | | | Q4 2023 | | 2023 |

| Stoneridge Brazil Operating Income | $ | 0.8 | | | $ | 3.1 | | | | | | | | | $ | 1.0 | | | $ | 4.5 | |

| | | | | | | | | | | | | |

| Add: Pre-Tax Brazilian Indirect Tax Credits, Net | — | | | (0.6) | | | | | | | | | — | | | (0.5) | |

| Add: Pre-Tax Business Realignment Costs | — | | | 0.1 | | | | | | | | | — | | | — | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Stoneridge Brazil Adjusted Operating Income | $ | 0.8 | | | $ | 2.7 | | | | | | | | | $ | 1.0 | | | $ | 4.0 | |

Exhibit 6 – Reconciliation of Adjusted Sales

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| (USD in millions) | Q4 2022 | | 2022 | | | | | | | | Q4 2023 | | 2023 |

| Sales | $ | 231.2 | | | $ | 899.9 | | | | | | | | | $ | 229.5 | | | $ | 975.8 | |

| | | | | | | | | | | | | |

| Less: Sales from Spot Purchases Recoveries | (6.0) | | | (58.4) | | | | | | | | | (0.2) | | | (14.6) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Adjusted Sales | $ | 225.2 | | | $ | 841.5 | | | | | | | | | $ | 229.4 | | | $ | 961.2 | |

Exhibit 7 – Reconciliation of Electronics Adjusted Sales

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| (USD in millions) | Q4 2022 | | 2022 | | | | | | | | Q4 2023 | | 2023 |

| Electronics Sales | $ | 140.7 | | | $ | 533.8 | | | | | | | | | $ | 146.9 | | | $ | 608.2 | |

| | | | | | | | | | | | | |

| Less: Sales from Spot Purchases Recoveries | (6.0) | | | (58.4) | | | | | | | | | (0.2) | | | (14.6) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Electronics Adjusted Sales | $ | 134.8 | | | $ | 475.4 | | | | | | | | | $ | 146.8 | | | $ | 593.6 | |

Exhibit 8 – Reconciliation of Adjusted Tax Rate

| | | | | | | | | | | |

| Reconciliation of Q4 2023 Adjusted Tax Rate |

| (USD in millions) | Q4 2023 | | Tax Rate |

| Income Before Tax | $ | 3.2 | | | |

| | | |

| Add: Pre-Tax Business Realignment Costs | 0.1 | | | |

| | | |

| Add: Pre-Tax Deferred Financing Fee Write Off | 0.3 | | | |

| | | |

| | | |

| Adjusted Income Before Tax | $ | 3.7 | | | |

| | | |

| Income Tax Expense | 0.2 | | | 6.6 | % |

| | | |

| Add: Tax Impact from Pre-Tax Adjustments | 0.1 | | | |

| | | |

| Adjusted Income Tax Expense | $ | 0.3 | | | 8.6 | % |

| | | | | | | | | | | |

| Reconciliation of Full-Year 2023 Adjusted Tax Rate |

| (USD in millions) | 2023 | | Tax Rate |

| Loss Before Tax | $ | (1.9) | | | |

| | | |

| Add: Pre-Tax Business Realignment Costs | 4.5 | | | |

| Add: Pre-Tax Brazilian Indirect Tax Credits, Net | (0.5) | | | |

| Add: Pre-Tax Deferred Financing Fee Write Off | 0.3 | | | |

| Add: After-Tax Environmental Remediation Costs | 0.1 | | |

| Less: Pre-Tax Gain on Disposal of Fixed Assets | (0.8) | | | |

| | | |

| Adjusted Income Before Tax | $ | 1.8 | | | |

| | | |

| Income Tax Expense | 3.3 | | | nm |

| | | |

| Add: Tax Impact from Pre-Tax Adjustments | 0.6 | | | |

| | | |

| Adjusted Income Tax Expense | $ | 3.9 | | | nm |

Exhibit 9 – Reconciliation of Compliance Leverage Ratio | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Adjusted EBITDA for Compliance Calculation |

| (USD in millions) | | | | | | | | Q1 2023 | | Q2 2023 | | Q3 2023 | | Q4 2023 |

| Income (Loss) Before Tax | | | | | | | | $ | (8.1) | | | $ | (1.5) | | | $ | 4.4 | | | 3.2 | |

| Interest Expense, net | | | | | | | | 2.7 | | | 3.1 | | | 3.3 | | | 3.8 | |

| Depreciation and Amortization | | | | | | | | 8.3 | | | 8.4 | | | 8.5 | | | 8.4 | |

| EBITDA | | | | | | | | $ | 3.0 | | | $ | 10.0 | | | $ | 16.2 | | | $ | 15.5 | |

| | | | | | | | | | | | | | |

| Compliance adjustments: | | | | | | | | | | | | | | |

| Add: Adjustments from Foreign Currency Impact | | | | | | | | 1.4 | | | 3.1 | | | 0.4 | | | (0.7) | |

| Add: Extraordinary, Non-recurring or Unusual Items | | | | | | | | 0.2 | | | — | | | 0.5 | | | — | |

| Add: Cash Restructuring Charges | | | | | | | | 1.4 | | | 0.5 | | | 0.1 | | | 0.3 | |

| Add: Charges for Transactions, Amendments, and Refinances | | | | | | | | — | | | — | | | — | | | 0.3 | |

| Add: Adjustment to Autotech Investments | | | | | | | | 0.2 | | | 0.3 | | | 0.1 | | | (0.1) | |

| Adjusted EBITDA (Compliance) | | | | | | | | $ | 6.1 | | | $ | 13.9 | | | $ | 17.4 | | | $ | 15.3 | |

| | | | | | | | | | | | | | |

| Adjusted TTM EBITDA (Compliance) | | | | | | | | | | | | | | $ | 52.7 | |

| | | | | | | | | | | | | | | | | | |

| Reconciliation of Adjusted Cash for Compliance Calculation |

| (USD in millions) | | | | | | | | | | | | Q4 2023 |

| Total Cash and Cash Equivalents | | | | | | | | | | | | $ | 40.8 | |

| | | | | | | | | | | | |

| Less: 35% Cash Foreign Locations | | | | | | | | | | | | (12.8) | |

| Total Adjusted Cash (Compliance) | | | | | | | | | | | | $ | 28.0 | |

| | | | | | | | | | | | | | | | | | |

| Reconciliation of Adjusted Debt for Compliance Calculation |

| (USD in millions) | | | | | | | | | | | | Q4 2023 |

| Total Debt | | | | | | | | | | | | $ | 191.5 | |

| | | | | | | | | | | | |

| Outstanding Letters of Credit | | | | | | | | | | | | 1.6 | |

| Total Adjusted Debt (Compliance) | | | | | | | | | | | | $ | 193.0 | |

| | | | | | | | | | | | |

| Adjusted Net Debt (Compliance) | | | | | | | | | | | | $ | 165.0 | |

| Compliance Leverage Ratio (Net Debt / TTM EBITDA) | | | | | | | | | | | | 3.13x |

stoneridge.com © 2024 Full-Year & Q4 2023 Results February 29, 2024 Exhibit 99.2

stoneridge.com © 2024 Full-Year & Q4 2023 Results 2 Non-GAAP Financial Measures This presentation contains information about the Company’s financial results that is not presented in accordance with accounting principles generally accepted in the United States (“GAAP”). Such non-GAAP financial measures are reconciled to their closest GAAP financial measures at the end of this presentation. The provision of these non-GAAP financial measures for 2023 and 2022 is not intended to indicate that Stoneridge is explicitly or implicitly providing projections on those non-GAAP financial measures, and actual results for such measures are likely to vary from those presented. The reconciliations include all information reasonably available to the Company at the date of this presentation and the adjustments that management can reasonably predict. Management believes the non-GAAP financial measures used in this presentation are useful to both management and investors in their analysis of the Company’s financial position and results of operations. In particular, management believes that adjusted sales, adjusted gross profit and margin, adjusted operating income (loss) and margin, adjusted income (loss) before tax, adjusted net income (loss), adjusted earnings (loss) per share, adjusted EBITDA, adjusted EBITDA margin, adjusted tax expense, adjusted tax rate, adjusted net debt and adjusted cash are useful measures in assessing the Company’s financial performance by excluding certain items that are not indicative of the Company’s core operating performance or that may obscure trends useful in evaluating the Company’s continuing operating activities. Management also believes that these measures are useful to both management and investors in their analysis of the Company’s results of operations and provide improved comparability between fiscal periods. Adjusted sales, adjusted gross profit and margin, adjusted operating income (loss) and margin, adjusted income (loss) before tax, adjusted net income (loss), adjusted earnings (loss) per share, adjusted EBITDA, adjusted EBITDA margin, adjusted tax expense, adjusted tax rate, adjusted net debt and adjusted cash should not be considered in isolation or as a substitute for sales, gross profit, operating income, income (loss) before tax, net income (loss), earnings per share, tax expense, tax rate, debt, cash and cash equivalents, cash provided by operating activities or other income statement or cash flow statement data prepared in accordance with GAAP. Q4 Reported Q4 Adjusted Full-Year Reported Full-Year Adjusted $961.2 million$975.8 million$229.4 million$229.5 million Sales $202.1 million 21.0% $201.3 million 20.6% $45.7 million 19.9% $45.5 million 19.8% Gross Profit Margin $16.2 million 1.7% $12.8 million 1.3% $6.2 million 2.7% $6.0 million 2.6% Operating Income Margin $3.9 million$3.3 million$0.3 million$0.2 millionTax Expense ($0.08)($0.19)$0.12$0.11EPS $48.1 million 5.0% -$15.6 million 6.8% -EBITDA Margin

stoneridge.com © 2024 Full-Year & Q4 2023 Results 3 Forward-Looking Statements Statements in this presentation that are not historical facts are forward-looking statements, which involve risks and uncertainties that could cause actual events or results to differ materially from those expressed or implied by the statements. Important factors that may cause actual results to differ materially from those in the forward-looking statements include, among other factors, the ability of our suppliers to supply us parts and components at competitive prices on a timely basis, including the impact of potential tariffs and trade considerations on their operations and output; fluctuations in the cost and availability of key materials (including semiconductors, printed circuit boards, resin, aluminum, steel and copper) and components and our ability to offset cost increases through negotiated price increases with our customers or other cost actions, as necessary; global economic trends, competition and geopolitical risks, including impacts from ongoing or potential conflicts and any related sanctions and other measures, or an escalation of sanctions, tariffs or other trade tensions between the U.S. and other countries; our ability to achieve cost reductions that offset or exceed customer-mandated selling price reductions; the reduced purchases, loss or bankruptcy of a major customer or supplier; the costs and timing of business realignment, facility closures or similar actions; a significant change in automotive, commercial, off-highway or agricultural vehicle production; competitive market conditions and resulting effects on sales and pricing; foreign currency fluctuations and our ability to manage those impacts; customer acceptance of new products; our ability to successfully launch/produce products for awarded business; adverse changes in laws, government regulations or market conditions, affecting our products, our suppliers, or our customers’ products; labor disruptions at Stoneridge’s facilities or at any of Stoneridge significant customers or suppliers; the amount of Stoneridge’s indebtedness and the restrictive covenants contained in the agreements governing its indebtedness, including its revolving Credit Facility; capital availability or costs, including changes in interest rates; the occurrence or non-occurrence of circumstances beyond Stoneridge’s control; and the items described in “Risk Factors” and other uncertainties or risks discussed in Stoneridge’s periodic and current reports filed with the Securities and Exchange Commission. Important factors that could cause the performance of the commercial vehicle and automotive industry to differ materially from those in the forward-looking statements include factors such as (1) continued economic instability or poor economic conditions in the United States and global markets, (2) changes in economic conditions, housing prices, foreign currency exchange rates, commodity prices, including shortages of and increases or volatility in the price of oil, (3) changes in laws and regulations, (4) the state of the credit markets, (5) political stability, (6) international conflicts and (7) the occurrence of force majeure events. These factors should not be construed as exhaustive and should be considered with the other cautionary statements in Stoneridge’s filings with the Securities and Exchange Commission. Forward-looking statements are not guarantees of future performance; Stoneridge’s actual results of operations, financial condition and liquidity, and the development of the industry in which Stoneridge operates may differ materially from those described in or suggested by the forward-looking statements contained in this presentation. In addition, even if Stoneridge’s results of operations, financial condition and liquidity, and the development of the industry in which Stoneridge operates are consistent with the forward-looking statements contained in this presentation, those results or developments may not be indicative of results or developments in subsequent periods. This presentation contains time-sensitive information that reflects management’s best analysis only as of the date of this presentation. Any forward-looking statements in this presentation speak only as of the date of this presentation, and Stoneridge undertakes no obligation to update such statements. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data Stoneridge does not undertake any obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. Rounding Disclosure: There may be slight immaterial differences between figures represented in our public filings compared to what is shown in this presentation. The differences are the result of rounding due to the representation of values in millions rather than thousands in public filings.

stoneridge.com © 2024 Full-Year & Q4 2023 Results • Announced Volvo MirrorEye OEM programs launching in Europe mid-year 2024 and in North America in early 2025 • Announced 5-Year extension of FMCSA exemption for MirrorEye US applications • Midpoint 2024 revenue guidance of $1.0 billion (~4% revenue growth) and EBITDA of $67 million (170 bps margin expansion) - expected to outpace our weighted- average OEM end markets which are expected to decline by ~5% Backlog (2024-2028) As of December 31, 2023 $3.5B 4.5X 2023 OEM Sales $961M $48.1M ($0.08) 14.2% Y/Y Growth ~$18.3M Y/Y Increase +$0.44 Y/Y Growth Overview of Achievements 4 $229M $15.6M $0.12 3.3% Decline vs. Q3 6.8% of Q4 sales +$0.02 Growth vs. Q3 Adjusted Sales* Adjusted EBITDA* Adjusted EPS* 2023 Full Year Q4 2023 *Adjusted for business realignment costs and other non-recurring items. Refer to US GAAP Reconciliations for reconciliations to US GAAP amounts. **Based on midpoints of 2024 guidance and 2028 targets Drivetrain Agnostic Products ~88% Based on 2023 sales 5-Year Long-term Revenue Target $1.35B – $1.55B By 2028 ~10% CAGR Growth** 5-Year Long-term EBITDA Margin Target 12% - 14% By 2028 ~630 bps expansion**

5stoneridge.com © 2024 Full-Year & Q4 2023 Results Adjusted Sales Adjusted Gross Profit Adjusted Operating Income Adjusted EBITDA Full-year 2022 vs. 2023 +14.2% +20 bps +140 bps +150 bps Full-Year 2023 Key Drivers • Revenue growth primarily driven by end market growth and the launch and ramp-up of new programs, including first NA MirrorEye OEM launch and Smart 2 Tachograph • Gross margin expansion driven by material cost improvements and manufacturing cost reduction initiatives – both of which are expected to continue in 2024 • Additional operating margin expansion primarily driven by initiatives related to operating expenses including the centralization of certain functions and better utilization of our global footprint, particularly related to our engineering resources Full-year adjusted revenue growth of 14.2% Adjusted EBITDA increased by $18.3 million and EBITDA margin expanded by 150 bps Financial Summary $174.9 $202.1 20.8% 21.0% FY 2022 FY 2023 $29.8 $48.1 3.5% 5.0% FY 2022 FY 2023 $2.7 $16.2 0.3% 1.7% FY 2022 FY 2023 $841.5 $961.2 FY 2022 FY 2023

stoneridge.com © 2024 Full-Year & Q4 2023 Results 6 MirrorEye® Updates MirrorEye sales expected to be ~$100 million in 2024 vs. $54 million in 2023 OEM Updates • Announced our next MirrorEye OEM programs will be launching with Volvo • Launching mid-year 2024 on the FH Aero model in Europe with an expected take rate of ~45% • Launching in early 2025 on the All-New VNL model in North America with an expected take rate of ~5-10% • Focused on Kenworth program ramp-up and Peterbilt program launch in mid- 2024 – working with OEM customer and dealership network to drive take rate expansion • Expecting 2024 OEM revenue of ~$65 million in OEM sales vs. $32 million in 2023 (2x growth in OEM MirrorEye revenue year-over-year) Retrofit Updates • Received FMCSA exemption renewal for an additional 5 years for retrofit applications in North America • Announcing new fleet partnerships with PS Logistics, Stokes Trucking and Cargo Transporters • Committed to full fleet adoption of MirrorEye over time • MirrorEye bus applications continue to expand in North America and Europe • Expecting 2024 retrofit and bus revenue of ~$35 million in non-OEM sales vs. $22 million in 2023

7stoneridge.com © 2024 Full-Year & Q4 2023 Results 5-year backlog remains strong Backlog Awarded Business 2024-2028 Backlog Drivers • Stoneridge Electronics backlog grew by ~5% vs. prior year • Total 2025-2027 backlog increased by ~4% vs. prior year • Large business awards are based on customer platform introductions. Several next-generation OEM CV platforms expected to launch starting in 2028. Expecting award activity for next generation platforms in 2024 – 2025 that will impact backlog 2028+. • Expecting award activity to increase in 2024 – 2025 for passenger vehicle applications related to extensions / renewal of existing platforms as well as electric vehicle platforms that are expected to impact the backlog in later years • Aftermarket expected to grow during the backlog period as a portion of overall business (not included in backlog) Backlog as of 12/31/22 Backlog as of 12/31/23 $’s in USD Millions $3,596M $3,526M Backlog 2022 vs. 2023 Based on December 2023 IHS LVP and Q4 2023 IHS MHCV; company data, customer provided data and management estimates

8stoneridge.com © 2024 Full-Year & Q4 2023 Results Long-Term EBITDA Targets Long-Term Revenue Targets ~10% CAGR* ~630 bps* • Maintaining previously provided 2027 long-term targets • Targeting ~10% 5-year revenue CAGR* (5x+ market growth**) supported by existing backlog, growing aftermarket business and new business opportunities • Targeting EBITDA margin of 12% - 14% in 2028 based on contribution margin and operating leverage on growth • Contribution margin on incremental revenue expected to be 25% - 30% • Focused on leveraging existing operating cost structure to drive operating margin expansion with growth • Targeting increased engineering capacity and capability without significant incremental cost through continued transformation of global engineering footprint and more cost-efficient structure Our long-term strategy is driving sustainable long-term growth and margin expansion Long-Term Targets *Based on midpoints of 2024 guidance and 2028 targets **Based on weighted-average OEM end market growth 2024 Guidance 2027 Previous Target 2028 Sales Target $1.35B - $1.55B $990M - $1,010M ~$1.3B - $1.5B 2024 Guidance 2027 Previous Target 2028 EBITDA Target ~$160M - $220M 12% - 14% 6.5% - 6.9% 11.5% -13.5% ~$64M - $70M ~$150M - $200M

stoneridge.com © 2024 Full-Year & Q4 2023 Results 9 2024 Priorities to Drive Shareholder Value Driving sustainable long-term growth and margin expansion Key Priorities* • 2-3x Market Growth – Focused on leveraging drivetrain agnostic technologies and leveraging products aligned with industry megatrends to drive outsized growth • Targeting ~4% growth in 2024 vs. ~5% weighted-average OEM end market decline • Gross Margin Expansion – Focus on material cost improvement and reduced quality related costs • Targeting 140 bps gross margin improvement in 2024 vs. 2023 • Leverage on Structural Costs – Leveraging our global footprint to maximize our capabilities and output through engineering rotation and function centralization • Targeting 170 bps EBITDA margin improvement in 2024 vs. 2023 • Efficient Cash Generation – Focus on targeted actions to reduce inventory levels at least aligned with historical turns • Capital Investment – Efficient capital deployment while maintaining appropriate capital structure • Targeting ~$40 million of capital expenditures in 2024 focused on supporting organic growth initiatives *Based on midpoints of 2024 guidance 2-3x Growth in underlying markets Gross margin expansion through enterprise-wide operational excellence Efficient cash generation Cost control to achieve fixed cost leverage with growth Invest capital (organic or inorganic) to drive growth Shareholder Value Creation

10stoneridge.com © 2024 Full-Year & Q4 2023 Results Summary • Strong revenue growth and earnings expansion versus prior year • Gross margin improving as price increases and manufacturing initiatives beginning to impact run-rate • Executed targeted structural cost reductions, including the centralization of certain global functions and improved engineering efficiency • 2023 actions setting the stage for strong contribution margins on incremental revenue forward and a strong foundation to create leverage with revenue growth • Focused on continuing to accelerate MirrorEye momentum in both the OEM and aftermarket channels – almost 2x MirrorEye revenue in 2024 vs. 2023 • Advanced development in both segments focused on drivetrain agnostic technologies, platform building and sustainable long-term growth opportunities • Long-term revenue target of $1.35 to $1.55 billion by 2028 supported by strong backlog, continued growth in aftermarket channels and new business opportunities • Long-term EBITDA margin target of 12% - 14% by 2028 driven by contribution margin and operating leverage on growth • Targeting ~$160 – 220 million of EBITDA by 2028 2023 Summary Driving Long-Term Shareholder Value

stoneridge.com © 2024 Financial Update

12stoneridge.com © 2024 Full-Year & Q4 2023 Results Q4 adjusted EPS performance in line with previous expectations 2023 Financial Highlights Q4 Reported Q4 Adjusted Full-Year Reported Full-Year Adjusted $961.2 million$975.8 million$229.4 million$229.5 million Sales $202.1 million 21.0% $201.3 million 20.6% $45.7 million 19.9% $45.5 million 19.8% Gross Profit Margin $16.2 million 1.7% $12.8 million 1.3% $6.2 million 2.7% $6.0 million 2.6% Operating Income Margin $3.9 million$3.3 million$0.3 million$0.2 millionTax Expense ($0.08)($0.19)$0.12$0.11EPS $48.1 million 5.0% -$15.6 million 6.8% -EBITDA Margin Q4 Highlights • Q4 adjusted sales of $229.4 million declined by 3.3% vs. Q3 2023 • Lower sales due to the impact of the UAW strike (~$6.0 million in Q4 vs. ~$0.5 million in Q3) and the continued softening of demand for electric vehicles • Q4 adjusted operating income of $6.2 million, or 2.7% of adjusted sales, declined by 40 bps vs. Q3 2023 • UAW strike impacted Q4 operating income by $2.1 million vs. $0.1 million in Q3 • Incurred costs related to distressed supplier of ~$1.8 million (~80 bps) in Q4 vs. ~$0.7 million in Q3 – costs expected to moderate in 1H 2024

13stoneridge.com © 2024 Full-Year & Q4 2023 Results Q4 adjusted EPS was in line with previous expectations Q4 Adjusted EPS Performance Drivers Operating Performance Drivers • Slightly lower sales versus previous expectations primarily attributable to lower production volumes for electric vehicles • Sales headwind related to FX of ~$7m in Q4 vs. prior expectations • Operating performance, net of material cost improvement, was impacted by unfavorably by elevated warranty and inventory-related costs on higher-than-normal inventory balances • Continued improvement in material costs favorably impacted Q4 results versus prior expectations – expected to continue • Reduced operating expenses driven primarily by engineering reimbursements and reduced incentive compensation • Costs related to single distressed supplier continued to impact Q4 • Below-the-line favorable impact of FX more than offsets the unfavorable FX impact to operating income of ~$0.9 million $0.10 - $0.20

14stoneridge.com © 2024 Full-Year & Q4 2023 Results Sales Adjusted Operating Income $345.3 $345.3 FY 2022 FY 2023 $23.9 $13.4 FY 2022 FY 2023 $1.4 $5.5 $5.6 $0.9 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Control Devices Performance 2023 Quarterly Performance 2022 vs 2023 2023 Financial Results • Full-year sales remained relatively in line with 2022 primarily due to incremental pricing and higher sales in China offset by the unfavorable impact of the UAW strike of ~$5.8 million • Full-year operating margin declined by 300 bps primarily due to unfavorable product mix, costs related to a distressed supplier of $2.5 million and relatively higher SG&A and D&D costs 2024 Expectations • Expecting sales to decline in 2024 driven primarily by end-of-life programs unable to be offset by growth in new actuation programs due to the continued slow ramp-up of electrified vehicle platforms • Focus remains on material cost reduction and improved manufacturing performance to drive stable margins despite revenue decline • Focus on drivetrain agnostic technologies to drive business awards as market landscape for EV platforms continues to evolve Focused on margin expansion driven by reduced material costs and improved manufacturing performance $17.8** 5.1%** $351.1* $4.5** 5.6%** $6.4** 7.1%** $86.7 $93.1 $90.1 $75.4 Q1 2023 Q2 2023 Q3 2023 Q4 2023 $90.5* $80.8* 5.9% 1.6% 1.2% 6.2% 6.9% 3.9% $’s in USD Millions *Excluding the estimated sales impact of the UAW strike of $0.5M, $5.4M and $5.8M in Q3 2023, Q4 2023 and YTD 2023, respectively. **Excluding the estimated operating income impact of UAW strike of $0.1M, $1.9M and $1.9M in Q3 2023, Q4 2023 and YTD 2023, respectively and the estimated impact of distressed supplier costs of $0.7M, $1.8M and $2.5M in Q3 2023, Q4 2023 and YTD 2023, respectively.

15stoneridge.com © 2024 Full-Year & Q4 2023 Results Electronics Performance Adjusted Sales Adjusted Operating Income 2023 Quarterly Performance 2022 vs 2023 2023 Financial Results • Full-year 2023 sales growth of 24.9% primarily due to higher customer production volumes vs. 2022 and new program launches, including MirrorEye and Smart 2 Tachograph • Operating margin expansion of ~400 bps vs. 2022 primarily due to contribution on revenue growth and material cost improvement, including incremental pricing, offset by incremental engineering costs related to the launch of new programs 2024 Expectations • Continued significant growth over market driven by new program launches and ramp-up of recently launched programs • Expecting strong contribution margin on incremental sales and operating leverage on existing structure to drive continued gross and operating margin expansion Expecting continued strong revenue growth and margin expansion in 2024 as recently launched large programs continue to ramp-up and additional programs launch $5.1 $30.2 1.1% 5.1% FY 2022 FY 2023 $’s in USD Millions $475.4 $593.6 FY 2022 FY 2023 $140.5 $163.9 $142.4 $146.8 Q1 2023 Q2 2023 Q3 2023 Q4 2023 $1.7 $8.8 $8.7 $11.0 1.2% 5.4% 6.1% 7.5% Q1 2023 Q2 2023 Q3 2023 Q4 2023

16stoneridge.com © 2024 Full-Year & Q4 2023 Results Stoneridge Brazil Performance Sales Adjusted Operating Income 2023 Quarterly Performance 2022 vs 2023 2023 Financial Results • Full-year 2023 sales growth of 9.5% vs. 2022 primarily due to higher local OEM sales and favorable FX translation of $1.8 million. • Full-year 2023 adjusted operating income improved by ~190 bps vs. 2022 primarily due to lower material costs and fixed cost leverage on higher sales 2024 Expectations • Expecting stable revenue and operating margin performance in 2024 • Focus remains on growth in local OEM business to support global customers and utilizing engineering resources to support global Electronics business Expecting continued stable performance in 2024. Focus remains on growth in local OEM business and engineering capabilities to support global business. $52.3 $57.2 FY 2022 FY 2023 $14.3 $14.9 $14.2 $13.9 Q1 2023 Q2 2023 Q3 2023 Q4 2023 $2.7 $4.0 5.1% 7.0% 1 3 5 FY 2022 FY 2023 $1.3 $0.9 $0.8 $1.0 9.4% 6.0% 5.6% 7.0% Q1 2023 Q2 2023 Q3 2023 Q4 2023 $’s in USD Millions

17stoneridge.com © 2024 Full-Year & Q4 2023 Results $25.2 $28.0 $162.3 $165.0 Q3 2023 Q4 2023 Q1 2024 End of 2024 Target Total Adjusted Cash (Compliance) Total Net Debt (Compliance) Capital Structure Update Continued focus on cash performance expected to improve working capital and reduce net debt and related interest expense 2.0x - 2.5xCompliance Leverage Ratio (Adj. Net Debt / TTM EBITDA*) $’s in USD Millions 3.11x 3.13x <2.75x Capital Structure Update • Q4 2023 compliance leverage ratio of 3.13x • With supply chain normalization we are focused on improving cash performance and reducing net debt through targeted actions to reduce net working capital – primarily inventory • Net debt / trailing-twelve-month EBITDA expected to continue to improve driven by earnings growth and net working capital performance • Expecting compliance leverage ratio of 2.0x - 2.5x by the end of 2024 Compliance Net Debt

Full-Year & Q4 2023 Results stoneridge.com © 2024 2024 Full-Year Guidance Revenue expected to continue to outperform our underlying end markets based on Stoneridge specific growth drivers. Growth of ~4% vs. weighted-average OEM end market decline of ~5%. Expecting operating margin expansion of ~130 bps driven by contribution margin on revenue growth, structural cost leverage and continued focus on operating improvement Expecting EBITDA growth of ~$19 million and EBITDA margin expansion of ~170 bps Based on estimated effective tax rate of ~33%, expecting midpoint EPS of $0.35 2024 Guidance Range 2024 Mid-point Guidance (vs. 2023 Adjusted) +$38.8 million$990.0 million - $1.01 billion Sales +140 bps $217.8 million - $229.8 million 22.0% - 22.75% Gross Profit Margin +130 bps $27.2 million - $32.8 million 2.75% - 3.25% Operating Income Margin +$0.43$0.30 - $0.40EPS +$19 million +170 bps $64 million - $70 million 6.5% - 6.9% EBITDA Margin 18

19stoneridge.com © 2024 Full-Year & Q4 2023 Results Expecting 2024 midpoint revenue growth of ~4%, outperforming our underlying weighted-average OEM end markets, which are expected to decline by ~5% 2024 Guidance Revenue 2024 Revenue Guidance Drivers • Weighted-average underlying OEM end markets are expected to decline by ~5% in 2024 vs. 2023 • Programs launches and ramp-up of recently launched programs expected to generate significantly above-market revenue growth • MirrorEye program launches with Peterbilt in North America and Volvo in Europe in mid-2024 as well as the ramp-up of the Kenworth program • MirrorEye retrofit and bus applications continue to expand • Smart 2 Tachograph growth in OEM and aftermarket end markets • Expecting incremental sales growth in off-highway and other products Weighted Avg End Markets Expected to Decline by ~5% $990M-$1,010M $’s in USD Millions *Applied to weighted-average OEM end markets based on IHS production data Feb 2024 LVP and Q1 2024 MHCV

20stoneridge.com © 2024 Full-Year & Q4 2023 Results 2024 EBITDA guidance based on expected strong contribution margin on revenue growth and initiatives targeting gross margin improvement 2024 Guidance EBITDA 2024 EPS Guidance Drivers • Contribution margin on incremental revenue expected to be 25% - 30% • Gross margin expansion driven by continued material cost improvements and manufacturing cost reduction initiatives • Expecting a moderate increase in operating expenses primarily driven by inflationary wage increases and normalization of incentive compensation from 2023 • Continued investment in D&D resources, offset by footprint optimization expected to result in approximately flat D&D expense year-over-year $64M - $70M $48.1M $10.7M $13.9M ($6.8M) $1.2M *Includes year-over-year difference in depreciation and amortization

21stoneridge.com © 2024 Full-Year & Q4 2023 Results Summary • Control Devices – Focused on margin expansion through reduced material costs and improved manufacturing performance. Driving growth through continued investment in drivetrain agnostic technologies. • Electronics – Expecting continued significant growth over market due to new program launches and ramp-up of recently launched programs. Expecting strong contribution margin and structural cost leverage on incremental sales to continue to improve operating margin. • Stoneridge Brazil – Focus remains on supporting global initiatives including growth in local OEM business to support global customers • Continued focus on cash performance expected to improve working capital (primarily through inventory reductions) • Adjusted sales guidance of $990 million - $1,010 million (midpoint of $1.0 billion) • Midpoint revenue suggests 4% growth over 2023 vs. weighted-average OEM end markets which are expected to decline by ~5% • Adjusted gross margin guidance of 22.0% - 22.75% (midpoint of ~22.4%) • Adjusted operating margin guidance of 2.75% - 3.25% (midpoint of ~3.0%) • Adjusted EPS guidance of $0.30 - $0.40 (midpoint of $0.35) • Adjusted EBITDA guidance of $64 million - $70 million (midpoint of $67 million) • Adjusted EBITDA margin guidance of 6.5% - 6.9% (midpoint of 6.7%) 2024 Outlook 2024 Guidance

stoneridge.com © 2024 Appendix Materials

stoneridge.com © 2024 Appendix 23 NORTH AMERICA 28.4% OF 2023 SALES CHINA 3.2% OF 2023 SALES PASSENGER CAR FORECAST (Millions of Units) NORTH AMERICA 20.0% OF 2023 SALES EUROPE 28.3% OF 2023 SALES COMMERCIAL VEHICLE FORECAST* (Thousands of Units) 9.7% 0.6%Y/Y Growth 10.0% 2.4% 8.1% -7.6%Y/Y Growth 12.8% -10.5% Production Forecast Outlook Stoneridge expected growth of ~4% in 2024 outpaces our weighted-average OEM end markets production expectations to decline by ~5%. 14.3 15.7 15.8 2022 2023 2024 26.2 28.8 29.5 2022 2023 2024 508.0 549.2 507.3 2022 2023 2024 543.7 613.1 548.6 2022 2023 2024 SOURCE: Feb 2024 LVP IHS; Q1 2024 MHCV IHS *Includes Class 5-8

stoneridge.com © 2024 Appendix 24 17% 15% 9% 8%6%4% 3% 38% PACCAR Tra ton Vo lvo Daimler Trucks Ford Motor Company Amer ican Ax le Genera l Motors Other Customers 51% 29% 2% 18% Commerc ia l Vehic le L ight Trucks / SUV / CUV Passenger Car Of f -h ighway / Af termarket / Other 2023 Adjusted Revenue 51% 37% 6% 6% North America Europe Asia Paci f ic South America By Region By End Market* By Customer** *Regional adjusted sales based on manufactured location and estimated end market exposure **Adjusted sales direct to customers. Total customer exposure may differ due to sales to suppliers that sell to end customers

stoneridge.com © 2024 Appendix 25 Balance Sheets 20222023December 31, (in thousands) ASSETS Current assets: $ 54,798$ 40,841Cash and cash equivalents 158,155166,545Accounts receivable, less reserves of $1,058 and $962, respectively 152,580187,758Inventories, net 44,01834,246Prepaid expenses and other current assets 409,551429,390Total current assets Long-term assets: 104,643110,126Property, plant and equipment, net 45,50847,314Intangible assets, net 34,22535,295Goodwill 13,76210,795Operating lease right-of-use asset 44,41646,980Investments and other long-term assets, net 242,554250,510Total long-term assets $ 652,105$ 679,900Total assets LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: $ 1,450$ 2,113Current portion of debt 110,202111,925Accounts payable 66,04064,203Accrued expenses and other current liabilities 177,692178,241Total current liabilities Long-term liabilities: 167,802189,346Revolving credit facility 8,4987,224Deferred income taxes 10,5947,684Operating lease long-term liability 6,5779,688Other long-term liabilities 193,471213,942Total long-term liabilities Shareholders' equity: ——Preferred Shares, without par value, 5,000 shares authorized, none issued ——Common Shares, without par value, 60,000 shares authorized, 28,966 and 28,966 shares issued and 27,549 and 27,341 shares outstanding at December 31, 2023 and December 31, 2022, respectively, with no stated value 232,758227,340Additional paid-in capital (50,366)(43,344)Common Shares held in treasury, 1,417 and 1,625 shares at December 31, 2023 and December 31, 2022, respectively, at cost 201,692196,509Retained earnings (103,142)(92,788)Accumulated other comprehensive loss 280,942287,717Total shareholders' equity $ 652,105$ 679,900Total liabilities and shareholders' equity

stoneridge.com © 2024 Appendix 26 Income Statement 202120222023Year ended December 31, (in thousands, except per share data) $ 770,462$ 899,923$ 975,818Net sales Costs and expenses: 603,604724,997774,512Cost of goods sold 116,000106,695117,395Selling, general and administrative (30,718)——Gain on sale of Canton Facility, net 66,16565,29671,075Design and development 15,4112,93512,836Operating income 5,1897,09713,000Interest expense, net (3,658)823522Equity in loss (earnings) of investee 1,4445,7111,236Other expense, net 12,436(10,696)(1,922)(Loss) income before income taxes 9,0303,3603,261Provision for income taxes $ 3,406$ (14,056)$ (5,183)Net (loss) income (Loss) earnings per share: $ 0.13$ (0.52)$ (0.19)Basic $ 0.12$ (0.52)$ (0.19)Diluted Weighted-average shares outstanding: 27,11427,25827,443Basic 27,41627,25827,443Diluted