TOKYO—Toshiba Corp. on Monday hung a "for sale" sign on its

health-care division, part of a broad move to get outside help for

a conglomerate that expects to lose $4.5 billion this year.

Toshiba has been racked this year by one of Japan's biggest

accounting scandals, which has morphed into a broader crisis

affecting nearly all its major units. Its shares plunged 10% Monday

and have lost more than half their value since March.

The company earlier said it was seeking investors for its

Westinghouse nuclear subsidiary and its semiconductor business, and

it is talking with Fujitsu Ltd. about a possible merger of

personal-computer units.

The company said Monday it would cut 6,800 jobs, or about 30% of

the total, in its consumer electronics and appliances unit, and a

further 1,000 jobs in its headquarters operations. While a few may

find other positions at Toshiba, most will leave the company,

Toshiba President Masashi Muromachi said.

Analysts said Toshiba needs to find buyers quickly to stem the

downward spiral and ensure its memory-chip business and other

hopeful areas aren't starved of capital. Otherwise, they said, the

company risks joining Sharp Corp., which has been bailed out twice

by its lenders in three years, on the list of Japanese electronics

firms struggling for survival.

"The biggest problem for Toshiba, in terms of making sure its

memory chips remain competitive, is its ugly balance sheet," said

Satoru Oyama, an analyst at IHS. "It should make sure it can raise

enough funds for further investment."

Confirming reports over the weekend about large losses, Toshiba

said it expected a net loss of ¥ 550 billion ($4.5 billion) in the

year ending March 2016. That includes ¥ 230 billion in

restructuring costs following the accounting scandal, in which the

company has acknowledged overstating profits by more than ¥ 150

billion over seven years.

Deepening problems in the company's consumer electronics

business are one reason for the losses, but tough market conditions

for the company's mainstay nuclear and semiconductor operations are

also playing a role. Toshiba said sales would fall by 7% this year

and projected an operating loss at its semiconductor unit, which

has been hit by a slowdown in China and weaker growth in global

smartphone sales.

"We admit our steps toward restructuring were behind the curve,"

Mr. Muromachi said at a news conference. "The damage wouldn't be

this large if we had been able to implement overhaul plans much

sooner."

Japan's sprawling electronics conglomerates have spent much of

the past two decades trying to rationalize their operations. The

rise of China particularly hit their consumer-electronics

businesses.

After the global economic crisis broke out in 2008, Hitachi

Ltd., Panasonic Corp., Mitsubishi Electric Corp., NEC Corp. and

Sony Corp. all cut back on consumer businesses to focus on more

profitable business-to-business sales. A deal symbolic of the shift

came Monday when Panasonic, which has long sold refrigerators to

consumers, said it would buy Hussmann Corp., a U.S. maker of

display cases and refrigeration systems for retailers, for $1.54

billion.

Toshiba took some steps to overhaul its consumer businesses,

unloading its mobile-phone unit, but analysts say it lagged behind

its rivals. The accounting irregularities made the problem worse by

concealing problems.

"What Toshiba can learn from other electronics companies is the

importance of quick decision-making," said Atsushi Osanai, an

associate professor at Waseda Business School in Tokyo. "Toshiba

should have done across-the-board restructuring years ago, but it's

not too late."

Mr. Muromachi, the president, said Monday the company would

"focus on businesses that can generate profits" and would "consider

withdrawals from unprofitable ones if a turnaround is

difficult."

Even the health-care unit, which Toshiba had described as a

pillar of growth, is now on the block. The company said the unit's

scale—it generates less than one-tenth of Toshiba total sales—was

inadequate, so it is seeking to sell a majority stake. Toshiba's

diagnostic scanners face stiff competition from the likes of

General Electric Co., Koninklijke Philips NV and Siemens AG, as

well as Samsung, which recently identified health-care as a growth

area.

Mr. Muromachi said Toshiba had received expressions of interest

for the health-care business. So far, deals have been hard to come

by, aside from a sale of Toshiba's image sensor operations to

Sony.

In the nuclear business, Toshiba's Westinghouse subsidiary has

struggled to win new orders for reactors since the Fukushima

Daiichi plant disaster in Japan in 2011.

Restructuring has been hampered by management turmoil. Toshiba's

president and his two predecessors left company posts over the

summer. Mr. Muromachi, who had been serving as chairman and stepped

in as president after the shake-up, is expected to step down next

June, according to people familiar with the situation.

"In order to compete against global giants such as General

Electric and Siemens, Toshiba should overhaul its management

quickly," said Hisashi Moriyama, an analyst at J.P. Morgan.

Write to Takashi Mochizuki at takashi.mochizuki@wsj.com and Eric

Pfanner at eric.pfanner@wsj.com

(END) Dow Jones Newswires

December 21, 2015 07:35 ET (12:35 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

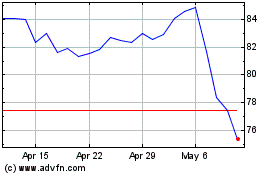

Sony (NYSE:SONY)

Historical Stock Chart

From Mar 2024 to Apr 2024

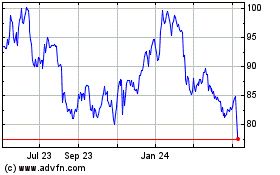

Sony (NYSE:SONY)

Historical Stock Chart

From Apr 2023 to Apr 2024