SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of July, 2015

Commission File Number 1-15106

PETRÓLEO BRASILEIRO S.A. - PETROBRAS

(Exact name of registrant as specified in its charter)

Brazilian Petroleum Corporation - PETROBRAS

(Translation of Registrant's name into English)

Avenida República do Chile, 65

20031-912 - Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

MINUTES OF SPECIAL MEETING OF SHAREHOLDERS OF PETRÓLEO BRASILEIRO S.A. – PETROBRAS, HELD ON MAY 25th, 2015

(Executed as summary, according to Act 6.404 of December 15th, 1976, article 130, first paragraph)

PUBLIC HOLDING COMPANY

NATIONAL REGISTER OF CORPORATE TAXPAYERS No. 33.000.167/0001-01

CORPORATE REGISTRY (NIRE) No. 33300032061

I. DATE, TIME AND VENUE:

The meeting was called to order on May 25th, 2015, at 3:00 PM (local time), in the Company´s headquarters, at Avenida República do Chile, no. 65, Centro, Rio de Janeiro, RJ.

II. ATTENDANCE, QUORUM AND CALLING:

The shareholders attended the meeting representing 76.79% of the ordinary shares which comprises the capital, according to registers and signatures in the Shareholders´ Attendance List, notified and called by notice published on April 24th, 27th and 28th, 2015 editions, and announcements published on April 24th, 27th and 28th, 2015 editions, in Rio de Janeiro State Register and Newspaper Valor Econômico. The meeting was presided by Mr. Francisco Augusto da Costa e Silva, shareholder appointed by the Company´s Chairman, Aldemir Bendine, according to article 42 of Petrobras´ Articles of Incorporation. Mrs. Maria Teresa Pereira Lima, Counsel to the Federal treasury, was present, accredited by means of Ordinance/Office of the General Counsel to the Federal Treasury No. 755, of September 19th, 2013, published in the Federal Register of September 20th, 2013. In attention to provided in article 134, first paragraph of Act 6.404 of December 15th, 1976, Business Corporation Act, there were also present Mr. Alexandre Vinícius Ribeiro de Figueiredo, Mr. Carlos Alberto de Souza and Mr. Marcos Donizete Panassol, representatives of PricewaterhouseCoopers, Mr. Deyvid Souza Bacelar da Silva, member of the Board of Directors, Mrs. Solange da Silva Guedes, Director, Mr. Ivan de Souza Monteiro, Mr. João Adalberto Elek Junior, Mr. Hugo Repsold Junior and Mr. Jorge Celestino Ramos, Directors, and Mr. Antônio Sérgio Oliveira Santana, the latter acting on behalf of Mr. José Eduardo de Barros Dutra, Director. There were also present Mr. Paulo José dos Reis Souza, Mr. Reginaldo Ferreira Alexandre, Mr. Waltr Luis Bernardes Albertoni and Mr. César Acosta Rech, members of the Company´s Executive Committee, in attention to provided in article 164 of the Business Corporation Act.

III. BOARD:

- Chairman: Francisco Augusto da Costa e Silva

- Representative of the Federal Government: Maria Teresa Pereira Lima

- Secretary: João Gonçalves Gabriel

IV. AGENDA:

Special Meeting of Shareholders

I – Report of the Company´s Board of Directors and Financial Statements, followed by the Executive Committee´s Opinion, related to accounting period ended on December 31st, 2014.

V. ADOPTING RESOLUTIONS:

In Objection

According to Act 6.404 of December 15th, 1976, article 130, the execution of the Minutes was approved by majority of present shareholders, as summary.

In Special Meeting of Shareholders:

Item I: The report of the Company´s Board of Directors and Financial Statements, followed by the Executive Committee´s Opinion, related to accounting period ended on December 31st, 2014, was approved by majority, with legal abstentions, as well as the Administrators Accounts related to aforementioned accounting period ended on December 31st, 2014, followed by the Executive Committee´s Opinion and the Independent Auditors´ Opinion, with emphases assigned in the Independent Auditors´ Opinion, as well as with the register of the Secretary of Federal Treasury, to emphasize the possible effects provided from the publication of new information related to the Lava Jato (“Car Wash”) Operation, which may substantially alter premises and estimates used in the preparation of the Financial Statements. The Federal Government also determined that Petrobras will continue to promote the necessary legal measures, before any authority or venue, individually and/or as Prosecutors Office´s co-party, according to Act 8.429 of July 2nd, 1992 (Administrative Dishonesty Act), able to recover the losses caused by acts perpetrated by its former officials and third parties, within the Lava Jato (“Car Wash”) Operation.

Before the beginning of voting, the Meeting´s Chairman asked shareholders if they wished to express or state any request for clarification in relation to several aspects involving the Financial Statements and the Administrators Accounts. After the demonstrations of several shareholders, the Federal Government pronounced its vote, followed by the assessment of other shareholders.

There being no further businesses, the Special Meeting of Shareholders was adjourned and the execution of the Minute was deliberated.

VI. Record of Statements:

The following verbal statements are assigned:

- Petrobras´ Engineers Association – AEPET (na sigla em português), represented in this Meeting by Mr. Silvio Sinedino Pinheiro, with vote justification that comprises the Company´s governance aspects and give comments on the historical performance of AEPET in Petrobras´ Meetings;

- Mr. José Martins Ribeiro, shareholder, on election to Petrobras´ Board member and considerations on accounting;

- Mr. Victor Adler, shareholder, questioning the non-use of revenue reserves to dividend allocation to preferred shares. The Chairman of the Meeting requested to Petrobras´ Legal Department to present the justifications to such positioning, which were granted by Counsel Grace Salomão de Pinho. Petrobras´ Accounting Department also provided clarifications through Mr. Amos da Silva Cancio, as well as external legal counsels Maria Isabel do Prado Bocater and João Laudo de Camargo, besides the Chairman itself, Mr. Francisco Augusto da Costa e Silva, Counsel;

- Mr. José Rodrigues Pinto, shareholder, questioned the profit sharing allocation to employees, in the absence of profit, whose clarifications were presented by Mr. Antônio Sérgio Oliveira Santana, Executive Manager of Human Resources, which pointed out the existence of operational results and commitment accepted by the Company in the Collective Agreement;

- “Tempo Capital Principal” Share of Investment Funds, represented in this Meeting by Mr. Raphael Manhães Martins, requesting the recognition of the right to vote to preferred shareholders in reason of non-payment of the minimum dividend and protesting against the denial of its request. The Chairman of the Meeting requested the statement of Petrobras´ Legal Department through Counsel Grace Salomão de Pinho who supported the non-recognition of the right to vote. Additionally, the shareholder presented statement on item I of the Meeting´s Agenda as to the financial statements should be rejected and the administrators account should be caveat;

- Mr. Marcelo Dias de Mattos, shareholder, requested clarifications on account issues and questioned the non-payment of dividends to preferred shareholders;

- Mr. Luiz Paulo Dario, shareholder, criticized the difficulties to gather information with the Company´s Investors Relations Department. Mr. Ivan de Souza Monteiro, Financial and Investors Relations Director, was available in person to present clarifications;

- Mr. Henyo Trindade Barretto, shareholder, on criteria to payment of profit sharing;

- Mr. Deyvid Souza Bacelar da Silva, Board member, on considerations regarding the Company´s employees and pointing indicators´ service, which justifies the payment of profit sharing.

VII. DOCUMENTS FILED IN THE HEADQUARTERS:

The following documents are filed in the Company´s headquarters, in attention to and as provided in Act 6.404/76, article 130, § 1st, item “a”:

- Papers filled in by shareholders or its proxies and delivered to the Board, containing resolutions provided in item I of the Special Meeting of Shareholders´ Agenda;

- Vote Proxy of shareholders registered on the Online Meeting, represented by its proxies Ana Paula Couri de Carvalho Oliveira, Carlos Henrique Dumortout Castro and Fábio Luíz Soares Xavier;

- Proxy Appointment and statement of vote of The Bank of New York Mellon – Depositary Receipts, depositary Institution abroad, issuer of ADR, which

represent the Company´s shares, represented in these Meetings by Mr. Ralph Figueiredo de Azevedo, stating the following statements of ADR´s holders, related to item I of the Agenda: 328. 295.178 votes in favour, 199.261.044 votes against and 3.955.954 abstentions, totaling 531.512.176 votes;

- Justification of vote of Petrobras´ Engineers Association – AEPET;

- Protest and Statement of “Tempo Capital” Share of Investment Funds;

- Statement of Mr. José Martins Ribeiro, shareholder;

- Statement of vote from Caixa de Previdência dos Funcionários do Banco do Brasil – Previ.

Francisco Augusto da Costa e Silva

Chairman of the Special Meeting of Shareholders

Maria Teresa Pereira Lima

Representative of the Federal Government

Ralph Figueiredo de Azevedo

Representative of the Bank of New York Mellon – Depositary Receipts

João Gonçalves Gabriel

Secretary

SPECIAL MEETING OF SHAREHOLDERS OF PETRÓLEO BRASILEIRO S.A. – PETROBRAS

MAY 25th, 2015

STATEMENT OF VOTE OF SHAREHOLDER

PREVI – CAIXA DE PREVIDÊNCIA DOS FUNCIONÁRIOS DO BANCO DO BRASIL

Mr. Chairman,

CAIXA DE PREVIDÊNCIA DOS FUNCIONÁRIOS DO BANCO DO BRASIL S.A. – PREVI, in the capacity of minority shareholder of Petróleo Brasileiro S.A. – Petrobras (“Company”), having 0.71% of common shares, 6.32% of preferred shares issued and 2.81% of Company´s capital stock, in attention to issues included in the Agenda of the Special Meeting of Shareholders of Petróleo Brasileiro S.A. – PETROBRAS (“PETROBRAS”), on May 25th, 2015, namely, resolution on the Administration Report and Financial Statements, with an Opinion of the Executive Committee, related to the accounting period ended on December 31st, 2014, according to notice of meeting on April 22nd, 2015, pursuant to such Special Meeting of Shareholders, declare its vote as follows:

The Report of the Company´s Board of Directors devotes one section to the reflections of Lava Jato (“Car Wash”) Operation in the Company, which, by recommendation of the Company´s executives, recognized a downfall of R$ 6.194 million in the third quarter of 2014. In the view of the Board of Directors, such amount represents the sum that Petrobras additionally paid in the acquisition of fixed assets in previous periods. Such amount was found from a methodology to estimate additional expenditures, admitting that Petrobras could not identify the sums of each overpayment made to suppliers implicated in the Lava Jato (“Car Wash”) Operation.

On one hand, we agree on the decision of a member of the Board of Directors, registered in the Minute of RCA, on April 22nd, 2015, substantiated in a legal opinion that states “the impracticality of the exact measurement of sums supposedly paid as overpricing.” The methodology applied in it only take into consideration the confessions of criminal acts perpetrated by two former executives, which indicated the commission percentage used, a number of suppliers allegedly involved in the cartelization and overcharging of works and services. Some investigations were converted into indictments, but it does not represent convictions at the end of the legal procedure. On the other hand, we disagree on the said Board in that the assessment should not be performed, once it has strong evidences that the Company was severely aggrieved in its property and that such percentage applied is ground for a posterior new adjustment of capitalized investments. It is certain that the accounting adjustments must have support in legal-fact condition. It is early to understand the operation outcome and to prove participation on criminal facts of all companies mentioned in state´s evidences. However, the Company must be conservative at this moment, pointing out to the market its desire to rectify illegal acts and indicating that its assets will not be overvalued.

In effect, the Explanatory Notes of the Financial Statements (Note 3) clarify that Petrobras “will follow the results on investigations and the availability of other information related to the overpayment schemes and, in case such information is available, which precisely indicates that estimates described must be readjusted, the

Company will evaluate if the adjustment é substantial, and, as the case may be, will recognize it.” It could not be otherwise.

Therefore, considering that Financial Statements presented meet the legal requirements approved by Pricewaterhouse external audit, without exception, PREVI, in the capacity of Petrobras´ minority shareholder, states its votes, relative to ordinary shares which holds, to approve, with exceptions, the Report of the Board of Directors of 2014 and the Financial Statements, that in view of possible outcomes from the Lava Jato (“Car Wash”) Operation and due to evidences of crimes perpetrated that have not yet correctly realized its impacts, PREVI understands that the Company´s administrators must not be exonerated from their responsibilities, for the time being, by any of the facts already disclosed, though none of them who hold office in 2014 have not been implicated in the investigations, at first and until it is known by such shareholder.

Accordingly, the statement of vote was based on documents and information available to Petrobras´ shareholders up to now, wherein PREVI is entitle to further state on illegal acts and facts posteriorly disclosed.

Therefore, REQUEST that such statement is annexed and entered upon the minutes of the Special Meeting of Shareholders.

Arthur Prado Silva

Directors of Participations e.e.

PREVI – CAIXA DE PREVIDÊNCIA DOS FUNCIONÁRIOS DO BANCO DO BRASIL

VOTE, PROTEST AND STATEMENT OF TEMPO CAPITAL PRINCIPAL SHARE OF INVESTMENT FUNDS (“Tempo Capital”) presented to the Board of the Special Meeting of Shareholders (“SMS”) of Petróleo Brasileiro S.A. – Petrobras (“Company”), held on May 25th, 2015, at 03:00 PM.

1. Initially, in this SMS and until the payment of minimum dividend provided in article 5o, § 2o of the Company´s Articles of Incorporation, the right of vote of Company´s preferred shares will be recognized, according to article 111, § 1st of Act 6.404, 1976. Tempo Capital votes on the REJECTION of the Board Proposal related to item (1) of the Agenda of the SMS, by reasons given as follows. Such vote serves as PROTEST, in case of non-observance of preferred shareholder with right to vote.

2. Without prejudice of item 1 above, Tempo Capital shareholder presents the following statement to the Board of the Special Meeting of Shareholders, to be subjected to other shareholders of the Company, with reasons in which consider the rejection of the Financial Statements submitted to the conclave, and with exceptions to administrators´ account for purposes of the release presented in article 134, §3rd of Act 6.404, 1976;

3. Initially, it is important to mention that the Financial Statements submitted to shareholder´s appreciation has evidences – according to criteria adopted by the Board of Directors – of the losses arising from the corruption scheme under investigation in the Lava Jato (“Car Wash”) Operation. Without further comments on a subject already of public domain, including Company´s and shareholder´s knowledge, it was estimated the sum of R$ 6.194 billion as overpayments; however there is no evidence to the amount of overpayments paid in 2014 fiscal year. The information presented do not explain the premises used or internal investigations made to verify the overpricing accredited to such assets; after all, it was not only the estimated corruption of R$ 6.194 billion that jeopardized the Company, but overpricing on projects and/or assets questioned and with expected return. Thus, a shareholder does not have the necessary information to verify if the write-offs are adequate or sufficient to adjust the balance of the Company. Besides that, the Company´s mismanagement created losses of R$ 30.976 billion due to, among other factors, “problems in projects´ planning. In both cases, it is possible to mention violation of legal duties of diligence, loyalty and fideicommissum by the Company´s Administration. Based on information presented in the Financial Statements, it is not possible to separate such acts from the 2014 fiscal year and others accredited to previous administrations, some of which counted with the participation of current administrators. Therefore, it is important to except such matters from the release presented in article 134, §3o of Act 6.404, 1976. The Company´s Independent Directors mentioned such concerns in its statements but, apparently, the remaining Board indicated by the Controlling Shareholder ignored them.

4. Apart from the matters previously indicated, it should be noted that the Explanatory Note No. 22.7 informs that “in the fiscal year ended on December 31st, 2014, the Administrations reached its goals and, despite the absence of profit in the fiscal year, and according to the new methodology settled in the collective-bargaining agreement, the Company provisioned R$ 1.045 of interest in the result. It is important to register that, according to Act 10.101, 2000, the Company´s Administration, in negotiation with its employees, might establish other goals than the profits to determine employees´ interest in profits or results.

However, such goals – which are not presented in the Financial Statements – must be established towards the Company´s best interest, and observing its other stakeholders. It is unlikely the establishment of reasonable goals to Company´s profit share, when it is recognized in an fiscal year (i) without positive accounting results; (ii) with absence of growth relevant to Oil Production, LNG, Condensated and Natural Gas; (iii) growth of approximately 28% in Company´s leverage; (iv) reduction of 11% in book value and 40% in Company´s market value; (v) delay on performance and closing of relevant projects to Company; (vi) policy of fuel pricing that generated losses to the Company, mainly in the first half of 2014; (viii) significant downfalls in Company´s main indicators, including, without limitation, its EBITDA; among other elements that defines 2014 as Company´s annus horriblis. However, it is evident that the Company´s Administration, whether its Board of Directors or its Executive Board, did not noticed the Company´s best interest and did not complied with its fiduciary duties while establishing profit share conditions. Furthermore, Mauro Rodrigues da Cunha in its statement of vote, while dealing with the issue, points out “under paragraph 3rd, Clause Three of the Collective-Bargaining Agreement, the limit for profit share payment is ZERO.” However, it is necessary to verify such Agreement for congruence with the result obtained by the Company´s shareholders. Therefore, it is necessary to except such issues from the release provided in §3rd, article 134 of Act 6.404, 1976.

5. Thirdly, it is important to mention that, in this fiscal year, the Company´s Administration chose not to declare the allocation of minimum dividend provided in article 5, § 2nd of the Article of Incorporation. Such behavior happened although the Company had immediate financial availabilities of R$ 44.239 million and reserves over R$ 104.802 million. Although willing to preserve its cash, the Administration had the obligation to declare such dividends, even if it choose to pay them in the future. The non-payment of compensation to preferred shareholders, besides questionable from a legal aspect, shows even more unreasonable and inconsistent pursuant to events described in items 2 and 3.

6. Thus, this instrument serves as Statement, containing the reasons in which the Company´s shareholders must reject the Financial Statements submitted to approval of this conclave, and with exceptions to administrators´ account for purposes of the release presented in article 134, §3rd of Act 6.404, 1976. It is important to mention that the “approval or cause of approval of irregular administrators´ accounts, by personal favoritism, or dispense the investigation of information knowing to be granted, or reason justification of alleged irregularity” (Article 117, §1st of Act 6.404, 1976) is an abusive form of exercise of power.

7. It is relevant to register that, according to the terms of the OFFICIAL LETTER/CVM/SEP/No.002/2015, in its item 2.4.4., the Company must include in the digital file containing this Minutes, in the APE system, in the Brazilian Securities Commission “possible statement of votes, dissent or protest”. Notice that this is not the Company´s best practice. The Director of Governance, Risk, and Conformity must pay attention to it.

TEMPO CAPITAL PRINCIPAL SHARE OF INVESTMENT FUNDS

p.p. Raphael Manhães Martins

OAB/RJ no. 147.187

Page 2 of 2 of VOTE, PROTEST AND STATEMENT OF TEMPO CAPITAL PRINCIPAL SHARE OF INVESTMENT FUNDS presented to the Board of the Special Meeting of Shareholders of Petróleo Brasileiro S.A. – PETROBRAS, held on April 25th, 2015, at 03:00 PM.

ACTUAL BALANCE SHEET OF PETROBRAS

Ladies and Gentlemen,

I am José Martins Ribeiro, candidate of Director, representative of the preferred minority shareholders, wherein candidate of the 2nd category, however, Mr. Guilherme Affonso Ferreira, candidate of 1st category, register of attorneys, including publicity of Petrobras´ website, as relevant fact. My question is To Whom is Mr. Affonso will serve. If he sold his soul to the Devil, with no shred of doubt, he will be a controller´s stooge. On the the hand, Mr. Murilo Ferreira cannot handle his management at Vale S.A., he cannot fix his own backyard, so how will be able to fix other´s backyard?

It was disappointing that Petrobras´ chairman could not be able to attend the most important Meeting of the Company. The sad part was the hiring of a Person who almost use its whip, but I think he forgot it at home. Now, let´s talk about the technical issue: the proprietary accounting registers all administrative, permutative, amending and mixed facts. All registers are based on cash or extra cash accounting documents. According to such elements, we reach the proprietary balance, result statement and other statements pertinent to corporations. As of fiscal year result statement, we reach a point so-called EBITDA, i.e., (profit before interests, taxes, depreciations and amortizations) such amount is approximately R$ 21.6 billion, and then it starts the distribution of profits, employee´s sharing and other distributions, taxes, statutory contributions, reaching the net profit where the dividend calculation is processed to shareholder, including the Government, who, through its Administration, lies the Brazilian people - real owner of Petrobras. Then, we have Petrobras´ real balance sheet, the result of the exhaustive work of all its employees – career or contracted charts. However, all acts performed that gave rise to Petrobras´ loss, such as Assets Devaluation of approximately R$ 44.6 billion, downfall of R$ 6.2 billion, due to “Lava Jato (Car Wash”) Operation”, provisioning of loss in the energy sector with account receivables of R$ 4.5 billion, downfall of refinery Premium I and II of approximately R$ 2.8 billion and the voluntary shutdown of approximately R$ 2.4, totaling the amount of approximately R$ 60.5 billion, all such figures were presented on Petrobras´ website and on newspapers. Such information is presented on article 117, Act 6.404 of 12/15/1976 (article 117 – The controlling shareholder is responsible for damage caused by acts performed with abuse of power).

In conclusion:

a) Mr. Guilherme Affonso Ferreira is not our representative and does not have the requirements. He entered the Board of Directors from the backdoor, and he

worked in the financial market, where has almost no credibility. Mr. Ferreira should resign from his post. Petrobras must call for another election with the same conditions to all candidates. I would appreciate a previous questionnaire in order to evaluate the next chosen person;

b) Mr. Murilo Ferreira should resign and manage Vale S.A., which needs its exclusive dedication, answering the shareholders´ calling;

c) All amount generated by acts performed in violation of the Business Corporation Law (article 117 and its paragraphs) should be assessed in an extra proprietary account (compensation account) under the responsibility of the controlling shareholder, which must be written-off with the occurrence of the so-called defalcation recoveries or assets recovery. Petrobras is prepared to a new development. The Brazilian people, who is real owner of Petrobras, through its shareholders, are different.

Finally:

For those who promised that things were about to chance, well, it started with the wrong foot. Certain laws must be revoked in Petrobras and in Brazil, such as:

a) Murici Law: Every man for himself;

b) Saint Fancis law: It is in “stealing” that we receive (adaptation);

c) Gerson Law: I want to take advantage of everything;

I expect that Petrobras finds its own way, in relation to it employees´ chart, whether employees and contracted charts. Rise up and be proud of its honest and productive work, which cannot be spotted by acts of half a dozen of traitors.

JOSÉ MARTINS RIBEIRO, SHAREHOLDER, ADMINISTRATOR, PROFESSOR AND HISTORIAN.

JOSEMARTINS@GMAIL.COM

This document must be annexed to the Minutes to be transcript in the Special Meeting of Shareholders held on 05/25/2015, and I authorize the use of such Minutes in public media in general.

Signed on 05/25/2015.

AEPET

Association of Engineers of Petrobras

Justification of Vote of Minority Shareholder of AEPET – Association of Engineers of Petrobras, in the Special Meeting of Shareholders of Petróleo Brasileiro S.A. – PETROBRAS, held on 05/25/2015, at 03:00 PM (local time).

Mr. Chairman, Ladies and Gentlemen Shareholders,

In the exercise of the right to supervise, a known shareholder´s essential prerogative, according to article 109, II, of Act 6.404/76, the minority shareholder, AEPET, ASSOCIATION OF ENGINEERS OF PETROBRAS – AEPET and others who desires to follow it – justified the vote the issues of the Agenda in this Special Meeting of Shareholders. Based on article 130 of the aforementioned Act, we request its entire transcription in the Minutes of this Meeting.

1 – PETROBRAS´ DEFENSE AGAINST CORRUPTION

The corruption´s attempt of the State-owned company is a historical problem; its nature is systematic and goes far beyond Petrobras´ and present Government. However, it is undeniable the great increase of the Company´s institutional fragility, in relation to its suppliers of goods and services.

“The Lava Jato (Cars Wash) Operation” has revealed how private business owners were organized in cartel in order to obtain overrated contracts and to prejudice Petrobras. In order to prevail the private interest over Petrobras´ interest and the majority of the society, the private business owners used influence peddling in conjunction with politicians to indicate hire employees in the top of the corporate hierarchy.

We understand the legal milestone of State-owned companies must be obeyed, which guarantees a competitive act according to private companies, but it does not allowed Social Function deviations to which exists. Thus, criteria must be established so that the choice of the members of the Executive Committee and Board of Directors must favors competence, independence, ethics and trustworthiness for being agents of the Social Function. A Management Contract must be established between officials and Government with a constant accountability.

Historically, AEPET denounces the prevalence of private interest in relation to private business owners and Petrobras. AEPET presented this subject on several letters to the Company´s executive board and in votes on Company´s meetings. We registered that, in our several votes, we pointed out agreements such as EPC (Engineering, Procurement and Construction), as harmful because it increases costs, reduces quality and, makes Company hostage of contractor, who has no commitment to the results Enterprise of the Enterprise. The performance of enterprises of COMPERJ, RNEST, PREMIUM 1 and PREMIUM 2 was carried out using this model, a real setback in relation to the successful historical practice of Petrobras – which resulted in a harmful practice to the Company´s interest. A center of excellence was created for EPC!

On March 17th, 2015, in order to cure these fragilities, we sent a letter to Chairman Aldemir Bendine, in which we presented 14 initiatives of corporate nature to the

Company´s defense. These proposals were the result of volunteer work from many experienced and competent professionals. The letter is available at www.aepet.org.br.

AEPET – Association of Engineers of Petrobras does not approve the 2014 accounts for two reasons:

- Due to use of inadequate actuarial premises by Petros, in relation to the actual growth of salaries and the familiar composition of the beneficiaries, Petrobras´ commitment towards Petros was undervalued.

- There was not an accounting downfall in the first Train of Abreu e Lima Refinery, when its accounting cost is definitely overvalued, since the international average maximum cost for construction of refineries is US$ 35 thousand/capacity of refined barrel, and Abreu e Lima Refinery presents a cost over US$ 80 thousand/capacity of refined barrel.

In conclusion, the problem with corruption in Petrobras will not only be settle with punishment to those involved in Lava Jato (“Car Wash”) Operation. Such process has been developed for decades and has had a harmful effect over Petrobras and the Country. The Company´s controllers indulged themselves at its and the Country´s expenses. They have caused a profound loss to the Company´s image and they must be punished for it. Besides, it is clear the fragility of the succession processes in the institution in order to prevent corruption. It is necessary to implement an effective staff policy, which privileges merit and responsibility of all with their processes.

The fragility the system´s planning - conducted by foreigners – and Company´s controls allowed that a new interference of interests from strangers – whether by consultancies, economics, government and political parties, led us to a terrible finance, image and governance fragility situation, despite the technological successes and good economic capacity. In order to improve itself, we have to adopt new proceedings of nomination of members in the Board of Directors and members of the Executive Board, which could favor its competence, ethics, trustworthiness and strong commitment to Petrobras´ social and strategic mission.

We profoundly regret that our several alerts and warnings expressed in this distinguished Meeting, due to experience and knowledge of members committed to Petrobras, have not been taken into due consideration by its Managements. A significant part of these problems would probably have been avoided if such event had occurred.

Rio de Janeiro, May 25th, 2015.

Executive Board of AEPET.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

PETRÓLEO BRASILEIRO S.A--PETROBRAS |

|

|

|

|

By: |

/S/ Ivan de Souza Monteiro

|

|

| |

Ivan de Souza Monteiro

Chief Financial Officer and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Exchange Act of 1934, as amended (Exchange Act) that are not based on historical facts and are not assurances of future results. These forward-looking statements are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

All forward-looking statements are expressly qualified in their entirety by this cautionary statement, and you should not place reliance on any forward-looking statement contained in this press release. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

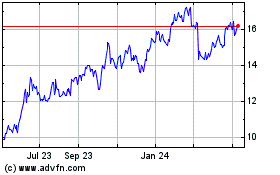

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

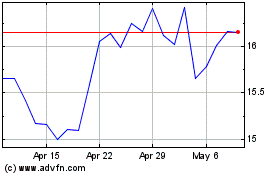

From Mar 2024 to Apr 2024

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Apr 2023 to Apr 2024