SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)

OWLET, INC.

(Name of Issuer)

Class A Common Stock, $0.0001 par value per share

(Title of Class of Securities)

69120X107

(CUSIP Number)

Lior Susan

Managing Member

Eclipse

Ventures

514 High Street, Suite 4

Palo Alto, CA 94301

(650) 720-4667

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

February 17, 2023

(Date of Event Which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box ☐.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

(Continued on following pages)

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS

Eclipse Continuity GP I, LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (see instructions) (a) ☐ (b) ☒

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (see

instructions) AF |

| 5 |

|

CHECK IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

14,930,616 (1) |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

14,930,616

(1) |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

14,930,616 (1) |

| 12 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 11 13.0% (2) |

| 14 |

|

TYPE OF REPORTING PERSON

(see instructions) OO |

| (1) |

All shares are held of record by Eclipse Continuity I (as defined in Item 2(a) below). Eclipse Continuity GP

(as defined in Item 2(a) below) is the general partner of Eclipse Continuity I and may be deemed to have voting and dispositive power over the shares held by Eclipse Continuity I. Mr. Susan (as defined in Item 2(a) below) is the sole managing

member of Eclipse Continuity GP and may be deemed to have voting and dispositive power with respect to these securities. |

| (2) |

Based on 114,852,448 shares of the Issuer’s Class A Common Stock outstanding as of November 10,

2022, as reported by the Issuer in its Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (the “Commission”) on November 14, 2022 (the “Form 10-Q”). |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS

Eclipse Continuity Fund I, L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (see instructions) (a) ☐ (b) ☒

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (see

instructions) WC |

| 5 |

|

CHECK IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

14,930,616 (1) |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

14,930,616

(1) |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

14,930,616 (1) |

| 12 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 11 13.0% (2) |

| 14 |

|

TYPE OF REPORTING PERSON

(see instructions) PN |

| (1) |

All shares are held of record by Eclipse Continuity I. Eclipse Continuity GP is the general partner of Eclipse

Continuity I and may be deemed to have voting and dispositive power over the shares held by Eclipse Continuity I. Mr. Susan is the sole managing member of Eclipse Continuity GP and may be deemed to have voting and dispositive power with respect

to these securities. |

| (2) |

Based on 114,852,448 shares of the Issuer’s Class A Common Stock outstanding as of November 10,

2022, as reported by the Issuer in its Form 10-Q. |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS

Eclipse Ventures GP I, LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (see instructions) (a) ☐ (b) ☒

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (see

instructions) AF |

| 5 |

|

CHECK IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

13,561,716 (1) |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

13,561,716

(1) |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

13,561,716 (1) |

| 12 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 11 11.8% (2) |

| 14 |

|

TYPE OF REPORTING PERSON

(see instructions) OO |

| (1) |

All shares are held of record by Eclipse I (as defined in Item 2(a) below). Eclipse I GP (as defined in Item

2(a) below) is the general partner of Eclipse I and may be deemed to have voting and dispositive power over the shares held by Eclipse I. Mr. Susan is the sole managing member of Eclipse I GP and may be deemed to have voting and dispositive

power with respect to these securities. |

| (2) |

Based on 114,852,448 shares of the Issuer’s Class A Common Stock outstanding as of November 10,

2022, as reported by the Issuer in its Form 10-Q. |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS

Eclipse Ventures Fund I, L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (see instructions) (a) ☐ (b) ☒

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (see

instructions) WC |

| 5 |

|

CHECK IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

13,561,716 (1) |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

13,561,716

(1) |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

13,561,716 (1) |

| 12 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 11 11.8% (2) |

| 14 |

|

TYPE OF REPORTING PERSON

(see instructions) PN |

| (1) |

All shares are held of record by Eclipse I. Eclipse I GP is the general partner of Eclipse I and may be deemed

to have voting and dispositive power over the shares held by Eclipse I. Mr. Susan is the sole managing member of Eclipse I GP and may be deemed to have voting and dispositive power with respect to these securities. |

| (2) |

Based on 114,852,448 shares of the Issuer’s Class A Common Stock outstanding as of November 10,

2022, as reported by the Issuer in its Form 10-Q. |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS

Eclipse Early Growth GP I, LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (see instructions) (a) ☐ (b) ☒

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (see

instructions) AF |

| 5 |

|

CHECK IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

8,501,524 (1)(2) |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

8,501,524

(1)(2) |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

8,501,524 (1)(2) |

| 12 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 11 6.9% (1)(2) |

| 14 |

|

TYPE OF REPORTING PERSON

(see instructions) OO |

| (1) |

These securities are held by Eclipse EGF I (as defined in Item 2(a) below) and consist of an aggregate of

8,501,524 shares of Class A Common Stock issuable upon conversion of shares of Series A Convertible Preferred Stock and/or upon exercise of the Warrant (as defined in Item 6 below). This total excludes an aggregate of 32,722,965 shares of

Class A Common Stock issuable upon the conversion of shares of Series A Convertible Preferred Stock held by Eclipse EGF I and/or upon exercise of the Warrant as a result of the Individual Holder Share Cap (as defined below in Item 6 below).

Eclipse EG GP I (as defined in Item 2(a) below) is the general partner of Eclipse EGF I and may be deemed to have voting and dispositive power over the shares held by Eclipse EGF I. Mr. Susan is the sole managing member of Eclipse EG GP I and

may be deemed to have voting and dispositive power with respect to these securities. |

| (2) |

Based on (i) 114,852,448 shares of the Issuer’s Class A Common Stock outstanding as of

November 10, 2022, as reported by the Issuer in its Form 10-Q, plus (ii) the issuance of an aggregate of 8,501,524 shares of Class A Common Stock upon the conversion of shares of Series A

Convertible Preferred Stock held by Eclipse EGF I and/or upon exercise of the Warrant. |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS

Eclipse Early Growth Fund I, L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (see instructions) (a) ☐ (b) ☒

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (see

instructions) WC |

| 5 |

|

CHECK IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

8,501,524 (1)(2) |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

8,501,524

(1)(2) |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

8,501,524 (1)(2) |

| 12 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 11 6.9% (2) |

| 14 |

|

TYPE OF REPORTING PERSON

(see instructions) PN |

| (1) |

These securities are held by Eclipse EGF I and consist of an aggregate of 8,501,524 shares of Class A

Common Stock issuable upon conversion of shares of Series A Convertible Preferred Stock and/or upon exercise of the Warrant. This total excludes an aggregate of 32,722,965 shares of Class A Common Stock issuable upon the conversion of shares of

Series A Convertible Preferred Stock held by Eclipse EGF I and/or upon exercise of the Warrant as a result of the Individual Holder Share Cap. Eclipse EG GP I is the general partner of Eclipse EGF I and may be deemed to have voting and dispositive

power over the shares held by Eclipse EGF I. Mr. Susan is the sole managing member of Eclipse EG GP I and may be deemed to have voting and dispositive power with respect to these securities. |

| (2) |

Based on (i) 114,852,448 shares of the Issuer’s Class A Common Stock outstanding as of

November 10, 2022, as reported by the Issuer in its Form 10-Q, plus (ii) the issuance of an aggregate of 8,501,524 shares of Class A Common Stock upon the conversion of shares of Series A

Convertible Preferred Stock held by Eclipse EGF I and/or upon exercise of the Warrant. |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS

Lior Susan |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (see instructions) (a) ☐ (b) ☒

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (see

instructions) AF |

| 5 |

|

CHECK IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION United States of

America |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

36,993,856 (1)(2) |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

36,993,856 (1)(2) |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

36,993,856 (1)(2) |

| 12 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 11 29.99% (1)(2) |

| 14 |

|

TYPE OF REPORTING PERSON

(see instructions) IN |

| (1) |

Consists of (i) 14,930,616 shares of Class A Common Stock held of record by Eclipse Continuity I, (ii)

13,561,716 shares of Class A Common Stock held of record by Eclipse I and (iii) an aggregate of 8,501,524 shares of Class A Common Stock issuable upon conversion of shares of Series A Convertible held by Eclipse EGF I and/or upon

exercise of the Warrant held by Eclipse EGF I. This total excludes an aggregate of 32,722,965 shares of Class A Common Stock issuable upon the conversion of shares of Series A Convertible Preferred Stock held by Eclipse EGF I and/or upon

exercise of the Warrant held by Eclipse EGF I as a result of the Individual Holder Share Cap. Eclipse Continuity GP is the general partner of Eclipse Continuity I and may be deemed to have voting and dispositive power over the shares held by Eclipse

Continuity I. Eclipse I GP is the general partner of Eclipse I and may be deemed to have voting and dispositive power over the shares held by Eclipse I. Eclipse EG GP I is the general partner of Eclipse EGF I and may be deemed to have voting and

dispositive power over the shares held by Eclipse EGF I. Mr. Susan is the sole managing member of each of Eclipse Continuity GP, Eclipse I GP and Eclipse EG GP I and may be deemed to have voting and dispositive power with respect to the shares

held by each of Eclipse Continuity I, Eclipse I and Eclipse EGF I. |

| (2) |

Based on (i) 114,852,448 shares of the Issuer’s Class A Common Stock outstanding as of

November 10, 2022, as reported by the Issuer in its Form 10-Q plus (ii) the issuance of an aggregate of 8,501,524 shares of Class A Common Stock upon the conversion of shares of Series A

Convertible Preferred Stock held by Eclipse EGF I and/or upon exercise of the Warrant held by Eclipse EGF I. |

Explanatory Note:

This joint statement on Schedule 13D/A (this “Statement”) is filed with respect to the Class A Common Stock, par value $0.0001 per share

(“Class A Common Stock”), of Owlet, Inc., a Delaware corporation (the “Issuer”). This Amendment No. 1. supplements and amends the Schedule 13D relating to the Class A Common Stock of the Issuer that was filed with

the Commission on July 26, 2021 (the “Original Schedule 13D”). Only those items that are reported are hereby amended; all other items reported in the Original Schedule 13D remain unchanged. Capitalized terms contained herein but not

otherwise defined shall have the meanings ascribed to such terms in the Original Schedule 13D. Information given in response to each item shall be deemed incorporated by reference in all other items as applicable.

Item 2. Identity and Background.

(a) This Statement

is being filed by Eclipse Ventures Fund I, L.P. (“Eclipse I”), Eclipse Ventures GP I, LLC (“Eclipse I GP”), Eclipse Continuity Fund I, L.P. (“Eclipse Continuity I”), Eclipse Continuity GP I, LLC (“Eclipse

Continuity GP”), Eclipse Early Growth Fund I, L.P. (“Eclipse EGF I”) and Eclipse Early Growth GP I, LLC (“Eclipse EG GP I”, and together with Eclipse I, Eclipse I GP, Eclipse Continuity I and Eclipse EGF I, the

“Reporting Entities” or “Eclipse”) and Lior Susan (“Mr. Susan”), a member of the Issuer’s board of directors (the “Board”). The Reporting Entities and the Mr. Susan are collectively referred to

as the “Reporting Persons.” The agreement among the Reporting Persons to file jointly in accordance with the provisions of Rule 13d-1(k)(1) under the Act is attached hereto as Exhibit 1. Each

Reporting Person disclaims beneficial ownership of all securities reported in this Statement except to the extent of such Reporting Person’s pecuniary interest therein, other than those securities reported herein as being held directly by such

Reporting Person.

(b) The address of the principal offices of each Reporting Entity and the business address of each Reporting Individual is c/o Eclipse

Ventures, 514 High Street, Suite 4, Palo Alto, California 94301.

(c) Each Reporting Entity is a venture capital investment entity. Mr. Susan is

engaged through venture capital investment entities in acquiring, holding and disposing of interests in various companies for investment purposes. Mr. Susan is the sole managing member of (i) Eclipse Continuity GP, the general partner of

Eclipse Continuity I, (ii) Eclipse I GP, the general partner of Eclipse I and (iii) Eclipse EG GP I, the general partner of Eclipse EGF I.

(d)

During the past five years, none of the Reporting Persons have been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) None of the Reporting Persons are, nor during the last five years have been, a party to a civil proceeding of a judicial or administrative body of

competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any

violation with respect to such laws.

(f) Each of Eclipse Continuity GP, Eclipse I GP and Eclipse EG GP I is a limited liability company organized under

the laws of the State of Delaware. Each of Eclipse Continuity I, Eclipse I and Eclipse EGF I is a limited partnership organized under the laws of the State of Delaware. Mr. Susan is a citizen of the United States of America.

Item 3. Source and Amount of Funds or Other Consideration.

Item 3 of the Schedule 13D is hereby amended by adding the following as the last paragraph thereof:

On February 17, 2023 (the “Closing Date”), pursuant to the Investment Agreement (as defined in Item 6) Eclipse EGF I purchased (i) 20,200 shares

of Series A Convertible Preferred Stock that, subject to the Individual Holder Share Cap, are initially convertible into 41,224,489 shares of the Issuer’s Class A Common Stock and (ii) a Warrant to purchase, subject to the Individual

Holder Share Cap, 74,204,080 shares of Class A Common Stock for a purchase price of $1,000.00 per share of Series A Convertible Preferred Stock and an aggregate purchase price of $20,200,000.00.

Item 4. Purpose of Transaction.

The information set forth in Item 3 of this Statement is incorporated herein by reference. The Reporting Persons hold the securities of the Issuer for general

investment purposes. The Reporting Persons may, from time to time, depending on prevailing market, economic and other conditions, acquire additional shares of Class A Common Stock or other securities of the Issuer, dispose of any such

securities, or engage in discussions with the Issuer concerning such acquisitions or dispositions or further investments in the Issuer. The Reporting Persons intend to review their investment in the Issuer on a continuing basis and, depending upon

the price and availability of shares of Class A Common Stock or other securities of the Issuer, subsequent developments affecting the Issuer, the Issuer’s business and prospects, other investment and business opportunities available to the

Reporting Persons, general stock market and economic conditions, tax considerations and other factors considered relevant, may decide at any time to increase or to decrease the size of their investment in the Issuer in the open market, in privately

negotiated transactions, pursuant to 10b5-1 trading plans or otherwise.

Mr. Susan is a member of the Board.

In addition, Mr. Susan, in his capacity as a director, may be entitled to receive cash compensation and equity compensation, including stock option or other equity awards, pursuant to the Issuer’s nonemployee director compensation program.

Except as set forth above, the Reporting Persons have no present plans or intentions which would result in or relate to any of the transactions described

in subparagraphs (a) through (j) of Item 4 of Schedule 13D.

Item 5. Interest in Securities of the Issuer.

(a) and (b) See Items 7-11 of the cover pages of this Statement and Item 2 above.

(c) Except as reported in this Statement, none of the Reporting Persons has effected any transactions in the Issuer’s securities within the past 60 days.

(d) Under certain circumstances set forth in the limited partnership agreements of Eclipse Continuity I, Eclipse I and Eclipse EGF I, the general partner

and limited partners of each of Eclipse Continuity I, Eclipse I and Eclipse EGF I may be deemed to have the right to receive dividends from, or the proceeds from, the sale of shares of the Issuer owned by such entity of which they are a partner.

(e) Not applicable.

Item 6. Contracts,

Arrangements, Understandings or Relationships With Respect to Securities of the Issuer.

Item 6 of the Schedule 13D is amended and supplemented as

follows:

On the Closing Date, the Issuer entered into an Investment Agreement (the “Investment Agreement”) with Eclipse EGF I, pursuant to which

Eclipse EGF I purchased (i) 20,200 shares of Series A Convertible Preferred Stock that, subject to the Individual Holder Share Cap, are initially convertible into 41,224,489 shares of the Issuer’s Class A Common Stock, and (ii) a

warrant (the “Warrant”) to purchase, subject to the Individual Holder Share Cap, 74,204,080 shares of Class A Common Stock for a purchase price of $1,000.00 per share of Series A Convertible Preferred Stock and an aggregate purchase

price of $20,200,000.00. The Investment Agreement is filed herewith as Exhibit 2, and any description thereof is qualified in its entirety by reference thereto.

The Warrant has a five-year term and an exercise price that is equal to $0.333 per share. The Warrant also provides for an exercise on a cash or cashless net

exercise basis at any time after the Closing Date and will be automatically exercised on a cashless basis if not exercised prior to the expiration of the five-year term. Upon a fundamental change or other liquidation event, the Warrant will

automatically net exercise if not exercised before the consummation of such event. The Form of Warrant is filed herewith as Exhibit 3, and any description thereof is qualified in its entirety by reference thereto.

In connection with the purchase of Series A Convertible Preferred Stock, Eclipse Continuity I, Eclipse I and

Eclipse EGF I entered into an Amended and Restated Stockholders Agreement with the Issuer, dated February 17, 2023 (the “Amended Stockholders Agreement”). The Amended Stockholders Agreement provides that (a) until such time as

Eclipse beneficially owns less than 20.0% of the total voting power entitled to elect directors, Eclipse shall be entitled to nominate two individuals to the Board (the “Eclipse Directors” and each, an “Eclipse Director”) and

(b) from such time that Eclipse beneficially owns less than 20.0% of the total voting power entitled to elect directors and until Eclipse beneficially owns less than 10.0% of the total voting power entitled to elect directors, Eclipse will be

entitled to nominate one Eclipse Director. The Amended Stockholders Agreement also provides that Mr. Susan shall serves as the Chairperson of the Board and that Jayson Knafel shall be appointed to the Board as a Class II Director for a

term expiring at the Issuer’s annual meeting of stockholders to be held in 2023 (the “2023 Annual Meeting”). The Amended Stockholders Agreement is filed herewith as Exhibit 4, and any description thereof is qualified in its

entirety by reference thereto.

On the Closing Date, the Issuer filed a Certificate of Designation (the “Certificate of Designation”) setting

forth the terms, rights, obligations and preferences of the Series A Convertible Preferred Stock.

Ranking and Dividends

The Series A Convertible Preferred Stock ranks, with respect to dividend rights, rights of redemption and rights upon a liquidation event, (i) senior to

the Class A Common Stock and all other classes or series of equity securities of the Company established after the Closing Date, unless such shares or equity securities expressly provide that they rank in parity with or senior to the Series A

Convertible Preferred Stock with respect to dividend rights, rights of redemption or rights upon a liquidation event, (ii) on parity with each class or series of equity securities of the Company established after the Closing Date, the terms of

which expressly provide that it ranks on parity with the Series A Convertible Preferred Stock with respect to dividend rights, rights of redemption and rights upon a liquidation event and (iii) junior to each class or series of equity

securities of the Company established after the Closing Date, the terms of which expressly provide that it ranks senior to the Series A Convertible Preferred Stock with respect to dividend rights, rights of redemption and rights upon a liquidation

event.

The Series A Convertible Preferred Stock has a liquidation preference of $1,000.00 per share (the “Liquidation Preference”). The Issuer

has agreed not to declare, pay or set aside any dividends on shares of Class A Common Stock unless the holders of the Series A Convertible Preferred Stock then outstanding first receive, or simultaneously receive, a dividend on each outstanding

share of Series A Convertible Preferred Stock in an amount at least equal to the product of (i) the dividend payable on each share of Class A Common Stock multiplied by (ii) the number of shares of Class A Common Stock issuable

upon conversion of a share of Series A Convertible Preferred Stock to Class A Common Stock thereunder, in each case calculated on the record date for determination of holders entitled to receive such dividend.

Voting and Consent Rights

Holders of Series A

Convertible Preferred Stock are entitled to vote with the holders of shares of Class A Common Stock on an as-converted to common basis at any annual or special meeting of stockholders of the Issuer, and

not as a separate class, except as required by Delaware law.

Additionally, for so long as any Series A Convertible Preferred Stock remain outstanding,

the Issuer will be prohibited, without the consent of the holders of at least a majority of the Series A Convertible Preferred Stock, from taking various corporate actions, including:

| |

• |

|

creating, authorizing or issuing any additional Series A Convertible Preferred Stock or shares which rank senior

to or on parity with the Series A Convertible Preferred Stock; |

| |

• |

|

amending, waiving or repealing the rights, preferences or privileges of the Series A Convertible Preferred Stock;

|

| |

• |

|

increasing or decreasing the authorized number of Series A Convertible Preferred Stock; |

| |

• |

|

exchanging, reclassifying or canceling the Series A Convertible Preferred Stock (except as contemplated by the

Certificate of Designations); |

| |

• |

|

declaring or paying any dividend on, or making any distribution to, or repurchasing any shares of Class A

Common Stock or other securities that rank junior to the Series A Convertible Preferred Stock, subject to certain exceptions; |

| |

• |

|

incurring any indebtedness other than Permitted Indebtedness (as defined in the Certificate of Designation); and

|

| |

• |

|

creating, adopting, amending, terminating or repealing any equity (or equity-linked) compensation or incentive

plan or increase the amount or number of equity securities reserved for issuance thereunder if the New York Stock Exchange (the “NYSE”) would require stockholder approval of such action; provided that the Company’s 2021 Incentive

Award Plan (as it exists on the Closing Date) (the “2021 Plan”) and any automatic annual increases pursuant to the 2021 Plan shall not require approval. |

Registration Rights

As promptly as reasonably

practicable after the Closing Date, but in any event within twenty (20) business days after the later of (i) the Closing Date or (ii) the filing of the Issuer’s Annual Report on Form 10-K

for the year ended December 31, 2022, the Issuer will file and use commercially reasonable efforts to cause to be declared effective or otherwise become effective pursuant to the Securities Act of 1933, as amended (the “Securities

Act”) a shelf registration statement to register the resale of all the shares of Class A Common Stock issuable upon conversion or exercise of the Series A Convertible Preferred Stock or Warrant (the “Resale Shelf”). Shares of

Class A Common Stock underlying the Series A Convertible Preferred Stock and Warrant held by Eclipse EGF I will be considered “Registrable Securities” for purposes of that certain Amended and Restated Registration Rights Agreement,

dated as of July 15, 2021, by and among the Issuer and the holders party thereto (the “Rights Agreement”), which will entitle such holders to the demand and piggyback registration rights set forth therein. The Rights Agreement is

filed herewith as Exhibit 5, and any description thereof is qualified in its entirety by reference thereto.

The Certificate of Designation is

filed herewith as Exhibit 6, and any description thereof is qualified in its entirety by reference thereto.

The Certificate of Designation and the

Warrant include certain provisions that prevent Eclipse EGF I, until Stockholder Approval (as defined below) is obtained, from converting its Series A Convertible Preferred Stock, voting its Series A Convertible Preferred Stock on an as-converted-to-Class A Common Stock basis or exercising the Warrant, as applicable, to the extent such action would result in Eclipse

EGF I, or any group (within the meaning of Section 13(d)(3) of the Exchange Act) that includes Eclipse EGF I, beneficially owning in excess of 29.99% of the Issuer’s outstanding Class A Common Stock (the “Individual Holder Share

Cap”).

The Issuer has agreed in the Investment Agreement to include a proposal in the definitive proxy statement for its 2023 Annual Meeting,

soliciting approval by the Issuer’s stockholders to issue Class A Common Stock to Eclipse such that the Individual Holder Share Cap shall no longer apply in accordance with applicable law and the rules and regulations of the NYSE (the

“Stockholder Approval”). If the Stockholder Approval is not obtained at the 2023 Annual Meeting, the Issuer has agreed to use its commercially reasonable efforts to call a special stockholder meeting within four months of the 2023 Annual

Meeting to obtain the Stockholder Approval as contemplated and if the Stockholder Approval is not obtained at such special meeting, the Issuer shall again include the Stockholder Approval for its annual stockholder meeting for 2024.

Item 7. Material to be Filed as Exhibits.

|

|

|

| Exhibit 1: |

|

Joint Filing Agreement, dated February 27, 2023, by and among the Reporting Persons (filed herewith). |

|

|

| Exhibit 2: |

|

Investment Agreement, dated February 17, 2023, by and among Owlet, Inc. and the investors listed on Schedule I thereto (Excluded Investors) (incorporated by reference to Exhibit 10.2 of the Issuer’s Current Report on Form 8-K, filed with the Commission on February 21, 2023). |

|

|

| Exhibit 3: |

|

Form of Warrant to Purchase Common Stock (incorporated by reference to Exhibit 4.1 of the Issuer’s Current Report on Form 8-K, filed with the Commission on February 21,

2023). |

|

|

| Exhibit 4: |

|

Amended and Restated Stockholders Agreement, dated February 17, 2023, by and among the Issuer, Eclipse Ventures Fund I, L.P., Eclipse Continuity Fund I, L.P. and Eclipse Early Growth Fund I, L.P. (incorporated by reference to

Exhibit 10.3 of the Issuer’s Current Report on Form 8-K, filed with the Commission on February 21, 2023). |

|

|

| Exhibit 5: |

|

Amended and Restated Registration Rights Agreement, dated July 15, 2021, by and among the Issuer and certain of its stockholders (filed as Exhibit 10.2 to the Issuer’s Current Report on

Form 8-K as filed with the Commission on July 21, 2021 (File No. 001-39516) and incorporated herein by reference.). |

|

|

| Exhibit 6: |

|

Certificate of Designation of Series A Convertible Preferred Stock of Owlet, Inc. (incorporated by reference to Exhibit 3.1 of the Issuer’s Current Report on Form 8-K, filed

with the Commission on February 21, 2023). |

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: February 27, 2023

|

|

|

| ECLIPSE VENTURES FUND I, L.P. |

|

| By: Eclipse Ventures GP I, LLC |

| Its: General Partner |

|

|

| By: |

|

/s/ Lior Susan |

|

|

Lior Susan |

| Its: |

|

Managing Member |

|

| ECLIPSE VENTURES GP I, LLC |

|

|

| By: |

|

/s/ Lior Susan |

|

|

Lior Susan |

| Its: |

|

Managing Member |

|

| ECLIPSE CONTINUITY FUND I, L.P. |

|

| By: Eclipse Continuity GP I, LLC |

| Its: General Partner |

|

|

| By: |

|

/s/ Lior Susan |

|

|

Lior Susan |

| Its: |

|

Managing Member |

|

| ECLIPSE CONTINUITY GP I, LLC |

|

|

| By: |

|

/s/ Lior Susan |

|

|

Lior Susan |

| Its: |

|

Managing Member |

|

| ECLIPSE EARLY GROWTH FUND I, L.P. |

|

| By: Eclipse Early Growth GP I, LLC |

| Its: General Partner |

|

|

| By: |

|

/s/ Lior Susan |

|

|

Lior Susan |

| Its: |

|

Managing Member |

|

| ECLIPSE EARLY GROWTH GP I, LLC |

|

|

| By: |

|

/s/ Lior Susan |

|

|

Lior Susan |

| Its: |

|

Managing Member |

|

| /s/ Lior Susan |

| Lior Susan |

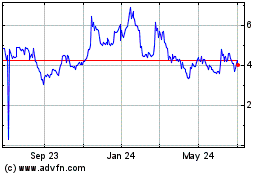

Sandbridge Aquisition (NYSE:OWLT)

Historical Stock Chart

From Mar 2024 to Apr 2024

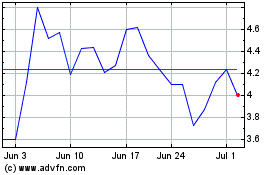

Sandbridge Aquisition (NYSE:OWLT)

Historical Stock Chart

From Apr 2023 to Apr 2024