Owlet, Inc. ("Owlet" or the "Company") (NYSE: OWLT) today

reported financial results for the third quarter ended September

30, 2022. Owlet’s President and Chief Executive Officer, Kurt

Workman, and Chief Financial Officer, Kate Scolnick, will host a

conference call to review the Company’s results and provide a

business update today, November 14, 2022 at 4:30 p.m. ET.

Recent Highlights and Updates

- Generated revenues of approximately $17.4 million in the third

quarter of 2022

- Submitted a 510(k) premarket notification to the U.S. Food and

Drug Administration (the “FDA”) for a new prescription monitoring

device for infants under the care of a physician

- Launched next-generation HD nursery Owlet Cam 2 and Predictive

Sleep Technology tool in July

- Expanded the Company’s retail footprint, adding approximately

1,200 new Walmart locations and new product offering to

approximately 600 existing Target locations

- Planned submission to the FDA of our software-as-a-medical

device marketing application for an over-the-counter heart rate and

oxygen opportunistic notifications function, compatible with

existing Dream Sock products, anticipated to be filed in the coming

weeks

“The third quarter also marked incredible progress on our

regulatory goals, as we submitted a 510(k) to the FDA for a

prescription-only Sock monitor for babies under the care of a

physician,” said Kurt Workman, Owlet Chief Executive Officer and

Co-Founder. “Additionally, we look forward to submitting a second

filing in the coming weeks for a software-as a medical device,

which would add opportunistic notifications to the existing Dream

Sock functionality. Other positive trends we’re seeing include

sell-through growing, efficiently reducing our costs and making

progress toward our goal of break even. These are especially

important as we navigate uncertain economic times. Despite that, we

remain optimistic about the long-term opportunity to build

regulatory leadership in our category. I am proud of the team’s

efforts to regain our market position and deliver best-in-class

solutions to better empower parents at home.”

Financial Results for the Third Quarter Ended September 30,

2022

See “Disclosure Regarding Non-GAAP Financial Measures” and the

reconciliation tables that accompany this release for a discussion

and reconciliation of certain non-GAAP financial measures included

in this release.

Revenues were approximately $17.4 million in third quarter 2022,

compared to revenues of approximately $31.5 million for the same

period in 2021. The revenue decline was primarily due to lower

sales volume during the quarter, impacted by reduced consumer

sell-through levels and retailers targeting lower inventory levels

due to prevailing macroeconomic conditions.

Cost of revenues was approximately $12.7 million with a gross

margin of 26.6% for the third quarter of 2022, compared to

approximately $16.6 million and 47.2% in the same period in 2021.

The gross margin decline was primarily due to provisions for

returns and chargeback allowances and customer discounts, which did

not decrease in proportion to lower sales volume, and cost

inflation.

Operating expenses were $26.4 million in third quarter 2022,

compared to $28.6 million for the same period in 2021. The decrease

in year-over-year operating expenses was primarily attributed to

decreases in sales and marketing expenses.

Operating loss and net loss were $21.8 million and $19.4

million, respectively, in third quarter 2022, compared to $13.8

million operating loss and $34.5 million net loss for the third

quarter of 2021.

Adjusted EBITDA loss was $18.4 million, compared to $11.5

million for the third quarter of 2021.

Net loss per share was $0.17 and adjusted net loss per share was

$0.17 for the third quarter of 2022, compared to a net loss per

share of $0.36 and adjusted net loss per share of $0.13 per share

for the third quarter of 2021.

Financial Outlook

The Company will speak to its financial outlook as part of the

business update provided during Owlet’s conference call today,

November 14, 2022 at 4:30 p.m. ET. Conference call details are

provided below and on the Company’s Investor Relations website at

investors.owletcare.com.

Cautionary Note Regarding Forward-Looking Statements

This release and oral statements made from time to time by

representatives of the Company may contain or incorporate by

reference certain statements that are “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995 (the “Reform Act”). Generally, forward-looking statements

include the words “estimate,” may,” “believes,” “plans,” “expects,”

“anticipates,” “intends,” “goal,” “potential,” “upcoming,”

“outlook,” “guidance,” the negation thereof or similar expressions,

although not all forward-looking statements contain these

identifying words. In addition, all statements that address future

operating, financial or business results, performance, strategies

or initiatives, future efficiencies or savings, anticipated costs

or charges, future capitalization, anticipated impacts of recent or

pending investments or transactions, and statements expressing

general views about future results or performance are

forward-looking statements within the meaning of the Reform Act.

Forward-looking statements are based on the Company’s expectations

at the time such statements are made, speak only as of the dates

they are made and are susceptible to a number of risks,

uncertainties and other factors. For all such forward-looking

statements, the Company claims the protection of the safe harbor

for forward-looking statements contained in the Reform Act. The

Company’s actual results, performance or achievements may differ

materially from any future results, performance or achievements

expressed or implied by the Company’s forward-looking

statements.

Many important factors could affect the Company’s future results

and cause those results to differ materially from those expressed

in or implied by the Company’s forward-looking statements. Such

factors include, but are not limited to, the following: (1) the

regulatory pathway for Owlet’s products, including submissions to,

actions taken by and decisions and responses from regulators, such

as the U.S. Food and Drug Administration and similar regulators

outside of the United States, as well as Owlet’s ability to obtain

and maintain regulatory approval or certification for our products

and other regulatory requirements and legal proceedings; (2)

Owlet’s competition and the Company’s ability to profitably grow

and manage growth; (3) the Company’s ability to enhance future

operating and financial results or obtain additional financing to

continue as a going concern; (4) Owlet’s ability to obtain

additional financing in the future, as well risks associated with

the Company’s current loan and debt agreements, including

compliance with debt covenants, restrictions on the Company’s

access to capital, the impact of the Company’s overall debt levels,

Owlet’s ability to finalized an amended agreement with our current

lender before the end of 2022 and the Company’s ability to generate

sufficient future cash flows to meet Owlet’s debt service

obligations and operate Owlet’s business; (5) the ability of Owlet

to implement strategic initiatives, reduce costs, grow revenues,

develop new products and innovate and enhance existing products,

meet customer demands and adapt to changes in consumer preferences

and retail trends; (6) Owlet’s ability to acquire, defend and

protect its intellectual property and satisfy regulatory

requirements, including but not limited to requirements concerning

privacy and data protection, breaches and loss, as well as other

risks associated with Owlet’s digital platforms and technologies;

(7) Owlet’s ability to maintain relationships with customers,

manufacturers and suppliers and retain Owlet’s management and key

employees; (8) Owlet’s ability to upgrade and maintain its

information technology systems; (9) changes in applicable laws or

regulations; (10) the impact of and disruption to Owlet’s business,

financial condition, operations, supply chain and logistics due to

economic and other conditions beyond the Company’s control, such as

health epidemics or pandemics, macro-economic uncertainties, social

unrest, hostilities, natural disasters or other catastrophic

events; (11) the possibility that Owlet may be adversely affected

by other economic, business, regulatory, competitive or other

factors, such as changes in discretionary consumer spending and

consumer preferences; and (12) other risks and uncertainties set

forth in the Company’s releases, public statements and filings with

the Securities and Exchange Commission, including those identified

in the “Risk Factors” sections of the Company’s Annual Reports on

Form 10-K and Quarterly Reports on Form 10-Q.

All future written and oral forward-looking statements

attributable to the Company or any person acting on the Company’s

behalf are expressly qualified in their entirety by the cautionary

statements contained or referred to above. Moreover, the Company

operates in an evolving environment. In addition to the factors

described above, new risk factors and uncertainties may emerge from

time to time, and factors that the Company currently deems

immaterial may become material, and it is impossible for the

Company to predict such events or how such events may affect

Owlet.

Except as required by federal securities laws, the Company

assumes no obligation to update any forward-looking statements

after the date of this release, whether as a result of new

information, future events or otherwise, although we may do so from

time to time. The Company does not endorse any projections

regarding future results or performance that may be made by third

parties.

Disclosure Regarding Non-GAAP Financial Measures

In addition to the financial measures presented in this release

in accordance with U.S. Generally Accepted Accounting Principles

(“GAAP”), the Company has included certain non-GAAP financial

measures in this release, including EBITDA, adjusted EBITDA,

adjusted net loss and adjusted net loss per share.

The Company uses such non-GAAP financial measures as internal

measures of business operating performance and as performance

measures for benchmarking against the Company’s peers and

competitors. The Company believes its presentation of EBITDA,

adjusted EBITDA, adjusted net loss and adjusted net loss per share

provide a meaningful perspective of the underlying operating

performance of our current business and enables investors to better

understand and evaluate its historical and prospective operating

performance. The Company believes that these non-GAAP financial

measures are important supplemental measures of operating

performance because they exclude items that vary from period to

period without correlation to the Company’s core operating

performance and highlight trends in its business that may not

otherwise be apparent when relying solely on GAAP financial

measures. Due to the nature of the items being excluded, such items

do not reflect future gains, losses, expenses or benefits and are

not indicative of the Company’s future operating performance. The

Company believes investors, analysts and other interested parties

use EBITDA, adjusted EBITDA, adjusted net loss and adjusted net

loss per share in evaluating issuers, and the presentation of these

measures facilitates a comparative assessment of the Company’s

operating performance in addition to the Company’s performance

based on GAAP results.

The Company’s non-GAAP financial measures should not be

considered as an alternative to net loss or net loss per share as a

measure of financial performance or any other performance measure

derived in accordance with GAAP, and should not be construed as an

inference that the Company’s future results will be unaffected by

unusual or non-recurring items. EBITDA is defined as net loss

adjusted for income tax provision, interest expense, interest

income, and depreciation and amortization. Adjusted EBITDA is

defined as net loss adjusted for income tax provision, interest

expense, interest income, depreciation and amortization,

restructuring costs, warrant liability adjustments, stock-based

compensation, and transaction costs. Adjusted net loss is defined

as net loss adjusted for warrant liability adjustments, stock-based

compensation, and transaction costs. Adjusted loss per share is

defined as Adjusted net loss divided by weighted-average shares of

common stock.

EBITDA, adjusted EBITDA, adjusted net loss and adjusted net loss

per share are not recognized terms under GAAP, and the Company’s

presentation of these non-GAAP financial measures does not replace

the presentation of the Company’s financial results in accordance

with GAAP. Because all companies do not use EBITDA, adjusted

EBITDA, adjusted net loss and adjusted net loss per share (and

similarly titled financial measures) in the same way, those

measures as used by other companies may not be consistent with the

way the Company calculates such measures. The non-GAAP financial

measures included in this release should not be construed as

substitutes for or better indicators of the Company’s performance

than the most directly comparable GAAP financial measures. See the

reconciliation tables that accompany this release for additional

information regarding certain of the non-GAAP financial measures

included herein.

Conference Call and Webcast information

Owlet will host a conference call and audio webcast today at

4:30 p.m. ET to discuss these results.

To access the conference call by telephone, please dial (844)

200-6205 (domestic) or +1 (929) 526-1599 (international) and

reference Access Code 718621. To listen to the conference call via

live audio webcast, please visit the Events section of Owlet’s

Investor Relations website at investors.owletcare.com.

A replay of the conference call will be available by telephone

by dialing (929) 458-6194 (domestic) or +44 (204) 525-0658

(international) and using Access Code 576627. The archived webcast

will also be available on Owlet’s Investor Relations website

mentioned above.

About Owlet, Inc.

Owlet was founded by a team of parents in 2012. Owlet’s mission

is to empower parents with the right information at the right time,

to give them more peace of mind and help them find more joy in the

journey of parenting. Owlet’s digital parenting platform aims to

give parents real-time data and insights to help parents feel more

calm and confident. Owlet believes that every parent deserves peace

of mind and the opportunity to feel their well-rested best. To

learn more, visit www.owletcare.com.

Owlet, Inc. Condensed

Consolidated Balance Sheets - Preliminary, Unaudited1 (in

millions)

Assets

September 30, 2022

December 31, 2021

Current assets:

Cash and cash equivalents

$

23.2

$

95.1

Accounts receivable

20.5

10.5

Inventory

23.8

18.0

Prepaid expenses and other current

assets

6.1

12.3

Total current assets

73.6

135.8

Property and equipment, net

1.4

1.9

Right of use assets, net

2.6

—

Intangible assets, net

2.3

1.7

Other assets

0.8

0.7

Total assets

$

80.7

$

140.0

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

28.5

$

27.8

Accrued and other expenses

25.4

31.7

Current portion of deferred revenues

1.3

1.1

Line of credit

5.0

—

Current portion of long-term debt

12.0

8.5

Total current liabilities

72.1

69.1

Long-term debt, net

—

8.0

Noncurrent lease liabilities

1.6

—

Common stock warrant liability

2.3

7.1

Other long-term liabilities

0.3

0.7

Total liabilities

76.3

84.9

Total stockholders’ equity

4.4

55.2

Total liabilities and stockholders’

equity

$

80.7

$

140.0

Owlet, Inc. Condensed

Consolidated Statements of Cash Flows - Preliminary, Unaudited1

(in millions)

For the Nine Months Ended

September 30,

2022

2021

Net cash used in operating activities

(71.6)

(34.7)

Net cash used in investing activities

(1.4)

(1.6)

Net cash provided by financing

activities

1.1

134.2

Net change in cash and cash

equivalents

(71.9)

97.9

1 Amounts may not sum due to rounding

Owlet, Inc. Condensed

Consolidated Statements of Operations and Comprehensive Loss -

Preliminary, Unaudited1 (in millions, except share and per

share amounts)

For the Three Months Ended

September 30,

For the Nine Months Ended

September 30,

2022

2021

2022

2021

Revenues

$

17.4

$

31.5

$

57.2

$

78.4

Cost of revenues

12.7

16.6

37.3

37.3

Gross profit

4.6

14.9

20.0

41.1

Operating expenses:

General and administrative

9.7

9.3

29.4

22.5

Sales and marketing

9.7

13.1

31.0

26.8

Research and development

7.1

6.3

23.4

14.3

Total operating expenses

26.4

28.6

83.9

63.5

Operating loss

(21.8

)

(13.8

)

(63.9

)

(22.5

)

Other income (expense):

Interest expense, net

(0.4

)

(0.5

)

(0.8

)

(1.4

)

Interest expense from contingent

beneficial conversion feature

—

(26.1

)

—

(26.1

)

Preferred stock warrant liability

adjustment

—

—

—

(5.6

)

Common stock warrant liability

adjustment

2.9

5.8

4.8

5.8

Gain on loan forgiveness

—

—

—

2.1

Other income (expense), net

—

0.1

0.1

—

Total other income (expense), net

2.5

(20.7

)

4.1

(25.2

)

Loss before income tax provision

(19.4

)

(34.4

)

(59.8

)

(47.6

)

Income tax provision

—

—

—

—

Net loss and comprehensive loss

$

(19.4

)

$

(34.5

)

$

(59.8

)

$

(47.6

)

Net loss per share attributable to common

stockholders, basic and diluted

$

(0.17

)

$

(0.36

)

$

(0.54

)

$

(1.00

)

Weighted-average number of shares

outstanding used to compute net loss per share attributable to

common stockholders, basic and diluted

111,775,265

96,681,887

110,995,687

47,421,668

1 Amounts may not sum due to rounding

Owlet, Inc.

Reconciliation of GAAP to Non-GAAP Measures - Preliminary,

Unaudited1 (in millions)

For the Three Months Ended

September 30,

For the Nine Months Ended

September 30,

2022

2021

2022

2021

Net Loss

$

(19.4

)

$

(34.5

)

$

(59.8

)

$

(47.6

)

Income tax provision

—

—

—

—

Interest expense, net

0.4

0.5

0.8

1.4

Interest expense from contingent

beneficial conversion feature

—

26.1

—

26.1

Depreciation and amortization

0.4

0.3

1.1

0.8

EBITDA

$

(18.5

)

$

(7.7

)

$

(58.0

)

$

(19.4

)

Restructuring costs

1.2

—

1.2

—

Preferred stock warrant liability

adjustment

—

—

—

5.6

Common stock warrant liability

adjustment

(2.9

)

(5.8

)

(4.8

)

(5.8

)

Gain on loan forgiveness

—

—

—

(2.1

)

Stock based compensation

1.8

0.7

8.4

2.3

Merger transaction costs

—

1.3

—

5.3

Loss on extinguishment of debt

—

—

—

0.2

Adjusted EBITDA

$

(18.4

)

$

(11.5

)

$

(53.1

)

$

(13.9

)

Owlet, Inc.

Reconciliation of GAAP to Non-GAAP Measures - Preliminary,

Unaudited1 (in millions, except share and per share

amounts)

For the Three Months Ended

September 30,

For the Nine Months Ended

September 30,

2022

2021

2022

2021

Net Loss

$

(19.4

)

$

(34.5

)

$

(59.8

)

$

(47.6

)

Non-GAAP Adjustments:

Non-recurring interest expense from

contingent beneficial conversion feature

—

26.1

—

26.1

Restructuring costs

1.2

—

1.2

—

Preferred stock warrant liability

adjustment

—

—

—

5.6

Common stock warrant liability

adjustment

(2.9

)

(5.8

)

(4.8

)

(5.8

)

Gain on loan forgiveness

—

—

—

(2.1

)

Stock based compensation

1.8

0.7

8.4

2.3

Merger transaction costs

—

1.3

—

5.3

Loss on extinguishment of debt

—

—

—

0.2

Adjusted Net Loss

$

(19.2

)

$

(12.2

)

$

(55.0

)

$

(16.1

)

Net loss per share

$

(0.17

)

$

(0.36

)

$

(0.54

)

$

(1.00

)

Adjusted net loss per share

$

(0.17

)

$

(0.13

)

$

(0.50

)

$

(0.34

)

Weighted average number of shares

outstanding

111,775,265

96,681,887

110,995,687

47,421,668

1 Amounts may not sum due to rounding

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221114006008/en/

Investors Mike Cavanaugh ICR

Westwicke Phone: (617) 877-9641 mike.cavanaugh@westwicke.com

Media Jane Putnam Owlet, Inc.

Phone: (801) 647-0025 jputnam@owletcare.com

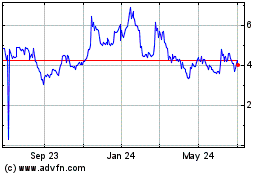

Sandbridge Aquisition (NYSE:OWLT)

Historical Stock Chart

From Mar 2024 to Apr 2024

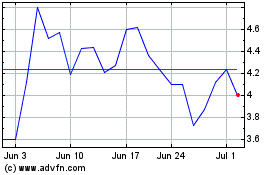

Sandbridge Aquisition (NYSE:OWLT)

Historical Stock Chart

From Apr 2023 to Apr 2024