Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

July 29 2022 - 6:07AM

Edgar (US Regulatory)

Filed pursuant to Rule 424(b)(3)

Registration Statement No. 333-258506

Prospectus Supplement No. 3

(To Prospectus dated April 27, 2022)

OWLET, INC.

This prospectus supplement updates, amends and supplements the prospectus dated April 27, 2022 (the “Prospectus”), which forms a part of our Registration Statement on Form S-1 (Registration No. 333-258506). Capitalized terms used in this prospectus supplement and not otherwise defined herein have the meanings specified in the Prospectus.

This prospectus supplement is being filed to update, amend and supplement the information included in the Prospectus with the information contained in (a) our Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on June 24, 2022 and (b) our Current Report on Form 8-K filed with the SEC on July 25, 2022, both of which are set forth below.

This prospectus supplement is not complete without the Prospectus. This prospectus supplement should be read in conjunction with the Prospectus, which is to be delivered with this prospectus supplement, and is qualified by reference thereto, except to the extent that the information in this prospectus supplement updates or supersedes the information contained in the Prospectus. Please keep this prospectus supplement with your Prospectus for future reference.

Owlet, Inc.’s common stock and warrants are listed on the New York Stock Exchange under the symbols “OWLT” and “OWLT WS.” On July 28, 2022, the closing price of our common stock was $2.09, and the closing price of our warrants was $0.35.

We are an “emerging growth company” under federal securities laws and are subject to reduced public company reporting requirements. Investing in our securities involves certain risks. See “Risk Factors” beginning on page 6 of the Prospectus.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is July 28, 2022.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 21, 2022

OWLET, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-39516 | 85-1615012 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

| 3300 North Ashton Boulevard, Suite 300, Lehi, Utah 84043 |

| (Address of principal executive offices) (Zip Code) |

|

| (844) 334-5330 |

| (Registrant’s telephone number, including area code) |

|

| N/A |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions.

| | | | | |

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | OWLT | New York Stock Exchange |

| Warrants to purchase Common Stock | OWLT WS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.05 Costs Associated with Exit or Disposal Activities.

On July 21, 2022, Owlet, Inc. (the “Company”) implemented a restructuring program to streamline the Company’s organizational structure in response to current business conditions, reduce the Company’s operating expenses and manage and conserve the Company’s cash resources. The Company is undertaking the restructuring program primarily to increase cost-efficiencies across the organization and strive for profitability.

As part of the restructuring program implementation, the Company commenced a workforce reduction of approximately 74 employees that is expected to be substantially completed in the third quarter of 2022. In connection with the restructuring program, the Company expects to incur an estimated total amount of approximately $1.1 million in the third quarter of 2022, consisting primarily of severance, one-time termination and other related costs, all of which will result in future cash expenditures.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K and oral statements made from time to time by representatives of the Company may contain or incorporate by reference certain statements that are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). Generally, forward-looking statements include the words “may,” “believes,” “plans,” “expects,” “anticipates,” “intends,” “estimate,” “goal,” “potential,” “upcoming,” “outlook,” “guidance,” or the negation thereof, or similar expressions. Forward-looking statements are based on the Company’s expectations at the time such statements are made, speak only as of the dates they are made and are susceptible to a number of risks, uncertainties and other factors. For all such forward-looking statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Reform Act. The Company’s actual results, performance or achievements may differ materially from any future results, performance or achievements expressed or implied by our forward-looking statements. Many important factors could affect the Company’s future results and cause those results to differ materially from those expressed in or implied by the Company’s forward-looking statements. Such factors include, but are not limited to, the following: (i) Owlet’s competition and ability to profitably grow and manage growth; (ii) the regulatory pathway for Owlet products and responses from regulators, including the U.S. Food and Drug Administration and similar regulators outside of the United States, as well as legal proceedings and regulatory requirements; (iii) the ability of Owlet to maintain relationships with customers, manufacturers and suppliers and retain Owlet’s management and key employees; (iv) changes in applicable laws or regulations; (v) the possibility that Owlet may be adversely affected by other economic, business, regulatory and/or competitive factors; (vi) the ability of Owlet to implement its strategic initiatives and continue to innovate its existing products; (vii) the ability of Owlet to acquire, defend and protect its intellectual property and satisfy regulatory requirements, including but not limited to those concerning privacy and data protection; (viii) the impact of the COVID-19 pandemic on Owlet’s business, financial condition, operations and supply chain; and (ix) other risks and uncertainties set forth in the Company’s releases, public statements and/or filings with the Securities and Exchange Commission, including those identified in the “Risk Factors” section in the Company’s Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q. All future written and oral forward-looking statements attributable to the Company or any person acting on the Company’s behalf are expressly qualified in their entirety by the cautionary statements contained or referred to above. Moreover, the Company operates in an evolving environment. In addition to the factors described above, new risk factors and uncertainties may emerge from time to time, and it is impossible for the Company to predict such events or how they may affect us. Except as required by federal securities laws, the Company assumes no obligation to update any forward-looking statements after the date of this Current Report on Form 8-K as a result of new information, future events or otherwise, although we may do so from time to time. The Company does not endorse any projections regarding future performance that may be made by third parties.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | OWLET, INC. |

| | | | |

| Date: | July 25, 2022 | | By: | /s/ Kathryn R. Scolnick |

| | | | Kathryn R. Scolnick |

| | | | Chief Financial Officer |

| | | | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 17, 2022

OWLET, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-39516 | 85-1615012 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

|

| 3300 North Ashton Boulevard, Suite 300, Lehi, Utah 84043 |

| (Address of principal executive offices) (Zip Code) |

|

| (844) 334-5330 |

| (Registrant’s telephone number, including area code) |

|

| N/A |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions.

| | | | | |

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | OWLT | New York Stock Exchange |

| Warrants to purchase Common Stock | OWLT WS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 5.07 Submission of Matters to a Vote of Security Holders.

On June 17, 2022, Owlet, Inc. (the “Company”) held its 2022 Annual Meeting of Shareholders (the “Annual Meeting”). The Company’s shareholders voted on two proposals at the Annual Meeting, each of which is described in more detail in the Company’s definitive proxy statement filed with the Securities and Exchange Commission on May 2, 2022. The final voting results for each proposal considered and voted upon at the Annual Meeting, as certified by the Company’s independent inspector of election, are set forth below.

Election of Directors

The Company’s shareholders elected each of the two nominees for Class I director to serve until the 2025 annual meeting of shareholders and until his successor is elected and qualified or until such director’s earlier death, resignation, disqualification or removal. Voting results for the nominees were as follows:

| | | | | | | | | | | | | | |

| Nominee | For | Against | Abstentions | Broker Non-Votes |

| Zane M. Burke | 58,196,881 | 1,289,416 | 12,577 | 5,950,226 |

| John C. Kim | 58,196,963 | 1,289,346 | 12,565 | 5,950,226 |

Ratification of the Appointment of PricewaterhouseCoopers LLP as the Company’s Independent Registered Public Accounting Firm for Fiscal 2022

The Company’s shareholders approved the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022. There were no broker non-votes on this matter. The voting results for this proposal were as follows:

| | | | | | | | | | | |

| For | Against | Abstentions | Broker Non-Votes |

| 62,845,568 | 2,574,681 | 28,851 | — |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | OWLET, INC. |

| | | | |

| Date: | June 23, 2022 | | By: | /s/ Kathryn R. Scolnick |

| | | | Kathryn R. Scolnick |

| | | | Chief Financial Officer |

| | | | |

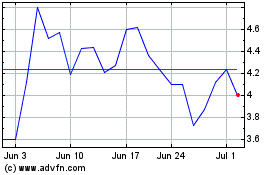

Sandbridge Aquisition (NYSE:OWLT)

Historical Stock Chart

From Mar 2024 to Apr 2024

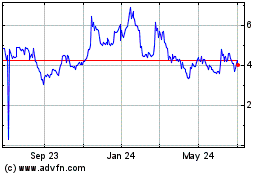

Sandbridge Aquisition (NYSE:OWLT)

Historical Stock Chart

From Apr 2023 to Apr 2024