PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The information specified

in Item 1 and Item 2 of Part I of this Registration Statement is omitted from this filing in accordance with the provisions of Rule 428

under the Securities Act and the introductory note to Part I of Form S-8. The documents containing the information specified

in Part I will be delivered to plan participants as required by Rule 428(b)(1).

Energy Vault Holdings, Inc.

6,012,135 Shares of Common Stock

Offered by Selling Stockholders

This reoffer prospectus (“Reoffer Prospectus”)

relates to the offer and sale from time to time by the selling stockholders named in this Reoffer Prospectus (the “Selling Stockholders”),

or their permitted transferees, of up to 6,012,135 shares of common stock, $0.0001 par value per share (“Common Stock”), of

Energy Vault Holdings, Inc., a Delaware corporation (the “Company”). This Reoffer Prospectus covers shares of Common

Stock issuable to Selling Stockholders pursuant to awards granted or assumed by the Company to the Selling Stockholder under Company’s

2022 Equity Incentive Plan (the “Equity Incentive Plan”), the Energy Vault, Inc. 2020 Stock Plan (the “2020 Plan”),

including restricted stock units and stock options, and under another “employee benefit plan” (as defined in Rule 405

under the Securities Act of 1933, as amended (the “Securities Act”)). We are not offering any shares of Common Stock and will

not receive any proceeds from the sale of the shares of Common Stock by the Selling Stockholders pursuant to this Reoffer Prospectus.

The Selling Stockholders include current and former directors, executive officers and other employees, some of whom are “affiliates”

of our company (as defined in Rule 405 under the Securities Act).

Subject to the satisfaction of any conditions

to vesting of the shares of Common Stock offered hereby pursuant to the terms of the relevant award agreements, and subject to the expiration

of any lock-up agreements, the Selling Stockholders may from time to time sell, transfer or otherwise dispose of any or all of the shares

of Common Stock covered by this Reoffer Prospectus through underwriters or dealers, directly to purchasers (or a single purchaser) or

through broker-dealers or agents. If underwriters or dealers are used to sell the shares of Common Stock, we will name them and describe

their compensation in a prospectus supplement. The shares of Common Stock may be sold in one or more transactions at fixed prices, prevailing

market prices at the time of sale, prices related to the prevailing market prices, varying prices determined at the time of sale or negotiated

prices. We do not know when or in what amount the Selling Stockholders may offer the shares of Common Stock for sale. The Selling Stockholders

may sell any, all or none of the shares of Common Stock offered by this Reoffer Prospectus. See “Plan of Distribution” beginning

on page 11 for more information about how the Selling Stockholders may sell or dispose of the shares of Common Stock covered

by this Reoffer Prospectus. The Selling Stockholders will bear all sales commissions and similar expenses. We will bear all expenses

of registration incurred in connection with this offering, including any other expenses incurred by us in connection with the registration

and offering that are not borne by the Selling Stockholders.

Certain shares of Common Stock that have been

or will be issued pursuant to restricted stock units granted to Selling Stockholders will be “control securities” under the

Securities Act before their sale under this Reoffer Prospectus. This Reoffer Prospectus has been prepared for the purposes of registering

the shares of Common Stock under the Securities Act to allow for future sales by Selling Stockholders on a continuous or delayed basis

to the public without restriction, provided that the amount of shares of Common Stock to be offered or resold under this Reoffer Prospectus

by each Selling Stockholder or other person with whom he or she is acting in concert for the purpose of selling shares of Common Stock,

may not exceed, during any three-month period, the amount specified in Rule 144(e) under the Securities Act.

Our Common Stock is listed on the New York Stock

Exchange under the symbols “NRGV.” On July 29, 2022, the closing price of our Common Stock was $4.45 per share.

We are an “emerging growth company”

under federal securities laws and are subject to reduced public company reporting requirements. Investing in our Common Stock involves

a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors”

on page 7 of this prospectus and under similar headings in the documents that are incorporated by reference into this prospectus,

as well as “Cautionary Note Regarding Forward-Looking Statements” on page 3 of this prospectus.

Neither the U.S. Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus or the accompanying

prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is August 1,

2022.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports,

proxy statements and other documents with the Commission under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange

Act”). The Commission maintains a website that contains reports, proxy and information statements and other information regarding

issuers, including the Company, that file electronically with the Commission. You may obtain copies of the registration statement and

its exhibits and the other documents that we file with the Commission at www.sec.gov.

We also make these documents available on the

investor relations portion of our website at https://investors.energyvault.com/financials/sec-filings. Our website and the information

contained or connected to our website is not incorporated by reference in this prospectus, and you should not consider it part of this

Reoffer Prospectus. Our principal executive office is located at 4360 Park Terrace Drive, Suite 100, Westlake Village, California

91361, and can be reached by telephone at (805) 852-0000.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The Commission rules permit us to incorporate

by reference information in this Reoffer Prospectus. This means that we can disclose important information to you by referring you to

another document filed separately with the Commission. The information incorporated by reference is considered to be part of this Reoffer

Prospectus, except for information superseded by information contained in this Reoffer Prospectus itself or in any subsequently filed

incorporated document. This Reoffer Prospectus incorporates by reference the documents set forth below that we have previously filed

with the Commission, other than information in such documents that is deemed to be furnished and not filed. These documents contain important

information about the Company and its business and financial condition.

| (4) | The Company’s Current Reports on

Form 8-K, filed with the Commission on January 4,

2022, February 1,

2022, February 10,

2022, February 14,

2022, as amended on March 31,

2022, April 20,

2022, May 17,

2022, July 1,

2022 and July 12,

2022, respectively; and |

All documents subsequently filed by the Company

with the Commission pursuant to Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act, prior to the filing of a post-effective

amendment to the Registration Statement of which this Reoffer Prospectus forms a part which indicates that all securities offered have

been sold or which deregisters all securities then remaining unsold, shall be deemed incorporated by reference into this Reoffer Prospectus

and to be a part hereof from the date of the filing of such documents, except that information furnished to the Commission under Item

2.02 or Item 7.01 in Current Reports on Form 8-K and any exhibit relating to such information, shall not be deemed to be incorporated

by reference in this Reoffer Prospectus.

Any statement contained herein or in a document

incorporated or deemed to be incorporated by reference in this Reoffer Prospectus shall be deemed to be modified or superseded for purposes

of this Reoffer Prospectus to the extent that a statement contained in this Reoffer Prospectus, or in any other subsequently filed document,

which also is or is deemed to be incorporated by reference in this Reoffer Prospectus, modifies or supersedes such earlier statement.

Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Reoffer

Prospectus.

The Company undertakes to provide without charge

to each person, including any beneficial owner, to whom a copy of this Reoffer Prospectus is delivered, upon written or oral request of

any such person, a copy of any and all of the information that has been incorporated by reference in this Reoffer Prospectus but not delivered

with this Reoffer Prospectus other than the exhibits to those documents, unless the exhibits are specifically incorporated by reference

into the information that this Reoffer Prospectus incorporates. Documents incorporated by reference in this Reoffer Prospectus may be

obtained by requesting them in writing or by telephone from us at:

Energy Vault Holdings, Inc.

4360 Park Terrace Drive

Suite 100

Westlake Village, CA 91361

Tel.: (805) 852-0000

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements included or incorporated by

reference in this Reoffer Prospectus and any accompanying prospectus supplement may constitute “forward-looking statements”

for purposes of the federal securities laws. The Company’s forward-looking statements include, but are not limited to, statements

regarding its and its management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition,

any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying

assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,”

“estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,”

“potential,” “predict,” “project,” “should,” “will,” “would” and

similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

Forward-looking statements contained in this prospectus may include, for example, statements about:

| · | the expected benefits of the business combination (the “Business Combination”) pursuant to that certain Business Combination

Agreement and Plan of Reorganization, dated as of September 8, 2021 by and among Novus Capital Corporation II (“Novus”),

our predecessor company, NCCII Merger Corp., a wholly owned subsidiary of Novus incorporated in the State of Delaware (“Merger Sub”)

and Energy Vault, Inc., a Delaware corporation, which was consummated on February 11, 2022 (the “Closing Date”); |

| · | the Company’s financial and business performance, including business metrics; |

| · | changes the Company’s strategy, expansion plans, customer opportunities, future operations, future financial position, estimated

revenues and losses, projected costs, prospects and plans; |

| · | the implementation, market acceptance and success of the Company’s business model and growth strategy; |

| · | the Company’s ability to develop and maintain its brand and reputation; |

| · | developments and projections relating to the Company’s competitors and industry; |

| · | the impact of health epidemics, including the COVID-19 pandemic, on the Company’s business and the actions it may take in response

thereto; |

| · | the Company’s expectations regarding its ability to obtain and maintain intellectual property protection and not infringe on

the rights of others; |

| · | expectations regarding the time during which the Company will be an emerging growth company under the JOBS Act; |

| · | the Company’s future capital requirements and sources and uses of cash; |

| · | the Company’s ability to obtain funding for its operations and future growth; and |

| · | the Company’s business, expansion plans and opportunities. |

These forward-looking statements are based on

information available as of the date of this prospectus, and current expectations, forecasts and assumptions, and involve a number of

judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing the Company’s

views as of any subsequent date, and the Company does not undertake any obligation to update forward-looking statements to reflect events

or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required

under applicable securities laws.

You should not place undue reliance on these forward-looking

statements. As a result of a number of known and unknown risks and uncertainties, the Company’s actual results or performance may

be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results

to differ include:

| · | the outcome of any legal proceedings that may be instituted against the Company following the closing of the Business Combination

and transactions contemplated thereby; |

| · | the ability to maintain the listing of the Common Stock on the NYSE following the Business Combination; |

| · | the risk that the Business Combination disrupts current plans and operations of the Company as a result of the consummation of the

transactions described herein; |

| · | risks relating to the anticipated growth rates and market opportunities of the Company; |

| · | risks related to the rollout of the Company’s business and the timing of expected business milestones; |

| · | risks relating to changes in the demand for renewable energy and associated energy storage systems, both in the United States and

internationally; |

| · | the implementation, market acceptance and success of the Company’s solutions, including the EVx and EVRC systems and any digital

platform it may develop, and its technologies; |

| · | the Company’s ability to maintain and develop relationships with third-party partners; |

| · | the Company’s ability to identify and complete sales with customers, including entering into sales agreements; |

| · | developments relating to the renewable energy and energy storage industry, including impacts arising from fuel prices and hydrocarbon

fuel sources, which may make renewable energy less competitive in pricing; |

| · | the Company’s expectations regarding its ability to obtain, maintain and enforce its intellectual property and its ability not

to infringe on the intellectual property rights of others; |

| · | the Company’s ability to comply with extensive, complex and evolving regulatory requirements applicable to the renewable energy

and energy storage industry and environmental related risks with respect to any hazardous waste used in its custom-made composite block

or “mobile masses”; |

| · | the Company’s ability to obtain and maintain governmental permits and approvals, including those needed for construction at

any future project that the Company may obtain; |

| · | the Company’ ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other

things, competition and the ability of the Company to grow and manage growth profitably following the Business Combination; |

| · | changes in applicable laws or regulations; |

| · | the effect of the COVID-19 pandemic and the measures taken in response thereto on the Company’s business and the economy in

general; |

| · | the ability of the Company to execute its business model, including market acceptance of its systems and related services; |

| · | the Company’s ability to raise capital; |

| · | the possibility that the Company may be adversely affected by other geopolitical, economic, business, and/or competitive factors,

including the outbreak of war or other hostilities; |

| · | any changes to U.S. tax laws; and |

| · | other risks and uncertainties set forth in the section titled “Risk Factors.” |

In addition, statements that the “Company

believes” and similar statements reflect the Company’s beliefs and opinions on the relevant subject. These statements are

based upon information available to the Company as of the date of this prospectus, and while the Company believes such information forms

a reasonable basis for such statements, such information may be limited or incomplete, and such statements should not be read to indicate

that such party has conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements

are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

PROSPECTUS SUMMARY

This Reoffer Prospectus

is part of a registration statement that we filed with the Commission. We have provided to you in this Reoffer Prospectus a general description

of the Selling Stockholders and the distribution of the shares. To the extent there is a conflict between the information contained in

this Reoffer Prospectus and any of our subsequent filings with the Commission, the information in the document having the later date shall

modify or supersede the earlier statement.

As permitted by the rules and

regulations of the Commission, the registration statement of which this Reoffer Prospectus forms part includes additional information

not included in this prospectus. You may read the registration statement and the other reports we file with the Commission at the Commission’s

website or at the Commission’s offices described above under the heading “Incorporation of Certain Information by Reference”

if necessary.

As used in this Reoffer

Prospectus, unless the context otherwise requires or indicates, references to “Energy Vault,” the “Company,” “we,”

“our,” and “us,” refer to Energy Vault Holdings, Inc. and its subsidiaries.

Overview

We develop sustainable

and flexible grid-scale energy storage solutions and energy management systems to orchestrate the optimal economic dispatching of multiple

energy assets, designed to advance the transition to a carbon free, resilient power grid. Our mission is to accelerate the decarbonization

of our economy through the development of sustainable and economical energy storage technologies. To achieve this, we are developing a

proprietary gravity-based energy storage technology. We are also designing proprietary energy management software based on artificial

intelligence (AI), advanced optimization algorithms designed to control and optimize entire energy systems and a flexible energy storage

integration platform suitable for storage technologies of many durations. Our product platform aims to help utilities, independent power

producers, and large energy users significantly reduce their levelized cost of energy while maintaining power reliability.

The mailing address of

our principal executive office is located at 4360 Park Terrace Drive, Suite 100, Westlake Village, CA 91361, and can be reached by

telephone at (805) 852-0000.

The Offering

This Reoffer Prospectus

relates to the public offering, which is not being underwritten, by the Selling Stockholders listed in this Reoffer Prospectus, of up

to 6,012,135 shares of Common Stock issued or issuable to Selling Stockholders pursuant to awards granted or assumed by the Company under

the Equity Incentive Plan, the 2020 Plan and another “employee benefit plan” as defined in Rule 405 of the Securities

Act. Subject to the satisfaction of any conditions to vesting of the shares of Common Stock offered hereby pursuant to the terms of the

relevant award agreements, and subject to the expiration of any lock-up agreements described herein, the Selling Stockholders may from

time to time sell, transfer or otherwise dispose of any or all of the shares of Common Stock covered by this Reoffer Prospectus through

underwriters or dealers, directly to purchasers (or a single purchaser) or through broker-dealers or agents. We will receive none of the

proceeds from the sale of the shares of Common Stock by the Selling Stockholders. The Selling Stockholders will bear all sales commissions

and similar expenses in connection with this offering. We will bear all expenses of registration incurred in connection with this offering,

as well as any other expenses incurred by us in connection with the registration and offering that are not borne by the Selling Stockholders.

RISK FACTORS

Investing in shares of our Common Stock involves

a high degree of risk. Investors should carefully consider the risks we have incorporated by reference herein under the sections titled

“Risk Factors” in our Current Report on Form 8-K filed with the Commission on February 14, 2022, which was amended

on March 31, 2022, and in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2022, filed with the Commission on May 16, 2022, together with all the other information included in or incorporated by reference into this prospectus, before deciding

to invest in our Common Stock. If any of the events or developments we have described occur, our business, financial condition, or results

of operations could be materially or adversely affected. As a result, the market price of our Common Stock could decline, and investors

could lose all or part of their investment. The risks and uncertainties we have described are not the only risks and uncertainties that

we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business

operations. The risks we have described also include forward-looking statements, and our actual results may differ substantially from

those discussed in these forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements.”

DETERMINATION OF OFFERING PRICE

The Selling Stockholders will determine at what

price they may sell the offered shares of Common Stock, and such sales may be made at prevailing market prices or at privately negotiated

prices. See “Plan of Distribution” below for more information.

USE OF PROCEEDS

We will not receive any proceeds from the sale

of shares of our Common Stock by the Selling Stockholders.

DESCRIPTION OF SECURITIES

The information set forth in “Description

of Securities” of the Company’s prospectus dated May 6, 2022 filed on May 9,

2022 pursuant to Rule 424(b) under the Securities Act, relating to the Registration Statement on Form S-1, as

amended (File No. 333-262720).

SELLING STOCKHOLDERS

The table below sets forth information concerning

the resale of the shares by the Selling Stockholders. We will not receive any proceeds from the resale of the shares by the Selling Stockholders.

The table below sets forth, as of June 30,

2022 (the “Determination Date”), (i) the name of each person who is offering the resale of shares by this Reoffer Prospectus;

(ii) the number of shares (and the percentage, if 1% or more) of Common Stock beneficially owned (determined in the manner described

in footnote (1) to the table below) by each person; (iii) the number of shares that each Selling Stockholder may offer for sale

from time to time pursuant to this Reoffer Prospectus, whether or not such Selling Stockholder has a present intention to do so; and (iv) the

number of shares (and the percentage, if 1% or more) of Common Stock each person will own after the offering, assuming they sell all of

the shares offered. As of the Determination Date, there were 134,441,241 shares of Common Stock outstanding. Unless otherwise indicated,

beneficial ownership is direct and the person indicated has sole voting and investment power. The address for each Selling Stockholder

listed in the table below is c/o Energy Vault Holdings, Inc., 4360 Park Terrace Drive, Suite 100, Westlake Village, CA

91361.

The Selling Stockholders identified below may

have sold, transferred or otherwise disposed of some or all of their shares since the date on which the information in the following table

is presented in transactions exempt from or not subject to the registration requirements of the Securities Act. Information concerning

the Selling Stockholders may change from time to time and, if necessary, we will amend or supplement this prospectus accordingly. We cannot

give an estimate as to the number of shares of Common Stock that will actually be held by the Selling Stockholders upon termination of

this offering because the Selling Stockholders may offer some or all of their Common Stock under the offering contemplated by this prospectus

or acquire additional shares of Common Stock.

The total number of shares that may be sold hereunder

will not exceed the number of shares offered hereby. Please read the section entitled “Plan of Distribution” in this Reoffer

Prospectus.

| Selling Stockholder | |

Shares of Common

Stock Beneficially

Owned Prior to

this Offering (1) | | |

Percentage

of

Common

Stock

Beneficially

Owned

Before

Resale (1)(3) | | |

Shares of Common

Stock Offered for

Resale in this

Offering (1) | | |

Shares of

Common

Stock

Beneficially

Owned

After this

Offering (2) | | |

Percentage

of

Common

Stock

Beneficially

Owned

After

Resale (1)(3) | |

| Andrea Pedretti (4) | |

| 3,634,895 | | |

| 2.7 | % | |

| 3,561,119 | | |

| 73,776 | | |

| * | |

| Christopher K. Wiese (5) | |

| 169,337 | | |

| * | | |

| 169,337 | | |

| - | | |

| - | |

| Marco Terruzzin (6) | |

| 609,615 | | |

| * | | |

| 609,615 | | |

| - | | |

| - | |

| Goncagul Icoren (7) | |

| 135,470 | | |

| * | | |

| 135,470 | | |

| - | | |

| - | |

| Richard Espy (8) | |

| 135,470 | | |

| * | | |

| 135,470 | | |

| - | | |

| - | |

| John Jung (9) | |

| 677,350 | | |

| * | | |

| 677,350 | | |

| - | | |

| - | |

| Laurence Alexander (10) | |

| 270,940 | | |

| * | | |

| 270,940 | | |

| - | | |

| - | |

| Former Service Providers (11) | |

| 452,834 | | |

| * | | |

| 452,834 | | |

| - | | |

| - | |

| (1) | The numbers of shares of Common Stock reflect all shares of Common Stock acquired or issuable to a person

pursuant to applicable grants previously made or that the Company’s board of directors (the “Board”) has previously

resolved to make irrespective of whether such grants are exercisable, vested or convertible as of the Determination Date or will become

exercisable, vested or convertible within 60 days after the Determination Date. |

| (2) | Assumes all of the shares of Common Stock being offered are sold in the offering, that shares of Common

Stock beneficially owned by such Selling Stockholder on the Determination Date but not being offered pursuant to this prospectus (if any)

are not sold, and that no additional shares are purchased or otherwise acquired other than pursuant to the restricted stock awards and

restricted stock units relating to the shares being offered. |

| (3) | Percentages are based on the 133,633,288 shares of Common Stock issued and outstanding as of the Determination

Date. |

| (4) | Shares beneficially owned consist of 2,343,407 shares of Common Stock issuable in respect of RSUs and

1,291,488 shares of Common Stock. Shares offered hereby consist of 2,343,407 shares of Common Stock issuable in respect of RSUs and 1,217,712

shares of Common Stock. |

| (5) | Shares offered hereby consist of 169,337 shares of Common Stock issuable in respect of RSUs. |

| (6) | Shares offered hereby consist of 609,615 shares of Common Stock. |

| (7) | Shares offered hereby consist of 135,470 shares of Common Stock issuable in respect of RSUs. |

| (8) | Shares offered hereby consist of 135,470 shares of Common Stock issuable in respect of RSUs. |

| (9) | Shares offered hereby consist of 677,350 shares of Common Stock issuable in respect of RSUs. |

| (10) | Shares offered hereby consist of 270,940 shares of Common Stock issuable in respect of RSUs. |

| (11) | Consists of (i) an aggregate of 44,088 shares of Common Stock issued upon the exercise of options

held by Kelly Tilford and Kenneth Yeh, and (ii) an aggregate of 408,746 shares of Common Stock issued pursuant to the settlement

of RSUs held by Casey Briseno, Richard Cooperstein, Dolly Singh and Andrea Wuttke. Each Former Service Provider is a non-affiliate person

and beneficially owns less than 1% of the Common Stock. |

Material Relationships with the Selling Stockholders

Employment Relationships

Each of Mr. Pedretti, Mr. Wiese, Mr. Terruzzin,

Ms. Icoren, Mr. Espy, Mr. Jung and Mr. Alexander have provided and continue to provide, services to Energy Vault commensurate

with his or her role.

Lock-Up Agreements

Each of the Selling Stockholders (other than one

of the former service providers) agreed, subject to certain exceptions, not to (i) sell, offer to sell, contract or agree to sell,

hypothecate, pledge, grant any option to purchase or otherwise dispose of or agree to dispose of, directly or indirectly, or establish

or increase a put equivalent position or liquidate or decrease a call equivalent position within the meaning of Section 16 of the

Exchange Act, and the rules and regulations of the Commission promulgated thereunder, the Lock-up Shares (as defined below), (ii) enter

into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of any

of the Lock-up Shares (as defined below), whether any such transaction is to be settled by delivery of such securities, in cash or otherwise

or (iii) publicly announce any intention to effect any transaction specified in clause (i) or (ii). The Lock-Up Period shall

terminate upon the earlier of (i) with respect to 50% of the Lock-Up Shares, 180 days after the closing of the Business Combination

(the “Closing”) and (ii) with respect to the remaining 50% of the Lock-Up Shares, one year after the Closing; provided

however that the Lock-Up Period shall terminate 180 days after the Closing with respect to our private warrants and the shares of

our Common Stock issuable upon exercise of the private warrants. “Lock-up Shares” means any shares of Common Stock held by

such holders immediately after the effective time of the Closing, any shares of Common Stock issuable upon the exercise of options to

purchase shares of Common Stock held by it immediately after the effective time of the Closing, or any securities convertible into or

exercisable or exchangeable for Common Stock held by it immediately after the effective time of the Closing. “Lock-up Period”

means until 365 days after the Closing Date subject to certain early release provisions set forth in the lock-up agreements (the “Prior

Lock-Up Agreements”).

In addition, certain Selling Stockholders who

are current executive officers held equity awards under the Energy Vault, Inc. 2020 Stock Plan prior to the Closing that vested or

will vest according to the satisfaction of (i) a time-based service requirement and (ii) a liquidity event vesting requirement,

which was satisfied on a “Qualified Transaction” (which, as defined in the applicable award agreements, included the Closing),

whereupon the time-based service requirement would be deemed satisfied with respect to 50% or more of the total number of shares underlying

such grant (the “Accelerated Shares”) as set forth in the applicable award agreements.

On July 10, 2022, the Company and all current

executive officers that hold Accelerated Shares, including certain Selling Stockholders, entered into agreements (the “New Lock-Up

Agreements”) pursuant to which they agreed, subject to certain exceptions, not to (i) sell, offer to sell, contract or agree

to sell, hypothecate, pledge, grant any option to purchase or otherwise dispose of or agree to dispose of, directly or indirectly, or

establish or increase a put equivalent position or liquidate or decrease a call equivalent position within the meaning of Section 16

of the Exchange Act, and the rules and regulations promulgated thereunder, with regards to the shares of our common stock underlying

50% of their Accelerated Shares, or in the case of Mr. Piconi, our chief executive officer and director, 100% of his Accelerated

Shares, or securities convertible into or exercisable or exchangeable for such shares of our common stock (the “Relocked Shares”),

(ii) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of

ownership of any of the Relocked Shares, whether any such transaction is to be settled by delivery of such securities, in cash or otherwise

or (iii) publicly announce any intention to effect any transaction specified in clause (i) or (ii).

Under the New Lock-Up Agreements, the Relocked

Shares shall be released from such transfer restrictions to the extent that the Relocked Shares would have vested in accordance with the

time-based service requirements set forth in the applicable award agreements but for the applicable acceleration provisions set forth

in such agreements, subject to the following:

| · | 33% of the Relocked Shares shall be released on the first trading day on which the closing price of the

our common stock as reported on the New York Stock Exchange over any twenty (20) trading days within the preceding thirty (30) consecutive

trading day period is greater than or equal to $15.00 (which shall be equitably adjusted to reflect certain corporate transactions); |

| · | 33% of the Relocked Shares shall be released on the first trading day on which the closing price of the

our common stock as reported on the New York Stock Exchange over any twenty (20) trading days within the preceding thirty (30) consecutive

trading day period is greater than or equal to $17.50 (which shall be equitably adjusted to reflect certain corporate transactions); and |

| · | The remaining Relocked Shares shall be released on the first trading day on which the closing price of

our common stock as reported on the New York Stock Exchange over any twenty (20) trading days within the preceding thirty (30) consecutive

trading day period is greater than or equal to $20.00 (which shall be equitably adjusted to reflect certain corporate transactions). |

The New Lock-Up Agreements do not modify, supersede

or amend the Prior Lock-Up Agreements in any way.

Indemnification Agreements and Directors’ and Officers’

Liability Insurance

Our second amended and restated bylaws (the “Bylaws”)

contains provisions limiting the liability of directors, and our second amended and restated certificate of incorporation (the “Charter”)

provides that we will indemnify each of our directors to the fullest extent permitted under Delaware law. The Charter and the Bylaws also

provide our Board with discretion to indemnify officers and employees when determined appropriate by our Board.

We intend to enter into new indemnification agreements

with each of our directors and executive officers. The indemnification agreements are expected to provide that we will indemnify each

of our directors and executive officers against any and all expenses incurred by that director or executive officer because of his or

her status as one of our directors or executive officers, to the fullest extent permitted by Delaware law, the Charter and the Bylaws.

In addition, the indemnification agreements are expected to provide that, to the fullest extent permitted by Delaware law, we will advance

all expenses incurred by our directors and executive officers in connection with a legal proceeding involving his or her status as a director

or executive officer.

PLAN OF DISTRIBUTION

The shares of Common Stock covered by this Reoffer

Prospectus are being registered by the Company for the account of the Selling Stockholders. The shares of Common Stock offered may be

sold from time to time directly by or on behalf of each Selling Stockholder in one or more transactions on the New York Stock Exchange

or any other stock exchange on which the Common Stock may be listed at the time of sale, in privately negotiated transactions, or through

a combination of such methods, at market prices prevailing at the time of sale, at prices related to such prevailing market prices, at

fixed prices (which may be changed) or at negotiated prices. The Selling Stockholders may sell shares through one or more agents, brokers

or dealers or directly to purchasers. Such brokers or dealers may receive compensation in the form of commissions, discounts or concessions

from the Selling Stockholders and/or purchasers of the shares or both. Such compensation as to a particular broker or dealer may be in

excess of customary commissions. The amount of shares of Common Stock to be reoffered or resold under the Reoffer Prospectus by each Selling

Stockholder and any other person with whom he or she is acting in concert for the purpose of selling shares of Common Stock, may not exceed,

during any three-month period, the amount specified in Rule 144(e) under the Securities Act.

A Selling Stockholder may enter into derivative

transactions with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated transactions.

If the applicable prospectus supplement indicates, in connection with those derivatives, the third parties may sell securities covered

by this prospectus and the applicable prospectus supplement, including in short sale transactions. If so, the third party may use securities

pledged by any Selling Stockholder or borrowed from any Selling Stockholder or others to settle those sales or to close out any related

open borrowings of stock, and may use securities received from any Selling Stockholder in settlement of those derivatives to close out

any related open borrowings of stock. The third party in such sale transactions will be an underwriter and will be identified in the applicable

prospectus supplement (or a post-effective amendment). In addition, any Selling Stockholder may otherwise loan or pledge securities to

a financial institution or other third party that in turn may sell the securities short using this prospectus. Such financial institution

or other third party may transfer its economic short position to investors in our securities or in connection with a concurrent offering

of other securities.

In connection with their sales, a Selling Stockholder

and any participating broker or dealer may be deemed to be “underwriters” within the meaning of the Securities Act, and any

commissions they receive and the proceeds of any sale of shares may be deemed to be underwriting discounts and commissions under the Securities

Act. We are bearing all costs relating to the registration of the shares of Common Stock. Any commissions or other fees payable to brokers

or dealers in connection with any sale of the shares will be borne by the Selling Stockholders or other party selling such shares. Sales

of the shares must be made by the Selling Stockholders in compliance with all applicable state and federal securities laws and regulations,

including the Securities Act. In addition to any shares sold hereunder, Selling Stockholders may sell shares of Common Stock in compliance

with Rule 144. There is no assurance that the Selling Stockholders will sell all or a portion of the shares of Common Stock offered

hereby. The Selling Stockholders may agree to indemnify any broker, dealer or agent that participates in transactions involving sales

of the shares against certain liabilities in connection with the offering of the shares arising under the Securities Act. We have notified

the Selling Stockholders of the need to deliver a copy of this Reoffer Prospectus in connection with any sale of the shares of Common

Stock.

The anti-manipulation rules of Regulation

M under the Exchange Act may apply to sales of shares of Common Stock and activities of the Selling Stockholders, which may limit the

timing of purchases and sales of any of the shares of Common Stock by the Selling Stockholders and any other participating person. Regulation

M may also restrict the ability of any person engaged in the distribution of the shares of Common Stock to engage in passive market-making

activities with respect to the shares of Common Stock. Passive market making involves transactions in which a market maker acts as both

our underwriter and as a purchaser of shares of Common Stock in the secondary market. All of the foregoing may affect the marketability

of the shares of Common Stock and the ability of any person or entity to engage in market-making activities with respect to the shares

of Common Stock.

Once sold under the registration statement of

which this Reoffer Prospectus forms a part, the shares of Common Stock will be freely tradable in the hands of persons other than our

affiliates.

LEGAL MATTERS

Gunderson Dettmer Stough Villeneuve Franklin &

Hachigian, LLP has issued an opinion regarding the legality of certain of the offered securities.

EXPERTS

The consolidated financial statements of Energy

Vault, Inc. as of December 31, 2021 and 2020 and for each of the two years in the period ended December 31, 2021 incorporated

herein by reference have been so included in reliance on the report of BDO USA, LLP, an independent registered public accounting firm,

incorporated herein by reference, given on the authority of said firm as experts in auditing and accounting.

The financial statements as of December 31,

2021 and 2020 and for the year ended December 31, 2021 and for the period from September 29, 2020 (inception) through December 31,

2020 of Novus incorporated herein by reference have been audited by Marcum LLP, an independent registered public accounting firm, as stated

in their report thereon (which contains an explanatory paragraph relating to the substantial doubt about the ability of Novus Capital

Corporation II to continue as a going concern as described in Note 1 to the financial statements) and incorporated herein by reference,

in reliance upon such report and upon the authority of such firm as experts in accounting and auditing.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents previously

filed by the Company with the Commission are incorporated by reference into this Registration Statement:

| (4) | The Company’s Current Reports on

Form 8-K, filed with the Commission on January 4,

2022, February 1,

2022, February 10,

2022, February 14,

2022, as amended on March 31,

2022, April 20,

2022, May 17,

2022, July 1,

2022 and July 12,

2022, respectively; and |

All documents subsequently

filed by the Company with the Commission pursuant to Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act, prior to the filing

of a post-effective amendment to the Registration Statement, which indicates that all securities offered have been sold or which deregisters

all securities then remaining unsold, shall be deemed incorporated by reference into this Registration Statement and to be a part hereof

from the date of the filing of such documents, except that information furnished to the Commission under Item 2.02 or Item 7.01 in Current

Reports on Form 8-K and any exhibit relating to such information, shall not be deemed to be incorporated by reference in this Registration

Statement.

Any statement contained herein

or in a document incorporated or deemed to be incorporated by reference in this Registration Statement shall be deemed to be modified

or superseded for purposes of this Registration Statement to the extent that a statement contained in this Registration Statement, or

in any other subsequently filed document which also is or is deemed to be incorporated by reference in this Registration Statement, modifies

or supersedes such earlier statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded,

to constitute a part of this Registration Statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

Section 145 of the Delaware

General Corporation Law authorizes a court to award, or a corporation’s board of directors to grant, indemnity to directors and

officers under certain circumstances and subject to certain limitations. The terms of Section 145 of the Delaware General Corporation

Law are sufficiently broad to permit indemnification under certain circumstances for liabilities, including reimbursement of expenses

incurred, arising under the Securities Act of 1933, as amended, or Securities Act.

Our Certificate of Incorporation

contains provisions limiting the liability of directors, and our Bylaws provide that we will indemnify each of our directors to the fullest

extent permitted under Delaware law. The Certificate of Incorporation and Bylaws also provide us with discretion to indemnify officers

and employees when determined appropriate by the Board of Directors.

We intend to enter into indemnification

agreements with each of our directors and executive officers. The indemnification agreements provide that we indemnify each of our directors

and executive officers against any and all expenses incurred by that director or executive officer because of his or her status as one

of our directors, executive officers or other key employees, to the fullest extent permitted by Delaware law, our Certificate of Incorporation

and our Bylaws. In addition, the indemnification agreements provide that, to the fullest extent permitted by Delaware law, we will advance

all expenses incurred by our directors, executive officers, and other key employees in connection with a legal proceeding involving his

or her status as a director or executive officer.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

|

Exhibit

No. |

|

Description |

| |

|

|

| 4.1 |

|

Amended and Restated Certificate of Incorporation of Energy Vault Holdings, Inc. (incorporated by reference to Exhibit 3.2 to Energy Vault Holdings, Inc.’s Current Report on Form 8-K (File No. 001-39982), filed with the SEC on February 14, 2022). |

| |

|

|

| 4.2 |

|

Amended and Restated Bylaws of Energy Vault Holdings, Inc. (incorporated by reference to Exhibit 3.1 to Energy Vault Holdings, Inc.’s Current Report on Form 8-K (File No. 001-39982), filed with the SEC on February 14, 2022). |

| |

|

|

| 5.1* |

|

Opinion of Gunderson Dettmer Stough Villeneuve Franklin & Hachigian, LLP. |

| |

|

|

| 23.1* |

|

Consent of Gunderson Dettmer Stough Villeneuve Franklin & Hachigian, LLP (included as part of Exhibit 5.1 hereto). |

| |

|

|

| 23.2* |

|

Consent of Marcum LLP, independent registered public accounting firm. |

| |

|

|

| 23.3* |

|

Consent of BDO USA, LLP, independent registered accounting firm. |

| |

|

|

| 99.1 |

|

Energy Vault Holdings, Inc. 2022 Equity Incentive Plan (incorporated by reference to Exhibit 10.4 to Energy Vault Holdings, Inc.'s Quarterly Report on Form 10-Q (File No. 001-39982), filed with the SEC on May 16, 2022 |

| |

|

|

| 99.2 |

|

Energy Vault, Inc. 2020 Stock Plan (incorporated by reference to Exhibit 10.16 to Energy Vault Holdings, Inc.’s Form S-4 (File No. 333-260307), filed with the SEC on October 18, 2021). |

| |

|

|

| 99.3 |

|

Energy Vault, Inc. 2017 Stock Incentive Plan (incorporated by reference to Exhibit 10.15 to Energy Vault Holdings, Inc.’s Form S-4 (File No. 333-260307), filed with the SEC on October 18, 2021). |

| |

|

|

| 99.4* |

|

Restricted Stock Purchase Agreement dated as of November 28, 2017, by and between Andrea Pedretti and Energy Vault, Inc. |

| |

|

|

| 107* |

|

Calculation of Filing Fee Table |

Item 9. Undertakings.

(a) The undersigned Company hereby undertakes:

(1) To file, during

any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus

required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the

prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment

thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement;

and

(iii) To include any

material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change

to such information in the Registration Statement; provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not

apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with

or furnished to the Commission by the Company pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated

by reference in the Registration Statement.

(2) That, for the purpose

of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona

fide offering thereof.

(3) To remove from registration

by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The undersigned Company hereby undertakes

that, for purposes of determining any liability under the Securities Act, each filing of the Company’s annual report pursuant to

Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s

annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the Registration Statement

shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at

that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities

arising under the Securities Act may be permitted to directors, officers and controlling persons of the Company pursuant to the foregoing

provisions, or otherwise, the Company has been advised that in the opinion of the Commission such indemnification is against public policy

as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities

(other than the payment by the Company of expenses incurred or paid by a director, officer or controlling person of the Company in the

successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the

securities being registered, the Company will, unless in the opinion of its counsel the matter has been settled by controlling precedent,

submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in

the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly

authorized, in the City of Westlake Village, in the State of California, on August 1, 2022.

| |

ENERGY VAULT HOLDINGS, INC. |

| |

|

| |

By |

/s/ Robert Piconi |

| |

Name: |

Robert Piconi |

| |

Title: |

Chief Executive Officer |

POWER OF ATTORNEY

Each person whose signature

appears below constitutes and appoints Robert Piconi as his or her true and lawful attorney-in-fact and agent, with full power of substitution

and resubstitution, for such person and in his or her name, place and stead, in any and all capacities, to sign any or all further amendments

(including post-effective amendments) to this registration statement (and any additional registration statement related hereto permitted

by Rule 462(b) promulgated under the Securities Act (and all further amendments, including post-effective amendments,

thereto)), and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange

Commission, granting unto said attorney-in-fact and agent full power and authority to do and perform each and every act and thing requisite

and necessary to be done in and about the premises, as fully to all intents and purposes as he might or could do in person, hereby ratifying

and confirming all that said attorney-in-fact and agent, or his or her substitute or substitutes, may lawfully do or cause to be done

by virtue hereof.

Pursuant to the requirements of the Securities

Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Robert Piconi |

|

Chief Executive Officer and Director |

|

August 1, 2022 |

| Robert Piconi |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| /s/ David Hitchcock |

|

Interim Chief Financial Officer |

|

August 1, 2022 |

| David Hitchcock |

|

(Principal Financial Officer and Principal Accounting Officer) |

|

|

| |

|

|

|

|

| /s/ Larry Paulson |

|

Director |

|

August 1, 2022 |

| Larry Paulson |

|

|

|

|

| |

|

|

|

|

| /s/ Bill Gross |

|

Director |

|

August 1, 2022 |

| Bill Gross |

|

|

|

|

| |

|

|

|

|

| /s/ Henry Elkus |

|

Director |

|

August 1, 2022 |

| Henry Elkus |

|

|

|

|

| |

|

|

|

|

| /s/ Zia Huque |

|

Director |

|

August 1, 2022 |

| Zia Huque |

|

|

|

|

| |

|

|

|

|

| /s/ Thomas Ertel |

|

Director |

|

August 1, 2022 |

| Thomas Ertel |

|

|

|

|

| |

|

|

|

|

| /s/ Mary Beth Mandanas |

|

Director |

|

August 1, 2022 |

| Mary Beth Mandanas |

|

|

|

|

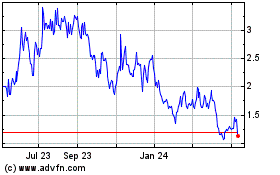

Energy Vault (NYSE:NRGV)

Historical Stock Chart

From Mar 2024 to Apr 2024

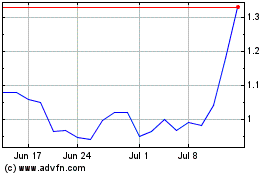

Energy Vault (NYSE:NRGV)

Historical Stock Chart

From Apr 2023 to Apr 2024