0001576914false00015769142024-02-272024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 27, 2024

MIX TELEMATICS LIMITED

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | | | | | | | | | | |

| Republic of South Africa | | 001-36027 | | Not Applicable |

| (State or Other Jurisdiction | | (Commission | | (IRS Employer |

| of Incorporation) | | File Number) | | Identification No.) |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 750 Park of Commerce Blvd | | | | |

| Suite 100 | Boca Raton | | | |

| Florida | 33487 | +1 | (887) | 585-1088 |

| (Address of Principal Executive Offices) | | Registrant’s telephone number, including area code |

| | | | | |

| | | | | |

| | | | |

| N/A | |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| American Depositary Shares, each representing 25 Ordinary Shares, no par value | | MIXT | | New York Stock Exchange |

| Ordinary Shares, no par value | | | | New York Stock Exchange (for listing purposes only) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

As previously disclosed in the Current Report on Form 8-K filed on October 10, 2023, MiX Telematics Limited, a public company incorporated under the laws of the Republic of South Africa (the “Company”), entered into an Implementation Agreement (the “Agreement”), by and among the Company, PowerFleet, Inc., a Delaware corporation (“Powerfleet”), and Main Street 2000 Proprietary Limited, a private company incorporated in the Republic of South Africa and a wholly owned subsidiary of Powerfleet (“Powerfleet Sub”), pursuant to which, subject to the terms and conditions thereof, Powerfleet Sub will acquire all of the issued ordinary shares of the Company (“MiX Ordinary Shares”), including the ordinary shares represented by the Company’s American Depositary Shares ( “MiX ADSs”), through the implementation of a scheme of arrangement (the “Scheme”) in accordance with Sections 114 and 115 of the South African Companies Act, No. 71 of 2008, in exchange for shares of common stock, par value $0.01 per share, of Powerfleet. As a result of the transactions, including the Scheme, contemplated by the Agreement (the “Transactions”), the Company will become an indirect, wholly owned subsidiary of Powerfleet.

On February 27, 2024, the Company issued a press release to the Johannesburg Stock Exchange announcing that the conditions that were required to be fulfilled or waived by the Pre-General Meeting Date as set out in the Scheme Circular as previously filed on January 30, 2024 as Exhibit 99.1 in Current Report on Form 8-K, have been fulfilled or, to the extent required and permitted in terms of the Scheme, waived by the Company and PowerFleet (“the parties”). The Company further announced that on February 14, 2024 the South African Competition Commission granted merger approval in respect of the proposed transaction, subject to certain conditions acceptable to the parties. The full text of the press release, a copy of which is attached hereto as Exhibit 99.1, is incorporated herein by reference.

The information contained in this Item 7.01 shall neither be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Additional Information and Where to Find It

In connection with the proposed transaction, Powerfleet has filed, and the SEC declared effective on January 24, 2024, a registration statement on Form S-4 (the “Registration Statement”), which includes a joint proxy statement of the Company and Powerfleet and a prospectus of Powerfleet. The Company and Powerfleet commenced the mailing of the joint proxy statement/prospectus on January 29, 2024. Each of the Company and Powerfleet may also file other relevant documents with the SEC regarding the proposed transaction. Any holder of MiX Ordinary Shares through an intermediary such as a broker/dealer or clearing agency or MiX ADSs should consult with their intermediary or The Bank of New York Mellon, the depositary for the MiX ADSs, as applicable, about how to obtain information on the Company’s shareholder meeting. INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE THEREIN) AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTIONS. Investors and shareholders will be able to obtain free copies of these documents (if and when available) and other documents containing important information about the Company and Powerfleet once such documents are filed with the SEC through the website maintained by the SEC at www.sec.gov. The Company and Powerfleet may file other relevant materials with the SEC in connection with the Transactions. The Company and Powerfleet will make available copies of materials they file with, or furnish to, the SEC free of charge at http://investor.mixtelematics.com and https://ir.powerfleet.com, respectively.

No Offer or Solicitation

This report shall not constitute an offer to buy or sell any securities, or the solicitation of an offer to buy or sell any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

Participants in the Solicitation

The Company, Powerfleet and their respective directors, executive officers and certain employees and other persons may be deemed to be participants in the solicitation of proxies from the Company’s shareholders and Powerfleet’s stockholders in connection with the Transactions. Securityholders may obtain information regarding the names, affiliations and interests of the Company’s directors and executive officers in the joint proxy statement/prospectus, its Annual Report on Form 10-K for the year ended March 31, 2023, which was filed with the SEC on June 22, 2023, and its definitive proxy statement for its 2023 annual general meeting of shareholders, which was filed with the SEC on July 28, 2023. Securityholders may obtain information regarding the names,

affiliations and interests of the Powerfleet’s directors and executive officers in the joint proxy statement/prospectus, its Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on March 31, 2023, its amended Annual Report on Form 10-K/A for the year ended December 31, 2022, which was filed with the SEC on May 1, 2023, and its definitive proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on June 21, 2023. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, may be contained in other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become available. Investors should read such materials carefully when they become available before making any voting or investment decisions. You may obtain free copies of these documents from the Company or Powerfleet using the sources indicated above.

Cautionary Note Regarding Forward-Looking Statements

This report contains forward-looking statements within the meaning of federal securities laws. The Company’s, Powerfleet’s and the combined business’s actual results may differ from their expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. All statements other than statements of historical fact are statements that could be forward-looking statements. Most of these factors are outside the parties’ control and are difficult to predict. The risks and uncertainties referred to above include, but are not limited to, risks related to: (i) the completion of the Transactions in the anticipated timeframe or at all; (ii) the satisfaction of the closing conditions to the Transactions including, but not limited to the ability to obtain approval of the shareholders of the Company and stockholders of Powerfleet and the ability to obtain the Financing; (iii) the failure to obtain necessary regulatory approvals; (iv) the ability to realize the anticipated benefits of the Transactions; (v) the ability to successfully integrate the businesses; (vi) disruption from the Transactions making it more difficult to maintain business and operational relationships; (vii) the negative effects of the announcement of the Transactions or the consummation of the Transactions on the market price of Powerfleet’s or the Company’s securities; (viii) significant transaction costs and unknown liabilities; (ix) litigation or regulatory actions related to the Transactions; and (x) such other factors as are set forth in the periodic reports filed by Powerfleet and the Company with the SEC, including but not limited to those described under the heading “Risk Factors” in their annual reports on Form 10-K, quarterly reports on Form 10-Q and any other filings made with the SEC from time to time, which are available via the SEC’s website at http://www.sec.gov. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove to be incorrect, actual results may vary materially from those indicated or anticipated by these forward-looking statements. Therefore, you should not rely on any of these forward-looking statements.

The forward-looking statements included in this report are made only as of the date of this report, and except as otherwise required by applicable securities law, neither Powerfleet nor the Company assume any obligation nor do they intend to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Exhibit

No. Description of Exhibit

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

MIX TELEMATICS LIMITED

By: /s/ Paul Dell

Name: Paul Dell

Title: Chief Financial Officer

Date: February 27, 2024

Exhibit 99.1

MiX TELEMATICS LIMITED

(Incorporated in the Republic of South Africa)

(Registration number 1995/013858/06)

JSE share code: MIX ISIN: ZAE000125316

NYSE share code: MIXT

LEI Code: 529900S6HHR7CK7BU646

| | |

| UPDATE TO THE PROPOSED TRANSACTION |

Unless otherwise indicated, capitalised words and terms contained in this announcement shall bear the same meanings ascribed thereto in the joint firm intention announcement published by MiX Telematics and PowerFleet, Inc. (“PowerFleet”) on SENS on 10 October 2023.

FULFILMENT OF PRE-MEETING CONDITIONS

Shareholders are referred to the various announcements published on SENS on 10 October 2023, 22 November 2023 and 30 January 2024 relating to the Proposed Transaction and are advised that the conditions that were required to be fulfilled or waived by the Pre-General Meeting Date as set out in the Scheme Circular, have been fulfilled or, to the extent required and permitted in terms of the Scheme, waived by Mix Telematics and PowerFleet (“the parties”).

Shareholders are further advised that on 14 February 2024 the Competition Commission granted merger approval in respect of the Proposed Transaction, subject to certain conditions acceptable to the parties.

MiX Telematics shareholders should note that the Scheme remains subject to the fulfilment or waiver, as applicable, of the remaining Scheme Conditions, as set out in paragraph 8.1.1 of the Scheme Circular. Shareholders will be provided with a further update regarding the fulfilment or waiver, as the case may be, of all of the Scheme Conditions via SENS in due course.

RESPONSIBILITY STATEMENT

The Independent Board and the MiX Telematics board (to the extent that the information relates to MiX Telematics) collectively and individually accept responsibility for the information contained in this announcement and certify that, to the best of their knowledge and belief, the information contained in this announcement relating to MiX Telematics is true and this announcement does not omit anything that is likely to affect the importance of such information.

The board of directors of PowerFleet (to the extent that the information relates to PowerFleet) collectively and individually accept responsibility for the information contained in this announcement and certify that to the best of their knowledge and belief, the information contained in this announcement relating to PowerFleet is true and this announcement does not omit anything that is likely to affect the importance of such information.

27 February 2024

Corporate advisor and sponsor to MiX Telematics

U.S. legal advisors to MiX Telematics

U.S. financial advisor to MiX Telematics

U.S. legal advisors to PowerFleet

SA legal advisors to PowerFleet

v3.24.0.1

Cover

|

Feb. 27, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 27, 2024

|

| Entity File Number |

001-36027

|

| Entity Registrant Name |

MIX TELEMATICS LIMITED

|

| Entity Incorporation, State or Country Code |

T3

|

| Entity Address, Address Line One |

750 Park of Commerce Blvd

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Boca Raton

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33487

|

| City Area Code |

(887)

|

| Local Phone Number |

585-1088

|

| Title of 12(b) Security |

American Depositary Shares, each representing 25 Ordinary Shares, no par value

|

| Trading Symbol |

MIXT

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001576914

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

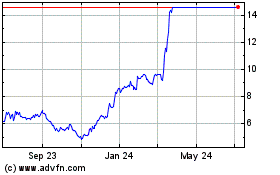

MiX Telematics (NYSE:MIXT)

Historical Stock Chart

From Mar 2024 to Apr 2024

MiX Telematics (NYSE:MIXT)

Historical Stock Chart

From Apr 2023 to Apr 2024