An explanation of non-IFRS measures used in this press release

is set out in the Non-IFRS financial measures section of

this press release. A reconciliation of these non-IFRS measures to

the most directly comparable IFRS measures is provided in the

financial tables that accompany this release.

References in this announcement to “R” are to South

African Rand and references to “U.S. Dollars” and “$”

are to United States Dollars. Unless otherwise stated MiX

Telematics has translated U.S. Dollar amounts from South African

Rand at the exchange rate of R15.1619 per $1.00, which was the R/$

exchange rate reported by Oanda.com as at September 30, 2019.

Highlights:

Second quarter fiscal 2020 (year over year):

- Subscription revenue of R471 million ($31.1 million), an

increase of 12.2% (10.7% on a constant currency basis)

- Net subscriber additions of over 22,600, bringing the total

base to over 789,000 subscribers, up 11%

- Adjusted EBITDA of R172 million ($11.3 million), up

12%

- Adjusted EBITDA margin of 31.9%, up 110 basis

points

- Diluted adjusted earnings per share of 12 South African

cents, or 19 U.S. cents per diluted ADS, up 20%

First half fiscal 2020 (year over year):

- Subscription revenue of R926 million ($61.1 million), an

increase of 14.3% (10.9% on a constant currency basis)

- Net subscriber additions of 39,100, compared to 37,100

additions in the first half of fiscal 2019

- Adjusted EBITDA of R326 million ($21.5 million), up

17%

- Adjusted EBITDA margin of 30.8%, up 150 basis

points

- Diluted adjusted earnings per share of 22 South African

cents, or 37 U.S. cents per diluted ADS, up 16%

- Free cash flow of R50 million ($3.3 million), up

35%

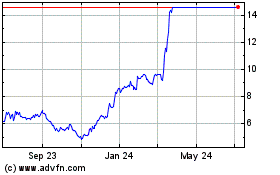

MiX Telematics Limited (NYSE: MIXT, JSE: MIX), a leading global

provider of fleet and mobile asset management solutions delivered

as Software-as-a-Service (SaaS), today announced financial results

for its second quarter and first half of fiscal 2020, which ended

on September 30, 2019.

“Our results were once again highlighted by double-digit

subscription revenue growth, solid subscriber additions as well as

continued EBITDA margin expansion and positive free cash flow” said

Stefan Joselowitz, Chief Executive Officer of MiX Telematics. “Our

revised guidance reflects some caution around macro issues, which

are resulting in elongated sales cycles in certain verticals, as

well as strategic investments in sales and marketing. We remain

confident that our diversified global footprint and the unmatched

range and quality of our product portfolio will continue to support

our growth and profitability objectives.”

Financial performance for the three months ended September

30, 2019

Subscription revenue: Subscription revenue was R471.2

million ($31.1 million), an increase of 12.2% compared to R420.2

million ($27.7 million) for the second quarter of fiscal 2019.

Subscription revenue increased by 10.7% on a constant currency

basis. Subscription revenue benefited from a net increase of over

75,500 subscribers from October 2018 to September 2019,

representing an increase in the subscriber base of 10.6% during

that period.

Total revenue: Total revenue was R538.2 million ($35.5

million), an increase of 8.4% compared to R496.7 million ($32.8

million) for the second quarter of fiscal 2019. Hardware and other

revenue was R67.0 million ($4.4 million), a decrease of 12.5%

compared to R76.6 million ($5.1 million) for the second quarter of

fiscal 2019.

Gross Margin: Gross profit was R352.4 million ($23.2

million), compared to R336.6 million ($22.2 million) for the second

quarter of fiscal 2019. Gross profit margin was 65.5%, compared to

67.8% for the second quarter of fiscal 2019.

Operating Margin: Operating profit was R91.6 million

($6.0 million), compared to R86.7 million ($5.7 million) for the

second quarter of fiscal 2019. Operating margin was 17.0%, compared

to 17.5% for the second quarter of fiscal 2019. Operating expenses

of R260.6 million ($17.2 million) increased by R10.3 million ($0.7

million), or 4.1%, compared to the second quarter of fiscal 2019.

Operating expenses for the second quarter of fiscal 2020 include

share based payment costs of R5.3 million ($0.3 million) relating

to Performance Share Awards issued post the second quarter of

fiscal 2019 in terms of the MiX Telematics Limited Long Term

Incentive Plan. Operating expenses represented 48.4% of revenue

compared to 50.4% of revenue in the second quarter of fiscal

2019.

Adjusted EBITDA: Adjusted EBITDA, a non-IFRS measure, was

R171.5 million ($11.3 million), compared to R152.9 million ($10.1

million) for the second quarter of fiscal 2019. Adjusted EBITDA

margin, a non-IFRS measure, for the second quarter of fiscal 2020

was 31.9%, compared to 30.8% for the second quarter of fiscal

2019.

Profit for the period and earnings per share: Profit for

the period was R44.5 million ($2.9 million), compared to R54.4

million ($3.6 million) in the second quarter of fiscal 2019. Profit

for the period included a net foreign exchange loss of R0.5 million

($0.03 million) before tax. During the second quarter of fiscal

2019, profit for the period included a net foreign exchange gain of

R0.5 million ($0.03 million).

Diluted earnings per ordinary share were 8 South African cents,

compared to 9 South African cents in the second quarter of fiscal

2019. For the second quarter of fiscal 2020, the calculation was

based on diluted weighted average ordinary shares in issue of 570.0

million, compared to 587.6 million diluted weighted average

ordinary shares in issue during the second quarter of fiscal

2019.

The Company’s effective tax rate was 50.3%, compared to 37.7%

for the second quarter of fiscal year 2019. Ignoring the impact of

net foreign exchange gains and losses, and related tax

consequences, the tax rate which is used in determining adjusted

earnings below, was 30.0% compared to 29.4% in the second quarter

of fiscal 2019.

On a U.S. Dollar basis, using the September 30, 2019 exchange

rate of R15.1619 per U.S. Dollar, and a ratio of 25 ordinary shares

to one American Depositary Share (“ADS”), profit for the period was

$2.9 million, or 13 U.S. cents per diluted ADS compared to $3.6

million, or 15 U.S. cents per diluted ADS in the second quarter of

fiscal 2019.

Adjusted earnings for the period and adjusted earnings per

share: Adjusted earnings for the period, a non-IFRS measure,

were R66.9 million ($4.4 million) compared to R61.2 million ($4.0

million) for the second quarter of fiscal 2019. Adjusted earnings

per diluted ordinary share, also a non-IFRS measure, were 12 South

African cents, compared to 10 South African cents in the second

quarter of fiscal 2019.

On a U.S. Dollar basis, using the September 30, 2019 exchange

rate of R15.1619 per U.S. Dollar, and a ratio of 25 ordinary shares

to one ADS, adjusted earnings for the period were $4.4 million, or

19 U.S. cents per diluted ADS, compared to 17 U.S. cents per

diluted ADS in the second quarter of fiscal 2019.

Statement of Financial Position and Cash Flow: At

September 30, 2019, the Company had R253.1 million ($16.7 million)

of net cash and cash equivalents, compared to R353.2 million ($23.3

million) at March 31, 2019. The Company generated R137.7 million

($9.1 million) in net cash from operating activities for the three

months ended September 30, 2019 and invested R98.2 million ($6.6

million) in capital expenditures during the quarter (including

investments in in-vehicle devices of R70.5 million ($4.6 million)),

leading to free cash flow, a non-IFRS measure, of R39.5 million

($2.6 million) compared to free cash flow of R92.8 million ($6.1

million) for the second quarter of fiscal 2019. The Company

utilized R146.0 million ($9.6 million) in financing activities,

compared to R10.6 million ($0.7 million) utilized during the second

quarter of fiscal 2019. The cash utilized in financing activities

during the second quarter of fiscal 2020 mainly consisted of

dividends paid of R22.5 million ($1.5 million), share repurchases

of R119.5 million ($7.9 million) and the payment of lease

liabilities of R4.1 million ($0.3 million). The cash utilized in

financing activities during the second quarter of fiscal 2019

mainly consisted of dividends paid of R16.9 million ($1.1 million)

and payment of lease liabilities of R4.7 million ($0.3 million),

offset by the proceeds from the issuance of shares in respect of

employee share options of R11.1 million ($0.7 million).

Financial performance for the first half of fiscal

2020

Subscription revenue: Subscription revenue increased to

R926.2 million ($61.1 million), an increase of 14.3% compared to

R810.5 million ($53.5 million) for the first half of fiscal 2019.

On a constant currency basis, subscription revenue increased by

10.9%. Subscription revenue benefited from a net increase of over

75,500 subscribers from October 2018 to September 2019,

representing an increase in subscribers of 10.6% during that

period.

Total revenue: Total revenue was R1,060.0 million ($69.9

million), an increase of 11.2% compared to R953.6 million ($62.9

million) for the first half of fiscal 2019. Hardware and other

revenue was R133.8 million ($8.8 million), compared to R143.0

million ($9.4 million) for the first half of fiscal 2019.

Gross margin: Gross profit was R695.2 million ($45.9

million), an increase of 8.2% compared to R642.4 million ($42.4

million) for the first half of fiscal 2019. Gross profit margin was

65.6%, compared to 67.4% for the first half of fiscal 2019.

Operating margin: Operating profit was R173.4 million

($11.4 million), compared to R154.4 million ($10.2 million) in the

first half of fiscal 2019. The operating margin was 16.4%, compared

to 16.2% in the first half of fiscal 2019. Operating expenses of

R521.9 million ($34.4 million) increased by R33.5 million ($2.2

million), or 6.9%, compared to the first half of fiscal 2019.

Operating expenses for the first half of fiscal 2020 include share

based payment costs of R8.5 million ($0.6 million) relating to

Performance Share Awards issued post the first half of fiscal 2019

in terms of the MiX Telematics Limited Long Term Incentive Plan.

Operating expenses represented 49.2% of revenue compared to 51.2%

in the first half of fiscal 2019.

Adjusted EBITDA: Adjusted EBITDA was R326.3 million

($21.5 million) compared to R279.4 million ($18.4 million) for the

first half of fiscal 2019. Adjusted EBITDA margin was 30.8%,

compared to 29.3% in the first half of fiscal 2019.

Profit for the period and earnings per share: Profit for

the period was R111.2 million ($7.3 million), compared to R68.8

million ($4.5 million) in the first half of fiscal 2019. Profit for

the period included a net foreign exchange gain of R0.2 million

($0.01 million) before tax. During the first half of fiscal 2019, a

net foreign exchange gain of R0.3 million ($0.02 million) was

recorded.

Diluted earnings per ordinary share were 19 South African cents,

compared to 12 South African cents in the first half of fiscal

2019. For the first half of fiscal 2020, the calculation was based

on diluted weighted average ordinary shares in issue of 574.5

million, compared to 587.2 million diluted weighted average

ordinary shares in issue during the first half of fiscal 2019.

The Company’s effective tax rate was 35.5%, compared to 55.6%

for the first half of fiscal 2019. Ignoring the impact of net

foreign exchange gains and losses, and related tax consequences,

the effective tax rate, which is used in calculating adjusted

earnings, was 29.5% compared to 29.0% in the first half of fiscal

2019.

Adjusted earnings for the period and adjusted earnings per

share: Adjusted earnings for the period were R127.5 million

($8.4 million), compared to R109.9 million ($7.2 million) in the

first half of fiscal 2019. Adjusted earnings per diluted ordinary

share were 22 South African cents, compared to 19 South African

cents for the first half of fiscal 2019. The impact of foreign

exchange movements and the related tax effects on the Group's

effective tax rate is included in note 17 of the unaudited Group

interim financial results for the six months ended September 30,

2019.

On a U.S. Dollar basis, using the September 30, 2019 exchange

rate of R15.1619 per U.S. Dollar, and a ratio of 25 ordinary shares

to one ADS, adjusted earnings were $8.4 million, or 37 U.S. cents

per diluted ADS, compared to $7.2 million, or 31 U.S. cents per

diluted ADS in the first half of fiscal 2019.

Cash Flow: The Company generated R228.6 million ($15.1

million) in net cash from operating activities for the first half

of fiscal 2020 and invested R178.3 million ($11.8 million) in

capital expenditures during the period (including investments in

in-vehicle devices of R122.4 million ($8.1 million), leading to

free cash flow of R50.4 million ($3.3 million), compared to free

cash flow of R37.3 million ($2.5 million) for the first half of

fiscal 2019. Capital expenditures in the first half of fiscal 2019

were R164.2 million ($10.8 million) and included in-vehicle devices

of R119.2 million ($7.9 million).

The Company utilized R171.3 million ($11.3 million) in financing

activities, compared to R29.7 million ($2.0 million) utilized

during the first half of fiscal 2019. The cash utilized in

financing activities during the first half of fiscal 2020 mainly

consisted of dividends paid of R44.8 million ($3.0 million), share

repurchases of R119.5 million ($7.9 million) and the payment of

lease liabilities of R7.0 million ($0.5 million). The cash utilized

during the first half of fiscal 2019 consisted primarily of

dividends paid of R33.8 million ($2.2 million) and the payment of

lease liabilities of R6.9 million ($0.5 million).

Segment commentary for the first half of fiscal 2020

The segment results below are presented on an integral margin

basis. In respect of revenue, this method of measurement entails

reviewing the segmental results based on external revenue only. In

respect of Adjusted EBITDA (the non-IFRS profit measure identified

by the Group), the margin generated by our Central Services

Organization (“CSO”), net of any unrealized inter-company profit,

is allocated to the geographic region where the external revenue is

recorded by our Regional Sales Offices (“RSOs”).

CSO continues as a central services organization that wholesales

our products and services to our RSOs who, in turn, interface with

our end-customers and distributors. CSO is also responsible for the

development of our hardware and software platforms and provides

common marketing, product management, technical and distribution

support to each of our other operating segments. CSO’s operating

expenses are not allocated to each RSO.

Each RSO’s results reflect the external revenue earned, as well

as the Adjusted EBITDA earned (or loss incurred) by each operating

segment before the CSO and corporate cost allocations.

For further information in this regard, please refer to note 3

of the unaudited Group interim financial results for the six months

ended September 30, 2019.

Segment

Subscription Revenue Half-year

2020 R'000

Total Revenue Half-year 2020

R'000

Adjusted EBITDA Half-year 2020

R'000

Adjusted EBITDA Half-year %

change on prior period

Adjusted EBITDA Margin

Half-year 2020

Africa

516,654

557,597

246,193

6.9%

44.2%

Subscription revenue increased by 9.8% in

the segment as a result of a 10.6% increase in subscribers since

October 1, 2018. Total revenue increased by 9.9%. The region

reported an Adjusted EBITDA margin above 40%.

Americas

164,739

184,226

77,952

4.1%

42.3%

Subscription revenue growth on a constant

currency basis was 11.0%. Subscribers increased by 8.1% since

October 1, 2018. Subscription revenue continued to receive

assistance from the market’s ongoing preference for bundled deals

across new and existing customers. Total revenue improved by 12.0%

on a constant currency basis as hardware and other revenue

increased by 31.8%. The region reported an Adjusted EBITDA margin

above 40%.

Middle East and Australasia

124,646

171,808

80,916

19.4%

47.1%

Subscription revenue increased by 8.6% on

a constant currency basis. Subscribers increased by 9.8% since

October 1, 2018. Total revenue in constant currency improved by

5.1% following lower hardware revenues compared to fiscal 2019. The

region reported an Adjusted EBITDA margin of 47.1% (up from the

45.1% Adjusted EBITDA margin reported in fiscal 2019).

Europe

82,098

101,238

35,421

(5.3%)

35.0%

Subscription revenue growth on a constant

currency basis was 21.8%. However, total revenue decreased by 10.3%

on a constant currency basis following lower hardware revenues

compared to fiscal 2019. Subscribers increased by 8.6% since

October 1, 2018. The region reported an Adjusted EBITDA margin of

35.0% (up from the 32.3% Adjusted EBITDA margin reported in fiscal

2019).

Brazil

37,310

43,789

18,807

66.6%

42.9%

Subscription revenue increased by 21.8% on

a constant currency basis. The increase was due to an increase in

subscribers of 22.1% since October 1, 2018. On a constant currency

basis, total revenue increased by 36.9% following a significant

increase in hardware revenues. The segment reported an Adjusted

EBITDA margin of 42.9% (up from the 40.3% Adjusted EBITDA margin

reported in fiscal 2019).

Central Services Organization

740

1,303

(75,204)

8.6%

—

CSO is responsible for the development of

our hardware and software platforms and provides common marketing,

product management, technical and distribution support to each of

our other operating segments. The negative Adjusted EBITDA reported

arises as a result of operating expenses carried by the

segment.

Business Outlook

MiX Telematics has translated U.S. Dollar amounts in this

Business Outlook paragraph from South African Rand at the exchange

rate of R14.5750 per $1.00, which was the R/$ exchange rate

reported by Oanda.com as at October 28, 2019.

Based on information as of today, October 31, 2019, for the

third quarter of fiscal 2020, the Group expects subscription

revenue to be in the range of R475 million to R480 million ($32.6

million to $32.9 million) which would represent subscription

revenue growth of 8.2% to 9.4% compared to the third quarter of

fiscal 2019. On a constant currency basis, this would represent

subscription revenue growth of 7.8% to 9.0%.

Based on information as of today, October 31, 2019, the Group is

issuing the following financial guidance for the full 2020 fiscal

year:

- Subscription revenue - R1,886 million to R1,901 million ($129.4

million to $130.4 million), which would represent subscription

revenue growth of 11.4% to 12.3% compared to fiscal 2019. On a

constant currency basis, this would represent subscription revenue

growth of 9.3% to 10.2%.

- Total revenue - R2,119 million to R2,144 million ($145.4

million to $147.1 million), which would represent revenue growth of

7.2% to 8.5% compared to fiscal 2019. On a constant currency basis,

this would represent revenue growth of 5.2% to 6.4%.

- Adjusted EBITDA - R650 million to R665 million ($44.6 million

to $45.6 million), which would represent Adjusted EBITDA growth of

7.8% to 10.3% compared to fiscal 2019.

- Adjusted earnings per diluted ordinary share of 41.6 to 45.1

South African cents based on 570 million diluted ordinary shares in

issue, and based on an effective tax rate of 28.0% to 29.0%. At a

ratio of 25 ordinary shares to one ADS, this equates to adjusted

earnings per diluted ADS of 71.4 to 77.4 U.S. cents.

The key assumptions used in deriving the forecast are as

follows:

- Growth in subscription revenue and subscribers are based on

expected growth rates related to market conditions and takes into

account growth rates achieved previously.

- Achieving hardware sales according to expectations, as hardware

sales are dependent on the volumes of bundled solutions selected by

customers.

- An average forecast exchange rate for the 2020 fiscal year of

R14.5800 per $1.00.

The forecast is the responsibility of the Board of Directors and

has not been reviewed or reported on by the Group’s external

auditors. The Group’s policy is to give guidance on a quarterly

basis, if necessary, and does not update guidance between

quarters.

The Group provides earnings guidance only on a non-IFRS basis

and does not provide a reconciliation of forward-looking Adjusted

EBITDA and Adjusted Earnings per Diluted Ordinary Share guidance to

the most directly comparable IFRS financial measures because of the

inherent difficulty in forecasting and quantifying certain amounts

that are necessary for such reconciliations, including adjustments

that could be made for foreign exchange gains/(losses) and related

tax consequences, restructuring costs, share-based compensation

costs, and other charges reflected in the Group’s reconciliation of

historic non-IFRS financial measures, the amounts of which, based

on past experience, could be material.

The information disclosed in this “Business Outlook”

paragraph complies with the disclosure requirements in terms of

paragraph 8.38 of the JSE Listings Requirements which deals with

profit forecasts.

Quarterly Reporting Policy in respect of JSE Listings

Requirements

Following the listing of the Group’s ADSs on the New York Stock

Exchange, the Group has adopted a quarterly reporting policy. As a

result of such quarterly reporting the Group is, in terms of

paragraph 3.4(b)(ix) of the JSE Listings Requirements, not required

to publish trading statements in terms of paragraph 3.4(b)(i) to

(viii) of the JSE Listings Requirements.

Conference Call Information

MiX Telematics management will also host a conference call and

audio webcast at 8:00 a.m. (Eastern Daylight Time) and 2:00 p.m.

(South African Time) on October 31, 2019 to discuss the Group’s

financial results and current business outlook:

- The live webcast of the call will be available at the “Investor

Information” page of the Group’s website, http://investor.mixtelematics.com.

- To access the call, dial 1-877-451-6152 (within the United

States) or 0 800 983 831 (within South Africa) or 1-201-389-0879

(outside of the United States). The conference ID is 13695048.

- A replay of this conference call will be available for a

limited time at +1-844-512-2921 (within the United States) or

1-412-317-6671 (within South Africa or outside of the United

States). The replay conference ID is 13695048.

- A replay of the webcast will also be available for a limited

time at http://investor.mixtelematics.com.

About MiX Telematics Limited

MiX Telematics is a leading global provider of fleet and mobile

asset management solutions delivered as SaaS to customers managing

over 789,000 assets in approximately 120 countries. The Group’s

products and services provide enterprise fleets, small fleets and

consumers with solutions for safety, efficiency, risk and security.

MiX Telematics was founded in 1996 and has offices in South Africa,

the United Kingdom, the United States, Uganda, Brazil, Mexico,

Australia, Romania, Thailand and the United Arab Emirates as well

as a network of more than 130 fleet partners worldwide. MiX

Telematics shares are publicly traded on the Johannesburg Stock

Exchange (JSE: MIX) and MiX Telematics American Depositary Shares

are listed on the New York Stock Exchange (NYSE: MIXT). For more

information, visit www.mixtelematics.com.

Forward-Looking Statements

This press release includes certain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995, including without limitation, statements concerning our

financial guidance for the third quarter and full year of fiscal

2020, our position to execute on our growth strategy, and our

ability to expand our leadership position. These forward-looking

statements reflect our current views about our plans, intentions,

expectations, strategies and prospects, which are based on the

information currently available to us and on assumptions we have

made. Actual results may differ materially from those described in

the forward-looking statements and will be affected by a variety of

risks and factors that are beyond our control including, without

limitation, those described under the caption “Risk Factors” in the

Group’s Annual Report on Form 20-F filed with the Securities and

Exchange Commission (the “SEC”) for the fiscal year ended March 31,

2019, as updated by other reports that the Company files with or

furnishes to the SEC. The Company assumes no obligation to update

any forward-looking statements contained in this press release as a

result of new information, future events or otherwise.

Non-IFRS financial measures

Adjusted EBITDA

To provide investors with additional information regarding its

financial results, the Group has disclosed within this press

release, Adjusted EBITDA and Adjusted EBITDA margin. Adjusted

EBITDA and Adjusted EBITDA margin are non-IFRS financial measures,

and they do not represent cash flows from operations for the

periods indicated, and should not be considered an alternative to

net income as an indicator of the Group’s results of operations, or

as an alternative to cash flows from operations as an indicator of

liquidity. Adjusted EBITDA is defined as the profit for the period

before income taxes, net finance income/(costs) including foreign

exchange gains/(losses), depreciation of property, plant and

equipment including capitalized customer in-vehicle devices and

right-of-use assets, amortization of intangible assets including

capitalized in-house development costs and intangible assets

identified as part of a business combination, share-based

compensation costs, restructuring costs, profits/(losses) on the

disposal or impairments of assets or subsidiaries, insurance

reimbursements relating to impaired assets and certain litigation

costs.

The Group has included Adjusted EBITDA and Adjusted EBITDA

margin in this press release because they are key measures that the

Group’s management and Board of Directors use to understand and

evaluate its core operating performance and trends; to prepare and

approve its annual budget; and to develop short and long-term

operational plans. In particular, the exclusion of certain expenses

in calculating Adjusted EBITDA and Adjusted EBITDA margin can

provide a useful measure for period-to-period comparisons of the

Group’s core business. Accordingly, the Group believes that

Adjusted EBITDA and Adjusted EBITDA margin provide useful

information to investors and others in understanding and evaluating

its operating results.

The Group’s use of Adjusted EBITDA has limitations as an

analytical tool, and you should not consider this performance

measure in isolation from or as a substitute for analysis of our

results as reported under IFRS. Some of these limitations are:

- although depreciation and amortization are non-cash charges,

the assets being depreciated and amortized may have to be replaced

in the future, and Adjusted EBITDA does not reflect cash capital

expenditure requirements for such replacements or for new capital

expenditure requirements;

- Adjusted EBITDA does not reflect changes in, or cash

requirements for, the Group’s working capital needs;

- Adjusted EBITDA does not consider the potentially dilutive

impact of equity-based compensation;

- Adjusted EBITDA does not reflect tax payments or the payment of

lease liabilities that may represent a reduction in cash available

to the Group; and

- other companies, including companies in our industry, may

calculate Adjusted EBITDA differently, which reduces its usefulness

as a comparative measure.

Because of these limitations, you should consider Adjusted

EBITDA alongside other financial performance measures, including

operating profit, profit for the year and our other results.

Headline Earnings

Headline earnings is a profit measure required for JSE-listed

companies and is calculated in accordance with circular 4/2018

issued by the South African Institute of Chartered Accountants. The

profit measure is determined by taking the profit for the period

prior to certain separately identifiable re-measurements of the

carrying amount of an asset or liability that arose after the

initial recognition of such asset or liability net of related tax

(both current and deferred) and related non-controlling

interest.

Adjusted Earnings and Adjusted Earnings Per Share

Adjusted earnings per share is defined as profit attributable to

owners of the parent, MiX Telematics Limited, excluding net foreign

exchange gains/(losses) net of tax and share based compensation

costs related to Performance Share Awards net of tax, divided by

the weighted average number of ordinary shares in issue during the

period.

We have included Adjusted earnings per share in this press

release because it provides a useful measure for period-to-period

comparisons of the Group’s core business by excluding net foreign

exchange gains/(losses) from earnings, as well as share based

compensation costs related to Performance Share Awards. Performance

Share Awards were awarded under the MiX Telematics Long-Term

Incentive Plan for the first time in November 2018 and are aimed at

incentivising management to achieve cumulative subscription revenue

and Adjusted EBITDA targets for the 2019 and 2020 fiscal years.

Accordingly, we believe that Adjusted earnings per share

provides useful information to investors and others in

understanding and evaluating the Group's operating results.

Free cash flow

Free cash flow is determined as net cash generated from

operating activities less capital expenditure for investing

activities. We believe that free cash flow provides useful

information to investors and others in understanding and evaluating

the Group’s cash flows as it provides detail of the amount of cash

the Group generates or utilizes after accounting for all capital

expenditures including investments in in-vehicle devices and

development expenditure.

Constant currency and U.S. Dollar financial

information

Financial information presented in United States Dollars and

constant currency financial information presented as part of the

segment commentary constitute pro forma financial information under

the JSE Listings Requirements. Unless otherwise stated, MiX

Telematics has translated U.S. Dollar amounts from South African

Rand at the exchange rate of R15.1619 per $1.00, which was the R/$

exchange rate reported by Oanda.com as at September 30, 2019.

Constant currency information has been presented to illustrate

the impact of changes in currency rates on the Group’s results. The

constant currency information has been determined by adjusting the

current financial reporting period results to the prior period

average exchange rates, determined as the average of the monthly

exchange rates applicable to the period. The measurement has been

performed for each of the Group’s currencies, including the U.S.

Dollar and British Pound. The constant currency growth percentage

has been calculated by utilizing the constant currency results

compared to the prior period results.

This pro-forma financial information is the responsibility of

the Group’s Board of Directors and is presented for illustrative

purposes. Because of its nature, the pro-forma financial

information may not fairly present MiX Telematics’ financial

position, changes in equity, results of operations or cash flows.

The pro-forma financial information does not constitute pro-forma

information in accordance with the requirements of Regulation S-X

of the SEC or generally accepted accounting principles in the

United States. In addition, the rules and regulations related to

the preparation of pro-forma financial information in other

jurisdictions may also vary significantly from the requirements

applicable in South Africa. The pro-forma financial information

contained in this results announcement has not been reviewed by our

auditors.

CONDENSED CONSOLIDATED INCOME

STATEMENT

South African Rand

Six months ended

Six months ended

Three months ended

Three months ended

Figures are in thousands unless otherwise

stated

September 30,

September 30,

September 30,

September 30,

2019

2018

2019

2018

Unaudited

Unaudited

Unaudited

Unaudited

Revenue

1,059,961

953,559

538,226

496,737

Cost of sales

(364,722

)

(311,168

)

(185,807

)

(160,107

)

Gross profit

695,239

642,391

352,419

336,630

Other income/(expenses) - net

58

423

(186

)

435

Operating expenses

(521,893

)

(488,383

)

(260,640

)

(250,359

)

-Sales and marketing

(97,775

)

(98,811

)

(46,286

)

(51,955

)

-Administration and other charges

(424,118

)

(389,572

)

(214,354

)

(198,404

)

Operating profit

173,404

154,431

91,593

86,706

Finance (costs)/income - net

(872

)

628

(1,942

)

473

-Finance income

6,710

5,970

3,254

3,524

-Finance costs

(7,582

)

(5,342

)

(5,196

)

(3,051

)

Profit before taxation

172,532

155,059

89,651

87,179

Taxation

(61,328

)

(86,274

)

(45,130

)

(32,829

)

Profit for the period

111,204

68,785

44,521

54,350

Attributable to:

Owners of the parent

111,204

68,786

44,520

54,350

Non-controlling interest

*

(1

)

1

*

111,204

68,785

44,521

54,350

Earnings per share

-basic (R)

0.20

0.12

0.08

0.10

-diluted (R)

0.19

0.12

0.08

0.09

Earnings per American Depositary Share

-basic (R)

4.98

3.04

2.01

2.40

-diluted (R)

4.84

2.93

1.95

2.31

Ordinary shares ('000)1

-in issue at September 30

550,118

569,756

550,118

569,756

-weighted average

558,401

565,249

554,781

566,025

-diluted weighted average

574,462

587,152

570,011

587,616

Weighted average American Depositary

Shares ('000)1

-in issue at September 30

22,005

22,790

22,005

22,790

-weighted average

22,336

22,610

22,191

22,641

-diluted weighted average

22,978

23,486

22,800

23,505

1

September 30, 2019 figure excludes

53,816,750 (September 30, 2018: 40,000,000) treasury shares held by

MiX Telematics Investments Proprietary Limited (“MiX Investments”),

a wholly owned subsidiary of the Group.

CONDENSED CONSOLIDATED INCOME

STATEMENT

United States Dollar

Six months ended

Six months ended

Three months ended

Three months ended

Figures are in thousands unless otherwise

stated

September 30,

September 30,

September 30,

September 30,

2019

2018

2019

2018

Unaudited

Unaudited

Unaudited

Unaudited

Revenue

69,910

62,892

35,499

32,762

Cost of sales

(24,056

)

(20,523

)

(12,255

)

(10,560

)

Gross profit

45,854

42,369

23,244

22,202

Other income/(expenses) - net

4

28

(12

)

29

Operating expenses

(34,422

)

(32,211

)

(17,191

)

(16,513

)

-Sales and marketing

(6,449

)

(6,517

)

(3,053

)

(3,427

)

-Administration and other charges

(27,973

)

(25,694

)

(14,138

)

(13,086

)

Operating profit

11,436

10,186

6,041

5,718

Finance (costs)/income - net

(57

)

42

(128

)

31

-Finance income

443

394

215

232

-Finance costs

(500

)

(352

)

(343

)

(201

)

Profit before taxation

11,379

10,228

5,913

5,749

Taxation

(4,045

)

(5,690

)

(2,977

)

(2,164

)

Profit for the period

7,334

4,538

2,936

3,585

Attributable to:

Owners of the parent

7,334

4,538

2,936

3,585

Non-controlling interest

*

*

*

*

7,334

4,538

2,936

3,585

Earnings per share

-basic ($)

0.01

0.01

0.01

0.01

-diluted ($)

0.01

0.01

0.01

0.01

Earnings per American Depositary Share

-basic ($)

0.33

0.20

0.13

0.16

-diluted ($)

0.32

0.19

0.13

0.15

Ordinary shares ('000)1

-in issue at September 30

550,118

569,756

550,118

569,756

-weighted average

558,401

565,249

554,781

566,025

-diluted weighted average

574,462

587,152

570,011

587,616

Weighted average American Depositary

Shares ('000)1

-in issue at September 30

22,005

22,790

22,005

22,790

-weighted average

22,336

22,610

22,191

22,641

-diluted weighted average

22,978

23,486

22,800

23,505

*

Amounts less than $1,000

1

September 30, 2019 figure excludes

53,816,750 (September 30, 2018: 40,000,000) treasury shares held by

MiX Telematics Investments Proprietary Limited (“MiX Investments”),

a wholly owned subsidiary of the Group.

MIX TELEMATICS LIMITED

CONDENSED CONSOLIDATED STATEMENT OF

COMPREHENSIVE INCOME

South African Rand

United States Dollar

Six months ended

Six months ended

Six months ended

Six months ended

Figures are in thousands unless otherwise

stated

September 30,

September 30,

September 30,

September 30,

2019

2018

2019

2018

Unaudited

Unaudited

Unaudited

Unaudited

Profit for the period

111,204

68,785

7,334

4,538

Other comprehensive income:

Items that may be subsequently

reclassified to profit or loss

Exchange differences on translating

foreign operations

18,292

96,206

1,206

6,345

- Attributable to owners of the parent

18,291

96,203

1,206

6,345

- Attributable to non-controlling

interest

1

3

*

*

Taxation relating to components of other

comprehensive income

(1

)

(262

)

*

(17

)

Other comprehensive income for the

period, net of tax

18,291

95,944

1,206

6,328

Total comprehensive income for the

period

129,495

164,729

8,540

10,866

Attributable to:

Owners of the parent

129,494

164,727

8,540

10,866

Non-controlling interest

1

2

*

*

Total comprehensive income for the

period

129,495

164,729

8,540

10,866

* Amounts less than $1,000

HEADLINE EARNINGS

Reconciliation of headline

earnings

South African Rand

United States Dollar

Six months ended

Six months ended

Six months ended

Six months ended

Figures are in thousands unless otherwise

stated

September 30,

September 30,

September 30,

September 30,

2019

2018

2019

2018

Unaudited

Unaudited

Unaudited

Unaudited

Profit for the period attributable to

owners of the parent

111,204

68,786

7,334

4,538

Adjusted for:

Profit on disposal of property, plant and

equipment and intangible assets

(711

)

(238

)

(47

)

(16

)

Impairment of product development costs

capitalized

421

51

28

3

Income tax effect on the above

components

1,806

53

119

3

Headline earnings attributable to

owners of the parent

112,720

68,652

7,434

4,528

Headline earnings

Headline earnings per share

-basic (R/$)

0.20

0.12

0.01

0.01

-diluted (R/$)

0.20

0.12

0.01

0.01

Headline earnings per American Depositary

Share

-basic (R/$)

5.05

3.04

0.33

0.20

-diluted (R/$)

4.91

2.92

0.32

0.19

ADJUSTED EARNINGS

Reconciliation of adjusted

earnings

South African Rand

Six months ended

Six months ended

Three months ended

Three months ended

Figures are in thousands unless otherwise

stated

September 30,

September 30,

September 30,

September 30,

2019

2018

2019

2018

Unaudited

Unaudited

Unaudited

Unaudited

Profit for the period attributable to

owners of the parent

111,204

68,786

44,520

54,350

Net foreign exchange (gains)/losses

(167

)

(309

)

516

(540

)

IFRS 2 charge on performance share

awards

8,532

—

5,329

—

Income tax effect on the above

component

7,927

41,434

16,546

7,352

Adjusted earnings attributable to

owners of the parent

127,496

109,911

66,911

61,162

Reconciliation of earnings per share to

adjusted earnings per share

Basic earnings per share (R)

0.20

0.12

0.08

0.10

Net foreign exchange (gains)/losses

#

#

#

#

IFRS 2 charge on performance share

awards

0.02

—

#

—

Income tax effect on the above

component

0.01

0.07

0.03

0.01

Basic adjusted earnings per share

(R)

0.23

0.19

0.12

0.11

Adjusted earnings per share

-basic (R)

0.23

0.19

0.12

0.11

-diluted (R)

0.22

0.19

0.12

0.10

Adjusted earnings per American Depositary

Share

-basic (R)

5.71

4.86

3.02

2.70

-diluted (R)

5.55

4.68

2.93

2.60

# Amounts less than R0.01

United States Dollar

Six months ended

Six months ended

Three months ended

Three months ended

Figures are in thousands unless otherwise

stated

September 30,

September 30,

September 30,

September 30,

2019

2018

2019

2018

Unaudited

Unaudited

Unaudited

Unaudited

Profit for the period attributable to

owners of the parent

7,334

4,538

2,936

3,585

Net foreign exchange (gains)/losses

(11

)

(20

)

34

(36

)

IFRS 2 charge on performance share

awards

563

—

351

—

Income tax effect on the above

component

523

2,733

1,091

485

Adjusted earnings attributable to

owners of the parent

8,409

7,251

4,412

4,034

Reconciliation of earnings per share to

adjusted earnings per share

Basic earnings per share ($)

0.01

0.01

0.01

0.01

Net foreign exchange (gains)/losses

#

#

#

#

IFRS 2 charge on performance share

awards

#

—

#

—

Income tax effect on the above

component

#

#

#

#

Basic adjusted earnings per share

($)

0.02

0.01

0.01

0.01

Adjusted earnings per share

-basic ($)

0.02

0.01

0.01

0.01

-diluted ($)

0.01

0.01

0.01

0.01

Adjusted earnings per American Depositary

Share

-basic ($)

0.38

0.32

0.20

0.18

-diluted ($)

0.37

0.31

0.19

0.17

# Amounts less than $0.01

CONDENSED CONSOLIDATED STATEMENT OF

FINANCIAL POSITION

South African Rand

United States Dollar

Figures are in thousands unless otherwise

stated

September 30,

March 31,

September 30,

March 31,

2019

2019

2019

2019

Unaudited

Audited

Unaudited

Unaudited

ASSETS

Non-current assets

Property, plant and equipment

560,805

457,446

36,988

30,171

Intangible assets

977,374

955,646

64,463

63,029

Capitalized commission assets

61,701

54,066

4,069

3,566

Loans to external parties

8,771

—

578

—

Deferred tax assets

57,603

51,666

3,799

3,408

Total non-current assets

1,666,254

1,518,824

109,897

100,174

Current assets

Assets classified as held for sale (Note

6)

—

17,058

—

1,125

Inventory

56,610

51,263

3,734

3,381

Trade and other receivables

443,203

376,475

29,231

24,830

Taxation

19,098

24,119

1,260

1,591

Restricted cash

21,473

20,187

1,416

1,331

Cash and cash equivalents

292,314

383,443

19,280

25,290

Total current assets

832,698

872,545

54,921

57,548

Total assets

2,498,952

2,391,369

164,818

157,722

EQUITY

Stated capital

667,154

786,633

44,002

51,882

Other reserves

106,547

83,212

7,028

5,489

Retained earnings

948,045

881,819

62,527

58,160

Equity attributable to owners of the

parent

1,721,746

1,751,664

113,557

115,531

Non-controlling interest

14

13

1

1

Total equity

1,721,760

1,751,677

113,558

115,532

LIABILITIES

Non-current liabilities

Deferred tax liabilities

162,590

139,049

10,724

9,171

Provisions

2,193

2,226

145

147

Recurring commission liability

913

1,798

60

119

Capitalized lease liability

100,064

31,183

6,600

2,057

Total non-current liabilities

265,760

174,256

17,529

11,494

Current liabilities

Trade and other payables

430,278

399,869

28,379

26,371

Capitalized lease liability

18,241

10,745

1,203

709

Taxation

3,840

2,511

253

166

Provisions

19,876

22,049

1,311

1,454

Bank overdraft

39,197

30,262

2,585

1,996

Total current liabilities

511,432

465,436

33,731

30,696

Total liabilities

777,192

639,692

51,260

42,190

Total equity and liabilities

2,498,952

2,391,369

164,818

157,722

CONDENSED CONSOLIDATED STATEMENT OF

CASH FLOWS

South African Rand

United States Dollar

Six months ended

Six months ended

Six months ended

Six months ended

September 30,

September 30,

September 30,

September 30,

Figures are in thousands unless otherwise

stated

2019

2018

2019

2018

Unaudited

Unaudited

Unaudited

Unaudited

Cash flows from operating

activities

Cash generated from operations

269,019

221,187

17,743

14,588

Net financing income

1,987

4,133

131

273

Taxation paid

(42,360

)

(23,851

)

(2,794

)

(1,573

)

Net cash generated from operating

activities

228,646

201,469

15,080

13,288

Cash flows from investing

activities

Capital expenditure payments

(178,272

)

(164,192

)

(11,758

)

(10,829

)

Proceeds on sale of property, plant and

equipment and intangible assets

19,281

412

1,582

27

Loans advanced to external parties

(5,086

)

—

(645

)

—

Decrease in restricted cash

9,679

323

638

21

Increase in restricted cash

(10,858

)

(1,057

)

(716

)

(70

)

Net cash used in investing

activities

165,257

(164,514

)

(10,899

)

(10,851

)

Cash flows from financing

activities

Proceeds from issuance of ordinary

shares

—

11,070

—

730

Share repurchase

(119,479

)

—

(7,880

)

—

Repayment of capitalized lease

liability

(6,976

)

(6,914

)

(460

)

(456

)

Dividends paid to Company’s owners

(44,812

)

(33,822

)

(2,956

)

(2,231

)

Net cash used in financing

activities

(171,267

)

(29,666

)

(11,296

)

(1,957

)

Net (decrease)/increase in cash and

cash equivalents

(107,877

)

7,289

(7,115

)

480

Net cash and cash equivalents at the

beginning of the period

353,181

290,538

23,294

19,162

Exchange gains on cash and cash

equivalents

7,813

14,449

516

951

Net cash and cash equivalents at the

end of the period

253,117

312,276

16,695

20,593

CONDENSED CONSOLIDATED STATEMENT OF

CHANGES IN EQUITY

Attributable to owners of the

parent

South African Rand Figures are in

thousands unless otherwise stated

Stated capital

Other reserves

Retained earnings

Total

Non- controlling

interest

Total equity

Balance at April 1, 2018

(Audited)

846,405

(51,614

)

747,055

1,541,846

10

1,541,856

Total comprehensive income

—

95,941

68,786

164,727

2

164,729

Profit for the period

—

—

68,786

68,786

(1

)

68,785

Other comprehensive income

—

95,941

—

95,941

3

95,944

Transactions with owners

11,070

6,772

(33,873

)

(16,031

)

—

(16,031

)

Shares issued in relation to share options

exercised

11,070

—

—

11,070

—

11,070

Share-based payment transaction

—

4,167

—

4,167

—

4,167

Share-based payment - change in excess tax

benefit

—

2,605

—

2,605

—

2,605

Dividends declared

—

—

(33,873

)

(33,873

)

—

(33,873

)

Balance at September 30, 2018

(Unaudited)

857,475

51,099

781,968

1,690,542

12

1,690,554

Total comprehensive income

—

19,803

133,550

153,353

1

153,354

Profit for the period

—

—

133,550

133,550

1

133,551

Other comprehensive income

—

19,803

—

19,803

—

19,803

Transactions with owners

(70,842

)

12,310

(33,699

)

(92,231

)

—

(92,231

)

Shares issued in relation to share options

exercised

2,706

—

—

2,706

—

2,706

Share-based payment transaction

—

7,973

—

7,973

—

7,973

Share-based payment - change in excess tax

benefit

—

4,337

—

4,337

—

4,337

Dividends declared

—

—

(33,699

)

(33,699

)

—

(33,699

)

Share repurchase (note 8)

(73,548

)

—

—

(73,548

)

—

(73,548

)

Balance at March 31, 2019

(Audited)

786,633

83,212

881,819

1,751,664

13

1,751,677

Total comprehensive income

—

18,291

111,204

129,495

1

129,496

Profit for the period

—

—

111,204

111,204

—

111,204

Other comprehensive income

—

18,291

—

18,291

1

18,292

Transactions with owners

(119,479

)

5,044

(44,978

)

(159,413

)

—

(159,413

)

Share-based payment transaction

—

12,730

—

12,730

—

12,730

Share-based payment - change in excess tax

benefit

—

(7,686

)

—

(7,686

)

—

(7,686

)

Dividends declared (note 9)

—

—

(44,978

)

(44,978

)

—

(44,978

)

Share repurchase (note 8)

(119,479

)

—

—

(119,479

)

—

(119,479

)

Balance at September 30, 2019

(Unaudited)

667,154

106,547

948,045

1,721,746

14

1,721,760

CONDENSED CONSOLIDATED STATEMENT OF

CHANGES IN EQUITY

Attributable to owners of the

parent

United States Dollar

Figures are in thousands unless otherwise

stated

Stated capital

Other reserves

Retained earnings

Total

Non- controlling

interest

Total equity

Balance at April 1, 2018

(Unaudited)

55,825

(3,404

)

49,272

101,693

1

101,694

Total comprehensive income

—

6,328

4,537

10,865

—

10,865

Profit for the period

—

—

4,537

4,537

—

4,537

Other comprehensive income

—

6,328

—

6,328

—

6,328

Transactions with owners

730

447

(2,234

)

(1,057

)

—

(1,057

)

Shares issued in relation to share options

exercised

730

—

—

730

—

730

Share-based payment transaction

—

275

—

275

—

275

Share-based payment - change in excess tax

benefit

—

172

—

172

—

172

Dividends declared

—

—

(2,234

)

(2,234

)

—

(2,234

)

Balance at September 30, 2018

(Unaudited)

56,555

3,371

51,575

111,501

1

111,502

Total comprehensive income

—

1,306

8,808

10,114

—

10,114

Profit for the period

—

—

8,808

8,808

—

8,808

Other comprehensive income

—

1,306

—

1,306

—

1,306

Transactions with owners

(4,673

)

812

(2,223

)

(6,084

)

—

(6,084

)

Shares issued in relation to share options

exercised

178

—

—

178

—

178

Share-based payment transaction

—

526

—

526

—

526

Share-based payment - change in excess tax

benefit

—

286

—

286

—

286

Dividends declared

—

—

(2,223

)

(2,223

)

—

(2,223

)

Share repurchase (note 8)

(4,851

)

—

—

(4,851

)

—

(4,851

)

Balance at March 31, 2019

(Unaudited)

51,882

5,489

58,160

115,531

1

115,532

Total comprehensive income

—

1,206

7,334

8,540

—

8,540

Profit for the period

—

—

7,334

7,334

—

7,334

Other comprehensive income

—

1,206

—

1,206

—

1,206

Transactions with owners

(7,880

)

333

(2,967

)

(10,514

)

—

(10,514

)

Share-based payment transaction

—

840

—

840

—

840

Share-based payment - change in excess tax

benefit

—

(507

)

—

(507

)

—

(507

)

Dividends declared (note 9)

—

—

(2,967

)

(2,967

)

—

(2,967

)

Share repurchase (note 8)

(7,880

)

—

—

(7,880

)

—

(7,880

)

Balance at September 30, 2019

(Unaudited)

44,002

7,028

62,527

113,557

1

113,558

NOTES TO CONDENSED CONSOLIDATED FINANCIAL RESULTS

1. Basis of preparation and accounting policies

Condensed unaudited Group interim financial results for the half

year ended September 30, 2019

These condensed unaudited Group interim financial results for

the half year ended September 30, 2019 have been prepared in

accordance with International Financial Reporting Standard

(“IFRS”), IAS 34: Interim financial reporting, the SAICA Financial

Reporting Guides as issued by the Accounting Practices Committee,

Financial Pronouncements as issued by the Financial Reporting

Standards Council (“FRSC”), the JSE Listings Requirements and the

requirements of the South African Companies Act, No. 71 of 2008.

The interim financial results have not been audited or reviewed by

the Group’s external auditors.

The condensed unaudited Group interim financial results do not

include all the information and disclosures required in the annual

financial statements and should be read in conjunction with the

Group’s annual financial statements for the year ended March 31,

2019, which have been prepared in accordance with IFRS.

The preparation of interim financial results requires management

to make judgments, estimates and assumptions that affect the

application of accounting policies and the reported amounts of

assets and liabilities, income and expenses. In preparing these

condensed interim financial results, the significant judgment made

by management in applying the Group’s accounting policies and the

key sources of estimation and uncertainty were the same as those

applied to the consolidated financial statements for the year ended

March 31, 2019.

The condensed unaudited Group interim financial results were

prepared under the supervision of the Chief Financial Officer, John

Granara. These results were made available on October 31, 2019.

Financial results for the second quarter of fiscal 2020

In addition to the condensed unaudited Group interim financial

results for the half year ended September 30, 2019, additional

financial information in respect of the second quarter of fiscal

2020 has been presented together with the relevant comparative

information. The quarterly information comprises a condensed

consolidated income statement, a reconciliation of adjusted

earnings to profit for the period, a reconciliation of Adjusted

EBITDA to profit for the period (note 4), a reconciliation of free

cash flow to net cash generated from operating activities (note 7),

other operating and financial data (note 11) and development costs

historical data (note 16).

The quarterly financial results have not been audited or

reviewed by the Group’s external auditors.

Presentation currency and convenience translation

The Group’s presentation currency is South African Rand. In

addition to presenting these interim financial results in South

African Rand, supplementary information in U.S. Dollars has been

prepared for the convenience of users of the Group interim

financial results. Unless otherwise stated, the Group has

translated U.S. Dollar amounts from South African Rand at the

exchange rate of R15.1619 per $1.00, which was the R/$ exchange

rate reported by Oanda.com as at September 30, 2019. The U.S.

Dollar figures may not compute as they are rounded

independently.

The supplementary information prepared in U.S. Dollars

constitutes pro forma financial information under the JSE Listings

Requirements. This pro forma financial information is the

responsibility of the Group’s Board of Directors and is presented

for illustrative purposes. Because of its nature, the pro forma

financial information may not fairly present MiX Telematics’

financial position, changes in equity, results of operations or

cash flows. The pro forma financial information does not constitute

pro forma information in accordance with the requirements of

Regulation S-X of the SEC or generally accepted accounting

principles in the United States. In addition, the rules and

regulations relating to the preparation of pro forma financial

information in other jurisdictions may also vary significantly from

the requirements applicable in South Africa.

2. Accounting policies

The accounting policies used in preparing these financial

results are in terms of IFRS and are consistent in all material

respects with those applied in the preparation of the Group’s

annual financial statements for the year ended March 31, 2019.

3. Segment information

Our operating segments are based on the geographical location of

our Regional Sales Offices (“RSOs”) and also include our Central

Services Organization (“CSO”). CSO is our central services

organization that wholesales our products and services to our RSOs

who, in turn, interface with our end-customers, distributors and

dealers. CSO is also responsible for the development of our

hardware and software platforms and provides common marketing,

product management, technical and distribution support to each of

our other operating segments.

The chief operating decision maker (“CODM”) reviews the segment

results on an integral margin basis as defined by management. The

CODM, who is responsible for allocating resources and assessing

performance of the operating segments, has been identified

collectively as the executive committee and the Chief Executive

Officer who make strategic decisions. In respect of revenue, this

method of measurement entails reviewing the segmental results based

on external revenue only. In respect of Adjusted EBITDA (the profit

measure identified by the CODM), the margin generated by CSO, net

of any unrealized intercompany profit, is allocated to the

geographic region where the external revenue is recorded by our

RSOs. The costs remaining in CSO relate mainly to research and

development of hardware and software platforms, common marketing,

product management and technical and distribution support to each

of the RSOs. CSO is a reportable segment of the Group because it

produces discrete financial information which is reviewed by the

CODM and has the ability to generate external revenues.

Each RSO’s results therefore reflect the external revenue

earned, as well as the Adjusted EBITDA earned (or loss incurred) by

each operating segment before the remaining CSO and corporate costs

allocations. Segment assets are not disclosed as segment

information is not reviewed on such a basis by the CODM.

3. Segment information (continued)

South African Rand Figures are in

thousands unless otherwise stated

Subscription revenue

Hardware and other

revenue

Total revenue

Adjusted EBITDA

Six months ended September 30, 2019

(Unaudited)

Africa

516,654

40,943

557,597

246,193

Europe

82,098

19,140

101,238

35,421

Americas

164,739

19,487

184,226

77,952

Middle East and Australasia

124,646

47,162

171,808

80,916

Brazil

37,310

6,479

43,789

18,807

Total Regional Sales Offices

925,447

133,211

1,058,658

459,289

Central Services Organization

740

563

1,303

(75,204

)

Total Segment Results

926,187

133,774

1,059,961

384,085

Corporate and consolidation entries

—

—

—

(57,792

)

Total

926,187

133,774

1,059,961

326,293

Six months ended September 30, 2018

(Unaudited)

Subscription revenue

Hardware and other revenue

Total revenue

Adjusted EBITDA

Africa

470,565

37,031

507,596

230,200

Europe

64,784

43,624

108,408

37,403

Americas

136,223

14,786

151,009

74,858

Middle East and Australasia

109,168

46,280

155,448

67,762

Brazil

29,417

1,290

30,707

11,292

Total Regional Sales Offices

810,157

143,011

953,168

421,515

Central Services Organization

385

6

391

(82,283

)

Total Segment Results

810,542

143,017

953,559

339,232

Corporate and consolidation entries

—

—

—

(59,879

)

Total

810,542

143,017

953,559

279,353

3. Segment information (continued)

United States Dollar Figures are in

thousands unless otherwise stated

Subscription revenue

Hardware and other

revenue

Total revenue

Adjusted EBITDA

Six months ended September 30, 2019

(Unaudited)

Africa

34,076

2,701

36,777

16,238

Europe

5,415

1,262

6,677

2,336

Americas

10,865

1,286

12,151

5,141

Middle East and Australasia

8,221

3,111

11,332

5,337

Brazil

2,461

427

2,888

1,240

Total Regional Sales Offices

61,038

8,787

69,825

30,292

Central Services Organization

48

37

85

(4,960

)

Total Segment Results

61,086

8,824

69,910

25,332

Corporate and consolidation entries

—

—

—

(3,811

)

Total

61,086

8,824

69,910

21,521

Six months ended September 30, 2018

(Unaudited)

Subscription revenue

Hardware and other revenue

Total revenue

Adjusted EBITDA

Africa

31,036

2,442

33,478

15,183

Europe

4,273

2,877

7,150

2,467

Americas

8,985

975

9,960

4,937

Middle East and Australasia

7,200

3,053

10,253

4,469

Brazil

1,940

85

2,025

745

Total Regional Sales Offices

53,434

9,432

62,866

27,801

Central Services Organization

25

1

26

(5,427

)

Total Segment Results

53,459

9,433

62,892

22,374

Corporate and consolidation entries

—

—

—

(3,950

)

Total

53,459

9,433

62,892

18,424

4. Reconciliation of Adjusted EBITDA to

Profit for the Period

South African Rand

Six months ended

Six months ended

Three months ended

Three months ended

Figures are in thousands unless otherwise

stated

September 30,

September 30,

September 30,

September 30,

2019

2018

2019

2018

Unaudited

Unaudited

Unaudited

Unaudited

Adjusted EBITDA

326,293

279,353

171,540

152,910

Add:

Decrease in restructuring cost

provision

8

—

8

—

Net profit on sale of property, plant and

equipment and intangible assets

711

238

635

217

Less:

Depreciation (1)

(106,275

)

(86,180

)

(55,264

)

(45,522

)

Amortization (2)

(34,182

)

(32,454

)

(16,971

)

(16,359

)

Impairment of product development costs

capitalized

(421

)

(51

)

(421

)

(51

)

Equity-settled share-based compensation

costs

(12,730

)

(4,167

)

(7,934

)

(2,159

)

Increase in restructuring cost

provision

—

(2,308

)

—

(2,330

)

Operating profit

173,404

154,431

91,593

86,706

Add: Finance (costs)/income - net

(872

)

628

(1,942

)

473

Less: Taxation

(61,328

)

(86,274

)

(45,130

)

(32,829

)

Profit for the period

111,204

68,785

44,521

54,350

(1)

Includes depreciation of property, plant

and equipment (including in-vehicle devices).

(2)

Includes amortization of intangible assets

(including product development costs and intangible assets

identified as part of a business combination).

4. Reconciliation of Adjusted EBITDA to

Profit for the Period (continued)

United States Dollar

Six months ended

Six months ended

Three months ended

Three months ended

Figures are in thousands unless otherwise

stated

September 30,

September 30,

September 30,

September 30,

2019

2018

2019

2018

Unaudited

Unaudited

Unaudited

Unaudited

Adjusted EBITDA

21,521

18,424

11,313

10,085

Add:

Decrease in restructuring cost

provision

1

—

1

—

Net profit on sale of property, plant and

equipment and intangible assets

47

16

42

13

Less:

Depreciation (1)

(7,009

)

(5,684

)

(3,645

)

(3,002

)

Amortization (2)

(2,254

)

(2,140

)

(1,119

)

(1,079

)

Impairment of product development costs

capitalized

(30

)

(3

)

(28

)

(3

)

Equity-settled share-based compensation

costs

(840

)

(275

)

(523

)

(142

)

Increase in restructuring cost

provision

—

(152

)

—

(154

)

Operating profit

11,436

10,186

6,041

5,718

Add: Finance (costs)/income - net

(57

)

42

(128

)

31

Less: Taxation

(4,045

)

(5,690

)

(2,977

)

(2,164

)

Profit for the period

7,334

4,538

2,936

3,585

(1)

Includes depreciation of property, plant

and equipment (including in-vehicle devices).

(2)

Includes amortization of intangible assets

(including product development costs and intangible assets

identified as part of a business combination).

5. Reconciliation of Adjusted EBITDA

margin to Profit for the Period margin

Six months ended

Six months ended

Three months ended

Three months ended

September 30,

September 30,

September 30,

September 30,

2019

2018

2019

2018

Unaudited

Unaudited

Unaudited

Unaudited

Adjusted EBITDA margin

30.8

%

29.3

%

31.9

%

30.8

%

Add:

Decrease in restructuring cost

provision

0.0

%

—

0.0

%

—

Net profit on sale of property, plant and

equipment and intangible assets

0.1

%

0.0

%

0.1

%

0.0

%

Less:

Depreciation

(10.0

%)

(9.0

%)

(10.2

%)

(9.1

%)

Amortization

(3.2

%)

(3.5

%)

(3.2

%)

(3.3

%)

Impairment of product development costs

capitalized

(0.1

%)

(0.0

%)

(0.1

%)

(0.0

%)

Equity-settled share-based compensation

costs

(1.2

%)

(0.4

%)

(1.5

%)

(0.4

%)

Increase in restructuring cost

provision

—

(0.2

%)

—

(0.5

%)

Operating profit margin

16.4

%

16.2

%

17.0

%

17.5

%

Add: Finance (costs)/income - net

(0.1

%)

0.1

%

(0.3

%)

0.1

%

Less: Taxation

(5.8

%)

(9.1

%)

(8.4

%)

(6.7

%)

Profit for the period margin

10.5

%

7.2

%

8.3

%

10.9

%

6. Assets Classified as Held for Sale