McDonald's and Mondelez Say Taste, Not Health, Will Drive Food Sales

October 08 2019 - 8:35AM

Dow Jones News

By Annie Gasparro and Micah Maidenberg

For some food companies, the hype surrounding healthier fare is

lip service.

McDonald's USA President Chris Kempczinski said most of its

customers order based on taste, not nutritional value or

environmental impact.

"Other considerations become tie breakers," Mr. Kempczinski said

at The Wall Street Journal Global Food Forum in New York on

Monday.

Dirk Van de Put, chief executive officer of Oreo maker Mondelez

International Inc., said at the forum that even as the snack

company cuts sugar in some of its products and adds probiotics to

others, indulgences such as Cadbury chocolate and Chips Ahoy

continue to drive sales.

"There's a difference between what people say and what they do,"

he said. "The facts of what people really buy are very

different."

McDonald's and Mondelez are among companies focusing on

improving and marketing their core products.

Healthier snacks make up about 20% of the global snack market,

Mr. Van de Put said. Those sales are growing faster than those of

indulgent snacks but won't ever reach 80% of sales, he said.

Food companies are still investing in healthier products, but

they don't always find fans.

McDonald's in recent years replaced french fries with apples in

its kids' meals. But it discontinued some of the salads it had

added to its menu. In 2017, Mondelez introduced a health-oriented

cracker it called Vea, with such flavors as Greek hummus and Tuscan

herbs. The high-fiber snack was ultimately a dud, and Mondelez

discontinued it after spending three years developing the product,

Mr. Van de Put said.

Now Mondelez is trying to test new ideas more nimbly, with

smaller numbers of consumers to gauge their response.

"It is difficult to predict what will be big," he said.

Food companies and restaurants have worked for years to give

consumers more healthful and natural foods. While sales for such

products have surged, some established food companies have

struggled to figure out how to keep up with new brands and chains

that have grabbed much of the growth.

Campbell Soup Co. is trying again to revive its soup sales after

abandoning an attempt to sell fresh foods, and the private-equity

backers that took Hostess Brands Inc. public three years ago found

new growth by improving the chain's decadent Twinkies and Ding

Dongs.

"There is a very, very small group of consumers out there who

will buy something that doesn't taste great because it conforms to

their particular values," Mr. Kempczinski said.

Some newer companies say young consumers in particular respond

to their claims of healthfulness and environmental mindfulness.

"Consumers want something else from food," said Jonathan Neman,

co-founder and CEO of the build-your-own salad chain Sweetgreen.

"They want food they can trust." He added that such products still

have to taste good.

"You can't just tell people to eat it because it's healthy," he

said.

Heather Haddon contributed to this article.

Write to Annie Gasparro at annie.gasparro@wsj.com and Micah

Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

October 08, 2019 08:20 ET (12:20 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

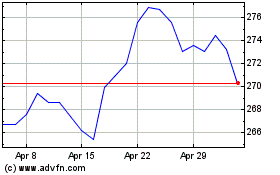

McDonalds (NYSE:MCD)

Historical Stock Chart

From Mar 2024 to Apr 2024

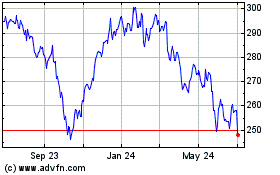

McDonalds (NYSE:MCD)

Historical Stock Chart

From Apr 2023 to Apr 2024