Lowe's Posts Revenue and Profit Gain -- 2nd Update

March 01 2017 - 1:28PM

Dow Jones News

By Sarah Nassauer and Austen Hufford

The strengthening U.S. economy and housing market boosted Lowe's

Cos. in its latest quarter, as more consumers replaced household

appliances and took on home-improvement projects.

The retailer's sales at stores open at least a year rose 4.2%,

driven by an uptick in categories such as appliances, plumbing,

lumber and lawn and garden.

"They feel it's a good time to invest in their homes again,"

said Chief Executive Robert Niblock in an interview Wednesday. "The

opportunity is there, it just means you need to capitalize on the

opportunity."

Lowe's said it expects the improving economic conditions to spur

sales through 2017, shoring up what had been two weaker previous

quarters for the company. Last November it cut its financial

forecast for the year, citing a slightly slower spending

environment.

Lowe's sales performance fell short of rival Home Depot Inc.,

which reported last week a 5.8% increase at existing stores for the

quarter.

Still, Lowe's shares rose 9.5% in midday trading to $81.44.

The results "provides some comfort that the company is getting

back onto a firmer growth trajectory after a period of relative

softness and widening underperformance compared to Home Depot,"

said Global Data in a research note.

Many retailers are struggling to adapt as consumers increasingly

shift their shopping online and away from physical stores. Target

Corp. on Tuesday warned that its 2017 profit would be as much as

25% lower than Wall Street's forecasts.

Some retailers appear to be thriving, however, including

Wal-Mart Stores Inc., which has invested heavily in its e-commerce

capabilities, as well as Home Depot, which like Lowe's is

benefiting from the resurgent housing market and rising property

values.

Lowe's said the number of customer transactions rose 15% as the

average each customer spent per sale rose 3.6%, mainly driven by

more big-ticket appliance purchases. The company reported positive

comparable sales in 12 of its 13 product categories.

Lowe's quarterly profit was helped by double-digit revenue

gains, though it included about $84 million in severance-related

costs.

So far this year it has laid off around 2,400 assistant store

managers and 525 headquarters staff, Mr. Niblock said. The company

is shifting its labor force to "best support where the consumer is

going in the future," he said.

In all for the quarter, Lowe's earnings rose to $663 million, or

74 cents a share, from $11 million, or 1 cent a share. Revenue rose

19% to $15.78 billion.

For 2017, Lowe's said it expects to add 35 stores, grow

comparable-store sales by 3.5% and post earnings per share of

$4.64. As of Feb. 3, Lowe's operated 2,129 stores, up 15% from last

year, largely from the purchase of Canadian home-improvement chain

Rona Inc.

Write to Sarah Nassauer at sarah.nassauer@wsj.com and Austen

Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

March 01, 2017 13:13 ET (18:13 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

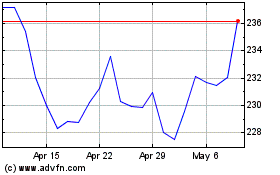

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

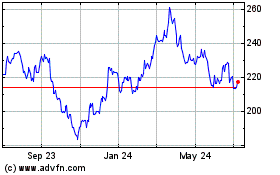

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Apr 2023 to Apr 2024