Statement of Changes in Beneficial Ownership (4)

November 23 2021 - 5:36PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Leo Investors III LP |

2. Issuer Name and Ticker or Trading Symbol

Local Bounti Corporation/DE

[

LOCL

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director __X__ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

21 GROSVENOR PLACE |

3. Date of Earliest Transaction

(MM/DD/YYYY)

11/19/2021 |

|

(Street)

LONDON, X0 SW1X 7HF

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 11/19/2021 | | J(1) | | 6770000 | A | (1) | 6770000 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Class B ordinary shares | (1) | 11/19/2021 | | J (1) | | | 6770000 | (1) | (1) | Class A ordinary shares | 6770000 | (1) | 0 | D | |

| Warrants to purchase Common stock | $11.50 | 11/19/2021 | | J (2) | | 5333333 | | 12/19/2021 (2) | 11/19/2026 (2) | Common Stock | 5333333 | $1.50 | 5333333 | D | |

| Explanation of Responses: |

| (1) | In connection with the consummation of the transactions contemplated by the Agreement and Plan of Merger, dated June 17, 2021, by and among Leo Holdings III Corp ("Leo"), Longleaf Merger Sub, Inc., Longleaf Merger Sub II, LLC and Local Bounti Corporation (the transactions contemplated thereby, the "Business Combination"), Leo domesticated as a Delaware corporation (the "Domestication") and changed its name to "Local Bounti Corporation" ("Local Bounti"). In connection with the Domestication, Leo Investors III LP's (the "Sponsor") Class B ordinary shares, par value $0.0001 per share, of Leo, which were previously convertible into Class A ordinary shares of Leo, were automatically converted into shares of Class A common stock of Local Bounti, par value $0.0001 per share, on a one-for-one basis. |

| (2) | Pursuant to the Private Placement Warrant Purchase Agreement, dated as of February 25, 2021, by and between Leo and the Sponsor, the Sponsor purchased warrants to purchase Class A ordinary shares, which following the Domestication entitle the Sponsor to purchase shares of Class A common stock of Local Bounti (the "Private Placement Warrants") for a price of $1.50 per Private Placement Warrant. Pursuant to the Warrant Agreement, dated March 2, 2021 (as amended on November 19, 2021), by and between Leo and Continental Stock Transfer & Trust Company, upon consummation of the Business Combination, the Private Placement Warrants became exercisable, beginning 30 days after the closing of the Business Combination, for one share of Class A common stock at a price of $11.50 per share. The Private Placement Warrants expire on the fifth anniversary of the consummation of the Business Combination. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Leo Investors III LP

21 GROSVENOR PLACE

LONDON, X0 SW1X 7HF |

| X |

|

|

Signatures

|

| /s/ Simon Brown | | 11/23/2021 |

| **Signature of Reporting Person | Date |

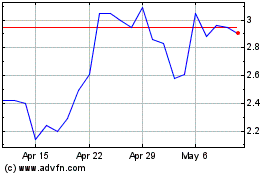

Local Bounti (NYSE:LOCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

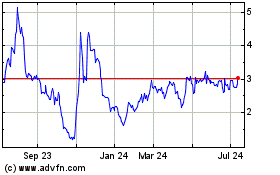

Local Bounti (NYSE:LOCL)

Historical Stock Chart

From Apr 2023 to Apr 2024