SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2022

Commission File Number 1-12260

COCA-COLA FEMSA, S.A.B. de C.V.

(Translation of Registrant’s name into English)

United Mexican States

(Jurisdiction of incorporation or organization)

Calle Mario Pani No. 100,

Sante Fe Cuajimalpa,

Cuajimalpa de Morelos,

05348, Ciudad de México,

México

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will

file annual reports

under cover of Form 20-F or Form 40-F:

Form 20-F x Form

40-F ¨

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(1): _______

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(7): _______

Indicate by check mark whether by furnishing the information

contained in this

Form, the registrant is also thereby furnishing the information

to the

Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.

Yes ¨ No

x

If "Yes" is marked, indicate below the file number

assigned to the registrant in

connection with Rule 12g3-2(b): 82-_____________

Coca-Cola

FEMSA announces successful pricing of the first

social

bonds in the consumer sector in the Americas

and

sustainability bonds in Mexico

| · | Coca-Cola FEMSA

becomes the first company in the consumer sector to price social bonds in the Americas, and prices the first social bonds of the Coca-Cola

System. |

| · | Furthermore, Coca-Cola

FEMSA has become the first company in the consumer sector in Mexico to price sustainability bonds. |

Mexico City, Mexico - October 6, 2022 -

Coca-Cola FEMSA, S.A.B. de C.V. (BMV: KOF UBL; NYSE: KOF) (“Coca-Cola FEMSA” or the “Company”), announces

the successful pricing of its social and sustainability bonds in the Mexican market for a total of Ps. 6,000 million, becoming the first

non-financial corporate in Mexico and the first corporation from the consumer sector to price financial instruments with a social label

in the Americas.

The transaction was completed through a dual-tranche

format with the tickers KOF22S and KOF22X. The first tranche was priced at a fixed rate of 9.95% (Mbono+0.30%) for an amount of Ps. 5,500

million due in 7 years; the net proceeds of this bond will be used to finance social projects. The second tranche was priced at a variable

rate of TIIE + 0.05% for an amount of Ps. 500 million due in 4 years; the net proceeds of this bond will be used to finance sustainability

projects. In both cases, the projects should comply with eligibility criteria defined in the Sustainability Bonds Framework attached to

each supplement.

Both issuances received a credit rating of

mxAAA from S&P Global Ratings S.A. de C.V. and AAA.mx by Moody’s de México, S.A. de C.V. BBVA México and HSBC

México acted as placement intermediaries and social structuring agents in the issuance of these bonds.

“This issuance reaffirms our commitment

to the development of our communities, while endorsing our environmental projects’ goals and our vision of placing sustainability

at the heart of our business. As industry leaders, we at Coca-Cola FEMSA are convinced that sustainable and social financing enables us

to promote projects that generate a positive impact, creating social and environmental value for our stakeholders,” said John

Santa Maria, CEO of Coca-Cola FEMSA.

Eduardo Osuna Osuna, Vice President and CEO

of BBVA Mexico, commented, "BBVA Mexico is strongly committed to promoting actions that enhance social development in order to

support the communities in need, and that are positive for our environment.” He added, “The bank has supported its

clients by participating as an intermediary in the placement of green and social bonds, reaching an amount of more than Ps. 21,000 million

year-to-date.”

Additionally, Juan Carlos Pérez Rocha,

Deputy CEO of Wholesale Banking of HSBC Mexico stated, “At HSBC we are committed to a sustainable future and, therefore, to providing

solutions to our clients that support them in their transition to a low-carbon economy. We are proud to be part of this important placement

for Coca-Cola FEMSA, which positions them as the first corporate in the consumer sector to issue a social bond in America and the first

investment grade corporate in the food and beverage sector in Latin America to place a sustainable bond.”

The net resources from these bonds will be

used to finance projects focused on the development of the communities in which the Company has a presence and that respond to their local

needs. Coca-Cola FEMSA has become the first non-financial corporation in the Americas and the first company in the Coca-Cola System to

issue a social bond, making the financing of social projects available to investors. Among the outstanding social projects are support

programs that provide entrepreneurial and self-employment skills, financial solutions that support store owners, and investments in sustainable

community development, including water replenishment projects and water access in vulnerable communities.

This issuance complements Coca-Cola FEMSA’s

Green Bond placed in 2020 and Sustainability-linked Bonds issued in 2021, and reinforces the Company's commitment to its stakeholders,

particularly in the territories where it has presence, aligned with the United Nations’ Sustainable Development Goals (SDGs), through

actions that impact both the environment and communities. In addition, by financially empowering initiatives in the hands of women, these

actions respond to the United Nations’ Women's Empowerment Principles (WEPs).

As part of the issuance, the Company published

a Sustainability Bonds Framework, which is aligned with the 2020 Sustainability Linked Bonds Principles (“SLBP”), as administered

by the International Association of Capital Markets. This Framework includes the pillars that guide the Company's long-term sustainability

strategy, as well as key indicators that are aligned with its sustainability goals for 2030. Additionally, the Company obtained an opinion

from S&P Global Ratings, an independent third party, confirming that the projects included in the Sustainability Bonds Framework are

aligned with the industry’s best practices.

Information on the Sustainable Bond Framework

and the opinion of the independent third party is available at: https://coca-colafemsa.com/en/sustainability-bonds/

For additional information, please contact the Investor

Relations team:

| • | Jorge Collazo | jorge.collazo@kof.com.mx |

| • | Lorena Martin | lorena.martinl@kof.com.mx |

| • | Marene Aranzabal | marene.aranzabal@kof.com.mx |

| • | Jose Enrique Solís | tmxjose.solis@kof.com.mx |

Media:

| • | Vanessa Aleman Ortíz | vanessa.aleman@femsa.com |

| • | Oscar Martínez Hernández | oscarf.martinez@femsa.com |

COCA-COLA FEMSA

October, 06 2022

SIGNATURE

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: October 6, 2022

COCA-COLA FEMSA, S.A.B. DE C.V.

By: /s/ Constantino Spas Montesinos

Name: Constantino Spas Montesinos

Title: Chief Financial Officer

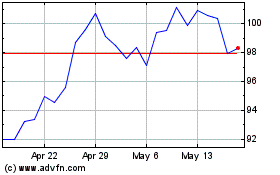

Coca Cola FEMSA SAB De CV (NYSE:KOF)

Historical Stock Chart

From Apr 2024 to May 2024

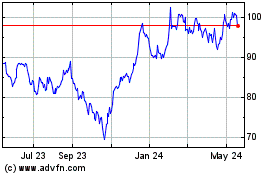

Coca Cola FEMSA SAB De CV (NYSE:KOF)

Historical Stock Chart

From May 2023 to May 2024