FALSE000176704200017670422024-03-062024-03-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM 8-K

____________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 6, 2024

____________________

Kodiak Gas Services, Inc.

(Exact name of registrant as specified in its charter)

____________________

| | | | | | | | | | | | | | |

| Delaware | | 001-41732 | | 83-3013440 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

9950 Woodloch Forest Dr., 19th Floor, The Woodlands, Texas | | 77380 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (936) 539-3300

Not Applicable

(Former name or former address, if changed since last report.)

____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

o | Written communications pursuant to Rule 425 under the Securities Act |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | | KGS | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On March 6, 2024, Kodiak Gas Services, Inc. (the “Company”) issued a press release providing information on its results of operations and financial condition for the quarter ended December 31, 2023. The press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information under this Item 2.02 and in Exhibit 99.1 to this Current Report on Form 8-K are being furnished and shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information under this Item 2.02 and in Exhibit 99.1 to this Current Report on Form 8-K shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits.

d) Exhibits.

| | | | | |

| No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Kodiak Gas Services, Inc. |

| | | |

Date: March 6, 2024 | By: | /s/ Kelly M. Battle |

| Name: | | Kelly M. Battle |

| Title: | | Executive Vice President, Chief Legal Officer, |

| Chief Compliance Officer and Corporate Secretary |

| | | | | | | | |

| | Contacts:

Kodiak Gas Services, Inc.

Graham Sones, VP – Investor Relations

ir@kodiakgas.com Dennard Lascar Investor Relations Ken Dennard / Rick Black KGS@DennardLascar.com |

Kodiak Gas Services Reports Fourth Quarter and Full Year 2023 Results; Achieves Record Annual Revenues and Adjusted EBITDA; Provides Full Year 2024 Guidance

The Woodlands, Texas — March 6, 2024 — Kodiak Gas Services, Inc. (NYSE: KGS) (“Kodiak” or the “Company”), a leading provider of critical energy infrastructure and contract compression services, today reported financial and operating results for the fourth quarter and full year ended December 31, 2023 and also provided full-year 2024 guidance.

Fourth Quarter 2023 Highlights

•Total revenues for fourth quarter 2023 were $226.0 million compared to $179.8 million for fourth quarter 2022.

•Fourth quarter 2023 Compression Operations segment Adjusted Gross Margin Percentage(1) increased 140 basis points over third quarter 2023.

•Net loss for the quarter ended December 31, 2023 was $6.9 million, including a $21.8 million loss on derivatives.

•Adjusted EBITDA(1) for the quarter ended December 31, 2023 was $113.9 million compared to $103.2 million for the quarter ended December 31, 2022.

•Paid inaugural cash dividend of $0.38 per share, or $1.52 per share annualized.

•Announced a definitive agreement to acquire CSI Compressco to create the industry's largest contract compression fleet.

Fiscal Year 2023 Highlights

•Total revenues for the year ended December 31, 2023 were $850.4 million compared to $707.9 million for the year ended December 31, 2022.

•Compression Operations segment revenues grew 12.3% over the year ended December 31, 2022.

•Compression Operations Adjusted Gross Margin increased 11.5% compared to the year ended December 31, 2022.

•Net income for the year ended December 31, 2023 was $20.1 million.

•Adjusted EBITDA was $438.1 million compared to $399.0 million for the year ended December 31, 2022.

•Horsepower utilization ended 2023 at 99.9%.

2024 Outlook Highlights

•Initiated standalone 2024 Adjusted EBITDA guidance of $460 million to $490 million.

•Expected Discretionary Cash Flow of $295 million to $310 million will allow for continued investment in the fleet and return of capital to shareholders.

"2023 was a historic year for Kodiak with several noteworthy milestones, including our June IPO, the November initiation of a quarterly dividend, and the announcement of the agreement to acquire CSI Compressco" stated Mickey McKee, Kodiak’s founder and Chief Executive Officer. “Financially, we set new annual revenue and Adjusted EBITDA records while at the same time maintaining capital discipline and generating a new Kodiak record level of Free Cash Flow. Our fourth quarter results continued to reflect the

(1) Adjusted Gross Margin and Adjusted EBITDA are Non-GAAP Financial Measures. Definitions and reconciliations to the most comparable GAAP financial measures are included herein.

strength of our customer-focused strategy with record Adjusted EBITDA and margin improvement in both our Compression Operations and Other Services segments. Kodiak’s record-setting year would not have been possible without the tireless efforts of our approximately 800 highly-capable employees to provide our customers with unequaled service quality.

"As we look forward, customer demand for large horsepower compression infrastructure continues to be strong, particularly in the Permian Basin, where over 70% of our horsepower is deployed. Our fleet is effectively fully utilized, and we expect this trend to last given the robust multi-year outlook for natural gas to supply the coming wave of LNG export projects. Our pending acquisition of CSI Compressco will give us the largest contract compression fleet in the industry and enhance both our service offerings and the scale of those offerings. Kodiak is fully contracted on our 2024 new unit deliveries, and deep in discussions with our customers on their 2025 needs. In closing, we remain committed to having the safest and most sustainable contract compression fleet in the industry and delivering the high quality of service and industry-leading mechanical availability that our customers have come to expect.”

Segment Information

Compression Operations segment revenues were $735.6 million in the year ended December 31, 2023, a 12.3% increase compared to $655.0 million in the year ended December 31, 2022. Compression Operations segment gross margin was $295.6 million in the year ended December 31, 2023, a 16.0% increase compared to $254.8 million in the year ended December 31, 2022. Compression Operations segment Adjusted Gross Margin was $478.5 million in the year ended December 31, 2023, an 11.5% increase compared to $429.2 million in the year ended December 31, 2022.

Other Services segment revenues were $114.8 million in the year ended December 31, 2023 compared to $53.0 million in the year ended December 31, 2022. This segment’s revenues finished the year well in excess of what the Company originally forecasted based on the award of and accelerated progress on two large projects in the second half of 2023. Other Services segment gross margin and Adjusted Gross Margin were each $21.0 million in the year ended December 31, 2023, up from $11.3 million in the year ended December 31, 2022.

Transaction Update

In December 2023, Kodiak announced a definitive merger agreement to acquire CSI Compressco in an all-equity transaction (the "Transaction") valued at approximately $854 million as of the announcement date, including the assumption of $619 million of net debt. The Transaction is expected to create the industry's largest contract compression fleet and be accretive to Discretionary Cash Flow and Free Cash Flow per share upon closing.

CSI Compressco majority unitholders delivered consents sufficient to approve the Transaction and closing is expected in the second quarter of 2024, subject to customary closing conditions and regulatory approval.

Long-Term Debt and Liquidity

Total debt outstanding was $1.8 billion as of December 31, 2023, comprised entirely of borrowings on the ABL Facility, and the leverage ratio was 3.96x. At December 31, 2023, the Company had $354.9 million available on its ABL Facility and was in compliance with all financial covenants.

In February 2024, the Company issued $750 million of 7.25% senior unsecured notes due 2029. In connection with the issuance, Kodiak was assigned corporate family/issuer credit ratings of 'Ba3', 'B+' and 'BB' by Moody's Investors Service, S&P Global Ratings and Fitch Ratings, respectively.

The proceeds from the notes offering were used to reduce borrowings under the ABL Facility. The Company intends to use the availability on its ABL Facility to repay CSI Compressco's outstanding indebtedness in full, as well as fees and expenses, in connection with the Transaction.

Summary Financial Data

(in thousands, except percentages)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Total Revenues | $ | 225,980 | | | $ | 230,983 | | | $ | 179,776 | | | $ | 850,381 | | | $ | 707,913 | |

| Net Income (loss) | $ | (6,874) | | | $ | 21,766 | | | $ | 1,909 | | | $ | 20,066 | | | $ | 106,265 | |

| Adjusted EBITDA (1) (2) | $ | 113,878 | | | $ | 110,067 | | | $ | 103,235 | | | $ | 438,148 | | | $ | 399,038 | |

| Adjusted EBITDA percentage (1) (2) | 50.4 | % | | 47.7 | % | | 57.4 | % | | 51.5 | % | | 56.4 | % |

| | | | | | | | | |

| Compression Operations Revenues | $ | 189,616 | | | $ | 186,673 | | | $ | 170,992 | | | $ | 735,605 | | | $ | 654,957 | |

| Compression Operations Adjusted Gross Margin (1) | $ | 125,781 | | | $ | 121,203 | | | $ | 112,422 | | | $ | 478,513 | | | $ | 429,242 | |

| Compression Operations Adjusted Gross Margin Percentage (1) | 66.3 | % | | 64.9 | % | | 65.7 | % | | 65.1 | % | | 65.5 | % |

| | | | | | | | | |

| Other Services Revenues | $ | 36,364 | | | $ | 44,310 | | | $ | 8,784 | | | $ | 114,776 | | | $ | 52,956 | |

| Other Services Adjusted Gross Margin (1) | $ | 8,492 | | | $ | 5,490 | | | $ | 1,786 | | | $ | 20,997 | | | $ | 11,320 | |

| Other Services Adjusted Gross Margin Percentage (1) | 23.4 | % | | 12.4 | % | | 20.3 | % | | 18.3 | % | | 21.4 | % |

| | | | | | | | | |

| Maintenance Capital Expenditures | $ | 8,934 | | | $ | 12,312 | | | $ | 20,542 | | | $ | 36,990 | | | $ | 48,313 | |

| Growth Capital Expenditures | $ | 60,472 | | | $ | 55,671 | | | $ | 49,791 | | | $ | 184,487 | | | $ | 212,953 | |

| | | | | | | | | |

| Discretionary Cash Flow (1) (2) | $ | 70,527 | | | $ | 63,044 | | | $ | 31,071 | | | $ | 248,149 | | | $ | 188,547 | |

| Free Cash Flow (1) (2) | $ | 10,449 | | | $ | 7,373 | | | $ | (18,661) | | | $ | 65,111 | | | $ | (16,324) | |

(1)Adjusted EBITDA, Adjusted EBITDA Percentage, Adjusted Gross Margin, Adjusted Gross Margin Percentage, Discretionary Cash Flow, and Free Cash Flow are non-GAAP financial measures. For definitions and reconciliations to the most directly comparable financial measures calculated and presented in accordance with GAAP, see “Non-GAAP Financial Measures” below.

(2)For the three months ended December 31, 2023, September 30, 2023 and December 31, 2022, includes $5.1 million, $2.0 million, and $0, respectively, of non-cash provisions for expected credit losses. For the years ended December 31, 2023 and 2022, includes $7.1 million and $0.1 million, respectively, of non-cash provisions for expected credit losses.

Summary Operating Data

(as of the dates indicated)

| | | | | | | | | | | | | | | | | |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 |

| Fleet horsepower (1) | 3,261,661 | | | 3,213,096 | | | 3,134,306 | |

| Revenue-generating horsepower (2) | 3,258,951 | | | 3,210,076 | | | 3,131,631 | |

| Fleet compression units (1) | 3,078 | | | 3,051 | | | 3,024 | |

| Revenue-generating compression units (2) | 3,062 | | | 3,034 | | | 3,021 | |

| Revenue-generating horsepower per revenue-generating compression unit (3) | 1,064 | | | 1,058 | | | 1,037 | |

| Horsepower utilization (4) | 99.9 | % | | 99.9 | % | | 99.9 | % |

(1)Fleet horsepower and fleet compression units include revenue-generating horsepower and idle horsepower, which are compression units that do not have a signed contract or are not subject to a firm commitment from our customer and are not yet generating revenue. Fleet horsepower excludes 33,020, 31,520 and 58,645 of non-marketable or obsolete horsepower as of three months ended December 31, 2023, September 30, 2023 and December 31, 2022, respectively.

(2)Revenue-generating horsepower and revenue-generating compression units include compression units that are operating under contract and generating revenue and compression units which are available to be deployed and for which we have a signed contract or are subject to a firm commitment from our customer.

(3)Calculated as (i) revenue-generating horsepower divided by (ii) revenue-generating compression units at period end.

(4)Calculated as (i) revenue-generating horsepower divided by (ii) fleet horsepower at period end.

Full-Year 2024 Guidance

Kodiak is providing initial guidance for the full year 2024. Note that the amounts below do not include any impact from the pending acquisition of CSI Compressco. All amounts below are in thousands except percentages.

| | | | | | | | | | | | | | |

| | Full-Year 2024 Guidance |

| | Low | | High |

| Adjusted EBITDA (1) | | $ | 460,000 | | $ | 490,000 |

| Discretionary Cash Flow (1) (2) | | $ | 295,000 | | $ | 310,000 |

| | | | |

| Segment Information | | | | |

| Compression Operations revenues | | $ | 795,000 | | $ | 825,000 |

| Compression Operations Adjusted Gross Margin Percentage (1) | | 64.0% | | 66.0% |

| Other Services revenues | | $ | 60,000 | | $ | 80,000 |

| Other Services Adjusted Gross Margin Percentage (1) | | 15.0% | | 20.0% |

| | | | |

| Capital Expenditures | | | | |

| Growth capital expenditures, net (3) | | $ | 165,000 | | $ | 185,000 |

| Maintenance capital expenditures | | $ | 40,000 | | $ | 50,000 |

(1)The Company is unable to reconcile projected Adjusted EBITDA to projected net income (loss), projected Discretionary Cash Flow to projected net cash provided by operating activities and projected Adjusted Gross Margin to projected gross margin, the most comparable financial measures calculated in accordance with GAAP, respectively, without unreasonable efforts because components of the calculations are inherently unpredictable, such as changes to current assets and liabilities, unknown future events, and estimating certain future GAAP measures. The inability to project certain components of the calculation would significantly affect the accuracy of the reconciliations.

(2)Discretionary Cash Flow guidance assumes no change to Secured Overnight Financing Rate futures and that our senior unsecured notes due 2029 remain outstanding for the duration of 2024.

(3)Growth capital expenditures include new compression units, compression unit upgrades, capitalized make-ready costs and capitalized installation costs, as well as expenditures on assets other than compression units required to operate the business. For 2024, growth capital expenditures include approximately $12.5 million of non-unit-related expenditures and are presented net of proceeds from expected facility sales.

Conference Call

Kodiak will conduct a conference call on Thursday, March 7, 2024 at 11:00 a.m. Eastern Time (10:00 a.m. Central Time) to discuss financial and operating results for the quarter and year ended December 31, 2023. To listen to the call by phone, dial 201-389-0872 and ask for the Kodiak Gas Services call at least 10 minutes prior to the start time. To listen to the call via webcast, please visit the Investors tab of Kodiak’s website at www.kodiakgas.com.

About Kodiak Gas Services, Inc.

Kodiak Gas Services, Inc. is one of the largest contract compression services providers in the continental United States with a revenue-generating fleet of approximately 3.3 million horsepower. The company focuses on providing contract compression services to oil and gas producers and midstream customers in high‐volume gas gathering systems, processing facilities, multi‐well gas lift applications and natural gas transmission systems. More information is available at www.kodiakgas.com.

Non-GAAP Financial Measures

Adjusted EBITDA is defined as net income (loss) before interest expense, net: income tax expense (benefit); and depreciation and amortization; plus (i) loss on extinguishment of debt; (ii) loss (gain) on derivatives; (iii) equity compensation expense; (iv) transaction expenses; (v) loss (gain) on sale of assets; and (vi) impairment of compression equipment. Adjusted EBITDA Percentage is defined as Adjusted EBITDA divided by total revenues. Adjusted EBITDA and Adjusted EBITDA Percentage are used as supplemental financial measures by our management and external users of our financial statements, such as investors, commercial banks and other financial institutions, to assess: (i) the financial performance of our assets without regard to the impact of financing methods, capital structure or historical cost basis of our assets; (ii) the viability of capital expenditure projects and the overall rates of return on alternative investment opportunities; (iii) the ability of our assets to generate cash sufficient to make debt payments and pay dividends; and (iv) our operating performance as compared to those of other companies in our industry without regard to the impact of financing methods and capital structure. We believe Adjusted EBITDA and Adjusted EBITDA Percentage provide useful information because, when viewed with our GAAP results and the accompanying reconciliation, they provide a more complete understanding of our performance than GAAP results alone. We also believe that external users of our financial statements benefit from having access to the same financial measures that management uses in evaluating the results of our business. Reconciliations of Adjusted EBITDA to net income (loss), the most directly comparable GAAP financial measure, and net cash provided by operating activities are presented below.

Adjusted Gross Margin is defined as revenue less cost of operations, exclusive of depreciation and amortization expense. Adjusted Gross Margin Percentage is defined as Adjusted Gross Margin divided by total revenues. We believe Adjusted Gross Margin and Adjusted Gross Margin Percentage are useful as supplemental measures to investors of our operating profitability. Reconciliations of Adjusted Gross Margin to gross margin are presented below.

Discretionary Cash Flow is defined as net cash provided by operating activities less (i) maintenance capital expenditures; (ii) gain (loss) on sale of property, plant and equipment; (iii) certain changes in operating assets and liabilities; and (iv) certain other expenses; plus (x) cash loss on extinguishment of debt; and (y) transaction expenses. We believe Discretionary Cash Flow is a useful liquidity and performance measure and supplemental financial measure for us in assessing our ability to pay cash dividends to our stockholders, make growth capital expenditures and assess our operating performance. Reconciliations of Discretionary Cash Flow to net income (loss) and net cash provided by operating activities are presented below.

Free Cash Flow is defined as net cash provided by operating activities less (i) maintenance capital expenditures; (ii) gain (loss) on sale of property, plant and equipment; (iii) certain changes in operating assets and liabilities; (iv) certain other expenses; and (v) net growth capital expenditures; plus (x) cash loss on extinguishment of debt; (y) transaction expenses; and (z) proceeds from sale of property, plant and equipment. We believe Free Cash Flow is a liquidity measure and useful supplemental financial measure for us in assessing our ability to pursue business opportunities and investments to grow our business and to service our debt. Reconciliations of Free Cash Flow to net income (loss) and net cash provided by operating activities are presented below.

Cautionary Note Regarding Forward-Looking Statements

This news release contains, and our officers and representatives may from time to time make, “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “will” and similar references to future periods. Examples of forward-looking statements include, among others, statements we make regarding: (i) expected operating results, such as revenue growth and earnings, including upon consummation of the Transaction, and our ability to service our indebtedness; (ii) anticipated levels of capital expenditures and uses of capital; (iii) current or future volatility in the credit markets and future market conditions; (iv) potential or pending acquisition transactions, including the Transaction, or other strategic transactions, the timing thereof, the receipt of necessary approvals to close such acquisitions, our ability to finance such acquisitions, and our ability to achieve the intended operational, financial, and strategic benefits from any such transactions; (v) expected synergies and efficiencies to be achieved as a result of the Transaction; (vi) expectations regarding the leverage and dividend profile upon consummation of the Transaction, including the amount and timing of future dividend payments; (vii) expectations of the effect on our financial condition of claims, litigation, environmental costs, contingent liabilities and governmental and regulatory investigations and proceedings; (viii) production and capacity forecasts for the natural gas and oil industry; (ix) strategy for customer retention, growth, fleet maintenance, market position and financial results; (x) our interest rate hedges; and (xi) strategy for risk management.

Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not place undue reliance on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following: (i) a reduction in the demand for natural gas and oil; (ii) the loss of, or the deterioration of the financial condition of, any of our key customers; (iii) nonpayment and nonperformance by our customers, suppliers or vendors; (iv) competitive pressures that may cause us to lose market share; (v) the structure of our Compression Operations contracts and the failure of our customers to continue to contract for services after expiration of the primary term; (vi) our ability to consummate the Transaction on a timely basis or at all; (vii) our ability to successfully integrate any acquired businesses, including CSI Compressco, and realize the expected benefits thereof; (viii) difficulties and delays in meeting the conditions required for the closing of the Transaction; (ix) our ability to fund purchases of additional compression equipment; (x) a deterioration in general economic, business, geopolitical or industry conditions, including as a result of the conflict between Russia and Ukraine and the Israel-Hamas war, inflation, and slow economic growth in the United States; (xi) a downturn in the economic environment, as well as inflationary pressures; (xii) tax legislation and administrative initiatives or challenges to our tax positions; (x) the loss of key management, operational personnel or qualified technical personnel; (xiii) our dependence on a limited number of suppliers; (xiv) the cost of compliance with existing and new governmental regulations, including climate change legislation; (xv) the cost of compliance with regulatory initiatives and stakeholder pressures, including ESG scrutiny; (xvi) the inherent risks associated with our operations, such as equipment defects and malfunctions; (xvii) our reliance on third-party components for use in our IT systems; (xviii) legal and reputational risks and expenses relating to the privacy, use and security of employee and client information; (xix) threats of cyber-attacks or terrorism; (xx) agreements that govern our debt contain features that may limit our ability to operate our business and fund future growth and also increase our exposure to risk during adverse economic conditions; (xi) volatility in interest rates; (xxii) our ability to access the capital and credit markets or borrow on affordable terms to obtain additional capital that we may require; (xxiii) the effectiveness of our disclosure controls and procedures; and (xxiv) such other factors as discussed throughout the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of our Annual Report on Form 10-K for the year ended December 31, 2023, to be filed with the U.S. Securities and Exchange Commission.

Any forward-looking statement made by us in this news release is based only on information currently available to us and speaks only as of the date on which it is made. Except as may be required by applicable law, we undertake no obligation to publicly update any forward-looking statement whether as a result of new information, future developments or otherwise.

KODIAK GAS SERVICES, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Revenues: | | | | | | | | | |

| Compression Operations | $ | 189,616 | | | $ | 186,673 | | | $ | 170,992 | | | $ | 735,605 | | | $ | 654,957 | |

| Other Services | 36,364 | | | 44,310 | | | 8,784 | | | 114,776 | | | 52,956 | |

| Total revenues | $ | 225,980 | | | $ | 230,983 | | | $ | 179,776 | | | $ | 850,381 | | | $ | 707,913 | |

| Operating expenses: | | | | | | | | | |

| Cost of operations (exclusive of depreciation and amortization shown below) | | | | | | | | | |

| Compression Operations | 63,835 | | | 65,470 | | | 58,570 | | | 257,092 | | | 225,715 | |

| Other Services | 27,872 | | | 38,820 | | | 6,998 | | | 93,779 | | | 41,636 | |

| Depreciation and amortization | 46,455 | | | 46,087 | | | 44,550 | | | 182,869 | | | 174,463 | |

| Selling, general and administrative expenses | 27,137 | | | 19,648 | | | 12,122 | | | 73,308 | | | 44,882 | |

| Gain on sale of capital assets | (56) | | | — | | | (49) | | | (777) | | | (874) | |

| Total operating expenses | $ | 165,243 | | | $ | 170,025 | | | $ | 122,191 | | | $ | 606,271 | | | $ | 485,822 | |

| Income from operations | 60,737 | | | 60,958 | | | 57,585 | | | 244,110 | | | 222,091 | |

| Other income (expenses): | | | | | | | | | |

| Interest expense, net | (40,484) | | | (39,710) | | | (61,251) | | | (222,514) | | | (165,867) | |

| Loss on extinguishment of debt | — | | | (6,757) | | | — | | | (6,757) | | | — | |

| Gain (loss) on derivatives | (21,814) | | | 15,141 | | | 6,144 | | | 20,266 | | | 83,116 | |

| Other income (expense) | (8) | | | 38 | | | 27 | | | 31 | | | 17 | |

| Total other income (expenses) | $ | (62,306) | | | $ | (31,288) | | | $ | (55,080) | | | $ | (208,974) | | | $ | (82,734) | |

| Income before income taxes | (1,569) | | — | | 29,670 | | — | | 2,505 | | | 35,136 | | | 139,357 | |

| Income tax expense | 5,305 | | | 7,904 | | | 596 | | | 15,070 | | | 33,092 | |

| Net income (loss) | $ | (6,874) | | | $ | 21,766 | | | $ | 1,909 | | | $ | 20,066 | | | $ | 106,265 | |

| Basic and diluted earnings per share | | | | | | | | | |

| Basic net earnings per share | $ | (0.09) | | | $ | 0.28 | | | $ | 0.03 | | | $ | 0.29 | | | $ | 1.80 | |

| Diluted net earnings per share | $ | (0.09) | | | $ | 0.28 | | | $ | 0.03 | | | $ | 0.29 | | | $ | 1.80 | |

| Basic weighted average shares of common stock outstanding | 77,400,000 | | 76,731,868 | | 59,000,000 | | 68,058,630 | | 59,000,000 |

| Diluted weighted average shares of common stock outstanding | 77,675,607 | | | 76,899,483 | | | 59,000,000 | | 68,327,018 | | 59,000,000 |

KODIAK GAS SERVICES, INC.

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

(in thousands, except share and per share data)

| | | | | | | | | | | |

| As of December 31, |

| 2023 | | 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 5,562 | | | $ | 20,431 | |

| Accounts receivable, net | 113,192 | | | 97,551 | |

| Inventories, net | 76,238 | | | 72,155 | |

| Fair value of derivative instruments | 8,194 | | | 823 | |

| Contract assets | 17,424 | | | 3,555 | |

| Prepaid expenses and other current assets | 10,353 | | | 9,520 | |

| Total current assets | 230,963 | | | 204,035 | |

| Property, plant and equipment, net | 2,536,091 | | | 2,488,682 | |

| Operating lease right-of-use assets, net | 33,716 | | | 9,827 | |

| Goodwill | 305,553 | | | 305,553 | |

| Identifiable intangible assets, net | 122,888 | | | 132,362 | |

| Fair value of derivative instruments | 14,256 | | | 64,517 | |

| Other assets | 639 | | | 564 | |

| Total assets | $ | 3,244,106 | | | $ | 3,205,540 | |

| Liabilities and Stockholders' Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 49,842 | | | $ | 37,992 | |

| Accrued liabilities | 97,078 | | | 93,873 | |

| Contract liabilities | 63,709 | | | 57,109 | |

| Total current liabilities | 210,629 | | | 188,974 | |

| Long-term debt, net of unamortized debt issuance cost | 1,791,460 | | | 2,720,019 | |

| Operating lease liabilities, net of current portion | 34,468 | | | 6,754 | |

| Deferred tax liabilities | 62,748 | | | 57,155 | |

| Other liabilities | 2,148 | | | 3,545 | |

| Total liabilities | 2,101,453 | | | 2,976,447 | |

| Commitments and contingencies (Note 13) | | | |

| Stockholders’ equity: | | | |

Preferred stock, par value $0.01 par value; 50,000,000 shares of preferred stock authorized, zero issued as of December 31, 2023 and 2022, respectively | — | | | — | |

| Common stock, par value $0.01 per share; 750,000,000 shares of common stock authorized, 77,400,000 and 59,000,000 shares of common stock issued and outstanding as of December 31, 2023 and 2022, respectively | 774 | | | 590 | |

| Additional paid-in capital | 963,760 | | | 33,189 | |

| Retained earnings | 178,119 | | | 195,314 | |

| Total stockholders’ equity | 1,142,653 | | | 229,093 | |

| Total liabilities and stockholders’ equity | $ | 3,244,106 | | | $ | 3,205,540 | |

KODIAK GAS SERVICES, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

(in thousands)

| | | | | | | | | | | | | | |

| | Year Ended |

| | December 31, 2023 | | December 31, 2022 |

| Cash flows from operating activities: | | | | |

| Net income | | $ | 20,066 | | | $ | 106,265 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation and amortization | | 182,869 | | | 174,463 | |

| Stock-based compensation expense | | 5,914 | | | 971 | |

| Amortization of debt issuance costs | | 13,556 | | | 13,727 | |

| Non-cash lease expense | | 4,465 | | | 2,817 | |

| Provision for credit losses | | 7,101 | | | 86 | |

| Inventory reserve | | 500 | | | 500 | |

| (Gain) loss on sale of property, plant and equipment | | (777) | | | (874) | |

| Change in fair value of derivatives | | 42,890 | | | (87,363) | |

Deferred tax provision | | 7,863 | | | 27,301 | |

| Loss on extinguishment of debt | | 4,359 | | | — | |

| Changes in operating assets and liabilities: | | | | |

| Accounts receivable | | (22,742) | | | (16,887) | |

| Inventories | | (4,583) | | | (24,302) | |

| Contract assets | | (13,869) | | | (3,555) | |

| Prepaid expenses and other current assets | | (833) | | | (3,269) | |

| Accounts payable | | 10,166 | | | (1,518) | |

| Accrued and other liabilities | | 2,781 | | | 25,579 | |

| Contract liabilities | | 6,600 | | | 5,905 | |

| Net cash provided by operating activities | | 266,326 | | | $ | 219,846 | |

| Cash flows from investing activities: | | | | |

| Purchase of property, plant and equipment | | (219,795) | | | (259,349) | |

| Proceeds from sale of property, plant and equipment | | 1,449 | | | 8,082 | |

| Other | | (75) | | | (115) | |

| Net cash used in investing activities | | (218,421) | | | (251,382) | |

| Cash flows from financing activities: | | | | |

| Borrowings on debt instruments | | 1,020,102 | | | 1,613,886 | |

| Payments on debt instruments | | (1,243,981) | | | (724,895) | |

| Payment of debt issuance cost | | (32,768) | | | (27,819) | |

| Proceeds from initial public offering, net of underwriter discounts | | 277,840 | | | — | |

| Offering costs | | (10,039) | | | — | |

| Loss on extinguishment of debt | | (1,835) | | | — | |

| Dividends paid to stockholders | | (29,793) | | | — | |

| Distribution to parent | | (42,300) | | | (838,000) | |

| Net cash (used in) provided by financing activities | | (62,774) | | | 23,172 | |

Net decrease in cash and cash equivalents | | (14,869) | | | (8,364) | |

| Cash and cash equivalents - beginning of year | | 20,431 | | | 28,795 | |

| Cash and cash equivalents - end of year | | $ | 5,562 | | | $ | 20,431 | |

| Supplemental cash disclosures: | | | | |

| Cash paid for interest | | $ | 216,648 | | | $ | 143,441 | |

| Cash paid for taxes | | $ | 9,762 | | | $ | 2,177 | |

| Supplemental disclosure of non-cash investing activities: | | | | |

| Increase in accrued capital expenditures | | $ | (1,682) | | | $ | (1,918) | |

| Purchase of property, plant and equipment through exchange of lease ROU asset | | $ | 3,227 | | | $ | — | |

| Supplemental disclosure of non-cash financing activities: | | | | |

| Non-cash debt novation | | $ | (689,829) | | | $ | — | |

Non-cash loss on extinguishment of debt | | $ | (563) | | | $ | — | |

| Non-cash offering costs | | $ | (25) | | | $ | — | |

KODIAK GAS SERVICES, INC.

RECONCILIATION OF NET INCOME TO ADJUSTED EBITDA

(in thousands, excluding percentages)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Net income (loss) | $ | (6,874) | | | $ | 21,766 | | | $ | 1,909 | | | $ | 20,066 | | | $ | 106,265 | |

| Interest expense, net | 40,484 | | | 39,710 | | | 61,251 | | | 222,514 | | | 165,867 | |

| Income tax expense | 5,305 | | | 7,904 | | | 596 | | | 15,070 | | | 33,092 | |

| Depreciation and amortization | 46,455 | | | 46,087 | | | 44,550 | | | 182,869 | | | 174,463 | |

| Loss on extinguishment of debt | — | | | 6,757 | | | — | | | 6,757 | | | — | |

| (Gain) loss on derivatives | 21,814 | | | (15,141) | | | (6,144) | | | (20,266) | | | (83,116) | |

| Equity compensation expense (1) | 2,462 | | | 2,544 | | | 352 | | | 5,914 | | | 971 | |

| Transaction expenses (2) | 4,288 | | | 440 | | | 770 | | | 6,001 | | | 2,370 | |

| Gain on sale of capital assets | (56) | | | — | | | (49) | | | (777) | | | (874) | |

| Adjusted EBITDA | $ | 113,878 | | | $ | 110,067 | | | $ | 103,235 | | | $ | 438,148 | | | $ | 399,038 | |

| Adjusted EBITDA Percentage | 50.4% | | 47.7% | | 57.4% | | 51.5% | | 56.4% |

(1)For the three months ended December 31, 2023, September 30, 2023, and December 31, 2022, there were $2.5 million, $2.5 million, and $0.4 million, respectively, of non-cash adjustments for equity compensation expense. For the years ended December 31, 2023 and 2022, there were $5.9 million and $1.0 million, respectively, of non-cash adjustments for equity compensation expense.

(2)Represents certain costs associated with non-recurring professional services, our equity owners’ expenses and other costs.

KODIAK GAS SERVICES, INC.

RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES TO ADJUSTED EBITDA

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Net cash provided by operating activities | $ | 62,627 | | | $ | 85,731 | | | $ | 32,992 | | | $ | 266,326 | | | $ | 219,846 | |

| Interest expense, net | 40,484 | | | 39,710 | | | 61,251 | | | 222,514 | | | 165,867 | |

| Income tax expense | 5,305 | | | 7,904 | | | 596 | | | 15,070 | | | 33,092 | |

| Deferred tax provision | (1,551) | | | (5,551) | | | (494) | | | (7,863) | | | (27,301) | |

| Cash received on derivatives | (7,525) | | | (7,163) | | | (5,457) | | | (63,156) | | | 4,247 | |

| Loss on extinguishment of debt | — | | | 2,398 | | | — | | | 2,398 | | | — | |

| Transaction expenses (1) | 4,288 | | | 440 | | | 770 | | | 6,001 | | | 2,370 | |

| Other (2) | (8,808) | | | (3,705) | | | (5,152) | | | (25,622) | | | (17,130) | |

| Change in operating assets and liabilities | 19,058 | | | (9,697) | | | 18,729 | | | 22,480 | | | 18,047 | |

| Adjusted EBITDA | $ | 113,878 | | | $ | 110,067 | | | $ | 103,235 | | | $ | 438,148 | | | $ | 399,038 | |

(1)Represents certain costs associated with non-recurring professional services, our equity owners’ expenses and other costs.

(2)Includes amortization of debt issuance costs, non-cash lease expense, provision for credit losses and inventory reserve.

KODIAK GAS SERVICES, INC.

RECONCILIATION OF ADJUSTED GROSS MARGIN TO GROSS MARGIN FOR COMPRESSION OPERATIONS

(in thousands, excluding percentages)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Total revenues | $ | 189,616 | | | $ | 186,673 | | | $ | 170,992 | | | $ | 735,605 | | | $ | 654,957 | |

| Cost of sales (excluding depreciation and amortization) | (63,835) | | | (65,470) | | | (58,570) | | | (257,092) | | | (225,715) | |

| Depreciation and amortization | (46,455) | | | (46,087) | | | (44,550) | | | (182,869) | | | (174,463) | |

| Gross margin | $ | 79,326 | | | $ | 75,116 | | | $ | 67,872 | | | $ | 295,644 | | | $ | 254,779 | |

| Gross margin percentage | 41.8 | % | | 40.2 | % | | 39.7% | | 40.2% | | 38.9% |

| Depreciation and amortization | 46,455 | | | 46,087 | | | 44,550 | | | 182,869 | | | 174,463 | |

| Adjusted Gross Margin | $ | 125,781 | | | $ | 121,203 | | | $ | 112,422 | | | $ | 478,513 | | | $ | 429,242 | |

| Adjusted Gross Margin Percentage (1) | 66.3 | % | | 64.9 | % | | 65.7% | | 65.1% | | 65.5% |

(1)Calculated using Adjusted Gross Margin for Compression Operations as a percentage of total Compression Operations revenues.

KODIAK GAS SERVICES, INC.

RECONCILIATION OF ADJUSTED GROSS MARGIN TO GROSS MARGIN FOR OTHER SERVICES

(in thousands, excluding percentages)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Total revenues | $ | 36,364 | | | $ | 44,310 | | | $ | 8,784 | | | $ | 114,776 | | | $ | 52,956 | |

| Cost of sales (excluding depreciation and amortization) | (27,872) | | | (38,820) | | | (6,998) | | | (93,779) | | | (41,636) | |

| Depreciation and amortization | — | | | — | | | — | | | — | | | — | |

| Gross margin | $ | 8,492 | | | $ | 5,490 | | | $ | 1,786 | | | $ | 20,997 | | | $ | 11,320 | |

| Gross margin percentage | 23.4 | % | | 12.4 | % | | 20.3% | | 18.3% | | 21.4% |

| Depreciation and amortization | — | | | — | | | — | | | — | | | — | |

| Adjusted Gross Margin | $ | 8,492 | | | $ | 5,490 | | | $ | 1,786 | | | $ | 20,997 | | | $ | 11,320 | |

| Adjusted Gross Margin Percentage (1) | 23.4 | % | | 12.4 | % | | 20.3% | | 18.3% | | 21.4% |

(1)Calculated using Adjusted Gross Margin for Other Services as a percentage of total Other Services revenues.

KODIAK GAS SERVICES, INC.

RECONCILIATION OF NET INCOME TO DISCRETIONARY CASH FLOW AND FREE CASH FLOW

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Net income (loss) | $ | (6,874) | | | $ | 21,766 | | | $ | 1,909 | | | $ | 20,066 | | | $ | 106,265 | |

| Depreciation and amortization | 46,455 | | | 46,087 | | | 44,550 | | | 182,869 | | | 174,463 | |

| Change in fair value of derivatives | 29,339 | | | (7,978) | | | (687) | | | 42,890 | | | (87,363) | |

| Loss on extinguishment of debt | — | | | 6,757 | | | — | | | 6,757 | | | — | |

| Deferred tax provision | 1,551 | | | 5,551 | | | 494 | | | 7,863 | | | 27,301 | |

| Amortization of debt issuance costs | 2,296 | | | 189 | | | 4,274 | | | 13,556 | | | 13,727 | |

| Equity compensation expense (1) | 2,462 | | | 2,544 | | | 352 | | | 5,914 | | | 971 | |

| Transaction expenses (2) | 4,288 | | | 440 | | | 770 | | | 6,001 | | | 2,370 | |

| Gain on sale of capital assets | (56) | | | — | | | (49) | | | (777) | | | (874) | |

| Maintenance capital expenditures | (8,934) | | | (12,312) | | | (20,542) | | | (36,990) | | | (48,313) | |

| Discretionary Cash Flow | $ | 70,527 | | | $ | 63,044 | | | $ | 31,071 | | | $ | 248,149 | | | $ | 188,547 | |

| Growth capital expenditures (3) (4) | (60,472) | | | (55,671) | | | (49,791) | | | (184,487) | | | (212,953) | |

| Proceeds from sale of property, plant and equipment | 394 | | | — | | | 59 | | | 1,449 | | | 8,082 | |

| Free Cash Flow | $ | 10,449 | | | $ | 7,373 | | | $ | (18,661) | | | $ | 65,111 | | | $ | (16,324) | |

(1)For the three months ended December 31, 2023, September 30, 2023, and December 31, 2022, there were $2.5 million, $2.5 million, and $0.4 million, respectively, of non-cash adjustments for equity compensation expense. For the years ended December 31, 2023 and 2022, there were $5.9 million and $1.0 million, respectively, of non-cash adjustments for equity compensation expense.

(2)Represents certain costs associated with non-recurring professional services, our equity owners’ expenses and other costs.

(3)For the three months ended December 31, 2023, September 30, 2023, and December 31, 2022, growth capital expenditures include a $4.8 million decrease, a $16.4 million increase and a $10.7 million increase in accrued capital expenditures, respectively. For the years ended December 31, 2023 and 2022, growth capital expenditures include a $1.7 million increase and $1.9 million increase in accrued capital expenditures, respectively.

(4)For the three months ended December 31, 2023, September 30, 2023, and December 31, 2022, there were $15.2 million, $3.5 million and $3.5 million of non-unit growth capital expenditures, respectively. For the years ended December 31, 2023 and 2022, non-unit growth capital expenditures amounted to $26.6 million and $7.4 million, respectively.

KODIAK GAS SERVICES, INC.

RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES TO DISCRETIONARY CASH FLOW AND FREE CASH FLOW

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Net cash provided by operating activities | $ | 62,627 | | | $ | 85,731 | | | $ | 32,992 | | | $ | 266,326 | | | $ | 219,846 | |

| Maintenance capital expenditures | (8,934) | | | (12,312) | | | (20,542) | | | (36,990) | | | (48,313) | |

| Loss on extinguishment of debt | — | | | 2,398 | | | — | | | 2,398 | | | — | |

| Transaction expenses (1) | 4,288 | | | 440 | | | 770 | | | 6,001 | | | 2,370 | |

| Gain on sale of capital assets | (56) | | | — | | | (49) | | | (777) | | | (874) | |

| Change in operating assets and liabilities | 19,058 | | | (9,697) | | | 18,729 | | | 22,480 | | | 18,047 | |

| Other (2) | (6,456) | | | (3,516) | | | (829) | | | (11,289) | | | (2,529) | |

| Discretionary Cash Flow | $ | 70,527 | | | $ | 63,044 | | | $ | 31,071 | | | $ | 248,149 | | | $ | 188,547 | |

| Growth capital expenditures (3) (4) | (60,472) | | | (55,671) | | | (49,791) | | | (184,487) | | | (212,953) | |

| Proceeds from sale of property, plant and equipment | 394 | | | — | | | 59 | | | 1,449 | | | 8,082 | |

| Free Cash Flow | $ | 10,449 | | | $ | 7,373 | | | $ | (18,661) | | | $ | 65,111 | | | $ | (16,324) | |

(1)Represents certain costs associated with non-recurring professional services, our equity owners’ expenses and other costs.

(2)Includes non-cash lease expense, provision for credit losses and inventory reserve.

(3)For the three months ended December 31, 2023, September 30, 2023, and December 31, 2022, growth capital expenditures include a $4.8 million decrease, a $16.4 million increase and a $10.7 million increase in accrued capital expenditures, respectively. For the years ended December 31, 2023 and 2022, growth capital expenditures include a $1.7 million increase and $1.9 million increase in accrued capital expenditures, respectively.

(4)For the three months ended December 31, 2023, September 30, 2023, and December 31, 2022, there were $15.2 million, $3.5 million and $3.5 million of non-unit growth capital expenditures, respectively. For the years ended December 31, 2023 and 2022, non-unit growth capital expenditures amounted to $26.6 million and $7.4 million, respectively.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

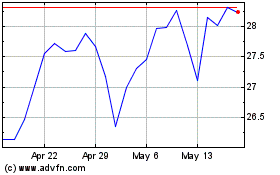

Kodiak Gas Services (NYSE:KGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kodiak Gas Services (NYSE:KGS)

Historical Stock Chart

From Apr 2023 to Apr 2024