UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the Month of January 2024

1-15240

(Commission File Number)

JAMES HARDIE INDUSTRIES plc

(Translation of registrant’s name into English)

First Floor, Block A

One Park Place

Upper Hatch Street, Dublin 2, D02, FD79, Ireland

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F..X.... Form 40-F.........

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): Not Applicable

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): Not Applicable

TABLE OF CONTENTS

Forward-Looking Statements

This Form 6-K contains forward-looking statements. James Hardie Industries plc (the “company”) may from time to time make forward-looking statements in its periodic reports filed with or furnished to the Securities and Exchange Commission, on Forms 20-F and 6-K, in its annual reports to shareholders, in offering circulars, invitation memoranda and prospectuses, in media releases and other written materials and in oral statements made by the company’s officers, directors or employees to analysts, institutional investors, existing and potential lenders, representatives of the media and others. Statements that are not historical facts are forward-looking statements and such forward-looking statements are statements made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995.

Examples of forward-looking statements include:

•statements about the company’s future performance;

•projections of the company’s results of operations or financial condition;

•statements regarding the company’s plans, objectives or goals, including those relating to strategies, initiatives, competition, acquisitions, dispositions and/or its products;

•expectations concerning the costs associated with the suspension or closure of operations at any of the company’s plants and future plans with respect to any such plants;

•expectations concerning the costs associated with the significant capital expenditure projects at any of the company’s plants and future plans with respect to any such projects;

•expectations regarding the extension or renewal of the company’s credit facilities including changes to terms, covenants or ratios;

•expectations concerning dividend payments and share buy-backs;

•statements concerning the company’s corporate and tax domiciles and structures and potential changes to them, including potential tax charges;

•statements regarding tax liabilities and related audits, reviews and proceedings;

•statements regarding the possible consequences and/or potential outcome of legal proceedings brought against us and the potential liabilities, if any, associated with such proceedings;

•expectations about the timing and amount of contributions to AICF, a special purpose fund for the compensation of proven Australian asbestos-related personal injury and death claims;

•expectations concerning the adequacy of the company’s warranty provisions and estimates for future warranty-related costs;

•statements regarding the company’s ability to manage legal and regulatory matters (including but not limited to product liability, environmental, intellectual property and competition law matters) and to resolve any such pending legal and regulatory matters within current estimates and in anticipation of certain third-party recoveries; and

•statements about economic or housing market conditions in the regions in which we operate, including but not limited to, the levels of new home construction and home renovations, unemployment levels, changes in consumer income, changes or stability in housing values, the availability of mortgages and other financing, mortgage and other interest rates, housing affordability and supply, the levels of foreclosures and home resales, currency exchange rates, and builder and consumer confidence.

Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,” “objective,” “outlook” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Readers are cautioned not to place undue reliance on these forward-looking statements and all such forward-looking statements are qualified in their entirety by reference to the following cautionary statements.

Forward-looking statements are based on the Company’s current expectations, estimates and assumptions and because forward-looking statements address future results, events and conditions, they, by their very nature, involve inherent risks and uncertainties, many of which are unforeseeable and beyond the Company’s control. Such known and unknown risks, uncertainties and other factors may cause actual results, performance or other achievements to differ materially from the anticipated results, performance or achievements expressed, projected or implied by these forward-looking statements. These factors, some of which are discussed under “Risk Factors” in Section 3 of the Form 20-F filed with the Securities and Exchange Commission on 16 May 2023, include, but are not limited to: all matters relating to or arising out of the prior manufacture of products that contained asbestos by current and former Company subsidiaries; required contributions to AICF, any shortfall in AICF funding and the effect of currency exchange rate movements on the amount recorded in the Company’s financial statements as an asbestos liability; compliance with and changes in tax laws and treatments; competition and product pricing in the markets in which the Company operates; the consequences of product failures or defects; exposure to environmental, asbestos, putative consumer class action or other legal proceedings; general economic and market conditions; the supply and cost of raw materials; possible increases in competition and the potential that competitors could copy the Company’s products; compliance with and changes in environmental and health and safety laws; risks of conducting business internationally; compliance with and changes in laws and regulations; currency exchange risks; dependence on customer preference and the concentration of the Company’s customer base; dependence on residential and commercial construction markets; the effect of adverse changes in climate or weather patterns; use of accounting estimates; and all other risks identified in the Company’s reports filed with Australian, Irish and US securities regulatory agencies and exchanges (as appropriate). The Company cautions you that the foregoing list of factors is not exhaustive and that other risks and uncertainties may cause actual results to differ materially from those referenced in the Company’s forward-looking statements. Forward-looking statements speak only as of the date they are made and are statements of the Company’s current expectations concerning future results, events and conditions. The Company assumes no obligation to update any forward-looking statements or information except as required by law.

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| | Q3 FY24 Results Notification |

| | Application for quotation of securities |

| | |

| | |

| | |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| | |

| | James Hardie Industries plc |

| Date: 19 January 2024 | | By: /s/ Aoife Rockett |

| |

| | Aoife Rockett |

| | Company Secretary |

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| | Q3 FY24 Results Notification |

| | Application for quotation of securities |

| | |

| | |

| | |

| | |

Exhibit 99.1

| | | | | |

Media Release 10 January 2024 | |

James Hardie Industries To Announce Third Quarter Fiscal Year 2024 Financial Results on 13 February 2024

James Hardie Industries plc (ASX: JHX; NYSE: JHX) will announce financial results, for its third quarter ended 31 December 2023, on the ASX before market on Tuesday, 13 February 2024.

The Company will host a conference call that morning at 9:00am Australian Eastern Time (AEDT).

For those in North America the conference call will commence at 5:00pm Eastern Time (ET), Monday 12 February.

Teleconference Registration: https://s1.c-conf.com/diamondpass/10035780-hf7t6r.html

Webcast URL: https://edge.media-server.com/mmc/p/hgpfv5vu

Once registered, participants will receive a calendar invitation with global dial-in numbers and a unique PIN which will be required to join the call.

A replay of the call will be available shortly after the call and will be available at;

https://ir.jameshardie.com.au/financial-information/financial-results

This media release has been authorized by Mr. Aaron Erter, Chief Executive Officer.

END

Investor/Media/Analyst Enquiries:

James Brennan-Chong

Director of Investor Relations and Market Intelligence

| | | | | | | | |

| | |

Email: | | media@jameshardie.com.au |

James Hardie Industries plc is a limited liability company incorporated in Ireland with its registered office at 1st Floor, Block A, One Park Place, Upper Hatch Street, Dublin 2, D02 FD79, Ireland

| | | | | |

| Media Release: James Hardie to Announce Third Quarter Fiscal Year 2024 Results | 1 |

| | | | | |

| Exhibit 99.2 |

This appendix is available as an online form Only use this form if the online version is not available | +Rule2.8,3.10.3Ato3.10.3D |

Appendix 2A

Application for quotation of +securities

Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public.

If you are an entity incorporated outside Australia and you are seeking quotation of a new class of +securities other than CDIs, you will need to obtain and provide an International Securities Identification Number (ISIN) for that class. Further information on the requirement for the notification of an ISIN is available from the Create Online Forms page. ASX is unable to create the new ISIN for non-Australian issuers.

*Denotes minimum information required for first lodgement of this form, with exceptions provided in specific notes for certain questions. The balance of the information, where applicable, must be provided as soon as reasonably practicable by the entity.

Part 1 – Entity and announcement details

| | | | | | | | |

| Question no | Question | Answer |

| 1.1 | *Name of entity We (the entity here named) apply for +quotation of the following +securities and agree to the matters set out in Appendix 2A of the ASX Listing Rules.1 | James Hardie Industries plc |

| 1.2 | *Registration type and number Please supply your ABN, ARSN, ARBN, ACN or another registration type and number (if you supply another registration type, please specify both the type of registration and the registration number). | ARBN |

| 1.3 | *ASX issuer code | JHX |

| 1.4 | *This announcement is Tick whichever is applicable. | ☐ A new announcement ☒ An update/amendment to a previous announcement ☐ A cancellation of a previous announcement |

| 1.4a | *Reason for update Answer this question if your response to Q 1.4 is an update/amendment to previous announcement. | Incorrect information submitted on Appendix 2A on 22 December 2023. The information contained on this form replaces the previously filed Appendix 2A. |

| 1.4b | *Date of previous announcement to this update Answer this question if your response to Q 1.4 is an update/amendment to previous announcement. | 22 December 2023 |

| 1.4c | *Reason for cancellation Answer this question if your response to Q 1.4 is “A cancellation of a previous announcement” | |

| 1.4d | *Date of previous announcement to this cancellation Answer this question if your response to Q 1.4 is “A cancellation of a previous announcement” | |

| 1.5 | *Date of this announcement | 9 January 2024 |

1 Appendix 2A of the Listing Rules includes a warranty that an offer of the securities for sale within 12 months after their issue will not require disclosure under section 707(3) or 1012C(6) of the Corporations Act. If you are in any doubt as to the application of, or the entity’s capacity to give, this warranty, please see ASIC Regulatory Guide 173 Disclosure for on-sale of securities and other financial products and consult your legal adviser.

| | |

| + See chapter 19 for defined terms |

5 June 2021 Page 1

| | | | | |

This appendix is available as an online form | Appendix 2A Application for quotation of +securities |

Part 2 – Type of issue

| | | | | | | | |

| Question No. | Question | Answer |

| 2.1 | *The +securities to be quoted are: Select whichever item is applicable. If you wish to apply for quotation of different types of issues of securities, please complete a separate Appendix 2A for each type of issue. | ☐ +Securities issued as part of a transaction or transactions previously announced to the market in an Appendix 3B ☐ +Securities issued under a +dividend or distribution plan ☐ +Securities issued, transferred or re-classified as a result of options being exercised or other +convertible securities being converted ☐ Unquoted partly paid +securities that have been fully paid up and are now to become quoted fully paid +securities Note: there is no need to apply for quotation of the fully paid securities if the partly paid securities were already quoted ☐ +Restricted securities where the escrow period has expired or is about to expire ☐ +Securities previously issued under an +employee incentive scheme where the restrictions on transfer have ceased or are about to cease ☒ +Securities issued under an +employee incentive scheme that are not subject to a restriction on transfer or that are to be quoted notwithstanding there is a restriction on transfer ☐ Other [please specify] If you have selected ‘other’ please explain the circumstances of the issue here: |

| 2.1a | *Have the +securities to be quoted been issued yet? | Yes |

| 2.1a.1 | *What was their date of issue? Answer this question if your response to Q2.1a is “Yes”. | 15 December 2023 |

| 2.1a.2 | *What is their proposed date of issue? Answer this question if your response to Q2.1a is “No”. | |

| 2.2a.1 | *Date of Appendix 3B notifying the market of the proposed issue of +securities for which quotation is now being sought Answer this question if your response to Q2.1 is “Securities issued as part of a transaction or transactions previously announced to the market in an Appendix 3B” | |

| 2.2a.2 | *Are there any further issues of +securities yet to take place to complete the transaction(s) referred to in the Appendix 3B? Answer this question if your response to Q2.1 is “Securities issued as part of a transaction or transactions previously announced to the market in an Appendix 3B”. | |

| | |

| + See chapter 19 for defined terms |

5 June 2021 Page 2

| | | | | |

This appendix is available as an online form | Appendix 2A Application for quotation of +securities |

| | | | | | | | |

| 2.2a.2.1 | *Please provide details of the further issues of +securities yet to take place to complete the transaction(s) referred to in the Appendix 3B Answer this question if your response to Q2.1 is “Securities issued as part of a transaction or transactions previously announced to the market in an Appendix 3B” and your response to Q2.2a.2 is “Yes”. Please provide details of the proposed dates and number of securities for the further issues. This may be the case, for example, if the Appendix 3B related to an accelerated pro rata offer with an institutional component being quoted on one date and a retail component being quoted on a later date. | |

| 2.2b.1 | Date of Appendix 3A.1 lodged with ASX in relation to the underlying +dividend or distribution Answer this question if your response to Q2.1 is “Securities issued under a dividend or distribution plan”. | |

| 2.2c.1 | Please state the number and type of options that were exercised or other +convertible securities that were converted (including their ASX security code) Answer this question if your response to Q2.1 is “Securities issued, transferred or re-classified as a result of options being exercised or other convertible securities being converted”. | |

| 2.2c.2 | And the date the options were exercised or other +convertible securities were converted Answer this question if your response to Q2.1 is “Securities issued, transferred or re-classified as a result of options being exercised or other convertible securities being converted”. Note: If this occurred over a range of dates, enter the first date and last date of the period in which the options were exercised or convertible securities were converted. | |

| 2.2c.3 | Is this all of the options or other +convertible securities on issue of that type (ie have all of those options now been exercised or have all of those convertible securities now been converted)? Answer this question if your response to Q2.1 is “Securities issued, transferred or re-classified as a result of options being exercised or other convertible securities being converted”. | |

| 2.2c.4 | The right of the holder of the options or other +convertible securities to receive the +underlying securities is being satisfied by: Answer this question if your response to Q2.1 is “Securities issued, transferred or re-classified as a result of options being exercised or other convertible securities being converted”. | ☐ An issue of new +securities ☐ A transfer of existing +securities ☐ A reclassification of the +convertible securities as securities in the same class as the +underlying securities |

| 2.2c.5 | The underlying securities being received by the holder are: Answer this question if your response to Q2.1 is “Securities issued, transferred or re-classified as a result of options being exercised or other convertible securities being converted”. | ☐ Already quoted by ASX ☐ Intended to be, but are not yet, quoted by ASX ☐ Are not, and are not intended to be, quoted by ASX |

| 2.2c.6 | Were the options being exercised or other +convertible securities being converted issued under an +employee incentive scheme? Answer this question if your response to Q2.1 is “Securities issued, transferred or re-classified as a result of options being exercised or other convertible securities being converted”. |

|

| | |

| + See chapter 19 for defined terms |

5 June 2021 Page 3

| | | | | |

This appendix is available as an online form | Appendix 2A Application for quotation of +securities |

| | | | | | | | |

| 2.2c.7 | *Are any of the options being exercised or other +convertible securities being converted held by +key management personnel (KMP) or an +associate? Answer this question if your response to Q2.1 is “Securities issued, transferred or re-classified as a result of options being exercised or other convertible securities being converted” and your response to Q2.2c.6 is “Yes”. | |

| 2.2c.7.a | *Provide details of the KMP or +associates who are exercising options or converting convertible securities. Answer this question if your response to Q2.1 is “Securities issued, transferred or re-classified as a result of options being exercised or other convertible securities being converted”, your response to Q2.2c.6 is “Yes” and your response to Q2.2c.7 is “Yes”. Repeat the detail in the table below for each KMP involved. If the options or other convertible securities are held by the KMP, repeat the name of the KMP or insert “Same” in “Name of registered holder”. If the options or other convertible securities are held by an associate of a KMP, insert the name of the associate in “Name of registered holder”.

|

| 2.2d.1 | Please state the number and type of unquoted partly paid +securities (including their ASX security code) that have been fully paid up and that are now to become quoted on ASX Answer this question if your response to Q2.1 is “Partly paid securities that have been fully paid up and are now to become quoted fully paid securities”. | |

| 2.2d.2 | And the date the +securities were fully paid up Answer this question if your response to Q2.1 is “Partly paid securities that have been fully paid up and are now to become quoted fully paid securities”. Note: If this occurred over a range of dates, enter the date the last of the securities was fully paid up. | |

| 2.2d.3 | Is this all of the partly paid +securities on issue of that type (ie have all of those partly paid securities now been fully paid up)? Answer this question if your response to Q2.1 is “Unquoted partly paid securities that have been fully paid up and are now to become quoted fully paid securities”. | |

| 2.2e.1 | Please state the number and type of +restricted securities (including their ASX security code) where the escrow period has expired or is about to expire Answer this question if your response to Q2.1 is “Restricted securities where the escrow period has expired or is about to expire”. | |

| 2.2e.2 | And the date the escrow restrictions have ceased or will cease Answer this question if your response to Q2.1 is “Restricted securities where the escrow period has expired or is about to expire”. Note: If this occurred over a range of dates, enter the date the last of the escrow restrictions has ceased or will cease. | |

| | |

| + See chapter 19 for defined terms |

5 June 2021 Page 4

| | | | | |

This appendix is available as an online form | Appendix 2A Application for quotation of +securities |

| | | | | | | | |

| 2.2f.1 | Please state the number and type of +securities (including their ASX security code) previously issued under the +employee incentive scheme where the restrictions on transfer have ceased or are about to cease Answer this question if your response to Q2.1 is “Securities previously issued under an employee incentive scheme where the restrictions on transfer have ceased or are about to cease”. | |

| 2.2f.2 | And the date the restrictions on transfer have ceased or will cease: Answer this question if your response to Q2.1 is “Securities previously issued under an employee incentive scheme where the restrictions on transfer have ceased or are about to cease”. Note: If this occurred over a range of dates, enter the date the last of the restrictions on transfer has ceased or will cease. | |

| 2.2g.1 | Please state the number and type of +securities (including their ASX security code) issued under the +employee incentive scheme that are not subject to a restriction on transfer or that are to be quoted notwithstanding there is a restriction on transfer Answer this question if your response to Q2.1 is “Securities issued under an employee incentive scheme that are not subject to a restriction on transfer or that are to be quoted notwithstanding there is a restriction on transfer”. | 2,982 From JHXAK: Restricted Stock Unit to JHX: CHESS DEPOSITARY INTERESTS 1:1 |

| 2.2g.2 | *Please attach a document or provide details of a URL link for a document lodged with ASX detailing the terms of the +employee incentive scheme or a summary of the terms. Answer this question if your response to Q2.1 is “Securities issued under an employee incentive scheme that are not subject to a restriction on transfer or that are to be quoted notwithstanding there is a restriction on transfer”. | The terms of the James Hardie 2020 Non-Executive Director Equity Plan were summarised in the Notice of Meeting at Item 9 and the applicable Explanatory Notes. That publication is accessible at: https://ir.jameshardie.com.au/jh/shareholder_meetings.jsp |

| 2.2g.3 | *Are any of these +securities being issued to +key management personnel (KMP) or an +associate Answer this question if your response to Q2.1 is “Securities issued under an employee incentive scheme that are not subject to a restriction on transfer or that are to be quoted notwithstanding there is a restriction on transfer”. | Yes |

| | |

| + See chapter 19 for defined terms |

5 June 2021 Page 5

| | | | | |

This appendix is available as an online form | Appendix 2A Application for quotation of +securities |

| | | | | | | | |

| 2.2g.3.a | *Provide details of the KMP or +associates being issued +securities. Answer this question if your response to Q2.1 is “Securities issued under an employee incentive scheme that are not subject to a restriction on transfer or that are to be quoted notwithstanding there is a restriction on transfer” and your response to Q2.2g.3 is “Yes”. Repeat the detail in the table below for each KMP involved in the issue. If the securities are being issued to the KMP, repeat the name of the KMP or insert “Same” in “Name of registered holder”. If the securities are being issued to an associate of a KMP, insert the name of the associate in “Name of registered holder”.

|

| 2.2h.1 | *Were the +securities issued for a cash consideration? Answer this question if your response to Q2.1 is “Other”. If the securities are being issued for nil cash consideration, answer this question “No”. | No |

| 2.2h.1.a | *In what currency was the cash consideration paid? Answer this question if your response to Q2.1 is “Other” and your response to Q2.2h.1 is “Yes”. For example, if the consideration is being paid in Australian Dollars, state AUD. |

|

| 2.2h.1.b | *What was the issue price per +security Answer this question if your response to Q2.1 is “Other” and your response to Q2.2h.1 is “Yes”, and by reference to the issue currency provided in your response to Q2.2h.1.a. Note: you cannot enter a nil amount here. If the securities are being issued for nil cash consideration, answer Q2.2h.1 as “No” and complete Q2.2h.1.c. |

|

| 2.2h.1.c | Please describe the consideration provided for the +securities Answer this question if your response to Q2.1 is “Other” and your response to Q2.2h.1 is “No”. |

|

| 2.2h.1.d | Please provide an estimate (in AUD) of the value of the consideration provided per +security for the +securities to be quoted Answer this question if your response to Q2.1 is “Other” and your response to Q2.2h.1 is “No”. |

|

| 2.2h.2 | *The purpose(s) for which the entity is issuing the +securities is: Answer this question if your response to Q2.1 is “Other”. You may select one or more of the items in the list. | ☐ To raise additional working capital ☐ To fund the retirement of debt ☐ To pay for the acquisition of an asset [provide details below] ☐ To pay for services rendered [provide details below] ☐ Other [provide details below]

Additional details: |

| | |

| + See chapter 19 for defined terms |

5 June 2021 Page 6

| | | | | |

This appendix is available as an online form | Appendix 2A Application for quotation of +securities |

| | | | | | | | |

| 2.2h.3 | *Please provide any further information needed to understand the circumstances in which you are applying to have these +securities quoted on ASX, including why the issue of the +securities has not been previously announced to the market in an Appendix 3B You must answer this question if your response to Q2.1 is “Other”. If there is no other information to provide, please answer “Not applicable” or “N/A”. | |

| 2.2i | *Have these +securities been offered under a +disclosure document or +PDS? Answer this question if your response to Q2.1 is “Other”. | |

| 2.2i.1 | *Date of +disclosure document or +PDS? Answer this question if your response to Q2.1 is “Other” and your response to Q2.2i is “Yes”. Under the Corporations Act, the entity must apply for quotation of the securities within 7 days of the date of the disclosure document or PDS. | |

| 2.3 | *Any on-sale of the +securities to be quoted within 12 months of their date of issue will comply with the secondary sale provisions in sections 707(3) and 1012C(6) of the Corporations Act by virtue of: Answer this question if your response to Q2.1 is “Other” and your response to Q2.2i is “No”. Note: Under Appendix 2A of the Listing Rules, when the entity applies for quotation of securities, it gives a warranty that an offer of the securities for sale within 12 months after their issue will not require disclosure under section 707(3) or 1012C(6) of the Corporations Act. If you are in any doubt as to the application of, or the entity’s capacity to give, this warranty, please see ASIC Regulatory Guide 173 Disclosure for on-sale of securities and other financial products and consult your legal adviser. | ☐ The publication of a +disclosure document or +PDS for the +securities to be quoted ☐ The publication of a cleansing notice under section 708A(5), 708AA(2)(f), 1012DA(5) or 1012DAA(2)(f) ☐ The publication of a +disclosure document or +PDS involving the same class of securities as the +securities to be quoted that meets the requirements of section 708A(11) or 1012DA(11) ☐ An applicable ASIC instrument or class order ☐ Not applicable – the entity has arrangements in place with the holder that ensure the securities cannot be on-sold within 12 months in a manner that would breach section 707(3) or 1012C(6) Note: Absent relief from ASIC, a listed entity can only issue a cleansing notice where trading in the relevant securities has not been suspended for more than 5 days during the shorter of: (a) the period during which the class of securities are quoted; and (b) the period of 12 months before the date on which the relevant securities under the offer were issued. |

| 2.4 | *The +securities to be quoted are: Tick whichever is applicable | ☒ Additional +securities in a class that is already quoted on ASX ("existing class") ☐ New +securities in a class that is not yet quoted on ASX ("new class") |

| | |

| + See chapter 19 for defined terms |

5 June 2021 Page 7

| | | | | |

This appendix is available as an online form | Appendix 2A Application for quotation of +securities |

Part 3A – number and type of +securities to be quoted (existing class or new class) where issue has previously been notified to ASX in an Appendix 3B

Answer the questions in this Part if your response to Q2.1 is “Securities issued as part of a transaction or transactions previously announced to the market in an Appendix 3B”.

| | | | | | | | |

| Question No. | Question | Answer |

| 3A.1 | *ASX security code & description |

|

| 3A.2 | *Number of +securities to be quoted |

|

| 3A.3 | Any other information the entity wishes to provide about the +securities to be quoted |

|

| 3A.4 | *Provide a distribution schedule for the new +securities according to the categories set out in the left hand column – including the number of recipients and the total percentage of the new +securities held by the recipients in each category.

Answer this question only if you are an ASX Listing (ASX Foreign Exempt Listings and ASX Debt Listings do not have to answer this question), your response to Q2.4 is “new class” and the securities to be quoted have already been issued. Note: if the securities to be quoted have not yet been issued, under listing rule 3.10.5, you will need to provide to ASX a list of the 20 largest recipients of the new securities, and the number and percentage of the new securities received by each of those recipients, and a distribution schedule for the securities when they are issued. |

| | |

| + See chapter 19 for defined terms |

5 June 2021 Page 8

| | | | | |

This appendix is available as an online form | Appendix 2A Application for quotation of +securities |

Part 3B – number and type of +securities to be quoted (existing class) where issue has not previously been notified to ASX in an Appendix 3B

Answer the questions in this Part if your response to Q2.1 is anything other than “Securities issued as part of a transaction or transactions previously announced to the market in an Appendix 3B” and your response to Q2.4 is “existing class”. If your response to Q2.1 is “Securities issued, transferred or re-classified as a result of options being exercised or other convertible securities being converted”, the questions in this part relate to the securities being issued, transferred or reclassified as a result of the exercise of the options or the conversion of the convertible securities. If your response to Q2.1 is “Unquoted partly paid securities that have been fully paid up and are now to become quoted fully paid securities”, the questions in this part relate to the fully paid securities arising from that payment up. Otherwise, the questions in this part relate to the securities issued by the entity which are to be quoted on ASX and which are described in the response to Q2.1.

| | | | | | | | |

| Question No. | Question | Answer |

| 3B.1 | *ASX security code & description | From: JHXAK: Restricted Stock Unit To: JHX: CHESS DEPOSITARY INTERESTS 1:1 |

| 3B.2 | *Number of +securities to be quoted | 2,982 |

| 3B.3a | *Will the +securities to be quoted rank equally in all respects from their issue date with the existing issued +securities in that class? | Yes |

| 3B.3b | *Is the actual date from which the +securities will rank equally (non-ranking end date) known? Answer this question if your response to Q3B.3a is “No”. | |

| 3B.3c | *Provide the actual non-ranking end date Answer this question if your response to Q3B.3a is “No” and your response to Q3B.3b is “Yes”. |

|

| 3B.3d | *Provide the estimated non-ranking end period Answer this question if your response to Q3B.3a is “No” and your response to Q3B.3b is “No”. |

|

| 3B.3e | *Please state the extent to which the +securities do not rank equally: •in relation to the next dividend, distribution or interest payment; or •for any other reason Answer this question if your response to Q3B.3a is “No”. For example, the securities may not rank at all, or may rank proportionately based on the percentage of the period in question they have been on issue, for the next dividend, distribution or interest payment; or they may not be entitled to participate in some other event, such as an entitlement issue. |

|

| 3B.4 | Any other information the entity wishes to provide about the +securities to be quoted |

|

| | |

| + See chapter 19 for defined terms |

5 June 2021 Page 9

| | | | | |

This appendix is available as an online form | Appendix 2A Application for quotation of +securities |

Part 3C – number and type of +securities to be quoted (new class) where issue has not previously been notified to ASX in an Appendix 3B

Answer the questions in this Part if your response to Q2.1 is anything other than “Securities issued as part of a transaction or transactions previously announced to the market in an Appendix 3B” and your response to Q2.4 is “new class”. If your response to Q2.1 is “Securities issued, transferred or re-classified as a result of options being exercised or other convertible securities being converted”, the questions in this part relate to the securities being issued, transferred or reclassified as a result of the exercise of the options or the conversion of the convertible securities. If your response to Q2.1 is “Unquoted partly paid securities that have been fully paid up and are now to become quoted fully paid securities”, the questions in this part relate to the fully paid securities arising from that payment up. Otherwise, the questions in this part relate to the securities issued by the entity which are to be quoted on ASX and which are described in the response to Q2.1.

| | | | | | | | | | | |

| Question No. | Question | Answer |

| 3C.1 | *Security description |

|

| 3C.2 | *Security type Select one item from the list that best describes the securities the subject of this form. This will determine more detailed questions to be asked about the security later in this section. Select “ordinary fully or partly paid shares/units” for stapled securities or CDIs. For interest rate securities, please select the appropriate choice from either “Convertible debt securities” or “Non-convertible debt securities”. Select “Other” for performance shares/units and performance options/rights or if the selections available in the list do not appropriately describe the security being issued. | ☐ Ordinary fully or partly paid shares/units ☐ Options ☐ +Convertible debt securities ☐ Non-convertible +debt securities ☐ Redeemable preference shares/units ☐ Wholesale debt securities ☐ Other |

| 3C.3 | ISIN code Answer this question if you are an entity incorporated outside Australia and you are seeking quotation of a new class of securities other than CDIs. See also the note at the top of this form. |

|

| 3C.4 | *Number of +securities to be quoted |

|

| 3C.5a | *Will all the +securities issued in this class rank equally in all respects from the issue date? | |

| 3C.5b | *Is the actual date from which the +securities will rank equally (non-ranking end date) known? Answer this question if your response to Q3C.5a is “No”. | |

| 3C.5c | *Provide the actual non-ranking end date Answer this question if your response to Q3C.5a is “No” and your response to Q3C.5b is “Yes”. |

|

| 3C.5d | *Provide the estimated non-ranking end period Answer this question if your response to Q3C.5a is “No” and your response to Q3C.5b is “No”. |

|

| 3C.5e | *Please state the extent to which the +securities do not rank equally: •in relation to the next dividend, distribution or interest payment; or •for any other reason Answer this question if your response to Q3C.5a is “No”. For example, the securities may not rank at all, or may rank proportionately based on the percentage of the period in question they have been on issue, for the next dividend, distribution or interest payment; or they may not be entitled to participate in some other event, such as an entitlement issue. |

|

| | |

| + See chapter 19 for defined terms |

5 June 2021 Page 10

| | | | | |

This appendix is available as an online form | Appendix 2A Application for quotation of +securities |

| | | | | | | | | | | |

| 3C.6 | Please attach a document or provide a URL link for a document lodged with ASX setting out the material terms of the +securities to be quoted You may cross-reference a disclosure document, PDS, information memorandum, investor presentation or other announcement with this information provided it has been released to the ASX Market Announcements Platform. |

|

| 3C.7 | *Have you received confirmation from ASX that the terms of the +securities are appropriate and equitable under listing rule 6.1? Answer this question only if you are an ASX Listing. (ASX Foreign Exempt Listings and ASX Debt Listings do not have to answer this question). If your response is “No” and the securities have any unusual terms, you should approach ASX as soon as possible for confirmation under listing rule 6.1 that the terms are appropriate and equitable. | |

| 3C.8 | *Provide a distribution schedule for the new +securities according to the categories set out in the left hand column – including the number of recipients and the total percentage of the new +securities held by the recipients in each category.

Answer this question only if you are an ASX Listing (ASX Foreign Exempt Listings and ASX Debt Listings do not have to answer this question) and the securities to be quoted have already been issued. Note: if the securities to be quoted have not yet been issued, under listing rule 3.10.5, you will need to provide to ASX a list of the 20 largest recipients of the new +securities, and the number and percentage of the new +securities received by each of those recipients, and a distribution schedule for the securities when they are issued. |

| 3C.9a | Ordinary fully or partly paid shares/units details Answer the questions in this section if you selected this security type in your response to Question 3C.2. |

| *+Security currency This is the currency in which the face amount of an issue is denominated. It will also typically be the currency in which distributions are declared. |

|

| *Will there be CDIs issued over the +securities? |

|

| *CDI ratio Answer this question if you answered “Yes” to the previous question. This is the ratio at which CDIs can be transmuted into the underlying security (e.g. 4:1 means 4 CDIs represent 1 underlying security whereas 1:4 means 1 CDI represents 4 underlying securities). | |

| *Is it a partly paid class of +security? | |

| | |

| + See chapter 19 for defined terms |

5 June 2021 Page 11

| | | | | |

This appendix is available as an online form | Appendix 2A Application for quotation of +securities |

| | | | | | | | | | | |

| *Paid up amount: unpaid amount Answer this question if answered “Yes” to the previous question. The paid up amount represents the amount of application money and/or calls which have been paid on any security considered ‘partly paid’ The unpaid amount represents the unpaid or yet to be called amount on any security considered ‘partly paid’. The amounts should be provided per the security currency (e.g. if the security currency is AUD, then the paid up and unpaid amount per security in AUD). | |

| *Is it a stapled +security? This is a security class that comprises a number of ordinary shares and/or ordinary units issued by separate entities that are stapled together for the purposes of trading. |

|

| 3C.9b | Option details Answer the questions in this section if you selected this security type in your response to Question 3C.2. |

| *+Security currency This is the currency in which the exercise price is payable. |

|

| *Exercise price The price at which each option can be exercised and convert into the underlying security. The exercise price should be provided per the security currency (i.e. if the security currency is AUD, the exercise price should be expressed in AUD). |

|

| *Expiry date The date on which the options expire or terminate. |

|

| *Details of the number and type of +security (including its ASX security code if the +security is quoted on ASX) that will be issued if an option is exercised For example, if the option can be exercised to receive one fully paid ordinary share with ASX security code ABC, please insert “One fully paid ordinary share (ASX:ABC)”. |

|

| 3C.9c | Details of non-convertible +debt securities, +convertible debt securities, or redeemable preference shares/units Answer the questions in this section if you selected one of these security types in your response to Question 3C.2. Refer to Guidance Note 34 and the “Guide to the Naming Conventions and Security Descriptions for ASX Quoted Debt and Hybrid Securities” for further information on certain terms used in this section |

| *Type of +security Select one item from the list | ☐ Simple corporate bond ☐ Non-convertible note or bond ☐ Convertible note or bond ☐ Preference share/unit ☐ Capital note ☐ Hybrid security ☐ Other |

| *+Security currency This is the currency in which the face value of the security is denominated. It will also typically be the currency in which interest or distributions are paid. |

|

| Face value This is the principal amount of each security. The face value should be provided per the security currency (i.e. if security currency is AUD, then the face value per security in AUD). |

|

| | |

| + See chapter 19 for defined terms |

5 June 2021 Page 12

| | | | | |

This appendix is available as an online form | Appendix 2A Application for quotation of +securities |

| | | | | | | | | | | |

| *Interest rate type Select one item from the list Select the appropriate interest or dividend rate type per the terms of the security. Definitions for each type are provided in the Guide to the Naming Conventions and Security Descriptions for ASX Quoted Debt and Hybrid Securities | ☐ Fixed rate ☐ Floating rate ☐ Indexed rate ☐ Variable rate ☐ Zero coupon/no interest or dividend ☐ Other |

| Frequency of coupon/interest/dividend payments per year Select one item from the list. | ☐ Monthly ☐ Quarterly ☐ Semi-annual ☐ Annual ☐ No coupon/interest payments ☐ Other |

| First interest/dividend payment date A response is not required if you have selected “No coupon/interest payments” in response to the question above on the frequency of coupon/interest payments | |

| Interest/dividend rate per annum Answer this question if the interest rate type is fixed. | % p.a. |

| *Is the interest/dividend rate per annum estimated at this time? Answer this question if the interest rate type is fixed. | |

| If the interest/dividend rate per annum is estimated, then what is the date for this information to be announced to the market (if known) Answer this question if the interest rate type is fixed and your response to the previous question is “Yes”. Answer “Unknown” if the date is not known at this time. | |

| *Does the interest rate include a reference rate, base rate or market rate (e.g. BBSW or CPI)? Answer this question if the interest rate type is floating or indexed. | |

| *What is the reference rate, base rate or market rate? Answer this question if the interest rate type is floating or indexed and your response to the previous question is “Yes”. | |

| *Does the interest/dividend rate include a margin above the reference rate, base rate or market rate? Answer this question if the interest rate type is floating or indexed. | |

| *What is the margin above the reference rate, base rate or market rate (expressed as a percent per annum) Answer this question if the interest rate type is floating or indexed and your response to the previous question is “Yes”. | % p.a. |

| | |

| + See chapter 19 for defined terms |

5 June 2021 Page 13

| | | | | |

This appendix is available as an online form | Appendix 2A Application for quotation of +securities |

| | | | | | | | | | | |

| *S128F of the Income Tax Assessment Act status applicable to the +security Select one item from the list For financial products which are likely to give rise to a payment to which s128F of the Income Tax Assessment Act applies, ASX requests issuers to confirm the s128F status of the security: •“s128F exempt” means interest payments are not taxable to non-residents; •“Not s128F exempt” means interest payments are taxable to non-residents; •“s128F exemption status unknown” means the issuer is unable to advise the status; •“Not applicable” means s128F is not applicable to this security | ☐ s128F exempt ☐ Not s128F exempt ☐ s128F exemption status unknown ☐ Not applicable |

| *Is the +security perpetual (i.e. no maturity date)? | |

| *Maturity date Answer this question if the security is not perpetual | |

| *Select other features applicable to the +security Up to 4 features can be selected. Further information is available in the Guide to the Naming Conventions and Security Descriptions for ASX Quoted Debt and Hybrid Securities. | ☐ Simple ☐ Subordinated ☐ Secured ☐ Converting ☐ Convertible ☐ Transformable ☐ Exchangeable ☐ Cumulative ☐ Non-Cumulative ☐ Redeemable ☐ Extendable ☐ Reset ☐ Step-Down ☐ Step-Up ☐ Stapled ☐ None of the above |

| *Is there a first trigger date on which a right of conversion, redemption, call or put can be exercised (whichever is first)? | |

| *If yes, what is the first trigger date Answer this question if your response to the previous question is “Yes”. |

|

| Details of the number and type of +security (including its ASX security code if the +security is quoted on ASX) that will be issued if the +securities to be quoted are converted, transformed or exchanged (per 1 new +security) Answer this question if the security features include “converting”, “convertible”, “transformable” or “exchangeable”. For example, if the security can be converted into 1,000 fully paid ordinary shares with ASX security code ABC, please insert “1,000 fully paid ordinary shares (ASX:ABC)”. |

|

| 3C.9d | Details of wholesale debt securities Answer the questions in this section if you selected this security type in your response to Question Q3C.2. Refer to Guidance Note 34 and the “Guide to the Naming Conventions and Security Descriptions for ASX Quoted Debt and Hybrid Securities” for further information on certain terms used in this section |

| CFI |

|

| FISN |

|

| | |

| + See chapter 19 for defined terms |

5 June 2021 Page 14

| | | | | |

This appendix is available as an online form | Appendix 2A Application for quotation of +securities |

| | | | | | | | | | | |

| *+Security currency This is the currency in which the face value of the security is denominated. It will also typically be the currency in which interest or distributions are paid. |

|

| Total principal amount of class |

|

| Face value This is the offer / issue price or value at which the security was offered on issue. |

|

| Number of +securities This should be the total principal amount of class divided by the face value |

|

| *Interest rate type Select the appropriate interest rate type per the terms of the security. Definitions for each type are provided in the Guide to the Naming Conventions and Security Descriptions for ASX Quoted Debt and Hybrid Securities. | ☐ Fixed rate ☐ Floating rate ☐ Fixed to floating ☐ Floating to fixed |

| *Frequency of coupon/interest payments per year Select one item from the list. The number of interest payments to be made per year for a wholesale debt security. | ☐ Monthly ☐ Quarterly ☐ Semi-annual ☐ Annual ☐ No payments |

| *First interest payment date A response is not required if you have selected “No payments” in response to the question above on the frequency of coupon/interest payments. |

|

| *Interest rate per annum A response is not required if you have selected “No payments” in response to the question above on the frequency of coupon/interest payments. The rate represents the total rate for the first payment period which may include a reference or base rate plus a margin rate and other adjustment factors where applicable, stated on a per annum basis. If the rate is only an estimate at this time please enter an indicative rate and provide the actual rate once it has become available. | % |

| *Maturity date The date on which the security matures. |

|

| Class type description |

|

| *S128F of the Income Tax Assessment Act status applicable to the +security Select one item from the list For financial products which are likely to give rise to a payment to which s128F of the Income Tax Assessment Act applies, ASX requests issuers to confirm the s128F status of the security: •“s128F exempt” means interest payments are not taxable to non-residents; •“Not s128F exempt” means interest payments are taxable to non-residents; •“s128F exemption status unknown” means the issuer is unable to advise the status; “Not applicable” means s128F is not applicable to this security | ☐ s128F exempt ☐ Not s128F exempt ☐ s128F exemption status unknown ☐ Not applicable |

| 3C.10 | Any other information the entity wishes to provide about the +securities to be quoted |

|

| | |

| + See chapter 19 for defined terms |

5 June 2021 Page 15

| | | | | |

This appendix is available as an online form | Appendix 2A Application for quotation of +securities |

Part 4 – Issued capital following quotation

| | | | | |

Following the quotation of the +securities the subject of this application, the issued capital of the entity will comprise: Note: the figures provided in the tables in sections 4.1 and 4.2 below are used to calculate the total market capitalisation of the entity published by ASX from time to time. Please make sure you include in the relevant table each class of securities issued by the entity. If you have quoted CHESS Depository Interests (CDIs) issued over your securities, include them in the table in section 4.1 and include in the table in section 4.2 any securities that do not have CDIs issued over them (and therefore are not quoted on ASX). Restricted securities should only be included in the table in section 4.1 if you are applying to have them quoted because the escrow period for the securities has expired or is about to expire. Otherwise include them in the table in section 4.2. |

| 4.1 | *Quoted +securities (total number of each +class of +securities quoted on ASX following the +quotation of the +securities the subject of this application)

|

| 4.2 | *Unquoted +securities (total number of each +class of +securities issued but not quoted on ASX):

|

Part 5 – Other Listing Rule requirements

The questions in this Part should only be answered if you are an ASX Listing (ASX Foreign Exempt Listings and ASX Debt Listings do not need to complete this Part) and your response to Q2.1 is:

-“Securities issued under a dividend/distribution plan”;

-“Securities issued under an employee incentive scheme that are not subject to a restriction on transfer or that are to be quoted notwithstanding there is a restriction on transfer”; or

-“Other”.

Note that if your response to Q2.1 is “Securities issued as part of a transaction or transactions previously announced to the market in an Appendix 3B”, it is assumed that you will have provided the information referred to in this Part in the Appendix 3B.

| | | | | | | | |

| Question No. | Question | Answer |

| 5.1 | *Are the +securities being issued under an exception in Listing Rule 7.2 and therefore the issue does not need any security holder approval under Listing Rule 7.1? | No |

| 5.1a | Enter the number of the applicable exception in Listing Rule 7.2 Answer this question is your response to Q5.1 is “Yes” Note this should be a number between 1 and 17. | |

| | |

| + See chapter 19 for defined terms |

5 June 2021 Page 16

| | | | | |

This appendix is available as an online form | Appendix 2A Application for quotation of +securities |

| | | | | | | | |

| 5.1a.1 | *Does the +dividend or distribution plan meet the requirement of listing rule 7.2 exception 4 that it does not impose a limit on participation? Answer this question if your response to Q5.1 is “Yes” and your response to Q5.1a is “4”. Note: Exception 4 only applies where security holders are able to elect to receive all of their dividend or distribution as securities. For example, Exception 4 would not apply in the following circumstances: 1) The entity has specified a dollar limit on the level of participation e.g. security holders can only participate to a maximum value of $x in respect of their entitlement, or 2) The entity has specified a maximum number of securities that can participate in the plan e.g. security holders can only receive securities in lieu of dividend payable for x number of securities. | |

| 5.2 | *Has the entity obtained, or is it obtaining, +security holder approval for the issue under listing rule 7.1? Answer this question if the response to Q5.1 is “No”. | No |

| 5.2a | *Date of meeting or proposed meeting to approve the issue under listing rule 7.1 Answer this question if the response to Q5.1 is “No” and the response to Q5.2 is “Yes”. | |

| 5.2b | *Are any of the +securities being issued without +security holder approval using the entity’s 15% placement capacity under listing rule 7.1? Answer this question if the response to Q5.1 is “No” and the response to Q5.2 is “No”. | No |

| 5.2b.1 | *How many +securities are being issued without +security holder approval using the entity’s 15% placement capacity under listing rule 7.1? Answer this question if the response to Q5.1 is “No”, the response to Q5.2 is “No” and the response to Q5.2b is “Yes”. If the response to Q5.2b is “Yes”, please complete and separately send by email to your ASX listings compliance adviser a work sheet in the form of Annexure B to Guidance Note 21 confirming the entity has the available capacity under listing rule 7.1 to issue that number of securities. | |

| 5.2c | *Are any of the +securities being issued without +security holder approval using the entity’s additional 10% placement capacity under listing rule 7.1A (if applicable)? Answer this question if the response to Q5.1 is “No” and the response to Q5.2 is “No”. | n/a |

| | |

| + See chapter 19 for defined terms |

5 June 2021 Page 17

| | | | | |

This appendix is available as an online form | Appendix 2A Application for quotation of +securities |

| | | | | | | | |

| 5.2c.1 | *How many +securities are being issued without +security holder approval using the entity’s additional 10% placement capacity under listing rule 7.1A? Answer this question if the response to Q5.1 is “No”, the response to Q5.2 is “No” and the response to Q5.2c is “Yes”. If the response to Q5.2c is “Yes”, please complete and separately send by email to your ASX listings compliance adviser a work sheet in the form of Annexure C to Guidance Note 21 confirming the entity has the available capacity under listing rule 7.1A to issue that number of securities. | |

Introduced 01/12/19; amended 31/01/20; 05/06/21

| | |

| + See chapter 19 for defined terms |

5 June 2021 Page 18

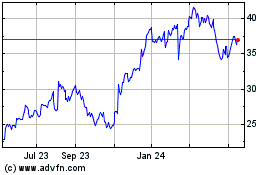

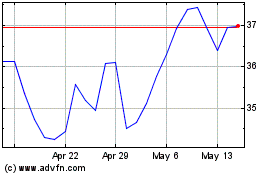

James Hardie Industries (NYSE:JHX)

Historical Stock Chart

From Mar 2024 to Apr 2024

James Hardie Industries (NYSE:JHX)

Historical Stock Chart

From Apr 2023 to Apr 2024