0001421461false00014214612024-03-062024-03-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): March 6, 2024

Intrepid Potash, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-34025 | | 26-1501877 |

(State or other jurisdiction

of incorporation) | | (Commission

file number) | | (IRS employer

identification no.) |

707 17th Street, Suite 4200

Denver, Colorado 80202

(Address of principal executive offices, including zip code)

(303) 296-3006

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 210.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | IPI | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On March 6, 2024, Intrepid Potash, Inc. issued a press release announcing its financial results and operating highlights for the fourth quarter and full year ended 2023. A copy of the press release is furnished as Exhibit 99.1 to this report.

The information furnished under this Item 2.02, including Exhibit 99.1, will not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 and will not be incorporated by reference into any filing under the Securities Act of 1933, except as expressly set forth by specific reference in that filing.

Item 9.01. Financial Statements and Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | | |

| | Press Release of Intrepid Potash, Inc. dated March 6, 2024. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | INTREPID POTASH, INC. |

| | | |

| | | |

| Dated: March 6, 2024 | By: | /s/ Matthew D. Preston |

| | | Matthew D. Preston |

| | | Chief Financial Officer |

Intrepid Announces Fourth Quarter and Full-Year 2023 Results

DENVER, CO --(GLOBE NEWSWIRE - March 6, 2024) -- Intrepid Potash, Inc. (NYSE:IPI) ("Intrepid", the "Company", "we", "us" and "our") today reports its financial results for the fourth quarter and full-year of 2023.

Key Financial & Operational Highlights for the Fourth Quarter and Full-Year 2023

•Total sales of $56.7 million in the fourth quarter and $279.1 million for the full-year 2023.

•Net loss of $37.3 million (or $2.91 per diluted share) and $35.7 million (or $2.80 per diluted share) in the fourth quarter and full-year 2023, respectively, and an adjusted net loss(1) of $5.2 million and $3.0 million, respectively.

◦Included in the GAAP net loss figures are non-cash impairment charges of $42.8 million in the fourth quarter of 2023 and $43.3 million for the full-year 2023.

•Adjusted EBITDA(1) of $7.1 million for the fourth quarter, bringing our full-year 2023 adjusted EBITDA to $41.6 million.

•Cash flow from operations of $4.6 million in the fourth quarter, bringing our full-year 2023 cash flow from operations to $43.2 million.

•In December 2023, we announced the Third Amendment to the Cooperative Development Agreement with XTO Holdings (“XTO”), pursuant to which Intrepid received an initial $50 million in fees for Intrepid’ s agreement to support and not oppose XTO’s development and operation of oil and gas interests within a specified area. The Third Amendment also stipulates the following:

◦Intrepid will receive an additional guaranteed, one-time $50 million payment, which XTO will pay within 90 days upon the earlier occurrence of (i) either the approval of the first new or expanded drilling island within a specific area to be used by XTO, or (ii) within seven years of the anniversary of the Third Amendment effective date; and

◦XTO is also required to pay additional amounts to Intrepid of up to a maximum of $100 million in the event of certain additional drilling activities, although the timing and exact amount are uncertain.

•The breakdown of the $42.8 million impairment charge in the fourth quarter of 2023 is as follows: $31.9 million related to our conventional langbeinite mine ("East mine"), $9.9 million related to the remaining assets at our West mine - which has been in care and maintenance since 2016 - and $1.0 million related to various water recycling assets.

Liquidity & Investments

•We ended 2023 with cash and cash equivalents of approximately $4.1 million and had $4.0 million of outstanding borrowings on our $150 million revolving credit facility.

•As of March 1, 2024, cash and cash equivalents totaled approximately $35.4 million and we had no outstanding borrowings on our credit facility, for total liquidity of approximately $185.4 million.

•Intrepid maintains an investment account of short-and-long-term fixed income securities that had a balance of approximately $3.9 million as of March 1, 2024.

Capital Expenditures

•Our capital expenditures for 2023 totaled $65.1 million, which was at the lower-end of our guidance range of $65 to $75 million. For 2024, our capital expenditure guidance range is $40 to $50 million. Our growth capital spending is expected to moderate to approximately $20 to $25 million in 2024 as we complete the projects described below.

Strategic Focus for Growth Capital & Key Recent/Remaining Projects

•Our growth capital is focused on improving the production rates at our solar solution potash assets, which on a combined basis, have had a declining production profile since 2017. Our goal is to maximize brine availability and underground residence time, which in turn drives higher-grade extraction brine and an improved production profile.

HB Solution Mine in Carlsbad, New Mexico

•Key Takeaways for HB: The three projects highlighted below are expected to deliver the step-change to higher production at HB starting in the second half of 2024 and start us back on the path of injecting more brine into our cavern system. Through improved injection rates, we expect to increase underground residence time of our brine which should lead to higher extraction brine grades and improved potash production over the long-term. We are also initiating discussions with the regulatory agencies to expand HB's solution mining footprint to further increase the productive capacity of this mine.

•Eddy Shaft Brine Extraction Project: We successfully commissioned this project in October 2023. To date, we have extracted approximately 143 million gallons of high-grade brine, which represents approximately 30% of HB's 2024 brine extraction volume. The extracted brine has measured at a potassium chloride ("KCl") concentration of 9.1%, which is the highest level seen since our peak potash production years from 2017 to 2019. This project serves as an important bridge to achieving our higher production goals until we commission the new Replacement Extraction Well and Phase Two of the HB Injection Pipeline, but is also designed to have a long-term operational life as part of the brine injection/extraction cycle for the HB cavern system.

•Replacement Extraction Well ("IP30B"): Construction of the drilling pad recently finished and we expect to commission the project in the second quarter of 2024. This new extraction well is designed to have a long-term operational life and will also extract brine from the Eddy Cavern that is at deeper depths than the Eddy Shaft project. Given the lower depths, this brine is expected have an equal or higher KCl concentration than what is being extracted from the Eddy Shaft project. The initial brine pool that IP30B will extract has been measured at over 330 million gallons and together with the Eddy Shaft project is expected to provide for enough brine to cover the majority of our extraction needs at HB for 2024 and through early 2025. Note that this production is in addition to the Eddy Shaft brine we extracted in 2023 post-project commissioning.

•Phase Two of HB Injection Pipeline Project: All permitting is expected to be complete by the end of March 2024 and we anticipate construction beginning shortly thereafter, with commissioning expected in the first half of 2024. Upon Phase 2 commissioning, we expect our brine injection rates at HB to be the highest in company

history. This project is key for maximizing brine availability and residence time, and in turn, developing higher-grade concentrations of KCl for the extraction brine. The injected brine associated with Phase Two commissioning is expected to result in improved brine grades ready for extraction by mid-2025.

Brine Recovery Mine in Wendover, Utah

•Primary Pond 7: We started construction on a new primary pond at Wendover to increase the brine evaporative area, which will result in Wendover having two primary ponds when complete. Similar to our caverns at Moab and HB, the primary ponds at Wendover serve as the brine storage area, and adding another primary pond will help meet our goals of maximizing brine availability, increasing the KCl concentration in the brine, and improving our potash production. We expect this project to be commissioned in the third quarter of 2024 and with production benefits beginning in 2025.

•Lithium Project: We engaged Pickering Energy Partners as an advisor to help maximize the value of the lithium resource and evaluate direct lithium extraction technologies at Wendover. The lithium already present in our byproduct magnesium brine is estimated to support approximately two thousand tons of lithium carbonate production per year assuming a commercially feasible extraction technology. With a commercially feasible project, we plan to pursue a royalty structure or joint venture to limit Intrepid’s capital investment and operating costs.

Intrepid South

•Sand Project: After significant delays in the permitting process, we received the final air permit for our sand project in Southeastern New Mexico and we now have all required permits necessary for project construction and operation. This project is planned to have a productive capacity of one million tons of wet sand per year and we estimate that the underlying resource contains enough sand to support decades of production. With all necessary permits in hand, we are continuing to evaluate the market and our options, including the potential to add a strategic partner.

Consolidated Results, Management Commentary, & Outlook

Intrepid generated fourth quarter and full-year 2023 sales of approximately $56.7 million and $279.1 million, respectively, which compares to fourth quarter and full-year 2022 sales of approximately $66.7 million and $337.6 million, respectively. The lower sales in 2023 were driven by lower pricing after the record levels seen in 2022, partially offset by higher sales volumes. Our average net realized sales price for potash(1) totaled $466 per ton in 2023, while the average net realized sales price for Trio®(1) totaled $321 per ton. During the fourth quarter, Intrepid generated a GAAP net loss of $37.3 million, a non-GAAP adjusted net loss(1) of $5.2 million, and adjusted EBITDA(1) of $7.1 million, bringing our full-year 2023 figures to a GAAP net loss of $35.7 million, a non-GAAP adjusted net loss(1) of approximately $3.0 million, and adjusted EBITDA(1) of $41.6 million.

Bob Jornayvaz, Intrepid's Executive Chairman and CEO commented: "Intrepid's fourth quarter saw the continuation of strong demand for our potash and Trio® with our combined 2023 sales volumes up approximately 16% compared to 2022. Slightly lower fertilizer pricing and higher costs associated with our current potash production profile again proved to be headwinds to our margins in the fourth quarter, although we are on track to start to see the first step-change to higher potash production beginning in the second half of 2024. Moreover, fertilizer pricing has

remained resilient and we expect to see steady sales through the spring application season.

The key highlight during the quarter was the December announcement that we entered into the Third Amendment to the Cooperative Development Agreement with XTO. Intrepid has already received the first $50 million for its commitments under the Amendment, and the Amendment also stipulates that Intrepid will receive an additional guaranteed, one-time $50 million payment upon certain events, with XTO also being required to pay additional amounts in the event of certain additional drilling activities, up to a maximum of $100 million. This is a milestone development for Intrepid and the cash infusion significantly helps de-risk our outlook. Our current balance sheet is close to fully funding our 2024 capital program, providing a cash runway until we see the positive impacts to our unit economics associated with the higher potash production rates.

Intrepid's primary strategic priority has been to revitalize our potash assets and I'm very pleased to share that we are on track to successfully achieve this goal. We still have a couple projects to bring online over the next few months but our potash production outlook is improving, highlighted by the significantly improved brine grades we're already seeing in our harvest ponds at HB from the Eddy Shaft project. We are a few quarters away from seeing the first inflection to higher production from our HB mine and we want to be clear that our investments are designed to sustainably support higher potash production over the long-term.

As for our other growth opportunities, we recently received the final permit for our sand project at Intrepid South and we continue to make progress on our lithium resource at Wendover. Overall, we're optimistic on Intrepid's future and we'll be laser-focused on getting appropriate value back in the stock."

Segment Highlights

Potash

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | (in thousands, except per ton data) |

| Sales | | $ | 28,557 | | | $ | 43,756 | | | $ | 155,920 | | | $ | 191,378 | |

| Gross margin | | $ | 4,333 | | | $ | 20,907 | | | $ | 35,049 | | | $ | 94,769 | |

| | | | | | | | |

| Potash production volume (in tons) | | 79 | | | 106 | | | 224 | | | 270 | |

| Potash sales volume (in tons) | | 45 | | | 50 | | | 258 | | | 222 | |

| | | | | | | | |

Average potash net realized sales price per ton(1) | | $ | 431 | | | $ | 693 | | | $ | 466 | | | $ | 713 | |

Our total potash segment sales in 2023 decreased $35.5 million to $155.9 million, or 19%, compared to 2022, as potash sales decreased 22%, partially offset by an 8% increase in byproduct sales. Potash sales decreased in 2023 as the average potash net realized sales price per ton decreased 35%, partially offset by a 16% increase in potash tons sold. Potash prices peaked during the second quarter of 2022 and steadily declined in each succeeding quarter in 2023. Potash tons sold increased in 2023 as supportive farm commodity prices and lower potash prices drove solid demand.

Potash segment cost of goods sold increased $20.9 million, or 27%, in 2023, compared to 2022, mainly due to a 16% increase in potash tons sold. In addition, our weighted average carrying cost per ton increased mainly due to a 15%, or $3.8 million increase in production labor and benefits expenses in 2023. Our total tons of potash produced decreased 17% in 2023, compared to 2022, which also drove an increase in our per ton production costs. As the majority of our production costs are fixed, decreases in tons produced results in higher per ton costs.

During 2023, we recorded $2.7 million in lower of cost or net realizable value inventory adjustments as our weighted average carry cost per ton exceeded our expected net realizable value per potash ton.

Our potash segment gross margin decreased $59.7 million in 2023, compared to 2022, which was primarily due to the $35.5 million decrease in potash segment sales, increased cost of goods sold, and the lower of cost or net realizable value inventory adjustments, as discussed above.

Trio®

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | (in thousands, except per ton data) |

| Sales | | $ | 21,130 | | | $ | 17,265 | | | $ | 102,182 | | | $ | 117,826 | |

| Gross (deficit) margin | | $ | (2,378) | | | $ | 3,429 | | | $ | (3,995) | | | $ | 39,123 | |

| | | | | | | | |

Trio® production volume (in tons) | | 57 | | | 51 | | | 216 | | | 226 | |

Trio® sales volume (in tons) | | 49 | | | 28 | | | 228 | | | 197 | |

| | | | | | | | |

Average Trio® net realized sales price per ton(1) | | $ | 292 | | | $ | 461 | | | $ | 321 | | | $ | 479 | |

Our total Trio® segment sales decreased $15.6 million, or 13%, in 2023, as compared to 2022, as Trio® sales decreased 15%, or $17.6 million, partially offset by a $2.0 million increase in segment byproduct sales, which was primarily driven by an increase in byproduct water sales.

Our 2023 Trio® sales decreased $17.6 million, or 15%, in 2023, as compared to 2022, as our average net realized sales price per ton decreased 33%, which was partially offset by a 16% increase in Trio® tons sold. Our Trio® average net realized sales price per ton decreased as the value of potassium fertilizers declined due to improved global production rates and product availability. Our higher Trio® tons sold in 2023 benefited from the reduced sales volumes we experienced in the second half of 2022 as customers delayed purchases in anticipation of lower price levels and overall strong commodity prices throughout 2023.

Our Trio® cost of goods sold increased $19.7 million in 2023, or 36%, compared to 2022, primarily driven by a 16% increase in our Trio® tons sold and an increase in our per ton production costs. In addition, we also began 2023 with a higher average cost per ton of inventory compared to 2022. Our Trio® production costs increased in 2023 due to a $1.8 million increase in labor and benefits expenses, a $1.8 million increase in operating and maintenance supplies, a $1.8 million increase in depreciation due to increased capital investments, and a $1.0 million increase in property taxes and insurance, and were partially offset by a $1.0 reduction in royalty expense due to decreased sales revenue.

In 2023, our Trio® segment gross deficit totaled $4.0 million which compares to gross margin of $39.1 million in 2022.

Oilfield Solutions

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | (in thousands) |

| Sales | | $ | 7,045 | | | $ | 5,732 | | | $ | 21,310 | | | $ | 28,668 | |

| Gross margin | | $ | 2,666 | | | $ | 1,315 | | | $ | 5,792 | | | $ | 7,516 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Our oilfield solutions segment sales decreased 26% in 2023, compared to 2022. Water sales decreased $7.9 million in 2023 to $9.6 million, and revenue from right-of-way agreements, surface damages and easements decreased by $0.7 million. Brine sales increased $1.4 million, and produced water disposal royalties increased $0.1 million during 2023, compared to 2022.

Our oilfield solutions water sales decreased as we purchased $5.0 million less in third-party water for resale in 2023 and due to reduced sales of Caprock water. Our sales of brine increased as we sold increased volumes of brine at a higher per barrel price in 2023.

Oilfield solutions cost of goods sold decreased 27% in 2023, compared to 2022, primarily due to a $5.0 million decrease in third-party water purchased for resale. We incurred $0.6 million in increased labor and benefits expenses and a $0.6 million increase in depreciation related to new infrastructure placed in service in 2023, compared to 2022. These increased costs were partially offset by a $0.5 million decrease in royalty expense in 2023, compared to 2022, due to reduced water sales. Segment gross margin decreased $1.7 million, or 23%, in 2023 compared to 2022, due to the factors described above.

Notes

1 Adjusted net (loss) income, average net realized sales price per ton and adjusted EBITDA are non-GAAP financial measures. See the non-GAAP reconciliations set forth later in this press release for additional information.

Unless expressly stated otherwise or the context otherwise requires, references to tons in this press release refer to short tons. One short ton equals 2,000 pounds. One metric tonne, which many international competitors use, equals 1,000 kilograms or 2,204.62 pounds.

Conference Call Information

Intrepid will host a conference call on Thursday, March 7, 2024, at 12:00 p.m. Eastern Time to discuss the results and other operating and financial matters and answer investor questions.

Management invites you to listen to the conference call by using the toll-free dial-in number 1 (800) 715-9871 or International dial-in number 1 (646) 307-1963; please use conference ID 1179359.

The call will also be streamed on the Intrepid website, intrepidpotash.com. A recording of the conference call will be available approximately two hours after the completion of the call by dialing 1 (800) 770-2030 for toll-free, 1 (609) 800-9909 for International, or at

intrepidpotash.com. The replay of the call will require the input of the conference identification number 1179359. The recording will be available through March 14, 2024.

About Intrepid

Intrepid is a diversified mineral company that delivers potassium, magnesium, sulfur, salt, and water products essential for customer success in agriculture, animal feed, and the oil and gas industry. Intrepid is the only U.S. producer of muriate of potash, which is applied as an essential nutrient for healthy crop development, utilized in several industrial applications, and used as an ingredient in animal feed. In addition, Intrepid produces a specialty fertilizer, Trio®, which delivers three key nutrients, potassium, magnesium, and sulfate, in a single particle. Intrepid also provides water, magnesium chloride, brine, and various oilfield products and services. Intrepid serves diverse customers in markets where a logistical advantage exists and is a leader in the use of solar evaporation for potash production, resulting in lower cost and more environmentally friendly production. Intrepid's mineral production comes from three solar solution potash facilities and one conventional underground Trio® mine.

Intrepid routinely posts important information, including information about upcoming investor presentations and press releases, on its website under the Investor Relations tab. Investors and other interested parties are encouraged to enroll at intrepidpotash.com, to receive automatic email alerts for new postings.

Forward-looking Statements

This document contains forward-looking statements - that is, statements about future, not past, events. The forward-looking statements in this document relate to, among other things, statements about Intrepid's future financial performance and cash flows, water sales, production costs, and its market outlook. These statements are based on assumptions that Intrepid believes are reasonable. Forward-looking statements by their nature address matters that are uncertain. The particular uncertainties that could cause Intrepid's actual results to be materially different from its forward-looking statements include the following:

•changes in the price, demand, or supply of our products and services;

•challenges and legal proceedings related to our water rights;

•our ability to successfully identify and implement any opportunities to grow our business whether through expanded sales of water, Trio®, byproducts, and other non-potassium related products or other revenue diversification activities;

•the costs of, and our ability to successfully execute, any strategic projects;

•declines or changes in agricultural production or fertilizer application rates;

•declines in the use of potassium-related products or water by oil and gas companies in their drilling operations;

•our ability to prevail in outstanding legal proceedings against us;

•our ability to comply with the terms of our revolving credit facility, including the underlying covenants;

•further write-downs of the carrying value of assets, including inventories;

•circumstances that disrupt or limit production, including operational difficulties or variances, geological or geotechnical variances, equipment failures, environmental hazards, and other unexpected events or problems;

•changes in reserve estimates;

•currency fluctuations;

•adverse changes in economic conditions or credit markets;

•the impact of governmental regulations, including environmental and mining regulations, the enforcement of those regulations, and governmental policy changes;

•adverse weather events, including events affecting precipitation and evaporation rates at our solar solution mines;

•increased labor costs or difficulties in hiring and retaining qualified employees and contractors, including workers with mining, mineral processing, or construction expertise;

•changes in the prices of raw materials, including chemicals, natural gas, and power;

•our ability to obtain and maintain any necessary governmental permits or leases relating to current or future operations;

•interruptions in rail or truck transportation services, or fluctuations in the costs of these services;

•our inability to fund necessary capital investments;

•the impact of global health issues and other global disruptions on our business, operations, liquidity, financial condition and results of operations; and

•the other risks, uncertainties, and assumptions described in Intrepid's periodic filings with the Securities and Exchange Commission, including in "Risk Factors" in Intrepid's Annual Report on Form 10-K for the year ended December 31, 2022, as updated by subsequent Quarterly Reports on Form 10-Q.

In addition, new risks emerge from time to time. It is not possible for Intrepid to predict all risks that may cause actual results to differ materially from those contained in any forward-looking statements Intrepid may make.

All information in this document speaks as of the date of this release. New information or events after that date may cause our forward-looking statements in this document to change. We undertake no duty to update or revise publicly any forward-looking statements to conform the statements to actual results or to reflect new information or future events.

Contact:

Evan Mapes, CFA, Investor Relations Manager

Phone: 303-996-3042

Email: evan.mapes@intrepidpotash.com

INTREPID POTASH, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

FOR THE THREE AND TWELVE MONTHS ENDED DECEMBER 31, 2023 AND 2022

(In thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Sales | | $ | 56,663 | | | $ | 66,677 | | | $ | 279,083 | | | $ | 337,568 | |

| Less: | | | | | | | | |

| Freight costs | | 7,620 | | | 6,880 | | | 37,635 | | | 34,137 | |

| Warehousing and handling costs | | 2,567 | | | 2,526 | | | 10,832 | | | 9,747 | |

| Cost of goods sold | | 38,776 | | | 31,620 | | | 187,278 | | | 152,276 | |

| Lower of cost or net realizable value inventory adjustments | | 3,079 | | | — | | | 6,492 | | | — | |

| | | | | | | | |

| Gross Margin | | 4,621 | | | 25,651 | | | 36,846 | | | 141,408 | |

| | | | | | | | |

| Selling and administrative | | 7,932 | | | 9,241 | | | 32,423 | | | 31,799 | |

| | | | | | | | |

| Accretion of asset retirement obligation | | 535 | | | 490 | | | 2,140 | | | 1,961 | |

| | | | | | | | |

| Impairment of long-lived assets | | 42,767 | | | — | | | 43,288 | | | — | |

| Loss on sale of assets | | 555 | | | 6,294 | | | 807 | | | 7,470 | |

| Other operating expense | | 277 | | | 3,499 | | | 2,157 | | | 4,738 | |

| Operating (Loss) Income | | (47,445) | | | 6,127 | | | (43,969) | | | 95,440 | |

| | | | | | | | |

| Other Income (Expense) | | | | | | | | |

| Equity in earnings of unconsolidated entities | | (194) | | | (77) | | | (486) | | | 689 | |

| Interest expense, net | | — | | | (16) | | | — | | | (101) | |

| Interest income | | 49 | | | 82 | | | 298 | | | 176 | |

| Other income | | 20 | | | 24 | | | 95 | | | 305 | |

| | | | | | | | |

| (Loss) Income Before Income Taxes | | (47,570) | | | 6,140 | | | (44,062) | | | 96,509 | |

| | | | | | | | |

| Income Tax Benefit (Expense) | | 10,282 | | | (2,158) | | | 8,389 | | | (24,289) | |

| Net (Loss) Income | | $ | (37,288) | | | $ | 3,982 | | | $ | (35,673) | | | $ | 72,220 | |

| | | | | | | | |

| Weighted Average Shares Outstanding: | | | | | | | | |

| Basic | | 12,792,650 | | | 12,946,415 | | | 12,760,937 | | | 13,151,752 | |

| Diluted | | 12,792,650 | | | 13,160,627 | | | 12,760,937 | | | 13,452,233 | |

| (Loss) Income Per Share: | | | | | | | | |

| Basic | | $ | (2.91) | | | $ | 0.31 | | | $ | (2.80) | | | $ | 5.49 | |

| Diluted | | $ | (2.91) | | | $ | 0.30 | | | $ | (2.80) | | | $ | 5.37 | |

INTREPID POTASH, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

AS OF DECEMBER 31, 2023 AND 2022

(In thousands, except share and per share amounts)

| | | | | | | | | | | | | | |

| | December 31, |

| | 2023 | | 2022 |

| ASSETS | | | | |

| Cash and cash equivalents | | $ | 4,071 | | | $ | 18,514 | |

| Short-term investments | | 2,970 | | | 5,959 | |

| Accounts receivable: | | | | |

| Trade, net | | 22,077 | | | 26,737 | |

| Other receivables, net | | 1,374 | | | 790 | |

| | | | |

| Inventory, net | | 114,252 | | | 114,816 | |

| Other current assets | | 7,200 | | | 4,863 | |

| | | | |

| Total current assets | | 151,944 | | | 171,679 | |

| | | | |

| | | | |

| Property, plant, equipment, and mineral properties, net | | 358,249 | | | 375,630 | |

| Water rights | | 19,184 | | | 19,184 | |

| Long-term parts inventory, net | | 30,231 | | | 24,823 | |

| Long-term investments | | 6,627 | | | 9,841 | |

| Other assets, net | | 8,016 | | | 7,294 | |

| Non-current deferred tax asset, net | | 194,223 | | | 185,752 | |

| Total Assets | | $ | 768,474 | | | $ | 794,203 | |

| | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | |

| | | | |

| Accounts payable | | $ | 12,848 | | | $ | 18,645 | |

| | | | |

| Income taxes payable | | 40 | | | 8 | |

| Accrued liabilities | | 19,061 | | | 16,212 | |

| Accrued employee compensation and benefits | | 7,254 | | | 6,975 | |

| Other current liabilities | | 7,265 | | | 7,036 | |

| | | | |

| | | | |

| Total current liabilities | | 46,468 | | | 48,876 | |

| | | | |

| Advances on credit facility | | 4,000 | | | — | |

| | | | |

| Asset retirement obligation | | 30,077 | | | 26,564 | |

| Operating lease liabilities | | 741 | | | 2,206 | |

| Finance lease liabilities | | 1,451 | | | — | |

| Other non-current liabilities | | 1,309 | | | 1,479 | |

| Total Liabilities | | 84,046 | | | 79,125 | |

| | | | |

| Commitments and Contingencies | | | | |

| | | | |

| Common stock, $0.001 par value; 40,000,000 shares authorized: | | | | |

and 12,807,316 and 12,687,822 shares outstanding | | | | |

| at December 31, 2023 and 2022, respectively | | 13 | | | 13 | |

| Additional paid-in capital | | 665,637 | | | 660,614 | |

| | | | |

| Retained earnings | | 40,790 | | | 76,463 | |

| Less treasury stock, at cost | | (22,012) | | | (22,012) | |

| Total Stockholders' Equity | | 684,428 | | | 715,078 | |

| Total Liabilities and Stockholders' Equity | | $ | 768,474 | | | $ | 794,203 | |

INTREPID POTASH, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

FOR THE THREE AND TWELVE MONTHS ENDED DECEMBER 31, 2023 AND 2022

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, | | | | |

| | 2023 | | 2022 | | 2023 | | 2022 | | | | |

| Cash Flows from Operating Activities: | | | | | | | | | | | | |

| Net (loss) income | | $ | (37,288) | | | $ | 3,982 | | | $ | (35,673) | | | $ | 72,220 | | | | | |

| Adjustments to reconcile net (loss) income to net cash provided by operating activities: | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Depreciation, depletion, and amortization | | 10,773 | | | 9,426 | | | 39,078 | | | 34,711 | | | | | |

| Amortization of intangible assets | | 81 | | | 81 | | | 322 | | | 322 | | | | | |

| Accretion of asset retirement obligation | | 535 | | | 490 | | | 2,140 | | | 1,961 | | | | | |

| Amortization of deferred financing costs | | 75 | | | 78 | | | 301 | | | 265 | | | | | |

| Stock-based compensation | | 1,463 | | | 2,187 | | | 6,534 | | | 6,152 | | | | | |

| Reserve for obsolescence | | 369 | | | — | | | 509 | | | 1,750 | | | | | |

| Allowance for doubtful accounts | | — | | | — | | | 110 | | | — | | | | | |

| Impairment of long-lived assets | | 42,767 | | | — | | | 43,288 | | | — | | | | | |

| Loss (gain) on disposal of assets | | 555 | | | 6,294 | | | 807 | | | 7,470 | | | | | |

| Equity in earnings of unconsolidated entities | | 194 | | | 77 | | | 486 | | | (689) | | | | | |

| Distribution of earnings from unconsolidated entities | | — | | | — | | | 452 | | | — | | | | | |

| | | | | | | | | | | | |

| Lower of cost or net realizable value inventory adjustments | | 3,079 | | | — | | | 6,492 | | | — | | | | | |

| | | | | | | | | | | | |

| Changes in operating assets and liabilities: | | | | | | | | | | | | |

| Trade accounts receivable, net | | 2,014 | | | 11,493 | | | 4,550 | | | 8,673 | | | | | |

| Other receivables, net | | 958 | | | 1,251 | | | (701) | | | 140 | | | | | |

| | | | | | | | | | | | |

| Inventory, net | | (14,240) | | | (17,329) | | | (11,861) | | | (33,283) | | | | | |

| Other current assets | | (2,959) | | | 1,695 | | | (3,857) | | | 191 | | | | | |

| Deferred tax assets | | (10,227) | | | 1,775 | | | (8,471) | | | 23,323 | | | | | |

Accounts payable, accrued liabilities, and accrued employee

compensation and benefits | | 6,500 | | | (4,595) | | | 1,284 | | | (3,596) | | | | | |

| Income tax payable | | 32 | | | (33) | | | 32 | | | (33) | | | | | |

| Operating lease liabilities | | (517) | | | (406) | | | (1,735) | | | (2,025) | | | | | |

| Other liabilities | | 440 | | | 3,243 | | | (858) | | | (28,731) | | | | | |

| Net cash provided by operating activities | | 4,604 | | | 19,709 | | | 43,229 | | | 88,821 | | | | | |

| | | | | | | | | | | | |

| Cash Flows from Investing Activities: | | | | | | | | | | | | |

| Additions to property, plant, equipment, mineral properties and other assets | | (6,576) | | | (31,596) | | | (65,060) | | | (68,696) | | | | | |

| Proceeds from sale of property, plant, equipment, and mineral properties | | — | | | 12 | | | 125 | | | 58 | | | | | |

| | | | | | | | | | | | |

| Purchase of investments | | — | | | (183) | | | (1,415) | | | (13,047) | | | | | |

| | | | | | | | | | | | |

| Proceeds from redemptions/maturities of investments | | 1,500 | | | 1,002 | | | 6,000 | | | 2,506 | | | | | |

| Other investing, net | | 128 | | | — | | | 796 | | | — | | | | | |

| Net cash used in investing activities | | (4,948) | | | (30,765) | | | (59,554) | | | (79,179) | | | | | |

| | | | | | | | | | | | |

| Cash Flows from Financing Activities: | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Payments of financing lease | | (198) | | | — | | | (597) | | | — | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Proceeds from borrowings on credit facility | | 2,000 | | | — | | | 9,000 | | | — | | | | | |

| Repayments of borrowings on credit facility | | — | | | — | | | (5,000) | | | — | | | | | |

| Capitalized debt costs | | — | | | (74) | | | — | | | (1,007) | | | | | |

| Employee tax withholding paid for restricted shares upon vesting | | (174) | | | (433) | | | (1,511) | | | (4,795) | | | | | |

| Repurchases of common stock | | — | | | (19,131) | | | — | | | (22,012) | | | | | |

| Proceeds from exercise of stock options | | — | | | — | | | — | | | 110 | | | | | |

| Net cash provided by (used in) financing activities | | 1,628 | | | (19,638) | | | 1,892 | | | (27,704) | | | | | |

| | | | | | | | | | | | |

| Net Change in Cash, Cash Equivalents, and Restricted Cash | | 1,284 | | | (30,694) | | | (14,433) | | | (18,062) | | | | | |

| Cash, Cash Equivalents, and Restricted Cash, beginning of period | | 3,367 | | | 49,778 | | | 19,084 | | | 37,146 | | | | | |

| Cash, Cash Equivalents, and Restricted Cash, end of period | | $ | 4,651 | | | $ | 19,084 | | | $ | 4,651 | | | $ | 19,084 | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

INTREPID POTASH, INC.

DISAGGREGATION OF REVENUE AND SEGMENT DATA (UNAUDITED)

FOR THE THREE AND TWELVE MONTHS ENDED DECEMBER 31, 2023 AND 2022

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2023 |

| Product | | Potash Segment | | Trio® Segment | | Oilfield Solutions Segment | | Intersegment Eliminations | | Total |

| Potash | | $ | 20,965 | | | $ | — | | | $ | — | | | $ | (69) | | | $ | 20,896 | |

Trio® | | — | | | 19,457 | | | — | | | — | | | 19,457 | |

| Water | | 69 | | | 1,426 | | | 4,249 | | | — | | | 5,744 | |

| Salt | | 2,976 | | | 247 | | | — | | | — | | | 3,223 | |

| Magnesium Chloride | | 3,322 | | | — | | | — | | | — | | | 3,322 | |

| Brines | | 1,225 | | | — | | | 1,203 | | | — | | | 2,428 | |

| Other | | — | | | — | | | 1,593 | | | | | 1,593 | |

| Total Revenue | | $ | 28,557 | | | $ | 21,130 | | | $ | 7,045 | | | $ | (69) | | | $ | 56,663 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, 2023 |

| Product | | Potash Segment | | Trio® Segment | | Oilfield Solutions Segment | | Intersegment Eliminations | | Total |

| Potash | | $ | 131,206 | | | $ | — | | | $ | — | | | $ | (329) | | | $ | 130,877 | |

Trio® | | — | | | 96,344 | | | — | | | — | | | 96,344 | |

| Water | | 297 | | | 5,316 | | | 9,569 | | | — | | | 15,182 | |

| Salt | | 11,973 | | | 522 | | | — | | | — | | | 12,495 | |

| Magnesium Chloride | | 8,161 | | | — | | | — | | | — | | | 8,161 | |

| Brines | | 4,283 | | | — | | | 4,056 | | | — | | | 8,339 | |

| Other | | — | | | — | | | 7,685 | | | — | | | 7,685 | |

| Total Revenue | | $ | 155,920 | | | $ | 102,182 | | | $ | 21,310 | | | $ | (329) | | | $ | 279,083 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2022 |

| Product | | Potash Segment | | Trio® Segment | | Oilfield Solutions Segment | | Intersegment Eliminations | | Total |

| Potash | | $ | 36,887 | | | $ | — | | | $ | — | | | $ | (76) | | | $ | 36,811 | |

Trio® | | — | | | 16,501 | | | — | | | — | | | 16,501 | |

| Water | | 73 | | | 580 | | | 4,250 | | | — | | | 4,903 | |

| Salt | | 3,133 | | | 184 | | | — | | | — | | | 3,317 | |

| Magnesium Chloride | | 2,450 | | | — | | | — | | | — | | | 2,450 | |

| Brines | | 1,213 | | | — | | | 491 | | | — | | | 1,704 | |

| Other | | — | | | — | | | 991 | | | | | 991 | |

| Total Revenue | | $ | 43,756 | | | $ | 17,265 | | | $ | 5,732 | | | $ | (76) | | | $ | 66,677 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, 2022 |

| Product | | Potash Segment | | Trio® Segment | | Oilfield Solutions Segment | | Intersegment Eliminations | | Total |

| Potash | | $ | 168,571 | | | $ | — | | | $ | — | | | $ | (304) | | | $ | 168,267 | |

Trio® | | — | | | 113,962 | | | — | | | — | | | 113,962 | |

| Water | | 1,637 | | | 3,302 | | | 17,510 | | | — | | | 22,449 | |

| Salt | | 11,270 | | | 562 | | | — | | | — | | | 11,832 | |

| Magnesium Chloride | | 6,472 | | | — | | | — | | | — | | | 6,472 | |

| Brines | | 3,428 | | | — | | | 2,670 | | | — | | | 6,098 | |

| Other | | — | | | — | | | 8,488 | | | — | | | 8,488 | |

| Total Revenue | | $ | 191,378 | | | $ | 117,826 | | | $ | 28,668 | | | $ | (304) | | | $ | 337,568 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 | | Potash | | Trio® | | Oilfield Solutions | | Other | | Consolidated |

Sales(1) | | $ | 28,557 | | | $ | 21,130 | | | $ | 7,045 | | | $ | (69) | | | $ | 56,663 | |

| Less: Freight costs | | 2,516 | | | 5,173 | | | — | | | (69) | | | 7,620 | |

Warehousing and handling costs | | 1,327 | | | 1,240 | | | — | | | — | | | 2,567 | |

Cost of goods sold | | 18,755 | | | 15,642 | | | 4,379 | | | — | | | 38,776 | |

Lower of cost or net realizable value inventory adjustments | | 1,626 | | | 1,453 | | | — | | | — | | | 3,079 | |

| | | | | | | | | | |

| Gross Margin (Deficit) | | $ | 4,333 | | | $ | (2,378) | | | $ | 2,666 | | | $ | — | | | $ | 4,621 | |

Depreciation, depletion, and amortization incurred(2) | | $ | 7,625 | | | $ | 1,923 | | | $ | 1,077 | | | $ | 229 | | | $ | 10,854 | |

| | | | | | | | | | |

| Year Ended December 31, 2023 | | Potash | | Trio® | | Oilfield Solutions | | Other | | Consolidated |

Sales(1) | | $ | 155,920 | | | $ | 102,182 | | | $ | 21,310 | | | $ | (329) | | | $ | 279,083 | |

| Less: Freight costs | | 14,753 | | | 23,211 | | | — | | | (329) | | | 37,635 | |

Warehousing and handling costs | | 5,957 | | | 4,875 | | | — | | | — | | | 10,832 | |

Cost of goods sold | | 97,452 | | | 74,308 | | | 15,518 | | | — | | | 187,278 | |

Lower of cost or net realizable value inventory adjustments | | 2,709 | | | 3,783 | | | — | | | — | | | 6,492 | |

| | | | | | | | | | |

| Gross Margin (Deficit) | | $ | 35,049 | | | $ | (3,995) | | | $ | 5,792 | | | $ | — | | | $ | 36,846 | |

Depreciation, depletion, and amortization incurred(2) | | $ | 28,378 | | | $ | 6,288 | | | $ | 3,849 | | | $ | 885 | | | $ | 39,400 | |

| | | | | | | | | | |

| Three Months Ended December 31, 2022 | | Potash | | Trio® | | Oilfield Solutions | | Other | | Consolidated |

Sales(1) | | $ | 43,756 | | | $ | 17,265 | | | $ | 5,732 | | | $ | (76) | | | $ | 66,677 | |

| Less: Freight costs | | 3,350 | | | 3,606 | | | — | | | (76) | | | 6,880 | |

Warehousing and handling costs | | 1,358 | | | 1,168 | | | — | | | — | | | 2,526 | |

Cost of goods sold | | 18,141 | | | 9,062 | | | 4,417 | | | — | | | 31,620 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Gross Margin | | $ | 20,907 | | | $ | 3,429 | | | $ | 1,315 | | | $ | — | | | $ | 25,651 | |

Depreciation, depletion, and amortization incurred(2) | | $ | 7,222 | | | $ | 1,248 | | | $ | 840 | | | $ | 197 | | | $ | 9,507 | |

| | | | | | | | | | |

| Year Ended December 31, 2022 | | Potash | | Trio® | | Oilfield Solutions | | Other | | Consolidated |

Sales(1) | | $ | 191,378 | | | $ | 117,826 | | | $ | 28,668 | | | $ | (304) | | | $ | 337,568 | |

| Less: Freight costs | | 14,780 | | | 19,661 | | | — | | | (304) | | | 34,137 | |

Warehousing and handling costs | | 5,305 | | | 4,442 | | | — | | | — | | | 9,747 | |

Cost of goods sold | | 76,524 | | | 54,600 | | | 21,152 | | | — | | | 152,276 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Gross Margin | | $ | 94,769 | | | $ | 39,123 | | | $ | 7,516 | | | $ | — | | | $ | 141,408 | |

Depreciation, depletion and, amortization incurred(2) | | $ | 26,572 | | | $ | 4,370 | | | $ | 3,298 | | | $ | 793 | | | $ | 35,033 | |

(1) Segment sales include the sales of byproducts generated during the production of potash and Trio®.

(2) Depreciation, depletion, and amortization incurred for potash and Trio® excludes depreciation and depletion amounts absorbed in or (relieved from) inventory.

INTREPID POTASH, INC.

UNAUDITED NON-GAAP RECONCILIATIONS

FOR THE THREE AND TWELVE MONTHS ENDED DECEMBER 31, 2023 AND 2022

(In thousands, except per share amounts)

To supplement Intrepid's consolidated financial statements, which are prepared and presented in accordance with GAAP, Intrepid uses several non-GAAP financial measures to monitor and evaluate its performance. These non-GAAP financial measures include adjusted net (loss) income, adjusted net (loss) income per diluted share, adjusted EBITDA, and average net realized sales price per ton. These non-GAAP financial measures should not be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. In addition, because the presentation of these non-GAAP financial measures varies among companies, these non-GAAP financial measures may not be comparable to similarly titled measures used by other companies.

Intrepid believes these non-GAAP financial measures provide useful information to investors for analysis of its business. Intrepid uses these non-GAAP financial measures as one of its tools in comparing period-over-period performance on a consistent basis and when planning, forecasting, and analyzing future periods. Intrepid believes these non-GAAP financial measures are used by professional research analysts and others in the valuation, comparison, and investment recommendations of companies in the potash mining industry. Many investors use the published research reports of these professional research analysts and others in making investment decisions.

Adjusted Net (Loss) Income and Adjusted Net (Loss) Income Per Diluted Share

Adjusted net (loss) income and adjusted net (loss) income per diluted share are calculated as net (loss) income or net (loss) income per diluted share adjusted for certain items that impact the comparability of results from period to period, as set forth in the reconciliation below. Intrepid considers these non-GAAP financial measures to be useful because they allow for period-to-period comparisons of its operating results excluding items that Intrepid believes are not indicative of its fundamental ongoing operations.

Reconciliation of Net (Loss) Income to Adjusted Net (Loss) Income:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net (Loss) Income | $ | (37,288) | | | $ | 3,982 | | | $ | (35,673) | | | $ | 72,220 | |

| Adjustments | | | | | | | |

| Impairment of long-lived assets | 42,767 | | | — | | | 43,288 | | | — | |

| Loss on sale of assets | 555 | | | 6,294 | | | 807 | | | 7,470 | |

| | | | | | | |

| | | | | | | |

Write-off of deferred offering fees(1) | — | | | 700 | | | — | | | 700 | |

| | | | | | | |

| | | | | | | |

Calculated income tax effect(2) | (11,264) | | | (1,818) | | | (11,465) | | | (2,124) | |

| Total adjustments | 32,058 | | | 5,176 | | | 32,630 | | | 6,046 | |

| Adjusted Net (Loss) Income | $ | (5,230) | | | $ | 9,158 | | | $ | (3,043) | | | $ | 78,266 | |

Reconciliation of Net (Loss) Income per Share to Adjusted Net (Loss) Income per Share:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net (Loss) Income Per Diluted Share | $ | (2.91) | | | $ | 0.30 | | | $ | (2.80) | | | $ | 5.37 | |

| Adjustments | | | | | | | |

| Impairment of long-lived assets | 3.34 | | | — | | | 3.39 | | | — | |

| Loss on sale of assets | 0.04 | | | 0.48 | | | 0.06 | | | 0.56 | |

| | | | | | | |

| | | | | | | |

Write-off of deferred offering fees(1) | — | | | 0.05 | | | — | | | 0.05 | |

| | | | | | | |

| | | | | | | |

Calculated income tax effect(2) | (0.88) | | | (0.14) | | | (0.90) | | | (0.16) | |

| Total adjustments | 2.50 | | | 0.39 | | | 2.55 | | | 0.45 | |

| Adjusted Net (Loss) Income Per Diluted Share | $ | (0.41) | | | $ | 0.69 | | | $ | (0.25) | | | $ | 5.82 | |

(1) - Costs incurred for a potential offering of shares of Intrepid Acquisition Corporation I, a special purpose acquisition company that is a subsidiary of Intrepid, that had been deferred were expensed in the fourth quarter of 2022, and are reflected in selling and administrative expense.

(2) - Assumes an annual effective tax rate of 26% for 2023 and 2022.

Average Potash and Trio® Net Realized Sales Price per Ton

Average net realized sales price per ton for potash is calculated as potash segment sales less potash segment byproduct sales and potash freight costs and then dividing that difference by the number of tons of potash sold in the period. Likewise, average net realized sales price per ton for Trio® is calculated as Trio® segment sales less Trio® segment byproduct sales and Trio® freight costs and then dividing that difference by Trio® tons sold. Intrepid considers average net realized sales price per ton to be useful, and believe it to be useful for investors, because it shows Intrepid's potash and Trio® average per-ton pricing without the effect of certain transportation and delivery costs. When Intrepid arranges transportation and delivery for a customer, it includes in revenue and in freight costs the costs associated with transportation and delivery. However, some of Intrepid's customers arrange for and pay their own transportation and delivery costs, in which case these costs are not included in Intrepid's revenue and freight costs. Intrepid uses average net realized sales price per ton as a key performance indicator to analyze potash and Trio® sales and price trends.

Reconciliation of Sales to Average Potash and Trio® Net Realized Sales Price per Ton:

| | | | | | | | | | | | | | |

| | Potash Segment |

| | Three Months Ended December 31, |

| (in thousands, except per ton amounts) | | 2023 | | 2022 |

| Total Segment Sales | | $ | 28,557 | | | $ | 43,756 | |

| Less: Segment byproduct sales | | 7,592 | | | 6,869 | |

| Potash freight costs | | 1,590 | | | 2,219 | |

Subtotal | | $ | 19,375 | | | $ | 34,668 | |

| | | | |

| Divided by: | | | | |

| Potash tons sold | | 45 | | | 50 | |

Average net realized sales price per ton | | $ | 431 | | | $ | 693 | |

| | | | | | | | | | | | | | |

| | Potash Segment |

| | Year Ended December 31, |

| (in thousands, except per ton amounts) | | 2023 | | 2022 |

| Total Segment Sales | | $ | 155,920 | | | $ | 191,378 | |

| Less: Segment byproduct sales | | 24,714 | | | 22,807 | |

| Potash freight costs | | 10,911 | | | 10,336 | |

| Subtotal | | $ | 120,295 | | | $ | 158,235 | |

| | | | |

| Divided by: | | | | |

| Potash tons sold | | 258 | | | 222 | |

| Average net realized sales price per ton | | $ | 466 | | | $ | 713 | |

| | | | | | | | | | | | | | |

| | Trio® Segment |

| | Three Months Ended December 31, |

| (in thousands, except per ton amounts) | | 2023 | | 2022 |

Total Segment Sales | | $ | 21,130 | | | $ | 17,265 | |

| Less: Segment byproduct sales | | 1,673 | | | 764 | |

Trio® freight costs | | 5,173 | | | 3,606 | |

Subtotal | | $ | 14,284 | | | $ | 12,895 | |

| | | | |

| Divided by: | | | | |

Trio® tons sold | | 49 | | | 28 | |

| Average net realized sales price per ton | | $ | 292 | | | $ | 461 | |

| | | | | | | | | | | | | | |

| | Trio® Segment |

| | Year Ended December 31, |

| (in thousands, except per ton amounts) | | 2023 | | 2022 |

Total Segment Sales | | $ | 102,182 | | | $ | 117,826 | |

| Less: Segment byproduct sales | | 5,838 | | | 3,864 | |

Trio® freight costs | | 23,211 | | | 19,661 | |

Subtotal | | $ | 73,133 | | | $ | 94,301 | |

| | | | |

| Divided by: | | | | |

Trio® tons sold | | 228 | | | 197 | |

| Average net realized sales price per ton | | $ | 321 | | | $ | 479 | |

Adjusted EBITDA

Adjusted earnings before interest, taxes, depreciation, and amortization (or adjusted EBITDA) is calculated as net income adjusted for certain items that impact the comparability of results from period to period, as set forth in the reconciliation below. Intrepid considers adjusted EBITDA to be useful because the measure reflects Intrepid's operating performance before the effects of certain non-cash items and other items that Intrepid believes are not indicative of its core operations. Intrepid uses adjusted EBITDA to assess operating performance.

Reconciliation of Net (Loss) Income to Adjusted EBITDA:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| Net (Loss) Income | $ | (37,288) | | | $ | 3,982 | | | $ | (35,673) | | | $ | 72,220 | |

| Adjustments | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Expense of deferred offering costs | — | | | 700 | | | — | | | 700 | |

| Impairment of long-lived assets | 42,767 | | | — | | | 43,288 | | | — | |

| Loss on sale of assets | 555 | | | 6,294 | | | 807 | | | 7,470 | |

| Interest expense | — | | | 16 | | | — | | | 101 | |

| Income tax (benefit) expense | (10,282) | | | 2,158 | | | (8,389) | | | 24,289 | |

| Depreciation, depletion, and amortization | 10,773 | | | 9,426 | | | 39,078 | | | 34,711 | |

| Amortization of intangible assets | 81 | | | 81 | | | 322 | | | 322 | |

| Accretion of asset retirement obligation | 535 | | | 490 | | | 2,140 | | | 1,961 | |

| Total adjustments | 44,429 | | | 19,165 | | | 77,246 | | | 69,554 | |

| Adjusted Earnings Before Interest, Taxes, Depreciation, | | | | | | | |

| and Amortization | $ | 7,141 | | | $ | 23,147 | | | $ | 41,573 | | | $ | 141,774 | |

v3.24.0.1

Cover

|

Mar. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 06, 2024

|

| Entity Registrant Name |

Intrepid Potash, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-34025

|

| Entity Tax Identification Number |

26-1501877

|

| Entity Address, Address Line One |

707 17th Street, Suite 4200

|

| Entity Address, City or Town |

Denver

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80202

|

| City Area Code |

303

|

| Local Phone Number |

296-3006

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

IPI

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001421461

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

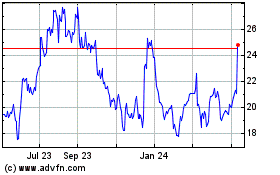

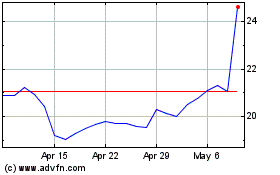

Intrepid Potash (NYSE:IPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Intrepid Potash (NYSE:IPI)

Historical Stock Chart

From Apr 2023 to Apr 2024