Tribune Publishing Gets Cash Infusion

February 04 2016 - 9:10AM

Dow Jones News

Tribune Publishing Co., owner of the Los Angeles Times and

Chicago Tribune, has secured a substantial cash infusion from a

private investor and cancelled its dividend payment following a

difficult year in which its stock price tumbled 60%.

Merrick Media LLC, which is owned by Chicago-based investor

Michael W. Ferro Jr., has acquired 5.2 million newly issued shares

of Tribune Publishing for $44.4 million, Tribune Publishing

announced Thursday. Merrick is now the largest single shareholder

with 16.6% of the company's shares.

Mr. Ferro, 49, will become Tribune Publishing's nonexecutive

chairman, replacing Eddy Hartenstein, who will become a regular

member of the board.

The newspaper publisher said the private placement will bolster

its ability to fund acquisitions and digital strategies. The

company also announced that its board had voted to suspend its

quarterly dividend in order to maintain flexibility while funding

its growth strategy.

"This gives us significant latitude and financial flexibility to

pursue our acquisition strategy as we continue to invest in digital

initiatives and transform the company," Tribune Publishing Chief

Executive Jack Griffin said in an interview.

The investment comes ahead of a bankruptcy auction next month

for the holdings of Freedom Communications Inc., owner of the

Orange County Register and several other southern California

newspapers in which Tribune Publishing has expressed keen interest.

Last year, Tribune Publishing acquired the San Diego Union-Tribune

and a handful of weeklies in southern California for $85 million as

an addition to the Los Angeles Times.

Tribune Publishing was spun off in late 2014 as a separate

company from broadcast holdings that became Tribune Media, less

than two years after their predecessor company emerged from

bankruptcy.

Tribune Publishing, with its geographically disparate holdings,

has since had difficulty finding its footing in a market where many

large media groups have moved toward operating regionally

integrated clusters of newspapers.

Since the spinoff, Tribune Publishing's stock has fallen from

$24.50 a share to $9 as of Wednesday, reducing the company's market

value to about $236 million. Merrick paid approximately $8.54 a

share for its stake.

Mr. Ferro, who sold his health records and imaging company,

Merge Healthcare to IBM in October for $1 billion, will step down

as chairman of Wrapports LLC, owner of the Chicago Sun-Times but

will maintain his equity stake there.

Cancelling the dividend, which paid out 70 cents a share

annually, will save Tribune Publishing about $18 million a year.

The company still plans to pay out the dividend due next week.

Several of its largest shareholders coming out of the spinoff,

such as investment firms Oaktree Capital and Angelo Gordon, had

been debt holders of the original company and have made moves to

sell their stakes. Angelo Gordon has since exited the company. In

November, Tribune disclosed in a regulatory filing that Oaktree,

its then-largest shareholder, was prepared to sell some or all of

it stake. It is not immediately clear what shares, if any, Oaktree

still holds.

Last summer, Tribune Publishing rejected overtures from

philanthropist Eli Broad and private equity-firm Apollo Global

Management to sell the Los Angeles Times, its largest revenue

generator. The process led to the ugly firing of the paper's

publisher, Austin Beutner, and elicited a letter from at least one

major shareholder to the board urging it to break up the company or

move to make it private.

Tribune Publishing has reported declining year-on-year revenues

in almost every quarter since the spinoff as it struggles with a

sharp industrywide fall-off in advertising dollars as readers and

marketers migrate online.

Ahead of its scheduled earnings report in early March, Tribune

Publishing released preliminary financial data for 2015. It said

revenue is expected to be between $1.66 billion to $1.67 billion

for the year and adjusted EBITDA is expected to be between $154

million to $157 million. It also said the company ended the year

with $41 million in cash.

The company had downgraded its guidance late in 2015, estimating

revenue at between $1.645 billion and $1.675 billion, down from

$1.67 billion and $1.7 billion. It also lowered its adjusted EBITDA

estimate to between $145 million and $160 million from between $165

million and $175 million.

Write to Lukas I. Alpert at lukas.alpert@wsj.com

(END) Dow Jones Newswires

February 04, 2016 08:55 ET (13:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

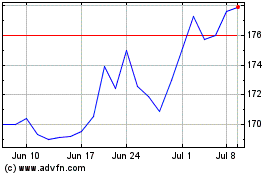

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

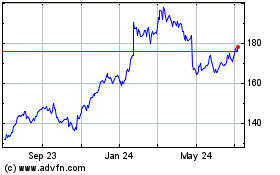

International Business M... (NYSE:IBM)

Historical Stock Chart

From Apr 2023 to Apr 2024