Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

February 09 2024 - 6:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under the

Securities Exchange Act of 1934

For the month of February, 2024

Commission File Number 001-15216

HDFC BANK LIMITED

(Translation of registrant’s name into English)

HDFC Bank House, Senapati Bapat Marg,

Lower Parel, Mumbai. 400 013, India

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

HDFC BANK LIMITED |

|

|

|

|

(Registrant) |

|

|

|

|

| Date: February 08, 2024 |

|

|

|

By: |

|

/s/ Santosh Haldankar |

|

|

|

|

Name: Santosh Haldankar |

|

|

|

|

Title: Company Secretary |

EXHIBIT INDEX

The following documents (bearing the exhibit number listed below) are furnished herewith and are made a part of this report pursuant to the General

Instructions for Form 6-K.

Exhibit No. 99

Description

Intimation

Exhibit 99

February 08, 2024

New York Stock Exchange

11, Wall Street,

New York,

NY 10005

USA

Dear Sir,

We are pleased to inform you that HDFC Bank

Limited acting through GIFT City IFSC Banking Unit has completed the issue of 750 Million US$ Senior Unsecured Bonds under dual tranche.

The details

in relation to above mentioned issuance are as follows:

|

|

|

| Particulars |

|

Details |

| Type of Instrument |

|

USD denominated senior unsecured |

| Rating |

|

Notes are expected to be rated Baa3 by Moody’s Rating Services and BBB- by S&P |

| Use of proceeds |

|

For banking activities |

| Whether proposed to be listed? If yes, name of the stock exchange(s) |

|

The Notes will be listed on the India International Exchange (IFSC) Limited |

| Size of the Issue |

|

USD 450,000,000 |

| Tenure of the instrument – date of allotment and date of maturity |

|

5 year, settlement on February 15, 2024, maturity on February 15, 2029 |

| Coupon/interest offered, schedule of payment of coupon and principal |

|

5.18% |

| Charge or security, if any, created over the assets |

|

Unsecured |

| Ranking |

|

Senior unsecured |

| Special right/interest/privileges attached to the instrument and changes thereof |

|

N/A |

| Delay in payment of interest or principal amount from the due date or default in payment of interest or principal |

|

As per the Clauses in the Terms and Conditions of Notes. |

| Details of any letter or comments regarding payment/non-payment of interest, principal on due dates, or any other matter concerning the security and /or the assets along with its

comments thereon, if any |

|

N/A |

| Details of redemption |

|

Redemption at the maturity |

| Type of Instrument |

|

USD denominated senior unsecured sustainability bond |

| Rating |

|

Notes are expected to be rated Baa3 by Moody’s Rating Services and BBB- by S&P |

| Use of proceeds |

|

For banking activities. The net proceeds from the issue of the Notes will be allocated towards Green and Social

projects that are consistent with the eligibility criteria set out in the HDFC Bank Sustainable Finance Framework (the “Eligible Projects”). |

| Whether proposed to be listed? If yes, name of the stock exchange(s) |

|

The Notes will be listed on the India International Exchange (IFSC) Limited |

| Size of the Issue |

|

USD 300,000,000 |

| Tenure of the instrument – date of allotment and date of maturity |

|

3-year, settlement on February 15, 2024, maturity on February 15,

2027 |

|

|

|

| Particulars |

|

Details |

| Coupon/interest offered, schedule of payment of coupon and principal |

|

5.196% |

| Charge or security, if any, created over the assets |

|

Unsecured |

| Ranking |

|

Senior unsecured |

| Special right/interest/privileges attached to the instrument and changes thereof |

|

N/A |

| Delay in payment of interest or principal amount from the due date or default in payment of interest or principal |

|

As per the Clauses

in the Terms and Conditions of Notes. |

| Details of any letter or comments regarding payment/non-payment of interest, principal on due dates, or any other matter concerning the security and /or the assets along with its

comments thereon, if any |

|

N/A |

| Details of redemption |

|

Redemption at the maturity |

Further, we would also like to inform you that the Issuer and the Lead Managers have also executed, inter alia, the

[Subscription] Agreement with Lead Managers appointed for the Issue.

Yours faithfully,

For HDFC Bank Limited

Sd/-

Santosh Haldankar

Company Secretary

Disclaimer

The Offering Memorandum has not been and

will not be registered or published as a prospectus or a statement in lieu of a prospectus with the Registrar of Companies, the Securities and Exchange Board of India or any other statutory or regulatory body of like nature in India in respect of a

public offer or information memorandum or other offering material in respect of any private placement of securities under the Companies Act, 2013, as amended, and the rules framed thereunder or any other applicable Indian laws. The Offering

Memorandum has not been and will not be reviewed or approved by any regulatory authority in India, including, but not limited to, the Securities and Exchange Board of India, any Registrar of Companies, the Reserve Bank of India, or any stock

exchange in India. This Offering Memorandum and the Notes are not and should not be construed as an advertisement, invitation, offer or sale of any securities to the public or any person resident in India.

The Notes have not been and will not be, offered or sold to any person resident in India.

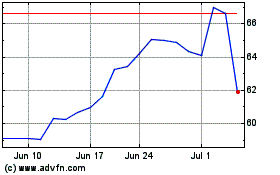

HDFC Bank (NYSE:HDB)

Historical Stock Chart

From Mar 2024 to Apr 2024

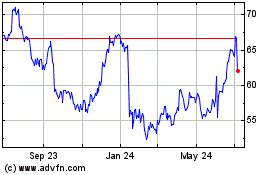

HDFC Bank (NYSE:HDB)

Historical Stock Chart

From Apr 2023 to Apr 2024