GlaxoSmithKline Posts Healthy Profit With Earnings Rise -- 2nd Update

April 27 2016 - 11:04AM

Dow Jones News

By Denise Roland

LONDON-- GlaxoSmithKline PLC said core earnings rose in the

first quarter of the year, in an early sign the company is

returning to growth after two years of falling profits.

The British drugs giant's transition to a lower-margin business

following a $20 billion asset swap with Novartis AG, combined with

falling sales of blockbuster respiratory drug Advair, have taken a

toll on the company's earnings growth recently.

But now that Glaxo's integration of the businesses it acquired

from Novartis is well under way, its prospects are brightening.

Core earnings per share (EPS), a measure which strips out one-time

gains or impairments, climbed 14% to 19.8 pence in the three months

ending March 31, while revenue rose 11% to GBP6.2 billion ($9.04

billion), up from GBP5.6 billion a year ago. Stripping out exchange

rate movements, revenue and core EPS both increased 8%.

Last year, Glaxo completed a major transaction with Novartis in

which it traded its portfolio of high-margin cancer drugs for the

Swiss company's lower-margin vaccines franchise, and took control

of a joint venture pooling the companies' consumer health care

arms, which sell low-margin drugstore staples from over-the-counter

remedies to toothpaste.

That deal was devised to reduce Glaxo's exposure to the

risk-laden drug development part of the business, which succeeds or

fails on the outcomes of lengthy and expensive clinical trials,

patent life cycles and the willingness of governments and health

insurers to spent ever-tighter budgets on medicines. Vaccines and

consumer health care products are cheaper to develop and are

considered more stable businesses.

Chief Executive Andrew Witty has promised Glaxo will bear the

first fruits of that transaction this year. He told investors to

expect a 10% to 12% percentage increase in core EPS in 2016, at

constant exchange rates, as he reported the company's first quarter

results on Wednesday. That would be the first increase in core EPS

since 2013.

He said the improved profitability in the first quarter

reflected stronger top-line growth, in part thanks to the promotion

of "power brands" in the consumer health care division. Combining

its consumer health care division with Novartis's has enabled Glaxo

to pick winners while leaving behind brands that don't make the cut

in an expanded portfolio, he said.

Mr. Witty added that the improved margins also reflected work

that predated the Novartis transaction, such as investments into

more efficient manufacturing and a new IT platform.

Those moves were reflected in a strong performance from the

consumer health care division, which posted a 26% increase in

revenue to GBP1.8 billion in the first quarter while core operating

profit increased 59% to GBP303 million.

The expanded vaccines division also delivered strong earnings

growth thanks to the integration of the Novartis business and

strong sales growth of two newly-launched meningitis vaccines. Core

operating profit increased 56% to GBP253 million, on a revenue

increase of 23% to GBP882 million.

In Glaxo's drug development arm, still the largest part of the

business, revenue fell 1% to GBP3.6 billion. That was partly

because the year-earlier quarter included one month of sales from

the now-divested cancer franchise. Stripping that out, sales

increased 5% as revenue from newly launched drugs in HIV and

respiratory medicine more than offset that lost from Advair. Core

operating profit for that division increased 8% to GBP1.2 billion,

largely thanks to those new drugs, which can command higher margins

than Glaxo's aging blockbusters.

The company also provided more clarity on its 2016 outlook,

saying it expected core EPS to grow 10-12% at constant exchange

rates. Previously, it had guided for a double-digit increase. The

company also confirmed plans to pay a full-year dividend of 80

pence.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

April 27, 2016 10:49 ET (14:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

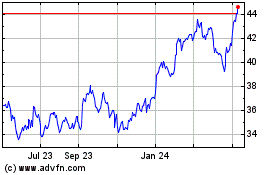

GSK (NYSE:GSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

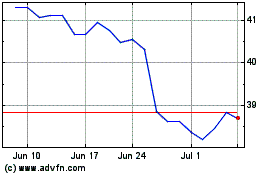

GSK (NYSE:GSK)

Historical Stock Chart

From Apr 2023 to Apr 2024