Today's Top Supply Chain and Logistics News From WSJ

March 22 2018 - 6:57AM

Dow Jones News

By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

FedEx Corp.'s investments in improved ground services paid off

for shippers during the peak season -- but not necessarily for the

parcel carrier itself. Some retailers gambled on deliveries by

choosing slower and cheaper options later than ever heading into

the holiday crunch, the WSJ's Paul Ziobro reports, avoiding the

express services that bring FedEx higher yields while still getting

their goods on time. In fact, FedEx Ground delivered 54 million

packages a day earlier than expected during the last quarter. The

results highlight the difficult holiday balancing act parcel

carriers face during the seasonal shipping surge, when demand

drives up costs and the crush of packages can bury profit-making

efficiency strategies. In this case, the holiday rush pushed

operating profit at FedEx's ground unit up 23%, but operating

profit at FedEx Express tumbled 24%, pulling down overall earnings.

Parcel carriers may be adjusting to changing delivery patterns, but

shippers may be shifting their own strategies just as fast.

Some of the biggest food suppliers are struggling to manage

soaring logistics costs in a fast-changing consumer market. General

Mills Inc. is the latest big company to succumb to tight capacity

and rising prices in shipping markets, saying its freight costs

neared 20-year highs in February while spending for its ingredients

was also on the upswing. The WSJ's Annie Gasparro reports the maker

of Cheerios cereal and Yoplait yogurt plans to raise prices on its

packaged foods, but the company is pulling back its earnings

outlook on the thinner profit margins brought on by its

supply-chain woes. General Mills and other suppliers to grocery

chains are struggling to preserve profits in a tumultuous transport

market. Cass Information Systems says its index for truckload

demand rose 6.5% year-over-year in February, the fourth straight

month of better-than 6% growth. Trucking companies have been

raising prices on their shipping customers, and General Mills'

comments show shippers are anxious to pass those costs along.

Some companies across Europe are starting to reset their supply

chains as the U.K. exit from the European Union approaches. A

survey of supply-chain managers shows around one in seven EU

companies have already switched suppliers, the WSJ's Nina Trentmann

reports, and more than 60% expect to do so ahead of Brexit. The

survey by the Chartered Institute of Procurement & Supply

suggests the dread and debate over Brexit is giving way to concrete

action, with a growing lineup of companies building new

distribution channels. British companies also are acting, with many

raising prices and preparing to reduce headcount to fit

expectations for leaner demand. Big supply-chain operators still

are trying to plan amid uncertainty over major issues like customs

rules. A European car makers' group warned this week that new

barriers at borders would undermine their "just-in-time" and

"just-in-sequence factory strategies and "could even lead to

assembly line stoppages."

ECONOMY & TRADE

Battle lines are being redrawn in the last hours before what

some believe will be a trade war over tough new protectionism in

Washington. The Trump administration is in close talks with several

allies and trading partners on exempting them from U.S. tariffs on

steel and aluminum, the WSJ's William Mauldin reports. The news

Wednesday in a congressional hearing adds new complications to an

extensive overhaul of U.S. trade relations that's reaching a

critical point, with metals tariffs set to take effect on Friday.

Talks over exemptions are underway or starting soon with Argentina,

Australia, and the European Union, and waivers also may go to South

Korea, Canada and Mexico, depending on broader negotiations. Those

separate talks with Mexico and Canada are picking up steam, with

signals emerging that the countries may have cleared a road block

on critical auto-industry issues. For now, the administration may

postpone the steel and aluminum tariffs for some countries, but

it's not putting the trade weapons away completely.

QUOTABLE

IN OTHER NEWS

The Federal Reserve will raise interest rates a

quarter-percentage point and says a strengthening economy may merit

more aggressive increases. (WSJ)

Borrowing rates for U.S. consumers have been rising across a

range of products. (WSJ)

Oil prices reached the highest level in a month, reaching close

to $70 a barrel. (WSJ)

Sales of previously owned U.S. homes rose 3% from January to

February. (WSJ)

Canada's currency has declined almost 4% against the U.S. dollar

this year as the Mexican peso has gained 5%. (WSJ)

Private-equity firm Sycamore Partners has racked up big profits

through its investments in the struggling brick-and-mortar retail

sector. (WSJ)

The founder of commodities shipping and trading giant Noble

Group Ltd. is retiring, leaving behind a business in financial

turmoil. (WSJ)

Amazon.com Inc. is considering acquiring some locations from

bankrupt Toys "R" Us Inc. (Bloomberg)

More trucking companies are adding electric logging devices as

the April 1 deadline for enforcement of the ELD mandate nears.

(Supply Chain Dive)

U.S. regulators say positive train control systems are operating

on about 56% of the track used by freight railroads. (Progressive

Railroading)

Insurers are expecting hundreds of millions of dollars of claims

stemming from the massive fire on the Maersk Honam. (The

Loadstar)

Loaded container imports at South Carolina's Port of Charleston

fell 4.7% in February. (Charleston Post and Courier)

Retail chain owner TJX Cos. plans a 1.2 million-square-foot

distribution center outside Youngstown, Ohio. (Youngstown

Vindicator)

Houston-based industrial distributor DXP Enterprises expanded

sales 19.5% in the fourth quarter. (Industrial Distribution)

New management wants to revive the long-gone Kozmo.com delivery

service, with a focus on groceries. (TechCrunch)

An Italian manufacturer says it will produce and sell a

3D-printed car in China next year. (Automotive Logistics)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the WSJ Logistics Report team:

@jensmithWSJ and @EEPhillips_WSJ. Follow the WSJ Logistics Report

on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

March 22, 2018 06:42 ET (10:42 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

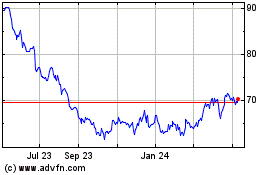

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

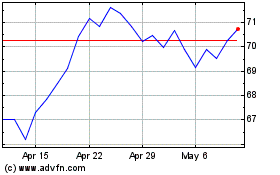

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024