Filed

by EQT Corporation

(Commission

File No. 001-3551)

Pursuant

to Rule 425 under

the

Securities Act of 1933

and

deemed filed pursuant to Rule 14a-12 of

the

Securities Exchange Act of 1934

Subject

Company: Equitrans Midstream Corp.

(Commission

File No. 001-38629)

Set

forth below are copies of several communications first published, sent or given by EQT Corporation (“EQT” or “Parent”)

on March 11, 2024 relating to its proposed acquisition (the “Transaction”) of Equitrans Midstream Corporation (“Equitrans”

or the “Company”).

*

* * * *

On

March 11, 2024, EQT and Equitrans held a joint conference call to discuss the details of the Transaction, which was broadcast live via

webcast. The following are a copy of the presentation accompanying this conference call and a transcript from this conference call:

1 3/11/20 24 1 Transformational Acquisition of Equitrans Midstream March 11, 2024 Creating the Premier, Vertically Integrated Natural Gas Business

2 Creating the Must - Own Energy Company Providing investors the best risk - adjusted exposure to natural gas + Strategic Combination Creates America’s First Vertically Integrated Natural Gas Business Prepared to Compete in a Global Market FORTIFIES THE BASE BUSINESS AND UNLEASHES THE UPSIDE x Unrivaled integrated cost structure drives durable free cash flow generation x Transforms quality of already peer - leading inventory depth x Unparalleled free cash flow margins strengthens credit quality x Financial accretion for shareholders over the near and long - term x Unrivaled low cost structure limits hedging needs, unleashing the upside x Identified >$425 MM of per annum synergies

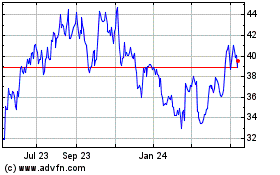

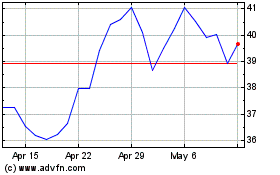

3 Equitrans Merger Creates the Premier American Natural Gas Company Solidifies EQT as the lowest cost natural gas producer, driving robust free cash generation in all commodity price environmen ts + >$35 B Enterprise Value ~$23 B Equity Value $7.5 B Long - Term Debt Target >8.0 Bcfe/d Gathered Volume Throughput ~90% EQT Integrated Volumes PROVIDING INVESTORS THE BEST RISK - ADJUSTED EXPOSURE TO NATURAL GAS ~6.3 Bcfe/d Upstream Net Production 1. Non - GAAP measure. See appendix for definition. EQT pro forma forecast assumes strip pricing as of March 6, 2024. ~$6 B Annual Adj. EBITDA (1) ~30% Midstream Cash Flows ~$16 B 2025E – 2029E Cumulative FCF (1) ETRN BRINGS EXTENSIVE OVERLAP AND DIRECT CONNECTIVITY IN CORE OPERATIONS AREA Gathering: ~1, 22 0 miles Water: ~200 miles Transmission: ~940 miles MVP: ~300 miles

4 MANAGEMENT TAKEOVER ALTA ACQUISITION TUG HILL / XCL ACQUISTION ETRN PRO FORMA CVX ACQUISITION STRATEGIC PATH INTENTIONALLY SET THE STAGE FOR THE CREATION OF AMERICA’S PREMIER NATURAL GAS BUSINESS Infrastructure Ownership Has Been a Core Focus of EQT’s M&A Strategy Every acquisition since management takeover included margin - enhancing midstream assets STRONG TRACK RECORD OF INTEGRATING ASSETS WITH MARGIN - ENHANCING INFRASTRUCTURE OWNERSHIP % of EQT’s operated production gathered internally › Every acquisition has deliberately included midstream assets as EQT recognized material cost structure advantage of integrated infrastructure › Successful track record of integrating $9 B of acquisitions all with midstream assets provides tremendous confidence in combining businesses and achieving synergies › More than 90% of pro - forma gross operated production will flow through EQT - owned midstream assets, creating unrivaled margin advantage vs. peers As we enter the global era of natural gas, it is imperative for U.S. natural gas companies to evolve their business models to compete on the global stage against vertically integrated rivals. The acquisition of Equitrans is a once in a lifetime opportunity to vertically integrate one of the highest quality natural gas resource bases anywhere in the world. “ ” - TOBY Z. RICE, PRESIDENT & CEO 0% 20% 40% 60% 80% 100% 2019 2020 2021 2022 2023 2024

5 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 Long-Term PF EQT + ETRN A B EQT C D E F Pro Forma EQT Has Unmatched Cost of Supply and Free Cash Flow Durability Integrated business model drives differentiated free cash flow durability and a resilient credit profile even at low prices NYMEX GAS PRICE NEEDED TO GENERATE FREE CASH FLOW (1) $/MMBtu 1. Non - GAAP measure. See appendix for definition. Peer data sourced from March 2024 J.P. Morgan Natural Gas Reservoir Report, assumes 2024 - 2025 average unhedged breakeven. Standa lone EQT (2024 - 2025 average) and long - term pro forma EQT and ETRN sourced from internal EQT estimates. Peers consist of AR, CHK, CNX, GPOR, RRC and SWN. 2. Average daily NYMEX gas settlement price in 2020 of $1.99/MMB tu. VERTICAL INTEGRATION MATERIALLY REDUCES FCF BREAKEVEN MULTI - DECADE LOW GAS PRICE (2) When a company is selling a product with commodity - like economic characteristics, being the low - cost producer is all - important. “ WARREN BUFFETT ” VERTICALLY INTEGRATED BUSINESS MODEL CREATES A STRUCTURAL HEDGE

6 - 1,000 2,000 3,000 4,000 EQT PF EQT + ETRN A B C D E F <$2.50 $2.50-$3.00 $3.00-$3.50 Integration Transforms Inventory, Further Differentiating Unparalleled Asset Base Materially lower cost structure means quality of inventory depth gets even deeper EQT HOLDS UNPARALLELED INVENTORY DEPTH (1) Gross operated Appalachian locations PRO FORMA LOWEST COST DRILLING INVENTORY IS ~3X TIMES DEEPER THAN CLOSEST PEERS 1. Source: Enverus Appalachia Play Fundamentals, August 2023. Peers include AR, CHK, CNX, CTRA, RRC and SWN. ETRN Acquisition Reduces EQT’S Inventory Breakeven >$0.50/MMBTU >200% Increase In Low - Cost Inventory BREAKEVEN PRICING

7 Integrated Model Uniquely Positions EQT to Thrive Amid Gas Price Volatility Midstream cash flow provides a structural hedge, unlocking differentiated upside by limiting need to hedge 1. Non - GAAP measure. See appendix for definition. 2. Assumes 35% hedged standalone business versus 15% hedged pro forma business . FREE CASH FLOW PER SHARE ACCRETION PROFILE (1) % FCF/Share Accretion vs Standalone Hedged Business Model (2) 5% ACCRETION Natural Gas Prices High Prices Low Prices FCF/Share Accretion Low High Volatility Will Drive “Fat Tail” Distributions of Outcomes Mid - Cycle AN INTEGRATED BUSINESS MODEL PROVIDES THE BEST RISK - ADJUSTED NATURAL GAS EXPOSURE MINIMIZES NEED TO HEDGE, UNLEASHING GAS PRICE UPSIDE DOWNSIDE PROTECTION THROUGH UNMATCHED LOW COST STRUCTURE

8 Pipelines G&P Majors Oil E&P Gas E&P ETRN EQT EQT PF 3.0x 4.0x 5.0x 6.0x 7.0x 8.0x 9.0x 10.0x 11.0x 40% 50% 60% 70% 80% 90% EV / 2025 Adj. EBITDA (1) (Unhedged) 2025 FCF (1) Conversion (Unlevered FCF / Adj. EBITDA (1) ) Unrivaled Free Cash Flow Conversion Materially Differentiates EQT’s Business Premium assets trade at premium multiples 2025 FCF (1) CONVERSION VS. VALUATION (UNHEDGED) VALUATION UNDERPINNED BY HIGH CASH CONVERSION > Valuation multiples reflect the quality of the underlying business’ cash flows, including among gas peers > Midstream integration improves cash flow quality through higher FCF/Adj. EBITDA conversion and less volatility > Cash flow de - risking limits the need to hedge cost structure, which unlocks max exposure to price upside > Symbiotic relationship of the assets and synergy capture should unlock further potential for multiple re - rating Forget what you know about buying fair businesses at wonderful prices; instead buy wonderful businesses at fair prices. “ ” - CHARLIE MUNGER SYNERGIES AND RE - RATE POTENTIAL Source: FactSet as of 3/8/24. Note: Gas E&P peers include AR, CHK, CNX, CRK, CTRA, GPOR, RRC, SWN; Oil E&P peers include APA, CH RD, CIVI, CRGY, DVN, EOG, FANG, MRO, MTDR, MUR, NOG, OVV, OXY, PR, SM; Major peers include BP, COP, CVX, SHEL, XOM; G&P peers in clude DTM, ENLC, ETRN, HESM, TRGP, USAC, WES; Pipeline peers include ENB, EPD, ET, KMI, KNTK, MPLX, OKE, PAA, SUN, TRP, WMB. 1. Includes Non - GAAP measures. See appendix for definition. FCF conversion excludes impacts from hedges and capital expenditures. FCF Conversion defined as unlevered free cash flow / Adj. EBITDA less Hedges. 2. Pro forma EQT based on Status Quo EQT plus Status Quo ETRN plus $250 mm of synergies. Reflects FactSet consensus e sti mates. (2)

9 $120 $75 $55 $250 $175 Financial & Corporate Costs Uptime & Production Optimization Capital & Operating Costs Total Near-Term Synergies Infrastructure Optimization Achievable Synergies Informed By Direct Knowledge of Equitrans Assets High confidence base synergy capture with material upside potential A significant portion of Equitrans’ gathering systems are legacy Rice Midstream assets, which were built and operated under a leadership team who currently runs EQT’s midstream operations. Our midstream team knows these assets, which along with our track record of highly efficient integration gives me exceptionally high confidence in our ability to maximize synergy potential. “ ” - TOBY Z. RICE, PRESIDENT & CEO ENHANCED STRATEGIC ALIGNMENT DRIVING STRONG SYNERGY POTENTIAL $ MM per annum HIGH CONFIDENCE SYNERGIES UPSIDE SYNERGIES TOTAL SYNERGY CAPTURE OPPORTUNITY $425+ MM Potential Annual Savings 1. Non - GAAP measure. See appendix for definition.

10 $0 $2 $4 $6 $8 $10 $12 $14 EQT ETRN Retirement Target Total Debt High Confidence Pathways to Achieve Material Debt Reduction Free cash flow, asset sales provide low risk path to $5+ billion of debt repayment post close with full vetting from rating a gen cies PRO FORMA DEBT PROFILE AND TARGETS $ B TARGETING TOTAL DEBT OF $7.5 B 12 – 18 months post - close UNWAVERING COMMITMENT TO INVESTMENT GRADE CREDIT › EQT has fully vetted pro forma balance sheet with S&P, Moody’s, and Fitch to ensure continuance of Investment Grade credit ratings › Pro forma business evaluated on a hybrid upstream / midstream ratings structure that appreciates merits of integrated business model and improved cash flow durability › Identified $5+ B of debt reduction potential via organic free cash flow generation and asset sales LOW RISK DEBT RETIREMENT PATHWAYS ORGANIC DE - LEVERAGING › Integrated business will generate durable free cash flow; 2024E - 2028E cumulative free cash flow expected to be ~2x combined debt due by 2028 providing ample room for natural de - levering › Integration of contractual volume commitments eliminates more than $11 billion of future liabilities › EQT transaction history and balance sheet stewardship underscores our commitment to low absolute debt and leverage ASSET SALES › Highly coveted non - core assets, including regulated assets of ETRN, provide significant coverage and optionality to achieve debt retirement goals › Previously initiated non - operated NE PA asset sale process progressing favorably HIGH CONFIDENCE DE - LEVERAGING PATHWAYS 1. Non - GAAP measure. See appendix for definition. Minimum volume commitments include gathering, water and MVP.

11 › On March 11, 2024, EQT announced the acquisition of ETRN in an all - stock transaction • 0.3504 shares of EQT stock for each share of ETRN stock, representing an implied value of $12.50 per ETRN share based on the vol ume weighted average price of EQT common stock for the 30 days ending on March 8, 2024 • Combined enterprise value of >$35 B TRANSACTION › ~1,220 miles of high - pressure pipeline, ~491,000 HP of compression • 13 - year weighted average firm gathering contracts • EQT directly holds firm capacity of 3 Bcf/d, stepping up to 4 Bcf/d by 2026, and an additional 1.2 Bcf/d on Hammerhead GATHERING › ~940 miles of FERC - regulated interstate pipelines with 4.4 Bcf/d of capacity, 135,000 HP of compression, and 43 Bcf of working g as storage • Direct connectivity to 7 interstate pipelines provides access to all major gas demand regions, including local demand • 12 - year weighted average firm transmission and storage contracts • EQT holds ~2.3 Bcf/d of aggregate firm capacity TRANSMISSION › ~200 miles of mixed - use water pipelines with ~350k Bbl of above ground storage • Water network reduces customers’ disposal and capital costs while also enhancing safety and environmental attributes • 10 - year firm contracts executed with EQT and another producer customer WATER › Mountain Valley Pipeline (MVP) Joint Venture, ~49.0% expected ownership and operator › ~300 mile, 42” diameter FERC - regulated pipeline connecting low - cost Appalachia natural gas to growing demand in the southeast U. S. • 2.0 Bcf/d capacity with ability to expand up to ~2.5 Bcf/d • 20 - year firm capacity contracts (EQT holds ~1.5 Bcf/d) MVP › Transaction expected to close in Q4 2024, subject to shareholder approvals and regulatory clearances • Pro forma ownership ~74% EQT / ~26% ETRN › Transaction closing contingent on FERC authorizing MVP to commence service › Upon the closing of the transaction, three representatives from ETRN will join EQT’s Board of Directors CLOSING Transaction Summary

12 ESG LEADERSHIP, LOW EMISSIONS INTENSITY › Entrepreneurial management team with proven track record and outperformance › Peer - leading emissions reduction targets, targeting net zero (2) by or before 2025 LOW COST OF CAPITAL, INVESTMENT GRADE BALANCE SHEET › Pro forma investment grade credit profile and de - leveraging plan fully vetted by all three credit rating agencies › S&P 500 inclusion drives liquidity and low cost of capital EQT + Equitrans is the Must - Own Energy Company World class, vertically integrated natural gas company creates unparalleled investment opportunity 1. Non - GAAP measure. See appendix for definition. 2 . “Net zero” refers to net zero Scope 1 and Scope 2 greenhouse gas emissions, in each case from assets owned by EQT on June 3 0, 2021 (i.e., when EQT announced its net zero goal). Scope 1 greenhouse gas emissions are based exclusively on emissions reported to the U.S. Environmental Protection Agency (EPA) under the EPA’s Greenhouse Gas Reporting Program (Subpart W) for t he onshore petroleum and natural gas production segment. VERTICAL INTEGRATION UNLOCKS MEANINGFUL VALUE CREATION › Peer - leading free cash flow breakeven drives unmatched free cash flow generation across commodity cycles › $250 MM per year of high - confidence synergies assumed with $425+ MM of synergies identified in total MODERN, DATA - DRIVEN OPERATING MODEL › Drives a culture of organizational transparency to maximize operating efficiencies › Super - charges the speed and quality of acquisition integrations with a proven track record PREMIER PURE - PLAY APPALACHIAN PRODUCER › ~1,100,000 EQT core net acres with world - class operating capabilities and pro forma >3,000 miles of pipeline › ~4,000 de - risked locations provides decades of inventory & repeatable performance EQT + ETRN COMBINATION CREATES THE MUST - OWN ENERGY COMPANY › Top U.S. natural gas producer with long - term <$2.00/MMBtu breakeven pro forma drives durable free cash flow (1) › Low - cost profile mitigates downside pricing exposure while allowing upside opportunity capture

13 13 Cautionary Statements and Non - GAAP Definitions

14 This presentation contains “forward - looking statements” within the meaning of the federal securities laws . Forward - looking statements may be identified by words such as “anticipates,” “believes,” “cause,” “continue,” “could,” “depend,” “develop,” “estimates,” “expects,” “forecasts,” “goal,” “guidance,” “have,” “impact,” “implement,” “increase,” “intends,” “lead,” “maintain,” “may,” “might,” “plans,” “potential,” “possible,” “projected,” “reduce,” “remain,” “result,” “scheduled,” “seek,” “should,” “will,” “would” and other similar words or expressions . The absence of such words or expressions does not necessarily mean the statements are not forward - looking . Forward - looking statements are not statements of historical fact and reflect EQT Corporation’s (“EQT”) and Equitrans Midstream Corporation’s (“Equitrans”) current views about future events . These forward - looking statements include, but are not limited to, statements regarding the proposed transaction between EQT and Equitrans, the expected closing of the proposed transaction and the timing thereof and the pro forma combined company and its operations, strategies and plans, integration, debt levels and leverage ratio, capital expenditures, cash flows and anticipated uses thereof, synergies, opportunities and anticipated future performance, expected accretion to earnings and free cash flow and anticipated dividends . Information adjusted for the proposed transaction should not be considered a forecast of future results . Although EQT believes EQT’s forward - looking statements are reasonable, statements made regarding future results are not guarantees of future performance and are subject to numerous assumptions, uncertainties and risks that are difficult to predict . Actual outcomes and results may be materially different from the results stated or implied in such forward - looking statements included in this presentation . Actual outcomes and results may differ materially from those included in the forward - looking statements in this presentation due to a number of factors, including, but not limited to : the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement ; the possibility that shareholders of EQT may not approve the issuance of EQT common stock in connection with the proposed transaction ; the possibility that the shareholders of Equitrans may not adopt the merger agreement ; the risk that EQT or Equitrans may be unable to obtain governmental and regulatory approvals required for the proposed transaction, or required governmental and regulatory approvals may delay the merger or result in the imposition of conditions that could cause the parties to abandon the merger ; the risk that the parties may not be able to satisfy the conditions to the proposed transaction in a timely manner or at all ; risks related to disruption of management’s time from ongoing business operations due to the proposed transaction ; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of EQT’s common stock ; the risk of any unexpected costs or expenses resulting from the proposed transaction ; the risk of any litigation relating to the proposed transaction ; the risk that the proposed transaction and its announcement could have an adverse effect on the ability of EQT and Equitrans to retain and hire key personnel, on the ability of EQT or Equitrans to attract third - party customers and maintain their relationships with derivatives and joint venture counterparties and on EQT’s and Equitrans' operating results and businesses generally ; the risk that problems may arise in successfully integrating the businesses of EQT and Equitrans, which may result in the combined company not operating as effectively and efficiently as expected ; the risk that the combined company may be unable to achieve synergies or other anticipated benefits of the proposed transaction or it may take longer than expected to achieve those synergies or benefits and other important factors that could cause actual results to differ materially from those projected ; the volatility in commodity prices for crude oil and natural gas ; Equitrans' ability to construct, complete and place in service the Mountain Valley Pipeline project ; the effect of future regulatory or legislative actions on EQT and Equitrans or the industry in which they operate, including the risk of new restrictions with respect to oil and natural gas development activities ; the risk that the credit ratings of the combined business may be different from what EQT and Equitrans expect ; the ability of management to execute its plans to meet its goals and other risks inherent in EQT’s and Equitrans' businesses ; public health crises, such as pandemics and epidemics, and any related government policies and actions ; the potential disruption or interruption of EQT’s or Equitrans' operations due to war, accidents, political events, civil unrest, severe weather, cyber threats, terrorist acts, or other natural or human causes beyond EQT’s or Equitrans' control ; the combined company’s ability to identify and mitigate the risks and hazards inherent in operating in the global energy industry ; and other factors detailed in EQT’s and Equitrans' Annual Reports on Form 10 - K for the year ended December 31 , 2023 and subsequent Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K . All such factors are difficult to predict and are beyond EQT’s and Equitrans' control . Additional risks or uncertainties that are not currently known to EQT or Equitrans, that EQT or Equitrans currently deem to be immaterial, or that could apply to any company could also cause actual outcomes and results to differ materially from those included in the forward - looking statements in this presentation . EQT and Equitrans undertake no obligation to publicly correct or update the forward - looking statements in this presentation, in other documents or on their respective websites to reflect new information, future events or otherwise, except as required by applicable law . All such statements are expressly qualified by this cautionary statement . Readers are cautioned not to place undue reliance on these forward - looking statements that speak only as of the date hereof . This presentation also refers to adjusted EBITDA, free cash flow, and free cash flow per share . These non - GAAP financial measures are not alternatives to GAAP measures and should not be considered in isolation or as an alternative for analysis of results as reported under GAAP . For additional disclosures regarding these non - GAAP measures, including definitions of these terms, please refer to the appendix of this presentation . Cautionary Statements Investor Contact EQT Plaza 625 Liberty Avenue, Suite 1700 Pittsburgh, PA 15222 Cameron Horwitz Managing Director, Investor Relations & Strategy Cameron . Horwitz@eqt . com 412 . 395 . 2555 EQT Corporation (NYSE : EQT)

15 Information About Proxy Solicitation IMPORTANT INFORMATION FOR INVESTORS AND SHAREHOLDERS ; ADDITIONAL INFORMATION AND WHERE TO FIND IT In connection with the proposed transaction between EQT and Equitrans, EQT intends to file with the U . S . Securities and Exchange Commission (“SEC”) a registration statement on Form S - 4 (the “registration statement”) that will include a joint proxy statement of EQT and Equitrans and that will also constitute a prospectus of EQT (the “joint proxy statement/prospectus”) . EQT and Equitrans also intend to file other documents regarding the proposed transaction with the SEC . This document is not a substitute for the joint proxy statement/prospectus or the registration statement or any other document EQT or Equitrans may file with the SEC . BEFORE MAKING ANY VOTING DECISION, INVESTORS ARE URGED TO CAREFULLY READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS, AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT MAY BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, AS THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT EQT, EQUITRANS, THE PROPOSED TRANSACTION, THE RISKS THERETO AND RELATED MATTERS . After the registration statement has been declared effective, a definitive joint proxy statement/prospectus will be mailed to the shareholders of EQT and the shareholders of Equitrans . Investors will be able to obtain free copies of the registration statement and joint proxy statement/prospectus and other relevant documents filed or that will be filed with the SEC by EQT or Equitrans through the website maintained by the SEC at www . sec . gov . Copies of the documents filed with the SEC by EQT may be obtained free of charge on EQT’s website at www . ir . eqt . com/investor - relations . Copies of the documents filed with the SEC by Equitrans may be obtained free of charge on Equitrans' website at www . ir . equitransmidstream . com . PARTICIPANTS IN SOLICITATION EQT and Equitrans and their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction contemplated by the joint proxy statement/prospectus . Information regarding EQT’s directors and executive officers and their ownership of EQT’s securities is set forth in EQT’s filings with the SEC, including EQT’s Annual Report on Form 10 - K for the fiscal year ended December 31 , 2023 and its Definitive Proxy Statement on Schedule 14 A that was filed with the SEC on March 1 , 2024 . To the extent such person’s ownership of EQT’s securities has changed since the filing of such proxy statement, such changes have been or will be reflected on Statements of Changes in Beneficial Ownership on Form 4 filed with the SEC . Information regarding Equitrans' directors and executive officers and their ownership of Equitrans' securities is set forth in Equitrans' filings with the SEC, including Equitrans' Annual Report on Form 10 - K for the fiscal year ended December 31 , 2023 and its Definitive Proxy Statement on Schedule 14 A that was filed with the SEC on March 4 , 2024 . To the extent such person’s ownership of Equitrans' securities has changed since the filing of such proxy statement, such changes have been or will be reflected on Statements of Changes in Beneficial Ownership on Form 4 filed with the SEC . Additional information regarding the interests of those persons and other persons who may be deemed participants in the proposed transaction may be obtained by reading the joint proxy statement/prospectus and other relevant materials that will be filed with the SEC regarding the proposed transaction when such documents become available . You may obtain free copies of these documents as described in the preceding paragraph . NO OFFER OR SOLICITATION This presentation relates to the proposed transaction between EQT and Equitrans . This presentation is for informational purposes only and shall not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities or a solicitation of any vote or approval, in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance, exchange or transfer of the securities referred to in this document in any jurisdiction in contravention of applicable law . No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 , as amended .

16 Non - GAAP Financial Measures ADJUSTED OPERATING CASH FLOW, FREE CASH FLOW, FREE CASH FLOW YIELD AND FREE CASH FLOW PER SHARE Adjusted operating cash flow is defined as net cash provided by operating activities less changes in other assets and liabilities . Free cash flow is defined as adjusted operating cash flow less accrual - based capital expenditures, excluding capital expenditures attributable to noncontrolling interests . Free cash flow yield is defined as free cash flow divided by market capitalization . Free cash flow per share is defined as free cash flow divided by EQT Corporation’s (the “Company”) weighted average common shares outstanding . Adjusted operating cash flow, free cash flow, free cash flow yield and free cash flow per share are non - GAAP supplemental financial measures used by the Company's management to assess liquidity, including the Company's ability to generate cash flow in excess of its capital requirements and return cash to shareholders . The Company’s management believes that these measures provide useful information to external users of the Company's consolidated financial statements, such as industry analysts, lenders and ratings agencies . Adjusted operating cash flow, free cash flow, free cash flow yield and free cash flow per share should not be considered as alternatives to net cash provided by operating activities or any other measure of liquidity presented in accordance with GAAP . The Company has not provided projected net cash provided by operating activities or reconciliations of projected adjusted operating cash flow and free cash flow to projected net cash provided by operating activities, the most comparable financial measure calculated in accordance with GAAP . The Company is unable to project net cash provided by operating activities for any future period because this metric includes the impact of changes in operating assets and liabilities related to the timing of cash receipts and disbursements that may not relate to the period in which the operating activities occurred . The Company is unable to project these timing differences with any reasonable degree of accuracy without unreasonable efforts such as predicting the timing of its payments and its customers’ payments, with accuracy to a specific day, months in advance . Furthermore, the Company does not provide guidance with respect to its average realized price, among other items, that impact reconciling items between net cash provided by operating activities and adjusted operating cash flow and free cash flow, as applicable . Natural gas prices are volatile and out of the Company’s control, and the timing of transactions and the income tax effects of future transactions and other items are difficult to accurately predict . Therefore, the Company is unable to provide projected net cash provided by operating activities, or the related reconciliations of projected adjusted operating cash flow and free cash flow to projected net cash provided by operating activities, without unreasonable effort . ADJUSTED EBITDA Adjusted EBITDA is defined as net income (loss), excluding interest expense, income tax (benefit) expense, depreciation and depletion, (gain) loss on sale/exchange of long - lived assets, impairments, the revenue impact of changes in the fair value of derivative instruments prior to settlement and certain other items that impact comparability between periods . Adjusted EBITDA is a non - GAAP supplemental financial measure used by the Company's management to evaluate period - over - period earnings trends . The Company's management believes that this measure provides useful information to external users of the Company's consolidated financial statements, such as industry analysts, lenders and ratings agencies . Management uses adjusted EBITDA to evaluate earnings trends because the measure reflects only the impact of settled derivative contracts ; thus, the measure excludes the often - volatile revenue impact of changes in the fair value of derivative instruments prior to settlement . The measure also excludes other items that affect the comparability of results or that are not indicative of trends in the ongoing business . Adjusted EBITDA should not be considered as an alternative to net income (loss) presented in accordance with GAAP . The Company has not provided projected net income (loss) or a reconciliation of projected adjusted EBITDA to projected net income (loss), the most comparable financial measure calculated in accordance with GAAP . Net income (loss) includes the impact of depreciation and depletion expense, income tax (benefit) expense, the revenue impact of changes in the projected fair value of derivative instruments prior to settlement and certain other items that impact comparability between periods and the tax effect of such items, which may be significant and difficult to project with a reasonable degree of accuracy . Therefore, projected net income (loss), and a reconciliation of projected adjusted EBITDA to projected net income (loss), are not available without unreasonable effort .

Transcript

Operator:

Good morning. My name is Krista, and I’ll be your conference

operator today. At this time, I would like to welcome everyone to the EQT Corporation Acquisition of Equitrans Midstream Conference Call.

(Operator Instructions) I would now like to turn the conference over to Cameron Horwitz, Managing Director of Investor Relations and Strategy.

Cameron, you may begin your conference.

Cameron Horwitz, EQT Corporation, Managing Director of Investor Relations

and Strategy:

Good morning, and thank you for joining today’s call

to discuss our highly-strategic and transformative acquisition of Equitrans Midstream.

With me today are Toby Rice, President and Chief Executive

Officer of EQT; Jeremy Knop, Chief Financial Officer of EQT; Diana Charletta, President and CEO of Equitrans Midstream; and Tom Karam,

Executive Chairman of Equitrans Midstream.

In a moment, Toby, Jeremy and Tom will present their prepared

remarks with a question and answer session to follow. An updated investor presentation outlining the acquisition has been posted to the

Investor Relations portion of our website, and we will reference certain slides during today’s discussion. A replay of today’s

call will be available on our website beginning this evening.

I’d like to remind you that today’s call may

contain forwarding looking statements. Actual results and future events could materially differ from these forward-looking statements

because of factors described in today's release, in our investor presentation, the risk factor section of our Form 10-K, and in subsequent

filings we make with the SEC. We do not undertake any duty to update forward-looking statements.

Today’s call also contains certain non-GAAP financial

measures. Please refer to our most recent press release and investor presentation for important disclosures regarding such measures, including

reconciliations to the most comparable GAAP financial measures.

Lastly, please note that in connection with the acquisition,

EQT intends to file with the SEC a registration statement, which will include a joint proxy statement of EQT and Equitrans Midstream and

will contain important information regarding the acquisition.

With that, I’ll turn the call over to Toby.

Toby Rice, EQT Corporation, President and Chief Executive Officer:

Thanks, Cam, and thank you all for joining our call this

morning.

Earlier this morning, we announced our agreement to acquire

Equitrans Midstream, which represents a once in a lifetime opportunity to transform EQT into America’s first fully-integrated, large-scale

natural gas business. As we enter the global era of natural gas, we believe it is imperative for U.S. natural gas companies to evolve

their business models to compete on the global stage against large, fully-integrated rivals.

Our peer-leading cost structure will unlock unrivaled free

cash flow durability in the downcycle while facilitating unmatched price upside due to the limited need to hedge in the upcycle, ultimately

providing investors with the best risk-adjusted exposure to natural gas prices.

When reflecting back on our upstream acquisition activities

since taking over EQT, you'll notice a common theme. Each acquisition we’ve done included Midstream ownership, which was by design

as we recognized early on the strategic value associated with owning integrated Midstream infrastructures.

Pro forma for Equitrans, approximately 90% of our operator

production will flow through EQT-owned Midstream assets, creating unrivaled margin enhancement relative to the rest of the industry. This

vertical integration positions EQT as the lowest-cost natural gas producer in the United States with a pro forma long-term corporate free

cash flow breakeven price of less than $2 per million BTU. This, in turn, transforms the quality of our already superior inventory depth

as we will have three times the number of extremely low-cost drilling locations relative to our closest peers.

As we outlined on our last earnings call, we see a low cost

structure as the only competitive advantage one can have in a commodity-driven business, which is why it has been our north star guiding

our strategic decision making over the past several years.

To put things into perspective, pro forma for the transaction,

our long-term free cash flow breakeven price will be approximately $0.75 per Mmbtu, below the peer average, and roughly $1.50 Mmbtu below

marginal producers in the Haynesville. Said another way, at a price that enables marginal producers to simply breakeven, we project EQT

will generate $1.50 per Mmbtu free cash flow margin, which means EQT should produce nearly $3 billion of free cash flow before Haynesville

assets begin generating their first dollar.

Further, our low cost structure will largely eliminate the

need to hedge long-term, which results in more upside for shareholders as compared to high-cost business models that are required to either

programmatically hedge significant volumes or let production decline to protect free cash flow and survive in downcycle environments.

This exemplifies how the acquisition of Equitrans uniquely

positions EQT to both capture upside price asymmetry while simultaneously providing a structural hedge against downside price environments

like we are in today. In a volatile global gas market, we believe this business model will be increasingly coveted by investors.

Taking a closer look at the combined business, the industrial

logic is clear as the pro forma midstream footprint of EQT will encompass approximately 2,000 miles of gathering lines, nearly 500 miles

of water pipelines, and almost 1,000 miles of transmission lines underpinning our 1.9 million net acres in Appalachia.

From a financial perspective, pro forma 2025 adjusted EBITDA

is forecasted at roughly $5.5 billion, growing to more than $6.5 million in 2029 at recent strip pricing, with roughly 30% of this cash

flow coming from midstream assets. Pro forma free cash flow is forecasted at approximately $2.5 billion in 2025, growing to more than

$4 billion by 2029 at recent strip pricing.

Our diligence has identified approximately $250 million of

near term, high confidence annual synergies comprised of a combination of organizational efficiency, production optimization and operating

cost savings. We’ve also identified an additional $175 million of upside potential associated with pressure optimization, water

network integration and capacity expansions. So, in total, we see a pathway to more than $400 million of per annum synergies over time.

We are highly confident in achieving synergies from this

transaction, given the direct knowledge we have of Equitrans’ operations and the extensive overlap across our core operating areas.

Recall, a significant portion of Equitrans’ gathering systems are legacy Rice Midstream assets, which were built and operated under

the leadership of Rob Wingo and Justin Trudell, who currently run EQT’s midstream operations. Rob, Justin and their team know these

assets, which along with our track record of highly efficient integration gives me exceptionally high conviction in our ability to achieve

these synergies.

In closing, we believe Equitrans is the most strategic transaction

that EQT has ever pursued, and we see this as a once in a lifetime opportunity to vertically integrate one of the highest quality natural

gas resources bases anywhere in the world. Our direct knowledge of these assets and track record of efficiently integrating $9 billion

of acquisitions since taking over EQT gives me tremendous confidence in our ability to seamlessly combine these businesses and maximize

value for both EQT and Equitrans’ shareholders.

I’ll now turn the call over to Tom.

Tom Karam, Equitrans Midstream, Executive Chairman:

Thanks, Toby, and good morning, everyone. It’s great

to be with you to discuss the combination of Equitrans and EQT. I’m very proud of the progress Equitrans has made since becoming

a standalone public company in 2018. Since then, the energy sector, and specifically, the natural gas market has changed considerably.

Six years ago, Appalachian Basin production growth was high

single digits or higher and new infrastructure was constantly required to transport that growth. And it was assumed it could be built.

Natural gas production and demand domestically has consistently grown year over year, including in Appalachia. Today, that paradigm has

changed.

As we noted in February, E-Tran’s Board of Directors,

with the support of external advisors had been engaged in a robust process with third parties interested in our company. After evaluating

a number of compelling opportunities, it became clear that a combination with EQT is the best path forward for our shareholders, employees

and stakeholders. This transaction delivers full and fair value to E-Tran’s shareholders and provides the opportunity to participate

in the future value growth, as Toby just described, as EQT executes on its strategy.

The operational efficiencies that will be realizable through

this transaction raised the floor substantially on stable cash flow production while also enhancing the upside on free cash flow opportunity.

The new EQT is a leader in cost efficiencies and upstream

processes. And our gathering infrastructure was largely built to serve EQT. This is simply a natural combination capitalized on this paradigm

for the future of natural gas. The result of this combination will facilitate lower cost production and transportation of clean natural

gas, ultimately benefitting American consumers and promoting American energy security.

The clear strategy of EQT to be a leader in natural gas production

for the world is significantly advanced by this transaction. The business model moving forward will be EQT as an innovator continually

evolving to improve energy production and transportation. It is clear that the domestic and global demand for natural gas will continue

to grow and our combination with EQT is well positioned to be a low-cost provider of it.

This is an exciting new chapter for both companies. And I

would like to thank the entire E-Tran team for their tremendous effort, professionalism and dedication over the past five and a half years.

With that said, I will now turn the call over to Jeremy.

Jeremy Knop, EQT Corporation, Chief Financial Officer:

Thanks, Tom. As I mentioned on our fourth quarter earnings

call, we see the natural gas macro landscape is one characterized by unpredictable volatility for the foreseeable future with an increasingly

fat tail distribution of outcomes. Amid this backdrop, we have been making strategic decisions and capital investments underpinned by

our view that the only way to truly thrive in this world is to be at the low end of the cost curves. I also highlighted how the infrastructure

projects we are investing in at EQT symbiotically work to enhance our upstream assets and facilitate risk adjusted compounding of shareholder

capital. The acquisition of Equitrans unequivocally aligns with these principles for creating value in a volatile, cyclical commodity

business and facilitate a seismic shift down the cost curve.

To further illustrate the impact of Equitrans has on our

cash generation profile, we show free cash flow conversion ratios across a peer group and our updated investor deck. Free cash flow conversion

measures how much of a company's EBITDA is converted to free cash flow, or intrinsic value. EQT was already at the high end of the peer

group in terms of free cash flow conversion with high-cost Haynesville producers at the low end. But this transaction catapults EQT into

a league of its own in terms of business quality, and intrinsic worth, and aligns us with a new peer group of major integrated businesses.

While the market already provides premium valuations for

higher free cash flow conversion businesses, we expect to see further premium accrue as this combination is truly a one plus one equals

three deal across the industry leading asset base.

Turning to the deal structure. Consideration is all-stock

with EQT shareholders owning approximately 74% of the pro forma company and Equitrans shareholders owning 26%. We are excited to broaden

our shareholder base to investors that covet the durability of critical infrastructure assets, while also providing the best upside exposure

to the structural growth we see in natural gas demand for decades to come.

Looking at the balance sheet. We've spent significant time

evaluating the deleveraging plan with all three credit rating agencies to ensure maintenance of investment grade ratings. This deleveraging

plan includes a combination of organic free cash flow generation, and a near term target of $3.5 billion of assets sales, including selected

regulated assets of Equitrans, providing significant coverage and optionality to achieve debt retirement goals. This leverage reduction

plan should put the combined company on a glide path to absolute pro forma debt of roughly $7.5 billion, which equates to 2x adjusted

EBITDA or approximately 6x unlevered free cash flow at $2.75 natural gas prices. Ensuring EQT maintains a bulletproof balance sheet through

all parts of the commodity cycle.

Note, at $2.75 gas prices, most of our natural gas peers

do not generate any free cash flow in maintenance mode without hedges, underscoring the resiliency of EQT’s low-cost business model

and balance sheet strength despite the higher absolute debt levels.

I also want to note our discussions with the credit rating

agencies have been highly constructive, and we expect them to evaluate the pro forma of business on a hybrid upstream and midstream rating

structure, with appreciation for the merits of the higher multiple integrated business model and improved cash flow durability.

Additionally, with the acquisition of Equitrans, we will

be eliminating significant minimum volume commitments associated with gathering and water contract and our MVP capacity that an aggregate

represent a current off balance sheet liability of greater than $11 billion. While not labeled as debt today, the elimination of these

liabilities materially enhances EQT's creditworthiness and operational flexibility, important characteristics in this volatile world we

find ourselves in.

As it relates to capital allocation moving forward, we will

remain laser focused on debt reduction until we complete our deleveraging plan. As we achieve our debt target, lower interest expense,

capture synergies, we plan to reap the benefits of our unrivaled cost structure, which will take the form of continued growth of our base

dividend and counter-cyclical share repurchases.

We also expect our integrated teams working in alignment

will uncover an extensive opportunity set of additional high return midstream growth investments, similar to the ones that are part of

our 2024 budget.

To wrap up our prepared remarks throughout the process of

working on the acquisition of Equitrans, I was constantly reminded of one of my favorite Charlie Munger quotes, which says, “Forget

what you know about buying fair businesses at wonderful prices, instead buy wonderful businesses at fair prices.” The majority of

M&A we've seen in the upstream sector over the past several years has been characterized by companies chasing lower multiple, lower

quality assets in an effort to engineer financial accretion at the expense of asset quality and long-term value. In essence, buying fair

businesses at what on the surface appear to be wonderful prices.

At EQT, we've always taken the Charlie Munger approach to

M&A. And this acquisition is no different, as Equitrans structurally improves the inherent quality of our business and places EQT

firmly at the low end of the dry gas cost curve, creating a truly wonderful business. This acquisition will also serve to draw sharp contrast

between EQT's high quality, durable business model and the high-cost business models of non-integrated gas peers who will find themselves

struggling to compete on the global stage amid increasing volatility. We believe this combination creates a must own energy stock that

will increasingly be viewed and valued by investors as a major integrated business with unrivaled asset quality and cash flow durability.

I'll now turn the call back over to Toby for some concluding

remarks.

Toby Rice:

Thanks, Jeremy. In closing, I want to highlight that this

deal would not have been possible without the efforts of our Qrew throughout the past four years, they have enabled us to enter this transaction

in a position of strength, and I want to thank them for all their hard work to date. I also want to thank the ETRN team, you've been an

important part of our success to date as well. In your relentless efforts to safely and responsibly construct critical energy infrastructure

has not only enabled the success of your stakeholders, you've enabled the success of America. Thank you for your efforts, and we look

forward to welcoming you to our Qrew.

With that, I'd like to open the call up for questions.

Operator:

(Operator Instructions) Your first question comes from the

line of Doug Leggate from Bank of America. Please go ahead.

Doug Leggate, Bank of America, Analyst:

Hey, good morning, guys. Thanks for the early update this

morning. And congrats on getting a very logical deal done.

Two quick questions, please. You've mentioned that $250 million

initial synergies go into full $425. What was the delta? And what's the timeline to achieve that? And my follow up is on the $3.5 billion

of asset sales. I wonder if you could offer some color around the nature of what those might be. I'm thinking specifically is MVP part

of that? And what is the upside risk to that number? Thanks.

Toby Rice:

Hey Doug, I'll take your first question. Good morning. So,

on the additional upside synergies, those are largely driven by system optimization, what we're talking about there specifically, is adding

compression, that will lower system pressures enhance the productivity of our wells, and that extra volumes would mitigate some of the

CapEx spend on the drilling and completion front.

Also, we've got some interconnect and expansive projects

in there, those from a timing perspective, those interconnect, any of those projects will take a little bit longer to get done. But we're

going to start working on these, as soon as this deal closes and hope to have meaningful progress on expectations within 12 to 18 months

and be able to start delivering some of these.

Doug Leggate:

And maybe before you go to the second question is a quick

follow up on that, Toby, that the lower pressure you talked about? Presumably that means less capital, fewer wells needed to sales, lower

decline rate? Can you just talk a little bit of color on some of that?

Toby Rice:

Yes, it's pretty simple. Investing in compression infrastructure

will lower the gathering system pressures, and these gathering system pressures are active -- are actually pushing back on our wells.

And so, our wells will be able to produce at higher rates, when they are operating in a lower compression system.

So that delta of volumes that we will see as a result of

enhanced compression will allow us to minimize the amount of drilling in CapEx, the drilling and completion CapEx because we'll need fewer

activity to maintain production volumes. It's really that simple, but we’ll spend more money on compression and less money on drilling

activity.

Doug Leggate:

That makes sense. Thank you. And lastly, on the on the disposals,

excuse me.

Jeremy Knop:

Yes. Hey, Doug. It's Jeremy. So, on asset sales, you'll see

what we put out publicly is focused on some of the regulated assets, it’s Equitrans MVP certainly could be part of that, it’s

a very logical divestment candidate, one of the highest quality pipelines in the country with brand new 20-year contract. So that that

is certainly something that is on the table.

And then I think it is -- has already -- has been leaked

out there. We do have that ongoing sale for our non-op assets that I would say that is going very, very well. And we hope to update investors

on that in the near term.

Doug Leggate:

Great stuff. Thanks very much, guys. Congrats again.

Toby Rice:

Thanks, Doug.

Operator:

Your next question comes from the line of Arun Jayaram from

JP Morgan. Please go ahead.

Arun Jayaram, JP Morgan, Analyst:

Yes. Good morning, gentlemen. Toby, Jeremy, I was wondering

if you could give us some thoughts on more specifics around kind of the vertical integration, and kind of the benefits to EQT. And secondly,

maybe just the path to the $2 or lower, breakeven price cost structure.

Toby Rice:

Yes, Arun, it's pretty straightforward. And I think it's

really well illustrated on the slides that we put out, aligning with Equitrans and allow us to continue our mission and deliver cheaper,

more reliable, cleaner energy for the future.

I think the cheaper part is really shown on Slide 5, I mean

this is going to be a material step change in our cost structure coming down and allow us to produce more affordable energy to our customers.

On the reliability front, having a lower cost structure is

going to transform and completely high grade and deepen our already pure leading inventory. That's illustrated on Slide 6. So, we'll be

able to produce, pretty healthy margins for decades with a high graded inventory.

And then on the clean energy aspect, I think this one's really

interesting, creating America's first large scale, fully integrated, natural gas company is going to give us the scale to be able to continue

to deliver cleaner energy into markets, whether that's domestically replacing coal meeting growing -- growing energy demand, domestically

or internationally and servicing, the burgeoning LNG market that we have. So, this really advances us on all key fronts.

And as far as the glide path to the cost structure, getting

down to that long term target, we will see material step change down in our cost structure day one, and then that will continue to improve

as we capture synergies, hopefully having meaningful progress 12 to 18 months within closing. And then from that point forward, as we

continue to deleverage, we'll be able to reduce the cost structure further. So that's generally how we're thinking about the glide path

down to that sub-$2 breakeven cost structure.

Arun Jayaram:

I’ll just hop in. Go ahead, Jeremy.

Jeremy Knop:

Yes, of course. Hey, one thing I wanted to add to so, I'd

say is we've looked back and really thought about, like lessons learned in the last couple years, one thing that really stood out to us

is we went through this really low-price period during COVID, followed by high prices afterward. And we and several of our peers lived

through periods of really high hedged losses. I think one thing that occurred to us at the time was is sort of the reflexive nature of

hedging, and how you really position yourself to actually capture high prices.

And I think the standard convention is that the higher price

you have, like higher operating costs business you have, the more upside you have the prices. I think what we learned was, in reality,

that really isn't the case. And certainly, going into an era of high volatility, the best way to capture that is actually just have a

really resilient, low-cost business model that you don't really have to hedge. And as we've talked about publicly, we see that price upside

really being so asymmetric that we want to be in a position where we don't really have to, and being -- having a high-cost business model

inherently forces you to hedge, and we just think in the world you're going into, that's really the opposite of how your business should

be setup.

So, what we're really trying to do in position here, I know

at a high level, it's easy to look at this and say, “Well, look, you guys are focused on downside protection and durability of your

business.” And that is certainly true. But I think that that the sort of second order impact of that, and I think it's critical

to recognize that we're really trying to sort of uncork here is really that upside, and we think this structurally does that in a really

differentiated way.

Arun Jayaram:

Great. Maybe just a follow up, I don't know, Toby, if you

could maybe just discuss maybe the regulatory climate of getting a deal like this approved. Obviously, your last transaction did get through

a decent level of FTC scrutiny. So I was wondering if you could comment on that.

Toby Rice:

Sure, I mean, we're not going to speculate on what the process

ultimately will be. But I will say we are looking forward to discussing with regulators, especially in this environment, where people

are talking about energy, it's a political issue. This is a great opportunity for us to communicate how this transaction is going to make

the energy we produce more affordable, more reliable, and cleaner, which is something that everyone in this world desires.

So, it'll be a great opportunity for us to continue to talk

about the benefits of this transaction and why this is great, not only for our companies, but for the Appalachian region, and also for

our country.

Arun Jayaram:

Great, thanks.

Operator:

Your next question comes from the line of David Deckelbaum

from TD Cowen. Please go ahead.

David Deckelbaum, TD Cowen, Analyst:

Thanks for taking my questions, Toby. And congrats on the

deal.

Toby Rice:

Thank you.

David Deckelbaum:

I was just curious if you could give any color, as you think

about long term planning here, this has opened up the portfolio to more upstream consolidation on upstream side, on things that wouldn't

be touching or that aren't touching the midstream assets right now that perhaps you wouldn't have had an opportunity to consolidate accretively

before.

Toby Rice:

Well, I think the industrial logic that we have with this

deal, I mean these assets are largely contained with our current operational footprint. So, I wouldn't say that this particularly opens

up newer opportunities because there's such strong industrial logic to begin with.

Going forward, I think we've laid a pretty consistent track

record of looking at deals that will move us closer to our north star, which is lowering our cost structure. Because we believe that that's

the key to unleash meaningful upside and exposure to a pretty compelling natural gas macro in front of us.

David Deckelbaum:

Appreciate that. And then I guess, just to -- it sounds like

on just the near term deleveraging targets post close, how do you square that I guess with the return on capital program unless I missed

it, is there it -- should we just assume that you support the base dividend at this point but then excess free cash goes towards deleveraging?

Jeremy Knop:

Yes, that's a good, simple way to think about it. And look,

I think with our deleveraging plan, the guidance we've gotten from the rating agencies has been post-closing, you typically have 12 to

18 months to complete that plan. And we think with what we have on the table today, and what we've outlined, I mean, we have really more

than two times the sort of number of sale candidates available.

So, we think that path to deleveraging is very low risk,

and very high confidence that we can execute on in pretty short order. But really, we're looking at kind of mid-year in 2025 is that timeframe

to get to that target debt level.

David Deckelbaum:

Thanks for the color, guys.

Operator:

Your next question comes from the line of Sam Margolin from

Wolfe Research. Please go ahead.

Sam Margolin, Wolfe Research, Analyst:

Hey, good morning, everybody. Thanks so much.

So, it's a question on the vertical integration topic, and

maybe just a follow up. And it sort of in the context of, the gas market going global, out of the U.S., as you guys pointed out. I mean,

when that happened, right, a producer's paying another layer of fees for liquefaction and shipping. And so, I mean, as part of this year,

that to the extent that you have a global orientation or an international orientation commercially, it's just not tenable to pay a whole

stack of fees in the Lower 48. And then another stack of fees to get into global markets, either directly or synthetically. In other words,

you just can't pay like, $3 or $4 per Mcf for gathering and transportation through the cycle?

Toby Rice:

Yes, I think that's a great question. I think, for us stepping

back, big picture strategy for us is the is to find markets and then be the low-cost energy provider of those markets. I'd say right now

the focus is to continue to serve as the best service the markets that we're supplying right now. And as we progress towards getting some

more exposure to the international markets, we believe that our asset base today is going to position EQT to be the low-cost energy provider

of international markets. But that's something that we're always evaluating the best path to do it.

But right now, the focus is just continuing to lower the

cost to the markets we already serve.

Jeremy Knop:

I think your question is spot on. I think your question is

spot on for what it's worth. And look, I think one of the things we've observed is we've been one of the first companies to reach sort

of this level of material scale we're at, is that even if you have a very clean balance sheet, a very high cost structure, which frankly

can potentially get even higher with some of these LNG contracts, high cost structure paired with scale, can be a pretty risky combination,

if not managed properly.

And what I mean by that is, if you have -- a look in a volatile

world, you see gas prices like they are today. And you have a cost structure much more $3 and significant production, your level of cash

flow outspend at even a mid or certainly low $2 level, in a volatile world can really upend your business very quickly, makes it very

difficult to make long term contractual commitments. And frankly, I think it's why the entire rest of the world, in energy companies are

organized in a vertically integrated way because it reduces that volatility.

And, look, as we've contemplated this deal for some time

now, as we watched the market become increasingly globalized, whether you have an LNG contract or not, you're going to be exposed to that

volatility. And so, unless you have your business sculpted in a way that's prepared to compete on that stage, in our view, it will frankly

just end poorly in time through those periods of volatility.

So, what we're trying to do here is position ourselves not

only for really being able to compete and thrive on that global stage, but even for companies that aren't trying to get directly involved

in LNG, you're still going to be subjected to the volatility and the impacts that that globalization of gas has on the U.S. market.

So, either way, it's critical. But I mean, look, as Toby

said, cost structure is our north star, and this is just our grip, really the ultimate manifestation of our way of capturing that.

Sam Margolin:

Well thanks for that. And maybe just a follow up, maybe it's

an opportune time to talk about your views about what's happening -- what's going to happen to the gas market at the end of MVP, because

that's been a topic of controversy and conversation. I mean, how do you -- how are you guys thinking at this point about that MVP terminus,

and how you're positioned and whether you need, more infrastructure or more vertical integration from that point? Thanks.

Toby Rice:

Yes, I think one thing that that will change. I mean, when

you look at historically, at the southeastern market, there's been some periods of time that look very similar to energy prices that you

see in Boston, Massachusetts. I mean, we've seen periods of time where Charlotte, Charlotte is paying north of $20 for their energy prices.

It's not because energy prices cannot be affordable. It's because they did not have enough pipeline infrastructure, MVP is going to help

solve that.

Another interesting dynamic that we are seeing in that market

is just the growth in power gen. And we highlighted this on our last call, how domestic power generation is going to be a really exciting

market that's specifically taking place in the southeastern market that MVP serves. And then thrown on top of that, the power demand from

AI, which MVP is servicing Data Center Alley, and it's going to create even more opportunity.

So, I think, again, MVP is an incredibly important piece

of infrastructure. And we are glad to see that leaders in D.C. have recognized this and have passed laws to make sure this pipeline gets

done, because it is critically important for the energy security of that region and the U.S.

Sam Margolin:

All right, thanks so much. Have a great day.

Operator:

Your next question comes from the line of Bert Donnes from

Truist Securities. Please go ahead.

Bert Donnes, Truist Securities, Analyst:

Hey, good morning guys. I just wanted to maybe discuss your

ability or your desire to change the corporate strategy to appeal to midstream holders. Is this transaction kind of a change in the way

the Company wants to present itself? Or should we look at it more as “Hey, we're still, core E&P investors are focused, but

now we're just kind of a lower cost bigger and better structure going forward.”

Toby Rice:

Yes, I mean, here's some -- here's some attributes that we're

really focused on every day at EQT that I think are extremely attractive to mystery investors. And it comes down to cash flow durability,

it's been able to produce sustainable free cash flow. And the key to making that happen is a lower cost structure.

Now, I think the alignment that we will have between the

upstream and midstream is going to drive operational efficiencies between the two organizations, that's going to lead to lower costs,

greater free cash flow generation, which I think, again, is going to be an attribute that's going to be, very well received from both

investor bases.

Jeremy Knop:

One data point that you might find interesting, we've actually

had some even inbounds over really I’ll call it recent history from traditional midstream investors who I think are trying to branch

out and see EQT and our business model, and what we're doing is actually something that potentially fits their strategies. And so I think,

really, this combination sets us up in a position where we can really capture and probably retain a lot of those traditional midstream

shareholders. It's not the world we were in 5 or 10 years ago, we're the shareholder groups are so bifurcated.

And then look, I'd point out, I think a lot of our top shareholders

to the way they think about shareholding, you've seen so much capital flow back into major oil companies really gravitating back towards

that integrated model. And I know a number of our top shareholders, that what they find most interesting in today's world is that that

style of coming company that structure, and they've added EQT is a complement to those holdings in the portfolio to make it a gassier

weighted portfolio. And so really, I think what we're trying to do in, a longer period of time to sort of emulate that model, which, again,

on a global stage is really the way that the rest of the entire global energy industry is structured.

So, I think it really opens us up for a much broader shareholder

base than what we have today. And what we've already seen, I think, is only going to be supercharged by that.

Bert Donnes:

That's great color on that. And then the next one is, did

this deal kind of impact your thinking around your refund curtailment at, in the announcement, you kind of implied that, hey, we'll reassess

as market conditions change? Should we look at this transaction when it closes? It's kind of a hard stop, like, does it lower your breakeven

cost low enough that maybe if you had already had Equitrans, in house, you wouldn't have curtailed? Just any thoughts around that.

Toby Rice:

It will certainly provide a little bit more flexibility without

having the MVCs that certainly will give us some more flexibility. But listen, I think what's important for us to understand when we're

curtailing volumes is that we are satisfying the market. And getting through this winter, and making sure people had abundant energy was

really important. But taking a step back and looking at the market today, that these volumes weren't needed. And we'll curtail accordingly

the balance of the market.

So, I think one thing that's equally as important is just

a disciplined approach towards curtailment is our unwavering commitment to continuing our activity levels that will give us -- continue

to enable to have productive capacity to serve the markets in the future, but we will continue to be cognizant of the market that we're

in and bring that production to market in the most prudent way responsible.

Bert Donnes:

All right. I appreciate the answers. Thank you.

Operator:

Your next question comes from the line of John Mackay from

Goldman Sachs. Please go ahead.

John Mackay, Goldman Sachs, Analyst:

Hey. Good morning, everyone. Congrats on the deal. I just

wanted to maybe swing this one to Tom and team. It’s been three weeks since we got the last update in MVP. Obviously you guys have

the language in here on the deal closing being contingent on FERC signing off on final commencement. Can you maybe just give us an update

on where it stands and how you're feeling about your most recent timeframe and service you gave us? Thanks.

Diana Charletta, Equitrans Midstream, President and Chief Executive

Officer:

Yes. This is Diana. Good morning. We continue to make daily

progress on MVP. It’s on track in accordance with our latest guidance, which Q2.

John Mackay:

All right. Very clear. Thanks enough for that. And then maybe

just looking more broadly, there’s a large kind of third party, we can call it now, business inside ETRN serving a couple of other

producers. Just Toby and team, are you guys looking to continue to grow that side of the business, or is this really going to be more

kind of internal EQT facing at this point? Thanks.

Toby Rice:

No, John. I mean, this is a consistent theme that we've brought

when we took over EQT was to realize the full potential of the assets under our management and realizing the full potential of ETRN’s

assets is the next focus for us. And a big part on realizing full potential of midstream infrastructure is to maximize the utilization

of that infrastructure.

And so, while these systems are designed and planned for

us at EQT, there’s tremendous opportunity to share these benefits with offset operators. And it’s going to -- these efficiency

gains will also help offset operators as well. And listen, our track record on doing this is not new. I mean, we did this at Rice Midstream

Partners. If you remember, we had about 2 Bcf a day of Rice-operated volumes, and our midstream team was gathering almost 3 Bcf a day.

So this has been a theme that is -- we’re looking forward to continue, and we’re motivated to do it because third-party volumes

in effect will help drive down our cost structure.

John Mackay:

All right. Makes sense. Thank you very much.

Operator:

Your next question comes from the line of Roger Read with

Wells Fargo. Please go ahead.

Roger Read, Wells Fargo, Analyst:

Yes, thank you. Good morning. Congrats on the deal here.

I think the key theme I’m picking up on is obviously

you have to be the lowest cost operator able to compete on a global scale. I was just curious how does this help you access global markets?

Is there any advantage now that you didn’t have before, whether that comes through the assets or it comes through scale or anything

else we might be missing here?

Toby Rice:

Yes. I think that there’s really two things. Having

a really low cost structure is going to help deliver affordable energy, but then also having a deep inventory of high-quality inventory

is going to be the other important dynamic. Having the infrastructure to be able to connect this low-cost, high-quality inventory to the

market are going to be two of the key elements you need to be able to create supply deals to access these markets.

So we think this is a big step forward in positioning us

to do that, but combining inventory, which EQT has, with infrastructure, which is what Equitrans is bringing to the table, is going to

set the table for some interesting opportunities hopefully.

Jeremy Knop:

Yes, and I would just say beyond that -- look, yeah. I think

beyond that, too…

Roger Read:

No. I’m sorry. Go ahead.

Jeremy Knop:

I think in terms of inventory depth, which is critical for

LNG, and look, as we’ve said before, if a lot of these contracts come online back half of this decade you really need 15 to 20 years

of inventory, like really high constant inventory to back those what, in effect, are liabilities. And so, look, we feel great about where

we are as a -- as a standalone company to serve those.

I think when we look around a lot of shale basins, there’s

not many companies who have really even close to that level of inventory depth, which is why I think you’ve seen some companies

hesitant to sign up at all. But I think what’s unique about this transaction is, it effectively takes inventory that might have

been Tier 3 or even Tier 4 across broader Appalachia. And when you integrate that cost structure away and you’re paying that fee

from one pocket to the other it moves that quality of inventory up to be core kind of Tier 1, Tier 2 inventory.

And so, it really puts us in an unparalleled position to

be able to constantly -- confidently deliver those gas volumes, whether it’s to a utility, whether it’s to an LNG facility

in a -- in a totally differentiated way. So, I know it’s -- at a high level you look at this and say, well it’s a midstream

deal, how does it help your upstream business. But I think if you peal back the onion a bit, it’s truly transformative in, I think,

from an inventory standpoint, what it allows us to do to provide that cheap, reliable, clean natural gas product for decades and decades

is really unlocked by getting this transaction done.

Roger Read:

Okay, no, I appreciate that. I don’t think it’s

been asked, it’s certainly an issue with some of the other M&A we’ve seen. Any thoughts on regulatory approvals that are

necessary here, be they state or federal?

Toby Rice:

Yes, Roger, I’d refer back to some comments we put

out 10 minutes ago. This is going to be an opportunity for us to work with our regulators and show them how the transaction is going to

ultimate -- be great for our companies but also great for the region and our country by making energy we produce cheaper, more reliable

and cleaner.

Roger Read:

All right, I’ll leave it there. Thank you.

Toby Rice:

Thanks, bud.

Operator:

Your next question comes from the line of Noel Parks from

Tuohy Brothers. Please goa ahead.

Noel Parks, Tuohy Brothers, Analyst:

Hi, good morning. I have a couple questions. I guess, thinking

more about the interaction, perhaps, with a macro outlook for you, I feel like over last few quarters or so I’ve heard on the EPG

side, you talked about some questions about whether they’re, aside from overall volatility, whether there’s sort of a later

in decade lull and sustained lull in net gas prices that could sort of upend some of the assumptions that the higher cost producers are

operating under. So, is it fair to say that there’s a bit of a sort of defensive aspects to proceeding with this particular level

of integration? And maybe just that you’re more concerned about enduring through the cycle rather than seeing just a hockey stick

up with LNG demand?

Jeremy Knop:

Yes, I think that is a -- it’s a great question. Look,

we talked about it on our last on quarterly conference call, which is probably what you’re referencing. And look, I think, in our

view, I think consensus seems to think that gas prices are just simply structurally higher forever. I think, again, like we said last

quarter, we think on average that might be true. But you’re not going to take the cyclical nature out of the business. Every commodity

is cyclical.

And certainly, look, I think we were in a bull cycle for

a couple years. It feels like we’re in a very mini bear cycle right now, which we anticipate to end by the end of this year. We

see a couple really strong years after that, but look, I think that never lasts forever. You have upcyles, downcycles, and it think what’s

unique about this transaction is we know we can’t predict that. And I think with what we saw with winter weather this year and how

it can just upend the market so quickly, we want to be in a position where our downside is very limited, if any, and this transactions

absolutely positions us in that way.

But look, if your downside is low $2 gas where this business

will be generating really robust free cash flow even in that environment unhedged, and then if the flipside happens and gas is $6, $10,