Filed by Ecolab Inc. pursuant to Rule 425 under the Securities

Act of 1933 and deemed filed pursuant to Rules 13e-4(c) and 14a-12 under the Securities Exchange Act of 1934 Filer: Ecolab lnc.

Subject Company: Ecolab lnc. SEC File No.: 001-09328 Transcript of a webcast hosted by Ecolab Inc. and held at 9:00 AM Central

on March 25, 2020. Operator: Greetings and welcome to the Ecolab COVID-19 Update Conference Call. At this time, all participants

are in listen-only mode. A question-and-answer session will follow the formal presentation. [Operator Instructions] As a reminder,

this conference is being recorded. It's now my pleasure to introduce your host, Mike Monahan. Please go ahead, sir. .....................................................................................................................................................................................................................................................................

Michael J. Monahan Senior Vice President-External Relations, Ecolab, Inc. Thank you. Hello, everyone, and welcome to Ecolab's conference

call. With me today is Doug Baker, Ecolab's Chairman and CEO; and Dan Schmechel, our Chief Financial Officer. A discussion of our

results, along with our earnings release and the slides referencing our comments today are available on the Ecolab's website at

ecolab.com/investor. Please take a moment to read the cautionary statements in these materials stating that this teleconference

and the associated supplemental materials are forward-looking statements, and actual results could differ materially from those

projected. Factors that could cause actual results to differ are described under our Risk Factors section in our most recent Form

10-K and in our posted materials. We also refer you to the supplemental information in our release. And now here is Doug Baker.

.....................................................................................................................................................................................................................................................................

Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc. Thank you, Mike. Good morning, everybody. I'm going

to walk through a series of slides really to dimensionalize what we're seeing, what we're doing, how we're working to position

ourselves as we move through this. We have a big difference that we can make and we're working hard to live up to both our obligation,

responsibility, and potential. So, I'll open with the first slide, which is our 2020 outlook. As a part of the bond offering that

we made last week, we reaffirmed our first quarter guidance. We also confirmed that we still do not have the ability to currently

forecast the impact of COVID-19 on our 2020 results. Obviously, it's not going to be positive. It's going to be a net negative.

But let me dimensionalize what we're seeing. First, COVID-19 – and I think we're all aware of this, but maybe not –

is going to be the biggest event or impact event on the globe since World War II, both on a human health standpoint and on an economic

standpoint. Importantly, the impact is asymmetrical both in human health, but here I'm talking economic for the short term. There's

going to be record demand in some sectors. We're seeing it. I'll talk more about that. We're, obviously, seeing record demand destruction

in others, but certainly there's no way this, in my mind, is going to be the end of days for either mankind or certainly for Ecolab.

So if you look at Ecolab, our view is we are healthy, we are very well-positioned to help. We have a responsibility to do our part

and I believe we're stepping up in the right way to do exactly that. Our positioning couldn't be more relevant. The positioning

around safe food, clean water, healthy environment, our capabilities in this area, our

ability to reach customers even in these times and help them

in their unit as they're trying to work through very difficult circumstances is unparalleled. I think our advantage has become

much clearer during these times and we're working to make sure that we utilize them in a way that best helps communities, customers,

our team, and investors. So our goal is to make sure that people continue to think of Ecolab in the way that we want them to think

of us, that we are a company people can count on in both good times and difficult times, and make sure we live up to our promise

and do our part. So our issue is really not survival, which I'll talk about. It is how do we emerge from this even stronger as

a team, as a business, and as a company. Our approach to do this really starts with continuing to make sure we support our customers

in the safest way possible through this event. We're doing that by, first, protecting our people. We are putting out, like many

companies, social distancing protocols, facility hygiene heightened protocols; you might imagine we had a fairly heightened standard

before. We've raised it even further. Those on our team who worked in offices, we have asked to work from home, over 90% are doing

so at this point. In our production facilities, we have 130 plants, 128 continue to run; at this point in time I had 129, but it's

128. We are separating shifts, i.e., creating gaps so that there's no overlap from one shift to another. They're not in the locker

room or in a break area at the same time so that we make sure that we minimize people contact the best we can. We are separating

lines and making sure that we isolate people as best we can, and ask for social distancing and heightened hygiene standards. In

the field, we have asked no group settings, no meetings, obviously, but no group selling situations or group meetings. We'll do

it virtually. When it comes to in-unit fixes, we also ask if we can do this virtually, do that first. But if we must go in there,

there are a number of protocol standards that we've issued to enable our people to help customers in a way that really minimizes

any risk for us individually. This enables us to protect our customers. Our field team is going to be absolutely critical. Our

manufacturing team is absolutely critical. We need to maintain production, but we also have to maintain our ability to protect

our customers, which I think we've done terrifically. At this point in time, we have field and tech support for our customers in

every country we operate. Next, we've got to protect the company and I think we've taken a number of smart steps. We have a slide

later on in the deck where we'll talk specifics around this. But certainly cash is king in these environments. We've done a number

of steps to make sure that we have enough cash to move through, what I will call, ridiculously severe scenario in terms of market

conditions, payment conditions, bad debt conditions, et cetera, and we are quite comfortable we can sail through virtually anything.

Importantly, we've taken a number of steps around capital, which we've cut back dramatically, 50% at minimum. We've stopped all

hiring weeks ago. We rescinded offers, which we've never done, and we've put in very stringent spending controls. All of this ultimately

because what we would like to do is protect our full team as we go through this. It's a smart thing to do from the company standpoint,

economically, culturally, and also from our ability to snap back and get back once this is over. If you look at end markets, which

is slide 9, what we've tried to dimensionalize for you is there's obvious markets where demand is depressed. And so there's a lot

of talk about what's going to happen in foodservice, what's going to happen in lodging, and the guess that we're going to have

big depressed demand there is true. What's less obvious to people is there are a number of markets where we have increased demand.

Our largest segment

now is Food & Beverage manufacturers. It represents 20%

of our sales when we factor in both our hygiene and water technologies. So it's a single biggest segment we compete in. It has

got record demand at this point in time and we expect to have a very favorable year there. We still have 7.5 billion people on

earth. They will continue to eat; they continue to desire safe food. We will continue to play extremely successfully in this market.

Healthcare, Food Retail, Long Term Care, and other segments will also have increased demand as a consequence of COVID-19. There

are a number of segments where you have, what we would call, low impact, i.e., Life Sciences. We expected double-digit growth in

Life Sciences before COVID-19, and we expect double-digit growth in Life Sciences with COVID-19. So the demand really isn't being

impacted one way or another, and there are other obvious categories in here which are listed on here, and then we have demand down.

Certainly, Refineries' going to be impacted negatively as a consequence of less fuel demand, et cetera, and Full Service Restaurants

and Lodging are probably two of the segments, like Cruise and some of the others, that are going to have the most significant demand

destruction. But in total, categories with demand plus are around a third of our business, categories with depressed demand are

about a third of our business, and then those in the middle a bit plus/minus as we look at this thing. But net, this will be a

negative impact, because those with demand depression are going to be more significantly impacted than those with demand plus as

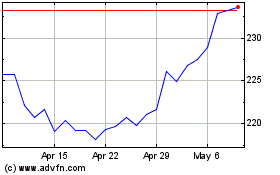

we go through this. China is probably a good story in terms of illustrating how this will play out potentially in other markets.

So, if you look at China, we had very strong demand going into this. It was, obviously, depressed and you a saw bottoming in February.

During this period of time, we had huge depression in customer activity, both in institutional and industrial. China took a very

aggressive stance and shut down of their economy during this period of time. And then you start seeing some return to normalcy.

I will point out, March, April, and May are forecast, not actual; February is actual. We're quite confident in the March number,

simply because we're so far through the month. But, obviously, April and May are what we believe will happen, but we don't know

that they will happen. But the China team expects this type of return, if you will, in recovery. I will say historically, they're

conservative, not progressive forecasters. Though we have started to see return of customer activity, I will say it does not snap

back. It's moving back, but you had low demand in Lodging with 10% occupancy. We started seeing it move back to 20%. It did not

snap from 80% to 10% back to 80%. It's going to be a longer recovery than that and we will expect the same in other markets. At

the same time we see huge demand in a number of categories, particularly sanitizers, and not all this demand can be met by us.

We've had 15x order demand on hand sanitizers. We have ramped up dramatically and we will continue to build capacity, but the world

over has seen a huge step-up in hand sanitizer. Hand care is more in the 5x category, hard surface sanitizes more in the 3x. Our

production team, our businesses are doing an unbelievable job in enhancing our production capabilities and we are working to meet

all this demand. Hand sanitizer, we will not meet all that demand, but we have stepped it up. Currently we're nearing 5x and moving

through that number as we go through. But we're taking a bunch of commercial actions.

The first, as I mentioned, is working to fully meet increased

demand. So we've got this max plan in place for sanitizers, but we also have other businesses within like Life Sciences, Bioquell

is a recent acquisition that we made that does vaporized hydrogen peroxide, which actually is a great program for decontaminating

physical spaces. And so we're having huge step-up in demand for technologies like this, which aren't as well known by our investor

base, but we're making sure it's well-known from our customer standpoint. There are a number of stories like this. We're also prioritizing

where we have limitations on product, i.e., where we have to allocate we're prioritizing meeting existing customer needs first,

which I think you would expect. Those who have counted on us and continue to count on us, we're going to work to make sure we meet

the demand. We also do believe we're going to have capacity to go meet demand outside of that. We are putting together a health

plan that we're calling for strategic targets. Strategic targets is a euphemism for customers that we have not heretofore successfully

convinced that Ecolab is the right answer. We have big advantages in field capability and balance sheet versus our competition,

and we want to utilize that to show these customers how we can help in bad times, as well as good, and we are really targeting

handful of these customers as we go out there. So we're not just on defense. We are playing, I think, very smart offense. In addition,

we are accelerating digital transformation efforts where we know they're going to translate into value-add for customers and reduce

long-term cost for us, and this is smart money to spend. It is incorporated in our reduction of capital, but not all capital is

created equal, not all spending's created equal, and we want to continue to invest in this area, because we know how important

it is to us, one, to position our self even stronger as we come out and to enable us to become even more efficient long term as

we progress also. And then finally, we've put in COVID stress reduction plans for our food service and hospitality customers, in

particular we are temporarily reducing some fixed payment plans that we have. We will then extend agreements and do other things.

These customers are in very difficult circumstances. They're important to us. They're going to go through stress whether we help

or not. We can alleviate this. Most importantly, we want to help everybody we can have some daylight to get to the other side.

I believe the new move by the federal government's going to go a long way towards doing that as well. And we're also then developing

reopening packages by chain, making sure we utilize some service capability in the interim that we enable them to open quickly

once they are able to reopen their doors. So we enter this in strong financial position. I think the finance team led by Dan has

done a great job positioning us in the event that the unimaginable happens. So Dan will talk about the steps taken, and then I'll

pick up after that. Dan? .....................................................................................................................................................................................................................................................................

Daniel J. Schmechel Chief Financial Officer, Ecolab, Inc. Yeah, thanks very much, Doug, and good morning, everybody. So, on slide

13 I'll share a couple of perspectives on why we are so confident in our financial position going into what we're about to experience.

The first is on the upper left hand side. So just some perspective on Ecolab's – this is pre-Nalco, of course – our

free cash flow in response to the financial crisis. You can see that in 2008 we saw a dent in free cash flow, which quickly recovered,

this in-line with what we've always said about Ecolab, which is look, this is a very, very resilient business model and a very,

very resilient cash flow generator. Also showing in the upper left hand side this perspective on how strong and progressive our

free cash flow generation has been over the past couple of years.

On the upper right hand side, we are going into this with $1

billion in cash on hand, slightly more. Also showing on the upper right hand side are term debt maturities. You'll note that our

nearest term debt maturity is in 2021 and just to be clear, it is in December 2021. So we feel like we've got a balanced term debt

maturity profile and nothing coming up soon, and therefore our ability to manage our debt requirements and interest obligations

is quite clear. I've noted that on the bottom left hand side of page 13, meaning if you think about our solid cash position, our

priorities, obviously, our immediate focus was on interest and the debt portfolio. We remain very committed to our dividend. Doug

mentioned earlier that we are taking, of course, a very hard look at all CapEx, of reducing it by 50% I would say is the target;

could be more. I've mentioned that we have taken steps to assure that we have ample liquidity going into the downturn. But from

a liquidity perspective on the bottom right hand side, Doug mentioned, listen, we have done a lot of modeling of all kinds of scenarios

and even in scenarios which I would consider to be quite catastrophic, we will continue to deliver positive free cash flow. We

have a $2 billion revolver, which is supported by very strong banks. We do have $1 billion of commercial paper outstanding, meaning

that there is $1 billion of revolver capacity available to us in excess of the $1 billion of cash that we have on hand. The revolver

does have a, by design, very, very loose financial covenant, which is a 3.5 times EBITDA-to-interest. And as noted here, at the

end of 2019 we were 16 times in excess of interest and across all of the scenarios that we modeled, we never come close to tripping

this covenant. From an accounts receivable and collections perspective, our experience in prior downturns is that we see something

like a 0.3% increase as a percentage of sales in bad debt experience and write-offs. The catastrophic scenarios that we have tested

would involve bad debt or write-off experience which are many, many multiples of that number. And so the net of all of this is

we're going in with a lot of cash. We're confident in our cash flow generation capabilities in all tested scenarios, which I think

cover the gamut. And we are supported by a very strong bank group. Our debt maturity profile is out a ways and consequently causes

us no concern, and we think that we are in a terrific position to weather through this in good shape. With Doug back to you please.

.....................................................................................................................................................................................................................................................................

Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc. Thank you, Dan. So in summary, we believe we're well-positioned

to help financially, strategically our customers, our communities. Our team is absolutely focused on the right thing right now.

How do we continue to help our customers? One, meet the needs they need to, because the vast majority are considered essential,

but also help our customers that are in really difficult straits to get through, navigate through this, and be prepared to get

to the other side. This will ultimately pass. A new normal will emerge. And when that new normal emerges, it's hard to imagine

an environment where cleaner, safer, healthier positioning will be even more relevant and hygiene, anti-microbial, and ESG know-how

will matter even more going forward. So, we know that at the end of the day, our company is positioned to weather a very deep and

ugly winter, if that's what occurs. We believe it's going to be less than that. We are focused on, now that we know we can do that,

making sure that we are maximizing our capabilities and our ability to hit the ground running when recovery comes.

Long term, this business is a absolutely fantastic business.

We know we're going to have to get through a difficult year, but we can't lose sight of what's most critical when we manage through

these events and get confused about priorities. And I think we've got our priorities quite straight here as we manage. And finally,

I'll leave you with a slide that I shared with the team and that is, we are living history. It is rarely fun to live through history,

but we want to make sure that as we look back on how we managed through this, that we're proud of what we did, steps we took, how

we managed the company for recovery, how we helped our customers, and how we helped communities. If we do those things successfully,

Ecolab's future is even brighter. And that's my comment. Thank you. .....................................................................................................................................................................................................................................................................

Michael J. Monahan Senior Vice President-External Relations, Ecolab, Inc. Thanks, Doug. That concludes our formal remarks. Operator,

please begin the question-and-answer period. .....................................................................................................................................................................................................................................................................

QUESTION AND ANSWER SECTION Operator: Certainly. We'll now be conducting a question-and-answer session. [Operator Instructions]

Our first question today is coming from Tim Mulrooney from William Blair. Your line is now live. .....................................................................................................................................................................................................................................................................

Q Tim Mulrooney Analyst, William Blair & Co. LLC Hey, guys. Thanks for hosting this and taking our questions. It was very timely.

I guess since I'm kicking it off, I've got to ask the question that's on everyone's mind here, the Energy spin-off. You still expect

this to close before the end of the second quarter and any updated thoughts, given how much Apergy's stock price has pulled back?

.....................................................................................................................................................................................................................................................................

A Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc. Yeah. No, we still expect this deal to close in the

second quarter as we move forward. I think Apergy is doing – taking a number of steps, I think, to clarify their position.

They will cash flow – the upstream business is a good cash flow business. It's continuing to have positive cash flow. The

expectation is it will full year. And I think as they do get out and explain the cash flow profile of these businesses, how it

reference it versus debt, et cetera, I think the story becomes clearer and, I think, will be welcomed by their shareholders. .....................................................................................................................................................................................................................................................................

Q Tim Mulrooney Analyst, William Blair & Co. LLC Thank you, Doug. One other thing I wanted to touch on is – staying in

the energy theme, is the gross margin. Can you share some thoughts on the gross margin here, since energy prices have essentially

been cut in half since you reported your fourth quarter? I mean, should we expect a pretty material expansion in margins, given,

as you say, you typically don't have necessarily to give back a ton – you typically don't give back a ton of pricing? But

then, again, you have the Energy business. So should the lower raw material costs more than offset any headwinds from lower margins

in the Energy business? Helping us think about the puts and takes there. .....................................................................................................................................................................................................................................................................

A Douglas M. Baker, Jr. Chairman & Chief Executive Officer,

Ecolab, Inc. Yeah. I guess for your modeling, I mean, our commitment to separate upstream from the company via the RMT that's on

the table is resolute, right? That is absolutely the thing we're doing and we're going to work to do that. Therefore, long term,

upstream will not be part of our equation as you go forward. If you look at then the remaining business and the impact certainly

lower energy prices typically and we expect to translate into somewhat lower raw material costs. You will also, though, have other

effects which offset some of that benefit, i.e., lower production numbers, which means you're going to have lower overhead coverage

for a period of business. And so, this certainly helps mitigate some of the challenge that we go through. We are in a position

where we're forecasting either gross profit for the year, OI for the year, or EPS for the year. What I would say is we don't see

anything that's going to impair what I would call our ability to continue to grow gross profit and resulting OI leverage long term.

In the short term, i.e., in 2020, right, it's very difficult to forecast, but I'm not even sure that's the most relevant piece

as you go through this. .....................................................................................................................................................................................................................................................................

Operator: Thank you. Our next question is coming from Manav Patnaik from Barclays. Your line is now live. .....................................................................................................................................................................................................................................................................

Q Manav Patnaik Analyst, Barclays Capital, Inc. Thank you. Good morning and thanks for this color as well. Doug, just for some

perspective in those demand depressed areas that you called out, I mean, maybe you shine as an example or however you want to.

But if you read the headlines, I think we're all led to believe that 100% of that gets shut down or goes away. But just for some

perspective, like is there base business that still goes on or how should we think about how depressed that can be? .....................................................................................................................................................................................................................................................................

A Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc. Yeah, it really depends by segment. I mean, I would

say in QSR, fast food, the lion's share of their business even before COVID was done through drive-through and takeout. I mean,

you're talking like 70-plus percent in many instances. And so, if anything, I don't know that there's going to be really any change

in demand there going forward. Meaning, if you don't have dining room service, you might lose table cleaning and some other, but

that's a very small percentage of that sale. So, enhanced hygiene standards as a consequence more than offset any demand destruction

you might see from dining rooms closing in that sector. And in most of the states, what you've seen is the dining rooms closing,

but the ability to continue carry-out, right, and/or delivery remains. Still, some restaurants view this as a situation whether

it's to close than remain open. But where they remain open, you turn the kitchen on, you're going to have to do a certain amount

of cleaning and everything else. So, I can't really imagine a scenario where you get down to zero restaurant sales. I just don't

think that's a realistic view. We didn't see that in China and we don't expect to see it anywhere else. I think if anything, this

is more a roving blackout. In the US, you're seeing it hit more severely in certain markets at different times, right, first Seattle,

currently New York. We'll probably see other cities impacted as we go through this. But it's not simultaneous, if you will, in

our largest market. So my expectation is it's probably a less severe decline at any single point, but it may be more of U-type

decline as we go forward. That's what I think. But, obviously, I don't know.

Q Manav Patnaik Analyst, Barclays Capital, Inc. Got it. And

then just a follow-up on the refining business or the piece of Energy that you're keeping. It seems like the dynamics in the oil

markets are different than 2015/2016, but maybe, maybe not. If you could just help us appreciate how resilient maybe that could

stay. .....................................................................................................................................................................................................................................................................

A Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc. Well, I think the difference between 2015 and 2016

is, one, you've got OPEC or Saudi and Russia trying to put a big squeeze through enhanced production, and you simultaneously have

demand destruction as a consequence to COVID. Now, COVID demand destruction is likely temporary. But none of us know what temporary

means, is that one quarter, two quarter. We certainly don't believe it's four quarters. And so, it's a different environment for

the oil business, and these are two, what I would call, temporary stresses in the oil market and how they manifest themselves and

play out could be harder to see. So, I don't know how to answer that any way else. .....................................................................................................................................................................................................................................................................

Q Manav Patnaik Analyst, Barclays Capital, Inc. Got it. Thanks, guys. .....................................................................................................................................................................................................................................................................

Operator: Thank you. Our next question is coming from David Begleiter from Deutsche Bank. Your line is now live. .....................................................................................................................................................................................................................................................................

Q David I. Begleiter Analyst, Deutsche Bank Securities, Inc. Thank you. Doug, are you guys wrapping up share buybacks at this depressed

price level? .....................................................................................................................................................................................................................................................................

A Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc. Well, one, we're precluded from buying any shares

at this point in time; two, I would say that would not be the move we would be taking right now, simply because we want to make

sure we have cash to weather a ridiculous winter. .....................................................................................................................................................................................................................................................................

Q David I. Begleiter Analyst, Deutsche Bank Securities, Inc. And on working capital, I presume you should see a nice source of

cash this year from low raws. Any sense how big that could be at current commodity price levels? .....................................................................................................................................................................................................................................................................

A Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc. Yeah, I would say this. I think we have gone through

and done more cash modeling than we ever have before. We proved ourselves what we proved ourselves in 2009 even though we're a

different company since the Nalco acquisition, and that is we're a very cash resilient company in very stressed scenarios. With

that said, we've got all kinds of scenarios on working capital, and I can give you pluses and minuses as we go through this. I

think the heart of this is cash isn't going to be our challenge. I think what we're focused on now and we know that we're in a

position to weather virtually anything is how do we best position

ourselves for the recovery, which we know is coming; we just don't know exactly what day. .....................................................................................................................................................................................................................................................................

Q David I. Begleiter Analyst, Deutsche Bank Securities, Inc. Thank you. .....................................................................................................................................................................................................................................................................

Operator: Thank you. Our next question is coming from Gary Bisbee from Bank of America. Your line is now live. .....................................................................................................................................................................................................................................................................

Q Gary E. Bisbee Analyst, Bank of America Hey, guys. Good morning. I guess the first question, can you just help us understand

how the mix of your business in China compares to the mix globally or in the rest of the world ex-China? And are there any key

differences that would make the overall results differ meaningfully from what you show in that China chart in terms of the revenue

progression, yeah, anything you call out? Thanks. .....................................................................................................................................................................................................................................................................

A Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc. Yeah. In China, our institutional mix is lower than

corporate average. If you added it, you would see very similar pattern, but you would see a deeper fall, and then a similar recovery.

.....................................................................................................................................................................................................................................................................

Q Gary E. Bisbee Analyst, Bank of America If we looked at it globally, you'd see a deeper fall? .....................................................................................................................................................................................................................................................................

A Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc. Well, yeah, but then you're assuming – yes,

if globally... .....................................................................................................................................................................................................................................................................

Q Gary E. Bisbee Analyst, Bank of America And you're right, assuming that the... .....................................................................................................................................................................................................................................................................

A Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc. The big difference is, obviously, I think what's going

to happen I mentioned earlier is China took – they have the ability to take – aggressive steps that, obviously, US

hasn't or can't take and Western Europe hasn't taken either, i.e., a virtual blackout shutdown across a vast majority of their

country over a very short period of time. And so, as a consequence, you saw a very distinct falloff in sales. I think what you're

going to see in other markets is a less dramatic falloff, a more prolonged decline and a more prolonged recovery, simply because

what we're seeing in these other markets is countries in Europe are taking different actions at different periods of time, so are

states in the US. So it's not going to be a single shock. It's going to be a series of shocks as we go through this. .....................................................................................................................................................................................................................................................................

Q Gary E. Bisbee Analyst, Bank of America And then the follow-up,

I guess, is there any way at this point to help us think through incremental margins on lost sales? It sounds like, obviously,

you have a raws benefit. It sounds like you're taking some cost actions, but also there's clearly de-levering as sales fall on

fixed costs and the cost to ramp production on the stuff that's in demand. Is there any commentary to help us think about all those

moving parts and how that impact margins? .....................................................................................................................................................................................................................................................................

A Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc. Yeah. Look, I think there is a couple ways to think

about it. I mean, ultimately if we wanted to pare down to bare bones, we probably have two-thirds variable costs, one-third fixed

costs in our Industrial and Institutional platforms. But that's like an incredibly draconian viewpoint of looking at this, and

this means steps you can go take to mitigate. What we are going to do is we believe firmly that smart play really in the medium

term and long term is we're going to keep our team in place. We're, obviously, not going to add to it. We're not going to replace

people who retire or leave the company. We're going to manage head count, but we are not going to take draconian head count actions,

because this is going to be a shock, and then a recovery. And it takes a lot of energy, money, time. We have a lot invested in

this field team. And so, near term, you're going to see some gross profit, meaning gross profit loss is what you're going to see

in some of the shares. We are not managing this to maximize second quarter EPS. We think that would be foolhardy. What we are doing

is managing this for long-term earnings potential. And I would tell you the long term here isn't very long term. I think the way

we're managing this will mean we have a better fourth quarter managing this way than we would if we took draconian action, because

you wouldn't be ready for the recovery. You would impair yourself. And recovery from that mistake would be really huge work and

a huge distraction. And frankly, the cultural damage and all the rest would be foolhardy in our minds. Now, obviously, if craziness

played out in something none of us can imagine, we can obviously make new decisions in the fall, if that was required. I don't

think anybody really believes that's how this plays out. That's not our plan. Our plan is to keep this team intact and move through

and plan for maximizing our capabilities, call it, Q4 on versus trying to maximize for Q2 or even Q3. .....................................................................................................................................................................................................................................................................

Q Gary E. Bisbee Analyst, Bank of America Thank you. That sounds like the right approach. .....................................................................................................................................................................................................................................................................

Operator: Thank you. Our next question is coming from Chris Parkinson from Credit Suisse. Your line is now live. .....................................................................................................................................................................................................................................................................

Q Christopher Parkinson Analyst, Credit Suisse Securities (USA) LLC Thank you. So just actually a corollary to that, just dialogue,

could you just add a little bit more detail on your thought process? I guess the right word would be calibrating some of that longer

term [ph] remaining gross (00:36:19) spends to come out stronger in the other end of this versus what you are explicitly. You've

mentioned

there are some areas you're pulling back on that spend. Could

you just help us to think about how you're thinking about that? Thank you. .....................................................................................................................................................................................................................................................................

A Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc. Yeah. I mean, look, the digital spend isn't going

completely untouched, but we are working very hard to protect what we feel the core areas of that spend are in terms of its capabilities

to enable us to do even more for customers and simultaneously become even more efficient. And so, that's been – we think

is very smart, it's smart to protect. Obviously, it's not sacrosanct in every scenario imaginable. But given what we believe is

going to happen and what we're prepared for, we believe we can do this quite safely. .....................................................................................................................................................................................................................................................................

Q Christopher Parkinson Analyst, Credit Suisse Securities (USA) LLC Got it. And the second question is just, obviously, none of

us have a crystal ball. But can you talk about how you're thinking about the rebounds eventually off the bottom in areas in the

Institutional, such as Lodging versus Restaurants? And on the latter, is it safe to say that your focus on restaurant chains on

the full service front will relatively insulate you from – little bit more from the potential for, let's say, restaurant

bankruptcies [ph] if it actually (00:37:36) does get that bad? Just how should we think about the recovery in these different areas?

.....................................................................................................................................................................................................................................................................

A Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc. Well, you're right about none of us have a crystal

ball. I guess what I've referred to earlier, and it's really the Institutional Lodging are going to be the most significantly impacted

segments of our business. And as we look for that, I think it's more U-shape than a V-shape. I think the federal government plan

is targeted the right way, which is to enable small businesses which would include many of the restaurants, because even if it's

a chain, frequently they're franchise groups, so they end up to be small businesses. They're going to emerge from this. People

are going to still eat out. We've been doing it for thousands of years. And I would say, all the trends over the last 30 years

have been up, up, up on away from home food consumption. That's going to get temporarily interrupted. I don't believe it's going

to be permanently interrupted. I have kids in their 20s and they're terrifically capable, except they don't know how to cook and

I don't think they're magically going to learn as they go through this. And so this is going to be a trend. So, what's on the other

side? Yeah, certainly I imagine people are going to go through Chapter 11. We've managed through this before and how we always

view this is we view this on a more medium-term basis. We want to continue to do business with these people, because you'll continue

to have consumption. You're going to always have some receivables risk as you go through this. But, again, this is going to be

like some temporary pain, some temporary shock that we're all going through. And the way we are viewing this is understanding the

difference between how do we mitigate the temporary pain, make sure that we manage intelligently to get through, but we know that

ultimately this will be history and we will talk about how we all managed through the pandemic and we will manage this intelligently.

As I mentioned before, it is not second quarter/third quarter. It is being ready for the recovery, which we do believe will be

in full force by Q4 at this point in time, and who knows if we're wrong and it's Q1 instead. I don't know, on the long view of

how we need to invest and the steps we need to take, that that make a hill of beans of difference either when you're sitting in

2023. .....................................................................................................................................................................................................................................................................

Q Christopher Parkinson Analyst, Credit Suisse Securities (USA)

LLC Thank you. .....................................................................................................................................................................................................................................................................

Operator: Thank you. Our next question is coming from Vincent Andrews from Morgan Stanley. Your line is now live. .....................................................................................................................................................................................................................................................................

Q Vincent Stephen Andrews Analyst, Morgan Stanley & Co. LLC Thank you. Thank you again for doing this call. Can you just talk

a little bit from a manufacturing perspective as we think about the areas of demand plus versus the areas of demand depressed and

presumably the volume is going to be net negative? I'm just thinking about what opportunities you have to optimize manufacturing

during this period in order to maybe shore up some of the otherwise lost gross margins? .....................................................................................................................................................................................................................................................................

A Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc. Yeah. I think, look, you end up with distinct filling

lines that are dedicated more or less for specific business categories. Obviously, solids are principally for our Institutional

customers; not exclusively, but principally. So you have the ability, if you will, if that volume ramps down, to ramp down variable

spend in your plants as that goes. Most of our plants do both. The Institutional plants also do Food & Beverage, et cetera.

And so, we will be able to shift resources also to meet heightened demand in some of those categories. They also produce products

for Healthcare, general hygiene purposes, et cetera. So, we don't believe this is going to create massive dislocations in our manufacturing

operation. But we certainly already have shifted resources to the huge demand spikes that we're seeing in sanitizers, shifted production

lines to meet those needs and offset some of the shortfall that we would have and expect to see in other parts of our business

demand profile. So those steps have been taken, they'll continue to be taken. We have, what I would call, a very strong manufacturing

team and the capabilities by design to enable us to up some production while we are offsetting some demand destruction in others.

.....................................................................................................................................................................................................................................................................

Q Vincent Stephen Andrews Analyst, Morgan Stanley & Co. LLC And just as a follow-up on the demand plus in Food & Beverage.

Do you have a sense of how much of that is that these customers that are just stepping up their hygiene game and their food safety

game across the board versus where they were before? And how much of it is that they're increasing their own production runs to

meet all the pantry loading that we're seeing going on by the consumer at food retail? .....................................................................................................................................................................................................................................................................

A Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc. I think that's different by segment. In Food &

Beverage, I mean, certainly there's this up in pantry loading and some of that, and also just this shift of share, if you will,

into retail and others and so that's occurring. Hygiene standards everywhere are being significantly increased, certainly in Food

& Beverage, for worker protection and others, but across every segment that we deal with. We've had sanitizer demand in, I

would say, virtually every segment that we compete. As you saw in the previous slide, that would move all the way from mining to

automotive manufacturing to virtually everything that happens and occurs. And we saw this in H1N1, if you remember back, office

buildings in, what I would call, the 2000s often didn't have – or 1990s did not have sanitizer

stands. Virtually every office after those events started having

sanitizer stations. I think you're going to see a big change in just hygiene generally is what we imagine. It would be hard to

imagine a bear case for hygiene standards post this event. .....................................................................................................................................................................................................................................................................

Q Vincent Stephen Andrews Analyst, Morgan Stanley & Co. LLC Thanks very much. .....................................................................................................................................................................................................................................................................

Operator: Thank you. Our next question is coming from John McNulty from BMO Capital Markets. Your line is now live. .....................................................................................................................................................................................................................................................................

Q John P. McNulty Analyst, BMO Capital Markets (United States) Yeah, thanks for taking my question. So I guess two questions. One

on the Industrial front, when you think about the potential for volatility in that business, should we be thinking about it as

kind of an industrial production type mover or is it going to be cushioned a little bit just because boilers still have to be filled,

whether they have plants running at 20% utilization rates or 80%? So, I guess, how should we be thinking about the volatility in

that particular large segment? .....................................................................................................................................................................................................................................................................

A Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc. Yeah. Well, I would say, look, we do own number of

utilities and as you pointed out, if you fire it up, you're going to be using water. But we also have process technologies that

are variable based on output. But the real demand destruction historically in that sector is when things are completely shuttered.

So, when a steel mill shuts down, that when we see the great impact. If a steel mill's output is down 10% or 20%, we have some

impact, but it's muted. .....................................................................................................................................................................................................................................................................

Q John P. McNulty Analyst, BMO Capital Markets (United States) Got it, okay. And then when you think about – I guess what

we've seen in some cases is the strongest companies going through a difficult period like this, they tend to be the bigger winners

on the outside. I guess, with that kind of as the backdrop when you think back to either the Great Recession or even back to after

September 11 when everything shut down in the leisure industries, I guess, is there any anecdotes that you can give us in terms

of share gain that you guys saw as you came out of those periods, just given kind of the way you stood up during those periods?

.....................................................................................................................................................................................................................................................................

A Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc. Yeah, I would say this, I don't have great factors.

I think if you went back and looked at our performance versus competition following those events, we greatly outpaced, we were

a lot bigger, and our sales percentage ended up to be a lot bigger. So our share gain was considerable after those events. And

I think it was because of how we managed then. I was managing Institutional when we went through 09/2011, and obviously I was CEO

and we went through 2009. Our philosophical approach isn't different. We protected our workers and our team during 09/2011. We

protected their pay. There was a recovery. We ended up in a very different position than everybody else, and we were able to capitalize.

I would say the same thing happened during the 2009 period as well.

And I would say, what you're asking is exactly what we're focused

on, and that's making sure that we are prepared to meet our customer needs when they come out of this and start reopening restaurants

or start upsizing hotel staffs in all the rest of this. They have huge training needs. They've got get-the-facility-back-in-order

needs. They've got unusual demands. And the companies that can help them meet these demands are the companies that they're going

to seek. So making sure that you've got the resources capability and you're prepared for this, positions you in a very favorable

place, and that's how we're focusing. .....................................................................................................................................................................................................................................................................

Q John P. McNulty Analyst, BMO Capital Markets (United States) Thanks a lot. .....................................................................................................................................................................................................................................................................

Operator: Thank you. Our next question is coming from John Roberts from UBS. Your line is now live. .....................................................................................................................................................................................................................................................................

Q John Roberts Analyst, UBS Securities LLC Thank you very much. For MRSA and other hospital acquired infection pathogens, you have

this DAZO Fluorescent Marking Gel product. Can you take the antibody tag for COVID-19 and make an affordable DAZO product for restaurants

and hotels? .....................................................................................................................................................................................................................................................................

A Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc. A DAZO? Yes, you could do DAZO there. I mean, fundamentally

what it's measuring is the presence of soil and a contamination. It can't determine what the contamination is, but it can determine

whether it's absolutely clean or not. And we've used some of that technology before, but absolutely, that technology would be usable

in other settings. .....................................................................................................................................................................................................................................................................

Q John Roberts Analyst, UBS Securities LLC And second, do you think you'll have guidance for the June quarter when you report,

even if it's a wide guidance range, or can you only see week-to-week at this point? .....................................................................................................................................................................................................................................................................

A Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc. Yeah. We're certainly not giving any guidance at this

point in time. I don't want to speculate on where we are. I would say that's not that far away, to be quite honest. And what people

count on us is straight talk and we want to make sure that we are communicating what we actually know and not falsely communicating

that we've got some crystal ball nobody else has. So, we'll be very forthright in the quarter in what we're actually seeing and

making sure that people have information to glean for themselves what's going on. With that said, I will say, we're quite comfortable

that what we're going to manage through is going to be, one, difficult, but we're equipped to go deal with it. And two, I think

our sites are the right sites, which is preparing for the ultimate change for the better. .....................................................................................................................................................................................................................................................................

Q John Roberts Analyst, UBS Securities LLC Okay. Thank you.

Operator: Thank you. Our next question is coming from Laurence

Alexander from Jefferies. Your line is now live. .....................................................................................................................................................................................................................................................................

Q Adam Bubes Analyst, Jefferies LLC Hi. This is Adam Bubes on for Laurence today. I was wondering, can you help us think about

current conditions in context of the 2008 crisis? Are conditions similar or are they worse? And how would you compare visibility?

.....................................................................................................................................................................................................................................................................

A Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc. Well, I think from a visibility standpoint, they're

similar. I mean, I think these are – okay, if you used the fog of war metaphor, we certainly have fog now and we had fog

then; they're just created by different events. I don't think these are fair comparisons on many fronts. I mean, that was a banking

crisis that affected the business community. This is more a virus/human action, much of it voluntary and it's smart stuff that

we're doing. And this virus will pass. The question is nobody knows exactly when. But I think if we get too focused on duration

and not what we do know, which is this virus we will ultimately figure out and focusing on what do we want to invest in and how

do we want to operate and understand the business. The difference in 2008/2009 was, I mean, there were periods where you really

didn't know that you're going to come through this. I don't know that that's – if I've ever had one of those days. I was

on a bank board at the time. So, I think I understood full well the depth of that crisis. But either way, it's unclear and there's

uncertainty, and what we focus on is what's knowable. And I think we're doing a good job doing that. I think what we've tried to

do here is reduce some of the fears that people are going to have if they don't have clarity around. We have the liquidity, solvency

to get through this. It's a firm answer of absolutely yes. Are we going to come out of this on the other side stronger? It's an

absolute yes. And will this ultimately go away? Absolute yes. .....................................................................................................................................................................................................................................................................

Q Adam Bubes Analyst, Jefferies LLC Okay, thanks. That's helpful. And then my last question, I mean, you may have touched on it

a little bit earlier, but how can we think about the offsets to demand destruction? What are some of the areas you're planning

to dial down costs and the extent of these savings? .....................................................................................................................................................................................................................................................................

A Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc. Yeah. As I mentioned before, we're not making –

I mean, we're dialing down expected spend in our people cost, obviously, and we will be well-below budget. And I would expect probably

for the year well below – even below last year, just through normal attrition, and that we're not going to replace. But with

that said, that's not where we're taking big actions by any stretch, because we want to protect the part of the team that's going

to be most hit by this from a financial standpoint, so that they can stay with us and weather through the storm. Where we're taking

these actions is what we call all discretionary spend. I mean, we're certainly postponing all training except if we bring somebody

on for some emergency reason, we'll obviously do safety training and the other thing to make sure that they don't create any risk

for themselves or for customer. You might imagine our T&E spending is going to be slashed and burned. So there is all these

discretionary buckets, which zero is the right answer, even though it's the impossible answer.

And from capital, as Dan's chart alluded to, we're targeting

a 50% reduction. And so they're still going to be spending in that area. We are going to target the stuff that we think matters

absolutely the most in the midterm and long term, but everything else, nothing is sacred. And so I think we're going to manage

through this very intelligently. It's not like we don't care about second and third quarter. It's just the priority is got to be

on where we stand, are we in a position to help our customers once we are all on recovery mode. .....................................................................................................................................................................................................................................................................

Q Adam Bubes Analyst, Jefferies LLC Got it. Thank you very much. .....................................................................................................................................................................................................................................................................

Operator: Thank you. Our next question today is coming from Shlomo Rosenbaum from Stifel. Your line is now live. .....................................................................................................................................................................................................................................................................

Q Shlomo H. Rosenbaum Analyst, Stifel, Nicolaus & Co., Inc. Hi, again. Thank you for taking my question. Hey, Doug, Ecolab

is in a unique position given its scale and its balance sheet. Can you talk a little bit more about the targeting of strategic

accounts? And you are running the business for the long term, which is the right way to do it, and this seems to me to be like

a real differentiator. Can you talk about how many accounts are there? What potential do you have? Just give us a little bit more

detail in how you are thinking about this and how this could play out over the next year or two. .....................................................................................................................................................................................................................................................................

A Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc. Yeah. A strategic account would be an account in the

markets we serve that we don't sell and we believe has long-term viability and advantage. And, unfortunately, there is a longer

list than we would like, because, of course, the share we would like is 100%, although it's impossible. And so what we're doing

is targeting the ones that we really have always thought for a long period of time we think we can make a – if we can make

a material difference. And we're going to go and make sure that we are in offence in talking to those accounts during this period

of time. I would say we know over the past, even if you're not successful in the immediate term, that having this conversations,

merchandizing your capability, talking to them prospectively and about the difference that we can make makes a difference, even

if they can't say yes in the next quarter. And so, our team loves to be on the hunt and we want to make sure the hunt isn't canceled.

.....................................................................................................................................................................................................................................................................

Q Shlomo H. Rosenbaum Analyst, Stifel, Nicolaus & Co., Inc. Okay. Thank you. And just a follow-up on a question that was asked

before. How hard is it to increase the production of the items on demand? How fast can you do it? And then kind of scale it back

when things get back to normal, is that something that can be done fairly quickly or is it really, not really? .....................................................................................................................................................................................................................................................................

A Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc.

Well, it all depends the position herein going in, meaning if

you're running two shifts, adding a third shift is fairly straightforward, because you've already got all the raw materials, you

know how to make the stuff, and all you're doing is utilizing the equipment for a longer period of time. So, you enhance production

pretty quickly. After you take those steps, you can repurpose some lines. You can do some other things. But once you get to maximum

production on a given technology, then you're looking for copackers. And, obviously, in a market like this, you're not alone. They

will, obviously, cherry pick who they choose to work with based on their belief in long-term viability of that company as a customer.

Certainly, we get stars on that front, but it really depends. Some things are easier to do than others. If all I got to do is fill

gallon bottles, I can do some of that even manually. If I'm trying to run solids, if I'm trying to do EPA or FDA registered products,

I've got some other requirements that I need to be and it's not as easily ramped up. .....................................................................................................................................................................................................................................................................

Q Shlomo H. Rosenbaum Analyst, Stifel, Nicolaus & Co., Inc. Okay. Thank you. .....................................................................................................................................................................................................................................................................

Operator: Thank you. Our next question is coming from Rosemarie Morbelli from Gabelli & Company. Your line is now live. .....................................................................................................................................................................................................................................................................

Q Rosemarie J. Morbelli Analyst, G.research, LLC Thank you. Good morning and thank you, everyone. With 128 plants operating versus

a total of 130, what do you think is actually – is production in-line with the demand or do you think there is building inventory

in the system? .....................................................................................................................................................................................................................................................................

A Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc. Rosemarie, I'm sorry, were you talking about the is

production in-line with the sanitizer demand or overall demand? .....................................................................................................................................................................................................................................................................

Q Rosemarie J. Morbelli Analyst, G.research, LLC In-line with the overall demand. Or do you think there is some inventory buildup,

which obviously is going to be used up when the recovery comes around? .....................................................................................................................................................................................................................................................................

A Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc. Yeah. Look, overall, with the exception of the callouts

that I made earlier on some specific – and it's really hand sanitizer in particular, which is the hardest thing for us to

ramp-up and meet. I mean, there's not many people who can ramp up 15x in anything anywhere. And so, we would be in that crowd,

but it'd be a filled room if you put all the people in there. In terms of generally, we aren't sitting here worried could we meet

the increased demand broadly in the segments that are going to have increased demand. In terms of where you have demand destruction,

look, we're trying to take that into account, getting this inventory exactly right isn't perfect, but the truth is, very few items

that we have are going to have any shelf life issue. So, we don't see this translating into huge write-offs ultimately. 1

There are certain segments, but the segments where typically

have shelf life are sanitizers. And they have the highest demand and we can't even meet that demand. So, I don't think this is

going to be a story we're talking about in 18 months. .....................................................................................................................................................................................................................................................................

Q Rosemarie J. Morbelli Analyst, G.research, LLC Okay, thanks. And I was wondering if you could give us your definition of a ridiculously

severe scenario. .....................................................................................................................................................................................................................................................................

A Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc. Well, look, I'm not going to go outline this, but

I would be comfortable saying, I think if we had all these parameters – let's say, first we had what we called catastrophic,

it was almost unimaginable. And then I asked for a times two once Dan and I were conferring on some stuff. And so our catastrophic

turned to severe and we created a new catastrophic, which really starts imagining the world shuts down for a long period of time

and all at once. So that's not going to happen. And even in that case, we knew how to navigate and have positive cash flow for

the year. What we really wanted to understand is what was our worst day. Do we have enough cash to sell through even the stupidest

forecasts we could imagine? And once we were comfortable there, then it's on to business. This is very much the approach we took

in 2009. And as I used to tell people, all of a sudden I found myself in 2009 presenting the board cash flow projections which

we couldn't even imagine two months earlier, and I would say we dusted those off. These are even much more severe than anything

we imagined then and we're still cash flow. And we then even in this model haven't pulled all the levers. So, the point is the

company is resilient from a cash standpoint. Dan and team have done very smart things to put us in a position of sailing through

even the worst scenario and really what I think investors should take away, it's what the board's taken away is that's not our

problem. So now it really is how do we smartly navigate through this, position ourselves intelligently, do the right things to

take your customers who have been partners for us for decades, and they will be here decades from now, and do smart moves in those

ways. That's what we're focused on. .....................................................................................................................................................................................................................................................................

Q Rosemarie J. Morbelli Analyst, G.research, LLC Thank you. Appreciate it. Good luck. .....................................................................................................................................................................................................................................................................

A Douglas M. Baker, Jr. Chairman & Chief Executive Officer, Ecolab, Inc. Thank you. .....................................................................................................................................................................................................................................................................