Additional Proxy Soliciting Materials (definitive) (defa14a)

April 04 2022 - 10:26AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨ Definitive Proxy Statement

x Definitive Additional Materials

¨ Soliciting Material under §240.14a-12

| | |

| Deluxe Corporation |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| | | | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| x | No fee required. |

¨

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | | |

| | 2) | Aggregate number of securities to which transaction applies: |

| | | |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | 4) | Proposed maximum aggregate value of transaction: |

| | | |

| | 5) | Total fee paid: |

| | | |

¨

| Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| 1) | Amount previously paid: |

| | | |

| | 2) | Form, Schedule or Registration Statement No.: |

| | | |

| | 3) | Filing Party: |

| | | |

| | 4) | Date Filed: |

April 4, 2022

To Our Shareholders,

As the Compensation and Talent Committee of the Board of Directors of Deluxe Corporation, we are providing this letter to serve as a Report Feedback Statement regarding Glass Lewis’ Proxy Paper for Deluxe Corporation published on March 28, 2022 (“Proxy Paper”). The Proxy Paper recommends an AGAINST vote on proposal 2, our advisory vote on executive compensation.

The Proxy Paper cites concerns regarding our pay for performance, as well as both the design and magnitude of the one-time 2021 Retention and Incentive Program.

Regarding the pay-for-performance concern, we note that the Glass Lewis calculation of pay for our CEO includes $3,250,000 of cash-denominated performance units granted in 2021, the payout of which is dependent on performance through the end of fiscal year 2022. Earned awards, if any, will be paid in the first quarter of fiscal year 2023. In accordance with proxy disclosure rules, we did not report this performance-based potential cash award in the Summary Compensation Table of our 2022 proxy statement. We will report this cash compensation, if earned, in the Summary Compensation Table of next year’s proxy statement. We note that the inclusion of this award in the calculation of pay is inconsistent with Glass Lewis’ methodology of including cash awards when earned as opposed to when granted. If Glass Lewis had excluded this award, we believe its analysis would have concluded that our pay and performance are aligned. We also note that there is little overlap in the peer companies used in the Glass Lewis analysis and the peer companies that are reviewed and approved annually by our Compensation and Talent Committee. Our internal pay-for-performance comparisons using our peer group indicates alignment as opposed to misalignment, and this has been validated by our Independent Compensation Consultant, FW Cook.

In regard to the design and magnitude of the one-time retention award, our rationale for making the award is clearly articulated in our proxy statement and other Securities and Exchange Commission filings. Our board concluded that existing long-term incentives were insufficient to retain executives. After we gained insight through extensive shareholder outreach by contacting our top 50 shareholders, representing approximately 77 percent of our outstanding shares, and meeting with seven of our shareholders representing nearly 20% of our outstanding shares, and after reviewing with FW Cook prevailing market practices, we recommended, and the board approved, these one-time, 100% performance-based awards. These awards were designed with shareholders in mind and are not a part of our ongoing pay practices.

We are committed to a fair and equitable pay-for-performance philosophy. We thank you for your support and ask that you consider a “FOR” vote on Item 2, Advisory Vote on Executive Compensation, in Deluxe’s proxy statement.

Best regards,

/s/ Thomas J. Reddin, Chair

Thomas J. Reddin, on behalf of the Compensation and Talent Committee of the Board of Directors of Deluxe Corporation.

Submitted by:

/s/ Jane Elliott

Jane Elliott, Chief Communications and Human Resources Officer

Phone: 770-833-3500

E-Mail: jane.elliott@deluxe.com

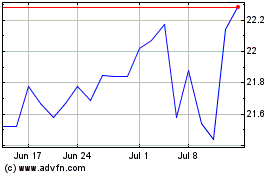

Deluxe (NYSE:DLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

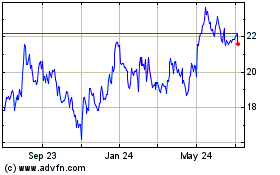

Deluxe (NYSE:DLX)

Historical Stock Chart

From Apr 2023 to Apr 2024