Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

August 09 2021 - 5:01PM

Edgar (US Regulatory)

Filed pursuant to Rule 433

Free Writing Prospectus dated August 9, 2021

Registration Statement No.: 333-238506

CVS HEALTH CORPORATION

Pricing Term Sheet—August 9, 2021

$1,000,000,000 2.125% Senior Notes due 2031

|

|

|

|

|

|

|

|

Issuer:

|

|

CVS Health Corporation (the “Issuer”)

|

|

|

|

|

Description of Securities:

|

|

$1,000,000,000 2.125% Senior Notes due 2031 (the “Notes”)

|

|

|

|

|

Maturity Date:

|

|

September 15, 2031

|

|

|

|

|

Settlement Date:

|

|

August 18, 2021 (T+7)

|

|

|

|

|

Extended Settlement:

|

|

It is expected that delivery of the Notes will be made, against payment of the Notes, on or about August 18, 2021, which will be the seventh business day in the United States following the date of pricing of the Notes. Under

Rule 15c6-1 under the Securities Exchange Act of 1934, as amended, purchases or sales of securities in the secondary market generally are required to settle within two business days (T+2), unless the parties

to any such transaction expressly agree otherwise. Accordingly, purchasers of the Notes who wish to trade the Notes prior to the second business day before delivery of the Notes will be required, because the Notes initially will settle within seven

business days (T+7) in the United States, to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement. Purchasers of the Notes who wish to trade the Notes prior to the second business day before delivery of

the Notes should consult their advisors.

|

|

|

|

|

Issue Price:

|

|

99.369% of principal amount

|

|

|

|

|

Coupon:

|

|

2.125%

|

|

|

|

|

Benchmark Treasury:

|

|

1.625% UST due May 15, 2031

|

|

|

|

|

Benchmark Treasury Price and Yield:

|

|

102-25; 1.320%

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

+87.5 basis points (0.875%)

|

|

|

|

|

Yield to Maturity:

|

|

2.195%

|

|

|

|

|

Interest Payment Dates:

|

|

Semiannually on March 15 and September 15, commencing on March 15, 2022.

|

|

|

|

|

Record Dates:

|

|

March 1 and September 1

|

|

|

|

|

Optional Redemption Provisions:

|

|

Prior to June 15, 2031 (three months prior to the maturity date), make-whole call at any time at the greater of 100% or discounted present value at Treasury Yield plus 15 basis points. On

or after June 15, 2031, redeemable at a redemption price equal to 100% of the aggregate principal amount of the Notes being redeemed.

|

|

|

|

|

|

|

|

|

Change of Control:

|

|

Upon certain change of control events, the Issuer will be required to make an offer to purchase the Notes in cash at a price equal to 101% of their aggregate principal amount.

|

|

|

|

|

Joint Book-Running Managers:

|

|

BARCLAYS CAPITAL INC.

BOFA SECURITIES, INC.

J.P. MORGAN SECURITIES LLC

GOLDMAN SACHS & CO. LLC

WELLS FARGO SECURITIES, LLC

|

|

|

|

|

Co-Managers:

|

|

CREDIT SUISSE SECURITIES (USA) LLC

MIZUHO

SECURITIES USA LLC

MUFG SECURITIES AMERICAS INC.

CITIGROUP

GLOBAL MARKETS INC.

RBC CAPITAL MARKETS, LLC

TRUIST

SECURITIES, INC.

U.S. BANCORP INVESTMENTS, INC.

FIFTH THIRD

SECURITIES, INC.

PNC CAPITAL MARKETS LLC

SANTANDER INVESTMENT

SECURITIES INC.

SMBC NIKKO SECURITIES AMERICA, INC.

BNY

MELLON CAPITAL MARKETS, LLC

ICBC STANDARD BANK PLC

KEYBANC

CAPITAL MARKETS INC.

LOOP CAPITAL MARKETS LLC

MFR

SECURITIES, INC.

TD SECURITIES (USA) LLC

|

|

|

|

|

CUSIP Number:

|

|

126650 DR8

|

|

|

|

|

Ratings*:

|

|

Baa2 (Moody’s) / BBB (S&P)

|

|

*

|

Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to

revision or withdrawal at any time.

|

1 ICBC Standard Bank Plc is restricted in

its U.S. securities dealings under the United States Bank Holding Company Act and may not underwrite, subscribe, agree to purchase or procure purchasers to purchase Notes that are offered or sold in the United States. Accordingly, ICBC Standard Bank

Plc shall not be obligated to, and shall not, underwrite, subscribe, agree to purchase or procure purchasers to purchase Notes that may be offered or sold by other underwriters in the United States. ICBC Standard Bank Plc shall offer and sell Notes

constituting part of its allotment solely outside the United States.

Changes to Preliminary Prospectus Supplement

Other Relationships

The following paragraph shall

replace the first paragraph under the heading “Underwriting—Other Relationships”

in the Preliminary Prospectus Supplement:

From time to time, certain of the underwriters and/or their respective affiliates have directly and indirectly engaged, and may engage in the future, in

investment and/or commercial banking transactions with us for which they have received, or may receive, customary compensation, fees and expense reimbursement. Barclays Capital Inc., Goldman Sachs & Co. LLC and Wells Fargo Securities, LLC

will act as dealer managers for the Tender Offer. To the extent any of the underwriters or their affiliates own notes that are the subject of the Tender Offer they may

2

tender such notes pursuant to the terms of the Tender Offer. A member of our board of directors is an officer of Bank of America Corporation, an affiliate of one of the underwriters. One of our

executive officers is a director of U.S. Bancorp, an affiliate of one of the underwriters. An affiliate of one of the underwriters, BNY Mellon Capital Markets, LLC, is acting as Trustee, Registrar and Paying Agent in the offering.

Capitalized terms used but not defined herein have the meanings given to them in the Preliminary Prospectus Supplement.

The Issuer has filed a registration statement (including a prospectus and preliminary prospectus supplement) with the SEC for the offering to which this

communication relates. Before you invest, you should read the prospectus and preliminary prospectus supplement in that registration statement, and other documents the Issuer has filed with the SEC for more complete information about the Issuer and

this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, you may obtain a copy of the prospectus and the preliminary prospectus supplement from Barclays

Capital Inc. by calling toll-free 1-888-603-5847, BofA Securities, Inc. by calling

1-800-294-1322 or emailing dg.prospectus_requests@bofa.com and J.P. Morgan Securities LLC by calling collect at 1-212-834-4533.

ANY DISCLAIMERS

OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL

SYSTEM.

3

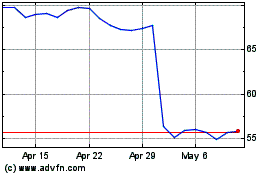

CVS Health (NYSE:CVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

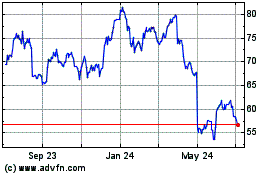

CVS Health (NYSE:CVS)

Historical Stock Chart

From Apr 2023 to Apr 2024