Additional Proxy Soliciting Materials (definitive) (defa14a)

January 07 2021 - 5:04PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule

14(a)-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Materials Pursuant to §240.14a-12

|

ALLIANZGI ARTIFICIAL INTELLIGENCE & TECHNOLOGY OPPORTUNITIES FUND

ALLIANZGI CONVERTIBLE & INCOME FUND

ALLIANZGI CONVERTIBLE & INCOME FUND II

ALLIANZGI CONVERTIBLE & INCOME 2024 TARGET TERM FUND

ALLIANZGI DIVERSIFIED INCOME & CONVERTIBLE FUND

ALLIANZGI EQUITY & CONVERTIBLE INCOME FUND

ALLIANZGI DIVIDEND, INTEREST & PREMIUM STRATEGY FUND

1633 Broadway

New York,

New York 10019

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy

Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

☒

|

|

No fee required

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

(set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials:

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identifying the filing for which the offsetting fee was paid previously. Identify the

previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

1)

|

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

3)

|

|

Filing Party:

|

|

|

|

|

|

|

|

4)

|

|

Date Filed:

|

-2-

THIS FILING CONSISTS OF REMINDER LETTERS SENT TO CERTAIN SHAREHOLDERS RELATED TO THE JOINT SPECIAL MEETING

OF SHAREHOLDERS, HELD ON OCTOBER 28, 2020 AND ADJOURNED UNTIL JANUARY 26, 2021, OF ALLIANZGI ARTIFICIAL INTELLIGENCE & TECHNOLOGY OPPORTUNITIES FUND, ALLIANZGI CONVERTIBLE & INCOME FUND, ALLIANZGI CONVERTIBLE &

INCOME FUND II, ALLIANZGI CONVERTIBLE & INCOME 2024 TARGET TERM FUND, ALLIANZGI DIVERSIFIED INCOME & CONVERTIBLE FUND, ALLIANZGI EQUITY & CONVERTIBLE INCOME FUND, AND ALLIANZGI DIVIDEND, INTEREST & PREMIUM

STRATEGY FUND, AND THE RELATED PROXY STATEMENT.

-3-

January 7, 2021

DEAR FELLOW SHAREHOLDER,

I hope you and your family are safe and healthy during this unprecedented time. We recently sent a letter informing you that AllianzGI

Artificial Intelligence & Technology Opportunities Fund (“AIO” or the “Fund”) has adjourned its Special Meeting of Shareholders (the “Special Meeting”) to January 26, 2021. As described in the Special

Meeting’s proxy statement, AllianzGI has agreed to a strategic partnership with Virtus Investment Partners, Inc. (“Virtus”). As part of the strategic partnership, you are being asked to consider and vote to approve a new investment

advisory agreement and sub advisory agreement for the Fund.

As of today, we have not received your vote, and shareholder participation is

substantially lower than normal as the COVID-19 pandemic continues. Critically, a super majority of the Fund’s investors are retail shareholders just like you. This means that without your vote and the

vote of approximately 15,000 of your fellow AIO investors, it will be challenging to meet the vote requirement necessary to approve the proposals. Please take the time to vote your proxy by signing, dating and mailing the enclosed proxy card in the

return envelope provided or follow the instructions on the enclosed proxy card to vote by telephone or internet.

AIO’S BOARD

UNANIMOUSLY RECOMMENDS AIO SHAREHOLDERS VOTE FOR THE PROPOSALS

After careful consideration, the Fund’s Board of Trustees

believes AllianzGI’s strategic partnership with Virtus is in the best interest of AIO and its shareholders. Below are a few reasons why the Board unanimously supports the proposals:

|

|

•

|

|

No changes to the Fund’s portfolio management team, investment strategies or investment processes will

occur as a direct result of the strategic partnership.

|

|

|

•

|

|

AIO’s total expenses will be limited, so that on a net basis, expenses will be equal or lower than

current expenses for a minimum of two years from the closing of the new management structure.

|

Virtus is a

multi-boutique asset manager with approximately $44 billion in assets. The combination of AIO’s portfolio management expertise with Virtus’ investment oversight and administration capabilities is intended to benefit the fund.

Again, it is important that you take advantage of your right to vote. Please take the time to sign, date, and

mail the enclosed proxy card in the postage paid return envelope or by following the phone or internet voting instructions on your proxy card. If for any reason you are hesitant to vote, please contact your Financial Advisor.

Please see reverse side

It is important that I keep you informed throughout the proxy solicitation process. I will

update you weekly on the progress of the vote until your vote is recorded. I will then share any further information with you after the Special Meeting.

Lastly, you may receive a call from our proxy solicitor who can answer any questions you have regarding the strategic partnership and assist

in securing your vote.

I thank you for your vote participation in advance.

SINCERELY,

THOMAS J. FUCCILLO

PRESIDENT AND CHIEF EXECUTIVE OFFICER

January 7, 2021

DEAR FELLOW SHAREHOLDER,

I wish you and your family a safe and healthy new year. I am contacting you in connection with AllianzGI Artificial Intelligence &

Technology Opportunities Fund’s (“AIO” or the “Fund”) Special Meeting of Shareholders (the “Special Meeting”) that has been adjourned until January 26, 2021. As you may know from previous communications,

Allianz Global Investors U.S. LLC (“AllianzGI”), the Fund’s investment manager has agreed to a strategic partnership with Virtus Investment Partners, Inc. (“Virtus”). As part of the strategic partnership, you are being asked

to consider and approve a new investment advisory agreement and sub advisory agreement for the Fund. You are one of AIO’s largest shareholders and as of today, we have not received your vote on the proposals being considered at the Special

Meeting.

There are a number of benefits relating to the strategic partnership between AllianzGI and Virtus. I am reaching out to invite

you to discuss such benefits and answer any questions you may have relating to the proposals.

To make it easy for you, I have asked

AIO’s proxy solicitor, Di Costa Partners (“DCP”), to be available to schedule a call between you and me. Please call Vincent Di Costa at (646) 764-5120 to schedule a call at a time that is

convenient for you. If you do not have time to call, I suggest that you ask your Financial Advisor to schedule a call with me on your behalf to discuss the proposals.

I look forward to talking with you and/or your Financial Advisor.

Thank you.

SINCERELY,

JOE

SCULL

DIRECTOR, HEAD OF BUSINESS SERVICE

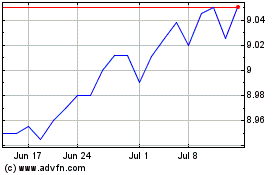

Virtus Convertible and I... (NYSE:CBH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Virtus Convertible and I... (NYSE:CBH)

Historical Stock Chart

From Apr 2023 to Apr 2024