Current Report Filing (8-k)

October 02 2019 - 8:30AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 30, 2019

Cardinal Health, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ohio

|

|

1-11373

|

|

31-0958666

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

7000 Cardinal Place, Dublin, Ohio 43017

(Address of Principal Executive Offices) (Zip Code)

(614) 757-5000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

Emerging growth company

|

¨

|

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common shares (without par value)

|

CAH

|

New York Stock Exchange

|

Item 1.01. Entry into a Material Definitive Agreement.

On September 30, 2019, Cardinal Health Funding, LLC (“CHFunding”), an indirectly owned receivables financing subsidiary of Cardinal Health, Inc. (the “Company”), Griffin Capital, LLC, an indirectly owned receivables financing subsidiary of the Company, Wells Fargo Bank, N.A., Liberty Street Funding LLC, The Bank of Nova Scotia, Atlantic Asset Securitization LLC, Credit Agricole Corporate and Investment Bank New York Branch, U.S. Bank National Association, PNC Bank, National Association, Victory Receivables Corporation and MUFG Bank, Ltd. (“MUFG Bank”), entered into a Fourth Amendment and Joinder (the “RPA Amendment”) to the Fourth Amended and Restated Receivables Purchase Agreement (as amended, the “Receivables Purchase Agreement”). The RPA Amendment extends the term of the Company’s $1.0 billion committed receivables sales facility program until September 30, 2022. The RPA Amendment is filed as Exhibit 10.1 to this Current Report on Form 8-K and the foregoing description is qualified by reference to the full text of the RPA Amendment set forth in Exhibit 10.1.

In connection with the RPA Amendment, the Company, CHFunding and MUFG Bank entered into Amendment No. 3 to Seventh Amended and Restated Performance Guaranty (the “Guaranty Amendment”), which requires the Company to maintain a maximum Consolidated Net Leverage Ratio at the end of every fiscal quarter from September 2019 through December 2020 of no greater than 4.00-to-1.00. The maximum ratio permitted at the end of any fiscal quarter will reduce to 3.75-to-1.00 in March 2021. The Guaranty Amendment is filed as Exhibit 10.2 to this Current Report on Form 8-K and the foregoing description is qualified by reference to the full text to the Guaranty Amendment set forth in Exhibit 10.2.

From time to time, the financial institutions party to the Receivables Purchase Agreement or their affiliates have performed, and may in the future perform, various commercial banking, investment banking and other financial advisory services for the Company, for which they receive customary fees and expenses. Wells Fargo Bank, N.A. serves as a dealer under the Company's commercial paper program. In addition, MUFG Bank, Wells Fargo Bank, N.A., The Bank of Nova Scotia, PNC Bank, National Association, Credit Agricole Corporate and Investment Bank and U.S. Bank National Association or their affiliates currently act as members of the lending syndicate under the Company’s revolving credit facility.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cardinal Health, Inc.

(Registrant)

|

|

|

|

|

|

|

Date: October 2, 2019

|

|

|

|

By:

|

/s/ David Evans

|

|

|

|

|

|

|

Name: David Evans

|

|

|

|

|

|

|

Title: Interim Chief Financial Officer

|

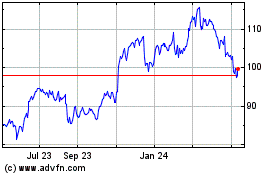

Cardinal Health (NYSE:CAH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cardinal Health (NYSE:CAH)

Historical Stock Chart

From Apr 2023 to Apr 2024