Amended Statement of Beneficial Ownership (sc 13d/a)

May 20 2020 - 4:31PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS

FILED PURSUANT

TO § 240.13d-1(a) AND AMENDMENTS

THERETO FILED

PURSUANT TO § 240.13d-2(a)

UNDER THE SECURITIES EXCHANGE ACT OF

1934

(Amendment No. 5)*

Babcock & Wilcox Enterprises, Inc.

(Name of Issuer)

Common Stock, par value $0.01

(Title of Class of Securities)

05614L 10 0

(CUSIP Number)

Bryant R. Riley

B. Riley Financial, Inc.

21255 Burbank Boulevard, Suite 400

Woodland Hills, CA 91367

(818) 884-3737

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

May 14, 2020

(Date of Event which Requires Filing of

this Statement)

If the filing person has previously filed

a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because

of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note. Schedules filed in paper format

shall include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for other

parties to whom copies are to be sent.

*The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for

any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder

of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of

1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

SCHEDULE 13D

CUSIP No. 05614L 10 0

|

1

|

NAMES OF REPORTING PERSONS

|

|

B.

Riley Financial, Inc.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

|

(a) ☐

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

|

4

|

SOURCE OF FUNDS (See Instructions)

|

|

WC

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

|

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

Delaware

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

0

|

|

8

|

SHARED VOTING POWER

|

|

8,578,274

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

0

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

8,578,274

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

8,578,274

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

|

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

17.8%*

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

|

|

HC

|

|

|

*

|

Percent of class is calculated based on (i) 46,407,555

shares of common stock, par value $0.01 (the “Common Stock”), of Babcock & Wilcox Enterprises, Inc. (the “Issuer”),

which is the total number of shares outstanding as of May 13, 2020 plus (ii) 1,666,666 shares of Common Stock issuable upon the

exercise of the Warrants (as defined herein), which are exercisable within 60 days.

|

BRF is also party to the Equitization Agreement,

pursuant to which it will receive shares of Common Stock the number of which is not currently determinable in lieu of certain fee

and interest payments owed by the Issuer to BRF, as further described in Item 4 herein.

SCHEDULE 13D

CUSIP No. 05614L 10 0

|

1

|

NAMES OF REPORTING PERSONS

|

|

B. Riley Capital Management, LLC

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

|

(a) ☐

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

|

4

|

SOURCE OF FUNDS (See Instructions)

|

|

WC

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

|

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

New

York

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

0

|

|

8

|

SHARED VOTING POWER

|

|

1,985,889

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

0

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

1,985,889

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

1,985,889

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

|

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

4.1%*

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

|

|

IA

|

|

|

*

|

Percent of class is calculated based on (i) 46,407,555

shares of Common Stock of the Issuer, which is the total number of shares outstanding as of May 13, 2020 plus (ii) 1,666,666 shares

of Common Stock issuable upon the exercise of the Warrants (as defined herein), which are exercisable within 60 days.

|

SCHEDULE 13D

CUSIP No. 05614L

10 0

|

1

|

NAMES OF REPORTING PERSONS

|

|

B. Riley FBR, Inc.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

|

(a) ☐

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

|

4

|

SOURCE OF FUNDS (See Instructions)

|

|

WC

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

|

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

Delaware

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

0

|

|

8

|

SHARED VOTING POWER

|

|

1,859,423

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

0

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

1,859,423

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

1,859,423

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

|

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

3.9%*

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

|

|

BD

|

|

|

*

|

Percent of class is calculated based on (i) 46,407,555

shares of Common Stock of the Issuer, which is the total number of shares outstanding as of May 13, 2020 plus (ii) 1,666,666 shares

of Common Stock issuable upon the exercise of the Warrants (as defined herein), which are exercisable within 60 days.

|

SCHEDULE 13D

CUSIP No. 05614L

10 0

|

1

|

NAMES OF REPORTING PERSONS

|

|

BRC Partners Opportunities Fund, LP

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

|

(a) ☐

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

|

4

|

SOURCE OF FUNDS (See Instructions)

|

|

WC

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

|

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

Delaware

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

0

|

|

8

|

SHARED VOTING POWER

|

|

1,985,889

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

0

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

1,985,889

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

1,985,889

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

|

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

4.1%*

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

|

|

PN

|

|

|

*

|

Percent of class is calculated based on (i) 46,407,555

shares of Common Stock of the Issuer, which is the total number of shares outstanding as of May 13, 2020 plus (ii) 1,666,666 shares

of Common Stock issuable upon the exercise of the Warrants (as defined herein), which are exercisable within 60 days.

|

SCHEDULE 13D

CUSIP No. 05614L

10 0

|

1

|

NAMES OF REPORTING PERSONS

|

|

BRC Partners Management GP, LLC

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

|

(a) ☐

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

|

4

|

SOURCE OF FUNDS (See Instructions)

|

|

WC

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

|

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

Delaware

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

0

|

|

8

|

SHARED VOTING POWER

|

|

1,985,889

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

0

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

1,985,889

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

1,985,889

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

|

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

4.1%*

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

|

|

OO

|

|

|

*

|

Percent of class is calculated based on (i) 46,407,555

shares of Common Stock of the Issuer, which is the total number of shares outstanding as of May 13, 2020 plus (ii) 1,666,666 shares

of Common Stock issuable upon the exercise of the Warrants (as defined herein), which are exercisable within 60 days.

|

SCHEDULE 13D

CUSIP No. 05614L

10 0

|

1

|

NAMES OF REPORTING PERSONS

|

|

Bryant R. Riley

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

|

(a) ☐

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

|

4

|

SOURCE OF FUNDS (See Instructions)

|

|

PF

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

|

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

United States of America

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

219,975

|

|

8

|

SHARED VOTING POWER

|

|

8,712,698 (1)

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

219,975

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

8,712,698 (1)

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

8,932,673

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

|

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

18.6%*

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

|

|

IN

|

|

|

*

|

Percent of class is calculated based on (i) 46,407,555

shares of Common Stock of the Issuer, which is the total number of shares outstanding as of May 13, 2020 plus (ii) 1,666,666 shares

of Common Stock issuable upon the exercise of the Warrants (as defined herein), which are exercisable within 60 days.

|

|

|

(1)

|

Reflects shares of Common Stock held jointly with Carleen

Riley, Mr. Riley’s spouse, with whom he shares voting and dispositive power, and shares of Common Stock held directly by

BRPLP and BRFBR.

|

Explanatory Note

This Amendment No.

5 (this “Amendment”) amends and supplements the Schedule 13D filed on November 30, 2018, as amended by Amendment No.

1 to Schedule 13D, filed with the Securities and Exchange Commission (the “SEC”) on April 10, 2019, Amendment No. 2

to the Schedule 13D, filed with the SEC on May 7, 2019, Amendment No. 3 to Schedule 13D, filed with the SEC on July 23, 2019 and

Amendment No. 4 to Schedule 13D, filed with the SEC on July 29, 2019 (as amended, the “Schedule 13D”), by the Reporting

Persons relating to the common stock, par value $0.01 (the “Common Stock”), of Babcock & Wilcox Enterprises, Inc.

(the “Issuer”).

Information reported

in the Schedule 13D remains in effect except to the extent that it is amended, restated or superseded by information contained

in this Amendment. Capitalized terms used but not defined in this Amendment have the respective meanings set forth in the Schedule

13D. All references in the Schedule 13D and this Amendment to the “Statement” will be deemed to refer to the Schedule

13D as amended and supplemented by this Amendment.

|

Item 3.

|

Source and Amount of Funds or Other Considerations

|

Item 3 is amended and restated in its entirety

as follows:

Of the shares of Common Stock to which

this Statement relates:

|

|

(1)

|

1,090,870 shares of Common

Stock were purchased on behalf of the Reporting Persons using its working capital. The Reporting Persons purchased such shares

for an aggregate purchase price of approximately $21,879,136 (excluding commissions);

|

|

|

(2)

|

240,200 shares of Common

Stock beneficially owned by Mr. Riley was acquired with personal funds through various transactions on the open market. The aggregate

purchase price of such shares of Common Stock beneficially owned by Mr. Riley was approximately $2,334,345.79 (excluding commissions);

|

|

|

(3)

|

1,190,775 shares of Common

Stock were purchased on behalf of the Reporting Persons using its investment capital or, in the case of Mr. Riley, personal funds.

The Reporting Persons purchased such shares for an aggregate purchase price of approximately $3,572,328.90 (excluding commissions)

in connection with the Issuer’s rights offering disclosed in the Issuer’s prospectus dated June 28, 2019 and filed

with the SEC on June 28, 2019 (the “Rights Offering”);

|

|

|

(4)

|

In connection with the Backstop

Exchange Agreement (as further described in Item 4 herein), the Reporting Persons purchased 2,744,163 shares of Common Stock,

through the cancellation and discharge of principal of the Issuer's Tranche A-3 term loans in an amount equal to approximately

$8,232,489.79.

|

|

|

(5)

|

In connection with the Exchange

and Purchase Agreements (as further described in Item 4 herein), the Reporting Persons purchased 1,999,999 shares of Common Stock,

through the cancellation and discharge of principal of the Issuer’s Tranche A-1 term loans in an amount equal to approximately

$6,000,000.00.

|

|

|

(6)

|

Simultaneously with the Equitization

Transactions, the Issuer issued an aggregate of 1,666,666 Warrants to BRF and BRPLP, each exercisable for one right to purchase

one share of our common stock at a purchase price of $0.01 per share.

|

|

Item 4.

|

Purpose of Transaction

|

Item 4 is amended to add the following:

On May 14, 2020, certain Reporting Persons

entered into the following transactions:

|

|

(a)

|

BRF entered into an amended and restated

credit agreement (the “A&R Credit Agreement”) with the Issuer, Bank of America, N.A., as administrative agent (the

“Administrative Agent”) and lender and the others lenders party thereto.

In connection with the A&R Credit Agreement,

BRF agreed to enter into a limited guaranty for the benefit of the Administrative Agent and the other lenders under the revolving

credit facility (the “Limited Guaranty”). In connection with the Limited Guaranty, BRF entered into a fee letter with

the Issuer pursuant to which the Issuer agreed to pay BRF a fee of $3.9 million (the “Guaranty Fee”).

BRF and, solely for certain limited purposes,

BRFBR entered into a Fee and Interest Equitization Agreement with the Issuer (the “Equitization Agreement”), pursuant

to which BRF will receive shares of Common Stock in lieu of receiving (i) $12.343 million of interest payments with respect to

last out term loans under the A&R Credit Agreement between May 14, 2020 and December 31, 2020 (the “Equitized Interest

Payments”) and (ii) the Guaranty Fee (the “Equitized Fee Payment” and, together with the Equitized Interest Payments,

the “Equitized Fees and Interest Payments”). Under the Equitization Agreement, BRF will receive a number of shares

of Common Stock equal to (i) the aggregate dollar value of the Equitized Fees and Interest Payments divided by (ii) the Conversion

Price. For purposes of the Equitization Agreement, the “Conversion Price” means the average volume weighted average

price of the common stock over 15 consecutive trading days beginning on and including May 15, 2020 (the “Measurement Period”),

subject to certain adjustments. For purposes of the listing requirements of the New York Stock Exchange (the "NYSE"),

the Equitization Agreement sets a minimum for the Conversion Price of $1.55 per share of common stock, unless and until approval

is obtained from the Company’s stockholders under the rules of the NYSE.

|

The second paragraph of Item 4 of Amendment No. 2 to the Schedule

13D, filed with the SEC on May 7, 2019, is deleted in its entirety and replaced with the following:

On April 30, 2019, the Issuer entered into an investor rights

agreement (the “Investor Rights Agreement”) with BRFBR and Vintage Capital in connection with the Equitization Transactions.

Under the Investor Rights Agreement, the Issuer agreed to appoint three directors to the Board nominated by each of BRFBR and Vintage,

with the size of the full Board to remain at seven directors. Pursuant to the Investor Rights Agreement, BRFBR designated Board-members

are Alan B. Howe, Brian R. Kahn and Mr. Riley Pursuant to the Investor Rights Agreement, each of BRFBR and Vintage Capital will

retain their right to nominate directors to serve on the Board so long as they continue to meet certain quantitative thresholds

with regard to the amount of Common Stock and debt they beneficially own.

|

Item 5.

|

Interest in Securities of the Issuer

|

Paragraphs (a), (b) and (c) of Item 5 are

amended and restated in their entirety as follows:

(a) - (b)

|

|

1.

|

As of the date hereof, (i) BRPLP beneficially

owned directly 1,860,889 shares of Common Stock and 125,000 shares of Common Stock issuable upon the exercise of the BRPLP Warrant,

together representing 4.1% of the Issuer’s Common Stock, (ii) BRFBR beneficially owned directly 1,859,423 shares of Common

Stock, representing 3.9% of the Issuer’s Common Stock, and (iii) BRF beneficially owned directly 3,191,296 shares of Common

Stock and 1,541,666.7 shares of Common Stock issuable upon the exercise of the BRF Warrant, together representing 17.8% of the

Issuer’s Common Stock.

As of the date hereof, BRF is also party

to the Equitization Agreement (as further described in Item 4 herein), pursuant to which it will receive shares of Common Stock

for the Equitized Fees and Interest Payments, the number of which will be determined based on the Conversion Rate applicable at

the time of settlement.

|

|

|

2.

|

BRPGP is a subsidiary of BRCM, a registered investment advisor, and is the general partner of BRPLP. BRF is the parent company of BRCM. As a result, BRPGP, BRCM and BRF may be deemed to indirectly beneficially own the Shares held by BRPLP.

|

|

|

3.

|

BRF is the parent company of BRFBR. As a result, BRF may be deemed to indirectly beneficially own the Shares held by BRFBR.

|

|

|

4.

|

Mr. Riley may beneficially own 354,399 shares of Common Stock representing 0.7% of the Issuer’s Common Stock, of which (i) 134,424 shares are held jointly with his wife, Carleen Riley, (ii) 33,402 shares are held as sole custodian for the benefit of Abigail Riley, (iii) 33,402 shares are held as sole custodian for the benefit of Charlie Riley, (iv) 33,404 shares are held as sole custodian for the benefit of Eloise Riley, (v) 31,416 shares are held as sole custodian for the benefit of Susan Riley, (vi) 50,998 shares are held as sole trustee of the Robert Antin Children Irrevocable Trust, (vii) 37,353 shares are held in Mr. Riley’s 401(k) account, and (viii) 8,578,274 shares outstanding or issuable upon the exercise of the Warrants are held directly by BRF, BRPLP or BRFBR in the manner specified in paragraph (1) above. Mr. Riley disclaims beneficial ownership of the shares held by BRF, BRPLP and BRFBR, which are not directly owned or controlled by Mr. Riley.

|

Each of the Reporting Persons, as a member

of a “group” with the other Reporting Persons for purposes of Rule 13d-5(b)(1) of the Exchange Act, may be deemed to

beneficially own the securities of the Issuer owned by the other Reporting Persons. The filing of this Schedule 13D shall not be

deemed an admission that the Reporting Persons are, for purposes of Section 13(d) of the Exchange Act, the beneficial owners of

any securities of the Issuer it does not directly own or control. Each of the Reporting Persons specifically disclaims beneficial

ownership of the securities reported herein that it does not directly own or control.

As of the date hereof, each of BRPLP, BRPGP,

BRCM and BRF have shared power to vote or direct the vote of, and to dispose or direct the disposition of, the Shares beneficially

owned directly by BRPLP.

As of the date hereof, each of BRFBR and

BRF have shared power to vote or direct the vote of, and to dispose or direct the disposition of, the Shares beneficially owned

directly by BRFBR.

(c) None of the Reporting Persons has effected

any transactions in the Common Stock in the 60 days prior to the date of this Amendment that were not previously reported.

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

|

Item 6 is amended to add the following:

The information with respect to the Equitization

Agreement, Limity Guaranty and A&R Credit Agreement in Item 4 is incorporated by reference herein. The foregoing descriptions

of each of the Agreements do not purport to be complete and are qualified in its entirety by reference to the Equitization Agreement,

Limited Guaranty and A&R Credit Agreement.

|

Item 7.

|

Material to Be Filed as Exhibits

|

The following documents are filed as exhibits:

|

Exhibit

|

|

|

|

Number

|

|

Description

|

|

|

|

|

|

1

|

|

Joint Filing Agreement, dated May 7, 2019, by and among B. Riley Financial, Inc., BRC Partners Opportunity Fund, L.P., BRC Partners Management GP, LLC, B. Riley Capital Management, LLC, B. Riley FBR, Inc. and Bryant R. Riley (incorporated by reference to Exhibit 1 to the Schedule 13D/A filed by the Reporting Persons on May 7, 2019).

|

|

|

|

|

|

2

|

|

Amended and Restated Credit Agreement, dated as of May 14, 2020, among Babcock & Wilcox Enterprises, Inc., as the borrower, Bank of America, N.A., as Administrative Agent, and the other lenders party thereto (incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K filed by the Issuer on May 15, 2020).

|

|

|

|

|

|

3

|

|

Fee Letter, dated as of May 14, 2020, among Babcock & Wilcox Enterprises, Inc. and B. Riley Financial, Inc. (incorporated by reference to Exhibit 10.2 to the Current Report on Form 8-K filed by the Issuer on May 15, 2020).

|

|

|

|

|

|

4

|

|

Fee and Interest Equitization Agreement, dated May 14, 2020, between Babcock & Wilcox Enterprises, Inc., B. Riley Financial, Inc. and, solely for limited purposes under the Equitization Agreement, B. Riley FBR, Inc. (incorporated by reference to Exhibit 10.3 to the Current Report on Form 8-K filed by the Issuer on May 15, 2020).

|

|

|

|

|

|

5

|

|

Limited Guaranty Agreement, dated as of May 14, 2020, among Babcock & Wilcox Enterprises, Inc., B. Riley Financial, Inc. and Bank of America, N.A. (incorporated by reference to Exhibit 99.1 to the Current Report on Form 8-K filed by the Issuer on May 15, 2020).

|

Signature

After reasonable inquiry and to the best

of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: May 20, 2020

|

|

B. RILEY FINANCIAL, INC.

|

|

|

|

|

|

By:

|

/s/ Bryant R.

Riley

|

|

|

Name: Bryant R. Riley

|

|

|

Title: Co-Chief Executive Officer

|

|

|

|

|

|

BRC PARTNERS OPPORTUNITY FUND, L.P.

|

|

|

|

|

|

By:

|

/s/ Bryant R.

Riley

|

|

|

Name: Bryant R. Riley

|

|

|

Title: Chief Investment Officer

|

|

|

|

|

|

BRC PARTNERS MANAGEMENT GP, LLC

|

|

|

|

|

|

By: B. Riley Capital Management, LLC, its sole member

|

|

|

|

|

|

By:

|

/s/ Bryant R.

Riley

|

|

|

Name: Bryant R. Riley

|

|

|

Title: Chief Executive Officer

|

|

|

|

|

|

B. RILEY CAPITAL MANAGEMENT, LLC

|

|

|

|

|

|

By:

|

/s/ Bryant R.

Riley

|

|

|

Name: Bryant R. Riley

|

|

|

Title: Chief Executive Officer

|

|

|

|

|

|

B. RILEY FBR, INC.

|

|

|

|

|

|

By:

|

/s/ Andrew Moore

|

|

|

Name: Andrew Moore

|

|

|

Title: Chief Executive Officer

|

|

|

/s/ Bryant R.

Riley

|

|

|

|

Bryant R. Riley

|

The original statement shall be signed

by each person on whose behalf the statement is filed or his authorized representative. If the statement is signed on behalf of

a person by his authorized representative (other than an executive officer or general partner of this filing person), evidence

of the representative’s authority to sign on behalf of such person shall be filed with the statement, provided, however,

that a power of attorney for this purpose which is already on file with the Commission may be incorporated by reference. The name

and any title of each person who signs the statement shall be typed or printed beneath his signature.

Attention: Intentional misstatements

or omissions of fact constitute Federal criminal violations (see 18 U.S.C. 1001).

SCHEDULE A

Executive Officers and Directors of B. Riley

Financial, Inc.

|

Name and Position

|

|

Present Principal Occupation

|

|

Business Address

|

|

Citizenship

|

|

Bryant R. Riley, Chairman and Co-Chief Executive Officer

|

|

Chief Investment Officer of BRC Partners Opportunity Fund, LP, Chief Executive Officer of B. Riley Capital Management, LLC, and Co-Chief Executive Officer of B. Riley Financial, Inc.

|

|

11100 Santa Monica Blvd.

Suite 800

Los Angeles, CA 90025

|

|

United States

|

|

|

|

|

|

|

|

|

|

Thomas J. Kelleher, Co-Chief Executive Officer and Director

|

|

Co-Chief Executive Officer of B. Riley Financial, Inc. and President of B. Riley Capital Management, LLC.

|

|

11100 Santa Monica Blvd.

Suite 800

Los Angeles, CA 90025

|

|

United States

|

|

|

|

|

|

|

|

|

|

Andrew Gumaer, Director

|

|

Director at B. Riley Financial, Inc.

|

|

21255 Burbank Blvd.

Suite 400

Woodland Hills, CA 91367

|

|

United States

|

|

|

|

|

|

|

|

|

|

Robert D’Agostino, Director

|

|

President of Q-mation, Inc., a supplier of software solutions

|

|

21255 Burbank Blvd.

Suite 400

Woodland Hills, CA 91367

|

|

United States

|

|

|

|

|

|

|

|

|

|

Mikel Williams, Director

|

|

CEO & Director of privately held Targus International, LLC, supplier of carrying cases and accessories

|

|

21255 Burbank Blvd.

Suite 400

Woodland Hills, CA 91367

|

|

United States

|

|

|

|

|

|

|

|

|

|

Todd D. Sims, Director

|

|

SVP of Digital Strategy, Anschutz Entertainment Group, Inc., a sports and entertainment company

|

|

21255 Burbank Blvd.

Suite 400

Woodland Hills, CA 91367

|

|

United States

|

|

|

|

|

|

|

|

|

|

Robert L. Antin, Director

|

|

Co-Founder, VCA, Inc., an owner and operator of Veterinary care centers & hospitals

|

|

21255 Burbank Blvd.

Suite 400

Woodland Hills, CA 91367

|

|

United States

|

|

|

|

|

|

|

|

|

|

Michael J. Sheldon, Director

|

|

Chairman & CEO of Deutsch North America, a creative agency

|

|

21255 Burbank Blvd.

Suite 400

Woodland Hills, CA 91367

|

|

United States

|

|

|

|

|

|

|

|

|

|

Marian K. Walters, Director

|

|

U.S. Representative from California’s 45th Congressional District – Retired

|

|

21255 Burbank Blvd.

Suite 400

Woodland Hills, CA 91367

|

|

United States

|

|

|

|

|

|

|

|

|

|

Kenneth Young, President1

|

|

Chief Executive Officer of Babcock & Wilcox Enterprises, Inc., President of B. Riley Financial, Inc. and Chief Executive Officer of B. Riley Principal Investments, LLC

|

|

21255 Burbank Blvd.

Suite 400

Woodland Hills, CA 91367

|

|

United States

|

|

|

|

|

|

|

|

|

|

Phillip J. Ahn, Chief Financial Officer and Chief Operating Officer

|

|

Chief Financial Officer and Chief Operating Officer of B. Riley Financial, Inc.

|

|

21255 Burbank Blvd.

Suite 400

Woodland Hills, CA 91367

|

|

United States

|

|

|

|

|

|

|

|

|

|

Alan N. Forman, Executive Vice President, General Counsel and Secretary

|

|

Executive Vice President, General Counsel and Secretary of B. Riley Financial, Inc.

|

|

299 Park Avenue, 7th Floor

New York, NY 10171

|

|

United States

|

|

|

|

|

|

|

|

|

|

Howard E. Weitzman, Senior Vice President & Chief Accounting Officer

|

|

Senior Vice President & Chief Accounting Officer of B. Riley Financial, Inc.

|

|

21255 Burbank Blvd.

Suite 400

Woodland Hills, CA 91367

|

|

United States

|

|

|

|

|

|

|

|

|

|

Daniel Shribman, Chief Investment Officer

|

|

Director at Alta Equipment Group, Inc. Chief Investment Officer of B. Riley Financial, Inc., and President of B. Riley Principal Investments, LLC

|

|

299 Park Avenue, 7th Floor

New York, NY 10171

|

|

United States

|

|

1

|

|

As of the

close of business on the date hereof, Kenneth Young directly owned 29,240 shares of Common Stock. The shares of Common Stock were

purchased with personal funds for approximately $103,571. On August 13, 2019, in his capacity as Chief Executive Officer of the

Issuer, Mr. Young received restricted stock units (“RSUs”) representing the right to receive 600,000 shares of Common

Stock. All RSUs vest on January 2, 2021. Mr. Young has the sole power to vote and dispose of such shares of Common Stock and the

right to receive, or the power to direct the receipt of dividends from, or proceeds from the sale of, such shares of Common Stock.

|

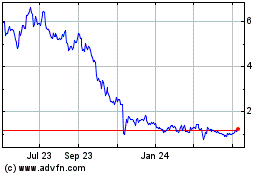

12

Babcock and Wilcox Enter... (NYSE:BW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Babcock and Wilcox Enter... (NYSE:BW)

Historical Stock Chart

From Apr 2023 to Apr 2024