Current Report Filing (8-k)

August 08 2019 - 7:23AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15 (d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 5, 2019

|

|

|

|

|

BABCOCK & WILCOX ENTERPRISES, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

DELAWARE

|

001-36876

|

47-2783641

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

20 SOUTH VAN BUREN AVENUE BARBERTON, OHIO

|

44203

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s Telephone Number, including Area Code:

(330) 753-4511

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Seciton 12(b) of the Act:

|

|

|

|

|

|

|

Title of Each Class

|

Trading Symbol

|

Name of Each Exchange on which Registered

|

|

Common stock, $0.01 par value per share

|

BW

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

|

|

|

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

On August 7, 2019, Babcock & Wilcox Enterprises, Inc. (“we”, “our” or the "Company") entered into Amendment No. 17 (the “Amendment”) to the Credit Agreement, dated May 11, 2015 (as amended to date, the “Credit Agreement”) with Bank of America, N.A., as administrative agent and lender, and the other lenders party thereto. The Amendment clarifies the method for calculating losses related to our Vølund contracts and resets the cap related to these losses to $15.0 million to align with the clarification commencing with the quarter ending March 31, 2019. Certain of the lenders, as well as certain of their respective affiliates, have performed and may in the future perform for the Company and its subsidiaries, various commercial banking, investment banking, lending, underwriting, trust services, financial advisory and other financial services, for which they have received and may in the future receive customary fees and expenses. Certain term loan lenders under the Credit Agreement are also significant shareholders of the Company, as we have previously disclosed in our public reports.

Item 2.02 Results of Operations and Financial Condition

On

August 8, 2019

, the Company issued a press release announcing our financial results for the quarter ended June 30, 2019. A copy of the press release is attached as Exhibit 99.1, and the information contained in Exhibit 99.1 is incorporated by reference.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

|

|

|

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

|

The information described in Item 1.01 above relating to the Amendment is incorporated into this Item 2.03 by reference.

|

|

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

|

On August 7, 2019, the Company announced that J. André Hall, the Company’s Senior Vice President, General Counsel and Corporate Secretary, had stepped down as an executive officer of the Company on August 5, 2019. The Company is grateful to Mr. Hall for his service and many contributions.

In connection with his resignation, Mr. Hall entered into a letter agreement with the Company pursuant to which he will (i) continue to remain employed through December 31, 2019 as a Special Advisor to the General Counsel; (ii) continue to receive his base salary; (iii) remain eligible to receive his bonus under the Company’s 2019 Management Incentive Plan; (iv) receive any outstanding equity awards that vest in accordance with the reduction in force rules outlined in his equity grant agreements; (v) receive any remaining tranche of time-vested restricted stock units issued under the Company’s November 2017 Retention Policy that vest as regularly scheduled on August 14, 2019; and (vi) receive a total of $570,000 over 24 months and a lump sum payment representing 18 months of medical, dental and vision insurance coverage in lieu of any amounts he might otherwise be entitled to under the Company’s Executive Severance Plan. In addition, Mr. Hall also entered into a consulting agreement, to become effective as of January 1, 2020, pursuant to which Mr. Hall will provide consulting services to the Company for at least an additional 12 months for a quarterly fee of $50,000.

On August 7, 2019, the Company also announced that Robert J. McKinney was appointed to succeed Mr. Hall as the Company’s Senior Vice President, General Counsel and Corporate Secretary effective August 5, 2019. A copy of the press release announcing Mr. McKinney’s appointment is attached as Exhibit 99.2 hereto and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

Press Release dated August 8, 2019

|

|

|

|

Press Release dated August 7, 2019

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

BABCOCK & WILCOX ENTERPRISES, INC.

|

|

|

|

|

|

|

|

|

|

|

|

August 8, 2019

|

By:

|

/s/ Louis Salamone

|

|

|

|

|

Louis Salamone

|

|

|

|

|

Executive Vice President, Chief Financial Officer and Chief Accounting Officer

(Principal Accounting Officer and Duly Authorized Representative)

|

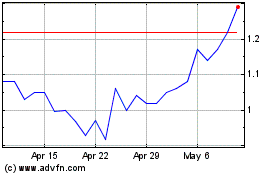

Babcock and Wilcox Enter... (NYSE:BW)

Historical Stock Chart

From Aug 2024 to Sep 2024

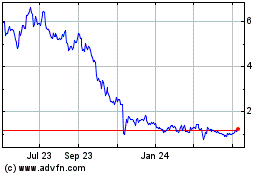

Babcock and Wilcox Enter... (NYSE:BW)

Historical Stock Chart

From Sep 2023 to Sep 2024