UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

REPORT

OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15b-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of February 2024

Commission

File Number 001-14370

COMPANIA

DE MINAS BUENAVENTURA S.A.A.

(Exact

name of registrant as specified in its charter)

BUENAVENTURA

MINING COMPANY INC.

(Translation of registrant’s name into English)

Republic

of Peru

(Jurisdiction of incorporation or organization)

CARLOS

VILLARAN 790

SANTA CATALINA, LIMA 13, PERU

(Address of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F

____X___ Form 40-F _______

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

_______ No ___X____

If

“Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

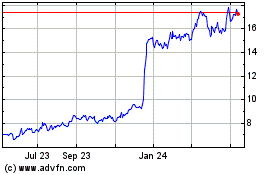

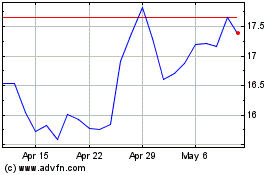

Buenaventura Announces

Fourth Quarter and Full year 2023 Results

Lima, Peru, February 29, 2024 – Compañia

de Minas Buenaventura S.A.A. (“Buenaventura” or “the Company”) (NYSE: BVN; Lima Stock Exchange: BUE.LM), Peru’s

largest publicly-traded precious metals mining company, today announced results for the fourth quarter (4Q23) and full year (FY23) ended

December 31, 2023. All figures have been prepared in accordance with IFRS (International Financial Reporting Standards) on a non-GAAP

basis and are stated in U.S. dollars (US$).

Fourth Quarter and Full Year 2023 Highlights:

| · | 4Q23 EBITDA from direct operations was US$ 116.4

million, compared to US$ 76.9 million reported in 4Q22. FY23 EBITDA from direct operations reached US$ 238.3 million, compared to US$

173.1 million reported in FY22. |

| · | 4Q23 net loss from continuing operations reached

US$ 3.0 million, compared to a US$ 56.7 million net income for the same period in 2022. FY23 net income from continuing operations was

US$ 39.5 million, compared to US$ 124.4 million net income for the FY22. |

| · | Buenaventura's cash position reached US$ 219.8

million and net debt decreased to US$ 486.8 million with an average maturity of 2.5 years by quarter’s end, December 31, 2023. |

| · | As planned within its non-core asset divestment

strategy, BVN executed the sale of Contacto to Howden for US$33.7 million. |

| · | Production from Yumpag´s pilot stope began

in November 2023 producing 2.3 million ounces of silver by quarter’s end. Yumpag continued processing pilot stope ore through

January 2024, after which mineral processing was suspended until definitive operating permits have been obtained, expected by the

end of 1Q24. Yumpag is therefore expected to initiate mineral processing in 2Q24. |

| · | A US$ 113.2 million provision was made in 4Q23

due to an adverse ruling by the Peruvian Supreme Court regarding tax loss carryforwards from 2009 and 2010. This provision negatively

affected Buenaventura’s 4Q23 net income. However, it does not imply a cash outflow as it has already been paid. |

| · | On December 14, 2023, Buenaventura received

US$49.0 million in dividends related to its stake in Cerro Verde. The Company received a total of US$146.9 million in dividends for FY23. |

| · | Buenaventura’s Board of Directors has proposed

a dividend payment of US$ 0.0726 per share/ADS, aligned with the Company’s commitment to shareholder value. |

Financial Highlights

(in millions of US$, except EPS figures):

| |

4Q23 |

4Q22 |

Var % |

FY23 |

FY22 |

Var % |

| Total Revenues |

253.8 |

246.4 |

3% |

823.8 |

824.8 |

0% |

| Operating Income |

59.9 |

13.0 |

N.A. |

20.9 |

-39.0 |

N.A. |

| EBITDA Direct Operations (1) |

116.4 |

76.9 |

51% |

238.3 |

173.1 |

38% |

| EBITDA Including Affiliates (1) |

202.2 |

196.4 |

3% |

620.7 |

866.2 |

-28% |

| Net Income (2) |

-9.8 |

54.1 |

-118% |

19.9 |

602.6 |

-97% |

| EPS (3) |

-0.04 |

0.21 |

-118% |

0.08 |

2.37 |

-97% |

| (1) | Does not include US$ 300 million from the sale of Buenaventura’s stake in Yanacocha. |

| (2) | Net Income attributable to owners of the parent |

| (3) | As of December 31, 2023, Buenaventura had a weighted average number of shares outstanding of 253,986,867. |

4Q23 capital expenditures were US$ 93.0

million, compared to US$ 58.8 million for the same period in 2022. FY23 capital expenditures reached US$ 238.7 million, compared to US$

152.0 million in FY22, and includes US$ 94.2 million related to the San Gabriel Project and US$ 49.5 million related to the Yumpag Project.

2024 Guidance: The Company expects

total CAPEX between US$ 300 - 320 million for the full year 2024. This includes US$ 65 - 75 million in sustaining CAPEX, which includes

investments related to become self-operator at El Brocal, as well as an approximate US$ 15 million investment in Yumpag. Growth CAPEX

is estimated to reach between US$ 235 - 245 million related to San Gabriel (~US$ 220 million) and Trapiche.

4Q23 net sales were US$ 253.8 million,

compared to US$ 246.4 million in 4Q22. Increased net sales were attributed to increased commodity prices and volume of copper and silver

sold, driven by the 10,000 tpd underground mine exploitation rate initiative at El Brocal and the restart of Uchucchacua and Yumpag.

The Company recorded a negative US$ 8.9

million provisional price adjustment for the FY23. This is comprised of US$ 8.4 million in fair value of accounts receivables and US$

0.5 million in adjustments to prior period liquidations. This compares to a positive US$ 5.7 million adjustment for the FY22.

| Operating Highlights |

4Q23 |

4Q22 |

Var % |

FY23 |

FY22 |

Var % |

| Net Sales (millions of US$) |

253.8 |

246.4 |

3% |

823.8 |

823.4 |

0% |

| Average Gold Price (US$/oz.) Direct Operations (1) (2) |

2,022 |

1,747 |

16% |

1,954 |

1,781 |

10% |

| Average Gold Price (US$/oz.) incl. Associated (2) (3) |

2,019 |

1,745 |

16% |

1,955 |

1,781 |

10% |

| Average Silver Price (US$/oz.) (2) |

23.55 |

19.62 |

20% |

23.98 |

20.89 |

15% |

| Average Lead Price (US$/MT) (2) |

2,148 |

2,037 |

5% |

2,093 |

2,082 |

1% |

| Average Zinc Price (US$/MT) (2) |

2,430 |

1,575 |

54% |

2,315 |

3,557 |

-35% |

| Average Copper Price (US$/MT) (2) |

7,574 |

6,804 |

11% |

8,418 |

8,113 |

4% |

| Volume Sold |

4Q23 |

4Q22 |

Var % |

FY23 |

FY22 |

Var % |

| Gold Oz Direct Operations (1) |

40,484 |

44,584 |

-9% |

143,185 |

168,276 |

-15% |

| Gold Oz incl. Associated (3) |

52,815 |

53,983 |

-2% |

170,054 |

202,761 |

-16% |

| Silver Oz |

3,522,212 |

1,904,345 |

85% |

8,188,411 |

7,559,712 |

8% |

| Lead MT |

5,428 |

3,299 |

65% |

10,227 |

15,829 |

-35% |

| Zinc MT |

11,813 |

5,349 |

N.A. |

20,137 |

30,220 |

-33% |

| Copper MT |

13,487 |

13,789 |

-2% |

55,427 |

45,301 |

22% |

| (1) | Buenaventura Consolidated figure includes 100% of Buenaventura’s operating

units, 100% of La Zanja and 100% of El Brocal. |

| (2) | Realized prices include both provisional sales and final adjustments for

price changes. |

| (3) | Considers 100% of Buenaventura’s operating units, 100% of La Zanja,

100% of El Brocal and 40.094% of Coimolache. |

| Production and Operating Costs |

Buenaventura’s 4Q23 equity gold production

was 52,231 ounces, compared to 53,079 ounces produced in 4Q22, primarily due to decreased production at La Zanja. 4Q23 silver production

was 3,934,706 ounces, compared to 1,678,051 ounces produced in 4Q22, mainly driven by Uchucchacua and Yumpag production initiation. 4Q23

lead and zinc production increased by 52% and 110%, respectively, due to increased production at El Brocal and Uchucchacua, and was partially

offset by decreased production at Tambomayo. The Company’s 4Q23 equity copper production was 28,749 MT, compared to 31,479 MT produced

in 4Q22, primarily due to decreased production at Cerro Verde.

| Equity Production |

4Q23 |

4Q22 |

Var % |

FY23 |

FY22 |

Var % |

| Gold Oz Direct Operations(1) |

41,264 |

44,632 |

-8% |

147,195 |

172,764 |

-15% |

| Gold Oz including Associated(2) Companies |

52,231 |

53,079 |

-2% |

174,114 |

205,804 |

-15% |

| Silver Oz Direct Operations(1) |

3,934,706 |

1,678,051 |

N.A. |

7,912,857 |

6,826,619 |

16% |

| Lead MT Direct Operations(1) |

4,896 |

3,228 |

52% |

9,472 |

14,991 |

-37% |

| Zinc MT Direct Operations(1) |

10,686 |

5,081 |

N.A. |

18,392 |

27,860 |

-34% |

| Copper MT Direct Operations(1) |

8,356 |

8,937 |

-6% |

35,463 |

29,088 |

22% |

| Copper MT including Associated Companies(3) |

28,749 |

31,479 |

-9% |

122,992 |

115,545 |

6% |

| Consolidated Production |

4Q23 |

4Q22 |

Var % |

FY23 |

FY22 |

Var % |

| Gold Oz(4) |

43,761 |

47,513 |

-8% |

155,334 |

181,773 |

-15% |

| Silver Oz(4) |

4,323,991 |

2,016,607 |

N.A. |

9,172,113 |

8,198,488 |

12% |

| Lead MT(4) |

6,002 |

3,694 |

62% |

11,410 |

17,610 |

-35% |

| Zinc MT(4) |

14,732 |

6,638 |

N.A. |

25,008 |

36,869 |

-32% |

| Copper MT(4) |

13,595 |

14,548 |

-7% |

57,721 |

47,352 |

22% |

| (1) | Buenaventura’s Direct Operations includes 100% of Buenaventura’s

operating units, 100% of La Zanja and 61.43% of El Brocal. |

| (2) | Based on 100% of Buenaventura´s operating units, 100% of La Zanja,

61.43% of El Brocal and 40.094% of Coimolache. |

| (3) | Based on 100% of Buenaventura´s operating units, 61.43% of El Brocal

and 19.58% of Cerro Verde. |

| (4) | Based on 100% of Buenaventura’s operating units, 100% of La Zanja and

100% of El Brocal |

Tambomayo

(100% owned by Buenaventura)

| Production |

| |

|

4Q23 |

4Q22 |

Var % |

FY23 |

FY22 |

Var % |

| Gold |

Oz |

12,052 |

12,348 |

-2% |

41,675 |

54,320 |

-23% |

| Silver |

Oz |

353,783 |

463,938 |

-24% |

1,590,784 |

1,863,411 |

-15% |

| |

|

|

|

|

|

|

|

| Cost Applicable to Sales |

| |

|

4Q23 |

4Q22 |

Var % |

FY23 |

FY22 |

Var % |

| Gold |

US$/Oz |

1,382 |

1,129 |

22% |

1,364 |

1,008 |

35% |

Tambomayo 4Q23 gold production decreased by 2%

year on year, however, this exceeded expectations as grade within areas mined during 4Q23 exceeded prior estimates by 40%. 4Q23 silver

production decreased by 24% year on year compared to the same period of 2022, aligned with the Company’s mine plan for this asset.

Cost Applicable to Sales (CAS) increased to 1,382 US$/Oz in 4Q23 from 1,129 US$/Oz in 4Q22. This increase was primarily due to decreased

by-product credits.

Orcopampa

(100% owned by Buenaventura)

| Production |

| |

|

4Q23 |

4Q22 |

Var % |

FY23 |

FY22 |

Var % |

| Gold |

Oz |

22,692 |

17,535 |

29% |

83,239 |

74,478 |

12% |

| Silver |

Oz |

8,136 |

8,687 |

-6% |

30,164 |

32,124 |

-6% |

| |

|

|

|

|

|

|

|

| Cost Applicable to Sales |

| |

|

4Q23 |

4Q22 |

Var % |

FY23 |

FY22 |

Var % |

| Gold |

US$/Oz |

893 |

919 |

-3% |

951 |

913 |

4% |

4Q23 gold production was 29% higher than 4Q22 and

exceeded expectations slightly, as ore extracted during the 4Q23 had higher than anticipated gold grades. CAS decreased to 893 US$/Oz

in 4Q23, compared to 919 US$/Oz in 4Q22; a 3% year on year decrease due to increased volume sold.

La

Zanja (100% owned by Buenaventura)

| Production |

| |

|

4Q23 |

4Q22 |

Var % |

FY23 |

FY22 |

Var % |

| Gold |

Oz |

2,308 |

10,163 |

-77% |

9,080 |

29,616 |

-69% |

| Silver |

Oz |

4,956 |

20,088 |

-75% |

20,589 |

105,435 |

-80% |

| |

|

|

|

|

|

|

|

| Cost Applicable to Sales |

| |

|

4Q23 |

4Q22 |

Var % |

FY23 |

FY22 |

Var % |

| Gold |

US$/Oz |

2,063 |

1,649 |

25% |

1,772 |

1,820 |

-3% |

4Q23 gold production decreased by 77% year on year,

in line with 2023 estimates, as mining and ore stockpiling was suspended in 4Q22. 4Q23 CAS was 2,063 US$/Oz, an increase from 1,649 US$/Oz

gold production in 4Q22 due to mining activity suspension.

Coimolache (40.09% owned by Buenaventura)

| Production |

| |

|

4Q23 |

4Q22 |

Var % |

FY23 |

FY22 |

Var % |

| Gold |

Oz |

27,351 |

21,067 |

30% |

67,140 |

82,408 |

-19% |

| Silver |

Oz |

88,080 |

68,135 |

29% |

264,835 |

296,968 |

-11% |

| |

|

|

|

|

|

|

|

| Cost Applicable to Sales |

| |

|

4Q23 |

4Q22 |

Var % |

FY23 |

FY22 |

Var % |

| Gold |

US$/Oz |

972 |

1,676 |

-42% |

1,376 |

1,393 |

-1% |

Coimolache 4Q23 gold production increased by 30%

year-over-year, as optimized leach pad space enabled higher-than-planned volumes of ore treated during 4Q23. This was partially offset

by lower grade and longer than expected percolation rates during 4Q23. However, it’s important to note that 65% of full year 2023

production was from the Tantahuatay NW-Ext pit which successfully achieved

target production within its first year of operation.

CAS therefore decreased to 972 US$/Oz in 4Q23, from 1,676 US$/Oz in 4Q22.

Uchucchacua &

Yumpag (100% owned by Buenaventura)

| Production |

| |

|

4Q23 |

4Q22 |

Var % |

FY23 |

FY22 |

Var % |

| Silver - Uchucchacua |

Oz |

278,538 |

0 |

N.A. |

278,538 |

0 |

N.A. |

| Silver - Yumpag |

Oz |

2,316,499 |

0 |

N.A. |

2,316,499 |

0 |

N.A. |

| Zinc |

MT |

2,763 |

0 |

N.A. |

2,763 |

0 |

N.A. |

| Lead |

MT |

1,962 |

0 |

N.A. |

1,962 |

0 |

N.A. |

| |

|

|

|

|

|

|

|

| Cost Applicable to Sales |

| |

|

4Q23 |

4Q22 |

Var % |

FY23 |

FY22 |

Var % |

| Silver |

US$/Oz |

12.09 |

0 |

N.A. |

19.92 |

0 |

N.A. |

Buenaventura re-initiated Uchucchacua and Yumpag

ore processing in the 4Q23 after the Uchucchacua processing plant had been placed under Care and Maintenance (C&M) since 3Q21.

Uchucchacua’s 2023 lead and zinc production

surpassed guidance, while silver production underperformed guidance due to a short-term planning adjustment to prioritize processing higher

value ore production at Yumpag.

Moving forward, Uchucchacua will primarily treat

polymetallic ore, with ore value balanced between silver, lead and zinc- as opposed to exclusively silver ore which was produced previously.

Additionally, Buenaventura has optimized Uchucchacua’s operations, which is now operating at approximately ~800 tpd and the plan

is to ramp-up to ~1,500 tpd by 4Q24.

Ore processed from the Yumpag pilot stope began

simultaneously with that of Uchucchacua in 4Q23. Both mineral outputs from Yumpag and Uchucchacua are treated at the Uchucchacua processing

plant. Yumpag 2023 silver production exceeded expectations, offsetting lower production at Uchucchacua. The increased silver production

is due to the prioritization of high-grade ore at Yumpag’s pilot stope.

Yumpag continued processing pilot stope ore through

January 2024, after which mineral processing was suspended until definitive operating permits have been obtained, expected by the end

of 1Q24. Yumpag is therefore expected to begin mineral processing in 2Q24 to achieve its estimated guidance. This suspension does not

disrupt Uchucchacua production, which will continue operation per usual.

4Q23 Silver CAS reached 12.09 US$/Oz, which is

below the average cost for Uchucchacua-Yumpag’s LOM as, under the exploration permit, costs incurred related to the Yumpag pilot

stope mining are considered to be CAPEX. Once the operating permit has been approved, the mining cost which has been recognized as CAPEX

will be recognized within Depreciation and Amortization in subsequent operating periods based on IFRS accounting principles.

Julcani (100% owned by Buenaventura)

| Production |

| |

|

4Q23 |

4Q22 |

Var % |

FY23 |

FY22 |

Var % |

| Silver |

Oz |

352,784 |

646,125 |

-45% |

1,670,679 |

2,640,689 |

-37% |

| |

|

|

|

|

|

|

|

| Cost Applicable to Sales |

| |

|

4Q23 |

4Q22 |

Var % |

FY23 |

FY22 |

Var % |

| Silver |

US$/Oz |

29.05 |

16.05 |

81% |

23.83 |

14.88 |

60% |

4Q23 silver production decreased by 45% year on

year primarily due to a negative geology reconciliation with decreased treated ore. However, it’s important to note that gold and

copper production from the Rosario sector began in December 2023. 4Q23 CAS was 29.05 US$/Oz, compared to 16.05 US$/Oz in 4Q22; an 81%

year on year increase due to decreased volume sold.

El Brocal

(61.43% owned by Buenaventura)

| Production |

| |

|

4Q23 |

4Q22 |

Var % |

FY23 |

FY22 |

Var % |

| Copper |

MT |

13,581 |

14,548 |

-7% |

57,707 |

47,352 |

22% |

| Zinc |

MT |

10,492 |

4,037 |

160% |

17,153 |

23,359 |

-27% |

| Silver |

Oz |

1,009,294 |

877,768 |

15% |

3,264,859 |

3,556,829 |

-8% |

| |

|

|

|

|

|

|

|

| Cost Applicable to Sales |

| |

|

4Q23 |

4Q22 |

Var % |

FY23 |

FY22 |

Var % |

| Copper |

US$/MT |

5,043 |

6,572 |

-23% |

5,962 |

6,614 |

-10% |

| Zinc |

US$/MT |

1,856 |

1,292 |

44% |

1,918 |

2,734 |

-30% |

El Brocal 4Q23 copper production decreased by 7%

year on year, primarily attributable to mining within lower grade areas with decreased recovery compared to the previous year, as per

the 2023 mine plan.

Record 2023 copper production resulted from successful

massive underground method migration completion, enabling El Brocal to ultimately achieve an average of 10,800 tpd during the 4Q23, surpassing

its targeted 10,000 tpd underground mine exploitation rate. Record 2023 copper production was also due to the successful implementation

of Buenaventura’s plan to increase production at its Marcapunta underground mine to offset the temporary suspension of mining activities

at Colquijirca’s Tajo Norte Mine, as was announced on October 3, 2023.

4Q23 silver production increased by 15% year on

year, exceeding expectations due to higher-than-expected silver grades at the El Brocal underground mine.

4Q23 zinc production was 10,492 metric tons, compared

to 4,037 metric tons in 4Q22. 593,000 tons of polymetallic ore previously considered to be inventories were processed in 4Q23. After a

positive metallurgic test result, 245,849 metric tons of ore were added to inventories in December 2023. Approximately 248,000 metric

tons of polymetallic ore are expected to be processed in 1Q24, with the remaining polymetallic and copper inventories processed in 2Q23.

4Q23 Copper CAS decreased by 23% year on year,

primarily due to higher by-product credits.

| Share in Associated Companies |

Buenaventura’s share in associated companies

was US$ 38.9 million in 4Q23, compared with US$ 58.1 million in 4Q22, comprised of:

Share in Associates’ Results (in

US$ millions) |

4Q23 |

4Q22 |

Var % |

FY23 |

FY22 |

Var % |

| Cerro Verde |

30.3 |

61.1 |

-50% |

152.6 |

181.2 |

-16% |

| Coimolache |

8.8 |

-2.7 |

N.A. |

1.1 |

-2.5 |

N.A. |

| Other minor |

-0.2 |

-0.3 |

-25% |

-1.4 |

-2.5 |

-43% |

| Total |

38.9 |

58.1 |

-33% |

152.2 |

176.3 |

-14% |

| Cerro Verde (19.58% owned by Buenaventura) |

4Q23 copper production

was 104,150 MT, 20,393 MT of which is attributable to Buenaventura; a 10% decrease as compared to 115,131 MT produced in 4Q22, 22,543

MT of which was attributable to Buenaventura.

Cerro Verde reported US$

165.5 million net income in 4Q23, compared to US$ 312.2 million net income in 4Q22. This decrease is primarily due to a 19% year-on-year

decrease in net sales resulting from a 9% decrease in volume of copper sold, as well as a lower average realized copper price of US$3.82

per pound in the 4Q23, compared to US$4.04 per pound in the 4Q22. Further, decreased molybdenum net sales for the quarter was in line

with lower realized prices. This decrease was partially offset by a lower tax paid during the quarter.

4Q23 Cerro Verde capital expenditures were

US$ 99.3 million.

| Coimolache (40.09% owned by Buenaventura) |

Coimolache reported US$ 22.4 million in 4Q23 net

income, compared to US$ 7.4 million net loss in 4Q22.

4Q23 and FY23 capital

expenditures were US$ 47.7 million and US$ 94.2 million, respectively. These expenses were primarily related to earth movement works,

underground contractor field work and progress establishing the San Gabriel mining camp. The earthmoving activities were primarily focused

on the processing plant platform, which has been 100% completed in the 4Q23. Buenaventura has also invested an additional US$ 33.1 million

in the San Gabriel project as advance payment for component equipment manufacturing, primarily related to the processing plant. This amount

has been reported within Buenaventura’s financial statements as Fixed Assets – Additions and will be reclassified as CAPEX

once Buenaventura has taken delivery of the equipment.

| Item |

Description |

Progress as of: |

| 1Q23 |

2Q23 |

3Q23 |

4Q23 |

| 1 |

Engineering |

66% |

81% |

90% |

92% |

| 2 |

Procurement |

85% |

85% |

89% |

89% |

| 3 |

Construction |

3% |

7% |

14% |

27% |

| 4 |

Commissioning |

0% |

0% |

0% |

0% |

| |

Total |

15% |

23% |

28% |

38% |

A US$ 113.2M provision was made related to the

ongoing tax dispute between Buenaventura and the Peruvian Tax Authority (SUNAT). Said dispute is related to the SUNAT´s refusal

to recognize the company´s deductions with respect to contracts for physical deliveries and certain contractual payments made by

the Company during the years 2007 and 2008, as well as tax loss which was offset in 2009 and 2010.

This provision has been made based on the recommendation

of the Company's Tax Lawyers. However, it is important to note that this provision does not indicate a write-off of the assets held in

accounts receivable, as the process remains ongoing. It is important to note that said provision does

not imply a cash outflow, as it represents an accounting

adjustment and has already been paid in full.

The provision has been recorded under the following

Income Statement Accounts: Others, net (US$ -9.6 million), Interest expense (US$ -58.4 million), and Income Tax (US$ -45.1 million).

| Annual Shareholders Meeting |

The following resolution was passed at the Company’s February

29, 2024 Board of Directors Meeting:

| · | Call for the Annual Shareholders Meeting to be held on March

27, 2024 with the following items proposed for approval: |

| 1. | Approval of the 2023 Annual Report. |

| 2. | Approval of the Financial Statements for the year ended on December 31, 2023. |

| 3. | Compensation for the Board of Directors - 2023. |

| 4. | Appointment of External Auditors for year 2024. |

| 5. | Distribution of dividends. |

| 6. | Appointment of the two board members required to complete the number of board members according to the

company’s bylaws. |

Compañía de Minas Buenaventura S.A.A.

is pleased to announce, effective immediately, the promotion of Mr. Juan Carlos Salazar to Vice President, Exploration. Mr. Salazar served

in his prior role within the Company as Buenaventura's Exploration and Geology Manager. His career at Buenaventura began in 1999 as Underground

Mine Geologist of the Julcani and Orcopampa mines.

Mr. Salazar received a Bachelor's Degree in Geological

Engineering from the Universidad Nacional de Ingeniería in Lima. He received a Master's Degree in Economic Geology from the University

of Western Australia.

***

Company Description

Compañía de Minas Buenaventura S.A.A.

is Peru’s largest, publicly traded precious and base metals Company and a major holder of mining rights in Peru. The Company is

engaged in the exploration, mining development, processing and trade of gold, silver and other base metals via wholly-owned mines and

through its participation in joint venture projects. Buenaventura currently operates several mines in Peru (Orcopampa*, Uchucchacua*,

Julcani*, Tambomayo*, La Zanja*, El Brocal and Coimolache).

The Company owns 19.58% of Sociedad Minera Cerro

Verde, an important Peruvian copper producer (a partnership with Freeport-McMorRan Inc. and Sumitomo Corporation).

For a printed version of the Company’s 2022

Form 20-F, please contact the investor relations contacts on page 1 of this report or download the PDF format file from the Company’s

web site at www.buenaventura.com.

(*) Operations wholly owned by Buenaventura

Note on Forward-Looking Statements

This press release and related conference call contain,

in addition to historical information, forward-looking statements including statements related to the Company’s ability to manage

its business and liquidity during and after the COVID-19 pandemic, the impact of the COVID-19 pandemic on the Company’s results

of operations, including net revenues, earnings and cash flows, the Company’s ability to reduce costs and capital spending in response

to the COVID-19 pandemic if needed, the Company’s balance sheet, liquidity and inventory position throughout and following the COVID-19

pandemic, the Company’s prospects for financial performance, growth and achievement of its long-term growth algorithm following

the COVID-19 pandemic, future dividends and share repurchases.

This press release may also contain forward-looking

information (as defined in the U.S. Private Securities Litigation Reform Act of 1995) that involve risks and uncertainties, including

those concerning the Company’s, Cerro Verde’s costs and expenses, results of exploration, the continued improving efficiency

of operations, prevailing market prices of gold, silver, copper and other metals mined, the success of joint ventures, estimates of future

explorations, development and production, subsidiaries’ plans for capital expenditures, estimates of reserves and Peruvian political,

economic, social and legal developments. These forward-looking statements reflect the Company’s view with respect to the Company’s,

Cerro Verde’s future financial performance. Actual results could differ materially from those projected in the forward-looking statements

as a result of a variety of factors discussed elsewhere in this Press Release.

**Tables to follow**

APPENDIX 1

|

Equity Participation in

Subsidiaries and Associates (as

of December 31, 2023) |

| |

BVN |

Operating |

| |

Equity % |

Mines / Business |

| El Molle Verde S.A.C* |

100.00 |

Trapiche Project |

| Minera La Zanja S.A* |

100.00 |

La Zanja |

| Sociedad Minera El Brocal S.A.A* |

61.43 |

Colquijirca and Marcapunta |

| Compañía Minera Coimolache S.A** |

40.09 |

Tantahuatay |

| Sociedad Minera Cerro Verde S.A.A** |

19.58 |

Cerro Verde |

| Processadora Industrial Rio Seco S.A* |

100.00 |

Rio Seco chemical plant |

| Consorcio Energético de Huancavelica S.A* |

100.00 |

Energy – Huanza Hydroelectrical plant |

(*) Consolidated

(**) Equity Accounting

APPENDIX 2

| Gold Production |

|

|

|

|

|

|

|

| Mining Unit |

Operating Results |

Unit |

4Q23 |

4Q22 |

△% |

FY23 |

FY22 |

△ % |

| Underground |

|

|

|

|

|

|

|

|

| Tambomayo |

Ore Milled |

DMT |

149,143 |

166,045 |

-10% |

584,246 |

634,368 |

-8% |

| Ore Grade |

Gr/MT |

2.92 |

2.75 |

6% |

2.66 |

3.06 |

-13% |

| Recovery Rate |

% |

86.08 |

84.01 |

2% |

83.10 |

86.94 |

-4% |

| Ounces Produced |

Oz |

12,052 |

12,348 |

-2% |

41,675 |

54,320 |

-23% |

| Orcopampa |

Ore Milled |

DMT |

74,629 |

56,163 |

33% |

288,104 |

236,505 |

22% |

| Ore Grade |

Gr/MT |

9.78 |

10.04 |

-3% |

9.34 |

10.01 |

-7% |

| Recovery Rate |

% |

96.70 |

96.72 |

0% |

96.19 |

97.83 |

-2% |

| Ounces Produced* |

Oz |

22,692 |

17,535 |

29% |

83,239 |

74,478 |

12% |

| Marcapunta |

Ore Milled |

DMT |

990,540 |

856,240 |

16% |

3,456,535 |

3,030,696 |

14% |

| Ore Grade |

Gr/MT |

0.86 |

0.73 |

18% |

0.70 |

0.67 |

4% |

| Recovery Rate |

% |

23.63 |

37.01 |

-36% |

26.81 |

34.87 |

-23% |

| Ounces Produced* |

Oz |

6,472 |

7,459 |

-13% |

20,442 |

23,170 |

-12% |

| Julcani |

Ounces Produced |

Oz |

237 |

- |

N.A. |

237 |

- |

N.A. |

| Open Pit |

|

|

|

|

|

|

|

|

| La Zanja |

Ounces Produced |

Oz |

2,308 |

10,163 |

-77% |

9,080 |

29,616 |

-69% |

Tajo Norte

Cu - Ag |

Ounces Produced |

Oz |

- |

8 |

N.A. |

661 |

189 |

N.A. |

| Coimolache |

Ounces Produced |

Oz |

27,351 |

21,067 |

30% |

67,140 |

82,408 |

-19% |

| Silver Production |

|

|

|

|

|

|

|

| Mining Unit |

Operating Results |

Unit |

4Q23 |

4Q22 |

△% |

FY23 |

FY22 |

△ % |

| Underground |

|

|

|

|

|

|

|

|

| Tambomayo |

Ore Milled |

DMT |

149,143 |

166,045 |

-10% |

584,246 |

634,368 |

-8% |

| Ore Grade |

Oz/MT |

2.71 |

3.10 |

-13% |

3.14 |

3.12 |

1% |

| Recovery Rate |

% |

87.61 |

89.98 |

-3% |

86.29 |

94.08 |

-8% |

| Ounces Produced |

Oz |

353,783 |

463,938 |

-24% |

1,590,784 |

1,863,411 |

-15% |

| Orcopampa |

Ore Milled |

DMT |

74,629 |

56,163 |

33% |

288,104 |

236,505 |

22% |

| Ore Grade |

Oz/MT |

0.15 |

0.19 |

-22% |

0.14 |

0.18 |

-23% |

| Recovery Rate |

% |

72.32 |

80.04 |

-10% |

73.76 |

74.32 |

-1% |

| Ounces Produced |

Oz |

8,136 |

8,687 |

-6% |

30,164 |

32,124 |

-6% |

| Uchucchacua |

Ore Milled |

DMT |

70,104 |

- |

N.A. |

70,104 |

- |

N.A. |

| Ore Grade |

Oz/MT |

4.85 |

- |

N.A. |

4.85 |

- |

N.A. |

| Recovery Rate |

% |

79.04 |

- |

N.A. |

79.04 |

- |

N.A. |

| Ounces Produced |

Oz |

278,538 |

- |

N.A. |

278,538 |

- |

N.A. |

| Yumpag |

Ore Milled |

DMT |

101,367 |

- |

N.A. |

101,367 |

- |

N.A. |

| Ore Grade |

Oz/MT |

9.96 |

- |

N.A. |

9.96 |

- |

N.A. |

| Recovery Rate |

% |

34.54 |

- |

N.A. |

34.54 |

- |

N.A. |

| Ounces Produced |

Oz |

2,316,499 |

- |

N.A. |

2,316,499 |

- |

N.A. |

| Julcani |

Ore Milled |

DMT |

25,371 |

34,004 |

-25% |

113,035 |

132,298 |

-15% |

| Ore Grade |

Oz/MT |

14.49 |

19.43 |

-25% |

15.37 |

20.34 |

-24% |

| Recovery Rate |

% |

95.77 |

97.78 |

-2% |

95.98 |

98.11 |

-2% |

| Ounces Produced* |

Oz |

352,784 |

646,125 |

-45% |

1,670,679 |

2,640,689 |

-37% |

| Marcapunta |

Ore Milled |

DMT |

990,540 |

856,240 |

16% |

3,456,535 |

3,030,696 |

14% |

| Ore Grade |

Oz/MT |

0.89 |

0.91 |

-3% |

0.90 |

0.89 |

1% |

| Recovery Rate |

% |

53.83 |

61.02 |

-12% |

55.49 |

55.46 |

0% |

| Ounces Produced |

Oz |

473,787 |

477,385 |

-1% |

1,733,686 |

1,513,932 |

15% |

| Open Pit |

|

|

|

|

|

|

|

|

Tajo Norte

Cu - Ag |

Ore Milled |

DMT |

- |

15,663 |

N.A. |

478,455 |

172,005 |

N.A. |

| Ore Grade |

Oz/MT |

- |

2.03 |

N.A. |

2.24 |

2.14 |

5% |

| Recovery Rate |

% |

- |

65.76 |

N.A. |

55.51 |

54.57 |

2% |

| Ounces Produced |

Oz |

- |

20,863 |

N.A. |

672,704 |

199,632 |

N.A. |

Tajo Norte

Pb - Zn |

Ore Milled |

DMT |

592,743 |

167,171 |

N.A. |

959,442 |

1,653,457 |

-42% |

| Ore Grade |

Oz/MT |

1.85 |

2.36 |

-21% |

1.74 |

1.69 |

3% |

| Recovery Rate |

% |

49.93 |

84.83 |

-41% |

53.37 |

60.97 |

-12% |

| Ounces Produced |

Oz |

535,507 |

379,520 |

41% |

858,469 |

1,843,264 |

-53% |

| La Zanja |

Ounces Produced |

Oz |

4,956 |

10,163 |

-51% |

20,589 |

29,616 |

-30% |

| Coimolache |

Ounces Produced |

Oz |

88,080 |

68,135 |

29% |

264,835 |

296,968 |

-11% |

| Lead Production |

|

|

|

|

|

|

|

| Mining Unit |

Operating Results |

Unit |

4Q23 |

4Q22 |

△% |

FY23 |

FY22 |

△ % |

| Underground |

|

|

|

|

|

|

|

|

| Tambomayo |

Ore Milled |

DMT |

149,143 |

166,045 |

-10% |

584,246 |

634,368 |

-8% |

| Ore Grade |

% |

0.82 |

1.56 |

-48% |

0.79 |

1.79 |

-56% |

| Recovery Rate |

% |

84.26 |

89.87 |

-6% |

83.63 |

90.57 |

-8% |

| MT Produced |

MT |

1,026 |

2,320 |

-56% |

3,877 |

10,290 |

-62% |

| Uchucchacua |

Ore Milled |

DMT |

70,104 |

- |

N.A. |

70,104 |

- |

N.A. |

| Ore Grade |

% |

3.13 |

- |

N.A. |

3.13 |

- |

N.A. |

| Recovery Rate |

% |

89.91 |

- |

N.A. |

89.91 |

- |

N.A. |

| MT Produced |

MT |

1,962 |

- |

N.A. |

1,962 |

- |

N.A. |

| Julcani |

Ore Milled |

DMT |

25,371 |

34,004 |

-25% |

113,035 |

132,298 |

-15% |

| Ore Grade |

% |

0.67 |

0.54 |

23% |

0.55 |

0.44 |

24% |

| Recovery Rate |

% |

86.27 |

90.29 |

-4% |

88.35 |

91.16 |

-3% |

| Ounces Produced* |

MT |

147 |

167 |

-12% |

545 |

530 |

3% |

| Open Pit |

|

|

|

|

|

|

|

|

Tajo Norte

Pb - Zn |

Ore Milled |

DMT |

592,743 |

167,171 |

N.A. |

959,442 |

1,653,457 |

-42% |

| Ore Grade |

% |

1.54 |

1.46 |

6% |

1.53 |

1.01 |

50% |

| Recovery Rate |

% |

31.73 |

48.52 |

-35% |

34.97 |

40.42 |

-13% |

| MT Produced |

MT |

2,866 |

1,207 |

N.A. |

5,026 |

6,791 |

-26% |

| Zinc Production |

|

|

|

|

|

|

|

| Mining Unit |

Operating Results |

Unit |

4Q23 |

4Q22 |

△% |

FY23 |

FY22 |

△ % |

| Underground |

|

|

|

|

|

|

|

|

| Tambomayo |

Ore Milled |

DMT |

149,143 |

166,045 |

-10% |

584,246 |

634,368 |

-8% |

| Ore Grade |

% |

1.25 |

1.82 |

-31% |

1.11 |

2.40 |

-54% |

| Recovery Rate |

% |

79.16 |

86.40 |

-8% |

77.92 |

88.62 |

-12% |

| MT Produced |

MT |

1,478 |

2,601 |

-43% |

5,092 |

13,511 |

-62% |

| Uchucchacua |

Ore Milled |

DMT |

70,104 |

- |

N.A. |

70,104 |

- |

N.A. |

| Ore Grade |

% |

5.36 |

- |

N.A. |

5.36 |

- |

N.A. |

| Recovery Rate |

% |

70.61 |

- |

N.A. |

70.61 |

- |

N.A. |

| MT Produced |

MT |

2,763 |

- |

N.A. |

2,763 |

- |

N.A. |

| Open Pit |

|

|

|

|

|

|

|

|

Tajo Norte

Pb - Zn |

Ore Milled |

DMT |

592,743 |

167,171 |

N.A. |

959,442 |

1,653,457 |

-42% |

| Ore Grade |

% |

3.61 |

3.45 |

5% |

3.61 |

2.54 |

42% |

| Recovery Rate |

% |

49.21 |

69.33 |

-29% |

50.23 |

54.83 |

-8% |

| MT Produced |

MT |

10,492 |

4,037 |

N.A. |

17,153 |

23,359 |

-27% |

| Copper Production |

|

|

|

|

|

|

|

| Mining Unit |

Operating Results |

Unit |

4Q23 |

4Q22 |

△% |

FY23 |

FY22 |

△ % |

| Underground |

|

|

|

|

|

|

|

|

| Marcapunta |

Ore Milled |

DMT |

990,540 |

856,240 |

16% |

3,456,535 |

3,030,696 |

14% |

| Ore Grade |

% |

1.60 |

1.93 |

-17% |

1.67 |

1.78 |

-6% |

| Recovery Rate |

% |

85.49 |

87.35 |

-2% |

85.55 |

85.66 |

0% |

| MT Produced |

MT |

13,581 |

14,456 |

-6% |

49,472 |

46,165 |

7% |

Tajo Norte

Cu - Ag |

Ore Milled |

DMT |

- |

15,663 |

N.A. |

478,455 |

172,005 |

N.A. |

| Ore Grade |

% |

- |

0.80 |

N.A. |

2.49 |

1.10 |

N.A. |

| Recovery Rate |

% |

- |

73.09 |

N.A. |

59.89 |

62.98 |

-5% |

| MT Produced |

MT |

- |

92 |

N.A. |

8,235 |

1,187 |

N.A. |

| Julcani |

MT Produced |

MT |

14 |

- |

N.A. |

14 |

- |

N.A. |

APPENDIX 3: Adjusted EBITDA Reconciliation (in thousand US$)

| |

4Q23 |

4Q22 |

FY23 |

FY22 |

| Net Income |

-10,271 |

55,342 |

32,682 |

602,935 |

| Add / Subtract: |

126,704 |

21,515 |

205,665 |

-129,807 |

| Income from sale of investment in Yanacocha |

0 |

0 |

0 |

300,000 |

| Depreciation and Amortization in cost of sales |

59,223 |

45,250 |

181,039 |

176,781 |

| Provision (credit) for income tax, net |

45,064 |

35,239 |

42,994 |

41 |

| Interest expense |

75,799 |

12,044 |

119,254 |

54,136 |

| Loss (gain) on currency exchange difference |

-15,925 |

-29,957 |

-19,375 |

-26,871 |

| Provision of bonuses and compensations |

4,738 |

3,856 |

15,129 |

15,820 |

| Loss (gain) from discontinued operations |

7,287 |

1,322 |

6,848 |

-478,547 |

| Workers' participation provision |

-515 |

762 |

4,176 |

1,033 |

| Depreciation and amortization in administration expenses |

960 |

644 |

2,903 |

2,460 |

| Depreciation and Amortization in other, net |

28 |

32 |

107 |

108 |

| Provision (reversal) for contingencies |

-1,393 |

-870 |

-6,927 |

2,935 |

| Share in associated companies by the equity method, net |

-38,857 |

-58,121 |

-152,225 |

-176,270 |

| Write-off of fixed assets |

464 |

3,602 |

1,334 |

3,924 |

| Impairment (reversal) of inventories |

-21,730 |

576 |

4,920 |

-932 |

| Interest income |

-2,984 |

-2,882 |

-9,057 |

-14,443 |

| Provision for accounts receivables |

9,597 |

253 |

9,597 |

253 |

| Changes in closure of mining units |

7,977 |

-302 |

7,977 |

-302 |

| Changes in environmental liabilities provisions |

4,765 |

-228 |

4,765 |

-228 |

| Impairment of long-term lived assets |

0 |

-19,874 |

0 |

-19,874 |

| Changes in provision of exploration activities |

-7,794 |

13,631 |

-7,794 |

13,631 |

| Write-off of inventories |

0 |

11,377 |

0 |

11,377 |

| Contractor claims provisions |

0 |

2,839 |

0 |

2,839 |

| Write-off of accounts receivable |

0 |

2,322 |

0 |

2,322 |

| EBITDA Buenaventura Direct Operations |

116,433 |

76,857 |

238,347 |

473,128 |

| EBITDA Cerro Verde (19.58%) |

72,473 |

116,984 |

369,039 |

378,084 |

| EBITDA Coimolache (40.095%) |

13,282 |

2,587 |

13,279 |

14,979 |

| EBITDA Buenaventura + All Associates |

202,188 |

196,428 |

620,665 |

866,191 |

*Cerro Verde’s EBITDA accounts for D&A related to the capitalization

of the stripping.

Note:

EBITDA (Buenaventura Direct Operations) consists

of earnings before net interest, taxes, depreciation and amortization, share in associated companies, net, loss on currency exchange difference,

other, net, provision for workers’ profit sharing and provision for long-term officers’ compensation.

EBITDA (including associated companies) consists

of EBITDA (Buenaventura Direct Operations), plus (1) Buenaventura’s equity share of EBITDA (Cerro Verde), plus (2) Buenaventura’s

equity share of EBITDA (Coimolache). All EBITDA mentioned were similarly calculated using financial information provided to Buenaventura

by the associated companies.

Buenaventura presents EBITDA (Buenaventura Direct

Operations) and EBITDA (including affiliates) to provide further information with respect to its operating performance and the operating

performance of its equity investees, the affiliates. EBITDA (Buenaventura Direct Operations) and EBITDA (including affiliates) are not

a measure of financial performance under IFRS and may not be comparable to similarly titled measures of other companies. You should not

consider EBITDA (Buenaventura Direct Operations) and EBITDA (including affiliates) as alternatives to operating income or net income determined

in accordance with IFRS, as an indicator of Buenaventura’s, affiliates operating performance, or as an alternative to cash flows

from operating activities.

APPENDIX 4: 2023 RESERVES

| RESERVES AS OF DECEMBER 31st 2023 |

| |

|

|

|

|

|

| PRELIMINARY PROVEN AND PROBABLE RESERVES |

| |

| |

|

|

|

|

|

| GOLD |

|

|

|

|

|

| |

% Ownership |

MT (000) |

Grade Oz/TMS |

Oz (000) |

Attributable (000) |

| Orcopampa |

100.00 |

222 |

0.314 |

70 |

70 |

| Julcani |

100.00 |

219 |

0.030 |

7 |

7 |

| Tambomayo |

100.00 |

573 |

0.073 |

42 |

42 |

| La Zanja |

100.00 |

- |

- |

- |

- |

| Coimolache |

40.09 |

43,692 |

0.009 |

396 |

159 |

| El Brocal Marcapunta |

61.43 |

28,281 |

0.021 |

592 |

364 |

| El Brocal (Tajo Norte Smelter - Cu-Ag) |

61.43 |

22,245 |

0.008 |

171 |

105 |

| San Gabriel |

100.00 |

14,934 |

0.130 |

1,940 |

1,940 |

| Total |

|

|

|

3,218 |

2,686 |

| |

|

|

|

|

|

| SILVER |

|

|

|

|

|

| |

% Ownership |

MT (000) |

Grade Oz/TMS |

Oz (000) |

Attributable (000) |

| Uchucchacua/Yumpag (Ag - Zn - Pb) |

100.00 |

5,322 |

14.32 |

76,239 |

76,239 |

| Julcani |

100.00 |

219 |

18.39 |

4,020 |

4,020 |

| Orcopampa |

100.00 |

222 |

0.16 |

36 |

36 |

| Tambomayo |

100.00 |

573 |

5.72 |

3,277 |

3,277 |

| La Zanja |

100.00 |

- |

- |

- |

- |

| Coimolache |

40.09 |

43,692 |

0.31 |

13,500 |

5,413 |

| El Brocal (Tajo Norte Smelter - Cu-Ag) |

61.43 |

22,245 |

0.69 |

15,398 |

9,459 |

| El Brocal (Tajo Norte Smelter - Zn-Pb-Ag) |

61.43 |

2,077 |

3.61 |

7,505 |

4,610 |

| El Brocal Marcapunta |

61.43 |

28,281 |

0.67 |

19,079 |

11,720 |

| San Gabriel |

100.00 |

14,934 |

0.21 |

3,087 |

3,087 |

| Total |

|

|

|

142,141 |

117,861 |

| |

|

|

|

|

|

| ZINC |

|

|

|

|

|

| |

% Ownership |

MT (000) |

% Zn |

MT (000) |

Attributable (000) |

| Uchucchacua/Yumpag (Ag - Zn - Pb) |

100.00 |

3,052 |

3.24 |

99 |

99 |

| Tambomayo |

100.00 |

573 |

1.04 |

6 |

6 |

| El Brocal (Tajo Norte - Smelter Zn - Pb - Ag ) |

61.43 |

2,077 |

3.67 |

76 |

47 |

| Total |

|

|

|

181 |

152 |

| |

|

|

|

|

|

| |

|

|

|

|

|

| LEAD |

|

|

|

|

|

| |

% Ownership |

MT (000) |

% Pb |

MT (000) |

Attributable (000) |

| Uchucchacua/Yumpag (Ag - Zn - Pb) |

100.00 |

3,052 |

1.97 |

60 |

60 |

| Julcani |

100.00 |

219 |

2.43 |

5 |

5 |

| Tambomayo |

100.00 |

573 |

0.61 |

3 |

3 |

| El Brocal (Tajo Norte - Smelter Zn - Pb - Ag ) |

61.43 |

2,077 |

1.70 |

35 |

22 |

| Total |

|

|

|

104 |

91 |

| |

|

|

|

|

|

| |

|

|

|

|

|

| COPPER |

|

|

|

|

|

| |

% Ownership |

MT (000) |

% Cu |

MT (000) |

Attributable (000) |

| Julcani |

100.00 |

219 |

0.55 |

1 |

1 |

| El Brocal Marcapunta Norte |

61.43 |

28,281 |

1.27 |

360 |

221 |

| El Brocal (Tajo Norte - Smelter Cu - Ag) |

61.43 |

22,245 |

1.82 |

404 |

248 |

| Trapiche |

100.00 |

283,200 |

0.51 |

1,444 |

1,444 |

| Total |

|

|

|

2,210 |

1,915 |

| |

|

|

|

|

|

| Prices used for Buenaventura´s Reserves calculation: |

|

|

|

|

| Gold 1,800 US$/Oz - Silver 22.00 US$/Oz - Zinc 3,000 US$/MT

- Lead 2,100 US$/MT - Copper 8,000 US$/MT |

APPENDIX 5: COST APPLICABLE TO SALES RECONCILIATION

Reconciliation of Costs Applicable to Sales

and Cost Applicable to Sales per Unit Sold

Cost applicable to sales consists of cost of sales,

excluding depreciation and amortization, plus selling expenses. Cost applicable to sales per unit sold for each mine consists of cost

applicable to sales for a particular metal produced at a given mine divided by the volume of such metal produced at such mine in the specified

period. We note that cost applicable to sales is not directly comparable to the cash operating cost figures disclosed in previously furnished

earnings releases.

Cost applicable to sales and Cost applicable to

sales per unit of mineral sold are not measures of financial performance under IFRS and may not be comparable to similarly titled measures

of other companies. We consider Cost applicable to sales and Cost applicable to sales per unit of mineral sold to be key measures in managing

and evaluating our operating performance. These measures are widely reported in the precious metals industry as a benchmark for performance,

but do not have standardized meanings. You should not consider Cost applicable to sales or Cost applicable to sales per unit of mineral

sold as alternatives to cost of sales determined in accordance with IFRS, as indicators of our operating performance. Cost applicable

to sales and Cost applicable to sales per unit of mineral sold are calculated without adjusting for by-product revenue amounts.

Operations’ Cost applicable to sales does

not include operating cost for those months during which Buenaventura’s operations were suspended due to COVID-19, as these have

been classified as “Unabsorbed costs due to production stoppage” within the financial statements.

The tables below set forth (i) a reconciliation

of consolidated Cost of sales, excluding depreciation and amortization to consolidated Cost applicable to sales, (ii) reconciliations

of the components of Cost applicable to sales (by mine and mineral) to the corresponding consolidated line items set forth on our consolidated

statements of profit or loss for the three and twelve months ended December 31, 2022 and 2021 and (iii) reconciliations of Cost of sales,

excluding depreciation and amortization to Cost applicable to sales for each of our mining units. The amounts set forth in Cost

applicable to sales and Cost applicable to sales per unit sold for each mine and mineral indicated in the tables below can be reconciled

to the amounts set forth on our consolidated statements of profit or loss for the three and twelve months ended December 31, 2021 and

2022 by reference to the reconciliations of Cost of sales, excluding depreciation and amortization (by mine and mineral), Selling Expenses

(by mine and metal) expenses and Exploration in units in operations (by mine and mineral) to consolidated Cost of sales, excluding depreciation

and amortization, consolidated Selling Expenses and consolidated Exploration in units in operations expenses, respectively, set forth

below.

Set

forth below is a reconciliation of consolidated Cost of sales, excluding depreciation and amortization, to consolidated Cost applicable

to sales:

| | |

For

the 3 months ended December 31 | | |

For

the 12 months ended December 31 | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| | |

(in

thousands of US$) | | |

| | |

| |

| Consolidated

Cost of sales excluding depreciation and amortization | |

| 121,426 | | |

| 127,602 | | |

| 463,597 | | |

| 465,105 | |

| | |

| | | |

| | | |

| | | |

| | |

| Add: | |

| | | |

| | | |

| | | |

| | |

| Consolidated

Exploration in units in operation | |

| 10,178 | | |

| 27,167 | | |

| 49,229 | | |

| 80,796 | |

| Consolidated

Commercial deductions | |

| 62,242 | | |

| 45,190 | | |

| 196,893 | | |

| 183,077 | |

| Consolidated

Selling expenses | |

| 6,647 | | |

| 4,732 | | |

| 19,392 | | |

| 20,222 | |

| Consolidated

Cost applicable to sales | |

| 200,493 | | |

| 204,691 | | |

| 729,111 | | |

| 749,200 | |

Set

forth below is a reconciliation of Cost of sales, excluding depreciation and amortization (by mine and mineral) to consolidated Cost

of sales:

| | |

For

the 3 months ended December 31 | | |

For

the 12 months ended December 31 | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Cost

of sales by mine and mineral | |

| | |

(in

thousands of US$) | | |

| |

| Julcani,

Gold | |

| 450 | | |

| 4 | | |

| 486 | | |

| 82 | |

| Julcani,

Silver | |

| 7,167 | | |

| 7,391 | | |

| 28,930 | | |

| 28,287 | |

| Julcani,

Lead | |

| 226 | | |

| 182 | | |

| 730 | | |

| 488 | |

| Julcani,

Copper | |

| 87 | | |

| 75 | | |

| 387 | | |

| 285 | |

| Orcopampa,

Gold | |

| 18,643 | | |

| 13,777 | | |

| 71,462 | | |

| 55,004 | |

| Orcopampa,

Silver | |

| 70 | | |

| 76 | | |

| 265 | | |

| 309 | |

| Orcopampa,

Copper | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Uchucchacua,

Gold | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Uchucchacua,

Silver | |

| 12,786 | | |

| 0 | | |

| 13,087 | | |

| 0 | |

| Uchucchacua,

Lead | |

| 936 | | |

| 0 | | |

| 814 | | |

| 0 | |

| Uchucchacua,

Zinc | |

| 1,372 | | |

| 0 | | |

| 1,193 | | |

| 0 | |

| Tambomayo,

Gold | |

| 12,329 | | |

| 9,313 | | |

| 41,954 | | |

| 34,865 | |

| Tambomayo,

Silver | |

| 4,213 | | |

| 3,984 | | |

| 19,620 | | |

| 13,391 | |

| Tambomayo,

Zinc | |

| 1,099 | | |

| 2,157 | | |

| 4,608 | | |

| 16,638 | |

| Tambomayo,

Lead | |

| 1,626 | | |

| 1,828 | | |

| 4,077 | | |

| 8,141 | |

| La

Zanja, Gold | |

| 4,436 | | |

| 16,695 | | |

| 15,435 | | |

| 49,923 | |

| La

Zanja, Silver | |

| 141 | | |

| 506 | | |

| 748 | | |

| 2,251 | |

| El

Brocal, Gold | |

| 2,982 | | |

| 5,815 | | |

| 10,621 | | |

| 13,874 | |

| El

Brocal, Silver | |

| 6,157 | | |

| 8,364 | | |

| 25,341 | | |

| 29,785 | |

| El

Brocal, Lead | |

| 2,019 | | |

| 1,270 | | |

| 3,944 | | |

| 5,930 | |

| El

Brocal, Zinc | |

| 7,044 | | |

| 2,841 | | |

| 13,436 | | |

| 31,697 | |

| El

Brocal, Copper | |

| 34,878 | | |

| 55,622 | | |

| 187,155 | | |

| 173,513 | |

| Non

Mining Units | |

| 2,765 | | |

| -2,300 | | |

| 19,303 | | |

| 642 | |

| Consolidated

Cost of sales, excluding depreciation and amortization | |

| 121,426 | | |

| 127,602 | | |

| 463,597 | | |

| 465,105 | |

Set forth below is a reconciliation of Exploration expenses in units in operation (by mine and mineral) to consolidated Exploration expenses

in mining units:

| | |

For

the 3 months ended December 31 | | |

For

the 12 months ended December 31 | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Exploration expenses in units in operation by mine and | |

| (in

thousands of US$) | |

| mineral | |

| | | |

| | | |

| | | |

| | |

| Julcani, Gold | |

| 104 | | |

| 1 | | |

| 111 | | |

| 19 | |

| Julcani, Silver | |

| 1,664 | | |

| 1,783 | | |

| 6,623 | | |

| 6,549 | |

| Julcani, Lead | |

| 53 | | |

| 44 | | |

| 167 | | |

| 113 | |

| Julcani, Copper | |

| 20 | | |

| 18 | | |

| 89 | | |

| 66 | |

| Orcopampa, Gold | |

| 1,352 | | |

| 2,030 | | |

| 6,049 | | |

| 11,529 | |

| Orcopampa, Silver | |

| 5 | | |

| 11 | | |

| 22 | | |

| 65 | |

| Orcopampa, Copper | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Uchucchacua, Gold | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Uchucchacua, Silver | |

| 3,245 | | |

| 17,243 | | |

| 21,176 | | |

| 32,806 | |

| Uchucchacua, Lead | |

| 238 | | |

| 0 | | |

| 1,317 | | |

| -214 | |

| Uchucchacua, Zinc | |

| 348 | | |

| 0 | | |

| 1,930 | | |

| 0 | |

| Tambomayo, Gold | |

| 769 | | |

| 1,073 | | |

| 2,058 | | |

| 4,764 | |

| Tambomayo, Silver | |

| 263 | | |

| 459 | | |

| 962 | | |

| 1,830 | |

| Tambomayo, Lead | |

| 69 | | |

| 249 | | |

| 200 | | |

| 1,112 | |

| Tambomayo, Zinc | |

| 101 | | |

| 211 | | |

| 226 | | |

| 2,274 | |

| La Zanja, Gold | |

| 96 | | |

| 609 | | |

| 512 | | |

| 3,073 | |

| La Zanja, Silver | |

| 3 | | |

| 18 | | |

| 25 | | |

| 139 | |

| El Brocal, Gold | |

| 104 | | |

| 269 | | |

| 343 | | |

| 908 | |

| El Brocal, Silver | |

| 214 | | |

| 387 | | |

| 818 | | |

| 1,949 | |

| El Brocal, Lead | |

| 70 | | |

| 59 | | |

| 127 | | |

| 388 | |

| El Brocal, Zinc | |

| 245 | | |

| 131 | | |

| 434 | | |

| 2,074 | |

| El Brocal, Copper | |

| 1,214 | | |

| 2,573 | | |

| 6,040 | | |

| 11,353 | |

| Non Mining Units | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Consolidated Exploration

expenses in units in operation | |

| 10,178 | | |

| 27,167 | | |

| 49,229 | | |

| 80,796 | |

Set

forth below is a reconciliation of Commercial Deductions in units in operation (by mine and mineral) to consolidated Commercial deductions:

| | |

For

the 3 months ended December 31 | | |

For

the 12 months ended December 31

| |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

Commercial Deductions

in units in operation by

mine and mineral | |

| (in

thousands of US$) | |

| | |

| | |

| Julcani, Gold | |

| 81 | | |

| 0 | | |

| 88 | | |

| -5 | |

| Julcani, Silver | |

| 396 | | |

| 466 | | |

| 1,670 | | |

| 1,962 | |

| Julcani, Lead | |

| 9 | | |

| 11 | | |

| 38 | | |

| 33 | |

| Julcani, Copper | |

| 3 | | |

| 5 | | |

| 20 | | |

| 18 | |

| Orcopampa, Gold | |

| 219 | | |

| 177 | | |

| 1,045 | | |

| 784 | |

| Orcopampa, Silver | |

| 3 | | |

| 0 | | |

| 3 | | |

| 13 | |

| Orcopampa, Copper | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Uchucchacua, Gold | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Uchucchacua, Silver | |

| 7,965 | | |

| 1,538 | | |

| 11,264 | | |

| 3,375 | |

| Uchucchacua, Lead | |

| 1,124 | | |

| 3 | | |

| 1,124 | | |

| 10 | |

| Uchucchacua, Zinc | |

| 3,099 | | |

| 0 | | |

| 3,099 | | |

| 272 | |

| Tambomayo, Gold | |

| 1,364 | | |

| 1,560 | | |

| 5,435 | | |

| 6,558 | |

| Tambomayo, Silver | |

| 668 | | |

| 744 | | |

| 3,023 | | |

| 3,183 | |

| Tambomayo, Lead | |

| 115 | | |

| 326 | | |

| 466 | | |

| 1,455 | |

| Tambomayo, Zinc | |

| 1,045 | | |

| 959 | | |

| 2,801 | | |

| 12,241 | |

| La Zanja, Gold | |

| 36 | | |

| 93 | | |

| 123 | | |

| 305 | |

| La Zanja, Silver | |

| 1 | | |

| 5 | | |

| 11 | | |

| 32 | |

| El Brocal, Gold | |

| 2,502 | | |

| 3,079 | | |

| 7,527 | | |

| 8,639 | |

| El Brocal, Silver | |

| 5,227 | | |

| 4,049 | | |

| 16,860 | | |

| 16,374 | |

| El Brocal, Lead | |

| 1,356 | | |

| 492 | | |

| 1,963 | | |

| 2,820 | |

| El Brocal, Zinc | |

| 7,977 | | |

| 1,212 | | |

| 12,356 | | |

| 17,426 | |

| El Brocal, Copper | |

| 29,051 | | |

| 30,471 | | |

| 127,979 | | |

| 107,581 | |

| Non Mining Units | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Consolidated Commercial deductions

in units in operation | |

| 62,242 | | |

| 45,190 | | |

| 196,893 | | |

| 183,077 | |

Set

forth below is a reconciliation of Selling expenses (by mine and mineral) to consolidated Selling expenses:

| | |

For

the 3 months ended December 31 | | |

For

the 12 months ended December 31

| |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Selling expenses by mine and mineral | |

| (in thousands of US$) | |

| Julcani, Gold | |

| 4 | | |

| 0 | | |

| 4 | | |

| 1 | |

| Julcani, Silver | |

| 69 | | |

| 71 | | |

| 226 | | |

| 378 | |

| Julcani, Lead | |

| 2 | | |

| 2 | | |

| 6 | | |

| 7 | |

| Julcani, Copper | |

| 1 | | |

| 1 | | |

| 3 | | |

| 4 | |

| Orcopampa, Gold | |

| 156 | | |

| 113 | | |

| 669 | | |

| 557 | |

| Orcopampa, Silver | |

| 1 | | |

| 1 | | |

| 2 | | |

| 3 | |

| Orcopampa, Copper | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Uchucchacua, Gold | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

| Uchucchacua, Silver | |

| 965 | | |

| 928 | | |

| 2,898 | | |

| 3,393 | |

| Uchucchacua, Lead | |

| 71 | | |

| 0 | | |

| 180 | | |

| -22 | |

| Uchucchacua, Zinc | |

| 104 | | |

| 0 | | |

| 264 | | |

| 0 | |

| Tambomayo, Gold | |

| 470 | | |

| 471 | | |

| 1,647 | | |

| 2,447 | |

| Tambomayo, Silver | |

| 161 | | |

| 201 | | |

| 770 | | |

| 940 | |

| Tambomayo, Lead | |

| 42 | | |

| 109 | | |

| 160 | | |

| 571 | |

| Tambomayo, Zinc | |

| 62 | | |

| 92 | | |

| 181 | | |

| 1,168 | |

| La Zanja, Gold | |

| 11 | | |

| 45 | | |

| 57 | | |

| 171 | |

| La Zanja, Silver | |

| 0 | | |

| 1 | | |

| 3 | | |

| 8 | |

| El Brocal, Gold | |

| 241 | | |

| 193 | | |

| 506 | | |

| 525 | |

| El Brocal, Silver | |

| 498 | | |

| 277 | | |

| 1,207 | | |

| 1,128 | |

| El Brocal, Lead | |

| 163 | | |

| 42 | | |

| 188 | | |

| 225 | |

| El Brocal, Zinc | |

| 569 | | |

| 94 | | |

| 640 | | |

| 1,200 | |

| El Brocal, Copper | |

| 2,819 | | |

| 1,844 | | |

| 8,916 | | |

| 6,571 | |

| Non Mining Units | |

| 239 | | |

| 245 | | |

| 865 | | |

| 948 | |

| Consolidated Selling expenses | |

| 6,647 | | |

| 4,732 | | |

| 19,392 | | |

| 20,222 | |

| |

JULCANI

|

| |

4Q

2023 |

4Q

2022 |

| |

GOLD

(OZ) |

SILVER

(OZ) |

LEAD

(MT) |

ZINC

(MT) |

COPPER

(MT) |

TOTAL |

GOLD

(OZ) |

SILVER

(OZ) |

LEAD

(MT) |

ZINC

(MT) |

COPPER

(MT) |

TOTAL |

| Cost

of Sales (without D&A) (US$000) |

450 |

7,167 |

226 |

- |

87 |

7,931 |

4 |

7,391 |

182 |

- |

75 |

7,652 |

| Add:

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exploration

Expenses (US$000) |

104 |

1,664 |

53 |

- |

20 |

1,841 |

1 |

1,783 |

44 |

- |

18 |

1,846 |

| Commercial

Deductions (US$000) |

81 |

396 |

9 |

- |

3 |

490 |

0 |

466 |

11 |

- |

5 |

482 |

| Selling

Expenses (US$000) |

4 |

68.68 |

2.17 |

- |

1 |

76 |

0 |

71 |

2 |

- |

1 |

74 |

| Cost

Applicable to Sales (US$000) |

640 |

9,296 |

290 |

- |

112 |

10,338 |

5 |

9,712 |

239 |

- |

99 |

10,054 |

| Divide:

|

|

|

|

|

|

|

|

|

|

|

|

|

| Volume

Sold |

241 |

319,975 |

122 |

- |

11 |

Not

Applicable |

4 |

605,128 |

138 |

- |

17 |

Not

Applicable |

| CAS

|

2,659 |

29.05 |

2,376 |

- |

10,283 |

Not

Applicable |

1,355 |

16.05 |

1,738 |

- |

5,889 |

Not

Applicable |

| |

ORCOPAMPA |

| |

4Q

2023 |

4Q

2022 |

| |

GOLD

(OZ) |

SILVER

(OZ) |

LEAD

(MT) |

ZINC

(MT) |

COPPER

(MT) |

TOTAL |

GOLD

(OZ) |

SILVER

(OZ) |

LEAD

(MT) |

ZINC

(MT) |

COPPER

(MT) |

TOTAL |

| Cost

of Sales (without D&A) (US$000) |

18,643 |

70 |

- |

- |

- |

18,713 |

13,777 |

76 |

- |

- |

- |

13,853 |

| Add:

|

|

|

|

|

- |

|

|

|

|

|

|

|

| Exploration

Expenses (US$000) |

1,352 |

5 |

- |

- |

- |

1,357 |

2,030 |

11 |

- |

- |

- |

2,041 |

| Commercial

Deductions (US$000) |

219 |

3 |

- |

- |

- |

222 |

177 |

0 |

- |

- |

- |

177 |

| Selling

Expenses (US$000) |

156 |

1 |

- |

- |

- |

157 |

113 |

1 |

- |

- |

- |

114 |

| Cost

Applicable to Sales (US$000) |

20,371 |

78 |

- |

- |

- |

20,449 |

16,097 |

88 |

- |

- |

- |

16,185 |

| Divide:

|

|

|

|

|

|

|

|

|

|

|

|

|

| Volume

Sold |

22,807 |

7,236 |

- |

- |

- |

Not

Applicable |

17,514 |

7,461 |

- |

- |

- |

Not

Applicable |

| CAS

|

893 |

10.80 |

- |

- |

- |

Not

Applicable |

919 |

11.77 |

- |

- |

- |

Not

Applicable |

| |

UCHUCCHACUA |

| |

4Q

2023 |

4Q

2022 |

| |

GOLD

(OZ) |

SILVER

(OZ) |

LEAD

(MT) |

ZINC

(MT) |

COPPER

(MT) |

TOTAL |

GOLD

(OZ) |

SILVER

(OZ) |

LEAD

(MT) |

ZINC

(MT) |

COPPER

(MT) |

TOTAL |

| Cost

of Sales (without D&A) (US$000) |

- |

12,786 |

936 |

1,372 |

- |

15,094 |

- |

- |

- |

- |

- |

- |

| Add:

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exploration

Expenses (US$000) |

- |

3,245 |

238 |

348 |

- |

3,831 |

- |

17,243 |

- |

- |

- |

17,243 |

| Commercial

Deductions (US$000) |

- |

7,965 |

1,124 |

3,099 |

- |

12,188 |

- |

1,538 |

3 |

- |

- |

1,541 |

| Selling

Expenses (US$000) |

- |

965 |

71 |

104 |

- |

1,139 |

- |

928 |

- |

- |

- |

928 |

| Cost

Applicable to Sales (US$000) |

- |

24,961 |

2,369 |

4,922 |

- |

32,252 |

- |

19,709 |

3 |

- |

- |

19,712 |

| Divide:

|

- |

|

|

|

|

|

- |

|

|

|

|

|

| Volume

Sold |

|

2,064,513 |

1,721 |

2,129 |

- |

Not

Applicable |

- |

152,471 |

- |

- |

- |

Not

Applicable |

| CAS

|

- |

12.09 |

1,376 |

2,312 |

- |

No

Applicable |

- |

129.27 |

- |

- |

- |

No

Applicable |

| |

TAMBOMAYO |

| |

4Q

2023 |

4Q

2022 |

| |

GOLD

(OZ) |

SILVER

(OZ) |

LEAD

(MT) |

ZINC

(MT) |

COPPER

(MT) |

TOTAL |

GOLD

(OZ) |

SILVER

(OZ) |

LEAD

(MT) |

ZINC

(MT) |

COPPER

(MT) |

TOTAL |

| Cost

of Sales (without D&A) (US$000) |

12,329 |

4,213 |

1,099 |

1,626 |

- |

19,267 |

9,313 |

3,984 |

2,157 |

1,828 |

- |

17,282 |

| Add:

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exploration

Expenses (US$000) |

769 |

263 |

69 |

101 |

- |

1,202 |

1,073 |

459 |

249 |

211 |

- |

1,991 |

| Commercial

Deductions (US$000) |

1,364 |

668 |

115 |

1,045 |

- |

3,192 |

1,560 |

744 |

326 |

959 |

- |

3,589 |

| Selling