Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

November 28 2023 - 12:39PM

Edgar (US Regulatory)

|

|

|

| Schedule of Investments (unaudited)

September 30, 2023 |

|

BlackRock Utilities, Infrastructure & Power

Opportunities Trust (BUI) (Percentages shown are based on Net Assets) |

|

|

|

|

|

|

|

|

|

| Security |

|

Shares |

|

|

Value |

|

|

|

|

| Common Stocks |

|

|

|

|

|

|

|

|

|

|

|

| Building Products — 6.0% |

|

|

|

|

|

|

| Johnson Controls International PLC(a) |

|

|

187,209 |

|

|

$ |

9,961,391 |

|

| Kingspan Group PLC(b) |

|

|

82,065 |

|

|

|

6,128,878 |

|

| Trane Technologies PLC(a) |

|

|

56,900 |

|

|

|

11,545,579 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27,635,848 |

|

|

|

|

| Chemicals — 4.5% |

|

|

|

|

|

|

| Air Liquide SA |

|

|

40,768 |

|

|

|

6,866,615 |

|

| LG Chem Ltd. |

|

|

9,200 |

|

|

|

3,368,453 |

|

| Linde PLC(a) |

|

|

18,778 |

|

|

|

6,991,988 |

|

| Sika AG, Registered Shares |

|

|

14,200 |

|

|

|

3,597,723 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20,824,779 |

|

|

| Commercial Services & Supplies(a) — 5.2% |

|

| Republic Services, Inc., Class A |

|

|

67,350 |

|

|

|

9,598,048 |

|

| Waste Management, Inc. |

|

|

92,650 |

|

|

|

14,123,566 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23,721,614 |

|

|

|

|

| Construction & Engineering — 5.4% |

|

|

|

|

|

|

| Quanta Services, Inc.(a) |

|

|

45,360 |

|

|

|

8,485,495 |

|

| Vinci SA |

|

|

148,150 |

|

|

|

16,389,986 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24,875,481 |

|

|

|

|

| Electric Utilities — 29.7% |

|

|

|

|

|

|

| American Electric Power Co., Inc.(a) |

|

|

169,950 |

|

|

|

12,783,639 |

|

| Duke Energy Corp.(a) |

|

|

118,418 |

|

|

|

10,451,573 |

|

| EDP - Energias de Portugal SA |

|

|

2,156,450 |

|

|

|

8,966,400 |

|

| Enel SpA |

|

|

3,339,949 |

|

|

|

20,483,045 |

|

| Exelon Corp.(a) |

|

|

307,758 |

|

|

|

11,630,175 |

|

| FirstEnergy Corp.(a) |

|

|

83,350 |

|

|

|

2,848,903 |

|

| Iberdrola SA |

|

|

901,218 |

|

|

|

10,079,626 |

|

| Neoenergia SA |

|

|

902,200 |

|

|

|

3,304,354 |

|

| NextEra Energy, Inc.(a)(c) |

|

|

583,230 |

|

|

|

33,413,247 |

|

| Orsted A/S(d) |

|

|

74,600 |

|

|

|

4,058,477 |

|

| PG&E Corp.(a)(b) |

|

|

641,800 |

|

|

|

10,352,234 |

|

| SSE PLC |

|

|

167,800 |

|

|

|

3,288,264 |

|

| Xcel Energy, Inc.(a) |

|

|

82,590 |

|

|

|

4,725,800 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

136,385,737 |

|

|

|

|

| Electrical Equipment — 5.4% |

|

|

|

|

|

|

| Eaton Corp. PLC(a) |

|

|

16,090 |

|

|

|

3,431,675 |

|

| Prysmian SpA |

|

|

100,900 |

|

|

|

4,049,951 |

|

| Schneider Electric SE |

|

|

34,332 |

|

|

|

5,657,641 |

|

| Sunrun, Inc.(b) |

|

|

187,900 |

|

|

|

2,360,024 |

|

| Vestas Wind Systems A/S(b) |

|

|

424,972 |

|

|

|

9,091,802 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24,591,093 |

|

|

| Electronic Equipment, Instruments & Components — 1.5% |

|

| Rogers Corp.(b) |

|

|

24,300 |

|

|

|

3,194,721 |

|

| Samsung SDI Co. Ltd. |

|

|

9,150 |

|

|

|

3,457,899 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,652,620 |

|

|

|

|

| Ground Transportation — 1.1% |

|

|

|

|

|

|

| Union Pacific Corp.(a) |

|

|

25,800 |

|

|

|

5,253,654 |

|

|

|

|

|

|

|

|

|

|

|

| Independent Power and Renewable Electricity Producers — 8.5% |

|

| AES Corp., Series 2021(a) |

|

|

222,890 |

|

|

|

3,387,928 |

|

| China Longyuan Power Group Corp. Ltd., Class H |

|

|

3,620,000 |

|

|

|

3,139,533 |

|

| EDP Renovaveis SA |

|

|

608,880 |

|

|

|

9,971,881 |

|

| Orron Energy AB(b) |

|

|

2,435,668 |

|

|

|

1,623,366 |

|

| RWE AG |

|

|

562,895 |

|

|

|

20,894,544 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

39,017,252 |

|

|

|

|

| Machinery — 5.6% |

|

|

|

|

|

|

| Atlas Copco AB, B Shares |

|

|

1,064,300 |

|

|

|

12,447,033 |

|

|

|

|

|

|

|

|

|

|

| Security |

|

Shares |

|

|

Value |

|

|

|

|

| Machinery (continued) |

|

|

|

|

|

|

| Ingersoll Rand, Inc.(a) |

|

|

131,700 |

|

|

$ |

8,391,924 |

|

| Spirax-Sarco Engineering PLC |

|

|

40,950 |

|

|

|

4,740,094 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25,579,051 |

|

|

|

|

| Multi-Utilities — 10.2% |

|

|

|

|

|

|

| CMS Energy Corp.(a) |

|

|

128,410 |

|

|

|

6,819,855 |

|

| Dominion Energy, Inc., Series A(a) |

|

|

176,898 |

|

|

|

7,902,034 |

|

| National Grid PLC |

|

|

552,524 |

|

|

|

6,607,826 |

|

| Public Service Enterprise Group, Inc. |

|

|

200,142 |

|

|

|

11,390,081 |

|

| Sempra(a)(c) |

|

|

203,300 |

|

|

|

13,830,499 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

46,550,295 |

|

|

|

|

| Oil, Gas & Consumable Fuels — 10.8% |

|

|

|

|

|

|

| Cheniere Energy, Inc.(c) |

|

|

88,950 |

|

|

|

14,762,142 |

|

| Enterprise Products Partners LP(a) |

|

|

194,363 |

|

|

|

5,319,715 |

|

| Kinder Morgan, Inc.(a) |

|

|

589,750 |

|

|

|

9,778,055 |

|

| TC Energy Corp. |

|

|

151,700 |

|

|

|

5,216,939 |

|

| Williams Cos., Inc.(a)(c) |

|

|

432,405 |

|

|

|

14,567,724 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

49,644,575 |

|

|

| Semiconductors & Semiconductor Equipment — 5.2% |

|

| Analog Devices, Inc.(a) |

|

|

27,174 |

|

|

|

4,757,896 |

|

| ASML Holding NV(b) |

|

|

7,750 |

|

|

|

4,562,812 |

|

| Canadian Solar, Inc.(b)(e) |

|

|

88,290 |

|

|

|

2,172,817 |

|

| First Solar, Inc.(a)(b) |

|

|

20,234 |

|

|

|

3,269,612 |

|

| Infineon Technologies AG |

|

|

132,850 |

|

|

|

4,400,090 |

|

| STMicroelectronics NV |

|

|

103,750 |

|

|

|

4,474,017 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23,637,244 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Long-Term Investments — 99.1%

(Cost: $359,191,010) |

|

|

|

|

|

|

454,369,243 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Short-Term Securities |

|

|

|

|

|

|

|

|

|

|

|

| Money Market Funds — 1.6% |

|

|

|

|

|

|

| BlackRock Liquidity Funds, T-Fund, Institutional Class, 5.23%(f)(g) |

|

|

6,009,552 |

|

|

|

6,009,552 |

|

| SL Liquidity Series, LLC, Money Market Series, 5.52%(f)(g)(h)

|

|

|

1,471,722 |

|

|

|

1,472,163 |

|

|

|

|

|

|

|

|

|

|

|

|

| Total Short-Term Securities — 1.6%

(Cost: $7,481,194) |

|

|

|

7,481,715 |

|

|

|

|

|

|

|

|

|

|

|

|

| Total Investments Before Options Written — 100.7%

(Cost: $366,672,204) |

|

|

|

461,850,958 |

|

|

|

|

|

|

|

|

|

|

|

|

| Options Written — (0.3)%

(Premiums Received: $(3,348,017)) |

|

|

|

(1,312,231 |

) |

|

|

|

|

|

|

|

|

|

|

|

| Total Investments, Net of Options Written — 100.4% (Cost: $363,324,187) |

|

|

|

460,538,727 |

|

| Liabilities in Excess of Other Assets — (0.4)% |

|

|

(1,825,172) |

|

|

|

|

|

|

|

|

|

|

|

|

| Net Assets — 100.0% |

|

|

$ 458,713,555 |

|

|

|

|

|

|

|

|

|

|

| (a) |

All or a portion of the security has been pledged and/or segregated as collateral in connection with outstanding

exchange-traded options written. |

| (b) |

Non-income producing security. |

| (c) |

All or a portion of the security has been pledged as collateral in connection with outstanding OTC derivatives.

|

| (d) |

Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may

be resold in transactions exempt from registration to qualified institutional investors. |

| (e) |

All or a portion of this security is on loan. |

| (f) |

Affiliate of the Trust. |

| (g) |

Annualized 7-day yield as of period end. |

| (h) |

All or a portion of this security was purchased with the cash collateral from loaned securities.

|

|

|

|

| Schedule of Investments (unaudited) (continued)

September 30, 2023 |

|

BlackRock Utilities, Infrastructure & Power Opportunities

Trust (BUI) |

For Trust compliance purposes, the Trust’s industry

classifications refer to one or more of the industry sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These

definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease.

Affiliates

Investments in issuers considered to be affiliate(s) of the Trust

during the period ended September 30, 2023 for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Affiliated Issuer |

|

Value at

12/31/22 |

|

|

Purchases

at Cost |

|

|

Proceeds

from Sales |

|

|

Net

Realized

Gain (Loss) |

|

|

Change in

Unrealized

Appreciation

(Depreciation) |

|

|

Value at

09/30/23 |

|

|

Shares

Held at

09/30/23 |

|

|

Income |

|

|

Capital Gain

Distributions

from

Underlying

Funds |

|

| BlackRock Liquidity Funds, T-Fund, Institutional Class |

|

$ |

11,042,199 |

|

|

$ |

— |

|

|

$ |

(5,032,647 |

)(a) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

6,009,552 |

|

|

|

6,009,552 |

|

|

$ |

415,072 |

|

|

$ |

— |

|

| SL Liquidity Series, LLC, Money Market Series |

|

|

225,179 |

|

|

|

1,245,749 |

(a) |

|

|

— |

|

|

|

835 |

|

|

|

400 |

|

|

|

1,472,163 |

|

|

|

1,471,722 |

|

|

|

9,555 |

(b) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

835 |

|

|

$ |

400 |

|

|

$ |

7,481,715 |

|

|

|

|

|

|

$ |

424,627 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(a) |

Represents net amount purchased (sold). |

|

| |

(b) |

All or a portion represents securities lending income earned from the reinvestment of cash collateral from loaned

securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities. |

|

Derivative Financial Instruments Outstanding as of Period End

Exchange-Traded Options Written

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Description |

|

Number of

Contracts |

|

|

Expiration

Date |

|

|

Exercise Price |

|

|

Notional

Amount (000) |

|

|

Value |

|

| Call |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PG&E Corp. |

|

|

136 |

|

|

|

10/06/23 |

|

|

|

USD |

|

|

|

17.00 |

|

|

|

USD |

|

|

|

219 |

|

|

$ |

(408 |

) |

| Exelon Corp. |

|

|

170 |

|

|

|

10/11/23 |

|

|

|

USD |

|

|

|

40.50 |

|

|

|

USD |

|

|

|

642 |

|

|

|

(709 |

) |

| Analog Devices, Inc. |

|

|

9 |

|

|

|

10/13/23 |

|

|

|

USD |

|

|

|

190.00 |

|

|

|

USD |

|

|

|

158 |

|

|

|

(180 |

) |

| Enterprise Products Partners LP |

|

|

101 |

|

|

|

10/13/23 |

|

|

|

USD |

|

|

|

27.00 |

|

|

|

USD |

|

|

|

276 |

|

|

|

(5,504 |

) |

| Kinder Morgan, Inc. |

|

|

554 |

|

|

|

10/13/23 |

|

|

|

USD |

|

|

|

16.74 |

|

|

|

USD |

|

|

|

919 |

|

|

|

(11,185 |

) |

| NextEra Energy, Inc. |

|

|

1,448 |

|

|

|

10/13/23 |

|

|

|

USD |

|

|

|

68.00 |

|

|

|

USD |

|

|

|

8,296 |

|

|

|

(14,480 |

) |

| PG&E Corp. |

|

|

851 |

|

|

|

10/13/23 |

|

|

|

USD |

|

|

|

17.00 |

|

|

|

USD |

|

|

|

1,373 |

|

|

|

(4,255 |

) |

| Union Pacific Corp. |

|

|

90 |

|

|

|

10/13/23 |

|

|

|

USD |

|

|

|

220.00 |

|

|

|

USD |

|

|

|

1,833 |

|

|

|

(1,350 |

) |

| Williams Cos., Inc. |

|

|

306 |

|

|

|

10/13/23 |

|

|

|

USD |

|

|

|

34.00 |

|

|

|

USD |

|

|

|

1,031 |

|

|

|

(13,005 |

) |

| AES Corp. |

|

|

330 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

18.59 |

|

|

|

USD |

|

|

|

502 |

|

|

|

(1,414 |

) |

| AES Corp. |

|

|

450 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

18.00 |

|

|

|

USD |

|

|

|

684 |

|

|

|

(2,250 |

) |

| Analog Devices, Inc. |

|

|

51 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

190.00 |

|

|

|

USD |

|

|

|

893 |

|

|

|

(2,295 |

) |

| CMS Energy Corp. |

|

|

228 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

57.02 |

|

|

|

USD |

|

|

|

1,211 |

|

|

|

(5,723 |

) |

| Dominion Energy, Inc. |

|

|

309 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

50.00 |

|

|

|

USD |

|

|

|

1,380 |

|

|

|

(3,090 |

) |

| Duke Energy Corp. |

|

|

195 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

93.01 |

|

|

|

USD |

|

|

|

1,721 |

|

|

|

(5,622 |

) |

| Eaton Corp. PLC |

|

|

95 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

220.00 |

|

|

|

USD |

|

|

|

2,026 |

|

|

|

(23,987 |

) |

| Enterprise Products Partners LP |

|

|

101 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

27.00 |

|

|

|

USD |

|

|

|

276 |

|

|

|

(6,363 |

) |

| Exelon Corp. |

|

|

170 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

41.00 |

|

|

|

USD |

|

|

|

642 |

|

|

|

(1,700 |

) |

| FirstEnergy Corp. |

|

|

146 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

37.00 |

|

|

|

USD |

|

|

|

499 |

|

|

|

(1,095 |

) |

| Ingersoll Rand, Inc. |

|

|

310 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

70.00 |

|

|

|

USD |

|

|

|

1,975 |

|

|

|

(3,100 |

) |

| Johnson Controls International PLC |

|

|

229 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

62.50 |

|

|

|

USD |

|

|

|

1,219 |

|

|

|

(1,145 |

) |

| Kinder Morgan, Inc. |

|

|

644 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

17.57 |

|

|

|

USD |

|

|

|

1,068 |

|

|

|

(3,240 |

) |

| Linde PLC |

|

|

35 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

385.00 |

|

|

|

USD |

|

|

|

1,303 |

|

|

|

(7,262 |

) |

| Quanta Services, Inc. |

|

|

74 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

210.00 |

|

|

|

USD |

|

|

|

1,384 |

|

|

|

(1,480 |

) |

| Republic Services, Inc., Class A |

|

|

121 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

150.00 |

|

|

|

USD |

|

|

|

1,724 |

|

|

|

(11,797 |

) |

| Sempra |

|

|

178 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

72.50 |

|

|

|

USD |

|

|

|

1,211 |

|

|

|

(3,560 |

) |

| Sempra |

|

|

178 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

75.00 |

|

|

|

USD |

|

|

|

1,211 |

|

|

|

(4,005 |

) |

| Trane Technologies PLC |

|

|

60 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

200.00 |

|

|

|

USD |

|

|

|

1,217 |

|

|

|

(42,000 |

) |

| Waste Management, Inc. |

|

|

165 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

165.00 |

|

|

|

USD |

|

|

|

2,515 |

|

|

|

(4,125 |

) |

| Williams Cos., Inc. |

|

|

537 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

35.00 |

|

|

|

USD |

|

|

|

1,809 |

|

|

|

(10,740 |

) |

| Xcel Energy, Inc. |

|

|

143 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

60.25 |

|

|

|

USD |

|

|

|

818 |

|

|

|

(4,255 |

) |

| Analog Devices, Inc. |

|

|

12 |

|

|

|

10/27/23 |

|

|

|

USD |

|

|

|

190.00 |

|

|

|

USD |

|

|

|

210 |

|

|

|

(1,020 |

) |

| Enterprise Products Partners LP |

|

|

101 |

|

|

|

10/27/23 |

|

|

|

USD |

|

|

|

27.00 |

|

|

|

USD |

|

|

|

276 |

|

|

|

(6,868 |

) |

| Kinder Morgan, Inc. |

|

|

866 |

|

|

|

10/27/23 |

|

|

|

USD |

|

|

|

17.50 |

|

|

|

USD |

|

|

|

1,436 |

|

|

|

(7,361 |

) |

| PG&E Corp. |

|

|

544 |

|

|

|

10/27/23 |

|

|

|

USD |

|

|

|

17.50 |

|

|

|

USD |

|

|

|

877 |

|

|

|

(4,080 |

) |

| Waste Management, Inc. |

|

|

159 |

|

|

|

10/27/23 |

|

|

|

USD |

|

|

|

160.00 |

|

|

|

USD |

|

|

|

2,424 |

|

|

|

(14,310 |

) |

|

|

|

|

S C H E D U L E O F I

N V E S T M E N T S |

|

2 |

|

|

|

| Schedule of Investments (unaudited) (continued)

September 30, 2023 |

|

BlackRock Utilities, Infrastructure & Power Opportunities

Trust (BUI) |

Exchange-Traded Options Written (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Description |

|

Number of

Contracts |

|

|

Expiration

Date |

|

|

Exercise Price |

|

|

Notional

Amount (000) |

|

|

Value |

|

| Call (continued) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Williams Cos., Inc. |

|

|

670 |

|

|

|

10/27/23 |

|

|

|

USD |

|

|

|

34.00 |

|

|

|

USD |

|

|

|

2,257 |

|

|

$ |

(45,225 |

) |

| Enterprise Products Partners LP |

|

|

184 |

|

|

|

10/30/23 |

|

|

|

USD |

|

|

|

28.00 |

|

|

|

USD |

|

|

|

504 |

|

|

|

(1,547 |

) |

| First Solar, Inc. |

|

|

35 |

|

|

|

11/03/23 |

|

|

|

USD |

|

|

|

180.00 |

|

|

|

USD |

|

|

|

566 |

|

|

|

(12,425 |

) |

| First Solar, Inc. |

|

|

35 |

|

|

|

11/10/23 |

|

|

|

USD |

|

|

|

175.31 |

|

|

|

USD |

|

|

|

566 |

|

|

|

(18,723 |

) |

| FirstEnergy Corp. |

|

|

145 |

|

|

|

11/10/23 |

|

|

|

USD |

|

|

|

37.25 |

|

|

|

USD |

|

|

|

496 |

|

|

|

(2,424 |

) |

| American Electric Power Co., Inc. |

|

|

478 |

|

|

|

11/17/23 |

|

|

|

USD |

|

|

|

82.00 |

|

|

|

USD |

|

|

|

3,596 |

|

|

|

(21,509 |

) |

| Analog Devices, Inc. |

|

|

23 |

|

|

|

11/17/23 |

|

|

|

USD |

|

|

|

185.00 |

|

|

|

USD |

|

|

|

403 |

|

|

|

(7,475 |

) |

| CMS Energy Corp. |

|

|

228 |

|

|

|

11/17/23 |

|

|

|

USD |

|

|

|

57.02 |

|

|

|

USD |

|

|

|

1,211 |

|

|

|

(16,002 |

) |

| Dominion Energy, Inc. |

|

|

294 |

|

|

|

11/17/23 |

|

|

|

USD |

|

|

|

49.25 |

|

|

|

USD |

|

|

|

1,313 |

|

|

|

(12,803 |

) |

| Duke Energy Corp. |

|

|

219 |

|

|

|

11/17/23 |

|

|

|

USD |

|

|

|

96.00 |

|

|

|

USD |

|

|

|

1,933 |

|

|

|

(9,510 |

) |

| Enterprise Products Partners LP |

|

|

193 |

|

|

|

11/17/23 |

|

|

|

USD |

|

|

|

27.60 |

|

|

|

USD |

|

|

|

528 |

|

|

|

(5,884 |

) |

| Exelon Corp. |

|

|

737 |

|

|

|

11/17/23 |

|

|

|

USD |

|

|

|

43.00 |

|

|

|

USD |

|

|

|

2,785 |

|

|

|

(7,370 |

) |

| Ingersoll Rand, Inc. |

|

|

150 |

|

|

|

11/17/23 |

|

|

|

USD |

|

|

|

67.30 |

|

|

|

USD |

|

|

|

956 |

|

|

|

(16,779 |

) |

| Johnson Controls International PLC |

|

|

426 |

|

|

|

11/17/23 |

|

|

|

USD |

|

|

|

58.94 |

|

|

|

USD |

|

|

|

2,267 |

|

|

|

(13,238 |

) |

| Linde PLC |

|

|

33 |

|

|

|

11/17/23 |

|

|

|

USD |

|

|

|

400.00 |

|

|

|

USD |

|

|

|

1,229 |

|

|

|

(7,672 |

) |

| PG&E Corp. |

|

|

715 |

|

|

|

11/17/23 |

|

|

|

USD |

|

|

|

18.00 |

|

|

|

USD |

|

|

|

1,153 |

|

|

|

(7,150 |

) |

| Quanta Services, Inc. |

|

|

84 |

|

|

|

11/17/23 |

|

|

|

USD |

|

|

|

210.00 |

|

|

|

USD |

|

|

|

1,571 |

|

|

|

(12,600 |

) |

| Republic Services, Inc., Class A |

|

|

116 |

|

|

|

11/17/23 |

|

|

|

USD |

|

|

|

150.00 |

|

|

|

USD |

|

|

|

1,653 |

|

|

|

(16,530 |

) |

| Sempra |

|

|

355 |

|

|

|

11/17/23 |

|

|

|

USD |

|

|

|

75.00 |

|

|

|

USD |

|

|

|

2,415 |

|

|

|

(11,537 |

) |

| Trane Technologies PLC |

|

|

139 |

|

|

|

11/17/23 |

|

|

|

USD |

|

|

|

211.83 |

|

|

|

USD |

|

|

|

2,820 |

|

|

|

(67,996 |

) |

| Xcel Energy, Inc. |

|

|

146 |

|

|

|

11/17/23 |

|

|

|

USD |

|

|

|

58.57 |

|

|

|

USD |

|

|

|

835 |

|

|

|

(21,113 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

(570,475 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTC Options Written

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Description |

|

Counterparty |

|

Number of

Contracts |

|

|

Expiration

Date |

|

|

Exercise Price |

|

|

Notional

Amount (000) |

|

|

Value |

|

| Call |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| China Longyuan Power Group Corp. Ltd., Class H |

|

Morgan Stanley & Co. International PLC |

|

|

670,000 |

|

|

|

10/03/23 |

|

|

|

HKD |

|

|

|

7.64 |

|

|

|

HKD |

|

|

|

4,550 |

|

|

$ |

(1 |

) |

| EDP - Energias de Portugal SA |

|

UBS AG |

|

|

243,700 |

|

|

|

10/03/23 |

|

|

|

EUR |

|

|

|

4.23 |

|

|

|

EUR |

|

|

|

958 |

|

|

|

— |

|

| EDP - Energias de Portugal SA |

|

UBS AG |

|

|

102,000 |

|

|

|

10/03/23 |

|

|

|

EUR |

|

|

|

4.27 |

|

|

|

EUR |

|

|

|

401 |

|

|

|

— |

|

| Iberdrola SA |

|

Morgan Stanley & Co. International PLC |

|

|

116,200 |

|

|

|

10/03/23 |

|

|

|

EUR |

|

|

|

10.78 |

|

|

|

EUR |

|

|

|

1,229 |

|

|

|

(1,791 |

) |

| Kingspan Group PLC |

|

UBS AG |

|

|

16,700 |

|

|

|

10/03/23 |

|

|

|

EUR |

|

|

|

76.54 |

|

|

|

EUR |

|

|

|

1,180 |

|

|

|

(30 |

) |

| Orron Energy AB |

|

Morgan Stanley & Co. International PLC |

|

|

236,000 |

|

|

|

10/03/23 |

|

|

|

SEK |

|

|

|

11.62 |

|

|

|

SEK |

|

|

|

1,719 |

|

|

|

— |

|

| Atlas Copco AB, B Shares |

|

UBS AG |

|

|

90,600 |

|

|

|

10/05/23 |

|

|

|

SEK |

|

|

|

131.34 |

|

|

|

SEK |

|

|

|

11,576 |

|

|

|

(2,169 |

) |

| Orsted A/S |

|

Morgan Stanley & Co. International PLC |

|

|

19,200 |

|

|

|

10/05/23 |

|

|

|

DKK |

|

|

|

556.02 |

|

|

|

DKK |

|

|

|

7,369 |

|

|

|

— |

|

| Public Service Enterprise Group, Inc. |

|

JPMorgan Chase Bank N.A. |

|

|

21,800 |

|

|

|

10/05/23 |

|

|

|

USD |

|

|

|

62.14 |

|

|

|

USD |

|

|

|

1,241 |

|

|

|

(27 |

) |

| RWE AG |

|

Barclays Bank PLC |

|

|

37,700 |

|

|

|

10/05/23 |

|

|

|

EUR |

|

|

|

39.54 |

|

|

|

EUR |

|

|

|

1,324 |

|

|

|

— |

|

| Spirax-Sarco Engineering PLC |

|

Barclays Bank PLC |

|

|

13,200 |

|

|

|

10/05/23 |

|

|

|

GBP |

|

|

|

103.63 |

|

|

|

GBP |

|

|

|

1,252 |

|

|

|

(26 |

) |

| LG Chem Ltd. |

|

Morgan Stanley & Co. International PLC |

|

|

3,300 |

|

|

|

10/10/23 |

|

|

|

USD |

|

|

|

646,127.52 |

|

|

|

USD |

|

|

|

1,630,412 |

|

|

|

(1 |

) |

| Samsung SDI Co. Ltd. |

|

Morgan Stanley & Co. International PLC |

|

|

3,300 |

|

|

|

10/10/23 |

|

|

|

USD |

|

|

|

650,060.16 |

|

|

|

USD |

|

|

|

1,682,852 |

|

|

|

(3 |

) |

| American Electric Power Co., Inc. |

|

JPMorgan Chase Bank N.A. |

|

|

11,600 |

|

|

|

10/11/23 |

|

|

|

USD |

|

|

|

81.61 |

|

|

|

USD |

|

|

|

873 |

|

|

|

(445 |

) |

| Neoenergia SA |

|

Morgan Stanley & Co. International PLC |

|

|

157,900 |

|

|

|

10/11/23 |

|

|

|

USD |

|

|

|

19.49 |

|

|

|

USD |

|

|

|

2,907 |

|

|

|

(1,836 |

) |

| Atlas Copco AB, B Shares |

|

UBS AG |

|

|

250,000 |

|

|

|

10/13/23 |

|

|

|

SEK |

|

|

|

129.07 |

|

|

|

SEK |

|

|

|

31,944 |

|

|

|

(35,695 |

) |

| EDP Renovaveis SA |

|

Morgan Stanley & Co. International PLC |

|

|

14,800 |

|

|

|

10/13/23 |

|

|

|

EUR |

|

|

|

17.77 |

|

|

|

EUR |

|

|

|

229 |

|

|

|

(9 |

) |

| Enel SpA |

|

Goldman Sachs International |

|

|

668,700 |

|

|

|

10/13/23 |

|

|

|

EUR |

|

|

|

6.26 |

|

|

|

EUR |

|

|

|

3,879 |

|

|

|

(3,994 |

) |

| Infineon Technologies AG |

|

UBS AG |

|

|

19,200 |

|

|

|

10/13/23 |

|

|

|

EUR |

|

|

|

34.22 |

|

|

|

EUR |

|

|

|

601 |

|

|

|

(1,085 |

) |

| National Grid PLC |

|

Morgan Stanley & Co. International PLC |

|

|

68,200 |

|

|

|

10/13/23 |

|

|

|

GBP |

|

|

|

10.03 |

|

|

|

GBP |

|

|

|

668 |

|

|

|

(3,797 |

) |

| Orron Energy AB |

|

Morgan Stanley & Co. International PLC |

|

|

264,200 |

|

|

|

10/13/23 |

|

|

|

SEK |

|

|

|

10.29 |

|

|

|

SEK |

|

|

|

1,924 |

|

|

|

(304 |

) |

| Orsted A/S |

|

UBS AG |

|

|

6,900 |

|

|

|

10/13/23 |

|

|

|

DKK |

|

|

|

572.07 |

|

|

|

DKK |

|

|

|

2,648 |

|

|

|

— |

|

| Schneider Electric SE |

|

UBS AG |

|

|

4,600 |

|

|

|

10/13/23 |

|

|

|

EUR |

|

|

|

163.05 |

|

|

|

EUR |

|

|

|

717 |

|

|

|

(3,894 |

) |

| Vestas Wind Systems A/S |

|

UBS AG |

|

|

62,500 |

|

|

|

10/13/23 |

|

|

|

DKK |

|

|

|

173.38 |

|

|

|

DKK |

|

|

|

9,433 |

|

|

|

(849 |

) |

| Neoenergia SA |

|

Morgan Stanley & Co. International PLC |

|

|

79,000 |

|

|

|

10/17/23 |

|

|

|

USD |

|

|

|

19.38 |

|

|

|

USD |

|

|

|

1,454 |

|

|

|

(2,124 |

) |

| Prysmian SpA |

|

Barclays Bank PLC |

|

|

22,800 |

|

|

|

10/17/23 |

|

|

|

EUR |

|

|

|

37.02 |

|

|

|

EUR |

|

|

|

866 |

|

|

|

(40,939 |

) |

| EDP Renovaveis SA |

|

Goldman Sachs International |

|

|

60,900 |

|

|

|

10/19/23 |

|

|

|

EUR |

|

|

|

17.03 |

|

|

|

EUR |

|

|

|

943 |

|

|

|

(1,485 |

) |

| RWE AG |

|

Goldman Sachs International |

|

|

159,300 |

|

|

|

10/19/23 |

|

|

|

EUR |

|

|

|

38.08 |

|

|

|

EUR |

|

|

|

5,593 |

|

|

|

(7,247 |

) |

| STMicroelectronics NV |

|

Goldman Sachs International |

|

|

36,400 |

|

|

|

10/19/23 |

|

|

|

EUR |

|

|

|

45.02 |

|

|

|

EUR |

|

|

|

1,485 |

|

|

|

(4,022 |

) |

| TC Energy Corp. |

|

Royal Bank of Canada |

|

|

26,900 |

|

|

|

10/20/23 |

|

|

|

CAD |

|

|

|

49.07 |

|

|

|

CAD |

|

|

|

1,256 |

|

|

|

(3,634 |

) |

| Public Service Enterprise Group, Inc. |

|

Goldman Sachs International |

|

|

27,500 |

|

|

|

10/23/23 |

|

|

|

USD |

|

|

|

62.75 |

|

|

|

USD |

|

|

|

1,565 |

|

|

|

(3,106 |

) |

|

|

|

| Schedule of Investments (unaudited) (continued)

September 30, 2023 |

|

BlackRock Utilities, Infrastructure & Power Opportunities

Trust (BUI) |

OTC Options Written (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Description |

|

Counterparty |

|

Number of

Contracts |

|

|

Expiration

Date |

|

|

Exercise Price |

|

|

Notional

Amount (000) |

|

|

Value |

|

| Call (continued) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Atlas Copco AB, B Shares |

|

Morgan Stanley & Co. International PLC |

|

|

16,000 |

|

|

|

10/24/23 |

|

|

|

SEK |

|

|

|

128.59 |

|

|

|

SEK |

|

|

|

2,044 |

|

|

$ |

(2,837 |

) |

| EDP Renovaveis SA |

|

Goldman Sachs International |

|

|

83,400 |

|

|

|

10/24/23 |

|

|

|

EUR |

|

|

|

16.45 |

|

|

|

EUR |

|

|

|

1,292 |

|

|

|

(9,812 |

) |

| Infineon Technologies AG |

|

Morgan Stanley & Co. International PLC |

|

|

21,100 |

|

|

|

10/24/23 |

|

|

|

EUR |

|

|

|

33.14 |

|

|

|

EUR |

|

|

|

661 |

|

|

|

(8,241 |

) |

| Vestas Wind Systems A/S |

|

Morgan Stanley & Co. International PLC |

|

|

81,700 |

|

|

|

10/24/23 |

|

|

|

DKK |

|

|

|

154.36 |

|

|

|

DKK |

|

|

|

12,330 |

|

|

|

(61,055 |

) |

| EDP - Energias de Portugal SA |

|

Goldman Sachs International |

|

|

266,500 |

|

|

|

10/25/23 |

|

|

|

EUR |

|

|

|

4.15 |

|

|

|

EUR |

|

|

|

1,048 |

|

|

|

(5,714 |

) |

| SSE PLC |

|

Goldman Sachs International |

|

|

29,400 |

|

|

|

10/25/23 |

|

|

|

GBP |

|

|

|

17.11 |

|

|

|

GBP |

|

|

|

472 |

|

|

|

(2,842 |

) |

| TC Energy Corp. |

|

Royal Bank of Canada |

|

|

27,900 |

|

|

|

10/25/23 |

|

|

|

CAD |

|

|

|

49.88 |

|

|

|

CAD |

|

|

|

1,303 |

|

|

|

(4,307 |

) |

| Public Service Enterprise Group, Inc. |

|

Goldman Sachs International |

|

|

20,700 |

|

|

|

10/30/23 |

|

|

|

USD |

|

|

|

61.96 |

|

|

|

USD |

|

|

|

1,178 |

|

|

|

(5,104 |

) |

| Atlas Copco AB, B Shares |

|

UBS AG |

|

|

16,000 |

|

|

|

11/07/23 |

|

|

|

SEK |

|

|

|

128.80 |

|

|

|

SEK |

|

|

|

2,044 |

|

|

|

(3,732 |

) |

| ASML Holding NV |

|

Goldman Sachs International |

|

|

2,400 |

|

|

|

11/08/23 |

|

|

|

EUR |

|

|

|

568.91 |

|

|

|

EUR |

|

|

|

1,336 |

|

|

|

(50,333 |

) |

| Air Liquide SA |

|

UBS AG |

|

|

15,400 |

|

|

|

11/09/23 |

|

|

|

EUR |

|

|

|

162.47 |

|

|

|

EUR |

|

|

|

2,453 |

|

|

|

(46,237 |

) |

| China Longyuan Power Group Corp. Ltd., Class H |

|

Bank of America N.A. |

|

|

597,000 |

|

|

|

11/09/23 |

|

|

|

HKD |

|

|

|

6.81 |

|

|

|

HKD |

|

|

|

4,055 |

|

|

|

(22,663 |

) |

| Kingspan Group PLC |

|

Morgan Stanley & Co. International PLC |

|

|

14,400 |

|

|

|

11/09/23 |

|

|

|

EUR |

|

|

|

72.52 |

|

|

|

EUR |

|

|

|

1,017 |

|

|

|

(28,921 |

) |

| Prysmian SpA |

|

Barclays Bank PLC |

|

|

12,600 |

|

|

|

11/09/23 |

|

|

|

EUR |

|

|

|

38.59 |

|

|

|

EUR |

|

|

|

478 |

|

|

|

(16,538 |

) |

| Vinci SA |

|

Morgan Stanley & Co. International PLC |

|

|

51,800 |

|

|

|

11/09/23 |

|

|

|

EUR |

|

|

|

107.32 |

|

|

|

EUR |

|

|

|

5,420 |

|

|

|

(105,181 |

) |

| SSE PLC |

|

Goldman Sachs International |

|

|

29,300 |

|

|

|

11/13/23 |

|

|

|

GBP |

|

|

|

17.28 |

|

|

|

GBP |

|

|

|

471 |

|

|

|

(4,038 |

) |

| EDP - Energias de Portugal SA |

|

Morgan Stanley & Co. International PLC |

|

|

102,300 |

|

|

|

11/14/23 |

|

|

|

EUR |

|

|

|

4.13 |

|

|

|

EUR |

|

|

|

402 |

|

|

|

(4,871 |

) |

| Iberdrola SA |

|

Morgan Stanley & Co. International PLC |

|

|

205,000 |

|

|

|

11/14/23 |

|

|

|

EUR |

|

|

|

11.03 |

|

|

|

EUR |

|

|

|

2,169 |

|

|

|

(29,816 |

) |

| Orron Energy AB |

|

Morgan Stanley & Co. International PLC |

|

|

236,000 |

|

|

|

11/14/23 |

|

|

|

SEK |

|

|

|

7.79 |

|

|

|

SEK |

|

|

|

1,719 |

|

|

|

(8,542 |

) |

| Schneider Electric SE |

|

Morgan Stanley & Co. International PLC |

|

|

5,900 |

|

|

|

11/14/23 |

|

|

|

EUR |

|

|

|

157.11 |

|

|

|

EUR |

|

|

|

920 |

|

|

|

(36,135 |

) |

| Sika AG, Registered Shares |

|

Morgan Stanley & Co. International PLC |

|

|

4,900 |

|

|

|

11/14/23 |

|

|

|

CHF |

|

|

|

236.86 |

|

|

|

CHF |

|

|

|

1,136 |

|

|

|

(38,346 |

) |

| EDP Renovaveis SA |

|

Morgan Stanley & Co. International PLC |

|

|

39,000 |

|

|

|

11/16/23 |

|

|

|

EUR |

|

|

|

15.71 |

|

|

|

EUR |

|

|

|

604 |

|

|

|

(20,829 |

) |

| Enel SpA |

|

Morgan Stanley & Co. International PLC |

|

|

519,400 |

|

|

|

11/16/23 |

|

|

|

EUR |

|

|

|

5.97 |

|

|

|

EUR |

|

|

|

3,013 |

|

|

|

(66,742 |

) |

| Infineon Technologies AG |

|

Barclays Bank PLC |

|

|

6,200 |

|

|

|

11/16/23 |

|

|

|

EUR |

|

|

|

32.16 |

|

|

|

EUR |

|

|

|

194 |

|

|

|

(8,577 |

) |

| National Grid PLC |

|

Goldman Sachs International |

|

|

125,200 |

|

|

|

11/16/23 |

|

|

|

GBP |

|

|

|

9.93 |

|

|

|

GBP |

|

|

|

1,227 |

|

|

|

(31,830 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

(741,756 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Hierarchy as of Period End

Various

inputs are used in determining the fair value of financial instruments. These inputs to valuation techniques are categorized into a fair value hierarchy consisting of three broad levels for financial reporting purposes as follows:

| |

• |

|

Level 1 – Unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the

Trust has the ability to access; |

| |

• |

|

Level 2 – Other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities

in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves,

volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market–corroborated inputs); and |

| |

• |

|

Level 3 – Unobservable inputs based on the best information available in the circumstances, to the extent

observable inputs are not available (including the Valuation Committee’s assumptions used in determining the fair value of financial instruments). |

The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority

to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of

the fair value hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is significant to the fair value measurement in its entirety. Investments classified within

Level 3 have significant unobservable inputs used by the Valuation Committee in determining the price for Fair Valued Investments. Level 3 investments include equity or debt issued by privately held companies or funds. There may not be a

secondary market, and/or there are a limited number of investors. The categorization of a value determined for financial instruments is based on the pricing transparency of the financial instruments and is not necessarily an indication of the risks

associated with investing in those securities. For information about the Trust’s policy regarding valuation of financial instruments, refer to its most recent financial statements.

Certain investments of the Trust were fair valued using net asset value (“NAV”) as a practical expedient as no quoted market value is available and therefore

have been excluded from the fair value hierarchy.

|

|

|

|

S C H E D U L E O F I

N V E S T M E N T S |

|

4 |

|

|

|

| Schedule of Investments (unaudited) (continued)

September 30, 2023 |

|

BlackRock Utilities, Infrastructure & Power Opportunities

Trust (BUI) |

Fair Value Hierarchy as of Period End (continued)

The following table

summarizes the Trust’s financial instruments categorized in the fair value hierarchy. The breakdown of the Trust’s financial instruments into major categories is disclosed in the Schedule of Investments above.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Long-Term Investments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common Stocks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Building Products |

|

$ |

21,506,970 |

|

|

$ |

6,128,878 |

|

|

$ |

— |

|

|

$ |

27,635,848 |

|

| Chemicals |

|

|

6,991,988 |

|

|

|

13,832,791 |

|

|

|

— |

|

|

|

20,824,779 |

|

| Commercial Services & Supplies |

|

|

23,721,614 |

|

|

|

— |

|

|

|

— |

|

|

|

23,721,614 |

|

| Construction & Engineering |

|

|

8,485,495 |

|

|

|

16,389,986 |

|

|

|

— |

|

|

|

24,875,481 |

|

| Electric Utilities |

|

|

89,509,925 |

|

|

|

46,875,812 |

|

|

|

— |

|

|

|

136,385,737 |

|

| Electrical Equipment |

|

|

5,791,699 |

|

|

|

18,799,394 |

|

|

|

— |

|

|

|

24,591,093 |

|

| Electronic Equipment, Instruments & Components |

|

|

3,194,721 |

|

|

|

3,457,899 |

|

|

|

— |

|

|

|

6,652,620 |

|

| Ground Transportation |

|

|

5,253,654 |

|

|

|

— |

|

|

|

— |

|

|

|

5,253,654 |

|

| Independent Power and Renewable Electricity Producers |

|

|

3,387,928 |

|

|

|

35,629,324 |

|

|

|

— |

|

|

|

39,017,252 |

|

| Machinery |

|

|

8,391,924 |

|

|

|

17,187,127 |

|

|

|

— |

|

|

|

25,579,051 |

|

| Multi-Utilities |

|

|

39,942,469 |

|

|

|

6,607,826 |

|

|

|

— |

|

|

|

46,550,295 |

|

| Oil, Gas & Consumable Fuels |

|

|

49,644,575 |

|

|

|

— |

|

|

|

— |

|

|

|

49,644,575 |

|

| Semiconductors & Semiconductor Equipment |

|

|

10,200,325 |

|

|

|

13,436,919 |

|

|

|

— |

|

|

|

23,637,244 |

|

| Short-Term Securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Money Market Funds |

|

|

6,009,552 |

|

|

|

— |

|

|

|

— |

|

|

|

6,009,552 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

282,032,839 |

|

|

$ |

178,345,956 |

|

|

$ |

— |

|

|

|

460,378,795 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investments Valued at NAV(a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,472,163 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

461,850,958 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Derivative Financial Instruments(b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity Contracts |

|

$ |

(330,799 |

) |

|

$ |

(981,432 |

) |

|

$ |

— |

|

|

$ |

(1,312,231 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(a) |

Certain investments of the Trust were fair valued using NAV as a practical expedient as no quoted market value is

available and therefore have been excluded from the fair value hierarchy. |

|

| |

(b) |

Derivative financial instruments are options written. Options written are shown at value. |

|

Currency Abbreviation

|

|

|

|

|

| CAD |

|

Canadian Dollar |

|

|

| CHF |

|

Swiss Franc |

|

|

| DKK |

|

Danish Krone |

|

|

| EUR |

|

Euro |

|

|

| GBP |

|

British Pound |

|

|

| HKD |

|

Hong Kong Dollar |

|

|

| SEK |

|

Swedish Krona |

|

|

| USD |

|

United States Dollar |

Portfolio Abbreviation

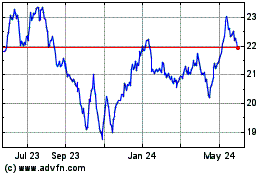

BlackRock Utility Infras... (NYSE:BUI)

Historical Stock Chart

From Apr 2024 to May 2024

BlackRock Utility Infras... (NYSE:BUI)

Historical Stock Chart

From May 2023 to May 2024